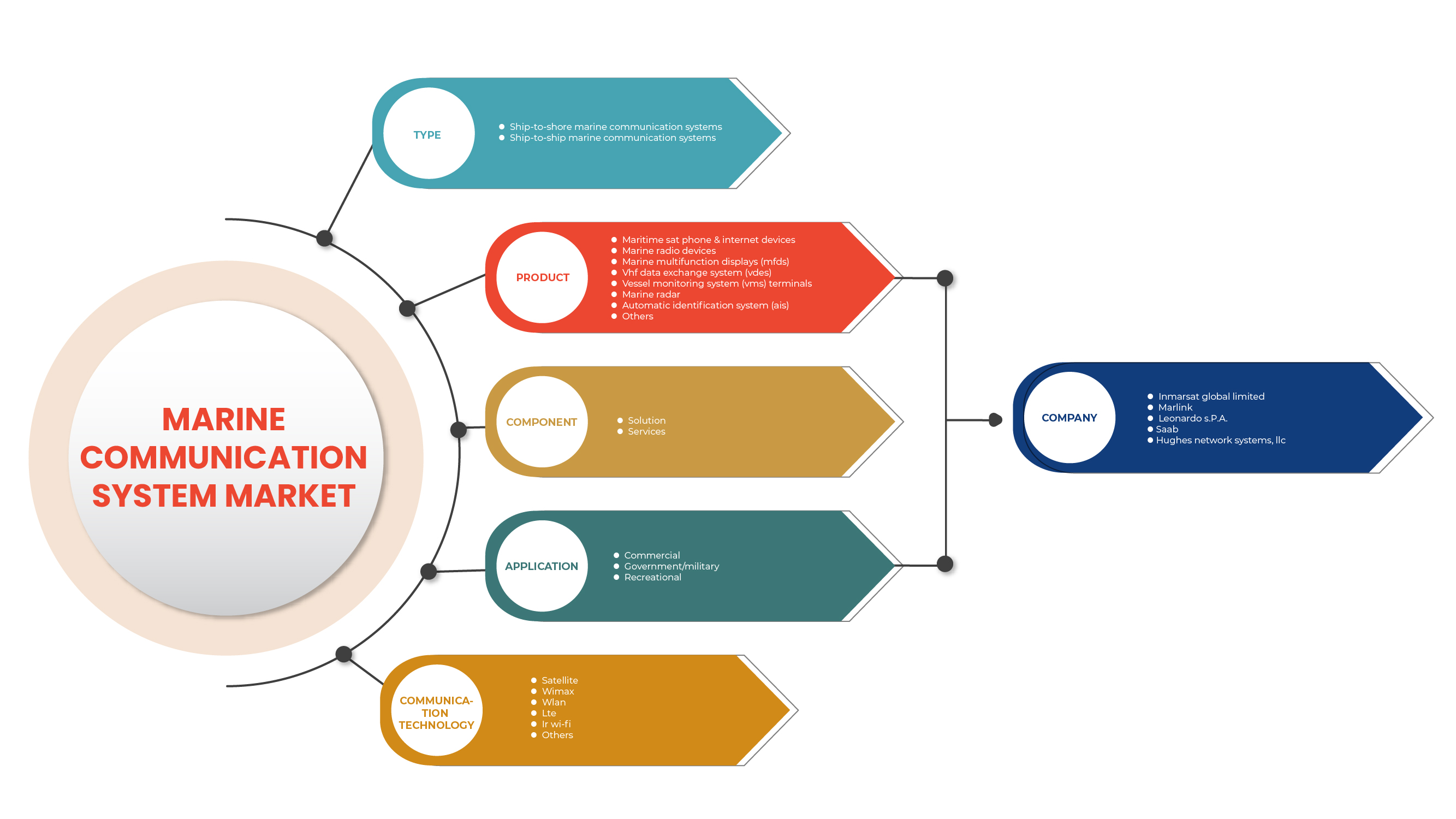

Marché des systèmes de communication marine au Moyen-Orient et en Afrique, par type (systèmes de communication marine navire-terre et systèmes de communication marine navire-navire), par produit (téléphones par satellite et appareils Internet maritimes, appareils radio marins, écrans multifonctions marins (MFDS), système d'échange de données VHF (VDES) , terminaux de système de surveillance des navires (VMS), radar marin, système d'identification automatique (AIS) et autres), par composant (solution et services), par application (commerciale, gouvernementale/militaire et récréative), par technologie de communication (satellite, WIMAX, WLAN, LTE, IR Wi-Fi et autres) – Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché

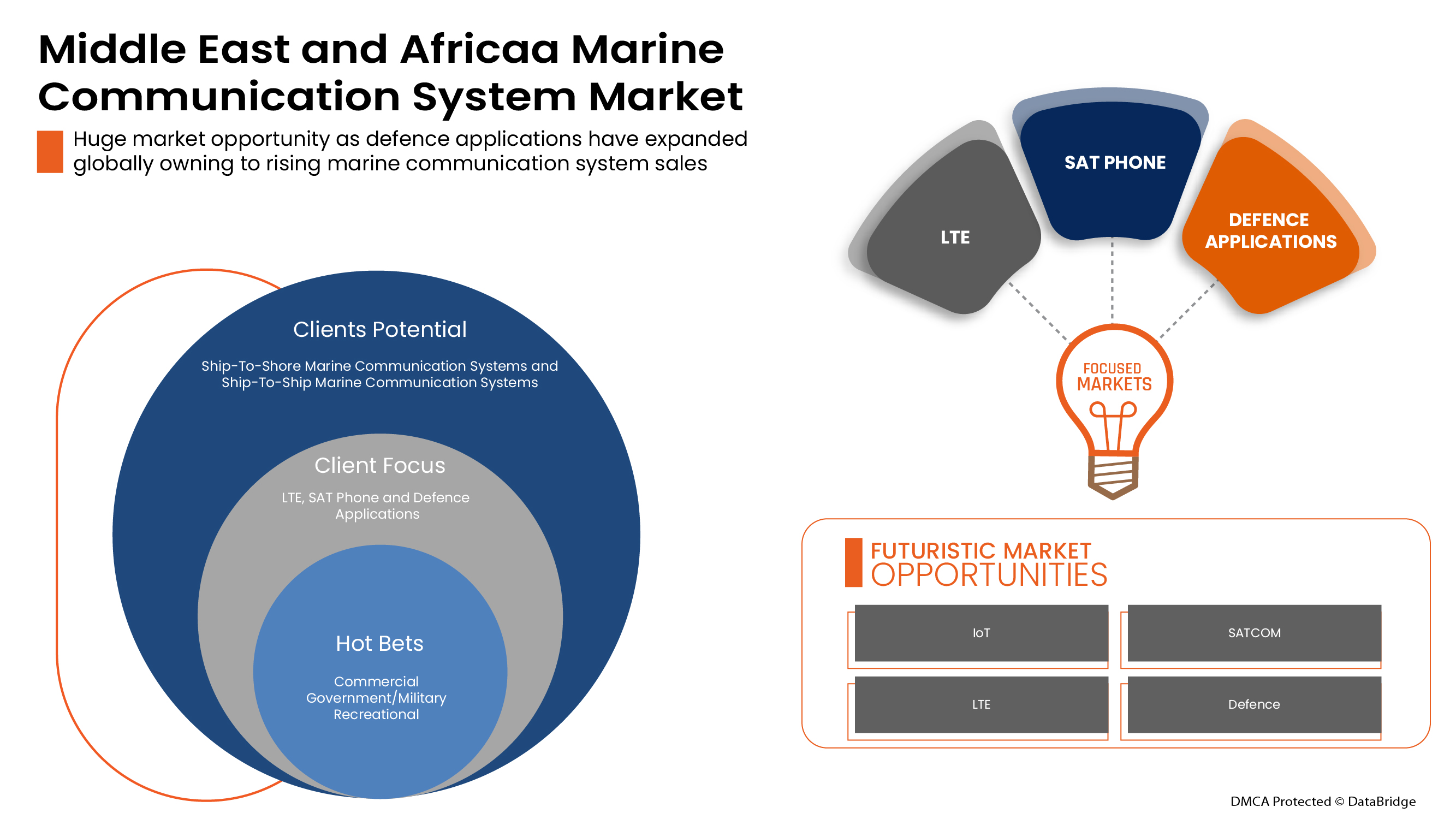

Les systèmes de communication maritime sont un ensemble de systèmes de communication utilisés pour la communication entre différents navires ou navires vers la côte. Les systèmes COMM comportent divers composants, par exemple, les systèmes de communication radio, le radiotéléphone VHF, le radiotéléphone MF/HF, le récepteur Navtex à double canal, Inmarsat, le radar marin, le système d'échange de données VHF (VDES), les appareils de téléphonie et Internet SAT maritimes et d'autres systèmes liés à la navigation. La demande croissante de communications sécurisées pour les applications IoT maritimes entraîne une augmentation de la demande de solutions de systèmes de communication marine sur le marché. Le marché des systèmes de communication marine au Moyen-Orient et en Afrique connaît une croissance rapide en raison de l'avènement de la communication bidirectionnelle utilisant VDES. Les entreprises lancent même de nouveaux produits pour gagner une plus grande part de marché.

