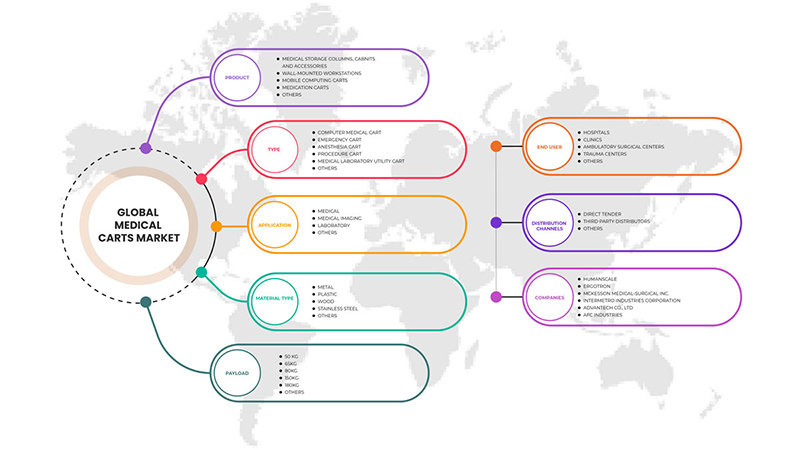

Marché des chariots médicaux au Moyen-Orient et en Afrique, par produit (chariots informatiques mobiles, colonnes de stockage médicales, armoires et accessoires, chariots à médicaments, postes de travail muraux et autres), type (chariot médical informatique, chariot d’urgence, chariot de procédure, chariot d’anesthésie, chariot utilitaire de laboratoire médical et autres), application (médical, imagerie médicale, laboratoire et autres), type de matériau (plastique, bois, acier inoxydable, métal et autres), charge utile (50 kg, 65 kg, 80 kg, 150 kg, 180 kg et autres), utilisateur final (hôpitaux, cliniques, centres de chirurgie ambulatoire, centres de traumatologie et autres), canal de distribution (appel d’offres direct, distributeurs tiers et autres) – Tendances et prévisions de l’industrie jusqu’en 2029.

Analyse et perspectives du marché des chariots médicaux au Moyen-Orient et en Afrique

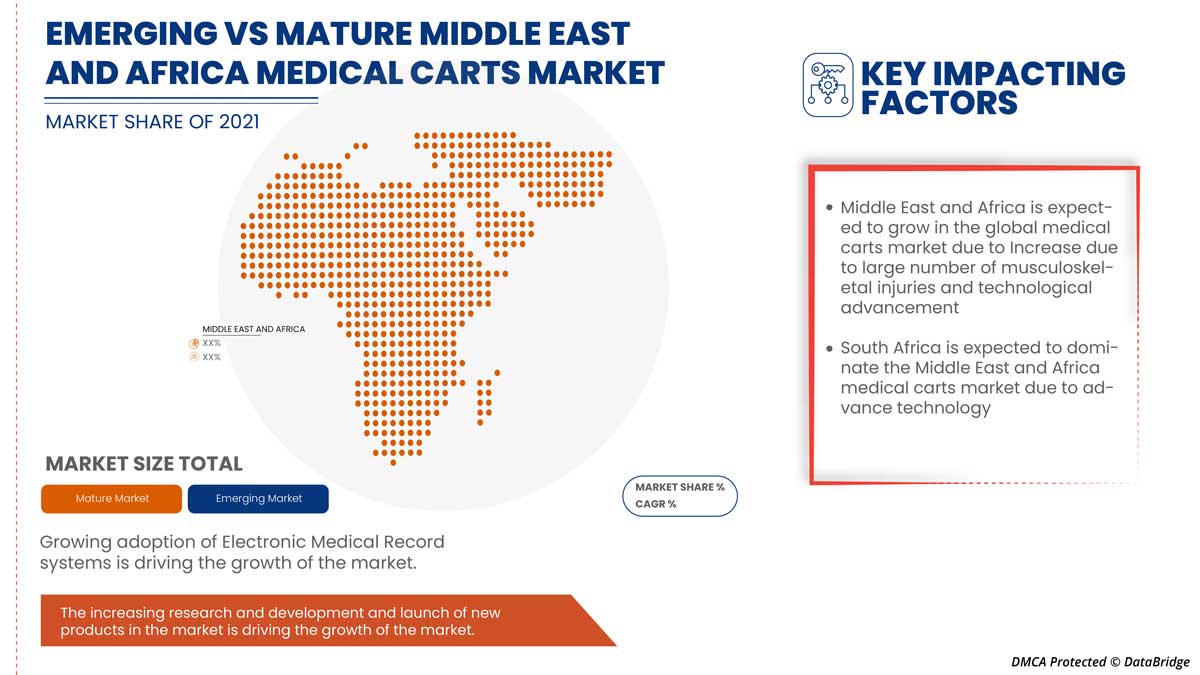

Le marché des chariots médicaux au Moyen-Orient et en Afrique devrait croître en raison de l'amélioration des installations et des infrastructures de soins de santé et de l'adoption de dossiers médicaux électroniques dans les hôpitaux, ce qui peut stimuler la croissance du marché. Les autres facteurs qui devraient propulser la croissance du marché des chariots médicaux comprennent l'augmentation des cas de blessures musculo-squelettiques et d'interventions chirurgicales.

