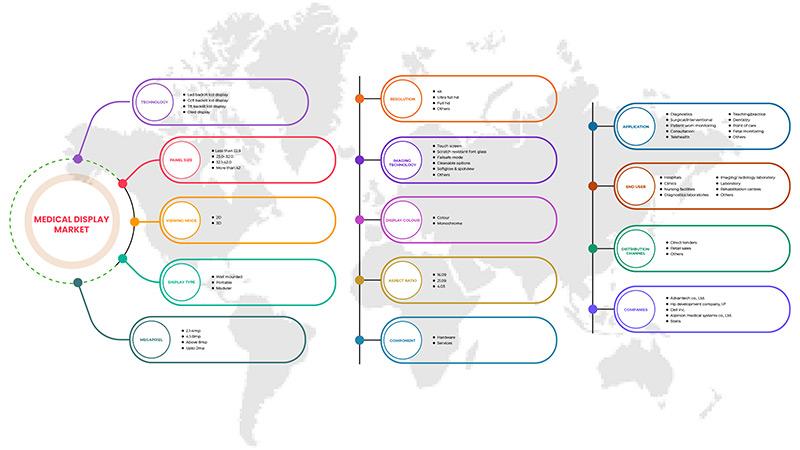

Middle East and Africa Medical Display Market, By Technology (LED-Backlit LCD Display, CCFL-Backlit LCD Display, TFT LCD Display And OLED Display), Panel Size (Under 22.9" Inch Panels, 23.0"- 32.0" Inch Panels, 27.0-41.9 Inch Panels and Above 42 Inch Panels), Viewing Mode (2D and 3D), Megapixel (UP TO 2MP, 2.1–4MP, 4.1–8MP and above 8MP), Resolution (4K, Ultra Full HD, Full HD and Others), Display Type (Wall Mounted, Portable, Modular), Imaging Technology (Touch Screen, Scratch Resistant Font Glass, Failsafe Mode, Cleanable Options, Softglow & Spotview And Others), Display Color (Colour, Monochrome), Aspect Ratio (16.09, 21.09, 4.03), Component (Hardware and Services), Application (Consultation, Diagnostic, Surgical/Interventional, Telehealth, Teaching / Practice, Fetal Monitoring, Dentistry, Point Of Care, Patient-Worn Monitoring And Others) End User (Hospitals, Clinics, Nursing Facilities, Diagnostic Laboratories, Imaging/Radiology Lab, Laboratory, Rehabilitation Centers And Others), Distribution Channel (Direct Tender, Retail Sales and Others) - Industry Trends and Forecast to 2029.

Middle East and Africa Medical Display Market Analysis and Insights

The main reasons for the growth of the medical display market is the rising demand for minimally invasive treatments (MIT) due to multiple benefits such as less post-operative pain, fewer operative, and major post-operative complications, shortened hospital stay, faster recovery times, less scarring, less stress on the immune system, smaller incision, and for some procedures it reduced operating time and reduced costs as well.