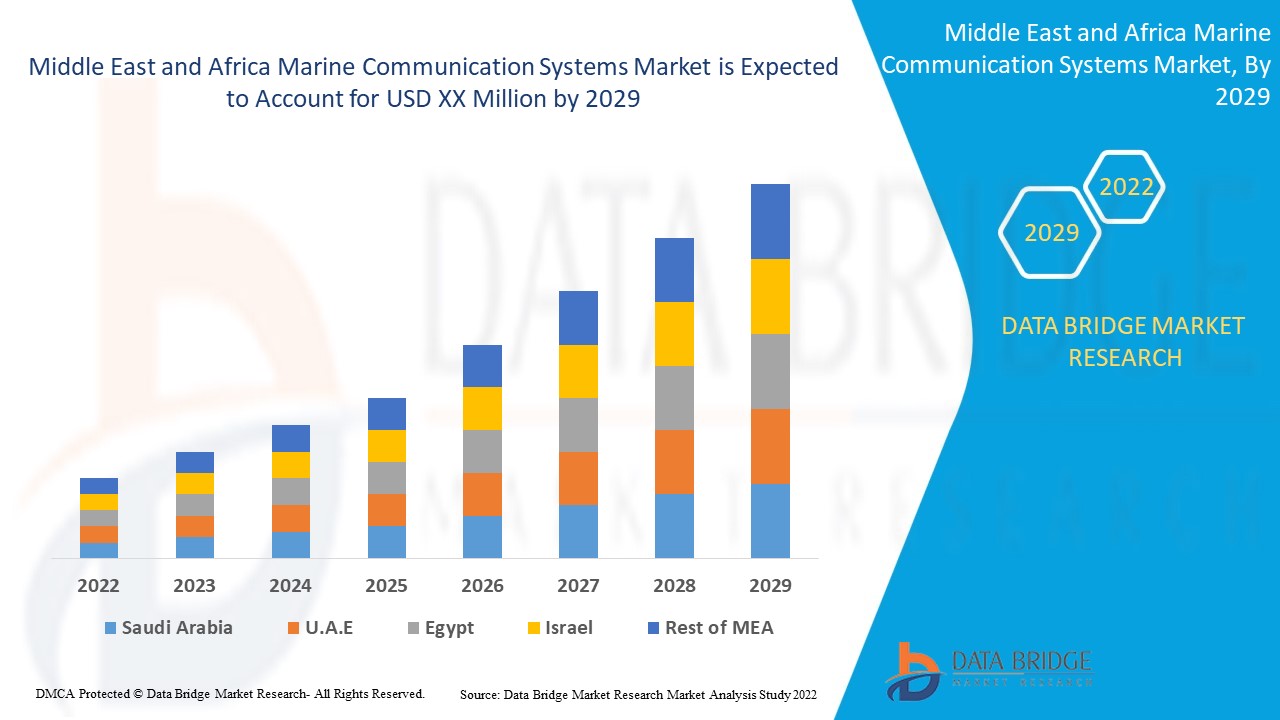

Data Bridge Market Research analyse que le marché des systèmes de communication marine devrait croître à un TCAC de 7,6 % au cours de la période de prévision. Les « systèmes de communication marine navire-terre » représentent le segment de système le plus important sur le marché des systèmes de communication marine. Le rapport sur le marché des systèmes de communication marine couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 |

|

Unités quantitatives |

Milliers de dollars américains |

|

Segments couverts |

Par type (systèmes de communication maritime navire-terre et systèmes de communication maritime navire-navire), par produit (téléphones par satellite et appareils Internet maritimes, appareils radio marins, écrans multifonctions marins (MFDS), système d'échange de données VHF (VDES), terminaux de système de surveillance des navires (VMS), radar marin, système d'identification automatique (AIS) et autres), par composant (solution et services), par application (commerciale, gouvernementale/militaire et récréative), par technologie de communication (satellite, WIMAX, WLAN, LTE, IR Wi-Fi et autres) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Égypte, Afrique du Sud, Israël et reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

