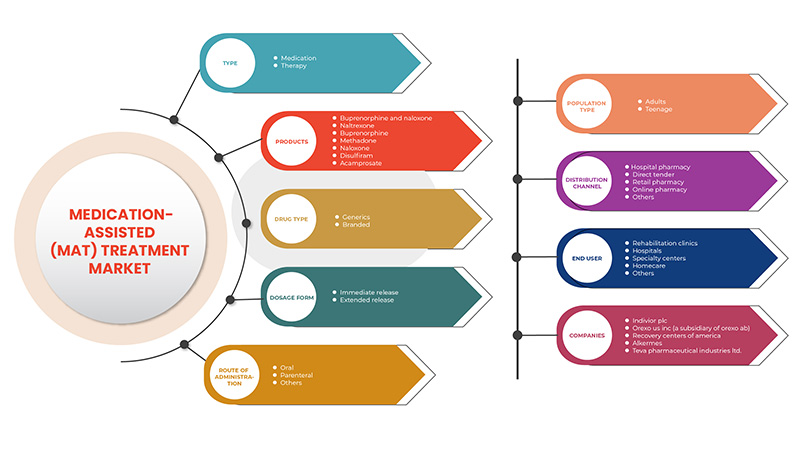

Middle East and Africa Medication-Assisted Treatment (MAT) Market, By Type (Medication and Therapy), Products (Buprenorphine and Naloxone, Naltrexone, Buprenorphine, Methadone, Naloxone, Disulfiram and Acamprosate), Drug Type (Generics and Branded), Dosage Form (Immediate Release and Extended Release), Route of Administration (Oral, Parenteral and Others), Population Type (Adults and Teenage), End User (Rehabilitation Clinics, Hospitals, Specialty Centres, Homecare and Others) Distribution Channel (Hospital Pharmacy, Direct Tender, Retail Pharmacy, Online Pharmacy and Others), Industry Trends and Forecast to 2029

