Middle East And Africa Meat Poultry And Seafood Processing Equipment Market

Taille du marché en milliards USD

TCAC :

%

USD

717.65 Million

USD

982.16 Million

2024

2032

USD

717.65 Million

USD

982.16 Million

2024

2032

| 2025 –2032 | |

| USD 717.65 Million | |

| USD 982.16 Million | |

|

|

|

|

Segmentation du marché des équipements de transformation de la viande, de la volaille et des fruits de mer au Moyen-Orient et en Afrique, par type d'équipement (équipements de portionnement, de friture, de filtration, d'enrobage, de cuisson, de fumage, d'abattage, de réfrigération, de traitement à haute pression, de massage et autres), procédé (réduction de la taille, augmentation de la taille, homogénéisation, mélange et autres), mode de fonctionnement (automatique, semi-automatique et manuel), application (produits frais transformés, produits crus cuits, produits précuits, produits crus fermentés, viandes séchées, produits salés, produits congelés et autres), fonction (découpe, mélange, attendrissement, remplissage, marinade, tranchage, broyage, fumage, abattage et plumage, désossage et écorchage, éviscération, éviscération, filetage et autres), type de produits transformés (viande, volaille et fruits de mer) - Tendances du secteur et prévisions jusqu'en 2032.

Quelle est la taille et le taux de croissance du marché des équipements de transformation de la viande, de la volaille et des fruits de mer au Moyen-Orient et en Afrique ?

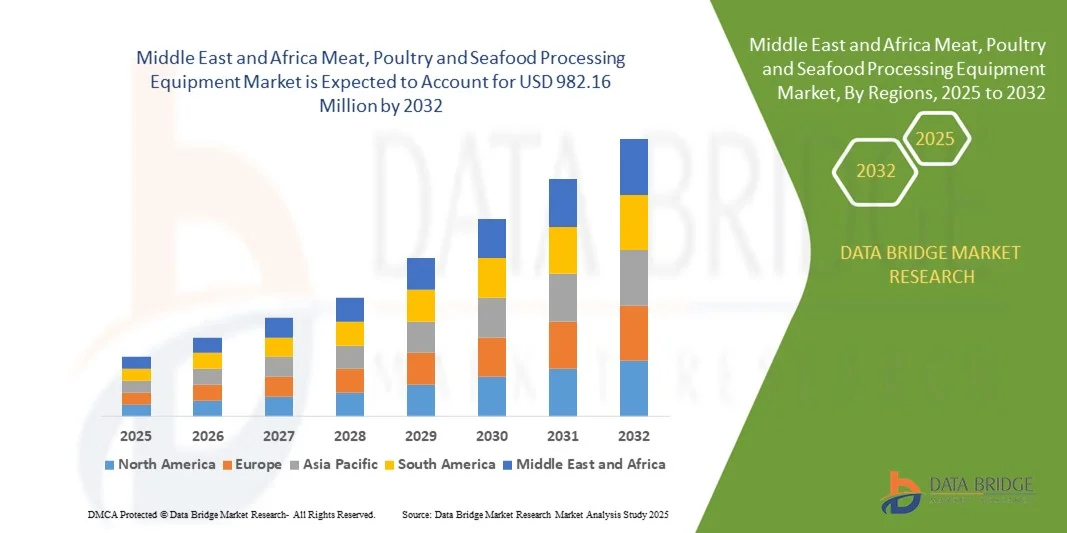

- Le marché des équipements de transformation de la viande, de la volaille et des produits de la mer au Moyen-Orient et en Afrique était évalué à 717,65 millions de dollars américains en 2024 et devrait atteindre 982,16 millions de dollars américains d'ici 2032 , soit un taux de croissance annuel composé (TCAC) de 4,00 % au cours de la période de prévision.

- La consommation croissante de viande transformée, de volaille et de produits de la mer, ainsi que le nombre grandissant de chaînes de restauration rapide et de restaurants, entraînent une demande accrue pour des produits carnés transformés et autres produits similaires de meilleure qualité. Par ailleurs, les progrès technologiques réalisés sur le marché des équipements, notamment dans les secteurs de la viande, de la volaille et des produits de la mer, ont contribué à l'augmentation de la valeur actuelle de ce marché.