Orbit Communications Systems Ltd., Leonardo SpA, groupe Telemar, Inmarsat Moyen-Orient et Afrique Limited, Rohde & Schwarz, SAAB, groupe Zenitel, Iridium Communications Inc., FURUNO ELECTRIC CO., LTD., Teledyne FLIR LLC, Icom Inc., Jotron., Garmin Ltd., BOCHI CORPORATION, Avatec Marine., NAVICO HOLDING AS, Cobham Satcom, Intellian Technologies, Inc., Hughes Network Systems, LLC, Thuraya Telecommunications Company, Applied Satellite Technology Ltd, Alphatron Marine BV, NSSL Global, Marlink SAS, Norsat International Inc., Global Technology House, Thales, entre autres |

Définition du marché

Les systèmes de communication maritime sont un ensemble de systèmes de communication utilisés pour la communication entre différents navires ou navires vers la côte. Les systèmes COMM comprennent divers composants, par exemple, les systèmes de communication radio, le radiotéléphone VHF, le radiotéléphone MF/HF, le récepteur Navtex à double canal, Inmarsat, le radar marin, le système d'échange de données VHF (VDES), les appareils de téléphonie et d'Internet maritimes par satellite et d'autres systèmes liés à la navigation. Les systèmes de communication maritime sont également utilisés pour la visualisation, la gestion des appels de détresse, la navigation et la fourniture d'alertes précoces en cas de conditions météorologiques défavorables. Il s'agit d'un système avancé utilisé pour la sécurité du navire et de la vie à bord.

Dynamique du marché des systèmes de communication maritime

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

DEMANDE CROISSANTE DE COMMUNICATIONS SÉCURISÉES POUR LES APPLICATIONS IOT MARITIMES

L'écosystème de l'IoT maritime a récemment connu une évolution progressive. Cet écosystème est desservi par divers composants électroniques standard qui sont le matériel intégré à de multiples logiciels. L'importance de l'utilisation de telles technologies d'application maritime à l'ère de l'IoT est une nécessité absolue qui stimule le marché mondial des systèmes de communication maritime.

-

L'avènement de la communication bidirectionnelle via VDES

Le système d'échange de données VHF (VDES) est un système de communication bidirectionnel à très haute fréquence (VHF) pour navires, largement utilisé dans les communications maritimes ces derniers temps. Il est considéré comme une extension standard du système d'identification automatique (AIS). Les systèmes de communication marine de nouvelle génération utilisent l'AIS et le VDES dans le même boîtier que celui utilisé dans la plupart des navires commerciaux.

-

ÉMERGENCE DES RÉSEAUX 5G ET LTE

La 5G est la prochaine génération de technologie cellulaire sans fil. Elle fournira des données à haut débit jusqu'à 3000 Mbps (3 Gbps) dans le monde réel. Les smartphones et autres appareils intelligents bénéficieront énormément de la 5G. L'Internet des objets (IoT) bénéficiera également énormément de la vitesse et de la bande passante de la 5G. En outre, le réseau 5G peut également améliorer l'industrie maritime, car la LTE/5G peut offrir des vitesses de communication beaucoup plus élevées à un coût nettement inférieur à celui des satellites, ce qui permet la prochaine vague de communications maritimes.

-

HAUSSE DE LA DEMANDE DE SYSTÈMES DE COMMUNICATION PAR SATELLITE

La communication par satellite est un type de télécommunication moderne dans lequel des satellites artificiels assurent des liaisons de communication entre différents points de la Terre. Elle joue un rôle essentiel dans de nombreuses industries pour la continuité des activités et la gestion des urgences dans différents secteurs d'activité tels que la communication maritime, la communication terrestre, les télécommunications, le pétrole et le gaz, l'IoT, la santé, le gouvernement, le maritime, l'exploitation minière, etc. De plus, les communications par satellite sont utilisées pour diverses autres applications commerciales, gouvernementales et militaires.