Market Analysis and Insights

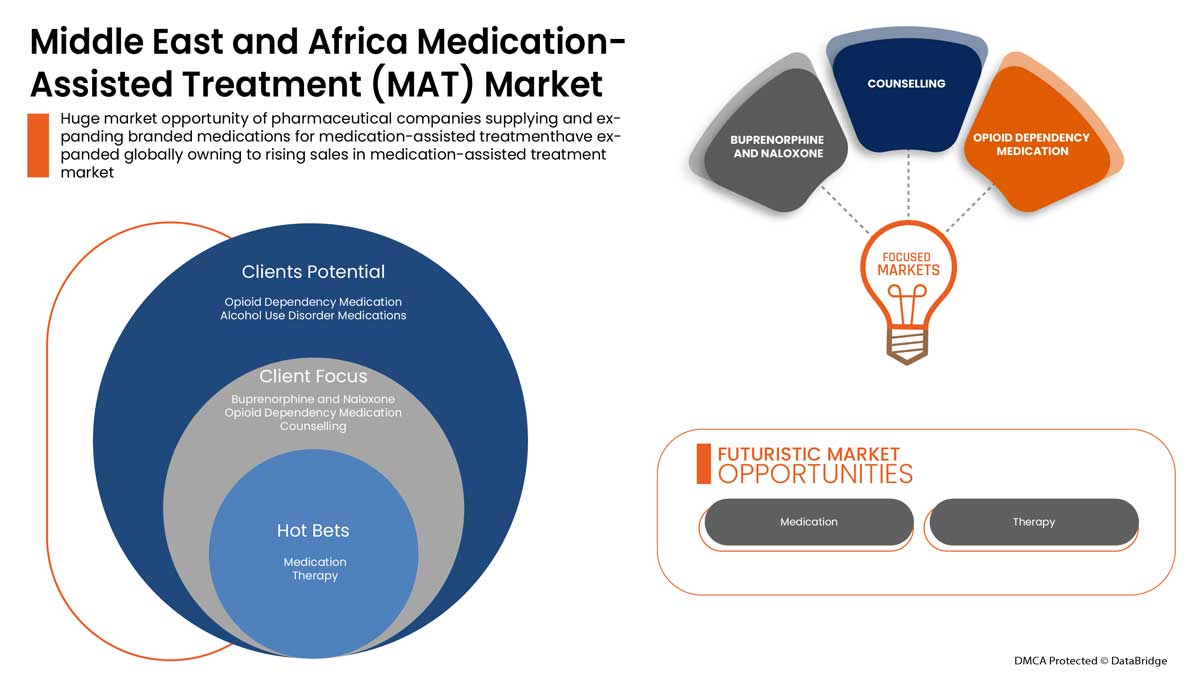

The Food and Drug Administration (FDA) approved three clinical drugs: buprenorphine, methadone, and naltrexone. Medication-assisted treatment (MAT) is applied to cure alcohol use disorder, opioid dependency medication, and opioid overdose prevention medication. Alcohol use disorder (AUD) is a medical condition characterized by an impaired ability to stop alcohol use despite adverse social, occupational, or health consequences. Acamprosate, disulfiram, and naltrexone are the most common medications used to treat alcohol use disorder (AUD). The opioid dependency medication, rise in addiction for opioids among patients. Buprenorphine, methadone and naltrexone are used to treat opioid use disorders to short-acting opioids such as heroin, morphine, and codeine, as well as semi-synthetic opioids like oxycodone and hydrocodone. These MAT medications are safe for months, years, or even a lifetime.

Market Definition

Medication-assisted treatment (MAT) involves using medications, combined with counselling and behavioural therapies, to provide a complete patient approach for the treatment of substance use disorders. MAT is primarily used to treat addiction to opioids such as heroin and prescription pain relievers. For opioid overdose prevention medication, naloxone is used to prevent opioid overdose by reversing the toxic effects of the overdose. According to the World Health Organization (WHO) and Substance Abuse and Mental Health Services Administration (SAMHSA) naloxone is one of many medications considered essential to a functioning health care system.

