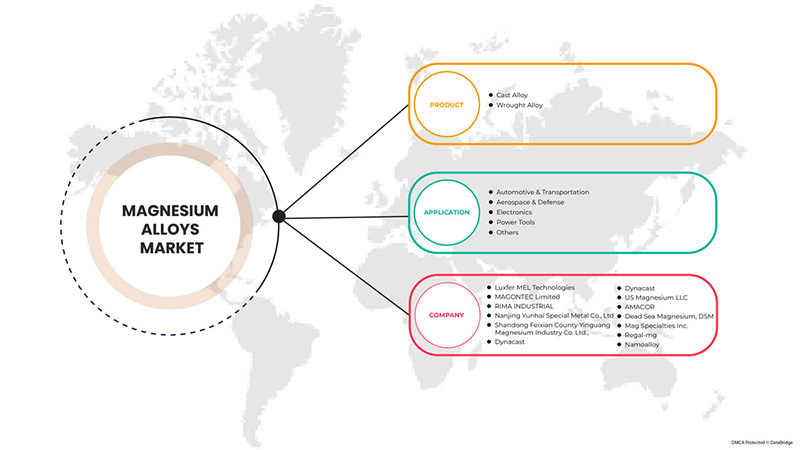

Marché des alliages de magnésium au Moyen-Orient et en Afrique, par produit (alliage moulé et alliage forgé), application (automobile et transport, aérospatiale et défense, électronique, outils électriques et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché des alliages de magnésium au Moyen-Orient et en Afrique

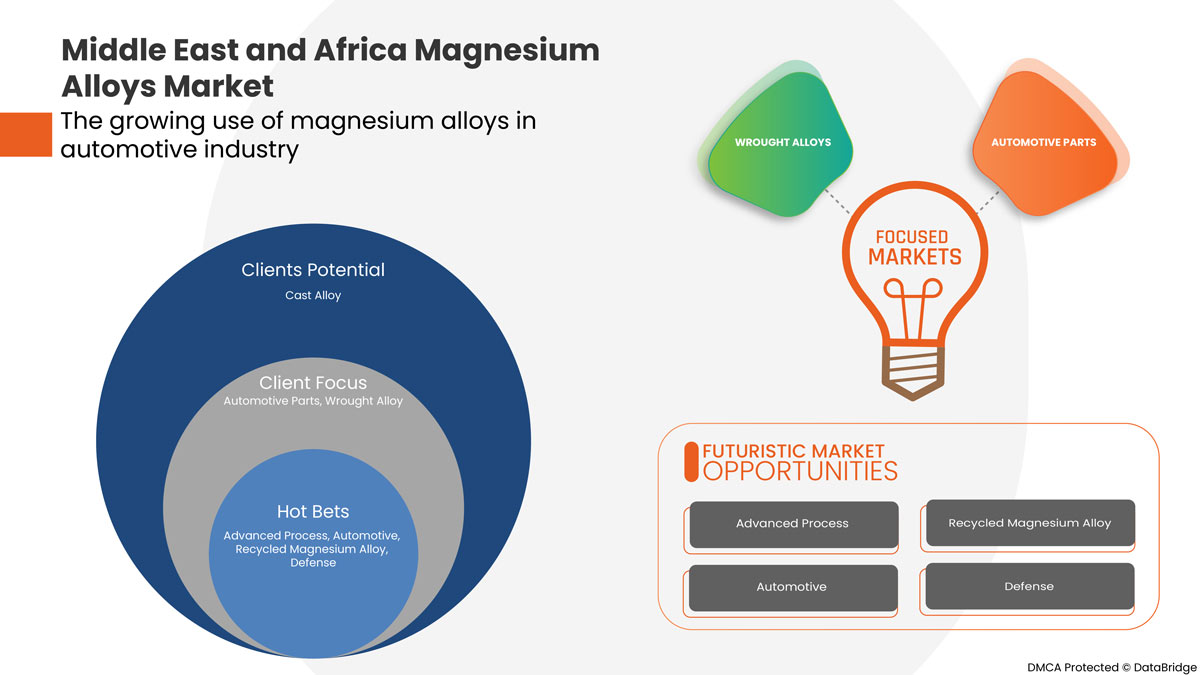

L'utilisation croissante des alliages de magnésium dans l'industrie automobile devrait stimuler la croissance du marché et la demande pour les alliages de magnésium au Moyen-Orient et en Afrique. Cependant, les principaux obstacles à l'expansion de ce marché sont l'incertitude des prix du magnésium et les problèmes de soudabilité et de résistance à la corrosion.