Opportunité

-

AUGMENTATION DE LA CONSTRUCTION DE NAVIRES MILITAIRES ET COMMERCIAUX

La pression géopolitique croissante oblige les pays à renforcer leur secteur de la défense, notamment terrestre, aérienne et maritime. Récemment, le financement de la construction d'une flotte navale solide est devenu une priorité absolue pour les pays. La construction d'une flotte navale comprend une large gamme de navires tels que des porte-avions, des destroyers, des navires amphibies, des navires ravitailleurs, des navires polyvalents et de recherche et des sous-marins, qui sont principalement utilisés dans les applications marines.

Retenue/Défi

- LES SYSTÈMES DE COMMUNICATION MARINE OBSOLÈTES REPRÉSENTENT UNE MENACE DE PIRATAGE INFORMATIQUE

Les problèmes de cybercriminalité/piratage informatique et de cybersécurité ont augmenté de 600 % pendant la pandémie dans tous les secteurs. Les failles de sécurité des réseaux ou des logiciels sont des faiblesses que les pirates exploitent pour effectuer des actions non autorisées au sein d'un système.

Impact post-COVID-19 sur le marché des systèmes de communication maritime

La COVID-19 a eu un impact majeur sur le marché des systèmes de communication maritime, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui font face à cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché des systèmes de communication maritime augmente en raison des politiques gouvernementales visant à stimuler le commerce international après la pandémie. De plus, la demande croissante de construction de navires militaires/commerciaux augmente la demande de systèmes de communication maritime sur le marché. Cependant, des facteurs tels que la congestion associée aux routes commerciales et les restrictions commerciales entre certains pays freinent la croissance du marché. La fermeture des installations de production pendant la pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans le marché des systèmes de communication marine. Grâce à cela, les entreprises apporteront au marché des solutions avancées et précises. En outre, les initiatives gouvernementales visant à stimuler le commerce international ont conduit à la croissance du marché.

Développement récent

- En mai 2022, Inmarsat Middle East and Africa Limited a fourni des communications sans fil modernes aux navires maritimes. Le service lancé pour l'équipe d'expédition du Titanic vise à offrir des capacités de réseau de communication par satellite pour l'expédition. Cette société pourrait proposer des solutions innovantes et avancées à ses clients

- En mai 2022, SAAB a reçu de l'Administration suédoise du matériel de défense un contrat pour un tube lance-torpilles pour torpilles légères dotées de fonctions de contrôle avancées. Pour ce contrat, l'entreprise a reçu 14,75 milliers de dollars américains. Grâce à ce contrat, l'entreprise a renforcé sa présence régionale

Portée du marché des systèmes de communication maritime au Moyen-Orient et en Afrique

Le marché des systèmes de communication marine est segmenté en fonction du type, du produit, du composant, de l'application et de la technologie de communication. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par type

- Systèmes de communication maritime navire-terre

- Systèmes de communication maritime de navire à navire

Sur la base du type, le marché des systèmes de communication marine du Moyen-Orient et de l'Afrique est segmenté en systèmes de communication marine navire-terre et systèmes de communication marine navire-navire.

Par produit

- Téléphones et appareils Internet par satellite maritimes

- Appareils radio marins

- Écrans multifonctions marins (MFDS)

- Système d'échange de données VHF (VDES)

- Terminaux du système de surveillance des navires (VMS)

- Radar marin

- Système d'identification automatique (AIS)

- Autres

Sur la base des produits dérivés, le marché des systèmes de communication marine du Moyen-Orient et de l'Afrique a été segmenté en appareils de téléphonie et Internet par satellite maritime, appareils radio marins, écrans multifonctions marins (MFDS), système d'échange de données VHF (VDES), terminaux de système de surveillance des navires (VMS), radar marin, système d'identification automatique (AIS) et autres.

Par composant

- Solution

- Services

Sur la base des composants, le marché des systèmes de communication marine du Moyen-Orient et de l’Afrique a été segmenté en solutions et services.

Par application

- Commercial

- Gouvernement/Militaire

- Récréatif

Sur la base des applications, le marché des systèmes de communication marine du Moyen-Orient et de l'Afrique a été segmenté en commercial, gouvernemental/militaire et récréatif.

Par la technologie de la communication

- Satellite

- Wimax

- Wi-Fi

- LTE

- Wi-Fi infrarouge

- Autres

Sur la base de la technologie de communication, le marché des systèmes de communication marine du Moyen-Orient et de l'Afrique a été segmenté en satellite, WIMAX, WLAN, LTE, IR Wi-Fi et autres.