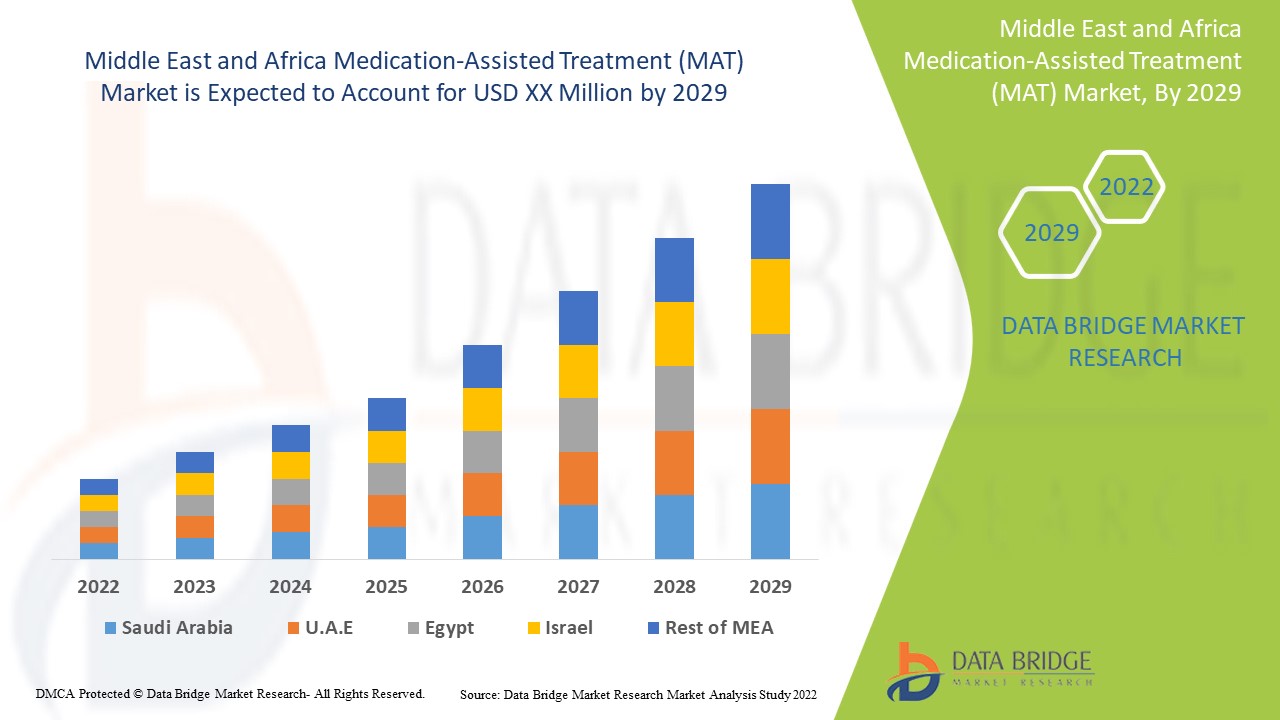

In the Middle East and Africa medication-assisted treatment is supportive and aims to reduce the severity of the symptoms. Data Bridge Market Research analyses that the medication-assisted treatment (MAT) market will grow at a CAGR of 7.1% from 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Par type (médicament et thérapie), produits (buprénorphine et naloxone, naltrexone, buprénorphine, méthadone, naloxone, disulfirame et acamprosate), type de médicament (génériques et de marque), forme posologique (libération immédiate et à libération prolongée), voie d'administration (orale, parentérale et autres), type de population (adultes et adolescents), utilisateur final (cliniques de réadaptation, hôpitaux, centres spécialisés, soins à domicile et autres), canal de distribution (pharmacie hospitalière, appel d'offres direct, pharmacie de détail, pharmacie en ligne et autres) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël, Koweït et reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

Sun Pharmaceutical Industries Ltd., Taj Pharmaceuticals Limited, Hikma Pharmaceuticals PLC, Pfizer Inc., Glenmark Pharmaceutical Inc., Viatris Inc., VistaPharm, Inc., Teva Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Amneal Pharmaceuticals LLC. entre autres |

Dynamique du marché du traitement assisté par médicaments (TAM) au Moyen-Orient et en Afrique

Conducteurs

- Augmentation de l'incidence des troubles liés à l'utilisation d'opioïdes (médicaments contre la dépendance aux opioïdes)

Le traitement assisté par médicaments (MAT) consiste à utiliser des médicaments en combinaison avec des conseils et des thérapies comportementales pour proposer une approche « globale » du patient pour traiter les troubles liés à la consommation de substances. Les médicaments utilisés dans le cadre du MAT sont approuvés par la Food and Drug Administration (FDA), et les programmes MAT sont axés sur la clinique et adaptés aux besoins de chaque patient.

Par exemple,

- La prévalence de la consommation d’opioïdes à haut risque (par injection ou utilisation de longue durée/régulière) chez les adultes (âgés de 15 à 64 ans) au Moyen-Orient et en Afrique est relativement stable depuis de nombreuses années, les estimations des utilisateurs s’élevant à environ 0,35 % de la population de l’UE.

Les entreprises étant constamment engagées dans des activités de recherche et de développement, les connaissances sur l'incidence des troubles liés à la consommation d'alcool et aux opioïdes aideraient à trouver de nouvelles solutions et à favoriser davantage de collaborations et de partenariats avec les acteurs du marché dans des pays tels que les États-Unis, l'Europe et la région Asie-Pacifique. Cela signifie une augmentation des investissements liés à la recherche et au développement pour le lancement de médicaments génériques dans le traitement assisté par médicament (MAT), ce qui devrait stimuler la croissance du marché.

- Utilisation du remboursement des traitements assistés par médicaments (TAM)

Le remboursement peut être accordé pour un traitement assisté par médicament même si le médicament n'a pas de statut valide. Si le médicament n'a pas de statut privilégié, le prescripteur doit obtenir l'autorisation du régime d'assurance-médicaments du membre.