- Les facteurs qui freinent la croissance du marché sont les investissements initiaux élevés et le remplacement lent des équipements en raison de leur longue durée de vie.

Quels sont les principaux enseignements du marché des équipements de transformation de la viande, de la volaille et des fruits de mer ?

- L'automatisation croissante dans l'industrie agroalimentaire peut représenter la meilleure opportunité pour le marché des équipements de transformation de la viande, de la volaille et des fruits de mer.

- Le coût élevé des machines, les infrastructures limitées dans les pays en développement et la consommation excessive d'eau lors du traitement et du nettoyage des canalisations peuvent constituer une menace pour le marché.

- L'Arabie saoudite a dominé le marché des équipements de transformation de la viande, de la volaille et des produits de la mer au Moyen-Orient et en Afrique en 2025, captant la plus grande part de revenus (28,7 %), grâce à la demande croissante d'installations de transformation de la viande modernisées, d'automatisation et d'infrastructures de chaîne du froid.

- Le marché des équipements de transformation de la viande, de la volaille et des fruits de mer aux Émirats arabes unis devrait connaître le taux de croissance le plus rapide, soit 12,1 %, sous l'effet d'une urbanisation rapide, d'une demande croissante de viande et de fruits de mer transformés et des initiatives gouvernementales promouvant la production alimentaire locale.

- Le segment des équipements de découpe et de portionnement a dominé le marché en 2025 avec une part de marché de 32,8 %, grâce à la demande croissante de découpe de précision, de contrôle des portions et de parage automatisé dans les grandes usines de transformation de la viande et des produits de la mer.

Portée du rapport et segmentation du marché des équipements de transformation de la viande, de la volaille et des fruits de mer

|

Attributs |

Aperçu du marché des équipements de transformation de la viande, de la volaille et des fruits de mer |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché des équipements de transformation de la viande, de la volaille et des fruits de mer ?

Automatisation et technologies de traitement durables

- L'adoption rapide de l'automatisation et de systèmes de transformation durables, conçus pour améliorer l'efficacité, réduire les déchets et renforcer la sécurité alimentaire, constitue une tendance majeure qui façonne le marché des équipements de transformation de la viande, de la volaille et des produits de la mer. L'importance croissante accordée aux opérations écoénergétiques et à la conception hygiénique incite les fabricants à développer des innovations respectueuses de l'environnement.

- Les entreprises intègrent de plus en plus la robotique, l'inspection basée sur l'IA et les systèmes de surveillance connectés à l'Internet des objets (IoT) pour rationaliser les processus de désossage, de découpe et d'emballage, garantissant ainsi la précision et réduisant les erreurs humaines.

- De plus, l'utilisation des technologies d'économie d'eau et de réduction des déchets gagne du terrain, les entreprises de transformation cherchant à respecter les réglementations en matière de développement durable et à réduire leurs coûts d'exploitation.

- Un exemple notable est celui du groupe GEA Aktiengesellschaft (Allemagne), qui a introduit sa ligne de production durable intégrant l'automatisation intelligente, un refroidissement efficace et des systèmes de valorisation des déchets afin d'optimiser la production de viande et de fruits de mer.

- Cette transition vers des solutions intelligentes, écologiques et économes en énergie transforme le secteur, encourageant les investissements dans des équipements de nouvelle génération qui concilient productivité, sécurité et durabilité.

Quels sont les principaux moteurs du marché des équipements de transformation de la viande, de la volaille et des fruits de mer ?

- La consommation mondiale croissante d'aliments riches en protéines et la demande accrue de produits carnés et de fruits de mer transformés sont les principaux moteurs de la croissance du marché. Les consommateurs recherchent des aliments pratiques, sûrs et transformés dans le respect des normes d'hygiène, ce qui favorise la modernisation des équipements.

- Par exemple, en 2025, Marel (Islande) a élargi sa gamme de produits avec des systèmes automatisés de portionnement et de tranchage qui améliorent la précision du rendement et la constance des produits dans la transformation de la volaille et des fruits de mer.

