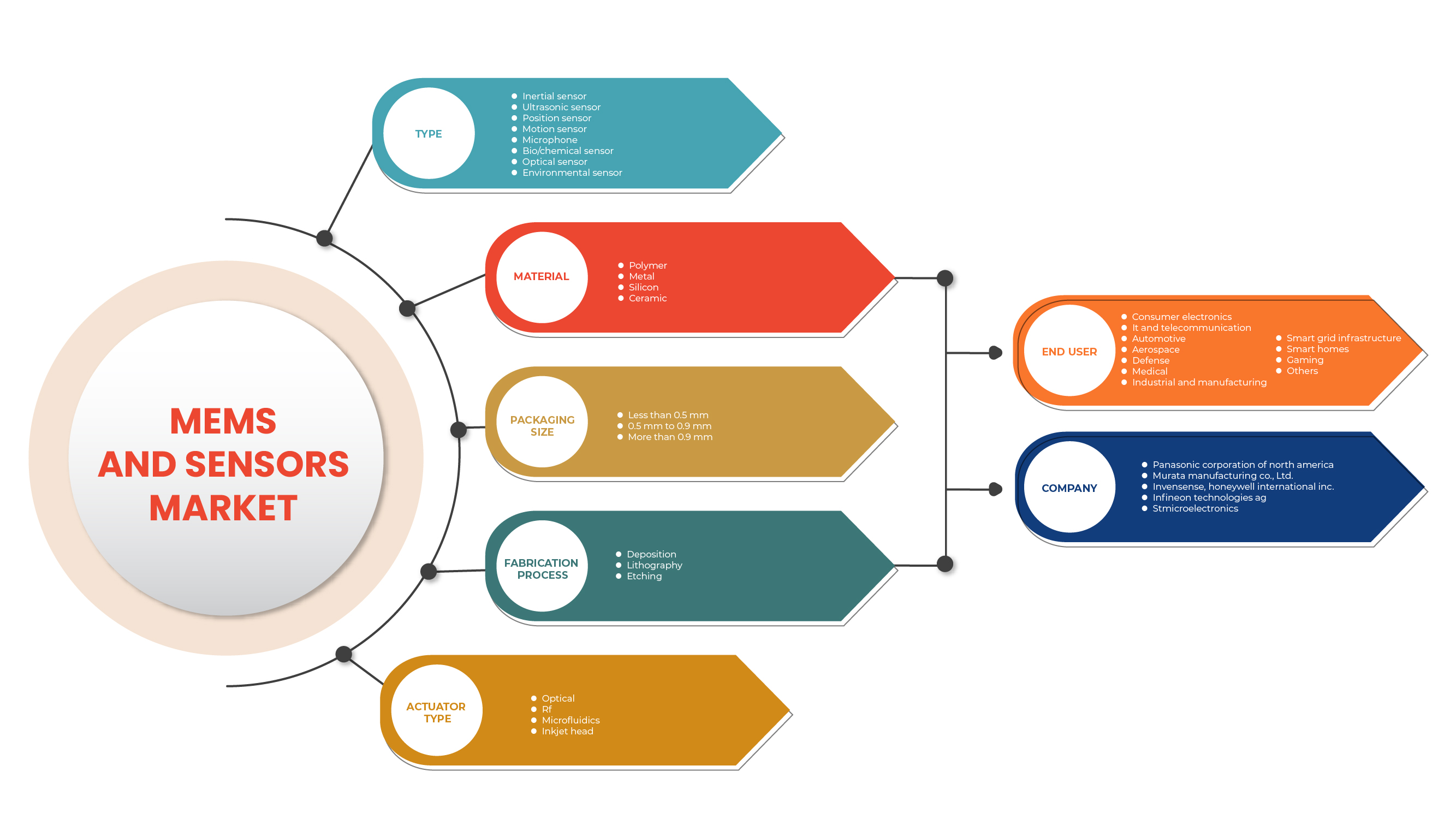

Middle East and Africa MEMS and Sensors Market, By Type (Inertial Sensor, Ultrasonic Sensor, Position Sensor, Motion Sensor, Microphone, Bio/Chemical Sensor, Optical Sensor And Environmental Sensor), Material (Polymer, Metal, Silicon and Ceramic), Packaging Size (Less Than 0.5 MM, 0.5 MM To 0.9 MM, More Than 0.9 MM), Fabrication Process (Deposition, Lithography and Etching), Actuator Type (Optical, RF, Microfluidics and Inkjet Head), End User (Consumer Electronics, IT and Telecommunication, Automotive, Aerospace, Defense, Medical, Industrial and Manufacturing, Smart Grid Infrastructure, Smart Homes, Gaming and Others), Industry Trends and Forecast To 2029.

Market Analysis and Insights

Sensors are devices or machines used to detect the presence of any physical object in the vicinity and send information about the same to the receiving end. The device is mostly used with other electronic devices. Any physical quantity, such as pressure, force, strain, light, and others, can be identified and converted into a desired electrical signal. These are classified as analogue and digital sensors. Others include temperature, ultrasonic, pressure, and proximity sensors. They use less energy and have high performance. Data is collected from the environment using sensors for the internet of things.