D'autres facteurs, tels que le manque de professionnels qualifiés et le coût élevé des chariots médicaux personnalisés, freinent la croissance du marché des chariots médicaux au Moyen-Orient et en Afrique. D'autre part, l'augmentation des dépenses de santé et l'émergence de pays dotés d'hôpitaux développés constituent une opportunité pour la croissance du marché des chariots médicaux au Moyen-Orient et en Afrique.

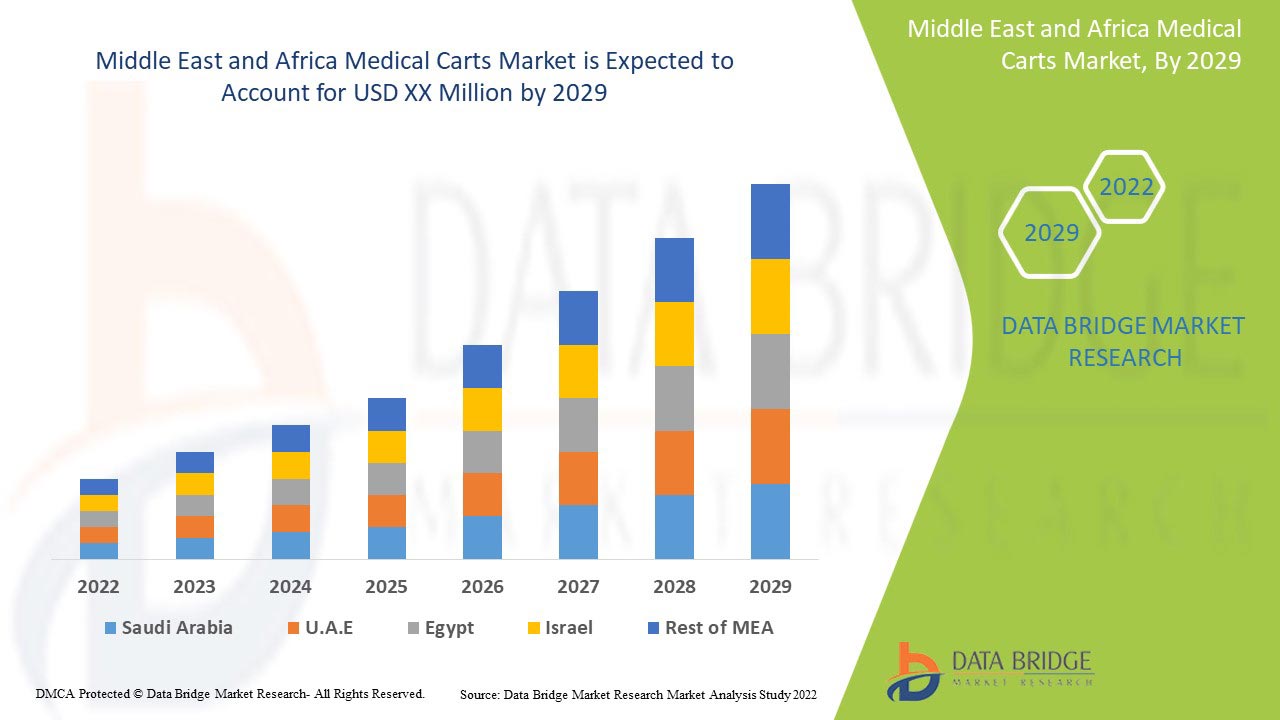

Data Bridge Market Research analyse que le marché des chariots médicaux au Moyen-Orient et en Afrique connaîtra un TCAC de 5,6 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par produit (chariots informatiques mobiles, colonnes de stockage médicales, armoires et accessoires, chariots à médicaments, postes de travail muraux et autres), type (chariot médical informatique, chariot d'urgence, chariot d'intervention, chariot d'anesthésie, chariot utilitaire de laboratoire médical et autres), application (médicale, imagerie médicale, laboratoire et autres), type de matériau (plastique, bois, acier inoxydable, métal et autres), charge utile (50 kg, 65 kg, 80 kg, 150 kg, 180 kg et autres), utilisateur final (hôpitaux, cliniques, centres de chirurgie ambulatoire, centres de traumatologie et autres), canal de distribution (appel d'offres direct, distributeurs tiers et autres) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

ITD Gmbh, Omnicell Inc., Midmark Corporation, Herman Miller, Inc. et AMD Telemedicine, entre autres. |