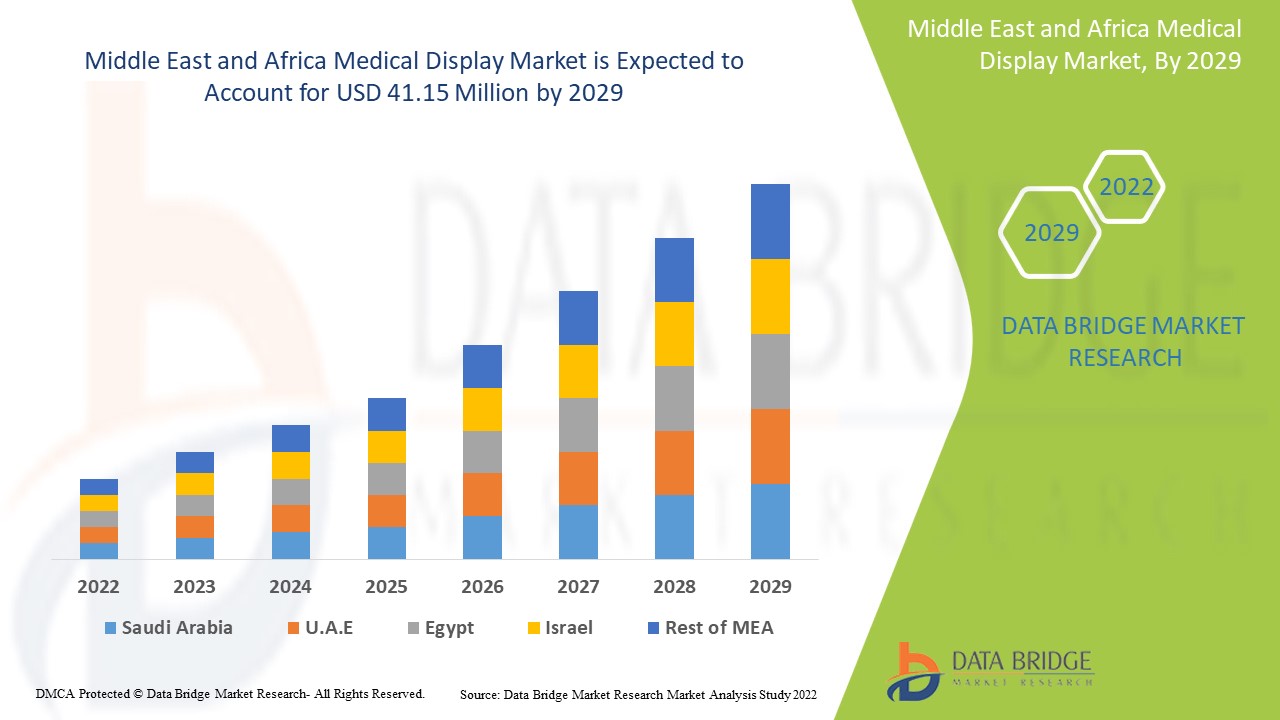

Data Bridge Market Research analyzes that the medical display market is expected to reach the value of USD 41.15 million by 2029, at a CAGR of 4.1% during the forecast period. Technology accounts for the largest type segment in the market due to rapid demand of advanced medical display and imaging services globally. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Technology (LED-Backlit LCD Display, CCFL-Backlit LCD Display, TFT LCD Display And OLED Display), Panel Size (Under 22.9" Inch Panels, 23.0"- 32.0" Inch Panels, 27.0-41.9 Inch Panels and Above 42 Inch Panels), Viewing Mode (2D and 3D), Megapixel (UP TO 2MP, 2.1–4MP, 4.1–8MP and above 8MP), Resolution (4K, Ultra Full HD, Full HD and Others), Display Type (Wall Mounted, Portable, Modular), Imaging Technology (Touch Screen, Scratch Resistant Font Glass, Failsafe Mode, Cleanable Options, Softglow & Spotview And Others), Display Color (Colour, Monochrome), Aspect Ratio (16.09, 21.09, 4.03), Component (Hardware and Services), Application (Consultation, Diagnostic, Surgical/Interventional, Telehealth, Teaching / Practice, Fetal Monitoring, Dentistry, Point Of Care, Patient-Worn Monitoring And Others) End User (Hospitals, Clinics, Nursing Facilities, Diagnostic Laboratories, Imaging/Radiology Lab, Laboratory, Rehabilitation Centers And Others), Distribution Channel (Direct Tender, Retail Sales and Others) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E, Israel, Egypt, Rest of Middle East & Africa |

|

Market Players Covered |

BenQ, ALPINION MEDICAL SYSTEMS Co., Ltd, Nanjing Jusha Commercial &Trading Co,Ltd, COJE CO.,LTD., Axiomtek Co., Ltd., Dell Inc., HP Development Company, L.P., Reshin, Onyx Healthcare Inc., Teguar Computers., Shenzhen Beacon Display Technology Co., Ltd., Rein Medical, STERIS., Barco., Hisense., Sony Corporation, Advantech Co., Ltd., LG Electronics., Sharp NEC Display Solutions, Koninklijke Philips N.V., EIZO INC., Novanta Inc., FSN Medical Technologies., Quest, Ampronix., Siemens Healthcare GmbH, Panasonic Corporation, among others. |

Medical Display Market Definition

A medical display is a monitor that meets the high demands of medical imaging. It usually comes with special image-enhancing technologies to ensure consistent brightness over the lifetime of the display, noise-free images, ergonomic reading and automated compliance with digital imaging and communications in medicine (DICOM) and other medical standards.

The development of medical imaging technologies has progressed healthcare, providing powerful diagnostic tools, supporting the non-invasive assessment of injuries and internal issues, and enabling diseases to be detected far earlier than ever before. Medical displays are preferred over consumer displays when used for medical imaging. The reason is simple: medical displays meet set requirements for image quality, medical regulations, and quality assurance.

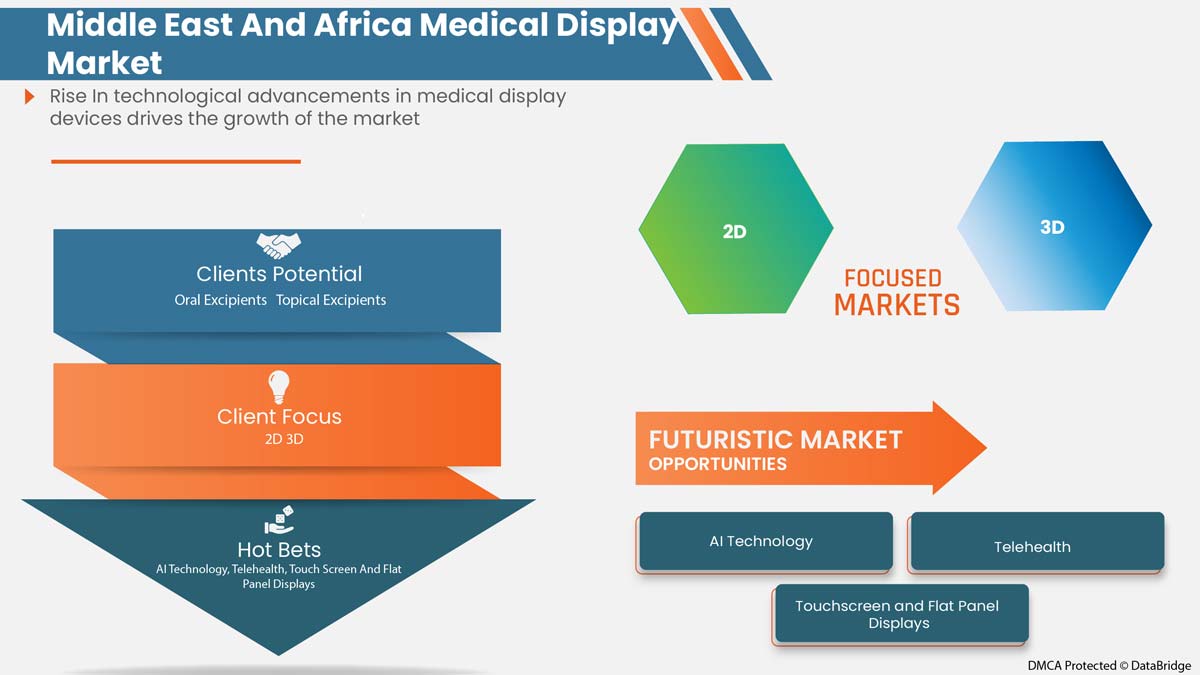

The future of medical display devices are based on the developments in artificial intelligence (AI) and data analytics. Medical devices are advancing disease management by allowing clinicians to personalize medicine like never before. These technologies provide revelatory insights into individual patients in real-time.

