Middle East And Africa Medical Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

392.99 Million

USD

525.54 Million

2025

2033

USD

392.99 Million

USD

525.54 Million

2025

2033

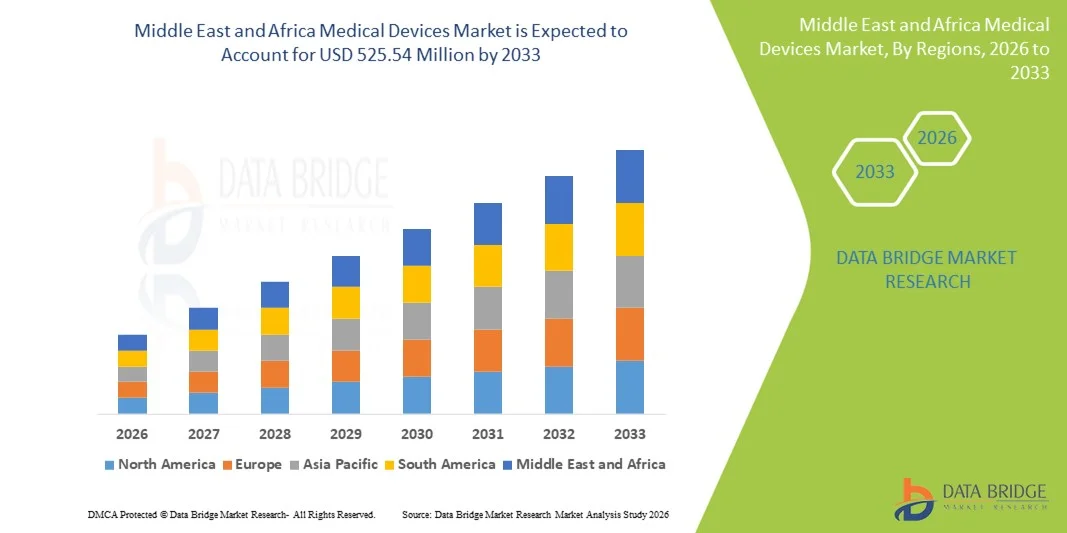

| 2026 –2033 | |

| USD 392.99 Million | |

| USD 525.54 Million | |

|

|

|

|

Segmentation du marché des dispositifs médicaux au Moyen-Orient et en Afrique, par produit (ventilateurs, spiromètres, concentrateurs d'oxygène, appareils d'anesthésie et CPAP/BIPAP), par mode (portable, de table et autonome), par application (diagnostic et thérapeutique), par type d'établissement (grands, petits et moyens), par utilisateur final (hôpitaux, centres de chirurgie ambulatoire, cliniques spécialisées, établissements de soins de longue durée, centres de réadaptation et soins à domicile), par canal de distribution (ventes directes et distributeurs tiers) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des dispositifs médicaux en Asie et en Afrique

- Le marché des dispositifs médicaux au Moyen-Orient et en Afrique était évalué à 392,99 millions de dollars en 2025 et devrait atteindre 525,54 millions de dollars d'ici 2033 , soit un TCAC de 3,7 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'augmentation des dépenses de santé, l'expansion des hôpitaux et des cliniques, les progrès technologiques dans les dispositifs de diagnostic et de traitement, et l'adoption croissante d'équipements médicaux modernes pour améliorer les résultats des traitements dans les systèmes de santé développés et émergents de la région.

- Par ailleurs, les initiatives gouvernementales de soutien, la prévalence croissante des maladies chroniques et la demande accrue de technologies médicales avancées, efficaces et centrées sur le patient favorisent l'adoption des dispositifs médicaux en tant que composantes essentielles de l'infrastructure des soins de santé. La convergence de ces facteurs accélère les taux d'adoption régionaux et renforce considérablement les perspectives de croissance à long terme du secteur.