Définition du marché des chariots médicaux au Moyen-Orient et en Afrique

Les chariots médicaux sont des chariots mobiles légers qui sont utilisés dans les établissements médicaux pour diverses applications. Ils sont largement utilisés pour stocker et transporter des médicaments, du matériel d'urgence et des fournitures médicales. Les chariots à médicaments sont généralement des unités rectangulaires ou carrées avec des roulettes pivotantes et des compartiments spécifiques pour contenir de nombreuses fournitures médicales. Ils sont conçus pour être pratiques pour les infirmières, les médecins et les professionnels de la santé afin d'administrer en permanence la routine de médicaments des patients pendant leur séjour à l'hôpital. Leur cadre est principalement en acier inoxydable ou en alliage d'acier. Les chariots d'urgence sont positionnés dans tous les hôpitaux, permettant un accès à tout moment en cas d'urgence. Chaque tiroir du chariot est correctement étiqueté pour que le personnel de santé puisse trouver facilement l'équipement dans l'urgence. Certains autres chariots médicaux comprennent les chariots d'anesthésie, les chariots utilitaires médicaux, les chariots de procédure et les chariots muraux. Certains chariots médicaux, comme les chariots mobiles pour appareils à ultrasons portables, sont dotés de technologies avancées comme un levier pneumatique pour un réglage facile de la hauteur. Ils sont équipés de supports pour sondes à ultrasons, de lingettes cliniques, de distributeurs de gel à ultrasons, de distributeurs de gants hygiéniques et sont livrés avec une roulette robuste.

Dynamique du marché des chariots médicaux au Moyen-Orient et en Afrique

Conducteurs

- Améliorer les installations et les infrastructures de santé

Les établissements de santé, les hôpitaux, les cliniques, les centres de soins ambulatoires, les centres de soins spécialisés, les centres de maternité et les centres de soins psychiatriques augmentent au Moyen-Orient et en Afrique en raison de l'augmentation des cas de maladies chroniques et de maladies infectieuses qui nécessitent des hospitalisations et des séjours à l'hôpital. La pandémie a considérablement augmenté la demande de chariots médicaux, avec des unités de soins intensifs (USI) pour le traitement des patients. De nombreux pays en développement adoptent diverses solutions et stratégies pour améliorer les installations de santé de leur pays.

- Adoption du dossier médical électronique (DME) dans les hôpitaux

De nombreux secteurs de la santé sont obligés d'installer des DME dans leurs hôpitaux ou cliniques pour convertir tous les dossiers médicaux au format numérique, principalement intégrés dans les chariots médicaux pour un accès facile. Tout hôpital qui n'active pas le DME sera considéré comme ayant des données ou des dossiers illisibles et incomplets.

- Application avancée de chariots médicaux

Les chariots médicaux récemment fabriqués sont dotés de nombreuses solutions informatiques pour faciliter le stockage et l'accès aux soins médicaux. La plupart des appareils sont équipés d'écrans tactiles aux designs fins pour une utilisation facile. Ils sont légers et dotés de roues lisses permettant une mobilité aisée avec une pression considérablement réduite de la part des infirmières pour éviter les douleurs musculaires. Ces écrans tactiles peuvent améliorer la qualité des soins et éliminer les conséquences humaines désastreuses, qui peuvent entraîner une erreur de dosage et d'approvisionnement du traitement. De nombreux fabricants tentent d'innover dans de nouvelles avancées dans leurs chariots médicaux.