Medical Display Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- The Growing Trend Towards Minimally Invasive Treatment

The main reasons for the growth of the Middle East and Africa medical display market is the rising demand for minimally invasive treatments (MIT) due to multiple benefits such as less post-operative pain, fewer operative, and major post-operative complications, shortened hospital stay, faster recovery times, less scarring, less stress on the immune system, smaller incision, and for some procedures it reduced operating time and reduced costs as well.

Minimal invasive surgery is an excellent approach for diagnosing and treating a wide range of thoracic disorders that previously required sternotomy or open thoracotomy. The prevalence of chronic diseases requiring surgery has increased worldwide. Due to the many advantages of minimally invasive treatment, many patients prefer it. In addition, vascular and endovascular surgeries, neurological and spinal surgeries, orthopedic trauma care, and cardiac surgeries are performed in hybrid operating rooms. This feature allows hospitals to perform advanced surgical operations, which increases the demand for medical displays. In addition, increasing healthcare costs and the number of pathology and radiology laboratories drive the demand for medical monitors.

Minimally invasive surgery allows surgeons to use modern technology and advanced surgical techniques to operate on the human body in a less harmful way. This is expected to boost the demand for minimally invasive surgeries.

- Growing Healthcare Infrastructure

Governments and non-profit organizations in several countries mainly focus on developing health infrastructure to minimize disease burden and provide better health services. In addition, the adoption of technologically advanced medical devices, screens, monitors, and various other devices has increased. All such factors are likely to create favorable opportunities for market growth during the forecast period. In addition, heavy investments by key players in innovative product launches and updated features in the coming years can also boost the market.

Moreover, the increasing demand for cost-effective healthcare services, increasing demand for technical solutions, increasing high mobility of information, increasing government initiatives and incentives, and increasing funding for high-quality medical displays in hospitals and research centers are expected to drive these healthcare facilities in the market. Medical software infrastructure has formed the basis for recent advances in medical displays, digital medical libraries, and management information systems. These factors are expected to drive the growth of the Middle East and Africa medical display market.

Opportunity

- Technological Advancements In Medical Display Instruments

Alors que le marché se concentre sur la production de formes galéniques à administration orale, il existe une lutte constante pour développer des formulations appropriées de nouvelles molécules qui permettent l'administration orale et, simultanément, garantissent au médicament une biodisponibilité optimale chez les patients. Pour surmonter ce problème, les fabricants d'excipients pharmaceutiques développent des produits plus simples et réduisent le temps et les coûts de développement. Le développement des technologies d'affichage médical a changé le secteur de la santé, en fournissant des outils de diagnostic, la télésanté, en fournissant un soutien pour les traitements non invasifs, en permettant l'évaluation des maladies et en permettant leur détection plus précoce.

Le lancement de développements technologiques dans les dispositifs d'affichage médical améliore l'efficacité de l'affichage médical et augmente la facilité d'utilisation des dispositifs d'affichage médical. L'essor des applications technologiques dans les dispositifs d'affichage médical entraînerait une réduction de la main-d'œuvre et un diagnostic et une guérison rapides des maladies. À l'avenir, la technologie de l'intelligence artificielle remplacera le marché de l'affichage médical. Ce facteur devrait constituer une opportunité pour la croissance du marché de l'affichage médical au Moyen-Orient et en Afrique au cours de la période de prévision.

Retenue/Défis

- Coûts élevés des dispositifs d’affichage médicaux

Le coût élevé des dispositifs d'affichage et leur mise en œuvre sont les principaux facteurs qui freinent la croissance du marché, en particulier dans les pays où le scénario de remboursement est médiocre. La plupart des établissements de santé des pays en développement, tels que les hôpitaux et les centres de diagnostic, ne peuvent pas se permettre ces appareils en raison des coûts d'installation et de maintenance élevés. En raison du coût élevé de ces équipements médicaux et des faibles ressources financières, les établissements de santé des pays émergents sont réticents à investir dans de nouveaux systèmes technologiquement avancés. Ces facteurs peuvent entraver la numérisation des établissements de santé et avoir un impact sur l'adoption de technologies avancées pour le diagnostic et l'analyse.

Les progrès technologiques conduisant au développement de dispositifs d'affichage avancés et innovants font grimper le coût de ces dispositifs. Ainsi, le coût élevé des dispositifs d'affichage devrait freiner la croissance du marché.

Développements récents

- En juin 2022, EIZO Corporation a lancé le RadiForce MX243W, un moniteur de 24,1 pouces et 2,3 mégapixels (1920 x 1200 pixels). Le moniteur de 24,1 pouces et 2,3 mégapixels (1920 x 1200 pixels) a été conçu pour une surveillance et un diagnostic minutieux de la physiologie complète du système du patient dans les cliniques et les hôpitaux. Le lancement a permis l'ajout d'un nouveau dispositif médical au portefeuille et a offert une pureté de marché exceptionnelle

- En mai 2021, Barco a lancé l'écran médical Nio Fusion 12MP. Le lancement du produit a donné lieu à un portefeuille de produits amélioré et à une augmentation des ventes et à l'expansion de la gamme de produits d'affichage médical en Amérique du Nord et en Europe

Portée du marché des écrans médicaux au Moyen-Orient et en Afrique

Le marché des écrans médicaux au Moyen-Orient et en Afrique est classé en treize segments notables qui sont basés sur la technologie, la taille du panneau, le mode d'affichage, le mégapixel, la résolution, le type d'affichage, la technologie d'imagerie, la couleur d'affichage, le rapport hauteur/largeur, le composant, l'application, l'utilisateur final et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

MARCHÉ DES AFFICHAGES MÉDICAUX AU MOYEN-ORIENT ET EN AFRIQUE, PAR TECHNOLOGIE

- ÉCRAN LCD RÉTROÉCLAIRÉ PAR LED

- ÉCRAN LCD RÉTROÉCLAIRÉ CCFL

- ÉCRAN LCD TFT

- ÉCRAN OLED

Sur la base de la technologie, le marché de l'affichage médical est segmenté en écran LCD rétroéclairé par LED, écran LCD rétroéclairé par CCFL, écran LCD TFT et écran OLED.

