Middle East And Africa Medical Clothing Market

Taille du marché en milliards USD

TCAC :

%

USD

198.24 Billion

USD

305.62 Billion

2021

2029

USD

198.24 Billion

USD

305.62 Billion

2021

2029

| 2022 –2029 | |

| USD 198.24 Billion | |

| USD 305.62 Billion | |

|

|

|

Marché des vêtements médicaux au Moyen-Orient et en Afrique, par produit (vêtements professionnels, vêtements pour patients, vêtements spécialisés, vêtements de premiers secours, bandages et serviettes, autres), utilisation (réutilisable et jetable), utilisateur final (hôpitaux, cliniques spécialisées, centres ambulatoires, établissements de soins à domicile, laboratoires de recherche et cliniques et autres), canal de distribution (appel d'offres direct, vente au détail, distributeur tiers, autres) – Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

Les tenues médicales sont souvent fournies aux hôpitaux par les fournisseurs de vêtements médicaux. Les vêtements des patients sont également inclus dans la tenue médicale et sont composés de coton pour plus de confort et de praticité. Pour entrer dans un hôpital, un médecin doit s'habiller de manière appropriée.

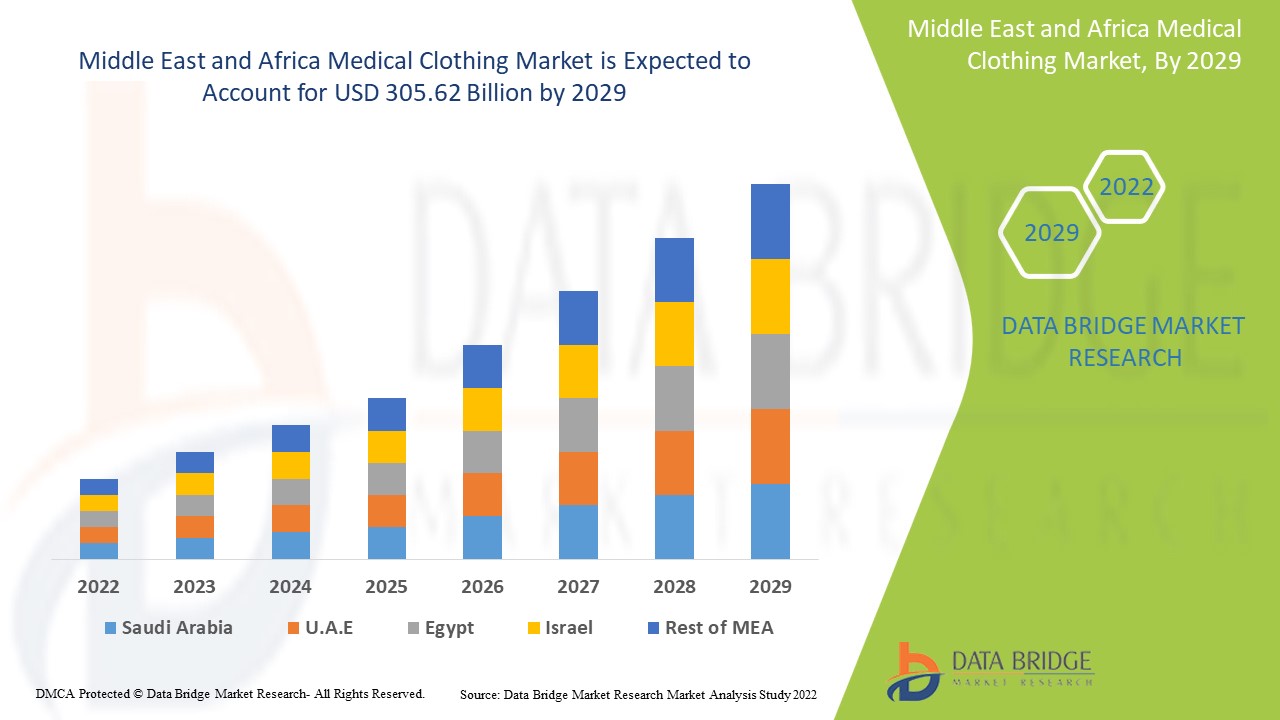

Français Data Bridge Market Research analyse que le marché des vêtements médicaux, qui était de 198,24 milliards USD en 2021, devrait atteindre 305,62 milliards USD d'ici 2029 et devrait connaître un TCAC de 5,56 % au cours de la période de prévision 2022 à 2029. En plus des informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario de marché, le rapport de marché organisé par l'équipe de Data Bridge Market Research comprend également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en milliards USD, volumes en unités, prix en USD |

