Middle East And Africa Medical Device Warehouse And Logistics Market

Taille du marché en milliards USD

TCAC :

%

USD

192.40 Billion

USD

263.31 Billion

2024

2032

USD

192.40 Billion

USD

263.31 Billion

2024

2032

| 2025 –2032 | |

| USD 192.40 Billion | |

| USD 263.31 Billion | |

|

|

|

|

Segmentation du marché des entrepôts et de la logistique de dispositifs médicaux au Moyen-Orient et en Afrique, par offres (services, matériel et logiciels), température (ambiante, réfrigérée, congelée et autres), mode de transport (logistique de fret maritime, logistique de fret aérien et logistique terrestre), application (dispositifs de diagnostic, dispositifs thérapeutiques, dispositifs de surveillance, dispositifs chirurgicaux et autres dispositifs), utilisation finale (hôpitaux et cliniques, entreprises de dispositifs médicaux, instituts universitaires et de recherche, laboratoires de référence et de diagnostic, entreprises de services médicaux d'urgence et autres), canal de distribution (logistique conventionnelle et tierce partie) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique

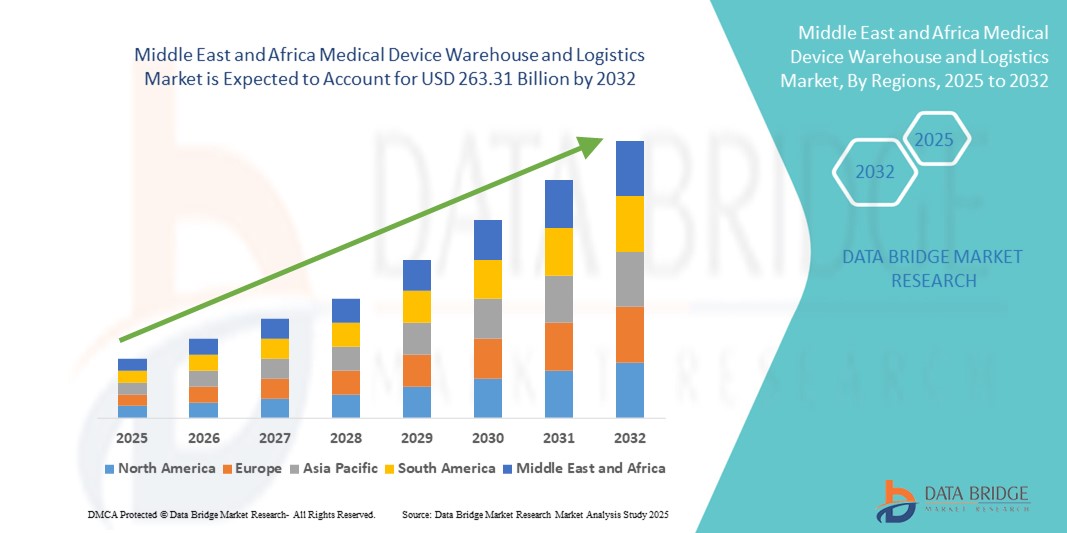

- La taille du marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique était évaluée à 192,4 milliards USD en 2024 et devrait atteindre 263,31 milliards USD d'ici 2032 , à un TCAC de 4,00 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'expansion des infrastructures de soins de santé et la demande accrue de systèmes de chaîne d'approvisionnement médicale efficaces au Moyen-Orient et en Afrique, alimentée par la prévalence croissante des maladies chroniques, la numérisation des soins de santé et le besoin croissant de distribution rapide de dispositifs médicaux essentiels.

- Par ailleurs, la demande croissante des consommateurs et des institutions pour des solutions d'entreposage sécurisées, à température contrôlée et technologiquement intégrées fait de la logistique spécialisée des dispositifs médicaux un élément clé de la prestation de soins de santé dans la région. Ces facteurs convergents accélèrent l'adoption de services avancés d'entreposage et de logistique pour dispositifs médicaux, stimulant ainsi considérablement la croissance du secteur dans les secteurs de la santé publique et privée au Moyen-Orient et en Afrique.