- Le secteur bénéficie également des investissements publics dans la réglementation en matière de sécurité alimentaire et les infrastructures d'exportation, ce qui stimule la demande en machines de transformation avancées.

- De plus, l'essor des produits prêts à consommer et des produits surgelés a accéléré la modernisation des équipements afin d'améliorer les capacités d'emballage, de réfrigération et de stockage.

- Des innovations telles que les systèmes de tri pilotés par l'IA, les convoyeurs hygiéniques et les technologies de scellage sous vide améliorent encore la qualité des produits, prolongent leur durée de conservation et stimulent l'expansion du marché dans les segments industriels et commerciaux.

Quel facteur freine la croissance du marché des équipements de transformation de la viande, de la volaille et des fruits de mer ?

- Les coûts élevés d'investissement initial et de maintenance demeurent des obstacles majeurs à l'adoption de ces technologies, notamment chez les petites et moyennes entreprises de transformation. Des équipements tels que les désosseuses automatisées et les remplisseuses sous vide nécessitent des investissements initiaux importants.

- Par exemple, en 2025, la hausse des prix de l'acier inoxydable et des composants électroniques a augmenté les coûts de fabrication des équipements pour des acteurs clés tels que BAADER (Allemagne) et JBT Corporation (États-Unis), affectant ainsi les marges bénéficiaires.

- De plus, les exigences complexes en matière de nettoyage et d'assainissement peuvent prolonger les temps d'arrêt, ce qui a un impact sur l'efficacité de la production.

- Les réglementations environnementales et énergétiques incitent également les entreprises à moderniser constamment leurs systèmes afin de réduire les émissions et la consommation d'eau.

- Malgré ces obstacles, des entreprises comme GEA Group Aktiengesellschaft et Key Technology (États-Unis) s'attaquent à ces problèmes grâce à des conceptions modulaires, économes en énergie et faciles à nettoyer. Trouver un équilibre entre coût, conformité et durabilité demeure essentiel pour garantir une croissance et une compétitivité durables sur le marché.

Comment le marché des équipements de transformation de la viande, de la volaille et des fruits de mer est-il segmenté ?

Le marché des équipements de transformation de la viande, de la volaille et des fruits de mer est segmenté en fonction du type d'équipement, du procédé, du mode de fonctionnement, de l'application, de la fonction et du type de produit transformé.

- Par type d'équipement

Selon le type d'équipement, le marché est segmenté en équipements de portionnement, de friture, de filtration, d'enrobage, de cuisson, de fumage, d'abattage, de réfrigération, de traitement haute pression (HPP), de massage et autres. Le segment des équipements de découpe et de portionnement dominait le marché en 2025 avec une part de marché de 32,8 %, porté par la demande croissante de découpe de précision, de contrôle des portions et de parage automatisé dans les grandes usines de transformation de viande et de produits de la mer. Ces systèmes améliorent l'efficacité, minimisent le gaspillage et garantissent une qualité de produit constante.

Le segment des équipements de traitement à haute pression (HPP) devrait enregistrer le TCAC le plus rapide entre 2026 et 2033, alimenté par l'adoption croissante de technologies de conservation non thermiques pour améliorer la durée de conservation et garantir des produits carnés et de fruits de mer exempts d'agents pathogènes sans compromettre leur valeur nutritionnelle ni leur texture.

- Par processus

Le marché des équipements de transformation de la viande, de la volaille et des produits de la mer est segmenté selon le procédé : réduction de la taille des produits, augmentation de la taille, homogénéisation, mélange et autres. Le segment de la réduction de la taille des produits dominait le marché en 2025 avec une part de 39,5 %, car le broyage, la découpe et le hachage constituent des étapes initiales cruciales de la transformation de la viande, garantissant une texture homogène et une uniformité de produit pour les saucisses, les steaks hachés et les produits à base de produits de la mer. L’efficacité des systèmes modernes de réduction de la taille des produits contribue à optimiser le rendement et la qualité.