|

Segments couverts |

Produit (vêtements professionnels, vêtements pour patients, vêtements spécialisés, vêtements de premiers secours, bandages et serviettes, autres), utilisation (réutilisable et jetable), utilisateur final (hôpitaux, cliniques spécialisées, centres ambulatoires, établissements de soins à domicile, laboratoires de recherche et cliniques et autres), canal de distribution (appel d'offres direct, vente au détail, distributeur tiers, autres) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, reste du Moyen-Orient et de l'Afrique (MEA) |

|

Acteurs du marché couverts |

Cardinal Health, Inc. (États-Unis), Mölnlycke Health Care AB (Suède), 3M (États-Unis), Smith+Nephew (Royaume-Uni), Ansell Ltd. (Australie), Superior Group of Companies (États-Unis), Semperit AG Holding (Autriche), Henry Schein, Inc. (États-Unis), Narang Medical Ltd. (Inde), Healing Hands (États-Unis), BARCO UNIFORMS (États-Unis), CHEROKEE UNIFORMS (États-Unis), Aramark Uniform & Career Apparel (États-Unis), Carhartt, Inc. (États-Unis), LynkTrac Technologies LLC (États-Unis), Owens & Minor, Inc. (États-Unis), Prestige Medical (Royaume-Uni), Landau Uniforms (États-Unis), Medline Industries, Inc. (États-Unis) |

|

Opportunités de marché |

|

Définition du marché

Les tenues de travail sont des tenues que portent les personnes travaillant dans les hôpitaux. Les tenues des médecins, des infirmières et du personnel médical sont de styles variés. Les médecins sont des prestataires de soins de santé qui travaillent dans les hôpitaux. Ils doivent porter des vêtements propres et hygiéniques. La tenue d'un médecin doit être pratique et disponible à tout moment.

Dynamique du marché des vêtements médicaux

Conducteurs

- Augmentation des maladies chroniques

Les maladies et troubles chroniques sont en augmentation dans le monde entier. La recherche sur l'augmentation de ce problème de santé à long terme, répandu et coûteux, est influencée par les changements de comportement social et le vieillissement de la population. Les problèmes de santé à long terme augmenteront le nombre de patients se rendant dans les hôpitaux et les cliniques, ce qui pourrait directement augmenter le marché des vêtements médicaux. Des vêtements médicaux de bonne qualité, tels que des gants, des masques et des blouses, seront utilisés pour fournir un traitement médical de qualité et hygiénique, ce qui fera croître le marché et la demande à l'avenir.

- Augmentation de la population de personnes âgées

L’allongement de l’espérance de vie a entraîné une augmentation constante de la population des adultes de 60 ans et plus. La prévalence des maladies chroniques est plus élevée chez les personnes âgées, ce qui entraîne une hausse de la demande de vêtements médicaux. D’ici 2050, il y aura 1,5 milliard de personnes âgées dans le monde, contre 750 millions en 2021. Le marché des vêtements médicaux connaîtra donc une augmentation de la demande dans les années à venir.

- L'incidence des maladies zoonotiques augmente

Les infections zoonotiques sont celles qui se propagent spontanément des animaux aux humains et vice versa. Ces maladies peuvent se propager soit directement par contact direct avec des personnes ou des animaux infectés, soit par la consommation d’aliments et d’eau contaminés qui ont été exposés à l’agent pathogène lors de la préparation. Plus de 75 % des nouvelles maladies infectieuses émergentes chez l’homme sont d’origine animale. En janvier 2020, un coronavirus a été responsable de l’épidémie pandémique. Ce virus a été qualifié d’urgence de santé publique de portée internationale et on pense qu’il provient de chauves-souris ou de serpents. Le besoin de vêtements médicaux devrait augmenter à mesure que la prévalence des maladies infectieuses augmente.

Opportunités

Les dispositifs médicaux portables utilisent les dernières avancées technologiques, notamment l'IA, pour identifier les états physiologiques anormaux et alerter les parties concernées. Le développement de l'industrie des vêtements médicaux pourrait bénéficier des opportunités offertes par la technologie. De plus, au cours de la période de projection, les chances de croissance du marché des vêtements médicaux seront plus grandes en raison du nombre croissant de prestataires de services et de l'expansion des marchés.