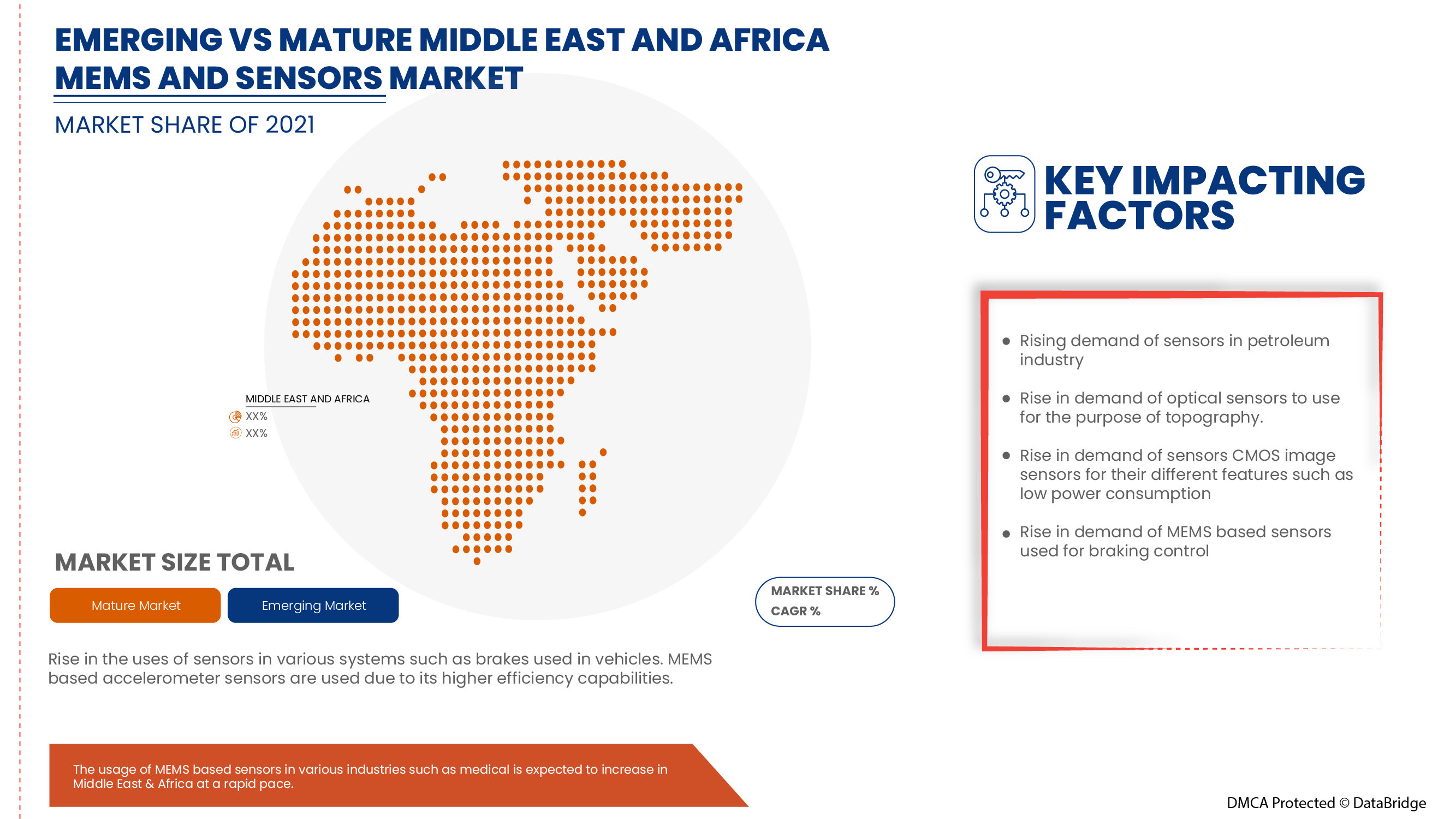

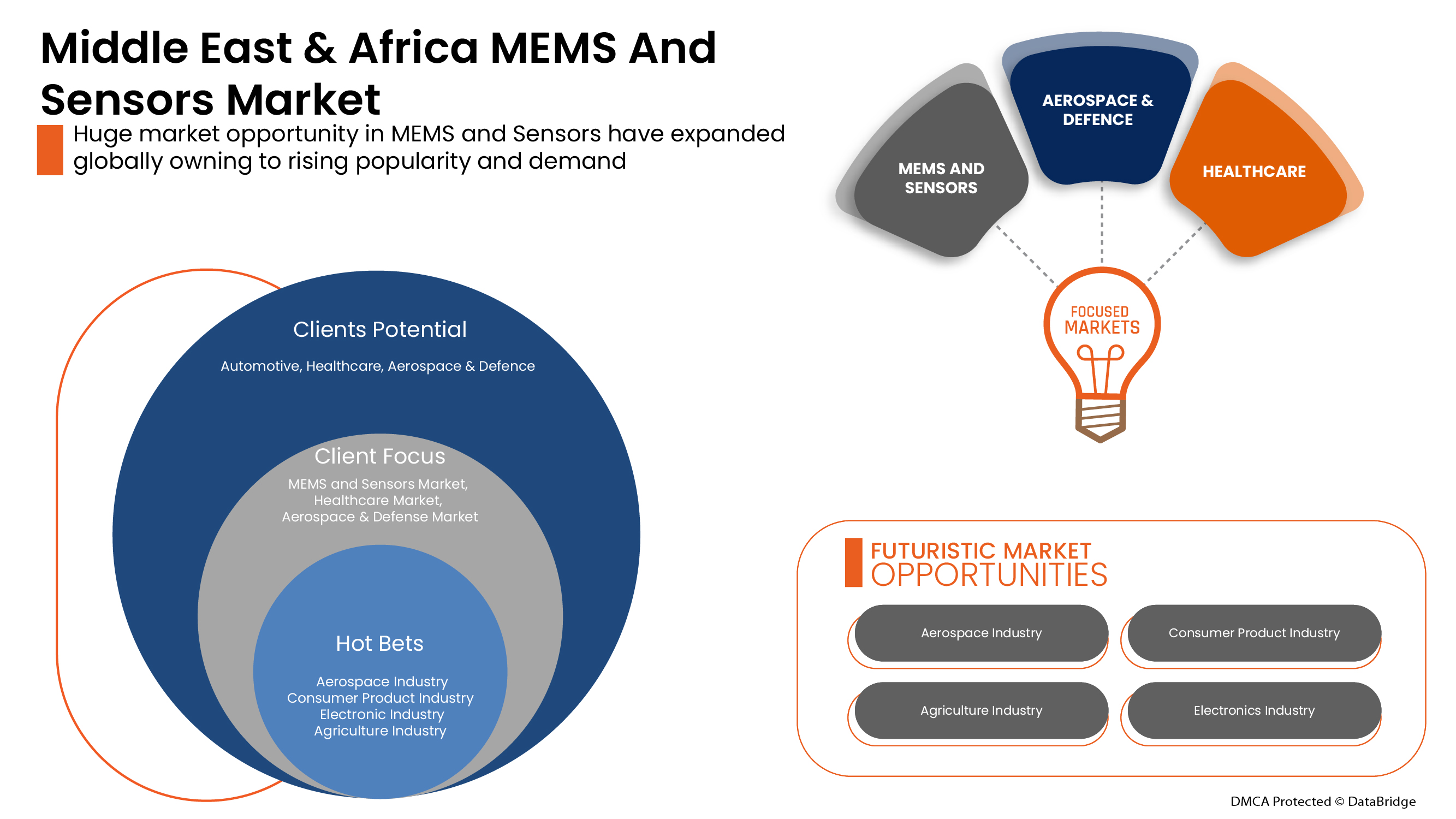

Technological developments in the semiconductor industry have increased the manufacturing of application-based and MEMS technology-based sensors used for various factors such as smart grid infrastructure, smart home appliances, and others. This has been made possible as the population is increasingly inclined toward digital platforms, internet services, and online services for their daily requirements. The growing popularity of IoT-based devices in semiconductors is increasing the demand for smart consumer electronics