Le segment du mélange devrait connaître le taux de croissance annuel composé le plus rapide entre 2026 et 2033, porté par la demande croissante de préparations à base de viande mélangée, de marinades et de produits de la mer transformés. Les mélangeurs sous vide et à palettes de pointe sont de plus en plus utilisés pour assurer une distribution homogène des ingrédients, une constance des saveurs et une meilleure stabilité des produits.

- Par mode de fonctionnement

Selon le mode de fonctionnement, le marché est segmenté en systèmes automatiques, semi-automatiques et manuels. Le segment automatique dominait le marché en 2025 avec une part de 46,7 %, grâce à l'adoption croissante de l'automatisation pour réduire les coûts de main-d'œuvre, accroître l'efficacité de la production et garantir le respect des normes d'hygiène. Les systèmes automatisés intègrent robotique, capteurs et logiciels pour réaliser avec précision des tâches complexes telles que le désossage et le conditionnement.

Le segment des systèmes semi-automatiques devrait enregistrer le taux de croissance annuel composé le plus rapide entre 2026 et 2033, les petites et moyennes entreprises de transformation cherchant à concilier les avantages de l'automatisation et l'accessibilité financière. Les systèmes semi-automatiques offrent flexibilité, simplicité d'utilisation et adaptabilité à différentes échelles de production.

- Sur demande

Selon l'application, le marché des équipements de transformation de la viande, de la volaille et des fruits de mer se segmente en produits frais transformés, produits crus cuits, produits précuits, produits crus fermentés, viandes séchées, produits salés, produits congelés et autres. Le segment des produits frais transformés détenait la plus grande part de marché (41,2 %) en 2025, grâce à la forte consommation de produits carnés et de fruits de mer peu transformés, tels que les saucisses, les nuggets et les galettes, qui nécessitent des machines performantes de découpe, de mélange et d'enrobage. La demande est soutenue par la préférence des consommateurs pour des plats cuisinés frais et prêts à consommer.

Le segment des produits surgelés devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, portée par la popularité croissante des produits de la mer surgelés et des plats cuisinés à l'échelle mondiale. Les progrès réalisés dans les technologies de congélation et la logistique de la chaîne du froid permettent d'allonger la durée de conservation et de préserver la texture et la saveur des produits.

- Par fonction

En fonction de leur fonction, les systèmes de découpe et de tranchage sont segmentés en plusieurs catégories : découpe, mélange, attendrissement, farce, marinade, tranchage, hachage, fumage, abattage et plumage, désossage et dépouillage, éviscération, éviscération, filetage et autres. Le segment de la découpe et du tranchage dominait le marché en 2025 avec une part de 36,4 %, car il représente une fonction essentielle dans la quasi-totalité des opérations de transformation de la viande et des produits de la mer. La demande en systèmes de découpe et de tranchage de précision est alimentée par la nécessité d’obtenir une épaisseur uniforme, de réduire les déchets et de préserver l’intégrité du produit.

Le segment du désossage et du dépeçage devrait afficher le TCAC le plus rapide entre 2026 et 2033, sous l'effet du besoin de systèmes à haut rendement qui minimisent le travail manuel, améliorent le rendement et renforcent l'hygiène, notamment dans les chaînes de transformation de volaille et de poisson.

- Par type de produits transformés

Selon le type de produit transformé, le marché est segmenté en viande, volaille et produits de la mer. Le segment de la viande dominait le marché en 2025 avec une part de marché de 44,9 %, grâce à la consommation croissante de produits carnés transformés tels que les saucisses, le bacon et le jambon, notamment en Amérique du Nord, au Moyen-Orient et en Afrique. Les lignes de transformation de la viande nécessitent des systèmes sophistiqués de hachage, de salaison et de conditionnement afin de garantir la sécurité et la qualité.

Le secteur des produits de la mer devrait connaître la croissance annuelle composée la plus rapide entre 2026 et 2033, soutenu par la demande mondiale croissante de poissons, de crevettes et de crustacés transformés. L'augmentation des exportations de produits de la mer, conjuguée aux progrès technologiques en matière de filetage et de congélation, favorise l'automatisation et l'expansion des capacités des usines de transformation des produits de la mer à travers le monde.