Contraintes/Défis

- Réglementations gouvernementales rigides

Les dispositifs médicaux, les tenues de travail, les gants, les masques et les blouses doivent tous être approuvés par la FDA. Ils sont souvent fabriqués pour répondre à des niveaux de protection allant d'un risque minimal à un risque élevé, en fonction des dangers encourus. L'autorisation de mise sur le marché des vêtements médicaux est soumise à un certain nombre d'exigences strictes, notamment la résistance aux infections, la résistance à la traction, la résistance à la déchirure et les niveaux de barrière. La fabrication du produit est rendue plus coûteuse par ces réglementations et permis stricts, ce qui peut entraver l'expansion du marché.

Ce rapport sur le marché des vêtements médicaux fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des vêtements médicaux, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché des vêtements médicaux

En raison de l’augmentation du nombre de cas de COVID-19 dans différentes parties du monde, le secteur de la santé s’est entièrement concentré sur les soins aux patients. L’objectif principal est de réduire les effets du virus, et les efforts vigoureux du gouvernement pour promouvoir la sécurité et l’hygiène ont conduit à des investissements substantiels dans le matériel médical. Par exemple, la Chine a déclaré en avril 2020 qu’elle augmenterait la production de masques à 116 millions par jour, soit 12 fois le niveau d’avant la pandémie.

L'épidémie de COVID-19 a ouvert de nombreuses opportunités pour les acteurs et les producteurs du marché mondial des vêtements médicaux. La demande de gants, de masques et de kits EPI de qualité médicale a récemment augmenté, stimulant l'industrie des vêtements médicaux.

Développement récent

- En juillet 2020, en raison du besoin croissant d'EPI, Herida Healthcare s'est associé à North Tees, Hartlepool Solutions et le NHS pour fabriquer des blouses médicales extrêmement stériles.

Portée du marché des vêtements médicaux au Moyen-Orient et en Afrique

Le marché des vêtements médicaux est segmenté en fonction du produit, de l'utilisation, du canal de distribution et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Vêtements professionnels

- Vêtements pour patients

- Vêtements spécialisés

- Vêtements de premiers secours

- Enveloppements et serviettes

- Autres

Usage

- Réutilisable

- Jetable

Utilisateur final

- Hôpitaux

- Cliniques spécialisées

- Centres ambulatoires

- Cadres de soins à domicile

- Laboratoires de recherche et cliniques

- Autres

Canal de distribution

- Appel d'offres direct

- Ventes au détail

- Distributeur tiers

- Autres

Analyse/perspectives régionales du marché des vêtements médicaux

Le marché des vêtements médicaux est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, produit, utilisation, canal de distribution et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des vêtements médicaux sont l’Arabie saoudite, les Émirats arabes unis, l’Afrique du Sud, l’Égypte, Israël, le reste du Moyen-Orient et de l’Afrique (MEA).

L'Allemagne devrait connaître le deuxième taux de croissance le plus élevé au cours de la période de prévision de 2022 à 2029 en raison de la proportion croissante de la population âgée dans le pays.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des vêtements médicaux

Le paysage concurrentiel du marché des vêtements médicaux fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des vêtements médicaux.

Certains des principaux acteurs opérant sur le marché des vêtements médicaux sont :

- Cardinal Health, Inc. (États-Unis)

- Mölnlycke Health Care AB (Suède)

- 3M (États-Unis)

- Smith+Nephew (Royaume-Uni)

- Ansell Ltd. (Australie)

- Groupe de sociétés Superior (États-Unis)

- Semperit AG Holding (Autriche)

- Henry Schein, Inc. (États-Unis)

- Narang Medical Ltd. (Inde)

- Les mains qui guérissent (États-Unis)

- UNIFORMES BARCO (États-Unis)

- UNIFORMES CHEROKEE (USA)

- Uniformes et vêtements de travail Aramark (États-Unis)

- Carhartt, Inc. (États-Unis)

- LynkTrac Technologies LLC (États-Unis)

- Owens & Minor, Inc. (États-Unis)

- Prestige Medical (Royaume-Uni)

- Uniformes Landau (États-Unis)

- Medline Industries, Inc. (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REGULATORY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 PANDEMIC OUTBREAK OF COVID-19

