Middle East And Africa Medical Aesthetics Market

Taille du marché en milliards USD

TCAC :

%

USD

593.91 Million

USD

1,387.09 Million

2024

2032

USD

593.91 Million

USD

1,387.09 Million

2024

2032

| 2025 –2032 | |

| USD 593.91 Million | |

| USD 1,387.09 Million | |

|

|

|

|

Middle East and Africa Medical Aesthetic Market, By Product Type (Aesthetic Laser Devices, Energy Devices, Body Contouring Devices, Facial Aesthetic Devices, Aesthetic Implants, and Skin Aesthetic Devices), Application (Anti-Aging and Wrinkles, Facial and Skin Rejuvenation, Breast Enhancement, Body Shaping and Cellulite, Tattoo Removal, Vascular Lesions, Sears, Pigment Lesions, Reconstructive, Psoriasis and Vitiligo, and Others), End User (Cosmetic Centers, Dermatology Clinics, Hospitals, and Medical Spas and Beauty Centers), Distribution Channel (Direct Tender and Retail) - Industry Trends And Forecast To 2032

Middle East and Africa Medical Aesthetic Market Analysis

Medical aesthetic has a rich history that dates backs in ancient civilizations, where beauty treatments were practiced using natural remedies and early forms of cosmetic procedures. In the early 20th century, medical aesthetics began to merge with advancements in medical technology, with innovations such as the first injectable collagen for wrinkle treatment in the 1970s. The development of Botox in the 1980s marked a major milestone, introducing non-surgical facial rejuvenation. Over the decades, the field expanded with the advent of laser technologies, dermal fillers, and non-invasive body contouring treatments. Today, medical aesthetics combines advanced technology with the growing desire for non-invasive cosmetic procedures, making it a rapidly growing industry in Middle East and Africa healthcare.

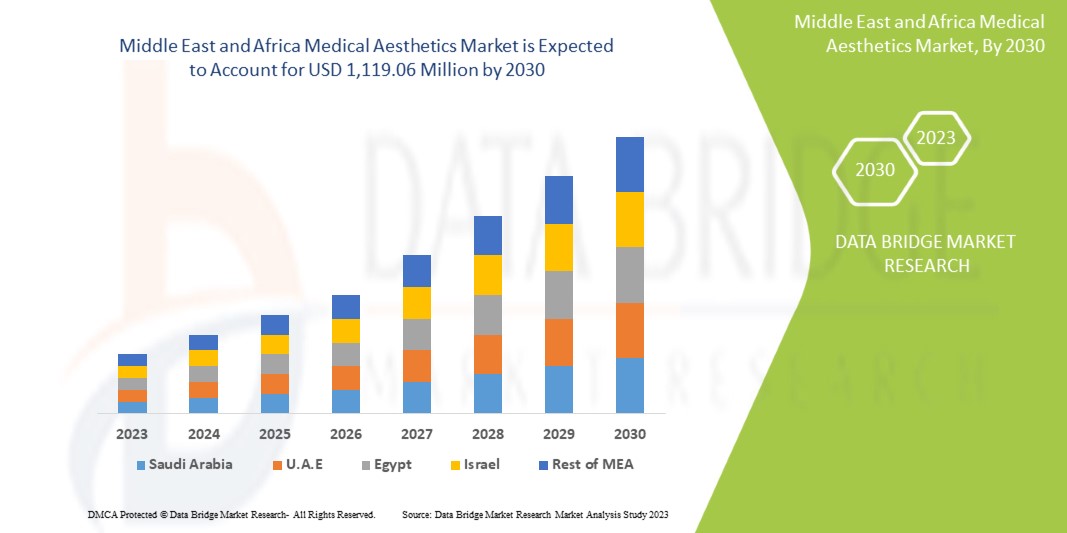

Middle East and Africa Medical Aesthetic Market Size

Middle East and Africa Medical Aesthetic Market Size was valued at USD 593.908 million in 2024 and is projected to reach USD 1,387.088 million by 2032, with a CAGR of 11.2% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Middle East and Africa Medical Aesthetic Market Trends

“Increasing Demand for Non-Surgical Procedures”

Le marché de l'esthétique médicale au Moyen-Orient et en Afrique connaît une tendance significative vers les procédures cosmétiques non chirurgicales, stimulée par les progrès technologiques, les temps de récupération minimes et la préférence croissante des consommateurs pour des traitements moins invasifs. Des procédures telles que les injections de Botox, les produits de comblement dermique, les traitements au laser et le remodelage corporel non chirurgical deviennent de plus en plus populaires, car les individus cherchent à améliorer leur apparence sans les risques et les temps d'arrêt associés aux chirurgies traditionnelles. La sensibilisation croissante aux traitements esthétiques, associée à l'influence des médias sociaux sur les normes de beauté, a contribué à cette augmentation de la demande. En outre, l'augmentation du revenu disponible, associée au vieillissement de la population dans les marchés développés, alimente l'expansion du marché. La disponibilité croissante de traitements innovants et personnalisés et l'acceptation croissante de l'esthétique médicale dans la société traditionnelle accélèrent encore cette tendance, positionnant les options non chirurgicales comme le choix préféré de nombreux consommateurs.