MARCHÉ DE L'AFFICHAGE MÉDICAL AU MOYEN-ORIENT ET EN AFRIQUE, PAR TAILLE DE PANNEAU

- PANNEAUX DE MOINS DE 22,9 POUCES

- PANNEAUX DE 23,0 À 26,9 POUCES

- PANNEAUX DE 27,0 À 41,9 POUCES

- PANNEAUX DE PLUS DE 42 POUCES

Sur la base de la taille du panneau, le marché de l'affichage médical est segmenté en panneaux de moins de 22,9 pouces, panneaux de 23,0 à 32,0 pouces, panneaux de 27,0 à 41,9 pouces et panneaux de plus de 42 pouces.

MARCHÉ DE L'AFFICHAGE MÉDICAL AU MOYEN-ORIENT ET EN AFRIQUE, PAR MODE DE VISUALISATION

- 2D

- 3D

Sur la base du mode de visualisation, le marché de l’affichage médical est segmenté en 2D et 3D.

MARCHÉ DE L'AFFICHAGE MÉDICAL AU MOYEN-ORIENT ET EN AFRIQUE, PAR MEGAPIXEL

- JUSQU'À 2MP

- 2,1 à 4 MP

- 4,1 à 8 MP

- AU-DESSUS DE 8MP

Sur la base des mégapixels, le marché des écrans médicaux est segmenté en JUSQU'À 2 MP, 2,1-4 MP, 4,1-8 MP et plus de 8 MP.

MARCHÉ DE L'AFFICHAGE MÉDICAL AU MOYEN-ORIENT ET EN AFRIQUE, PAR RÉSOLUTION

- Full HD

- ULTRA FULL HD

- 4K

- AUTRES

Sur la base de la résolution, le marché de l'affichage médical est segmenté en Full HD, ultra-full HD, 4K et autres.

MARCHÉ DE L'AFFICHAGE MÉDICAL AU MOYEN-ORIENT ET EN AFRIQUE, PAR TYPE D'AFFICHAGE

- MONTAGE MURAL

- PORTABLE

- MODULAIRE

Sur la base du type d'affichage, le marché des écrans médicaux est segmenté en écrans muraux, portables et modulaires.

MARCHÉ DE L'AFFICHAGE MÉDICAL AU MOYEN-ORIENT ET EN AFRIQUE, PAR TECHNOLOGIE D'IMAGERIE

- ÉCRAN TACTILE

- VERRE DE POLICE RÉSISTANT AUX RAYURES

- MODE DE SÉCURITÉ INTÉGRÉE

- OPTIONS DE NETTOYAGE

- SOFTGLOW ET SPOTVIEW

- AUTRES

Sur la base de la technologie d'imagerie, le marché de l'affichage médical est segmenté en écran tactile, verre de police résistant aux rayures, mode de sécurité intégrée, options de nettoyage, softglow et spotview et autres.

MARCHÉ DE L'AFFICHAGE MÉDICAL AU MOYEN-ORIENT ET EN AFRIQUE, PAR COULEUR D'AFFICHAGE

- COULEUR

- MONOCHROME

Sur la base de la couleur d'affichage, le marché de l'affichage médical est segmenté en couleur et monochrome.

MARCHÉ DES AFFICHAGES MÉDICAUX AU MOYEN-ORIENT ET EN AFRIQUE, PAR RAPPORT D'ASPECT

- 16:09

- 21:09

- 4:03

Sur la base du rapport hauteur/largeur, le marché de l'affichage médical est segmenté en 16:09, 21:09 et 4:03.

MARCHÉ DES AFFICHAGES MÉDICAUX AU MOYEN-ORIENT ET EN AFRIQUE, PAR COMPOSANT

- MATÉRIEL

- SERVICES

Sur la base des composants, le marché de l'affichage médical est segmenté en matériel et services.

MARCHÉ DE L'AFFICHAGE MÉDICAL AU MOYEN-ORIENT ET EN AFRIQUE, PAR APPLICATION

- DIAGNOSTIC

- CHIRURGICAL/INTERVENTIONNEL

- SURVEILLANCE PORTÉE PAR LE PATIENT

- CONSULTATION

- TÉLÉSANTÉ

- ENSEIGNEMENT/PRATIQUE

- DENTISTERIE

- POINT DE SOINS

- SURVEILLANCE FŒTALE

- AUTRES

Sur la base des applications, le marché de l'affichage médical est segmenté en consultation, diagnostic, chirurgie/intervention, télésanté, enseignement/pratique, surveillance fœtale, dentisterie, point de service, surveillance portée par le patient et autres.