5.1.2 ESCALATION IN NUMBER OF SURGERIES

5.1.3 GROWING DEMAND FOR BETTER QUALITY HEALTHCARE AND HYGIENE

5.1.4 INCREASING GERIATRIC POPULATION

5.1.5 UPSURGE IN INCIDENCES OF CHRONIC DISEASES

5.2 RESTRAINTS

5.2.1 HIGH NUMBER PROBLEMS ASSOCIATED DURING DONNING AND DOFFING OF PPE

5.2.2 POOR COMFORT ABILITY

5.2.3 ALLERGIC REACTIONS ASSOCIATED WITH LATEX AND POWDERED GLOVES

5.3 OPPORTUNITIES

5.3.1 INTRODUCTION OF INNOVATIVE PRODUCT LAUNCHES

5.3.2 PARTNERSHIP AGREEMENT AND ACQUISITION

5.3.3 INCREASING PRODUCTION CAPACITY

5.4 CHALLENGES

5.4.1 STRINGENT REGULATION POLICIES

6 COVID-19 IMPACT ON MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET

6.1 PRICE IMPACT

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON DEMAND

6.4 STRATEGIC DECISIONS FOR MANUFACTURERS

6.5 CONCLUSION

7 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 PROFESSIONAL APPAREL

7.2.1 FACE MASKS

7.2.1.1 NON-WOVEN MASK

7.2.1.2 CLOTH MASK

7.2.2 SCRUBS

7.2.2.1 TYPE

7.2.2.1.1 TOPS

7.2.2.1.2 PANTS

7.2.2.1.3 JACKETS

7.2.2.1.4 CAPS

7.2.2.1.5 OTHERS

7.2.2.2 MATERIAL

7.2.2.2.1 WOVEN MEDICAL SCRUBS

7.2.2.2.2 NON-WOVEN MEDICAL SCRUBS

7.2.3 LAB COATS

7.2.3.1 Length

7.2.3.1.1 HIP LENGTH

7.2.3.1.2 KNEE LENGTH

7.2.3.2 TYPE

7.2.3.2.1 FLUID-RESISTANT LAB COAT

7.2.3.2.2 STATIC-RESISTANT LAB COAT

7.2.4 HEADWEAR

7.2.4.1 BOUFFANT CAPS

7.2.4.1.1 COMFORT BOUFFANT CAPS

7.2.4.1.2 PREMIUM BOUFFANT CAPS

7.2.4.1.3 OTHERS

7.2.4.2 BEARD COVERS

7.2.5 SHOE COVERS

7.2.5.1 NON-CONDUCTIVE

7.2.5.2 NON-SKID

7.3 PATIENT APPAREL

7.3.1 TYPE

7.3.1.1 IV GOWN WITH SNAP SLEEVE CLOSURE

7.3.1.2 PLUS SIZE TEAL GOWNS

7.3.1.3 COMPLETE COVERAGE GOWNS

7.3.1.4 PEDIATRIC GOWN

7.3.1.5 OTHERS

7.3.2 MATERIAL

7.3.2.1 REINFORCED TISSUE

7.3.2.2 NON-WOVEN

7.3.2.3 OTHERS

7.4 SPECIALTY APPAREL

7.4.1 ISOLATION GOWNS

7.4.1.1 AAMI ISOLATION GOWN

7.4.1.1.1 LEVEL 1

7.4.1.1.2 LEVEL 4

7.4.1.1.3 LEVEL 3

7.4.1.1.4 LEVEL 2

7.4.1.2 TRI-LAYER SMS GOWN

7.4.1.3 SPUNBOND POLYPROPYLENE GOWN

7.4.1.4 OTHERS

7.4.2 COVERALLS

7.4.2.1 TYPE

7.4.2.1.1 MEDIUM WEIGHT COVERALLS

7.4.2.1.2 HEAVY WEIGHT COVERALLS

7.4.2.2 MATERIAL

7.4.2.2.1 POLYETHYLENE

7.4.2.2.2 SMS MATERIAL

7.4.2.2.3 OTHERS

7.4.3 APRONS

7.4.3.1 COTTON APRON

7.4.3.2 PLASTIC APRON

7.4.3.3 NON-WOVEN APRON

7.4.3.4 OTHERS

7.4.4 OTHERS

7.5 FIRST AID CLOTHING

7.5.1 HEALTHCARE EMERGENCIES

7.5.2 CIVIL PROTECTION

7.6 WRAPS & TOWELS

7.6.1 WASH TOWELS

7.6.2 DOCTOR TOWELS

7.6.3 SURGICAL TOWELS

7.7 OTHERS

8 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET, BY USAGE

8.1 OVERVIEW

8.2 DISPOSABLE

8.3 REUSABLE

9 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET, BY END USER

9.1 OVERVIEW

9.2 HOSPITALS

9.3 SPECIALTY CLINICS

9.4 AMBULATORY CENTERS

9.5 RESEARCH & CLINICAL LABORATORIES

9.6 HOME CARE SETTINGS

9.7 OTHERS

10 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT TENDER

10.3 THIRD PARTY DISTRIBUTOR

10.4 RETAIL SALES

10.5 OTHERS

11 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST & AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 UAE

11.1.4 ISRAEL

11.1.5 REST OF MIDDLE EAST & AFRICA

11.1.6 EGYPT

12 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 SWOT

14 COMPANY PROFILES

14.1 CARDINAL HEALTH

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 MEDLINE INDUSTRIES, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 OWENS & MINOR, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 ARAMARK UNIFORM & CAREER APPAREL (A SUBSIDIARY OF ARAMARK)

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 MÖLNLYCKE HEALTH CARE AB (A SUBSIDIARY OF INVESTOR AB)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 LANDAU UNIFORMS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 3M

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 ABG UNIFORMS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ANSELL LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BARCO UNIFORMS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 BBN MEDICAL EQUIPMENT

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 CARHARTT, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 CHEROKEE UNIFORMS.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 HEALING HANDS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 HENRY SCHEIN, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 LYNKTRAC TECHNOLOGIES LLC

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 NARANG MEDICAL LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 SEMPERIT AG HOLDING

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 SUPERIOR GROUP OF COMPANIES

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 PRESTIGE MEDICAL.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 POPULATION AGES 65 AND ABOVE

TABLE 2 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 4 MIDDLE EAST AND AFRICA PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA AAMI ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA OTHERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA DISPOSABLE IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA REUSABLE IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA HOSPITALS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA SPECIALTY CLINICS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA AMBULATORY CENTERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA RESEARCH & CLINICAL LABORATORIES IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA HOME CARE SETTINGS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA OTHERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA DIRECT TENDER IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA THIRD PARTY DISTRIBUTOR IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA RETAIL SALES IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA OTHERS IN MEDICAL CLOTHING MARKET, BY REGION 2017-2026 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 47 MIDDLE EAST & AFRICA PROFESSIONAL APPAREL IN MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 69 SOUTH AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 70 SOUTH AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 71 SOUTH AFRICA PROFESSIONAL APPAREL IN SOUTH AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 72 SOUTH AFRICA FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 73 SOUTH AFRICA SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 74 SOUTH AFRICA SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 75 SOUTH AFRICA LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 76 SOUTH AFRICA LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 77 SOUTH AFRICA HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 78 SOUTH AFRICA BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 79 SOUTH AFRICA SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 80 SOUTH AFRICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 81 SOUTH AFRICA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 82 SOUTH AFRICA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 83 SOUTH AFRICA ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 84 SOUTH AFRICA AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 85 SOUTH AFRICA COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 86 SOUTH AFRICA COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 87 SOUTH AFRICA APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 88 SOUTH AFRICA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 89 SOUTH AFRICA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 90 SOUTH AFRICA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 91 SOUTH AFRICA MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 92 SOUTH AFRICA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 93 SAUDI ARABIA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 94 SAUDI ARABIA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 95 SAUDI ARABIA PROFESSIONAL APPAREL IN SAUDI ARABIA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 96 SAUDI ARABIA FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 97 SAUDI ARABIA SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 98 SAUDI ARABIA SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 99 SAUDI ARABIA LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 100 SAUDI ARABIA LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 101 SAUDI ARABIA HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 102 SAUDI ARABIA BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 103 SAUDI ARABIA SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 104 SAUDI ARABIA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 105 SAUDI ARABIA PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 106 SAUDI ARABIA SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 107 SAUDI ARABIA ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 108 SAUDI ARABIA AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 109 SAUDI ARABIA COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 110 SAUDI ARABIA COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 111 SAUDI ARABIA APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 112 SAUDI ARABIA FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 113 SAUDI ARABIA WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 114 SAUDI ARABIA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 115 SAUDI ARABIA MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 116 SAUDI ARABIA MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 117 UAE MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 118 UAE MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 119 UAE PROFESSIONAL APPAREL IN SAUDI ARABIA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 120 UAE FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 121 UAE SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 122 UAE SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 123 UAE LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 124 UAE LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 125 UAE HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 126 UAE BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 127 UAE SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 128 UAE PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 129 UAE PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 130 UAE SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 131 UAE ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 132 UAE AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 133 UAE COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 134 UAE COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 135 UAE APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 136 UAE FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 137 UAE WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 138 SAUDI ARABIA MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 139 UAE MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 140 UAE MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 141 ISRAEL MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 142 ISRAEL MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 143 ISRAEL PROFESSIONAL APPAREL IN SAUDI ARABIA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 144 ISRAEL FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 145 ISRAEL SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 146 ISRAEL SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 147 ISRAEL LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 148 ISRAEL LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 149 ISRAEL HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 150 ISRAEL BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 151 ISRAEL SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 152 ISRAEL PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 153 ISRAEL PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 154 ISRAEL SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 155 ISRAEL ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 156 ISRAEL AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 157 ISRAEL COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 158 ISRAEL COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 159 ISRAEL APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 160 ISRAEL FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 161 ISRAEL WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 162 ISRAEL MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 163 ISRAEL MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 164 ISRAEL MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 165 REST OF MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 166 REST OF MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 167 EGYPT MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 168 EGYPT MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (UNITS)