Analyse du marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique

- Les systèmes d'entreposage et de logistique des dispositifs médicaux sont de plus en plus essentiels pour garantir une livraison rapide, sécurisée et conforme des produits de santé au Moyen-Orient et en Afrique. Ces systèmes permettent un stockage thermosensible, un suivi en temps réel et une distribution efficace, essentiels pour les dispositifs et équipements médicaux vitaux.

- La demande croissante est alimentée par le développement croissant des infrastructures de soins de santé, l'augmentation des importations et des exportations de technologies médicales et les exigences réglementaires strictes en matière de traçabilité de la chaîne d'approvisionnement et de gestion de la chaîne du froid.

- L'Arabie saoudite a dominé le marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique avec une part de revenus de 34,7 % en 2024, soutenue par les réformes des soins de santé Vision 2030, des investissements massifs dans les villes médicales et la modernisation des infrastructures logistiques pour soutenir la distribution centralisée des dispositifs médicaux.

- Les Émirats arabes unis devraient être le pays à la croissance la plus rapide sur le marché des entrepôts et de la logistique des dispositifs médicaux, avec un TCAC de 10,3 % prévu entre 2025 et 2032, grâce à une transformation numérique rapide, à l'augmentation des importations de produits pharmaceutiques et de dispositifs médicaux et à l'intégration d'entrepôts intelligents dans des pôles comme Dubai Healthcare City et KIZAD.

- Le segment de la logistique terrestre a dominé le marché de l'entreposage et de la logistique des dispositifs médicaux avec une part de marché de 51,4 % en 2024, reflétant son utilisation généralisée dans les livraisons de dispositifs médicaux à courte et moyenne distance dans toute la région MEA, soutenue par un vaste réseau de transport routier qui permet une distribution rapide et rentable.

Portée du rapport et segmentation du marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique

|

Attributs |

Aperçu du marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique

« Intégration croissante des technologies intelligentes de logistique et de conformité sur le marché de l'entreposage et de la logistique des dispositifs médicaux »

- Une tendance majeure qui façonne le marché de l'entreposage et de la logistique des dispositifs médicaux est l'essor de l'automatisation et des technologies logistiques intelligentes conçues pour rationaliser le stockage, la manutention et la distribution des dispositifs médicaux de grande valeur. Ces innovations améliorent la précision, la traçabilité et la conformité réglementaire dans un secteur où précision et sécurité sont primordiales.

- Les systèmes de gestion des stocks basés sur le cloud et les capteurs IoT sont de plus en plus utilisés pour surveiller en temps réel les conditions de stockage telles que la température, l'humidité et l'exposition aux chocs, particulièrement cruciales pour les dispositifs diagnostiques ou implantables sensibles. Ces technologies offrent une visibilité de bout en bout et des alertes rapides, contribuant ainsi à réduire les pertes et les gaspillages.

- Aux États-Unis et au Canada, les principaux acteurs intègrent la robotique et les véhicules à guidage automatique (AGV) à leurs opérations d'entreposage afin d'améliorer l'efficacité et de réduire les erreurs humaines lors de la préparation des commandes et de l'expédition. Ces systèmes sont particulièrement utiles aux centres de distribution à haut volume qui gèrent un éventail diversifié et complexe d'appareils.

- L'optimisation de la chaîne du froid est également un axe prioritaire. Les entreprises investissent dans des infrastructures de stockage frigorifique intelligentes, dotées de systèmes de surveillance à distance et d'alimentation de secours, pour protéger les produits thermosensibles tels que les implants chirurgicaux, les stents et les dispositifs cardiovasculaires.

- Les collaborations entre les prestataires logistiques et les fabricants de dispositifs médicaux permettent une plus grande personnalisation des chaînes d'approvisionnement, avec des services logistiques tiers (3PL) offrant des solutions de conformité, d'emballage et de logistique inverse sur mesure.

- La conformité réglementaire demeure un moteur de la transformation numérique. Les exigences de la FDA américaine en matière d'identification unique des dispositifs médicaux (UDI) et la réglementation de Santé Canada sur les dispositifs médicaux ont encouragé l'adoption de la sérialisation, du suivi en temps réel et d'outils de reporting automatisés afin de renforcer la responsabilisation tout au long de la chaîne d'approvisionnement.