Quelle région détient la plus grande part du marché des équipements de transformation de la viande, de la volaille et des fruits de mer ?

- L'Arabie saoudite a dominé le marché des équipements de transformation de la viande, de la volaille et des produits de la mer au Moyen-Orient et en Afrique en 2025, captant la plus grande part de revenus (28,7 %), grâce à la demande croissante d'installations de transformation de la viande modernisées, d'automatisation et d'infrastructures de chaîne du froid.

- Les investissements du pays dans la sécurité alimentaire, la production industrielle de volaille et de viande, et les initiatives de substitution aux importations ont accéléré l'adoption d'équipements de transformation performants. Les technologies avancées d'abattage, de désossage et de conditionnement sont de plus en plus intégrées afin de garantir la conformité aux normes de sécurité alimentaire HACCP et ISO.

- Globalement, l'accent mis par l'Arabie saoudite sur la modernisation, l'expansion industrielle et le respect des normes de sécurité alimentaire l'a positionnée comme le pays leader au Moyen-Orient et en Afrique pour les équipements de transformation de la viande, de la volaille et des fruits de mer.

Analyse du marché des équipements de transformation de la viande, de la volaille et des fruits de mer aux Émirats arabes unis

Le marché des équipements de transformation de la viande, de la volaille et des produits de la mer aux Émirats arabes unis devrait connaître la croissance la plus rapide, à 12,1 %, portée par une urbanisation rapide, une demande croissante de viande et de produits de la mer transformés et des initiatives gouvernementales encourageant la production alimentaire locale. Les fabricants et transformateurs alimentaires basés aux Émirats arabes unis investissent massivement dans des systèmes automatisés de portionnement, de congélation et de conditionnement afin de répondre à la demande croissante des secteurs de l'hôtellerie, de la distribution et de l'exportation. L'intégration de systèmes de contrôle intelligents, de systèmes de réfrigération écoénergétiques et de lignes de production hygiéniques améliore la productivité et réduit les coûts d'exploitation. L'accent mis par les Émirats arabes unis sur des technologies de transformation avancées, durables et à haute efficacité positionne le pays comme un pôle de croissance clé au Moyen-Orient et en Afrique.

Analyse du marché égyptien des équipements de transformation de la viande, de la volaille et des fruits de mer

Le marché égyptien des équipements de transformation de la viande, de la volaille et des produits de la mer est en constante expansion, porté par le développement des industries de transformation de la volaille et des produits de la mer et par les initiatives gouvernementales visant à améliorer la sécurité alimentaire et l'autosuffisance. Les fabricants égyptiens adoptent de plus en plus d'équipements modernes d'abattage, de découpe et de congélation afin d'améliorer l'hygiène, la productivité et la conformité aux normes internationales d'exportation. Les investissements dans les infrastructures d'entreposage frigorifique, le portionnement automatisé et les systèmes d'enrobage contribuent également à accroître l'efficacité. Grâce à sa situation géographique stratégique, à son vaste marché intérieur et à ses capacités industrielles croissantes, l'Égypte joue un rôle majeur dans le développement de l'industrie régionale des équipements de transformation de la viande, de la volaille et des produits de la mer.

Analyse du marché des équipements de transformation de la viande, de la volaille et des fruits de mer en Afrique du Sud

Le marché sud-africain des équipements de transformation de la viande, de la volaille et des produits de la mer connaît une croissance soutenue, portée par un secteur d'exportation de viande dynamique et une demande croissante d'aliments transformés de haute qualité. Les fabricants sud-africains adoptent des systèmes automatisés de désossage, de tranchage, de marinade et de conditionnement afin d'améliorer leur productivité, de réduire leurs coûts de main-d'œuvre et de garantir leur conformité aux normes internationales de sécurité alimentaire. Les initiatives de développement durable, telles que les systèmes de réfrigération économes en énergie et les lignes de production économes en eau, contribuent également à l'expansion du marché. En définitive, la combinaison d'une demande tirée par les exportations, de capacités industrielles solides et d'un engagement fort en faveur du développement durable renforce la position de l'Afrique du Sud comme marché leader au Moyen-Orient et en Afrique.