Par exemple,

- En février 2021, l'American College of Emergency Physicians (ACEP) a élaboré les FAQ et les perles sur le remboursement et le codage à des fins d'information sur le traitement assisté par médicaments.

Des recherches approfondies soulignent que les médicaments utilisés dans le cadre du traitement assisté par médicaments sont efficaces pour le traitement des troubles liés à la consommation d’alcool et d’opioïdes et que la naloxone est efficace pour traiter les surdoses aiguës d’opioïdes. Alors que les programmes Medicaid continuent d’évaluer les besoins des personnes souffrant de troubles liés à la consommation d’alcool et d’opioïdes dans leurs États, ce rapport peut être une ressource. Ainsi, cela signifie l’avantage de la couverture du remboursement par Medicaid, qui devrait stimuler la croissance du marché mondial du traitement assisté par médicaments (MAT).

Opportunités

- Initiative stratégique des acteurs du marché

La demande de traitement assisté par médicaments a augmenté aux États-Unis, au Moyen-Orient et en Afrique en raison du traitement rapide des maladies chroniques. Ces facteurs favorables accroissent le besoin de médicaments et, pour répondre à la demande du marché, les petits et grands acteurs du marché utilisent diverses stratégies.

Par exemple,

- En avril 2021, Adamis Pharmaceuticals Corporation et USWM ont annoncé le lancement et la disponibilité d'un produit injectable à base de naloxone ZIMHI à haute dose pour aider à lutter contre les décès par surdose d'opioïdes. Le lancement devrait augmenter les revenus du segment de produits, ce qui stimulera la croissance du marché, et le ZIMHI sera disponible à un tarif réduit pour les premiers intervenants et les organismes de santé communautaire.

Ces initiatives stratégiques des acteurs du marché, notamment les acquisitions, les conférences et les lancements de produits ciblés, aident les entreprises à se développer et à améliorer leurs portefeuilles de produits, ce qui conduit finalement à une augmentation de la génération de revenus. Par conséquent, ces initiatives stratégiques des acteurs du marché offrent une opportunité qui les aide à stimuler la croissance du marché.

Contraintes/Défis

- Effets secondaires des médicaments utilisés dans le cadre du traitement assisté par médicaments (TAM)

Le traitement assisté par médicaments (TAM) consiste à utiliser des médicaments associés à des thérapies psychologiques et comportementales pour proposer une approche « globale du patient » dans le cadre d'une stratégie de traitement globale. Par conséquent, le coût élevé actuel devrait connaître une tendance à la baisse. Le TAM est le plus efficace pour traiter les troubles liés à la consommation d'alcool et d'opioïdes. Cependant, des effets secondaires spécifiques ont été signalés.

Par exemple,

- La méthadone et la buprénorphine, les médicaments génériques, sont chimiquement similaires aux opioïdes, leurs effets secondaires peuvent donc être similaires également. Ceux-ci peuvent inclure la constipation, la somnolence et les étourdissements. Certaines personnes peuvent ressentir des effets secondaires plus graves

Les complications indésirables signalées pourraient entraîner une baisse des ventes de médicaments contre la dépendance aux opioïdes, ce qui limiterait les ventes de ces médicaments. En outre, cela affecterait la fiabilité des fabricants impliqués dans ce marché et devrait donc freiner la croissance du marché.

Le rapport sur le marché du traitement assisté par médicament (MAT) fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché du traitement assisté par médicament (MAT), contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du Covid-19 sur le marché des traitements assistés par médicaments (TAM)

Pendant la pandémie, le traitement assisté par médicaments réduit considérablement la mortalité et la morbidité des patients atteints de COVID-19. D'autres études à grande échelle sont nécessaires pour valider ces résultats. Un protocole de traitement assisté par médicaments dans l'infection à COVID-19 doit être défini pour obtenir les meilleurs résultats cliniques possibles. Des essais cliniques ont été menés pendant la pandémie de Covid-19. Les services de traitement des troubles liés à l'utilisation d'opioïdes (MOUD) sont essentiels pour faire face à la crise des opioïdes, et la COVID-19 a eu un impact significatif sur la prestation de ces services.