Opportunités

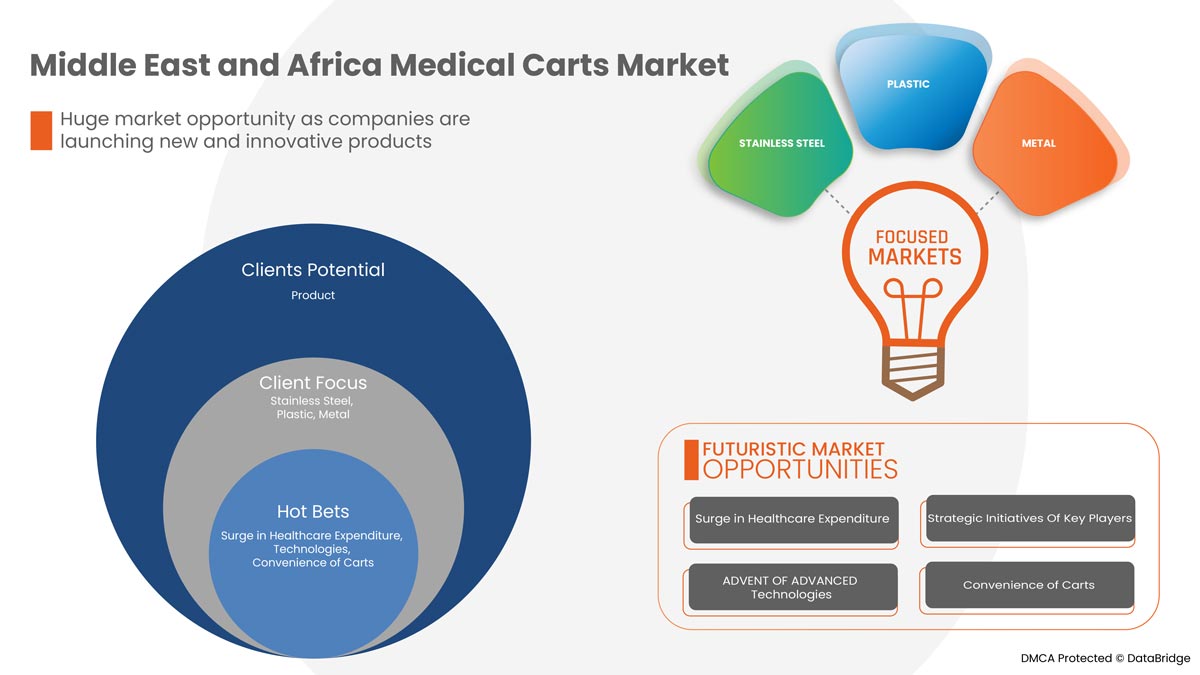

- augmentation des dépenses de santé

Le montant des dépenses de santé d'un pays et son taux de croissance au fil du temps dépendent d'une grande variété de facteurs économiques et sociaux, notamment des modalités de financement et de la structure de l'organisation du système de santé. En particulier, il existe une forte corrélation entre le niveau global de revenu et le montant que la population de ce pays dépense en soins de santé.

Les dépenses de santé ont augmenté dans les pays développés et les économies émergentes en raison de l'augmentation du revenu disponible des personnes. De plus, pour répondre aux besoins de la population, les organismes gouvernementaux et les organisations de santé de différentes régions prennent des initiatives en accélérant les dépenses de santé. L'augmentation des dépenses de santé aide les organisations de santé à améliorer leurs installations et leurs équipements, y compris les chariots médicaux.

- Initiatives stratégiques des principaux acteurs du marché

Les initiatives stratégiques telles que les acquisitions, les partenariats, les accords contractuels et la participation à des conférences offrent des opportunités d'élargir leur base de clientèle. De plus, grâce à de telles stratégies d'initiatives, les deux entreprises étendent leur portée grâce à de nouveaux marchés géographiques ou sectoriels, à l'accès à de nouveaux produits ou services ou à de nouveaux types de clients. Les deux acteurs du marché ouvrent la porte à des ressources supplémentaires ou nouvelles telles que la technologie et le talent.

- Commodité des chariots

Les chariots médicaux aident le personnel médical et chirurgical à se dépêcher grâce à leur application pratique. De nombreux prestataires de soins de santé ont opté pour des chariots médicaux équipés de systèmes EMR pour stocker les données médicales et les maintenir sur place afin d'avoir une vision continue de l'évolution du traitement. Ces chariots ont aidé les prestataires de soins de santé à éliminer la montagne de documents papier liés aux données médicales. La charge a été réduite grâce à un seul écran tactile permettant de stocker et d'accéder à plusieurs données sur les chariots médicaux EMR. En cas d'urgence, ces chariots équipés de systèmes EMR permettent une recherche et une visualisation rapides des dossiers instantanément.

- Pays émergents dotés d'hôpitaux développés

Les pays en développement comme l'Inde, la Chine et l'Argentine, entre autres, améliorent leurs installations de soins de santé. L'augmentation des cas de maladies chroniques non transmissibles, d'arrêts cardiaques, de diabète et d'autres maladies impose des exigences élevées aux établissements hospitaliers, avec une augmentation des admissions et des traitements hospitaliers. Les taux élevés de maladies dans les pays en développement augmentent également la possibilité pour les acteurs du marché de distribuer leurs produits à un rythme soutenu. La principale raison de leur charge de morbidité est les conséquences de la pauvreté, comme la mauvaise nutrition, la pollution de l'air et les habitudes alimentaires et de vie insalubres. Par conséquent, cela augmente le besoin d'hôpitaux hautement équipés dans ces pays en développement.

Contraintes/Défis

- poste de travail lourd sur roulettes

La plupart des chariots médicaux utilisés dans les hôpitaux ou les services médicaux doivent être conçus de manière ergonomique pour éviter les problèmes de poids pour tout professionnel de la santé qui les utilise. Un poste de travail lourd sur roulettes pèse toujours sur les infirmières qui poussent le chariot.

- cadre réglementaire strict

L'utilisation de chariots médicaux avec de nombreuses spécificités et avancées dans les hôpitaux augmente rapidement, avec la croissance de la population âgée et plusieurs maladies cancérigènes nécessitant de longs séjours à l'hôpital et un entretien médical de routine. Dans le même temps, les acteurs des fabricants de chariots médicaux sur le marché doivent suivre des réglementations spécifiques pour obtenir l'approbation des autorités supérieures pour lancer le produit sur le marché. Ces directives strictes doivent être suivies, et c'est l'une des tâches les plus difficiles parmi toutes les étapes. L'approbation préalable à la mise sur le marché de divers dispositifs médicaux varie d'un pays à l'autre. La FDA américaine réglemente les chariots médicaux aux États-Unis. L'Union européenne (UE) détient en Europe. Cependant, le développement rapide des politiques et réglementations de confidentialité est en cours en Asie-Pacifique, en Europe, au Moyen-Orient et en Afrique, notamment en Inde, en Russie, en Chine, en Corée du Sud, à Singapour, à Hong Kong et en Australie.