TABLE 169 EGYPT PROFESSIONAL APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 170 EGYPT FACE MASKS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 171 EGYPT SCRUBS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 172 EGYPT SCRUBS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 173 EGYPT LAB COATS IN MEDICAL CLOTHING MARKET, BY LENGTH, 2018-2027 (USD MILLION)

TABLE 174 EGYPT LAB COATS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 175 EGYPT HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 176 EGYPT BOUFFANT CAPS HEADWEAR IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 177 EGYPT SHOE COVERS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 178 EGYPT PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 179 EGYPT PATIENT APPAREL IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 180 EGYPT SPECIALTY APPAREL IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 181 EGYPT ISOLATION GOWNS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 182 EGYPT AAMI ISOLATION IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 183 EGYPT COVERALLS IN MEDICAL CLOTHING MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 184 EGYPT COVERALLS IN MEDICAL CLOTHING MARKET, BY MATERIAL, 2018-2027 (USD MILLION)

TABLE 185 EGYPT APRONS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 186 EGYPT FIRST AID CLOTHING IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 187 EGYPT WRAPS & TOWELS IN MEDICAL CLOTHING MARKET, BY PRODUCT, 2018-2027 (USD MILLION)

TABLE 188 EGYPT MEDICAL CLOTHING MARKET, BY USAGE, 2018-2027 (USD MILLION)

TABLE 189 EGYPT MEDICAL CLOTHING MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 190 EGYPT MEDICAL CLOTHING MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

Liste des figures

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: SEGMENTATION

FIGURE 11 PROFESSIONAL APPAREL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET

FIGURE 13 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY PRODUCT, 2019

FIGURE 14 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY PRODUCT, 2019-2027 (USD MILLION)

FIGURE 15 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY PRODUCT, CAGR (2020-2027)

FIGURE 16 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 17 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY USAGE, 2019

FIGURE 18 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY USAGE, 2019-2027 (USD MILLION)

FIGURE 19 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY USAGE, CAGR (2020-2027)

FIGURE 20 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY USAGE, LIFELINE CURVE

FIGURE 21 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY END USER, 2019

FIGURE 22 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY END USER, 2019-2027 (USD MILLION)

FIGURE 23 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY END USER, CAGR (2020-2027)

FIGURE 24 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY END USER, LIFELINE CURVE

FIGURE 25 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 26 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

FIGURE 27 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2020-2027)

FIGURE 28 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 29 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET: SNAPSHOT (2019)

FIGURE 30 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET: BY COUNTRY (2019)

FIGURE 31 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET: BY COUNTRY (2020 & 2027)

FIGURE 32 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET: BY COUNTRY (2020 & 2027)

FIGURE 33 MIDDLE EAST & AFRICA MEDICAL CLOTHING MARKET: BY PRODUCT (2018-2027)

FIGURE 34 MIDDLE EAST AND AFRICA MEDICAL CLOTHING MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.