- Cette convergence croissante de l'innovation logistique, de l'automatisation de la conformité et des systèmes de suivi en temps réel remodèle le paysage de l'entreposage et de la distribution des dispositifs médicaux au Moyen-Orient et en Afrique, positionnant le marché pour une croissance soutenue jusqu'en 2032.

Dynamique du marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique

Conducteur

« Demande croissante due à l'expansion des infrastructures de santé et aux besoins de la chaîne du froid »

- Le marché de l'entreposage et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique connaît une croissance substantielle en raison de l'augmentation des investissements dans les infrastructures de santé, de la demande croissante de dispositifs médicaux avancés et de l'attention croissante portée à la logistique des produits pharmaceutiques et des dispositifs thermosensibles.

- Par exemple, en avril 2024, CEVA Logistics a étendu son empreinte logistique dans le domaine de la santé au Moyen-Orient en lançant une nouvelle installation certifiée Good Distribution Practice (GDP) à Dubaï, visant à fournir des services spécialisés pour les dispositifs médicaux et les produits pharmaceutiques.

- Avec la croissance rapide des procédures diagnostiques et chirurgicales dans la région, les prestataires logistiques se concentrent de plus en plus sur des solutions de stockage et de transport sur mesure qui garantissent l'intégrité, la sécurité et la conformité des dispositifs.

- Les initiatives gouvernementales visant à améliorer l’accès aux soins de santé, en particulier dans les pays du CCG et en Afrique du Sud, soutiennent l’expansion des systèmes d’entreposage centralisés et des centres de distribution d’équipements et de consommables médicaux.

- L'augmentation des maladies chroniques et l'importation croissante de dispositifs médicaux haut de gamme ont entraîné un besoin accru de services logistiques à température contrôlée, en particulier dans les catégories ambiantes, réfrigérées et congelées, qui deviennent essentielles pour garantir l'efficacité et la sécurité des produits.

- De plus, l'adoption croissante des technologies de santé numériques et des systèmes de suivi intelligents, tels que les capteurs RFID et IoT, améliore la transparence de la chaîne d'approvisionnement et l'efficacité opérationnelle, stimulant ainsi davantage la croissance du marché dans les secteurs de la santé privés et publics.

Retenue/Défi

« Coûts élevés et lacunes en matière d'infrastructures dans les régions à faible revenu »

- Malgré une forte demande, le marché est confronté à des défis majeurs tels qu'une infrastructure logistique limitée dans plusieurs pays d'Afrique subsaharienne, des environnements réglementaires incohérents et des coûts opérationnels élevés associés à la chaîne du froid et aux installations de stockage sécurisées.

- Par exemple, alors que l’Afrique du Sud et les Émirats arabes unis ont développé des centres d’entreposage avancés, les pays dotés d’infrastructures moins matures continuent de faire face à des problèmes tels qu’un approvisionnement en électricité irrégulier, un accès limité à des solutions de fret spécialisées et des réseaux de transport fragmentés.

- Les coûts élevés associés à la mise en place d'installations de stockage frigorifique conformes aux BPD et à la sécurisation du suivi des appareils de bout en bout constituent des obstacles pour les acteurs logistiques de petite et moyenne taille.

- De plus, les réglementations douanières et d'importation strictes dans divers pays de la région entraînent souvent des retards et des inefficacités, affectant la livraison rapide des appareils et les résultats pour les patients.

- Pour surmonter ces contraintes, les partenariats public-privé, les incitations logistiques soutenues par le gouvernement et les collaborations internationales sont essentiels pour normaliser les processus et élargir l’accès à une logistique fiable des dispositifs médicaux dans les zones reculées et sous-développées de la région.

Portée du marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique

Le marché est segmenté en fonction des offres, de la température, du mode de transport, de l’application, de l’utilisation finale et du canal de distribution.

- Par offrandes

Sur la base des offres, le marché de l'entreposage et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique est segmenté en services, matériel et logiciels. Le segment du matériel a dominé le marché avec la plus grande part de chiffre d'affaires, soit 42,8 % en 2024, grâce au besoin croissant de solutions de stockage avancées, d'infrastructures de chaîne du froid et de systèmes de suivi RFID. Les composants matériels constituent l'épine dorsale d'opérations d'entreposage efficaces, permettant le stockage et le transport des dispositifs médicaux dans des conditions réglementées.