Développement récent

- En avril 2021, Adamis Pharmaceuticals Corporation et USWM ont annoncé le lancement et la disponibilité d'un produit injectable à base de naloxone ZIMHI à haute dose pour aider à lutter contre les décès par surdose d'opioïdes. Le lancement devrait augmenter les revenus du segment de produits, ce qui stimulera la croissance du marché, et le ZIMHI sera disponible à un tarif réduit pour les premiers intervenants et les organismes de santé communautaire.

Portée du marché du traitement assisté par médicaments (TAM) au Moyen-Orient et en Afrique

Le marché du traitement assisté par médicament (MAT) est segmenté sur la base de huit segments : type, produits, type de médicament, forme posologique, voie d'administration, type de population, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Médicament

- Thérapie

Sur la base du type, le marché du traitement assisté par médicaments (MAT) du Moyen-Orient et de l'Afrique est segmenté en médicaments et en thérapie.

Produits

- Buprénorphine et naloxone

- Naltrexone

- Buprénorphine

- Méthadone

- Naloxone

- Disulfirame

- Acamprosate

Sur la base des produits, le marché du traitement assisté par médicaments (MAT) du Moyen-Orient et de l'Afrique est segmenté en buprénorphine et naloxone, naltrexone, buprénorphine, méthadone, naloxone, disulfirame et acamprosate.

Type de médicament

- Génériques

- De marque

Sur la base du type de médicament, le marché du traitement assisté par médicaments (MAT) au Moyen-Orient et en Afrique est segmenté en génériques et en produits de marque.

Forme posologique

- Diffusion immédiate

- Version étendue

Sur la base de la forme posologique, le marché du traitement assisté par médicaments (MAT) au Moyen-Orient et en Afrique est segmenté en libération immédiate et libération prolongée.

Voie d'administration

- Oral

- Parentérale

- Autres

Sur la base de la voie d'administration, le marché du traitement assisté par médicaments (MAT) au Moyen-Orient et en Afrique est segmenté en voie orale, parentérale et autres.

Type de population

- Adultes

- Adolescent

Sur la base du type de population, le marché du traitement assisté par médicaments (MAT) au Moyen-Orient et en Afrique est segmenté en adultes et adolescents.

Utilisateur final

- Cliniques de réadaptation

- Hôpitaux

- Centres spécialisés

- Soins à domicile

- Autres

Sur la base de l'utilisateur final, le marché du traitement assisté par médicaments (MAT) du Moyen-Orient et de l'Afrique est segmenté en cliniques de réadaptation, hôpitaux, centres spécialisés, soins à domicile et autres.

Canal de distribution

- Pharmacie de l'hôpital

- Appel d'offres direct

- Pharmacie de détail

- Pharmacie en ligne

- Autres

Sur la base du canal de distribution, le marché du traitement assisté par médicaments (MAT) au Moyen-Orient et en Afrique est segmenté en pharmacie hospitalière, appel d'offres direct, pharmacie de détail, pharmacie en ligne et autres.

Analyse/perspectives régionales du marché du traitement assisté par médicaments (TAM)

Le marché du traitement assisté par médicaments (MAT) au Moyen-Orient et en Afrique est analysé. Les informations sur la taille du marché et les tendances sont fournies par régions, type de produit, type, application, flux de travail, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché du traitement assisté par médicaments (MAT) sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, l’Égypte, Israël, le Koweït et le reste du Moyen-Orient et de l’Afrique.