Portée du rapport et segmentation du marché de l'esthétique médicale au Moyen-Orient et en Afrique

|

Attributs |

Informations sur le marché de l'esthétique médicale au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Région couverte |

Afrique du Sud, Arabie saoudite, Émirats arabes unis et reste du Moyen-Orient et de l’Afrique. |

|

Principaux acteurs du marché |

Mentor WorldWide LLC (une filiale de Johnsons & Johnsons) (États-Unis), Allergan (une filiale d'AbbVie Inc.) (Irlande), GALDERMA (Suisse), Cutera, Inc. (États-Unis), Lumenis Be Ltd. (Israël), Densply Sirona (États-Unis), Institut Straumann AG (États-Unis), Candela Corporation (États-Unis), Medytrox (Corée du Sud), BioHorizons (États-Unis), BTL (Inde), Nobel Biocare Services AG (Suisse), Merz Pharma (Allemagne), Cynosure, LLC (États-Unis), Sharplight Technologies Inc. (Israël), Alma Lasers (États-Unis), MEGA'GEN IMPLANT CO., LTD. (Inde), 3M (États-Unis), Quanta System (Italie), Sciton (Californie) et entre autres. |

|

Opportunités de marché |

|

|

Ensembles d'informations sur les données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Définition du marché de l'esthétique médicale au Moyen-Orient et en Afrique

L'esthétique médicale comprend tous les traitements médicaux qui visent à améliorer l'apparence esthétique des patients. L'esthétique médicale se situe dans une jolie petite niche entre l'industrie de la beauté et la chirurgie plastique. Les médecins, infirmières ou dentistes qualifiés peuvent vous proposer une multitude de traitements étonnants pour améliorer votre apparence. Ces traitements nécessitent un haut degré de compétence, de formation et de connaissance de votre anatomie et de votre physiologie. C'est ce qui distingue les traitements médico-esthétiques des traitements de beauté tels que l'épilation des sourcils, l'épilation à la cire ou les extensions de cils. En revanche, les traitements médico-esthétiques ne sont pas aussi agressifs que les interventions chirurgicales (les traitements médicaux esthétiques sont parfois appelés traitements cosmétiques non chirurgicaux), qui incluent des procédures telles que le lifting du visage, l'augmentation mammaire ou la liposuccion.

Définition et dynamique du marché de l'esthétique médicale au Moyen-Orient et en Afrique

Conducteurs

- Augmentation du vieillissement de la population

L’augmentation de la population vieillissante stimule considérablement le marché des services esthétiques en raison du désir croissant des personnes âgées de conserver une apparence jeune et d’améliorer leur qualité de vie. À mesure que les gens vieillissent, ils subissent souvent une diminution de l’élasticité de la peau, l’apparition de rides et d’autres signes de vieillissement qui peuvent avoir un impact sur l’estime de soi et le bien-être général. Ce changement démographique a entraîné une demande accrue de divers traitements esthétiques, notamment des procédures non invasives telles que le botox, les produits de comblement dermique et les thérapies de rajeunissement de la peau. La sensibilisation croissante à ces options esthétiques, associée à l’accent culturel mis sur la beauté et l’apparence, incite les personnes âgées à rechercher des solutions qui leur permettent d’avoir une apparence aussi dynamique qu’elles le ressentent, alimentant ainsi la croissance du marché.