Analyse du marché des dispositifs médicaux au Moyen-Orient et en Afrique

- Les dispositifs médicaux, notamment les ventilateurs , les spiromètres, les concentrateurs d'oxygène, les appareils d'anesthésie et les appareils CPAP/BIPAP, sont des composantes de plus en plus essentielles des infrastructures de santé au Moyen-Orient et en Afrique, en raison de leur rôle dans l'amélioration des résultats pour les patients, l'optimisation de l'efficacité opérationnelle et la mise en place d'options de traitement avancées dans les établissements de santé publics et privés.

- La demande croissante de dispositifs médicaux est principalement alimentée par l'augmentation des dépenses de santé, la prévalence croissante des maladies chroniques et respiratoires, les progrès technologiques en matière d'équipements médicaux et l'adoption croissante de solutions de soins de santé modernes dans les hôpitaux et les cliniques.

- L'Arabie saoudite a dominé le marché des dispositifs médicaux au Moyen-Orient et en Afrique en 2025, avec la plus grande part de revenus (22,5 %). Cette situation se caractérise par des investissements importants dans le secteur de la santé, des infrastructures médicales de pointe et de fortes initiatives gouvernementales favorisant la santé numérique et l'innovation médicale.

- Le Nigéria devrait être le marché à la croissance la plus rapide au cours de la période de prévision, grâce à l'élargissement de l'accès aux soins de santé, au développement des réseaux d'hôpitaux et de cliniques, ainsi qu'à la sensibilisation et à l'adoption croissantes des dispositifs médicaux de pointe.

- Le segment des ventilateurs a dominé le marché des dispositifs médicaux au Moyen-Orient et en Afrique (MEA) avec une part de marché de 28,8 % en 2025, sous l'effet de la demande croissante dans les hôpitaux et les services de soins à domicile, de la prévalence accrue des maladies respiratoires et du besoin de solutions de soins intensifs dans les établissements de santé publics et privés.

Portée du rapport et segmentation du marché des dispositifs médicaux au Moyen-Orient et en Afrique

|

Attributs |

Principaux enseignements du marché des dispositifs médicaux au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché des dispositifs médicaux au Moyen-Orient et en Afrique

Expansion des solutions de soins à domicile et de télésurveillance

- Une tendance importante et croissante sur le marché des dispositifs médicaux au Moyen-Orient et en Afrique est l'adoption grandissante de dispositifs médicaux de soins à domicile tels que les ventilateurs portables, les concentrateurs d'oxygène et les systèmes CPAP/BIPAP, permettant aux patients de recevoir des soins intensifs en dehors des hôpitaux.

- Par exemple, les concentrateurs d'oxygène portables d'Invacare et de Philips Respironics permettent aux patients souffrant de maladies respiratoires chroniques de gérer leur traitement à domicile en toute mobilité et facilité, réduisant ainsi leur dépendance aux visites à l'hôpital.

- Les fonctionnalités de télésurveillance intégrées aux dispositifs médicaux permettent le suivi en temps réel des données de santé des patients, l'alerte en cas de valeurs anormales et la connectivité à la télémédecine, améliorant ainsi la qualité des soins et les résultats pour les patients.

- L'intégration des dispositifs médicaux aux applications mobiles et aux plateformes cloud facilite une surveillance continue par les professionnels de santé, permettant des interventions et des ajustements de traitement opportuns via une interface centralisée.

- Cette tendance vers des solutions de santé connectées et centrées sur le patient redéfinit fondamentalement les attentes en matière de prestation de services médicaux, incitant des entreprises comme ResMed à développer des dispositifs respiratoires de pointe pour les soins à domicile, dotés de capacités de surveillance intelligente et d'accès à distance.

- La demande en dispositifs médicaux connectés et adaptés aux soins à domicile croît rapidement dans les zones urbaines et rurales, car les patients et les soignants privilégient de plus en plus la commodité, la surveillance continue et la réduction de la dépendance aux hôpitaux.