Le segment des logiciels devrait connaître le TCAC le plus rapide de 12,9 % entre 2025 et 2032, alimenté par la numérisation croissante des opérations logistiques, la demande croissante de systèmes de gestion d'entrepôt basés sur le cloud (WMS) et le besoin de visibilité en temps réel et de suivi de la conformité.

- Par température

En fonction de la température, le marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique est segmenté en produits à température ambiante, réfrigérés, congelés et autres. Le segment à température ambiante a dominé le marché avec une part de chiffre d'affaires de 47,3 % en 2024, en raison du volume important de dispositifs médicaux non thermosensibles, tels que les instruments chirurgicaux et les équipements de diagnostic.

Le segment des produits réfrigérés devrait connaître la croissance la plus rapide, avec un TCAC projeté de 10,2 % entre 2025 et 2032, en raison de la demande croissante de stockage à température contrôlée de vaccins, de réactifs de diagnostic et de dispositifs implantables.

- Par mode de transport

En fonction du mode de transport, le marché est segmenté en logistique terrestre, logistique de fret aérien et logistique de fret maritime. Le segment de la logistique terrestre détenait la plus grande part de marché, soit 51,4 % en 2024, grâce à l'utilisation généralisée des réseaux de transport routier dans toute la région MEA pour les livraisons de dispositifs médicaux à courte et moyenne distance.

Le segment de la logistique du fret aérien devrait connaître le TCAC le plus rapide de 11,7 % entre 2025 et 2032, car il est de plus en plus utilisé pour les expéditions d'appareils urgents et sensibles à la température, en particulier dans les régions éloignées ou mal desservies.

- Par application

En fonction des applications, le marché de l'entreposage et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique est segmenté en dispositifs de diagnostic, dispositifs thérapeutiques, dispositifs de surveillance, dispositifs chirurgicaux et autres dispositifs. Le segment des dispositifs de diagnostic a représenté la plus grande part de chiffre d'affaires, soit 33,6 % en 2024, grâce à l'augmentation des volumes de tests, notamment après la COVID-19, et au besoin de stockage sécurisé des outils de diagnostic sensibles.

Le segment des appareils de surveillance devrait connaître le TCAC le plus rapide, soit 10,5 %, entre 2025 et 2032, soutenu par la forte demande de technologies de surveillance de la santé portables et à distance.

- Par utilisation finale

En fonction de l'utilisation finale, le marché est segmenté en hôpitaux et cliniques, fabricants de dispositifs médicaux, instituts universitaires et de recherche, laboratoires de référence et de diagnostic, entreprises de services médicaux d'urgence, etc. En 2024, le segment des hôpitaux et cliniques détenait la part de marché la plus élevée, soit 38,9 %, en raison des besoins d'approvisionnement à grande échelle et de la demande constante de dispositifs médicaux en milieu clinique.

Le segment des entreprises de dispositifs médicaux devrait connaître le TCAC le plus rapide de 11,2 % entre 2025 et 2032, car de plus en plus de fabricants externalisent leurs opérations logistiques à des fournisseurs tiers pour des raisons d'évolutivité et de rentabilité.

- Par canal de distribution

En fonction du canal de distribution, le marché de l'entreposage et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique est segmenté en logistique conventionnelle et logistique tierce partie (3PL). Le segment de la logistique tierce partie (3PL) dominait avec une part de marché de 62,4 % en 2024, porté par la tendance croissante à l'externalisation des opérations logistiques, notamment pour les dispositifs médicaux thermosensibles et conformes à la réglementation.

Le segment de la logistique conventionnelle devrait connaître le TCAC le plus rapide de 2025 à 2032, largement utilisé par les hôpitaux et les établissements de santé publics dotés de capacités logistiques internes.

Analyse régionale du marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique

- Le marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique représentait 8,4 % de la part de marché mondiale en 2024 et devrait croître à un TCAC de 10,7 % de 2025 à 2032.

- Le marché est alimenté par l'augmentation des dépenses de santé, la croissance du tourisme médical et une demande croissante de solutions efficaces de chaîne d'approvisionnement et de chaîne du froid pour les dispositifs médicaux de grande valeur et sensibles à la température.