Par exemple,

- En septembre 2022, selon un article publié par The Nation, le secteur de la santé et de l'esthétique en Thaïlande a été stimulé par le vieillissement de la population du pays. De plus, selon la même source, au 31 décembre de l'année dernière, 12,24 millions de personnes, soit 18,5 %, de la population thaïlandaise étaient âgées de 60 ans ou plus

- En janvier 2024, selon les informations publiées par PRB, une augmentation significative de la population vieillissante aux États-Unis, le nombre d'Américains âgés de 65 ans et plus devant passer de 17 % à 23 % d'ici 2060. Ce changement démographique stimule le marché de l'esthétique médicale au Moyen-Orient et en Afrique, car les personnes âgées recherchent des traitements pour répondre aux problèmes liés à l'âge comme les rides, le relâchement cutané et la perte de volume. La demande croissante de procédures anti-âge, telles que le Botox, les produits de comblement dermique et les traitements de rajeunissement de la peau, alimente la croissance du marché et l'innovation dans les produits et services esthétiques

- En mai 2023, selon les informations publiées par le US Census Bureau, le rapport met en évidence une augmentation de 38,6 % de la population américaine âgée de 65 ans et plus de 2010 à 2020, stimulant la demande de traitements anti-âge tels que le Botox et les produits de comblement dermique, alimentant ainsi la croissance du marché de l'esthétique médicale au Moyen-Orient et en Afrique

De plus, l’augmentation du revenu disponible de la population vieillissante contribue à l’expansion du marché des services esthétiques. Les personnes âgées cherchant à investir dans leur apparence personnelle et leur bien-être sont plus disposées à dépenser pour des traitements d’amélioration.

En conclusion, les progrès technologiques ont rendu les procédures esthétiques plus sûres, moins invasives et plus accessibles, attirant un segment plus large de personnes âgées qui pouvaient auparavant hésiter à recourir à de telles interventions. Cette convergence des tendances démographiques, l’augmentation des revenus disponibles et l’amélioration des offres de services représentent une croissance significative pour le secteur des services esthétiques, stimulant l’innovation et la concurrence entre les prestataires.

- L'évolution des standards de beauté et l'influence des réseaux sociaux

L’évolution des standards de beauté et l’influence des réseaux sociaux stimulent considérablement la demande de traitements d’esthétique médicale. Les réseaux sociaux comme Instagram et TikTok présentent des standards de beauté idéalisés, encourageant les individus à rechercher des améliorations esthétiques pour obtenir des looks similaires. Les influenceurs et les célébrités font souvent la promotion des traitements esthétiques, les rendant plus courants et plus désirables. Cette tendance conduit à une sensibilisation et une acceptation accrues de l’esthétique médicale, stimulant ainsi la croissance du marché.

Par exemple,

- En juin 2023, selon un article publié dans la National Library of Medicine, la demande croissante en esthétique médicale est alimentée par le vieillissement de la population et les progrès technologiques. À mesure que les gens vieillissent, ils recherchent des traitements pour traiter les signes du vieillissement, tels que les rides et le relâchement cutané. Les progrès technologiques ont rendu ces traitements plus efficaces et plus accessibles, ce qui a encore stimulé la croissance du marché. En outre, la sensibilisation et l'acceptation croissantes des procédures esthétiques contribuent à l'expansion du marché

- En juillet 2024, selon un article publié dans ResearchGate, les médias sociaux ont eu une influence significative sur l’image corporelle et les considérations en matière de chirurgie esthétique. Les plateformes de médias sociaux présentent souvent des normes de beauté idéalisées, ce qui incite les individus à rechercher des améliorations esthétiques pour obtenir une apparence similaire. Cette tendance stimule la demande de traitements d’esthétique médicale, car les gens sont de plus en plus influencés par les images et les modes de vie qu’ils voient en ligne. L’étude souligne le rôle des médias sociaux dans la formation des perceptions de la beauté et l’acceptation croissante des procédures cosmétiques, alimentant ainsi la croissance du marché

Le marché de l'esthétique médicale au Moyen-Orient et en Afrique est propulsé par l'évolution des normes de beauté et l'influence omniprésente des médias sociaux. Alors que les individus s'efforcent de répondre à ces idéaux en constante évolution, la demande de traitements esthétiques continue d'augmenter, favorisant l'innovation et l'expansion au sein du secteur.

Opportunités

- Développement de nouveaux traitements innovants

L’introduction de nouveaux traitements innovants représente une opportunité importante pour le marché de l’esthétique médicale. Grâce aux progrès de la technologie médicale, les traitements esthétiques ont évolué pour inclure des options non invasives et très efficaces qui répondent à la demande croissante de meilleurs résultats avec un temps d’arrêt minimal. Des traitements tels que les thérapies à base de cellules souches, les techniques laser avancées et les liftings non chirurgicaux du visage remodèlent le marché en offrant aux consommateurs un plus large éventail de choix qui répondent à leurs divers besoins et préférences. Ces innovations améliorent non seulement l’efficacité et la sécurité des traitements, mais réduisent également les risques associés aux procédures chirurgicales plus traditionnelles. Alors que les consommateurs recherchent de plus en plus des solutions de pointe pour préserver leur jeunesse et améliorer leur apparence, la demande pour ces services esthétiques avancés continue d’augmenter. Cette évolution vers des traitements plus récents et plus efficaces constitue une opportunité clé, stimulant la croissance du marché et le positionnant pour une expansion à long terme alors que la technologie continue de transformer l’industrie.