and wearables. It is expected that the Middle East and Africa MEMS and Sensors market will boom in the future.

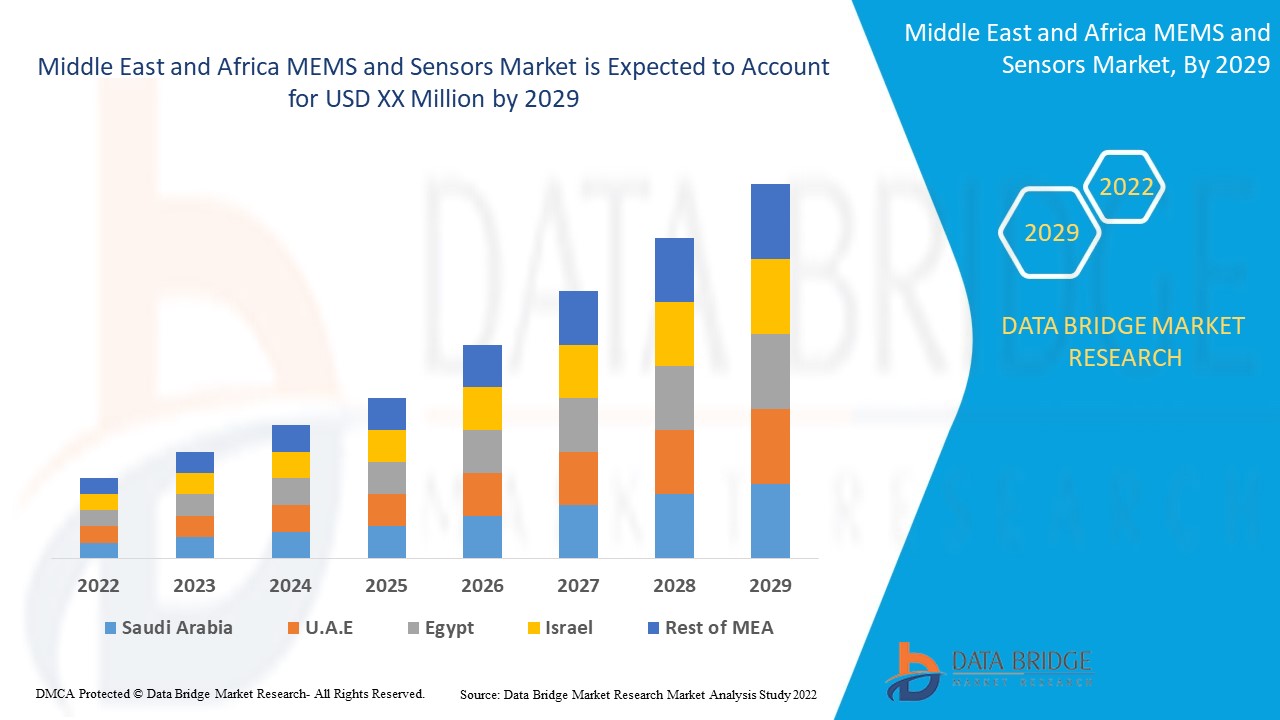

Currently, the importance of MEMS device has grown drastically, and the growth of inertial sensor, ultrasonic sensor, and packaging size based services across Middle East and Africa. In addition, the growing demand for MEMS and sensor in various sectors has fuelled the market boom. Data Bridge Market Research analyses that the Middle East and Africa MEMS and sensors market will grow CAGR of 7.6% during the forecast period of 2022 to 2029.