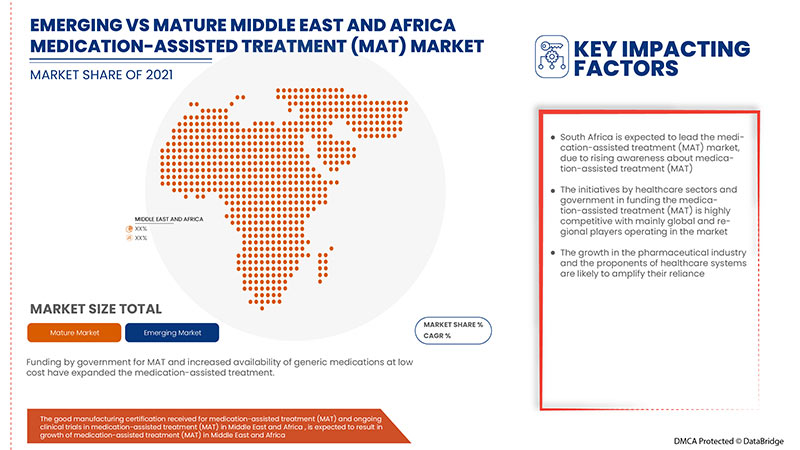

L'Afrique du Sud devrait dominer le marché en raison du manque de sensibilisation aux troubles liés à la consommation de substances et de l'augmentation de la population bénéficiant de traitements assistés par médicaments (MAT) et de programmes de sensibilisation aux traitements assistés par médicaments (MAT) dans la région du Moyen-Orient et de l'Afrique.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et les changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du traitement assisté par médicaments (TAM)

Le paysage concurrentiel du marché du traitement assisté par médicaments (MAT) au Moyen-Orient et en Afrique fournit des informations détaillées sur les concurrents. Les composants inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché du traitement assisté par médicaments (MAT).

Certains des principaux acteurs opérant sur le marché du traitement assisté par médicaments (MAT) sont Indivior PLC, Sun Pharmaceutical Industries Ltd., Taj Pharmaceuticals Limited, Hikma Pharmaceuticals PLC, Pfizer Inc., Glenmark Pharmaceutical Inc., Viatris Inc., Alvogen, Accord Healthcare, Teva Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd.Amneal Pharmaceuticals LLC. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 EPIDEMIOLOGY

4.2 PESTEL

4.3 PORTER'S FIVE FORCES MODEL

4.4 ANNUAL INCIDENCE OF SUBJECTS ENTERING MEDICATION-ASSISTED TREATMENT IN ALCOHOL, OPIOID USE DISORDER, AND OPIOID OVERDOSE PREVENTION (2021)

4.5 ANNUAL NUMBER OF TREATMENTS WITH CLONIDINE AND WITH LOFEXIDINE IN OPIOID USE DISORDER AND OPIOID OVERDOSE PREVENTION (2021)

4.6 ANNUAL INCIDENCE OF INDIVIDUALS RE-ENTERING MEDICATION-ASSISTED TREATMENT. FOR EXAMPLE, SOMEONE MAY DROP OUT OF TREATMENT AND RESTART TREATMENT LATER (2021)

4.7 ANNUAL USE OF NALTREXONE INJECTION AS PART OF TREATMENT FOR THE INITIAL WITHDRAWAL FROM OPIOIDS, AND ANNUAL MAINTENANCE THERAPY USING NALTREXONE INJECTION (2021)

4.8 PIPELINE ANALYSIS FOR MEDICATION-ASSISTED TREATMENT (MAT) MARKET

5 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE IN INCIDENCE OF ALCOHOL USE DISORDER AND OPIOID USE DISORDERS

6.1.2 THE FUNDING BY THE GOVERNMENT FOR MEDICATION-ASSISTED TREATMENT (MAT)

6.1.3 THE RISE IN THE POPULATION RECEIVING MEDICATION-ASSISTED TREATMENT (MAT) AND MEDICATION-ASSISTED AWARENESS PROGRAMMESMEDICATION-ASSISTED TREATMENT (MAT)

6.1.4 USE OF REIMBURSEMENT FOR MEDICATION-ASSISTED TREATMENT (MAT)

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS OF DRUGS USED IN MEDICATION-ASSISTED TREATMENT (MAT)

6.2.2 ETHICAL ISSUES RELATED TO USE OF MEDICATION-ASSISTED TREATMENTMEDICATION-ASSISTED TREATMENT (MAT)

6.2.3 RISE IN PRODUCT RECALLS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 THE LACK OF SKILLED PROFESSIONALS, REQUIRED FOR MEDICATION-ASSISTED TREATMENT