Par exemple,

- En février 2022, selon l’article publié par Science Direct, les cellules souches, utilisées à l’origine pour les maladies dégénératives chroniques, apparaissent désormais comme un traitement prometteur et peu invasif en esthétique. Cette évolution vers les thérapies à base de cellules souches offre des solutions efficaces pour le rajeunissement de la peau et la lutte contre le vieillissement, suscitant un intérêt croissant des consommateurs. À mesure que ce traitement innovant gagne du terrain, il présente une opportunité significative pour le marché des services esthétiques d’Asie du Sud-Est de se développer et d’évoluer

- En août 2021, selon l’article publié par le NCBI, les cellules souches, en particulier celles dérivées du tissu adipeux, gagnent en popularité en dermatologie esthétique en raison de leur capacité à s’auto-renouveler et à se différencier en différents types de cellules. Leur facilité de collecte et leur abondance en font une option intéressante pour les traitements esthétiques, tels que le rajeunissement de la peau. Cette innovation représente une opportunité précieuse pour le marché des services esthétiques d’Asie du Sud-Est de se développer et de diversifier ses offres

- En janvier 2023, selon l'article publié dans le magazine MedEsthetics, des innovations technologiques importantes stimulent la croissance du marché de l'esthétique médicale. Ces avancées comprennent des procédures indolores de nouvelle génération, des appareils avancés, le resurfaçage fractionné, la lipoplastie assistée par ultrasons de troisième génération et l'imagerie cutanée avancée. L'intégration de la RV, de la RA, de l'IA, de la CAO, de la télémédecine et de l'IoT améliore la précision et l'efficacité des procédures, les rendant plus précises et moins invasives

- En février 2024, selon l'article publié dans MDPI, les avancées en médecine régénératrice pour la dermatologie esthétique se concentrent sur des traitements innovants et peu invasifs pour le rajeunissement et la régénération du visage. La corrélation étroite entre la réparation, la régénération et le vieillissement des tissus a ouvert la voie à l'application des principes de la médecine régénératrice en dermatologie esthétique

L’introduction de traitements nouveaux et avancés offre une opportunité précieuse au marché de l’esthétique médicale. Des innovations telles que les thérapies à base de cellules souches, les traitements au laser améliorés et les liftings non chirurgicaux offrent aux consommateurs des options plus sûres et plus efficaces qui nécessitent moins de temps de récupération. Ces avancées répondent à la demande croissante de procédures non invasives et séduisent ceux qui recherchent des résultats meilleurs et plus durables. À mesure que ces traitements gagnent en popularité, ils créent une forte demande, agissant comme un moteur clé de la croissance du marché et le positionnant pour une expansion continue.

- Partenariats et innovations médicales

Les partenariats et innovations médicales représentent une opportunité importante pour le marché de l’esthétique médicale en améliorant la crédibilité et la qualité des services offerts. Les collaborations entre les prestataires de services esthétiques et les professionnels de la santé qualifiés, tels que les dermatologues et les chirurgiens plasticiens, garantissent que les traitements sont non seulement efficaces mais également sûrs pour les consommateurs. Ces partenariats permettent également l’intégration de technologies et de techniques médicales avancées dans les procédures esthétiques, rendant les services plus fiables et plus attrayants pour une clientèle plus large. Avec l’implication de professionnels de la santé de confiance, les consommateurs se sentent plus confiants dans les procédures, ce qui entraîne une demande accrue de services esthétiques. De plus, de telles collaborations ouvrent la voie au développement de nouveaux traitements de pointe qui répondent aux besoins émergents des consommateurs. Cette alliance entre l’esthétique et la médecine stimule la croissance du marché en le positionnant comme un secteur de confiance, innovant et de haute qualité.