Market Definition

Les MEMS sont des systèmes intégrés de dispositifs et de structures mécaniques et électromécaniques fabriqués à l'aide de techniques de microfabrication. Un dispositif MEMS est constitué de propriétés tridimensionnelles qui détectent et manipulent toute propriété physique ou chimique. Les composants de base utilisant des microcapteurs, des microactionneurs et d'autres microstructures sont fabriqués sur un seul substrat de silicium. Les composants de base des dispositifs MEMS comprennent des microcapteurs et des microactionneurs, qui convertissent une forme d'énergie en une autre. Un dispositif MEMS peut avoir des composants statiques ou mobiles dont la dimension physique varie de moins d'un micron à plusieurs millimètres.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Par type (capteur inertiel, capteur à ultrasons, capteur de position, capteur de mouvement, microphone, capteur bio/chimique, capteur optique et capteur environnemental), matériau (polymère, métal, silicium et céramique), taille de l'emballage (moins de 0,5 mm, de 0,5 mm à 0,9 mm, plus de 0,9 mm), procédé de fabrication (dépôt, lithographie et gravure), type d'actionneur (optique, RF, microfluidique et tête à jet d'encre), utilisateur final (électronique grand public, informatique et télécommunications, automobile, aérospatiale, défense, médical, industriel et fabrication, infrastructure de réseau intelligent, maisons intelligentes, jeux et autres) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Panasonic Corporation of North America, Murata Manufacturing Co., Ltd, InvenSense, Honeywell International Inc., Infineon Technologies AG, STMicroelectronics, Texas Instruments Incorporated, NXP Semiconductors, Analog Devices, Inc., ROHM CO., LTD., Teledyne Technologies Incorporated., Robert Bosch GmbH., Sensata Technologies, Inc., DENSO CORPORATION., Hitachi, Ltd., Qualcomm Technologies, Inc., Allegro MicroSystems, Inc., MegaChips Corporation., Vishay Intertechnology, Inc. |

Dynamique du marché des MEMS et des capteurs au Moyen-Orient et en Afrique

Conducteurs

- Demande croissante de capteurs automobiles pour la sécurité

Le monde a progressivement changé de préférence pour les véhicules électriques plutôt que pour les véhicules conventionnels. Dans les véhicules, les capteurs et les dispositifs à base de MEMS sont des éléments essentiels du système de contrôle électronique des automobiles. Les voitures modernes, telles que les véhicules électriques hybrides et les véhicules hybrides rechargeables (PHEV), prennent des milliers de décisions en fonction des données fournies par divers capteurs interfacés avec le système informatique embarqué du véhicule. Les capteurs sont utilisés à des fins de sécurité dans les automobiles car ils peuvent fonctionner dans des conditions difficiles et rudes impliquant des températures extrêmes, des vibrations et une exposition aux contaminants environnementaux.

- Demande croissante de capteurs dans l'électronique grand public

La pandémie de COVID-19 a eu un impact positif sur le marché de l'électronique grand public en 2020. La croissance a été stimulée par le manque d'opportunités de divertissement en dehors du domicile et par le nombre croissant d'employés travaillant à domicile. L'électronique grand public comprend de nombreux appareils allant du divertissement aux loisirs en passant par la communication.

Les consommateurs adoptent rapidement de nouveaux produits émergents tels que les objets connectés, les enceintes intelligentes à commande vocale, les consoles de jeux vidéo et l'électronique automobile. Les capteurs sont largement utilisés dans l'électronique grand public pour la surveillance, la mesure, l'enregistrement des données et le contrôle. Diverses applications de l'électronique grand public, telles que les systèmes de télécommande de télévision, utilisent des capteurs infrarouges pour modifier les paramètres liés à l'appareil.

- Utilisation croissante des gyroscopes MEMS (microsystèmes électromécaniques)

Les gyroscopes MEMS ont été utilisés dans de nombreuses applications différentes, notamment dans les domaines grand public, automobile, industriel et militaire. Les gyroscopes MEMS ont permis des applications intéressantes dans les appareils portables, notamment la stabilisation optique de l'image pour les appareils photo, la navigation à l'estime et l'assistance GPS. L'avènement de la technologie MEMS a permis le développement de capteurs miniaturisés, peu coûteux et à faible consommation d'énergie pour diverses applications.

Ces dernières années, les semi-conducteurs, les composants passifs et les interconnexions ont connu des améliorations continues pour permettre une acquisition et un traitement de données de haute précision. Les capteurs MEMS sont largement acceptés en raison de la demande de capteurs pouvant tolérer plus de 175 degrés. Les gyroscopes MEMS sont utilisés en raison de leur tolérance aux températures élevées, de leurs tailles plus petites et de leur faible coût de maintenance.

- Applications croissantes des capteurs MEMS dans la défense et l'armée

Les capteurs destinés aux applications militaires et de défense nécessitent des technologies éprouvées et fiables. Les capteurs sont un élément essentiel des technologies car ils fournissent des solutions à l'écosystème de la défense, notamment en matière de surveillance et d'exécution.

Les différents systèmes, notamment les drones, les engins spatiaux, les missiles, les véhicules militaires, les navires, les systèmes marins, les satellites et les fusées, ont besoin de capteurs car ces systèmes sont utilisés pour collecter des données depuis l'espace. Les différents types de capteurs, tels que les capteurs actifs, intelligents, à caméra, infrarouges et nano, sont utilisés dans les applications militaires. Les capteurs actifs fournissent des solutions de détection dans les applications de contrôle et de mesure militaires hautes performances.

Opportunités

- Demande croissante d'infrastructures de réseaux intelligents

Les infrastructures de réseaux électriques intelligents ont besoin de capteurs pour surveiller la température des lignes électriques et les conditions météorologiques. Les capteurs qui surveillent les paramètres électriques sur l'ensemble d'une infrastructure de réseau électrique jouent un rôle fondamental dans la protection du réseau intelligent et l'amélioration de l'efficacité énergétique du réseau. Les réseaux intelligents comprennent des dispositifs de protection pour détecter les défauts électriques allant des relais électromécaniques analogiques classiques aux dispositifs électroniques intelligents modernes. Les systèmes de protection jouent un rôle essentiel dans le maintien de la qualité et de la fiabilité de l'énergie des réseaux intelligents.