- L'intégration de l'analyse basée sur l'IA pour la médecine prédictive est en plein essor, permettant aux dispositifs de prévoir les événements de santé des patients et d'optimiser automatiquement les protocoles de traitement.

- Les partenariats entre les fabricants de dispositifs médicaux et les fournisseurs de télémédecine se multiplient, créant des solutions de soins à distance complètes qui combinent diagnostic, surveillance et interventions thérapeutiques.

Dynamique du marché des dispositifs médicaux au Moyen-Orient et en Afrique

Conducteur

Augmentation des dépenses de santé et prévalence des maladies chroniques

- L'augmentation des investissements dans les infrastructures de santé, conjuguée à la prévalence croissante des maladies respiratoires chroniques, cardiaques et liées au mode de vie, est un facteur important de la demande accrue de dispositifs médicaux.

- Par exemple, en mars 2025, l'Arabie saoudite a annoncé l'expansion de son programme national de soins à domicile et de télémédecine, visant à fournir des appareils respiratoires et de surveillance modernes aux patients des zones urbaines et reculées.

- Alors que les patients et les professionnels de santé recherchent des solutions avancées pour améliorer le diagnostic, le traitement et la continuité des soins, des dispositifs tels que les ventilateurs, les spiromètres et les appareils d'anesthésie gagnent en popularité dans les hôpitaux, les cliniques et les services de soins à domicile.

- De plus, l'adoption croissante des systèmes de santé numériques et des dispositifs médicaux connectés fait des solutions de surveillance et de thérapie avancées des éléments essentiels des flux de travail modernes en matière de soins de santé.

- Les initiatives gouvernementales, la sensibilisation croissante à la santé et le désir d'obtenir de meilleurs résultats de traitement sont des facteurs clés qui stimulent l'adoption des dispositifs médicaux, tandis que la disponibilité d'appareils portables et de table conviviaux contribue également à la croissance du marché.

- L'essor du tourisme médical dans les pays du Golfe stimule la demande d'équipements de diagnostic et de traitement de haute qualité dans les hôpitaux privés et les cliniques spécialisées.

- L'élargissement de la couverture d'assurance pour les soins à domicile et la gestion des maladies chroniques encourage une adoption plus large des dispositifs médicaux portables et de télésurveillance.

Retenue/Défi

Coûts élevés et obstacles liés à la conformité réglementaire

- Le coût initial élevé des dispositifs médicaux de pointe et l'environnement réglementaire complexe constituent des obstacles importants à une plus large pénétration du marché au Moyen-Orient et en Afrique.

- Par exemple, les appareils tels que les ventilateurs dotés d'IA et les systèmes CPAP/BIPAP avancés nécessitent souvent des investissements importants, ce qui les rend moins accessibles aux petits hôpitaux ou aux prestataires de soins de santé soucieux de leur budget.

- Le respect des réglementations et des approbations strictes relatives aux dispositifs médicaux dans de nombreux pays contribue aux retards de lancement des produits et augmente les coûts opérationnels pour les fabricants.

- Bien que des alternatives portables et abordables émergent, les appareils haut de gamme dotés de fonctionnalités intégrées de surveillance, d'analyse et de télésanté restent onéreux, ce qui limite leur adoption par certains segments de la population.

- Surmonter ces défis grâce à une conception de dispositifs rentable, des procédures réglementaires simplifiées et des programmes de financement pour les hôpitaux et les prestataires de soins à domicile sera crucial pour une croissance durable du marché des dispositifs médicaux au Moyen-Orient et en Afrique.

- Le manque de compétences techniques et de formation du personnel de santé en matière d'utilisation des dispositifs médicaux de pointe peut ralentir leur adoption dans les petites cliniques et les zones rurales.

- Les perturbations des chaînes d'approvisionnement et la dépendance aux importations pour les appareils de haute technologie peuvent entraîner des retards et une augmentation des coûts, en particulier dans les pays dont l'infrastructure de production locale est sous-développée.

Étendue du marché des dispositifs médicaux au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du produit, du mode de distribution, de l'application, de l'installation, de l'utilisateur final et du mode de distribution.