Impact de la pandémie de COVID-19 sur le marché des chariots médicaux au Moyen-Orient et en Afrique

La COVID-19 a eu un impact majeur sur le marché des chariots médicaux au Moyen-Orient et en Afrique. La COVID-19 n'a pas eu d'effet délétère sur le prix et la demande de produits de chariots médicaux à un niveau plus élevé en raison des ventes en ligne progressives et des alternatives de livraison innovantes disponibles avec les plus grandes préoccupations de sécurité pour les principaux centres de santé, hôpitaux, cliniques et centres de chirurgie ambulatoire. Cependant, l'augmentation des maladies chroniques, des cas chirurgicaux et des admissions à l'hôpital a considérablement augmenté l'utilisation des chariots médicaux au Moyen-Orient et en Afrique. Pendant et après la COVID-19, les chariots médicaux ont connu une demande accrue en raison des besoins croissants des hôpitaux dans diverses régions et les progrès de la recherche et du développement en matière d'équipements médicaux ont accéléré la croissance du marché au Moyen-Orient et en Afrique. La demande de chariots médicaux a augmenté au cours des dernières années, car les chariots médicaux se sont développés dans les hôpitaux, les cliniques, les centres de traumatologie et les centres de chirurgie ambulatoire. Par conséquent, la demande de chariots médicaux est toujours restée élevée, car de nombreux hôpitaux ont augmenté avec le besoin de meilleures installations d'équipement. L'épidémie de COVID-19 a eu un impact positif sur la croissance du marché en raison de la forte demande de chariots médicaux, en particulier dans divers hôpitaux, mais la perturbation de la chaîne d'approvisionnement a été difficile. Cependant, de nombreux autres chariots médicaux utilisés dans les cabinets médicaux et les services de soins intensifs d'urgence sont mis à la disposition des hôpitaux grâce à des moyens de transport innovants et à des ventes en ligne. La priorité actuelle dans la plupart des hôpitaux est donnée aux traitements COVID-19, car la flambée des cas de COVID-19 est toujours persistante, ce qui augmente également l'utilisation de chariots médicaux pour de nombreuses fournitures de médicaments. De plus, de nombreux gouvernements internationaux et organisations de soins de santé ont soutenu l'approvisionnement de ces produits en raison de leur haute priorité dans les cas cruciaux.

Développements récents

- En septembre 2021, Omnicell, Inc. a annoncé avoir finalisé l'acquisition précédemment annoncée de FDS Amplicare. Cette acquisition ajoute une suite complète et complémentaire de solutions SaaS de gestion financière, d'analyse et de santé de la population à la division EnlivenHealth d'Omnicell, ce qui a un impact sur la croissance du marché de l'entreprise

- En septembre 2020, Midmark Corp a annoncé l'acquisition de Schroer Manufacturing Company (« Shor-Line »), un fabricant d'équipements de santé animale basé à Kansas City, au Kansas. Cette acquisition vient enrichir le portefeuille de Midmark et positionne l'entreprise comme un partenaire de conception privilégié pour les professionnels des soins aux animaux.

Portée du marché des chariots médicaux au Moyen-Orient et en Afrique

Le marché des chariots médicaux du Moyen-Orient et de l'Afrique est classé en sept segments notables en fonction du produit, du type, de l'application, du type de matériau, de la charge utile, de l'utilisateur final et du canal de distribution. La croissance de ces segments aidera à analyser les segments de croissance du marché dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Chariots informatiques mobiles

- Colonnes de stockage médicales

- Armoires et accessoires

- Chariots à médicaments

- Postes de travail muraux

- Autre

En fonction du produit, le marché des chariots médicaux est segmenté en chariots informatiques mobiles, colonnes de stockage médicales, armoires et accessoires, chariots à médicaments, postes de travail muraux et autres.

Taper

- Chariot médical informatisé

- Chariot d'urgence

- Chariot de procédure

- Chariot d'anesthésie

- Chariot utilitaire pour laboratoire médical

- Autres

En fonction du type, le marché des chariots médicaux est segmenté en chariot médical informatique, chariot d'urgence, chariot de procédure, chariot d'anesthésie, chariots utilitaires de laboratoire médical et autres.

Application

- Médical

- Imagerie médicale

- Laboratoire

- Autres

En fonction des applications, le marché des chariots médicaux est segmenté en médical, imagerie médicale, laboratoire et autres.

Type de matériau

- Plastique

- Bois

- Acier inoxydable

- Métal

- Autres

En fonction du type de matériau, le marché des chariots médicaux est segmenté en plastique, bois, acier inoxydable, métal et autres .

Charge utile

- 50 kg

- 65 kg

- 80 kg

- 150 kg

- 180 kg

- Autres

En fonction de la charge utile, le marché des chariots médicaux est segmenté en 50 kg, 65 kg, 80 kg, 150 kg, 180 kg et autres.

Utilisateur final

- Hôpitaux

- Cliniques

- Centres de chirurgie ambulatoire

- Centres de traumatologie

- Autres.

En fonction de l’utilisateur final, le marché des chariots médicaux est segmenté en hôpitaux, cliniques, centres de chirurgie ambulatoire, centres de traumatologie et autres.

Canal de distribution

- Appel d'offres direct

- Distributeurs tiers

- Autres

En fonction du canal de distribution, le marché des chariots médicaux est segmenté en appels d'offres directs, distributeurs tiers et autres.