L'infrastructure des réseaux intelligents se caractérise par une forte pénétration des sources d'énergie renouvelables disponibles. Elle se concentre principalement sur les indices de durée tels que l'indice de durée moyenne des interruptions du système (SAIDI) ou les indices de fréquence tels que l'indice de fréquence moyenne des interruptions du système (SAIFI).

- Développements dans le domaine des capteurs environnementaux

Des capteurs environnementaux polyvalents pour la surveillance des conditions environnementales sont adoptés à l'échelle mondiale. Les développements croissants dans les capteurs environnementaux tels que les capteurs de gaz, de température et de fumée disposent d'interfaces basées sur l'intelligence artificielle, qui ont conduit à la protection des conditions environnementales. À l'échelle industrielle, la technologie présente de nombreux avantages, tels que la surveillance continue des rejets chimiques, et contribuera à les réduire pour protéger les ressources environnementales.

De nombreux capteurs environnementaux, tels que les biocapteurs, sont introduits sur le marché pour surveiller les substances nocives pour l'environnement. Diverses entreprises prennent des initiatives pour fabriquer et développer des capteurs environnementaux

- Hausse des investissements en R&D de capteurs MEMS

Les capteurs MEMS ont beaucoup évolué depuis leur développement en 1971. Il s'agit d'une technologie à base de puces composée de capteurs composés d'une masse suspendue entre une paire de plaques capacitives. Leur taille a considérablement diminué tandis que leur efficacité a augmenté de manière exponentielle. Cependant, ils ont encore un long chemin à parcourir car la demande d'écrans ultra-minces et flexibles augmente. C'est pourquoi les grandes entreprises consacrent beaucoup d'efforts à la recherche du potentiel futur des capteurs MEMS et à leur développement pour en faire une réalité.

Les capteurs MEMS sont utilisés et exploités à des températures extrêmes. Ils sont principalement utilisés en raison de leurs propriétés de résistance aux chocs et aux vibrations. Par conséquent, pour surmonter de nombreuses limitations telles que les facteurs de précision et augmenter la précision des mesures, de nombreux travaux de R&D sont en cours pour améliorer encore cette technologie afin de réduire le coût des capteurs.

Impact du Covid-19 sur le marché des MEMS et des capteurs au Moyen-Orient et en Afrique

La pandémie de COVID-19 a eu un impact positif sur le marché de l'électronique grand public en 2020. La croissance a été stimulée par le manque d'opportunités de divertissement en dehors du domicile et par le nombre croissant d'employés travaillant à domicile. L'électronique grand public comprend de nombreux appareils allant du divertissement aux loisirs en passant par la communication.

Les consommateurs adoptent rapidement de nouveaux produits émergents tels que les objets connectés, les enceintes intelligentes à commande vocale, les consoles de jeux vidéo et l'électronique automobile. Les capteurs sont largement utilisés dans l'électronique grand public pour la surveillance, la mesure, l'enregistrement des données et le contrôle. Diverses applications de l'électronique grand public, telles que les systèmes de télécommande de télévision, utilisent des capteurs infrarouges pour modifier les paramètres liés à l'appareil.

Les capteurs utilisés dans l'électronique grand public et les appareils électroménagers comprennent des capteurs de pression, de proximité, de mouvement, de température, de débit et de niveau, des capteurs acoustiques, tactiles et d'image. De plus, les capteurs ont subi un changement radical, car leurs tailles ont diminué et leur efficacité a été multipliée par plusieurs. Une maison connectée est devenue une réalité où un seul geste peut contrôler toute une maison.

Développement récent

- En mai 2022, Analog Devices Inc. et Synopsys ont collaboré pour accélérer la conception de systèmes d'alimentation. Cette collaboration a permis de proposer des options de modèles pour les circuits intégrés CC/CC et les régulateurs µModule. Cette collaboration contribuera à développer l'innovation des systèmes électroniques et à répondre aux objectifs de conception des clients. Cette collaboration aidera les entreprises à accroître leur clientèle

- En mai 2022, Honeywell International Inc. a annoncé l'élargissement de son portefeuille de communication à l'intérieur des bâtiments. Cette expansion aidera l'entreprise à développer le spectre de sécurité et sera en mesure de fournir des solutions évolutives. Cela aidera l'entreprise à cibler de nouveaux clients.

Portée du marché des MEMS et des capteurs au Moyen-Orient et en Afrique

Le marché des MEMS et des capteurs du Moyen-Orient et de l'Afrique est segmenté en fonction du type, du matériau, de la taille de l'emballage, du processus de fabrication, du type d'actionneur et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par type

- Capteur inertiel

- Capteur à ultrasons

- Capteur de position

- Détecteur de mouvement

- Microphone

- Capteur bio/chimique

- Capteur optique

- Capteur environnemental

Sur la base du type, le marché des MEMS et des capteurs est segmenté en capteurs inertiels, capteurs à ultrasons, capteurs de position, capteurs de mouvement, microphone, capteurs bio/chimiques, capteurs optiques et capteurs environnementaux.

Matériel

- Polymère

- Métal

- Silicium

- Céramique

Sur la base du matériau, le marché des MEMS et des capteurs est segmenté en polymère, métal, silicium et céramique.

Taille de l'emballage

- Moins de 0,5 mm

- 0,5 mm à 0,9 mm

- Plus de 0,9 mm

Sur la base de la taille de l'emballage, le marché des MEMS et des capteurs est segmenté en moins de 0,5 mm, 0,5 mm à 0,9 mm et plus de 0,9 mm.

Processus de fabrication

- Déposition

- Lithographie

- Gravure

Sur la base du processus de fabrication, le marché des MEMS et des capteurs est segmenté en dépôt, lithographie et gravure.