MARCHÉ DES AFFICHAGES MÉDICAUX AU MOYEN-ORIENT ET EN AFRIQUE, PAR UTILISATEUR FINAL

- HÔPITAUX

- PAR TECHNOLOGIE

- CLINIQUES

- ÉTABLISSEMENTS DE SOINS INFIRMIERS

- LABORATOIRES DE DIAGNOSTIC

- LABO D'IMAGERIE/RADIOLOGIE

- LABORATOIRE

- CENTRES DE RÉADAPTATION

- AUTRES

Sur la base de l'utilisateur final, le marché de l'affichage médical est segmenté en hôpitaux, cliniques, établissements de soins infirmiers, laboratoires de diagnostic, laboratoires d'imagerie/radiologie, laboratoires, centres de rééducation et autres.

MARCHÉ DE L'EXPOSITION MÉDICALE AU MOYEN-ORIENT ET EN AFRIQUE, PAR CANAL DE DISTRIBUTION

- APPEL D'OFFRES DIRECT

- VENTES AU DÉTAIL

- AUTRES

Sur la base du canal de distribution, le marché de l'affichage médical est segmenté en appels d'offres directs, ventes au détail et autres.

Analyse/perspectives régionales du marché de l'affichage médical

Le marché de l'affichage médical est analysé et des informations sur la taille du marché sont fournies sur la technologie, la taille du panneau, le mode de visualisation, les mégapixels, la résolution, le type d'affichage, la technologie d'imagerie, la couleur d'affichage, le rapport hauteur/largeur, le composant, l'application, l'utilisateur final et le canal de distribution.

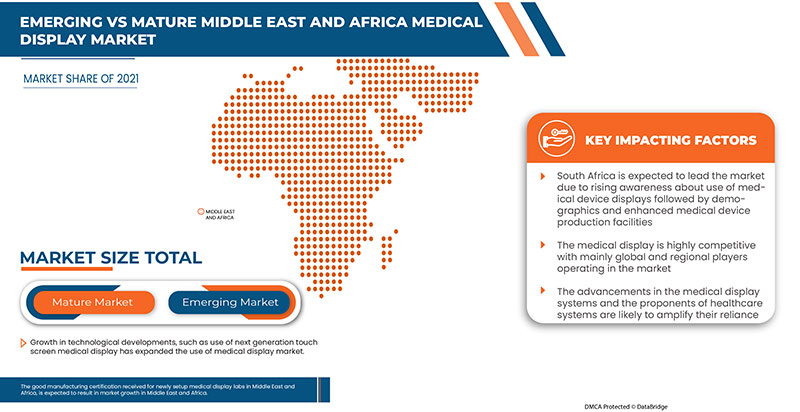

Les pays couverts dans ce rapport de marché sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, Israël, l’Égypte et le reste du Moyen-Orient et de l’Afrique.

L’Afrique du Sud devrait dominer le marché en raison de l’augmentation du revenu disponible de la population.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des écrans médicaux

Le paysage concurrentiel du marché de l'affichage médical fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché de l'affichage médical.

Some of the major players operating in the market are BenQ, ALPINION MEDICAL SYSTEMS Co., Ltd, Nanjing Jusha Commercial &Trading Co,Ltd, COJE CO.,LTD., Axiomtek Co., Ltd., Dell Inc., HP Development Company, L.P., Reshin, Onyx Healthcare Inc., Teguar Computers., Shenzhen Beacon Display Technology Co., Ltd., Rein Medical, STERIS., Barco., Hisense., Sony Corporation, Advantech Co., Ltd., LG Electronics., Sharp NEC Display Solutions, Koninklijke Philips N.V., EIZO INC., Novanta Inc., FSN Medical Technologies., Quest, Ampronix., Siemens Healthcare GmbH, Panasonic Corporation, among others.

Research Methodology: Medical Display Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East and Africa vs Regional, and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TECHNOLOGYLIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL

3.2 PORTER'S FIVE FORCES MODEL

3.3 TECHNOLOGICAL LANDSCAPE IN THE MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET

3.3.1 ORGANIC LIGHT EMITTING DIODE (OLED)

3.3.2 LIGHT EMITTING DIODE (LED), TECHNOLOGY

3.3.3 LIQUID CRYSTAL DISPLAY (LCD)

4 VALUE CHAIN ANALYSIS: MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET

5 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING TREND TOWARDS MINIMALLY INVASIVE TREATMENT

6.1.2 GROWING HEALTHCARE INFRASTRUCTURE

6.1.3 SURGE IN THE NUMBER OF DIAGNOSTIC IMAGING CENTERS

6.2 RESTRAINTS

6.2.1 INCREASE IN USE OF REFURBISHED MEDICAL DISPLAYS

6.2.2 MEDICAL COMMUNITY HAS ATTEMPTED TO TAKE ADVANTAGE

6.2.3 HIGH COSTS OF MEDICAL DISPLAY DEVICES

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DISPLAY INSTRUMENTS

6.3.3 RISING DISPOSABLE INCOME

6.4 CHALLENGES

6.4.1 LACK OF SKILLED EXPERTISE

6.4.2 STRINGENT REGULATIONS

7 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 LED BACKLIT LCD DISPLAY

7.3 CCFL BACKLIT LCD DISPLAY

7.4 TFT BACKLIT LCD DISPLAY

7.5 OLED DISPLAY

7.5.1 AMOLED

7.5.2 PMOLED

8 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY PANEL SIZE

8.1 OVERVIEW

8.2 LESS THAN 22.9

8.2.1 LED BACKLIT LCD DISPLAY

8.2.2 CCFL BACKLIT LCD DISPLAY

8.2.3 TFT BACKLIT LCD DISPLAY

8.2.4 OLED DISPLAY

8.3 23.0- 32.0

8.3.1 LED BACKLIT LCD DISPLAY

8.3.2 CCFL BACKLIT LCD DISPLAY

8.3.3 TFT BACKLIT LCD DISPLAY

8.3.4 OLED DISPLAY

8.4 32.1-42.0

8.4.1 LED BACKLIT LCD DISPLAY

8.4.2 CCFL BACKLIT LCD DISPLAY

8.4.3 TFT BACKLIT LCD DISPLAY

8.4.4 OLED DISPLAY

8.5 MORE THAN 42

8.5.1 LED BACKLIT LCD DISPLAY

8.5.2 CCFL BACKLIT LCD DISPLAY

8.5.3 TFT BACKLIT LCD DISPLAY

8.5.4 OLED DISPLAY

9 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY VIEWING MODE

9.1 OVERVIEW

9.2 2D

9.3 3D

10 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY MEGAPIXEL

10.1 OVERVIEW

10.2 2.1-4MP

10.3 4.1-8MP

10.4 ABOVE 8MP

10.5 UPTO 2MP

11 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY RESOLUTION

11.1 OVERVIEW

11.2 4K

11.3 ULTRA FULL HD

11.4 FULL HD

11.5 OTHERS

12 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY DISPLAY TYPE

12.1 OVERVIEW

12.2 WALL MOUNTED

12.3 PORTABLE

12.4 MODULAR

13 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY DISPLAY COLOR

13.1 OVERVIEW

13.2 COLOR

13.2.1 LED BACKLIT LCD DISPLAY

13.2.2 CCFL BACKLIT LCD DISPLAY

13.2.3 TFT BACKLIT LCD DISPLAY

13.2.4 OLED DISPLAY

13.3 MONOCHROME

13.3.1 LED BACKLIT LCD DISPLAY

13.3.2 CCFL BACKLIT LCD DISPLAY

13.3.3 TFT BACKLIT LCD DISPLAY

13.3.4 OLED DISPLAY

14 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY COMPONENT

14.1 OVERVIEW

14.2 HARDWARE

14.2.1 ACCESSORIES

14.2.2 SENSORS

14.2.3 PANELS

14.2.4 OTHERS

14.3 SERVICES

14.3.1 CONSULTING

14.3.2 INSTALLATION

14.3.3 AFTER-SALE SERVICES

15 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY APPLICATION

15.1 OVERVIEW

15.2 DIAGNOSTICS

15.2.1 BY TYPE

15.2.1.1 GENERAL RADIOLOGY

15.2.1.2 MAMMOGRAPHY

15.2.1.3 DIGITAL PATHOLOGY

15.2.1.4 MULTI-MODALITY

15.2.2 BY PANEL SIZE

15.2.2.1 LESS THAN 22.9

15.2.2.2 23.0- 32.0

15.2.2.3 32.1-42.0

15.2.2.4 MORE THAN 42

15.3 SURGICAL/INTERVENTIONAL

15.3.1 BY TYPE

15.3.1.1 CARDIOVASCULAR

15.3.1.2 ONCOLOGY

15.3.1.3 NEUROLOGY

15.3.1.4 OPHTHALMOLOGY

15.3.1.5 OTHERS

15.3.2 BY PANEL SIZE

15.3.2.1 LESS THAN 22.9

15.3.2.2 23.0- 32.0

15.3.2.3 32.1-42.0

15.3.2.4 MORE THAN 42

15.4 PATIENT WORN MONITORING

15.5 CONSULTATION

15.6 TELEHEALTH

15.6.1 BY PANEL SIZE

15.6.1.1 LESS THAN 22.9

15.6.1.2 23.0- 32.0

15.6.1.3 32.1-42.0

15.6.1.4 MORE THAN 42

15.7 TEACHING/PRACTICE

15.7.1 BY PANEL SIZE

15.7.1.1 LESS THAN 22.9

15.7.1.2 23.0- 32.0

15.7.1.3 32.1-42.0

15.7.1.4 MORE THAN 42