Analyse/perspectives régionales du marché des systèmes de communication marine

Le marché des systèmes de communication marine est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, produit, composant, application et technologie de communication comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des systèmes de communication marine sont l’Arabie saoudite, les Émirats arabes unis, l’Égypte, l’Afrique du Sud, Israël et le reste du Moyen-Orient et de l’Afrique.

L'Arabie saoudite domine le marché des systèmes de communication maritime. Le marché des systèmes de communication maritime en Arabie saoudite devrait connaître la croissance la plus rapide au monde. L'Arabie saoudite dispose des principales routes commerciales qui partent de ses territoires, ce qui en fait un marché important.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des systèmes de communication maritime

Le paysage concurrentiel du marché des systèmes de communication marine fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des systèmes de communication marine.

Certains des principaux acteurs opérant sur le marché des systèmes de communication marine sont :

Français Orbit Communications Systems Ltd., Leonardo SpA, groupe Telemar, Inmarsat Moyen-Orient et Afrique Limited, Rohde & Schwarz, SAAB, groupe Zenitel, Iridium Communications Inc., FURUNO ELECTRIC CO., LTD., Teledyne FLIR LLC, Icom Inc., Jotron., Garmin Ltd., BOCHI CORPORATION, Avatec Marine., NAVICO HOLDING AS, Cobham Satcom, Intellian Technologies, Inc., Hughes Network Systems, LLC, Thuraya Telecommunications Company, Applied Satellite Technology Ltd, Alphatron Marine BV, NSSL Global, Marlink SAS, Norsat International Inc., Global Technology House, Thales entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 REGULATORY STANDARDS

4.4 TECHNOLOGICAL ADVANCEMENT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS

5.1.2 ADVENT OF TWO-WAY COMMUNICATION USING VDES

5.1.3 EMERGENCE OF 5G AND LTE NETWORKS

5.1.4 SURGE IN DEMAND FOR SATELLITE COMMUNICATION SYSTEMS

5.1.5 INCREASING CONSTRUCTION OF MILITARY/COMMERCIAL VESSELS

5.2 RESTRAINT

5.2.1 OUTDATED MARINE COMMUNICATION SYSTEMS POSE THE THREAT OF HACKING

5.3 OPPORTUNITIES

5.3.1 SURGE IN DEMAND FOR MIDDLE EAST & AFRICA MARITIME DISTRESS SAFETY SYSTEM

5.3.2 INCREASING NEED FOR MARINE COMMUNICATION FOR AUTONOMOUS SHIPS

5.3.3 GROWING NEED FOR E-NAVIGATION/ ADVANCED NAVIGATION SYSTEMS

5.3.4 STRATEGIC SOLUTION LAUNCHES PARTNERSHIPS & MERGERS TAKEN BY MAJOR PLAYERS

5.4 CHALLENGES

5.4.1 SATURATION PROBLEMS IN AREAS WITH A HIGH CONCENTRATION OF USERS

5.4.2 FACTORS HINDERING RELIABILITY OF MARINE COMMUNICATION

6 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE

6.1 OVERVIEW

6.2 SHIP-TO-SHORE MARINE COMMUNICATION SYSTEMS

6.3 SHIP-TO-SHIP MARINE COMMUNICATION SYSTEMS

7 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 MARITIME SAT PHONE & INTERNET DEVICES