- Les réformes gouvernementales, les investissements dans les infrastructures de santé et l'adoption de normes de distribution mondiales améliorent l'efficacité logistique de la région. L'expansion des parcs logistiques et des zones franches, notamment dans les pays du Conseil de coopération du Golfe (CCG), encourage les fabricants internationaux de dispositifs médicaux à mettre en place des centres de distribution régionaux.

Aperçu du marché saoudien des entrepôts et de la logistique des dispositifs médicaux

En 2024, le marché saoudien des entrepôts et de la logistique de dispositifs médicaux détenait la plus grande part de chiffre d'affaires au Moyen-Orient et en Afrique, avec 34,7 %. Le pays investit massivement dans le cadre de sa Vision 2030, privilégiant la modernisation du secteur de la santé, la fabrication locale de dispositifs médicaux et les parcs logistiques intelligents. Des projets d'envergure tels que NEOM et le King Salman Park Logistics Hub sont conçus pour inclure des zones d'entreposage conformes aux BPD, dotées de robotique avancée, de suivi par IA et de solutions de chaîne du froid basées sur l'IoT, adaptées aux équipements médicaux. Le cadre réglementaire mis à jour par l'Autorité saoudienne des produits alimentaires et pharmaceutiques (SFDA) garantit des normes de manipulation rigoureuses pour les dispositifs chirurgicaux et de diagnostic, encourageant ainsi les acteurs mondiaux à pénétrer ce marché.

Aperçu du marché de l'entreposage et de la logistique des dispositifs médicaux aux Émirats arabes unis

Le marché émirien de l'entreposage et de la logistique des dispositifs médicaux a conquis 22,1 % du marché régional en 2024, se positionnant comme le centre névralgique de la logistique des dispositifs médicaux au Moyen-Orient. La présence de plusieurs zones franches, telles que le Dubai Science Park, la zone franche de Jebel Ali (JAFZA) et Dubaï Sud, fait du pays une destination de réexportation privilégiée pour les entreprises mondiales de dispositifs médicaux. Grâce à des infrastructures de pointe, des systèmes automatisés de gestion d'entrepôt et une surveillance de la température en temps réel, les distributeurs basés aux Émirats arabes unis peuvent gérer avec précision les produits biologiques, les implants et les dispositifs de diagnostic à haut risque. Des partenariats stratégiques avec des fournisseurs de technologies et des compagnies aériennes renforcent encore les capacités de livraison du dernier kilomètre.

Aperçu du marché sud-africain des entrepôts et de la logistique des dispositifs médicaux

Le marché sud-africain des entrepôts et de la logistique de dispositifs médicaux représentait 17,6 % du marché régional en 2024, ce qui en fait le principal pôle logistique d'Afrique australe. Le pays bénéficie d'un réseau de transport bien développé, de ports en eau profonde et de capacités de stockage importantes, permettant l'importation de dispositifs chirurgicaux, d'équipements d'imagerie diagnostique et de consommables hospitaliers. Les efforts des acteurs privés et des partenariats gouvernementaux, notamment avec le ministère de la Santé et des initiatives financées par des donateurs (par exemple, le Fonds mondial), permettent la mise en place d'entrepôts à contrôle numérique et d'un suivi par RFID. La demande croissante de produits oncologiques et respiratoires thermosensibles alimente également le développement des infrastructures de la chaîne du froid.

Aperçu du marché égyptien des entrepôts et de la logistique des dispositifs médicaux

Le marché égyptien de l'entreposage et de la logistique des dispositifs médicaux a représenté 11,8 % de la part de marché régionale en 2024, grâce à l'expansion dynamique des zones logistiques et au déploiement de la couverture maladie universelle. La position du Caire, axe commercial central entre l'Afrique, l'Europe et l'Asie, lui confère une importance stratégique pour le transbordement des produits médicaux. Les nouveaux corridors logistiques prévus par la Vision 2030 de l'Égypte et les partenariats avec le secteur privé favorisent la croissance de l'entreposage de produits pharmaceutiques et de dispositifs médicaux, notamment dans les zones d'Alexandrie et du canal de Suez. La demande d'entreposage est également stimulée par l'augmentation des importations de dispositifs orthopédiques, ophtalmiques et cardiovasculaires.