Analyse/perspectives régionales du marché des chariots médicaux au Moyen-Orient et en Afrique

Le marché des chariots médicaux au Moyen-Orient et en Afrique est analysé. Les informations sur la taille du marché et les tendances sont basées sur le produit, le type, l'application, le type de matériau, la charge utile, l'utilisateur final et le canal de distribution.

The countries covered in the Middle East and Africa medical carts market report are South Africa, Saudi Arabia, U.A.E, Egypt, Israel and Rest of Middle East and Africa.

South Africa dominates the Middle East and Africa medical carts market with a CAGR of around 7.4% in terms of market share and market revenue. It will continue to flourish its dominance during the forecast period. This is due to the rising cases of musculoskeletal injuries, surgeries, and the adoption electronic medical records at the hospital.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Medical Carts Market Share Analysis

Middle East and Africa medical carts market competitive landscape provides details about the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, company strengths and weaknesses, product launch, regulatory guidelines, brand analysis, product approvals, product payload, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Middle East and Africa medical carts market.

Some of the major players operating in the Middle East and Africa medical carts market are ITD Gmbh, Omnicell Inc., Midmark Corporation, Herman Miller, Inc., and AMD Telemedicine, among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.1 PRODUCT LIFELINE CURVE

2.2 DBMR MARKET POSITION GRID

2.3 VENDOR SHARE ANALYSIS

2.4 MARKET APPLICATION COVERAGE GRID

2.5 SECONDARY SOURCES

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: REGULATIONS

5.1 REGULATION IN THE U.S.

5.2 REGULATIONS IN EUROPE:

5.3 REGULATIONS IN CHINA:

5.4 REGULATIONS IN JAPAN:

5.5 REGULATION IN INDIA:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 IMPROVING HEALTHCARE FACILITIES AND INFRASTRUCTURE

6.1.2 ADOPTION OF ELECTRONIC MEDICAL RECORD (EMR) AT HOSPITALS

6.1.3 ADVANCED MEDICAL CARTS APPLICATION

6.1.4 DURING COVID-19, MEDICAL CARTS SUPPLIED BY THE VENDORS, RISING THE MARKET GROWTH

6.2 RESTRAINTS

6.2.1 HIGH COST OF PRODUCT CUSTOMIZED MEDICAL CARTS

6.2.2 POTENTIAL PROBLEMS WITH BATTERY-OPERATED CARTS

6.2.3 LACK OF SKILLED PROFESSIONALS

6.3 OPPORTUNITIES

6.3.1 SURGE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.3.3 CONVENIENCE OF CARTS

6.3.4 EMERGING COUNTRIES WITH DEVELOPED HOSPITALS

6.4 CHALLENGES

6.4.1 HEAVY WORKSTATION ON WHEELS

6.4.2 STRINGENT REGULATORY FRAMEWORK

7 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 MOBILE COMPUTING CARTS

7.2.1 BY APPLICATION

7.2.1.1 TELEHEALTH WORKSTATION

7.2.1.2 DOCUMENTATION

7.2.1.3 MEDICATION DELIVERY

7.2.1.4 EQUIPMENT

7.2.1.5 OTHERS

7.2.2 BY ENERGY SOURCE

7.2.2.1 NON-POWERED

7.2.2.2 POWERED

7.2.3 BY DISPLAY TYPE

7.2.3.1 1 MONITOR

7.2.3.2 LAPTOP

7.2.3.3 TABLET

7.2.3.4 2 MONITORS

7.3 MEDICAL STORAGE COLUMNS, CABINETS AND ACCESSORIES

7.3.1 STORAGE CABINETS

7.3.2 SUPPLY CABINETS

7.3.3 STERILIZATION CABINETS

7.3.4 DRYING CABINETS

7.3.5 TRANSFER CABINETS

7.3.6 DISPENSING CABINETS

7.3.7 OTHERS

7.4 MEDICATION CARTS

7.4.1 PUNCH-CARD CARTS

7.4.2 BOX-BIN-PUNCH CARD CARTS

7.4.3 BOX CARTS

7.4.4 BIN CARTS

7.5 WALL-MOUNTED WORKSTATIONS

7.5.1 SIT-STAND COMBO SYSTEM

7.5.2 WALL-MOUNT SYSTEM

7.5.3 OTHERS

7.6 OTHERS

8 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 COMPUTER MEDICAL CART

8.2.1 TELEMEDICINE CART

8.2.2 POINT OF CARE PC CART

8.3 EMERGENCY CART

8.4 ANESTHESIA CART

8.5 PROCEDURE CART

8.6 MEDICAL LABORATORY UTILITY CART

8.7 OTHERS

9 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL

9.2.1 TELEMEDICINE

9.2.2 SURGERY

9.3 LABORATORY

9.4 MEDICAL IMAGING

9.5 OTHERS

10 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE

10.1 OVERVIEW

10.2 PLASTIC

10.3 STAINLESS STEEL

10.4 METAL

10.5 WOOD

10.6 OTHERS

11 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PAYLOAD

11.1 OVERVIEW

11.2 80 KG

11.3 65 KG

11.4 50 KG

11.5 150 KG

11.6 180 KG

11.7 OTHERS

12 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 LONG-TERM CARE HOSPITALS