7.2.1 INMARSAT

7.2.2 COSPAS-SARSAT SYSTEM

7.2.2.1 LEOSAR

7.2.2.2 MEOSAR

7.2.2.3 GEOSAR

7.2.3 IRIDIUM/HIBLEO 2

7.2.4 MIDDLE EAST & AFRICASTAR

7.2.5 OTHERS

7.3 MARINE RADIO DEVICES

7.3.1 FIXED-MOUNT VHF MARINE RADIOS

7.3.2 HANDHELD MARINE VHF RADIOS

7.3.3 MF/HF RADIOS

7.4 MARINE MULTIFUNCTION DISPLAYS (MFDS)

7.5 VHF DATA EXCHANGE SYSTEM (VDES)

7.6 VESSEL MONITORING SYSTEM (VMS) TERMINALS

7.7 MARINE RADAR

7.8 AUTOMATIC IDENTIFICATION SYSTEM (AIS)

7.8.1 AIS TRANSPONDERS

7.8.2 AIS RECEIVERS

7.9 OTHERS

8 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 SOLUTION

8.2.1 DATA

8.2.2 VOICE

8.2.3 TRACKING AND MONITORING

8.2.4 VIDEO

8.2.5 OTHERS

8.3 SERVICES

8.3.1 INSTALLATION AND INTEGRATION

8.3.2 AFTER-SALES SUPPORT & MAINTENANCE

8.3.3 CONSULTING

9 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 COMMERCIAL

9.2.1 BY TYPE

9.2.1.1 MERCHANT NAVY

9.2.1.2 OIL AND GAS

9.2.1.3 FISHING

9.2.1.4 OTHERS

9.2.2 BY PRODUCT

9.2.2.1 MARITIME SAT PHONE & INTERNET DEVICES

9.2.2.2 MARINE RADIO DEVICES

9.2.2.3 MARINE MULTIFUNCTION DISPLAYS (MFDS)

9.2.2.4 VHF DATA EXCHANGE SYSTEM (VDES)

9.2.2.5 VESSEL MONITORING SYSTEM (VMS) TERMINALS

9.2.2.6 MARINE RADAR

9.2.2.7 AUTOMATIC IDENTIFICATION SYSTEM (AIS)

9.2.2.8 OTHERS

9.3 GOVERNMENT/MILITARY

9.3.1 BY PRODUCT

9.3.1.1 MARITIME SAT PHONE & INTERNET DEVICES

9.3.1.2 MARINE RADIO DEVICES

9.3.1.3 MARINE MULTIFUNCTION DISPLAYS (MFDS)

9.3.1.4 VHF DATA EXCHANGE SYSTEM (VDES)

9.3.1.5 VESSEL MONITORING SYSTEM (VMS) TERMINALS

9.3.1.6 MARINE RADAR

9.3.1.7 AUTOMATIC IDENTIFICATION SYSTEM (AIS)

9.3.1.8 OTHERS

9.4 RECREATIONAL

9.4.1 BY PRODUCT

9.4.1.1 MARITIME SAT PHONE & INTERNET DEVICES

9.4.1.2 MARINE RADIO DEVICES

9.4.1.3 MARINE MULTIFUNCTION DISPLAYS (MFDS)

9.4.1.4 VHF DATA EXCHANGE SYSTEM (VDES)

9.4.1.5 VESSEL MONITORING SYSTEM (VMS) TERMINALS

9.4.1.6 MARINE RADAR

9.4.1.7 AUTOMATIC IDENTIFICATION SYSTEM (AIS)

9.4.1.8 OTHERS

10 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY

10.1 OVERVIEW

10.2 SATELLITE

10.3 WIMAX

10.4 WLAN

10.5 LTE

10.6 IR WI-FI

10.7 OTHERS

11 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST & AFRICA

11.1.1 SAUDI ARABIA

11.1.2 U.A.E.

11.1.3 EGYPT

11.1.4 SOUTH AFRICA

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 INMARSAT MIDDLE EAST & AFRICA LIMITED

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCTS PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 MARLINK SAS

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 LEONARDO S.P.A.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCTS PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 SAAB

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCTS PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 HUGHES NETWORK SYSTEMS, LLC

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 THALES

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 RODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 FURUNO ELECTRIC CO., LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCTS PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 ROHDE & SCHWARZ

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 GARMIN LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCTS PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 APPLIED SATELLITE TECHNOLOGY LTD

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 ALPHATRON MARINE B.V.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 AVATEC MARINE.

14.12.1 COMPANY SNAPSHOT

14.12.2 SOLUTION PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 BOCHI CORPORATION

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCTS PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 COBHAM SATCOM

14.14.1 COMPANY SNAPSHOT

14.14.2 SOLUTION PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 MIDDLE EAST & AFRICA TECHNOLOGY HOUSE

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 ICOM INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCTS PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 INTELLIAN TECHNOLOGIES, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCTS PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 IRIDIUM COMMUNICATIONS INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCTS PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 JOTRON.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCTS PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 NAVICO HOLDING AS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCTS PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 NORSAT INTERNATIONAL INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.22 NSSL MIDDLE EAST & AFRICA

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.23 ORBIT COMMUNICATIONS SYSTEMS LTD.