Par exemple,

- En novembre 2024, selon l'article publié par The Nation, le partenariat de MASTER avec l'entreprise indonésienne « Lumeo Health » le positionne comme le premier fournisseur de chirurgie esthétique en Asie du Sud-Est. Cette collaboration favorise l'innovation et renforce les partenariats médicaux, offrant des services esthétiques avancés à un marché en pleine croissance. En combinant expertise et ressources, cette alliance ouvre de nouvelles opportunités pour un accès élargi, des traitements de pointe et de meilleurs résultats pour les patients, alimentant la croissance du secteur esthétique

- En octobre 2023, selon l'article publié par Health365, leur partenariat avec l'hôpital de Bangkok marque une étape importante dans l'amélioration des services esthétiques en Asie du Sud-Est. En combinant l'expertise de Health365 avec l'innovation médicale de l'hôpital de Bangkok, cette collaboration favorise l'accès à des traitements de classe mondiale et à des technologies avancées. Cette alliance stratégique présente une opportunité précieuse d'élever le marché des services esthétiques de la région, de stimuler la croissance et d'améliorer les soins aux patients

Les partenariats médicaux représentent une opportunité précieuse pour le marché des services médico-esthétiques en améliorant la crédibilité et la qualité des services. Les collaborations entre prestataires de soins esthétiques et professionnels de la santé qualifiés garantissent des traitements sûrs et efficaces, renforçant ainsi la confiance des consommateurs. Ces partenariats facilitent également l'introduction de techniques et de technologies avancées, attirant ainsi une clientèle plus large. En combinant l'expertise médicale à l'innovation esthétique, le marché connaît une croissance et une demande accrues.

Contraintes/Défis

- Manque de professionnels formés

Le manque de professionnels qualifiés sur le marché des services esthétiques freine considérablement la croissance et la prolifération de ces services. Les procédures esthétiques, qui nécessitent souvent des compétences et des connaissances spécialisées, nécessitent une main-d'œuvre bien au fait des dernières technologies, techniques et protocoles de sécurité. La pénurie de praticiens certifiés limite la disponibilité des services et présente des risques pour la sécurité des patients, entraînant des complications potentielles et une insatisfaction quant aux résultats. Cela crée un cycle dans lequel les consommateurs hésitent à s'engager dans des offres esthétiques, ce qui freine encore davantage la croissance du marché.

Par exemple,

- En août 2023, selon un article publié par The Malaysian Reserve, l’ignorance ou le manque de sensibilisation concernant les procédures esthétiques à risque pratiquées par des esthéticiennes ou des praticiens non agréés en Malaisie constitue une menace sérieuse pour les consommateurs. L’utilisation de produits de qualité inférieure ou de pratiques insalubres peut entraîner de graves problèmes de santé, des infections ou des dommages irréversibles. De plus, l’absence de surveillance réglementaire rend les consommateurs vulnérables aux pratiques trompeuses, ce qui rend difficile pour eux de chercher un recours en cas de faute professionnelle ou d’effets indésirables

- En juillet 2019, selon un article intitulé « L'association promeut les esthéticiennes qualifiées en Malaisie », il a été déclaré que les estimations locales suggéraient qu'il y avait 20 000 esthéticiennes non certifiées contre seulement 200 titulaires de qualifications professionnelles certifiées. Cela met le secteur au défi de maintenir ses normes de prestation de services esthétiques

- En octobre 2024, selon l'article publié dans The Evaluation Company, la pénurie importante de personnel médical aux États-Unis constitue un frein pour le marché de l'esthétique médicale au Moyen-Orient et en Afrique. La pénurie touche non seulement les médecins, mais aussi les infirmières et autres professionnels de la santé, ce qui entraîne des délais d'attente plus longs et une disponibilité réduite des traitements esthétiques. Cette pénurie de professionnels qualifiés peut limiter la croissance et l'expansion du marché de l'esthétique médicale, car la demande de praticiens qualifiés dépasse l'offre

De plus, ce manque de talents peut empêcher les cliniques et les prestataires de services d’étendre leurs activités ou d’élargir leur offre. Alors que la demande de services esthétiques continue d’augmenter, en particulier parmi les jeunes à la recherche de traitements non invasifs, la capacité à répondre à cette demande est entravée par un bassin limité de professionnels qualifiés. Ce défi a un impact sur la réputation et la confiance de la marque, car les clients sont plus susceptibles de choisir des établissements connus pour leur personnel qualifié et expérimenté. Par conséquent, sans programmes de formation ciblés et initiatives de soutien pour former les professionnels de la santé en esthétique, le potentiel du marché de l’esthétique médicale au Moyen-Orient et en Afrique reste sous-exploité.