Type d'actionneur

- Optique

- RF

- Microfluidique

- Tête à jet d'encre

Sur la base du type d'actionneur, le marché des MEMS et des capteurs est segmenté en optique, RF, microfluidique et tête à jet d'encre.

Utilisateur final

- Électronique grand public

- Informatique et télécommunication

- Automobile

- Aérospatial

- Défense

- Médical

- Industrie et fabrication

- Infrastructures de réseaux intelligents

- Maisons intelligentes

- Jeux

- Autres

Sur la base de l'utilisateur final, le marché des MEMS et des capteurs est segmenté en électronique grand public, informatique et télécommunications, automobile, aérospatiale, défense, médical, industriel et manufacturier, infrastructure de réseau intelligent, maisons intelligentes, jeux et autres.

Analyse/perspectives régionales du marché des MEMS et des capteurs au Moyen-Orient et en Afrique

Le marché des MEMS et des capteurs est analysé par type, matériau, taille de l'emballage, processus de fabrication, type d'actionneur, utilisateur final comme référencé ci-dessus.

Les pays couverts par le marché des MEMS et des capteurs au Moyen-Orient et en Afrique sont l'Afrique du Sud, l'Arabie saoudite, les Émirats arabes unis, l'Égypte, Israël, le reste du Moyen-Orient et de l'Afrique.

L’Arabie saoudite est le pays dominant en raison de l’utilisation de la technologie et de la modernisation.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et les changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des MEMS et des capteurs au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des MEMS et des capteurs fournit des détails sur le concurrent. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des MEMS et des capteurs.

Français Certains des principaux acteurs opérant sur le marché des MEMS et des capteurs sont Panasonic Corporation of North America, Murata Manufacturing Co., Ltd, InvenSense, Honeywell International Inc., Infineon Technologies AG, STMicroelectronics, Texas Instruments Incorporated, NXP Semiconductors, Analog Devices, Inc., ROHM CO., LTD., Teledyne Technologies Incorporated., Robert Bosch GmbH., Sensata Technologies, Inc., DENSO CORPORATION., Hitachi, Ltd., Qualcomm Technologies, Inc., Allegro MicroSystems, Inc, MegaChips Corporation., Vishay Intertechnology, Inc entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATIONS

4.1.1 OVERVIEW

4.1.2 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)