15.8 DENTISTRY

15.8.1 BY PANEL SIZE

15.8.1.1 LESS THAN 22.9

15.8.1.2 23.0- 32.0

15.8.1.3 32.1-42.0

15.8.1.4 MORE THAN 42

15.9 POINT OF CARE

15.9.1 BY PANEL SIZE

15.9.1.1 LESS THAN 22.9

15.9.1.2 23.0- 32.0

15.9.1.3 32.1-42.0

15.9.1.4 MORE THAN 42

15.1 FETAL MONITORING

15.10.1 BY PANEL SIZE

15.10.1.1 LESS THAN 22.9

15.10.1.2 23.0- 32.0

15.10.1.3 32.1-42.0

15.10.1.4 MORE THAN 42

15.11 OTHERS

16 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 BY AREA

16.2.1.1 OPERATING ROOM

16.2.1.2 SURGERY UNIT

16.2.1.3 OTHERS

16.2.2 BY TECHNOLOGY

16.2.2.1 LED BACKLIT LCD DISPLAY

16.2.2.2 CCFL BACKLIT LCD DISPLAY

16.2.2.3 TFT BACKLIT LCD DISPLAY

16.2.2.4 OLED DISPLAY

16.2.3 CLINICS

16.2.3.1 LED BACKLIT LCD DISPLAY

16.2.3.2 CCFL BACKLIT LCD DISPLAY

16.2.3.3 TFT BACKLIT LCD DISPLAY

16.2.3.4 OLED DISPLAY

16.2.4 NURSING FACILITIES

16.2.4.1 LED BACKLIT LCD DISPLAY

16.2.4.2 CCFL BACKLIT LCD DISPLAY

16.2.4.3 TFT BACKLIT LCD DISPLAY

16.2.4.4 OLED DISPLAY

16.2.5 DIAGNOSTIC LABORATORIES

16.2.5.1 LED BACKLIT LCD DISPLAY

16.2.5.2 CCFL BACKLIT LCD DISPLAY

16.2.5.3 TFT BACKLIT LCD DISPLAY

16.2.5.4 OLED DISPLAY

16.3 IMAGING/ RADIOLOGY LABORATORY

16.3.1 LABORATORY

16.3.1.1 LED BACKLIT LCD DISPLAY

16.3.1.2 CCFL BACKLIT LCD DISPLAY

16.3.1.3 TFT BACKLIT LCD DISPLAY

16.3.1.4 OLED DISPLAY

16.3.2 REHABILITATION CENTERS

16.3.2.1 LED BACKLIT LCD DISPLAY

16.3.2.2 CCFL BACKLIT LCD DISPLAY

16.3.2.3 TFT BACKLIT LCD DISPLAY

16.3.2.4 OLED DISPLAY

16.4 OTHERS

17 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY

17.1 OVERVIEW

17.2 TOUCH SCREEN

17.3 SCRATCH RESISTANT FONT GLASS

17.4 FAILSAFE MODE

17.5 CLEANABLE OPTIONS

17.6 SOFTGLOW & SPOTVIEW

17.7 OTHERS

18 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY ASPECT RATIO

18.1 OVERVIEW

18.2 12/30/1899 4:09:00 PM

18.3 12/30/1899 9:09:00 PM

18.4 12/30/1899 4:03:00 AM

19 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 DIRECT TENDERS

19.3 RETAIL SALES

19.4 OTHERS

20 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY GEOGRAPHY

20.1 MIDDLE EAST AND AFRICA

20.1.1 SOUTH AFRICA

20.1.2 SAUDI ARABIA

20.1.3 U.A.E

20.1.4 EGYPT

20.1.5 ISRAEL

20.1.6 REST OF MIDDLE EAST AND AFRICA

21 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

22 SWOT ANALYSIS

23 COMPANY PROFILE

23.1 ADVANTECH CO., LTD

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 COMPANY SHARE ANALYSIS

23.1.4 PRODUCT PORTFOLIO

23.1.5 RECENT DEVELOPMENTS

23.2 HP DEVELOPMENT COMPANY, L.P

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 COMPANY SHARE ANALYSIS

23.2.4 PRODUCT PORTFOLIO

23.2.5 RECENT DEVELOPMENT

23.3 DELL INC.

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 COMPANY SHARE ANALYSIS

23.3.4 PRODUCT PORTFOLIO

23.3.5 RECENT DEVELOPMENTS

23.4 ALPINION MEDICAL SYSTEMS CO., LTD

23.4.1 COMPANY SNAPSHOT

23.4.2 COMPANY SHARE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 STERIS

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 COMPANY SHARE ANALYSIS

23.5.4 PRODUCT PORTFOLIO

23.5.5 RECENT DEVELOPMENT

23.6 AMPRONIX

23.6.1 COMPANY SNAPSHOT

23.6.2 PRODUCT PORTFOLIO

23.6.3 RECENT DEVELOPMENT

23.7 AXIOMTEK CO., LTD.

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENT

23.8 BARCO

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 BENQ

23.9.1 COMPANY SNAPSHOT

23.9.2 PRODUCT PORTFOLIO

23.9.3 RECENT DEVELOPMENTS

23.1 COJE CO., LTD.

23.10.1 COMPANY SNAPSHOT

23.10.2 PRODUCT PORTFOLIO

23.10.3 RECENT DEVELOPMENTS

23.11 EIZO INC (2021)

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENT

23.12 FSN MEDICAL TECHNOLOGIES.

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 HISENSE MEDICAL EQUIPMENT CO, LTD (A SUBSIDIARY OF HISENSE GROUP)