- Risque d'effets secondaires associés à ces procédures

Le risque d’effets secondaires associés aux procédures esthétiques constitue un frein important pour le marché de l’esthétique médicale en créant une appréhension chez les clients potentiels. De nombreuses procédures esthétiques, qu’elles soient chirurgicales ou non, comportent un risque inhérent de complications telles que des infections, des cicatrices ou des résultats insatisfaisants. Cette peur des effets indésirables peut dissuader les individus de recourir à ces services, car les consommateurs sont de plus en plus informés via les médias sociaux et les plateformes en ligne des expériences des autres, y compris des résultats négatifs. Par conséquent, le risque d’effets secondaires peut créer une perception selon laquelle ces procédures ne valent pas le risque, ce qui entraîne une réduction de la demande et de la participation au marché.

Par exemple,

- En octobre 2024, selon un article intitulé « Dangers de la chirurgie esthétique en Thaïlande par le Dr Ehsan Jadoon », les dangers liés aux chirurgies esthétiques comprennent le gonflement, les ecchymoses, les infections, les réactions allergiques, les résultats asymétriques, les lésions vasculaires, les traumatismes nerveux, les troubles visuels, les traumatismes psychologiques et les lésions corporelles graves.

- En octobre 2024, selon un article publié dans le Journal of Cutaneous and Aesthetic Surgery, de nombreux événements indésirables ne sont pas signalés en raison d’un manque de réglementation et d’une mauvaise application de la loi, car les procédures sont souvent effectuées dans des environnements non médicaux tels que des spas et des salons de beauté. Ce manque de surveillance peut entraîner des complications telles que la nécrose graisseuse, des infections et d’autres effets secondaires, en particulier lorsque des praticiens inexpérimentés effectuent des procédures. La crainte d’une publicité médiatique négative et les faibles taux de signalement aggravent encore ces problèmes, ce qui rend crucial pour le secteur de mettre en œuvre des mesures rigoureuses d’évaluation des risques et de prévention pour garantir la sécurité des patients et maintenir la croissance du marché

- En août 2020, selon les informations publiées dans The PMFA Journal, des complications peuvent survenir en raison de divers facteurs, notamment la sélection des patients, les techniques d’injection et les risques inhérents aux procédures elles-mêmes. Ces complications peuvent aller de problèmes mineurs tels que des ecchymoses et des gonflements à des problèmes plus graves tels que des infections, des occlusions vasculaires et des réactions allergiques. La peur de ces complications potentielles peut dissuader les individus de rechercher des traitements esthétiques, limitant ainsi la croissance du marché

De plus, l’influence des systèmes de santé locaux et des environnements réglementaires amplifie encore davantage les inquiétudes concernant les effets secondaires dans la région. Si les individus ont l’impression que la clinique ne donne pas la priorité à la sécurité ou ne respecte pas les réglementations sanitaires rigoureuses, ils peuvent être moins susceptibles de recourir à des traitements esthétiques. Ce scepticisme peut être aggravé par la couverture médiatique des procédures bâclées et des pratiques dangereuses, ce qui rend les clients potentiels méfiants quant aux risques associés. En conséquence, la peur de ressentir des effets secondaires non seulement freine l’intérêt individuel, mais pose également des défis pour la croissance du marché, car les entreprises s’efforcent de renforcer la confiance des consommateurs dans leurs services.

Portée du marché de l'esthétique médicale au Moyen-Orient et en Afrique

Le marché est segmenté en fonction des produits, des applications, des utilisateurs finaux et des canaux de distribution. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Appareils laser esthétiques