12.2.2 ACUTE CARE HOSPITALS

12.2.3 NURSING FACILITIES

12.2.4 REHABILITATION CENTERS

12.3 CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 TRAUMA CENTERS

12.6 OTHERS

13 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 THIRD PARTY DISTRIBUTORS

13.3 DIRECT TENDER

13.4 OTHERS

14 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E

14.1.4 EGYPT

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 HUMANSCALE

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.1.5 PARTNERSHIP

17.1.6 ACQUISITION

17.2 MCKESSON MEDICAL-SURGICAL INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 ERGOTRON, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.3.4.1 PRODUCT PORTFOLIO

17.3.5 PARTNERSHIP

17.3.5.1 PRODUCT PORTFOLIO

17.4 HERMAN MILLER, INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 INTERMETRO INDUSTRIES CORPORATION

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 ADVANTECH CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 AFC INDUSTRIES

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.7.3.1 ACQUISITION

17.8 AMD MIDDLE EAST & AFRICA TELEMEDICINE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.8.3.1 PARTNERSHIP

17.9 ALTUS, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.9.3.1 EXPANSION

17.9.3.2 PARTNERSHIP

17.9.3.3 PRODUCT PORTFOLIO

17.1 BAILIDA MEDICAL.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BERGMANN GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 BIHEALTHCARE (ZHANGJIAGANG BRAUN INDUSTRY CO., LTD.)

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.12.3.1 THE COMPANY’S WEBSITE HAS NO RECENT DEVELOPMENT RELATED TO THE MARKET

17.13 BYTEC HEALTHCARE LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 CAPSA HEALTHCARE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.14.3.1 ACQUISITION

17.15 CHANG GUNG MEDICAL TECHNOLOGY CO., LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 ENOVATE MEDICAL.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.16.3.1 PRODUCT LAUNCH

17.17 HARLOFF MANUFACTURING COMPANY

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 HI-LIFE TECHNOLOGY

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 HUA SHUO PLASTIC CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 ITD GMBH

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.20.3.1 ACQUISITION

17.20.3.2 MODIFICATION

17.21 JACO INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.21.3.1 PRODUCT LAUNCH

17.22 JEGNA (XIAMEN) INFO&TECH CO., LTD

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 JOSON-CARE ENTERPRISE CO., LTD.

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENTS

17.24 MEDICAL MASTER CO., LTD.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 MIDMARK CORPORATION

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.25.3.1 ACQUISITION

17.26 OMNICELL INC.

17.26.1 COMPANY SNAPSHOT

17.26.2 REVENUE ANALYSIS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENTS

17.27 PEDIGO PRODUCTS

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 PERFORMANCE HEALTH

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 VILLARD

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 ZHANGJIAGANG BESTRAN TECHNOLOGY CO.,LTD

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 3 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 6 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 8 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 10 MIDDLE EAST & AFRICA MEDICAL STORAGE COLUMNS, CABINETS AND ACCESSORIES IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 13 MIDDLE EAST & AFRICA MEDICATI0N CARTS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 16 MIDDLE EAST & AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 22 MIDDLE EAST & AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 25 MIDDLE EAST & AFRICA EMERGENCY CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ANESTHESIA CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA PROCEDURE CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA MEDICAL LABORATORY UTILITY CART IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA LABORATORY IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA MEDICAL IMAGING IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 38 MIDDLE EAST & AFRICA PLASTIC IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA STAINLESS STEEL IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA METAL IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA WOOD IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA 80 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA 65 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA 50 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA 150 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA 180 KG IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA CLINICS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA TRAUMA CENTERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA THIRD PARTY DISTRIBUTORS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA DIRECT TENDER IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA OTHERS IN MEDICAL CARTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 64 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 66 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 68 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 70 MIDDLE EAST AND AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 72 MIDDLE EAST AND AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 74 MIDDLE EAST AND AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 ASIA-PACIFIC WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 76 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 78 MIDDLE EAST AND AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 80 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 84 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 SOUTH AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 90 SOUTH AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 91 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 93 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 94 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 95 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 96 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 97 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 99 SOUTH AFRICA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 100 SOUTH AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 SOUTH AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 102 SOUTH AFRICA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 103 SOUTH AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 105 SOUTH AFRICA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 106 SOUTH AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 108 SOUTH AFRICA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 109 SOUTH AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 111 SOUTH AFRICA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 112 SOUTH AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 114 SOUTH AFRICA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 115 SOUTH AFRICA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 119 SOUTH AFRICA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 120 SOUTH AFRICA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 121 SOUTH AFRICA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 122 SOUTH AFRICA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 SOUTH AFRICA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 126 SAUDI ARABIA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 127 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 129 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 130 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 131 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 132 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 133 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 135 SAUDI ARABIA MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 136 SAUDI ARABIA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 137 SAUDI ARABIA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 138 SAUDI ARABIA MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 139 SAUDI ARABIA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 SAUDI ARABIA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 141 SAUDI ARABIA MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 142 SAUDI ARABIA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 SAUDI ARABIA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 144 SAUDI ARABIA WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 145 SAUDI ARABIA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SAUDI ARABIA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 147 SAUDI ARABIA MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 148 SAUDI ARABIA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 SAUDI ARABIA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 150 SAUDI ARABIA COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 151 SAUDI ARABIA MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 SAUDI ARABIA MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 SAUDI ARABIA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 154 SAUDI ARABIA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 155 SAUDI ARABIA MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 156 SAUDI ARABIA MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 157 SAUDI ARABIA MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 SAUDI ARABIA HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 159 SAUDI ARABIA MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 160 U.A.E MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 161 U.A.E MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 162 U.A.E MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 163 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 165 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 166 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 167 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 168 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 169 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 170 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 171 U.A.E MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 172 U.A.E MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 173 U.A.E MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 174 U.A.E MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 175 U.A.E MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 176 U.A.E MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 177 U.A.E MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 178 U.A.E WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 179 U.A.E WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 180 U.A.E WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 181 U.A.E MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 U.A.E MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 183 U.A.E MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 184 U.A.E COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 U.A.E COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 186 U.A.E COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 187 U.A.E MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 U.A.E MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 U.A.E MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 190 U.A.E MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 191 U.A.E MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 192 U.A.E MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 193 U.A.E MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 194 U.A.E HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 195 U.A.E MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 196 EGYPT MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 197 EGYPT MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 198 EGYPT MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 199 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 201 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 202 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 203 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 204 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 205 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 206 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 207 EGYPT MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 208 EGYPT MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 209 EGYPT MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 210 EGYPT MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 211 EGYPT MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 212 EGYPT MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 213 EGYPT MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 214 EGYPT WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 215 EGYPT WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 216 EGYPT WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 217 EGYPT MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 EGYPT MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 219 EGYPT MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 220 EGYPT COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 221 EGYPT COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 222 EGYPT COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 223 EGYPT MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 EGYPT MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 225 EGYPT MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 226 EGYPT MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 227 EGYPT MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 228 EGYPT MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 229 EGYPT MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 230 EGYPT HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 231 EGYPT MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 232 ISRAEL MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 233 ISRAEL MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 234 ISRAEL MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 235 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 236 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 237 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (ASP)