- Sous-produit

Le marché des dispositifs médicaux au Moyen-Orient et en Afrique (MEA) est segmenté, selon le type de produit, en ventilateurs, spiromètres, concentrateurs d'oxygène, appareils d'anesthésie et appareils CPAP/BIPAP. Le segment des ventilateurs a dominé le marché en 2025, représentant 28,8 % des revenus. Cette domination est due à la prévalence croissante des maladies respiratoires, aux besoins en soins intensifs dans les hôpitaux et à la demande grandissante de solutions de soins à domicile. Les ventilateurs sont essentiels tant en soins intensifs qu'à domicile, car ils assurent une assistance respiratoire vitale. La croissance de ce segment est soutenue par les initiatives gouvernementales des pays du Golfe visant à développer les infrastructures de soins intensifs et par les progrès technologiques, tels que les ventilateurs portables et ceux dotés d'intelligence artificielle. Les hôpitaux privilégient les ventilateurs pour leur fiabilité, leur adaptabilité et leur intégration aux systèmes de surveillance. Par ailleurs, la sensibilisation accrue des patients et des aidants aux soins respiratoires chroniques stimule la demande à domicile.

Le segment des appareils CPAP/BIPAP devrait connaître la croissance la plus rapide, soit 9,8 %, entre 2026 et 2033, portée par une sensibilisation accrue à l'apnée du sommeil et aux autres affections respiratoires, tant en milieu urbain que rural. Ces appareils sont de plus en plus utilisés à domicile en raison de leur portabilité et de leur simplicité d'utilisation. Le développement de la télémédecine permet un suivi à distance de l'utilisation des appareils CPAP/BIPAP, favorisant ainsi leur adoption. Ce segment bénéficie également de la multiplication des campagnes de sensibilisation à la santé et du soutien des assurances qui couvrent les thérapies respiratoires à domicile. L'innovation technologique continue en matière de conception, de réduction du bruit et de confort du patient contribue également à la croissance du marché.

- Par mode

Selon leur mode d'utilisation, le marché se segmente en appareils portables, de table et autonomes. Les appareils portables dominaient le marché en 2025 avec une part de 31,2 %, grâce à l'adoption croissante des dispositifs médicaux de soins à domicile et au besoin accru de mobilité des patients. Les appareils portables, tels que les ventilateurs, les concentrateurs d'oxygène et les appareils CPAP, permettent aux patients de gérer leurs maladies chroniques à domicile ou en déplacement. Les hôpitaux et les centres de réadaptation utilisent également ces appareils pour le transfert des patients et les soins d'urgence. Leur praticité, leur conception compacte et leur facilité d'utilisation les rendent très attractifs sur les marchés développés et émergents du Moyen-Orient et d'Afrique. Les fabricants privilégient de plus en plus les modèles légers et alimentés par batterie afin d'améliorer l'accessibilité. Par ailleurs, les appareils portables s'intègrent aux systèmes de télésurveillance, permettant ainsi aux professionnels de santé de suivre l'état de santé des patients en temps réel.

Le modèle de table devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 8,5 %, entre 2026 et 2033, grâce à son utilisation généralisée dans les hôpitaux, les cliniques spécialisées et les centres de diagnostic. Les appareils de table offrent une précision, une durabilité et une fonctionnalité supérieures aux appareils portables, ce qui les rend idéaux pour les applications diagnostiques et thérapeutiques. L'augmentation des investissements dans les infrastructures hospitalières, notamment aux Émirats arabes unis et en Arabie saoudite, stimule la demande pour ces appareils fiables et performants. Les appareils de table servent également d'unités centrales pour la prise en charge de plusieurs patients dans les services de soins intensifs ou les centres de soins à domicile, améliorant ainsi l'efficacité opérationnelle. L'innovation continue des produits et leur intégration aux systèmes informatiques hospitaliers contribuent également à la croissance de ce modèle.