- Dispositifs de resurfaçage cutané ablatif

- Laser CO2

- Laser Erbium

- Autres

- Dispositifs de resurfaçage laser fractionné non ablatif

- Radiofréquence

- Lumière pulsée intense

- Laser fractionné

- Le laser ND:YAG à commutation Q

- Autres

- Appareils énergétiques

- Appareils de chirurgie au laser

- Appareils d'électrocautérisation

- Appareils d'électrochirurgie

- Dispositifs de cryochirurgie

- Scalpel harmonique

- Appareils à micro-ondes

- Appareils de remodelage corporel

- Liposuccion

- Raffermissement cutané non chirurgical

- Traitement de la cellulite

- Appareils d'esthétique faciale

- Injection de Botox

- Remplissage dermique

- Agents de comblement cutané naturels

- Agents de comblement dermique synthétiques

- Injections de collagène

- Peeling chimique

- Tonification du visage

- Fraxel

- Acupuncture esthétique

- Électrothérapie

- Microdermabrasion

- Maquillage permanent

- Implants esthétiques

- Augmentation mammaire

- Implants salins

- Implants en silicone

- Buttock Augmentation

- Aesthetic Dental Implants

- Dental Titanium Implants

- Dental Zerconium Implants

- Facial Implants

- Soft Tissue Implants

- Transdermal Implant

- Others

- Skin Aesthetic Devices

- Laser Skin Resurfacing Devices

- Non Surgical Skin Tightening Devices

- Light Therapy Devices

- Tattoo Removal Devices

- Micro-Needling Products

- Thread Lift Products

- Nail Treatment Laser Devices

- Others

Application

- Anti-Aging and Wrinkles

- Facial and Skin Rejuvenation

- Breast Enhancement

- Body Shaping and Cellulite

- Tattoo Removal

- Vascular Lesions

- Sears, Pigment Lesions, Reconstructive

- Psoriasis and Vitiligo

- Others

End User

- Cosmetic Centers

- Dermatology Clinics

- Hospitals

- Medical Spas and Beauty Centers

Distribution Channel

- Direct Tender

- Retail

Middle East and Africa Medical Aesthetic Market Regional Analysis

The market is analyzed and market size insights and trends are provided country, products, application, end user, and distribution channel as referenced above.

The region covered in the market are South Africa, Saudi Arabia, U.A.E., and rest of Middle East and Africa.

The UAE dominates the global medical aesthetics market due to its high demand for cosmetic procedures, advanced healthcare infrastructure, and a growing focus on beauty and wellness.

Saudi Arabia is the fastest-growing market, driven by a young population, increased disposable income, and a cultural shift towards cosmetic treatments, making it a booming sector in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Medical Aesthetic Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Middle East and Africa Medical Aesthetic Market Leaders Operating in the Market Are:

- Mentor WorldWide LLC (a subsidiary of Johnsons & Johnsons) (U.S.)

- Allergan (A Subsidiary of AbbVie Inc.) (Ireland)

- GALDERMA (Switzerland)

- Cutera, Inc. (U.S.)

- Lumenis Be Ltd. (Israel)

- Densply Sirona (U.S.)

- Institut Straumann AG (U.S.)

- Candela Corporation (U.S.)

- Medytrox (South Korea)

- BioHorizons(U.S.)

- BTL (India)

- Nobel Biocare Services AG (Switzerland)

- Merz Pharma (Germany)

- Cynosure, LLC (U.S.)

- Sharplight Technologies Inc. (Israel)

- Alma Lasers (U.S.)

- MEGA'GEN IMPLANT CO., LTD. (India)

- 3M (U.S)

- Quanta System (Italy)

- Sciton (California)

Latest Developments in Middle East and Africa Medical Aesthetic Market

- In January 2023, Galderma announced the launch of FACE by Galderma, an innovative augmented reality application. The ground-breaking solution enables aesthetic practitioners and patients to visualize treatment results at the planning stage. The technology will be presented to the aesthetic scientific community at the International Master Course on Aging Science (IMCAS) World Congress 2023

- In February 2022, Allergan (a subsidiary of AbbVie Inc.) has announced the FDA approval of JUVÉDERM VOLBELLA XC for improvement of infraorbital hollows in adult’s age above 21. This helped the company to expand the product portfolio of aesthetics in the U.S. market

- In January 2022, Mentor Worldwide LLC (a subsidiary of the Johnson & Johnson Medical Devices Companies) announced that the FDA has approved the MENTOR MemoryGel BOOST breast implant for breast augmentation and breast reconstruction. This product has helped the company to expand the product portfolio of aesthetics in the U.S. market

- In January 2021, Cutera, Inc. announced that the company has launched a truSculpt Flex+, optimized to deliver targeted, repeatable, and uniform sculpting of problem areas. This helps the company to enhance its product portfolio within the market

- In November 2019, Lumenis Be Ltd. has announced its acquisition with the Baring Private Equity Asia (BPEA), a leading provider of specialty energy-based medical-based devices across the field of aesthetics. This shows the company is held by strong support within the aesthetics market for the product portfolio