4.1.3 OCCUPATIONAL SAFETY & HEALTH ADMINISTRATION (OSHA)

4.1.4 AMERICAN NATIONAL STANDARDS INSTITUTE (ANSI)

4.1.5 UNDERWRITERS LABORATORIES (UL)

4.1.6 UNDERWRITERS LABORATORIES (UL)

4.1.7 EN ISO/IEC 17025

4.1.8 CCC CERTIFICATION

4.2 PORTER'S FIVE FORCE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR AUTOMOTIVE SENSORS FOR SECURITY

5.1.2 RISING DEMAND FOR SENSORS IN CONSUMER ELECTRONICS

5.1.3 INCREASING USE OF (MICRO-ELECTRO-MECHANICAL-SYSTEM) MEMS GYROSCOPES

5.1.4 GROWING APPLICATIONS OF MEMS SENSORS IN DEFENSE AND MILITARY

5.2 RESTRAINT

5.2.1 LACK OF STANDARDIZED FABRICATION PROCESS OF MEMS (MICRO-ELECTRO-MECHANICAL-SYSTEM)

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR SMART GRID INFRASTRUCTURE

5.3.2 DEVELOPMENTS IN ENVIRONMENTAL BASED SENSORS

5.3.3 RISE IN INVESTMENTS FOR R&D OF MEMS SENSORS

5.4 CHALLENGES

5.4.1 TECHNICAL CHALLENEGS AND HIGH COST OF END PRODUCTS

5.4.2 TOUCH SENSORS LEAD TO HIGH SENSITIVITY

6 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY TYPE

6.1 OVERVIEW

6.2 MICROPHONE

6.3 MOTION SENSOR

6.3.1 ACTIVE

6.3.1.1 ULTRASONIC SENSOR

6.3.1.2 MICROWAVE SENSOR

6.3.1.3 TOMOGRAPHIC SENSOR

6.3.2 PASSIVE

6.3.2.1 DUAL OR HYBRID TECHNOLOGY

6.3.2.2 INFRARED MOTION SENSOR

6.3.2.3 OTHERS

6.4 OPTICAL SENSOR

6.4.1 AMBIENT LIGHT SENSOR

6.4.2 MICROBOLOMETER

6.4.3 PIR AND THERMOPHILE

6.4.4 OTHERS

6.5 INERTIAL SENSOR

6.5.1 ACCELEROMETER

6.5.1.1 SINGLE AXIS

6.5.1.2 MULTI AXIS

6.5.2 GYROSCOPE

6.5.3 COMBO SENSOR

6.5.4 MAGNETOMETER

6.6 POSITION SENSOR

6.6.1 PROXIMITY SENSORS

6.6.2 LINEAR SENSORS

6.6.3 DISPLACEMENT SENSORS

6.6.4 3D SENSORS

6.6.5 PHOTOELECTRIC SENSORS

6.6.6 ROTARY SENSOR

6.7 ULTRASONIC SENSOR

6.8 ENVIRONMENTAL SENSOR

6.8.1 HUMIDITY SENSORS

6.8.1.1 ABSOLUTE HUMIDITY SENSORS

6.8.1.2 RELATIVE HUMIDITY SENSORS

6.8.1.3 OSCILLATING HYGROMETER

6.8.1.4 OPTICAL HYGROMETER

6.8.1.5 GRAVIMETRIC HYGROMETER

6.8.2 PRESSURE SENSORS

6.8.2.1 GAUGE PRESSURE SENSORS

6.8.2.2 DIFFERENTIAL PRESSURE SENSORS

6.8.2.3 ABSOLUTE PRESSURE SENSORS

6.8.2.4 VACUUM PRESSURE SENSORS

6.8.2.5 SEALED PRESSURE SENSORS

6.8.3 TEMPERATURE SENSORS

6.8.3.1 CONTACT

6.8.3.1.1 THERMOCOUPLES

6.8.3.1.2 BIMETALLIC TEMPERATURE SENSORS

6.8.3.1.3 RESISTIVE TEMPERATURE DETECTORS

6.8.3.1.4 TEMPERATURE SENSORS ICS

6.8.3.1.5 THERMISTORS

6.8.3.2 NON-CONTACT

6.8.3.2.1 FIBER OPTIC TEMPERATURE SENSORS

6.8.3.2.2 INFRARED TEMPERATURE SENSORS

6.8.4 GAS SENSORS

6.8.4.1 OXYGEN

6.8.4.2 CARBON DIOXIDE

6.8.4.3 AMMONIA

6.8.4.4 HYDROGEN

6.8.4.5 HYDROGEN SULFIDE

6.8.4.6 CARBON MONOXIDE

6.8.4.7 METHANE

6.8.4.8 NITROGEN OXIDE

6.8.4.9 CHLORINE

6.8.4.10 HYDROCARBON

6.8.4.11 VOLATILE ORGANIC COMPOUND

6.8.5 OTHERS

6.9 BIO/CHEMICAL SENSOR

6.9.1 ELECTROCHEMICAL

6.9.2 SENSOR PATCH

7 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY ACTUATOR TYPE

7.1 OVERVIEW

7.2 OPTICAL

7.3 RF

7.3.1 SWITCH

7.3.2 FILTER

7.3.3 OSCILLATOR

7.4 MICROFLUIDICS

7.5 INKJET HEAD

8 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY PACKAGING SIZE

8.1 OVERVIEW

8.2 LESS THAN 0.5 MM

8.3 0.5 MM TO 0.9 MM

8.4 MORE THAN 0.9 MM

9 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY FABRICATION PROCESS

9.1 OVERVIEW

9.2 DEPOSITION

9.3 LITHOGRAPHY

9.4 ETCHING

10 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 POLYMER

10.3 METAL

10.4 SILICON

10.5 CERAMIC

11 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY END USER

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 BY TYPE

11.2.1.1 SMARTPHONES

11.2.1.2 LAPTOPS

11.2.1.3 TABLETS

11.2.1.4 CAMERAS

11.2.1.5 WEARABLE DEVICES

11.2.1.6 HEADPHONES

11.2.1.7 SMART AUDIO DEVICES

11.2.1.8 TELEVISION

11.2.1.9 INKJET PRINTERS

11.2.1.10 AR/VR

11.2.1.11 OTHERS

11.2.2 BY SENSOR TYPE

11.2.2.1 MICROPHONE

11.2.2.2 MOTION SENSOR

11.2.2.3 OPTICAL SENSOR

11.2.2.4 INERTIAL SENSOR

11.2.2.5 POSITION SENSOR

11.2.2.6 ULTRASONIC SENSOR

11.2.2.7 ENVIRONMENTAL SENSOR

11.2.2.8 BIO/CHEMICAL SENSOR

11.2.2.9 OTHERS

11.3 IT AND TELECOMMUNICATION

11.4 AUTOMOTIVE

11.4.1 BY TYPE

11.4.1.1 VEHICLE COMFORT SYSTEMS

11.4.1.2 AIR CONDITIONING COMPRESSOR

11.4.1.3 BRAKE FORCE AND SUSPENSION CONTROL

11.4.1.4 FUEL AND VAPOUR LEVEL SENSOR

11.4.1.5 ENGINE MANAGEMENT SYSTEM

11.4.1.6 RESTRAINT SYSTEMS

11.4.1.7 TIRE PRESSURE

11.4.1.8 OTHERS

11.4.2 BY SENSOR TYPE

11.4.2.1 MICROPHONE

11.4.2.2 MOTION SENSOR

11.4.2.3 OPTICAL SENSOR

11.4.2.4 INERTIAL SENSOR

11.4.2.5 POSITION SENSOR

11.4.2.6 ULTRASONIC SENSOR

11.4.2.7 ENVIRONMENTAL SENSOR

11.4.2.8 BIO/CHEMICAL SENSOR

11.4.2.9 OTHERS

11.5 GAMING

11.5.1 MICROPHONE

11.5.2 MOTION SENSOR

11.5.3 OPTICAL SENSOR

11.5.4 INERTIAL SENSOR

11.5.5 POSITION SENSOR

11.5.6 ULTRASONIC SENSOR

11.5.7 ENVIRONMENTAL SENSOR

11.5.8 BIO/CHEMICAL SENSOR

11.5.9 OTHERS

11.6 AEROSPACE

11.6.1 MICROPHONE

11.6.2 MOTION SENSOR

11.6.3 OPTICAL SENSOR

11.6.4 INERTIAL SENSOR

11.6.5 POSITION SENSOR

11.6.6 ULTRASONIC SENSOR

11.6.7 ENVIRONMENTAL SENSOR

11.6.8 BIO/CHEMICAL SENSOR

11.6.9 OTHERS

11.7 DEFENSE

11.7.1 BY TYPE

11.7.1.1 AIRCRAFT CONTROL

11.7.1.2 SURVEILLANCE

11.7.1.3 ARMING SYSTEMS

11.7.1.4 EMBEDDED SENSORS

11.7.1.5 MUNITIONS GUIDANCE

11.7.1.6 DATA STORAGE

11.7.2 BY SENSOR TYPE

11.7.2.1 MICROPHONE

11.7.2.2 MOTION SENSOR

11.7.2.3 OPTICAL SENSOR

11.7.2.4 INERTIAL SENSOR

11.7.2.5 POSITION SENSOR

11.7.2.6 ULTRASONIC SENSOR

11.7.2.7 ENVIRONMENTAL SENSOR

11.7.2.8 BIO/CHEMICAL SENSOR

11.7.2.9 OTHERS

11.8 MEDICAL

11.8.1 BY TYPE

11.8.1.1 MONITORING DEVICES

11.8.1.2 SURGICAL DEVICES

11.8.1.3 DIAGNOSTIC DEVICES

11.8.1.4 THERAPEUTIC DEVICES

11.8.1.5 OTHERS

11.8.2 BY SENSOR TYPE

11.8.2.1 MICROPHONE

11.8.2.2 MOTION SENSOR

11.8.2.3 OPTICAL SENSOR

11.8.2.4 INERTIAL SENSOR

11.8.2.5 POSITION SENSOR

11.8.2.6 ULTRASONIC SENSOR

11.8.2.7 ENVIRONMENTAL SENSOR

11.8.2.8 BIO/CHEMICAL SENSOR

11.8.2.9 OTHERS

11.9 INDUSTRIAL AND MANUFACTURING

11.9.1 BY TYPE

11.9.1.1 INDUSTRIAL ROBOTS

11.9.1.2 DRONES

11.9.1.3 OTHERS

11.9.2 BY SENSOR TYPE

11.9.2.1 MICROPHONE

11.9.2.2 MOTION SENSOR

11.9.2.3 OPTICAL SENSOR

11.9.2.4 INERTIAL SENSOR

11.9.2.5 POSITION SENSOR

11.9.2.6 ULTRASONIC SENSOR

11.9.2.7 ENVIRONMENTAL SENSOR

11.9.2.8 BIO/CHEMICAL SENSOR

11.9.2.9 OTHERS

11.1 SMART GRID INFRASTRUCTURE

11.10.1 MICROPHONE

11.10.2 MOTION SENSOR

11.10.3 OPTICAL SENSOR

11.10.4 INERTIAL SENSOR

11.10.5 POSITION SENSOR

11.10.6 ULTRASONIC SENSOR

11.10.7 ENVIRONMENTAL SENSOR

11.10.8 BIO/CHEMICAL SENSOR

11.10.9 OTHERS

11.11 SMART HOMES

11.11.1 MICROPHONE