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCTS PORTFOLIO

14.23.4 RECENT DEVELOPMENTS

14.24 TELEDYNE FLIR LLC

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 PRODUCTS PORTFOLIO

14.24.4 RECENT DEVELOPMENT

14.25 TELEMAR GROUP

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCTS PORTFOLIO

14.25.3 RECENT DEVELOPMENT

14.26 THURAYA TELECOMMUNICATIONS COMPANY

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENTS

14.27 ZENITEL GROUP

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCTS PORTFOLIO

14.27.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 VARIOUS MARINE COMMUNICATION SYSTEMS REGULATORY STANDARDS.

TABLE 2 CYBER-ATTACKS ON VESSELS/MARITIME INDUSTRY

TABLE 3 POSSIBILITY OF ATTACKS ON COMMUNICATION SYSTEMS

TABLE 4 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA SHIP-TO-SHORE MARINE COMMUNICATION SYSTEMS IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA SHIP-TO-SHIP MARINE COMMUNICATION SYSTEMS IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA MARINE MULTIFUNCTION DISPLAYS (MFDS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA VHF DATA EXCHANGE SYSTEM (VDES) IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA VESSEL MONITORING SYSTEM (VMS) TERMINALS IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA MARINE RADAR IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA AUTOMATIC IDENTIFICATION SYSTEMS (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA SATELLITE IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA WIMAX IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA WLAN IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA LTE IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA IR WI-FI IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA OTHERS IN MARINE COMMUNICATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 56 SAUDI ARABIA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 SAUDI ARABIA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 58 SAUDI ARABIA MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 SAUDI ARABIA COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 SAUDI ARABIA MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 SAUDI ARABIA AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 SAUDI ARABIA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 63 SAUDI ARABIA SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 SAUDI ARABIA SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 SAUDI ARABIA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 SAUDI ARABIA GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 SAUDI ARABIA RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 SAUDI ARABIA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 71 U.A.E. MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 U.A.E. MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 U.A.E. MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 U.A.E. COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 U.A.E. MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 U.A.E. AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 U.A.E. MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 78 U.A.E. SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 U.A.E. SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 U.A.E. MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 U.A.E. COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 U.A.E. COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 U.A.E. GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 84 U.A.E. RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 U.A.E. MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 86 EGYPT MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 EGYPT MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 88 EGYPT MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 EGYPT COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 EGYPT MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 EGYPT AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 EGYPT MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 93 EGYPT SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 EGYPT SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 EGYPT MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 EGYPT COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 EGYPT COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 98 EGYPT GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 EGYPT RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 100 EGYPT MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 101 SOUTH AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 SOUTH AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 103 SOUTH AFRICA MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 SOUTH AFRICA COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 SOUTH AFRICA MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 106 SOUTH AFRICA AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 SOUTH AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 108 SOUTH AFRICA SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 SOUTH AFRICA SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 SOUTH AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 SOUTH AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 SOUTH AFRICA COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 SOUTH AFRICA GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 114 SOUTH AFRICA RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 SOUTH AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 116 ISRAEL MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 ISRAEL MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 ISRAEL MARITIME SAT PHONE & INTERNET DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 ISRAEL COSPAS-SARSAT SYSTEM IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 ISRAEL MARINE RADIO DEVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 ISRAEL AUTOMATIC IDENTIFICATION SYSTEM (AIS) IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 122 ISRAEL MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 123 ISRAEL SOLUTION IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 ISRAEL SERVICES IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 ISRAEL MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 126 ISRAEL COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 ISRAEL COMMERCIAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 128 ISRAEL GOVERNMENT/MILITARY IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 129 ISRAEL RECREATIONAL IN MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 130 ISRAEL MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 131 REST OF MIDDLE EAST AND AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: DBMRMARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR SECURE COMMUNICATION FOR MARITIME IOT APPLICATIONS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 SHIP-TO-SHORE MARINE COMMUNICATION SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA TO DOMINATING AND THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 TECHNOLOGICAL TRENDS IN MARINE COMMUNICATION SYSTEMS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET

FIGURE 15 TOP 7 COUNTRIES WITH LARGEST NAVAL FLEET

FIGURE 16 MIDDLE EAST & AFRICA SHIPPING LOSSES BY NUMBER OF VESSELS, 2011-2020

FIGURE 17 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY PRODUCT, 2021

FIGURE 19 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMPONENT, 2021

FIGURE 20 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY APPLICATION, 2021

FIGURE 21 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET, BY COMMUNICATION TECHNOLOGY, 2021

FIGURE 22 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: BY TYPE (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA MARINE COMMUNICATION SYSTEMS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.