- Sur demande

En fonction de leur application, le marché est segmenté en dispositifs de diagnostic et dispositifs thérapeutiques. Le segment des applications thérapeutiques a dominé le marché en 2025, représentant 55 % des revenus, grâce à la demande croissante en assistance respiratoire, dispositifs de soins intensifs et thérapies à domicile. Les dispositifs thérapeutiques tels que les ventilateurs, les appareils CPAP/BIPAP et les concentrateurs d'oxygène sont essentiels au traitement des affections chroniques et aiguës. Les hôpitaux, les centres de réadaptation et les établissements de soins de longue durée sont les principaux utilisateurs de ces dispositifs. La prévalence accrue des troubles respiratoires, cardiaques et du sommeil stimule la demande, tant en milieu urbain que rural. Les dispositifs thérapeutiques bénéficient également des progrès réalisés en matière de surveillance assistée par l'IA et de conception portable, ce qui les rend plus efficaces et accessibles. Les gouvernements de la région du Golfe investissent dans le développement des infrastructures de soins intensifs et de soins à domicile, contribuant ainsi à la croissance de ce segment.

Le segment des applications de diagnostic devrait connaître le taux de croissance le plus rapide, soit 10,2 %, entre 2026 et 2033, porté par l'augmentation des investissements dans le dépistage précoce des maladies et la médecine préventive. Les dispositifs de diagnostic, tels que les spiromètres et les systèmes de surveillance, sont de plus en plus utilisés dans les hôpitaux, les cliniques et les services de soins à domicile pour détecter précocement les affections respiratoires et chroniques. La sensibilisation croissante à la prévention et le renforcement des capacités de diagnostic dans les hôpitaux privés sont des facteurs clés de cette croissance. L'intégration aux plateformes de télémédecine et de santé numérique permet la collecte de données à distance et le suivi médical, ce qui accroît l'attrait des dispositifs de diagnostic. L'innovation technologique continue et les initiatives gouvernementales en faveur de la médecine préventive accélèrent encore davantage leur adoption.

- Par établissement

En fonction de la taille de l'établissement, le marché est segmenté en grands, moyens et petits établissements de santé. Le segment des grands établissements a dominé le marché en 2025, représentant 45 % des revenus, grâce à l'adoption massive de dispositifs médicaux de pointe dans les grands hôpitaux, les cliniques spécialisées et les centres de réadaptation. Ces établissements disposent de budgets et d'infrastructures plus importants pour intégrer des équipements de soins intensifs, de diagnostic et de traitement. Ils privilégient également l'intégration des dispositifs aux systèmes informatiques et de surveillance hospitaliers afin d'améliorer leur efficacité opérationnelle. Les grands établissements d'Arabie saoudite et des Émirats arabes unis investissent de plus en plus dans l'extension des unités de soins intensifs, les services équipés de télémédecine et les programmes de dispositifs de soins à domicile. L'ampleur des opérations et le nombre de patients dans les grands hôpitaux stimulent également la demande en dispositifs multifonctionnels. De plus, ces établissements adoptent souvent des dispositifs conformes aux normes internationales, ce qui favorise encore davantage l'adoption de dispositifs haut de gamme.