6.4.2 STRINGENT REGULATIONS

6.4.3 DISCONTINUATION OF MEDICATION-ASSISTED TREATMENT (MAT)

7 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE

7.1 OVERVIEW

7.2 MEDICATION

7.2.1 OPIOID DEPENDENCY MEDICATION

7.2.1.1 BUPRENORPHINE AND NALOXONE

7.2.1.2 BUPRENORPHINE

7.2.1.3 METHADONE

7.2.1.4 NALTREXONE

7.2.2 ALCOHOL USE DISORDER MEDICATIONS

7.2.2.1 NALTREXONE

7.2.2.2 DISULFIRAM

7.2.2.3 ACAMPROSATE

7.2.3 OPIOID OVERDOSE PREVENTION MEDICATION

7.2.3.1 NALOXONE

7.3 THERAPY

7.3.1 BEHAVIORAL THERAPY

7.3.2 EDUCATIONAL THERAPY

7.3.3 COUNSELLING

7.3.4 VOCATIONAL THERAPY

7.3.5 OTHERS

8 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS

8.1 OVERVIEW

8.2 BUPRENORPHINE AND NALOXONE

8.3 NALTREXONE

8.4 BUPRENORPHINE

8.5 METHADONE

8.6 NALOXONE

8.7 DISULFIRAM

8.8 ACAMPROSATE

9 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE

9.1 OVERVIEW

9.2 GENERICS

9.3 BRANDED

9.3.1 SUBOXONE

9.3.2 VIVITROL

9.3.3 BUTRANS

9.3.4 ZUBSOLV

9.3.5 PROBUPHINE

9.3.6 OTHERS

10 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM

10.1 OVERVIEW

10.2 IMMEDIATE RELEASE

10.3 EXTENDED RELEASE

11 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.2.1 TABLET

11.2.2 SUBLINGUAL FILM

11.2.3 OTHERS

11.3 PARENTERAL

11.3.1 SOLUTION

11.3.2 SUSPENSION

11.4 OTHERS

12 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE

12.1 OVERVIEW

12.2 ADULTS

12.3 TEENAGE

13 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER

13.1 OVERVIEW

13.2 REHABILITATION CLINICS

13.3 HOSPITALS

13.4 SPECIALTY CENTERS

13.5 HOMECARE

13.6 OTHERS

14 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 HOSPITAL PHARMACY

14.3 DIRECT TENDER

14.4 RETAIL PHARMACY

14.5 ONLINE PHARMACY

14.6 OTHERS

15 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 SOUTH AFRICA

15.1.2 SAUDI ARABIA

15.1.3 U.A.E

15.1.4 ISRAEL

15.1.5 EGYPT

15.1.6 KUWAIT

15.1.7 REST OF MIDDLE EAST AND AFRICA

16 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 TEVA PHARMACEUTICAL INDUSTRIES LTD. (2021)

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 INDIVOR PLC (2021)

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 VIATRIS INC (2021)

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 SUN PHARMACEUTICAL INDUSTRIES LTD (2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 ALKERMES (2021)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 PURDUE PHARMA L.P. (2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 PFIZER (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 GLENMARK PHARMACEUTICAL INC (2021)

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 DR. REDDY’S LABORATORIES LTD (2021)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 ALVOGEN (2021)

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 ADAMIS PHARMACEUTICALS CORPORATION (2021)

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 ACCORD HEALTHCARE (A SUBSIDIARY OF INTAS PHARMACEUTICALS)

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 AMNEAL PHARMACEUTICALS LLC (2021)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 AMERICAN ADDICTION CENTERS (2021)

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 HIKMA PHARMACEUTICALS PLC (2021)

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 LANNETT (2021)

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 MALLINCKRODT (2021)

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 OREXO US INC (A SUBSIDIARY OF OREXO, INC) (2021)

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 PINNACLE TREATMENT CENTERS

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 RECOVERY CENTERS OF AMERICA

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 TAJ PHARMACEUTICALS LIMITED