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE AGEING POPULATION

5.1.2 CHANGING BEAUTY STANDARDS AND SOCIAL MEDIA INFLUENCE

5.1.3 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES

5.1.4 INCREASE IN THE NUMBER OF TECHNOLOGICAL ADVANCEMENTS IN DERMATOLOGY

5.2 RESTRAINTS

5.2.1 LACK OF TRAINED PROFESSIONALS

5.2.2 RISK OF SIDE EFFECTS ASSOCIATED WITH THESE PROCEDURES

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF NEW INNOVATIVE TREATMENTS

5.3.2 MEDICAL PARTNERSHIPS AND INNOVATIONS

5.3.3 INCREASING DISPOSABLE INCOME

5.4 CHALLENGES

5.4.1 SAFETY AND LIABILITY RISKS ASSOCIATED WITH AESTHETIC TREATMENTS

5.4.2 LIMITED INSURANCE COVERAGE

6 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 AESTHETIC LASER DEVICES

6.2.1 ABLATIVE SKIN RESURFACING DEVICES

6.2.2 NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES

6.3 ENERGY DEVICES

6.4 BODY CONTOURING DEVICES

6.5 FACIAL AESTHETIC DEVICES

6.5.1 DERMAL FILLERS

6.6 AESTHETIC IMPLANTS

6.6.1 BREAST AUGMENTATION

6.6.2 AESTHETIC DENTAL IMPLANTS

6.7 SKIN AESTHETIC DEVICES

7 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 ANTI-AGING AND WRINKLES

7.3 FACIAL AND SKIN REJUVENATION

7.4 BREAST ENHANCEMENT

7.5 BODY SHAPING AND CELLULITE

7.6 TATTOO REMOVAL

7.7 VASCULAR LESIONS

7.8 SEARS, PIGMENT LESIONS, RECONSTRUCTIVE

7.9 PSORIASIS AND VITILIGO

7.1 OTHERS

8 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY END USER

8.1 OVERVIEW

8.2 COSMETIC CENTERS

8.3 DERMATOLOGY CLINICS

8.4 HOSPITALS

8.5 MEDICAL SPAS AND BEAUTY CENTERS

9 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.3 RETAIL

10 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 UAE

10.1.3 SAUDI ARABIA

10.1.4 REST OF MIDDLE EAST & AFRICA

11 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ALLERGAN (A SUBSIDIARY OF ABBVIE INC.)

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CUTERA, INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MENTOR WORLDWIDE LLC (A SUBSIDIARY OF JOHNSONS & JOHNSONS)

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 LUMENIS BE LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 GALDERMA

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALMA LASERS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BIOHORIZONS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BTL

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CANDELA CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CYNOSURE, LLC

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 DENTSPLY SIRONA

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 INSTITUT STRAUMANN AG

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 MEDYTROX

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MEGA'GEN IMPLANT CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 MERZ PHARMA

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 3M

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 NOBEL BIOCARE SERVICES AG

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 QUANTA SYSTEM

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SCITON

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 SHARPLIGHT TECHNOLOGIES INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA DERMAL FILLERS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA BREAST AUGMENTATION IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA ANTI-AGING AND WRINKLES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA FACIAL AND SKIN REJUVENATION IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA BREAST ENHANCEMENT IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA BODY SHAPING AND CELLULITE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA VASCULAR LESIONS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA SEARS, PIGMENT LESIONS, RECONSTRUCTIVE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA PSORIASIS AND VITILIGO IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA COSMETIC CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA DERMATOLOGY CLINICS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA HOSPITALS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA MEDICAL SPAS AND BEAUTY CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA DIRECT TENDER IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA RETAIL IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 SOUTH AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 SOUTH AFRICA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 SOUTH AFRICA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 SOUTH AFRICA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH AFRICA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH AFRICA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH AFRICA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH AFRICA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH AFRICA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SOUTH AFRICA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SOUTH AFRICA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 SOUTH AFRICA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SOUTH AFRICA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 SOUTH AFRICA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 66 SOUTH AFRICA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 UAE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 UAE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 UAE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 UAE NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 UAE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 UAE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 UAE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 UAE DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 UAE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 UAE BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 UAE AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 UAE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 UAE MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 80 UAE MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 81 UAE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 82 SAUDI ARABIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 SAUDI ARABIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 SAUDI ARABIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 SAUDI ARABIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 SAUDI ARABIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 SAUDI ARABIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 SAUDI ARABIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 SAUDI ARABIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 SAUDI ARABIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SAUDI ARABIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SAUDI ARABIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SAUDI ARABIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SAUDI ARABIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 SAUDI ARABIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 96 SAUDI ARABIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 97 REST OF MIDDLE EAST & AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 SIX SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES IS DRIVING THE GROWTH OF THE MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET FROM 2025 TO 2032

FIGURE 14 THE AESTHETIC LASER DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET IN 2025 AND 2032

FIGURE 15 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2024

FIGURE 16 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 17 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: PRODUCT TYPE, CAGR (2025-2032)

FIGURE 18 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY APPLICATION, 2024

FIGURE 20 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 21 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 22 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 23 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY END USER, 2024

FIGURE 24 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 25 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY END USER, CAGR (2025-2032)

FIGURE 26 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 27 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 28 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 29 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 30 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: SNAPSHOT (2024)

FIGURE 32 MIDDLE EAST AND AFRICA MEDICAL AESTHETIC MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.