Le segment des petites structures devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 9,5 %, entre 2026 et 2033, porté par la hausse des investissements dans les cliniques locales, les centres de chirurgie ambulatoire et les plateformes de soins à domicile. Ces petites structures privilégient les appareils portables et de table pour leur rentabilité, leur facilité d'utilisation et leur flexibilité. L'accès croissant aux soins de santé dans les zones rurales et les petites villes d'Afrique stimule la demande pour ces équipements. Les appareils abordables et faciles à entretenir, compatibles avec la télémédecine et la surveillance à distance, sont particulièrement recherchés. Les fabricants proposent des appareils compacts et multifonctionnels adaptés aux petites cliniques, contribuant ainsi à l'accélération de la croissance du marché.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, centres de chirurgie ambulatoire, cliniques spécialisées, établissements de soins de longue durée, centres de réadaptation et services de soins à domicile. Le segment hospitalier dominait le marché avec une part de 50 % en 2025, porté par un volume élevé de patients et le besoin en dispositifs de soins intensifs, de diagnostic et de traitement. Les hôpitaux des pays du Golfe augmentent leur capacité en soins intensifs et investissent dans des équipements respiratoires et d'anesthésie de pointe. L'intégration aux systèmes de santé numériques, à la télémédecine et à l'infrastructure informatique hospitalière stimule davantage la demande. Les hôpitaux privilégient également les dispositifs multifonctionnels adaptés à diverses applications et types de patients. Les programmes de santé gouvernementaux et les initiatives de tourisme médical favorisent l'adoption de ces dispositifs dans les hôpitaux haut de gamme. La modernisation continue des infrastructures médicales garantit une demande soutenue.

Le segment des soins à domicile devrait connaître le taux de croissance le plus rapide, soit 12 %, entre 2026 et 2033. Cette croissance est alimentée par la prévalence croissante des maladies respiratoires et cardiaques chroniques, une meilleure sensibilisation des patients et l'adoption d'appareils portables. Les solutions de soins à domicile, telles que les appareils CPAP/BIPAP, les ventilateurs portables et les concentrateurs d'oxygène, permettent aux patients de gérer leur traitement à domicile en toute mobilité et simplicité. Les plateformes de télésanté et la surveillance à distance favorisent l'adoption de ces solutions, permettant aux professionnels de santé de suivre l'évolution de l'état de santé des patients. La prise en charge des dispositifs de soins à domicile par les assurances s'étend et les programmes gouvernementaux de soutien à la gestion des maladies chroniques accélèrent encore cette croissance. La commodité, le confort du patient et la rentabilité des soins à domicile en font un segment de croissance particulièrement attractif.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en ventes directes et distributeurs tiers. Le segment des ventes directes dominait le marché avec une part de 60 % en 2025, grâce à des relations solides entre les fabricants et les grands hôpitaux, les cliniques spécialisées et les prestataires de soins à domicile. Les ventes directes permettent de proposer des solutions personnalisées, un support technique et des formations à l'utilisation des dispositifs pour le personnel soignant. Les entreprises des pays du Golfe et d'Afrique du Sud privilégient les ventes directes pour pénétrer les hôpitaux de pointe et les grands établissements de santé. Les ventes directes garantissent également une adoption plus rapide des nouvelles technologies et offrent des opportunités de contrats de service après-vente. Les fabricants privilégient ce canal pour les dispositifs à forte valeur ajoutée tels que les ventilateurs, les appareils d'anesthésie et les appareils CPAP/BIPAP. La relation directe facilite également la conformité réglementaire et accélère l'installation.

Le segment des distributeurs tiers devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 11 %, entre 2026 et 2033, porté par l'adoption croissante des dispositifs dans les petites cliniques, les services de soins à domicile et les zones rurales. Les distributeurs offrent une couverture plus large, des solutions économiques et un soutien logistique, rendant ainsi les dispositifs accessibles dans les régions isolées ou mal desservies. La distribution par des tiers permet aux fabricants de se concentrer sur le développement de leurs produits tout en s'appuyant sur les réseaux de distributeurs pour les ventes et le service après-vente. La croissance en Afrique et sur les marchés émergents du Moyen-Orient et d'Afrique est alimentée par des stratégies de pénétration du marché mises en œuvre par les distributeurs. La demande croissante de dispositifs portables et de table dans les petites structures contribue également à la croissance rapide de ce segment.

Analyse régionale du marché des dispositifs médicaux au Moyen-Orient et en Afrique

- L'Arabie saoudite a dominé le marché des dispositifs médicaux au Moyen-Orient et en Afrique en 2025, avec la plus grande part de revenus (22,5 %). Cette situation se caractérise par des investissements importants dans le secteur de la santé, des infrastructures médicales de pointe et de fortes initiatives gouvernementales favorisant la santé numérique et l'innovation médicale.