TABLE 238 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (USD MILLION)

TABLE 239 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (UNITS)

TABLE 240 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY ENERGY SOURCE, 2020-2029 (ASP)

TABLE 241 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (USD MILLION)

TABLE 242 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (UNITS)

TABLE 243 ISRAEL MOBILE COMPUTING CARTS IN MEDICAL CARTS MARKET, BY DISPLAY TYPE, 2020-2029 (ASP)

TABLE 244 ISRAEL MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 245 ISRAEL MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 246 ISRAEL MEDICAL STORAGE COLUMNS, CABINETS, AND ACCESSORIES IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 247 ISRAEL MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 248 ISRAEL MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 249 ISRAEL MEDICATION CARTS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 250 ISRAEL WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 251 ISRAEL WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 252 ISRAEL WALL-MOUNTED WORKSTATIONS IN MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

TABLE 253 ISRAEL MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 ISRAEL MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 255 ISRAEL MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 256 ISRAEL COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 ISRAEL COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 258 ISRAEL COMPUTER MEDICAL CART IN MEDICAL CARTS MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 259 ISRAEL MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 260 ISRAEL MEDICAL IN MEDICAL CARTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 261 ISRAEL MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 262 ISRAEL MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (UNITS)

TABLE 263 ISRAEL MEDICAL CARTS MARKET, BY MATERIAL TYPE, 2020-2029 (ASP)

TABLE 264 ISRAEL MEDICAL CARTS MARKET, BY PAYLOAD, 2020-2029 (USD MILLION)

TABLE 265 ISRAEL MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 266 ISRAEL HOSPITALS IN MEDICAL CARTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 267 ISRAEL MEDICAL CARTS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 268 REST OF MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 269 REST OF MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 270 REST OF MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET, BY PRODUCT, 2020-2029 (ASP)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: SEGMENTATION

FIGURE 11 IMPROVING HEALTHCARE FACILITIES AND INFRASTRUCTURE AND ADOPTION OF ELECTRONIC MEDICAL RECORD (EMR) AT HOSPITAL IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 MOBILE COMPUTING CARTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA MEDICAL CARTS MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA MEDICAL CARTS MARKET

FIGURE 15 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, 2021

FIGURE 16 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, 2020-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, 2021

FIGURE 24 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, 2021

FIGURE 28 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, 2020-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY MATERIAL TYPE, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, 2021

FIGURE 32 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, 2020-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY PAYLOAD, LIFELINE CURVE

FIGURE 35 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, 2021

FIGURE 36 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 37 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 38 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, 2021

FIGURE 40 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, 2020-2029 (USD MILLION)

FIGURE 41 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, CAGR (2022-2029)

FIGURE 42 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: BY THIRD PARTY DISTRIBUTORS, LIFELINE CURVE

FIGURE 43 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: SNAPSHOT (2021)

FIGURE 44 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY COUNTRY (2021)

FIGURE 45 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA MEDICAL CARTS MARKET: BY PRODUCT (2022-2029)

FIGURE 48 MIDDLE EAST & AFRICA MEDICAL CARTS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.