Analyse du marché marocain des équipements de transformation de la viande, de la volaille et des fruits de mer

Le marché marocain des équipements de transformation de la viande, de la volaille et des produits de la mer est en croissance soutenue, porté par la hausse de la consommation intérieure, l'expansion des élevages de volailles et de produits de la mer et l'augmentation des investissements dans des installations de transformation modernes. Les transformateurs marocains adoptent des équipements de congélation, de conditionnement et de portionnement de pointe afin d'améliorer la qualité, la sécurité et l'aptitude à l'exportation de leurs produits. Les incitations gouvernementales à la modernisation de l'industrie agroalimentaire et la collaboration avec les fournisseurs internationaux favorisent le transfert de technologies et l'efficacité opérationnelle. De ce fait, le Maroc s'affirme comme un acteur majeur de la croissance et de la compétitivité du marché des équipements de transformation de la viande, de la volaille et des produits de la mer au Moyen-Orient et en Afrique.

Quelles sont les principales entreprises du marché des équipements de transformation de la viande, de la volaille et des fruits de mer ?

Le secteur des équipements de transformation de la viande, de la volaille et des fruits de mer est principalement dominé par des entreprises bien établies, notamment :

- Equipamientos Cárnicos, SL (Espagne)

- BRAHER INTERNACIONAL, SA (Espagne)

- RZPO (Pologne)

- Minerva Omega Group srl (Italie)

- Groupe GEA Aktiengesellschaft (Allemagne)

- RISCO SpA (Italie)

- PSS SVIDNÍK, comme (Slovaquie)

- Metalbud (Pologne)

- BAADER (Allemagne)

- JBT Corporation (États-Unis)

- Marel (Islande)

- Key Technology (États-Unis)

- Illinois Tool Works Inc. (États-Unis)

- La société Middleby (États-Unis)

- Bettcher Industries, Inc. (États-Unis)

- BIZERBA (Allemagne)

Quels sont les développements récents sur le marché des équipements de transformation de la viande, de la volaille et des fruits de mer au Moyen-Orient et en Afrique ?

- En février 2025, JBT Marel a conclu une alliance stratégique avec Ace Aquatec, désignant cette dernière comme son fournisseur privilégié de solutions d'étourdissement du poisson pour les machines de transformation alimentaire. Cette collaboration renforce la position de JBT Marel dans le domaine de la transformation durable des produits de la mer et enrichit son portefeuille de machines innovantes.

- En janvier 2025, JBT, société américaine, a acquis la totalité de Marel, donnant naissance à la nouvelle entité JBT Marel Corporation. Cette fusion crée un leader mondial de premier plan dans le domaine des technologies de transformation alimentaire, renforçant l'efficacité et l'innovation dans de nombreux secteurs de l'alimentation.

- En novembre 2024, Fortifi Food Processing Solutions a annoncé l'acquisition de la propriété intellectuelle, des relations clients, d'une partie des stocks et des immobilisations de JWE-BANSS GmbH (Allemagne), un fabricant majeur de systèmes de transformation des protéines. Cette acquisition renforce l'expertise de Fortifi dans le domaine de la transformation de la viande et consolide sa présence sur les marchés du Moyen-Orient et d'Afrique.

- En juillet 2024, Ross Industries a lancé l'éplucheur à membrane AMS 400, une solution conçue pour les transformateurs de viande artisanaux et de taille moyenne, afin d'améliorer leur efficacité opérationnelle et la qualité de leurs produits finis. Ce lancement témoigne de l'engagement de Ross Industries à répondre aux besoins d'automatisation évolutifs des petits et moyens producteurs alimentaires.

- En mars 2024, Fortifi Food Processing Solutions a été officiellement lancée en tant que plateforme mondiale unifiée de marques de transformation et d'automatisation alimentaires présentes sur les cinq continents. Cette création marque une étape stratégique vers l'offre de solutions intégrées pour les industries de transformation des protéines, des produits laitiers, des fruits et légumes.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.