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENTS

18.22 TITAN PHARMACEUTICALS (2021)

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 VISTAPHARM, INC (A SUBSIDIARY OF VERTICE PHARMA, LLC. (2021))

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA BUPRENORPHINE AND NALOXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA NALTREXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA BUPRENORPHINE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA METHADONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA NALOXONE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA DISULFIRAM IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA ACAMPROSATE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA GENERICS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA IMMEDIATE RELEASE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA EXTENDED RELEASE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA ADULTS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA TEENAGE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA REHABILITATION CLINICS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA HOSPITALS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA SPECIALTY CENTERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA HOMECARE IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA HOSPITAL PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA DIRECT TENDER IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA RETAIL PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA ONLINE PHARMACY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA OTHERS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH AFRICA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH AFRICA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SAUDI ARABIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 U.A.E MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.A.E MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.A.E OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.A.E ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.A.E OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.A.E THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 U.A.E MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 100 U.A.E MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 101 U.A.E MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 102 U.A.E MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 103 U.A.E ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 104 U.A.E PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 105 U.A.E MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.A.E MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 U.A.E MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 108 ISRAEL MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 ISRAEL OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 ISRAEL OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 ISRAEL THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 ISRAEL MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 115 ISRAEL MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 116 ISRAEL BRANDED IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 117 ISRAEL MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 118 ISRAEL MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 119 ISRAEL ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 120 ISRAEL PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 121 ISRAEL MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 122 ISRAEL MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 ISRAEL MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 EGYPT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 EGYPT MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 EGYPT OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 EGYPT ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 EGYPT OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 EGYPT THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 EGYPT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 131 EGYPT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 132 EGYPT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 133 EGYPT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 134 EGYPT ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 135 EGYPT PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 136 EGYPT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 137 EGYPT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 EGYPT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 KUWAIT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 KUWAIT MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 KUWAIT OPIOID DEPENDENCY MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 KUWAIT ALCOHOL USE DISORDER MEDICATIONS IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 KUWAIT OPIOID OVERDOSE PREVENTION MEDICATION IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 KUWAIT THERAPY IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 KUWAIT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY PRODUCTS, 2020-2029 (USD MILLION)

TABLE 146 KUWAIT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 147 KUWAIT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DOSAGE FORM, 2020-2029 (USD MILLION)

TABLE 148 KUWAIT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 149 KUWAIT ORAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 150 KUWAIT PARENTERAL IN MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 151 KUWAIT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY POPULATION TYPE, 2020-2029 (USD MILLION)

TABLE 152 KUWAIT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 KUWAIT MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 REST OF MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET, BY TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET : SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: DBMR POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED INCIDENCE OF ALCOHOL USE DISORDERS AND RISE IN PRODUCT APPROVALS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET FROM 2022 TO 2029

FIGURE 13 TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET

FIGURE 15 INCIDENCE OF ALCOHOL CONSUMPTION IN 2019

FIGURE 16 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, 2021

FIGURE 21 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, 2022-2029 (USD MILLION)

FIGURE 22 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, CAGR (2022-2029)

FIGURE 23 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 24 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, 2021

FIGURE 25 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 26 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 28 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, 2021

FIGURE 29 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, 2022-2029 (USD MILLION)

FIGURE 30 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, CAGR (2022-2029)

FIGURE 31 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 32 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 33 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 34 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 35 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 36 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, 2021

FIGURE 37 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, 2022-2029 (USD MILLION)

FIGURE 38 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, CAGR (2022-2029)

FIGURE 39 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY POPULATION TYPE, LIFELINE CURVE

FIGURE 40 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, 2021

FIGURE 41 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 42 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 43 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 45 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 46 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 47 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 48 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: SNAPSHOT (2021)

FIGURE 49 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2021)

FIGURE 50 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 MIDDLE EAST AND AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: BY TYPE (2022-2029)

FIGURE 53 MIDDLE EAST & AFRICA MEDICATION-ASSISTED TREATMENT (MAT) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.