23.13.1 COMPANY SNAPSHOT

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENT

23.14 KONINKLIJKE PHILIPS N.V.( 2021)

23.14.1 COMPANY SNAPSHOT

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENT

23.15 LG DISPLAY CO., LTD.

23.15.1 COMPANY SNAPSHOT

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENT

23.16 NANJING JUSHA COMMERCIAL &TRADING CO,LTD

23.16.1 COMPANY SNAPSHOT

23.16.2 PRODUCT PORTFOLIO

23.16.3 RECENT DEVELOPMENTS

23.17 NOVANTA INC. (2021)

23.17.1 COMPANY SNAPSHOT

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENTS

23.18 ONYX HEALTHCARE INC. (SUBSIDIARY OF AAEON TECHNOLOGY INC.)

23.18.1 COMPANY SNAPSHOT

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT DEVELOPMENTS

23.19 PANASONIC HOLDINGS CORPORATION

23.19.1 COMPANY SNAPSHOT

23.19.2 REVENUE ANALYSIS

23.19.3 RECENT DEVELOPMENT

23.2 QUEST MEDICAL, INC. (A SUBSIDIARY OF ATRION CORPORATION)

23.20.1 COMPANY SNAPSHOT

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT DEVELOPMENTS

23.21 REIN MEDICAL GMBH

23.21.1 COMPANY SNAPSHOT

23.21.2 PRODUCT PORTFOLIO

23.21.3 RECENT DEVELOPMENTS

23.22 SHARP NEC DISPLAY SOLUTIONS ( 2021)

23.22.1 COMPANY SNAPSHOT

23.22.2 PRODUCT PORTFOLIO

23.22.3 RECENT DEVELOPMENTS

23.23 SHENZHEN BEACON DISPLAY TECHNOLOGY CO., LTD.

23.23.1 COMPANY SNAPSHOT

23.23.2 PRODUCT PORTFOLIO

23.23.3 RECENT DEVELOPMENT

23.24 SHENZHEN JLD DISPLAY EXPERT CO., LTD

23.24.1 COMPANY SNAPSHOT

23.24.2 PRODUCT PORTFOLIO

23.24.3 RECENT DEVELOPMENTS

23.25 SIEMENS HEALTHCARE GMBH

23.25.1 COMPANY SNAPSHOT

23.25.2 REVENUE ANALYSIS

23.25.3 PRODUCT PORTFOLIO

23.25.4 RECENT DEVELOPMENT

23.26 SONY GROUP CORPORATION

23.26.1 COMPANY SNAPSHOT

23.26.2 REVENUE ANALYSIS

23.26.3 PRODUCT PORTFOLIO

23.26.4 RECENT DEVELOPMENT

23.27 TEGUAR COMPUTERS

23.27.1 COMPANY SNAPSHOT

23.27.2 PRODUCT PORTFOLIO

23.27.3 RECENT DEVELOPMENTS

24 QUESTIONNAIRE

25 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA LED BACKLIT LCD DISPLAY MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA CCFL BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA TFT BACKLIT LCD DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA OLED DISPLAY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA OLED DISPLAY TYPE IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA LESS THAN 22.9 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA 23.0- 32.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA 32.1-42.0 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA 32.1-40.0 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA MORE THAN 42 IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY VIEWING MODE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA 2D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA 3D IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY MEGAPIXEL, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA 2.1-4MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA 4.1-8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ABOVE 8MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA UPTO 2MP IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY RESOLUTION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA 4K IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ULTRA FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FULL HD IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA WALL MOUNTED IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA PORTABLE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA MODULAR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY DISPLAY COLOR, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA COLOR IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA COLOR IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA MONOCHROME IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA MONOCHROME IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA HARDWARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA HARDWARE IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA SERVICES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA SERVICES IN MEDICAL DISPLAY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA DIAGNOSTICS IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA SURGICAL/INTERVENTIONAL IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA BY TYPE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA BY PANEL SIZE IN MEDICAL DISPLAY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA PATIENT WORN MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA CONSULTATION IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA TELEHEALTH IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA TELEHEALTH IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA TEACHING/PRACTICE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA DENTISTRY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA DENTISTRY IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA POINT OF CARE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA POINT OF CARE IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA FETAL MONITORING IN MEDICAL DISPLAY MARKET, BY PANEL SIZE, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA HOSPITALS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA HOSPITALS IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA BY AREA IN MEDICAL DISPLAY MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA BY TECHNOLOGY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA CLINICS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA CLINICS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA NURSING FACILITIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 MIDDLE EAST & AFRICA DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA DIAGNOSTIC LABORATORIES IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA IMAGING/ RADIOLOGY LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA LABORATORY IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA LABORATORY IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 MIDDLE EAST & AFRICA REHABILITATION CENTERS IN MEDICAL DISPLAY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 81 MIDDLE EAST & AFRICA OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY IMAGING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 MIDDLE EAST & AFRICA TOUCH SCREEN IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA SCRATCH RESISTANT FONT GLASS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 MIDDLE EAST & AFRICA FAILSAFE MODE IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA CLEANABLE OPTIONS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 MIDDLE EAST & AFRICA SOFTGLOW & SPOTVIEW IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 MIDDLE EAST & AFRICA OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY ASPECT RATIO, 2020-2029 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA 16:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA 21:09 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA 4:03 IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA DIRECT TENDERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA RETAIL SALES IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA OTHERS IN MEDICAL DISPLAY MARKET, BY REGION, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET : DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET: VENDOR SHARE ANALYSIS

FIGURE 11 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: SEGMENTATION

FIGURE 12 RISE IN GENERIC DRUG PRODUCTION AND TECHNOLOGICAL FOCUS IN MEDICAL DISPLAYIS DRIVING THE MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 TECHNOLOGYSEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MEDICAL DISPLAYMARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET

FIGURE 15 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2021

FIGURE 16 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2021

FIGURE 20 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY PANEL SIZE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY PANEL SIZE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY PANEL SIZE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2021

FIGURE 24 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY VIEWING MODE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY VIEWING MODE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY VIEWING MODE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2021

FIGURE 28 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY MEGAPIXEL, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY MEGAPIXEL, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY MEGAPIXEL, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY RESOLUTION, 2021

FIGURE 32 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY RESOLUTION, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY RESOLUTION, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY RESOLUTION, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2021

FIGURE 36 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, 2022-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY DISPLAY TYPE, LIFELINE CURVE

FIGURE 39 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2021

FIGURE 40 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, 2022-2029 (USD MILLION)

FIGURE 41 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, CAGR (2022-2029)

FIGURE 42 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY DISPLAY COLOR, LIFELINE CURVE

FIGURE 43 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY COMPONENT, 2021

FIGURE 44 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 45 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY COMPONENT, CAGR (2022-2029)

FIGURE 46 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET : BY COMPONENT, LIFELINE CURVE

FIGURE 47 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY APPLICATION, 2021

FIGURE 48 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 49 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 50 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 51 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY END USER, 2021

FIGURE 52 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 53 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 54 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY END USER, LIFELINE CURVE

FIGURE 55 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2021

FIGURE 56 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 57 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, CAGR (2022-2029)

FIGURE 58 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY IMAGING TECHNOLOGY, LIFELINE CURVE

FIGURE 59 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2021

FIGURE 60 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY ASPECT RATIO, 2022-2029 (USD MILLION)

FIGURE 61 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY ASPECT RATIO, CAGR (2022-2029)

FIGURE 62 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY ASPECT RATIO, LIFELINE CURVE

FIGURE 63 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 64 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 65 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 66 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 67 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: SNAPSHOT (2021)

FIGURE 68 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: BY COUNTRY (2021)

FIGURE 69 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 70 MIDDLE EAST AND AFRICA MEDICAL DISPLAY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 71 MIDDLE EAST & AFRICA MEDICAL DISPLAY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.