- Dans la région, les professionnels de santé et les patients accordent une importance croissante aux dispositifs de diagnostic et de traitement de haute qualité, aux solutions de soins à domicile avancées et à l'intégration aux plateformes de télémédecine, ce qui améliore les résultats pour les patients et l'efficacité opérationnelle dans les hôpitaux, les centres de réadaptation et les services de soins à domicile.

- Cette adoption généralisée est également favorisée par la hausse des dépenses de santé, la présence d'une population férue de technologie dans les centres urbains, la prévalence croissante des maladies chroniques et respiratoires et l'essor du tourisme médical dans les pays du Golfe, faisant des dispositifs médicaux des solutions essentielles pour la prestation de soins de santé modernes dans les établissements publics et privés.

Analyse du marché des dispositifs médicaux en Arabie saoudite

Le marché saoudien des dispositifs médicaux a généré 22,5 % des revenus en 2025, grâce à d'importants investissements publics dans les infrastructures de santé, l'agrandissement des hôpitaux et les programmes de soins à domicile. Les établissements de santé privilégient de plus en plus les dispositifs de diagnostic et de traitement de pointe afin d'améliorer la prise en charge des patients et l'efficacité opérationnelle. L'adoption croissante de la télémédecine, des respirateurs portables et des concentrateurs d'oxygène stimule la demande. Par ailleurs, les initiatives visant à promouvoir le tourisme médical et les services de santé spécialisés accélèrent la croissance du marché, tandis que les progrès technologiques dans les systèmes de surveillance basés sur l'intelligence artificielle et les dispositifs de soins intensifs renforcent le leadership du pays au Moyen-Orient et en Afrique.

Analyse du marché des dispositifs médicaux aux Émirats arabes unis

Le marché des dispositifs médicaux aux Émirats arabes unis devrait connaître une croissance annuelle composée (TCAC) importante tout au long de la période de prévision, principalement sous l'effet des dépenses de santé élevées, du développement des réseaux d'hôpitaux privés et de l'adoption croissante des solutions de soins à domicile intelligentes. L'urbanisation, conjuguée à la hausse des maladies chroniques et liées au mode de vie, favorise l'utilisation de dispositifs médicaux de pointe. Les consommateurs et les professionnels de santé privilégient la facilité d'utilisation, la qualité et la fiabilité, notamment pour les ventilateurs portables, les appareils CPAP/BIPAP et les systèmes de surveillance. Les initiatives gouvernementales soutenant la santé numérique, la télémédecine et le tourisme médical stimulent davantage l'adoption de ces dispositifs dans les établissements de soins résidentiels et commerciaux.

Analyse du marché nigérian des dispositifs médicaux

Le marché nigérian des dispositifs médicaux devrait connaître une croissance annuelle composée (TCAC) remarquable au cours de la période de prévision, portée par un meilleur accès aux soins, le développement des réseaux hospitaliers et cliniques, et la prévalence croissante des maladies respiratoires et chroniques. Les dispositifs portables et de table sont de plus en plus utilisés dans les zones urbaines et périurbaines à des fins diagnostiques et thérapeutiques. Par ailleurs, les campagnes de sensibilisation aux solutions de prévention et de soins à domicile incitent les patients à investir dans des dispositifs de surveillance et respiratoires. L'amélioration des infrastructures de santé au Nigéria, conjuguée aux programmes financés par des donateurs et aux partenariats avec des fabricants internationaux, devrait continuer à soutenir la croissance du marché.