11.11.2 MOTION SENSOR

11.11.3 OPTICAL SENSOR

11.11.4 INERTIAL SENSOR

11.11.5 POSITION SENSOR

11.11.6 ULTRASONIC SENSOR

11.11.7 ENVIRONMENTAL SENSOR

11.11.8 BIO/CHEMICAL SENSOR

11.11.9 OTHERS

11.12 OTHERS

12 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET BY GEOGRAPHY

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 SOUTH AFRICA

12.1.3 U.A.E.

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SENSATA TECHNOLOGIES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 ROBERT BOSCH GMBH

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DENSO CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 HITACHI, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 HONEYWELL INTERNATIONAL INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALLEGRO MICROSYSTEMS, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ANALOG DEVICES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 INVENSENSE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 INFINEON TECHNOLOGIES AG

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MURATA MANUFACTURING CO., LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 MEGACHIPS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 NXP SEMICONDUCTORS

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 PANASONIC CORPORATION OF NORTH AMERICA

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 QUALCOMM TECHNOLOGIES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 ROHM CO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 STMICROELECTRONICS

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TEXAS INSTRUMENTS INCORPORATED

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 TELEDYNE TECHNOLOGIES INCORPORATED

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VISHAY INTERTECHNOLOGY, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 MIDDLE EAST & AFRICA MICROPHONE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA MOTION SENSORS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA MOTION SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA ACTIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA PASSIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA OPTICAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA OPTICAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA INERTIAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA INERTIAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA ACCELEROMETER IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA POSITION SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA POSITION SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA ULTRASONIC SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA ENVIRONMENTAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA HUMIDITY SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA PRESSURE SENSORS IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA TEMPERATURE SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA CONTACT IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA NON-CONTACT IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA GAS SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA BIO/CHEMICAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA BIO/CHEMICAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY ACTUATOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA OPTICAL IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA RF IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA RF IN MEMS AND SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA MICROFLUIDICS IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA INKJET HEAD IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA LESS THAN 0.5 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA 0.5MM TO 0.9 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA MORE THAN 0.9 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY FABRICATION PROCESS, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA DEPOSITION IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA LITHOGRAPHY IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA ETCHING IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA POLYMER IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA METAL IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA SILICON IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA CERAMIC IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA IT AND TELECOMMUNICATION IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA AUTOMOTIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA AUTOMOTIVE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA GAMING IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA GAMING IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA AEROSPACE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA AEROSPACE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA DEFENSE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA DEFENSE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA DEFENSE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA MEDICAL IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA MEDICAL IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA MEDICAL IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA SMART GRID INFRASTRUCTURE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA SMART GRID INFRASTRUCTURE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA SMART HOMES IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA SMART HOMES IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA OTHERS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: SEGMENTATION

FIGURE 11 DEMAND FOR HIGH DEFINITION CONTENT BY CONSUMERS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC EXPECTED TO DOMINATE, AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET

FIGURE 15 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY ACTUATOR TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY PACKAGING SIZE, 2021

FIGURE 18 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY FABRICATION PROCESS, 2021

FIGURE 19 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET, BY MATERIAL, 2021

FIGURE 20 MIDDLE EAST & AFRICA MEMS & SENSORS MARKET, BY END USER, 2021

FIGURE 21 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2021)

FIGURE 23 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: BY TYPE (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA MEMS AND SENSORS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.