Part de marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique

Le marché de l'entreposage et de la logistique des dispositifs médicaux est principalement dirigé par des entreprises bien établies, notamment :

- Deutsche Post AG (Allemagne)

- FedEx (États-Unis)

- Kuehne+Nagel (Royaume-Uni)

- AWL India Private Limited (Inde)

- CH Robinson Worldwide, Inc. (États-Unis)

- CEVA (France)

- Dimerco (Taïwan)

- DSV (Danemark)

- Hansa International (Chine)

- Hellmann Worldwide Logistics SE & Co. KG (Allemagne)

- Impérial (Afrique du Sud)

- Mercury Business Services (États-Unis)

- OIA Global (États-Unis)

- Omni Logistics, LLC (États-Unis)

- Groupe Rhenus (Allemagne)

- SEKO (États-Unis)

- TIBA (Espagne)

- Toll Holdings Limited (Australie)

Derniers développements sur le marché des entrepôts et de la logistique des dispositifs médicaux au Moyen-Orient et en Afrique

- En novembre 2023, DHL Express a officiellement inauguré son hub d'Asie centrale agrandi à Hong Kong, investissant 562 millions d'euros pour renforcer ses capacités dans un contexte de croissance du commerce mondial. Ce hub, essentiel pour relier l'Asie au reste du monde, a vu sa capacité de traitement des expéditions de pointe augmenter de près de 70 % et peut désormais gérer un volume six fois supérieur à celui de sa création en 2004. Cette expansion souligne l'engagement de DHL à soutenir la croissance de ses clients et à consolider le statut de Hong Kong comme plaque tournante internationale incontournable de l'aviation.

- En décembre 2022, DHL Supply Chain a annoncé un investissement de 10,93 millions de dollars américains pour étendre ses capacités d'entreposage dans le nord de Taïwan, en se concentrant notamment sur les secteurs des semi-conducteurs, des sciences de la vie et de la santé. Le nouveau centre de distribution de Taoyuan-Jian Guo ajoute 10 000 mètres carrés à la surface d'entreposage totale de DHL à Taoyuan, la portant à 37 000 mètres carrés. Cette installation améliore la connectivité pour des opérations logistiques efficaces et soutient l'objectif de l'entreprise d'atteindre 200 000 mètres carrés d'empreinte totale à Taïwan d'ici 2027.

- En septembre 2024, FedEx a lancé la plateforme fdx, une solution commerciale basée sur les données, désormais accessible aux entreprises américaines. Cette plateforme s'appuie sur le réseau FedEx pour améliorer l'expérience client en améliorant la croissance de la demande, les taux de conversion et l'optimisation du traitement des commandes. Parmi ses fonctionnalités notables figurent les estimations de livraison prédictives, les analyses de durabilité, le suivi des commandes personnalisé et la simplification des processus de retour. Raj Subramaniam, PDG de FedEx, a souligné le rôle de la plateforme dans des chaînes d'approvisionnement plus intelligentes lors de l'événement Dreamforce 2024.

- En mars 2024, UPS Healthcare a lancé UPS Supply Chain Symphony R, une plateforme cloud conçue pour intégrer et gérer les données de la chaîne d'approvisionnement des soins de santé issues de divers systèmes opérationnels. Cet outil offre aux clients du secteur de la santé une visibilité complète sur leur logistique, leur permettant de prendre des décisions éclairées, d'améliorer leur planification et d'établir des prévisions précises. En améliorant le contrôle, l'efficacité et la transparence, cette plateforme répond au besoin crucial de rationalisation des chaînes d'approvisionnement dans le secteur de la santé. Kate Gutmann a souligné son potentiel transformateur pour optimiser les opérations mondiales et les soins aux patients.

- En septembre 2024, Kuehne+Nagel, prestataire logistique de premier plan, a inauguré un nouveau centre de traitement des commandes à température contrôlée pour Medtronic à Milton, en Ontario, à seulement 50 km de Toronto. D'une superficie de 25 000 m², ce centre distribuera des dispositifs médicaux aux hôpitaux et abritera les centres d'entretien, de réparation et de maintenance préventive de Medtronic pour ses équipements.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.