Analyse du marché des dispositifs médicaux en Afrique du Sud

Le marché sud-africain des dispositifs médicaux devrait connaître une croissance annuelle composée (TCAC) considérable au cours de la période de prévision, portée par des systèmes de santé privés bien établis, des investissements croissants dans les hôpitaux et les cliniques spécialisées, et une demande accrue d'équipements médicaux de pointe. Les hôpitaux et les centres de réadaptation adoptent des dispositifs de diagnostic et de traitement haut de gamme, tandis que le recours aux soins à domicile progresse pour la prise en charge des maladies chroniques. L'intégration aux plateformes de télémédecine et aux systèmes de dossiers médicaux électroniques se généralise, favorisant l'efficacité opérationnelle et le suivi des patients. Par ailleurs, la sensibilisation accrue aux troubles respiratoires, cardiaques et du sommeil stimule l'adoption de dispositifs tels que les ventilateurs, les appareils CPAP/BIPAP et les concentrateurs d'oxygène.

Part de marché des dispositifs médicaux au Moyen-Orient et en Afrique

L'industrie des dispositifs médicaux au Moyen-Orient et en Afrique est principalement dominée par des entreprises bien établies, notamment :

- Medtronic (Irlande)

- GE HealthCare (États-Unis)

- Koninklijke Philips NV (Pays-Bas)

- Siemens Healthineers AG (Allemagne)

- Services Johnson & Johnson, Inc. (États-Unis)

- Abbott (États-Unis)

- Stryker (États-Unis)

- B. Braun SE (Allemagne)

- F. Hoffmann-La Roche Ltd (Suisse)

- Getinge AB (Suède)

- Drägerwerk AG & Co. KGaA (Allemagne)

- Boston Scientific Corporation (États-Unis)

- BD (États-Unis)

- Zimmer Biomet. (États-Unis)

- Fresenius Medical Care AG & Co. KGaA (Allemagne)

- PureHealth (Émirats arabes unis)

- East African Medical Vitals Limited (Ouganda)

- Cordis (États-Unis)

- Systèmes médicaux Al Faisaliah (Arabie saoudite)

Quels sont les développements récents sur le marché des dispositifs médicaux au Moyen-Orient et en Afrique ?

- En mars 2025, Medtronic a annoncé un partenariat stratégique avec Methinks AI pour intégrer le triage radiologique piloté par l'IA pour la prise en charge des AVC au Moyen-Orient, en Afrique, en Turquie et en Europe centrale et orientale, dans le but d'améliorer les parcours de soins et d'évaluation précoce des AVC dans les hôpitaux.

- En janvier 2025, Royal Philips a dévoilé, lors du salon Arab Health 2025, des innovations basées sur l'IA dans les domaines du diagnostic, du suivi des patients et du traitement, notamment des partenariats et des solutions de télééchographie avancées visant à élargir l'accès aux soins et à améliorer l'aide à la décision clinique au Moyen-Orient et en Afrique.

- En octobre 2024, Philips a présenté des innovations technologiques de pointe dans le domaine de la santé lors du salon Global Health Exhibition 2024 à Riyad, notamment une connectivité avancée pour les unités de soins intensifs électroniques (eICU), des systèmes d'imagerie et d'échographie améliorés par l'IA, ainsi que des solutions cliniques de nouvelle génération conformes aux objectifs de transformation du système de santé de la Vision 2030 de l'Arabie saoudite.

- En février 2024, Philips et Malaffi (Abu Dhabi Health Data Services) ont étendu leur partenariat lors d'Arab Health 2024 afin d'établir des normes mondiales pour l'échange fluide d'images médicales grâce à la solution d'échange d'images de Philips, améliorant ainsi considérablement l'interopérabilité et le partage des données en radiologie entre les établissements de santé des Émirats arabes unis.

- En janvier 2023, United Imaging a annoncé, lors du salon Arab Health 2023, de multiples partenariats et le déploiement de systèmes d'imagerie médicale de pointe au Moyen-Orient et en Afrique, notamment des scanners TEP/IRM haute résolution, des systèmes de tomodensitométrie et d'IRM avancés, ainsi que des unités de radiographie numérique mobiles. L'entreprise a également signé des accords stratégiques pour l'installation de ces technologies dans des hôpitaux et des centres de recherche.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.