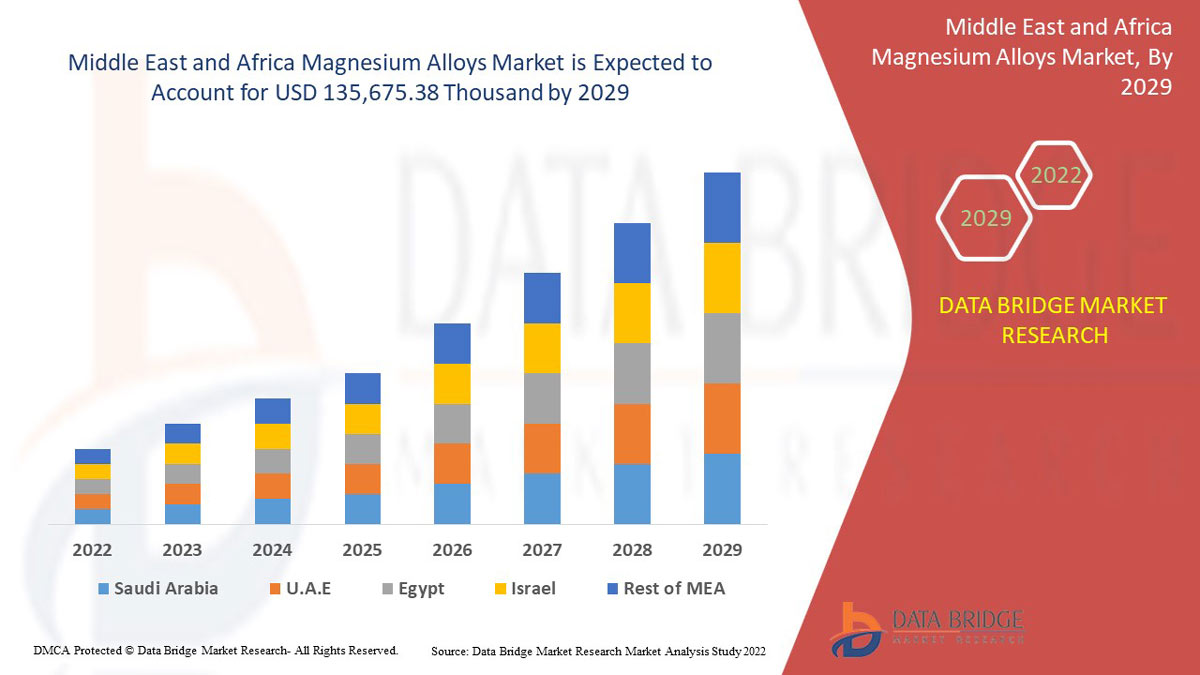

Ces alliages de magnésium du Moyen-Orient et d'Afrique sont principalement utilisés dans l'automobile et le transport, les boîtes de vitesses, les poutres avant et IP, la colonne de direction et les boîtiers d'airbag conducteur, les volants, les cadres de siège et les couvercles de réservoir de carburant. Data Bridge Market Research analyse que le marché des alliages de magnésium du Moyen-Orient et d'Afrique devrait atteindre 135 675,38 milliers de dollars d'ici 2029, à un TCAC de 3,9 % au cours de la période de prévision. Le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en tonnes |

|

Segments couverts |

Par produit (alliage moulé et alliage forgé), application (automobile et transport, aérospatiale et défense, électronique, outils électriques et autres). |

|

Pays couverts |

Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Luxfer MEL Technologies, Shandong Feixian County Yinguang Magnesium Industry Co. Ltd., regal-mg, US Magnesium LLC, Namoalloy, Dead sea Magnesium, DSM, Amacor, Dynacast, RIMA INDUSTRIAL, Mag Specialties Inc., MAGONTEC Limited, Nanjing Yunhai Special Metal Co., Ltd entre autres. |

Définition du marché

Le magnésium est le matériau structurel le plus léger avec une densité de 1,74 g/cm2. L'alliage de magnésium avec du métal augmente la dureté, la coulabilité et la résistance tout en ayant un effet négligeable sur la viscosité. L'aluminium est principalement utilisé comme métal d'alliage avec le magnésium. Les alliages de magnésium ont des propriétés telles que la légèreté, la conductivité thermique, la résistance, la durabilité, la résistance à la corrosion et le fluage à haute température.

Le COVID-19 a eu un impact minimal sur le marché des alliages de magnésium au Moyen-Orient et en Afrique

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Pendant l'épidémie de COVID-19, le marché des alliages de magnésium a subi une perte importante, la fabrication dans les industries automobile et aérospatiale ayant été interrompue. Seuls les secteurs de l'approvisionnement médical et du maintien des fonctions vitales ont été autorisés à fonctionner. La chaîne d'approvisionnement a également été perturbée en raison de restrictions logistiques. En conséquence, la croissance du marché des alliages de magnésium a également été entravée.

La dynamique du marché des alliages de magnésium au Moyen-Orient et en Afrique comprend :

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Facteurs moteurs/opportunités rencontrés par le marché des alliages de magnésium au Moyen-Orient et en Afrique

- La croissance de l'utilisation des alliages de magnésium dans l'industrie automobile

L'utilisation croissante des alliages de magnésium dans l'industrie automobile est essentielle car elle stimulera davantage le marché des alliages de magnésium au Moyen-Orient et en Afrique. Le marché est stimulé par la fabrication croissante de composants techniques pour la réduction du poids sans compromettre la résistance globale des véhicules et la demande croissante de capacité d'amortissement des vibrations. De plus, les alliages de magnésium offrent au véhicule résistance, légèreté, durabilité, conductivité thermique, fluage à haute température et résistance à la corrosion. En conséquence, la demande d'alliages de magnésium devrait augmenter considérablement en raison de ces caractéristiques.

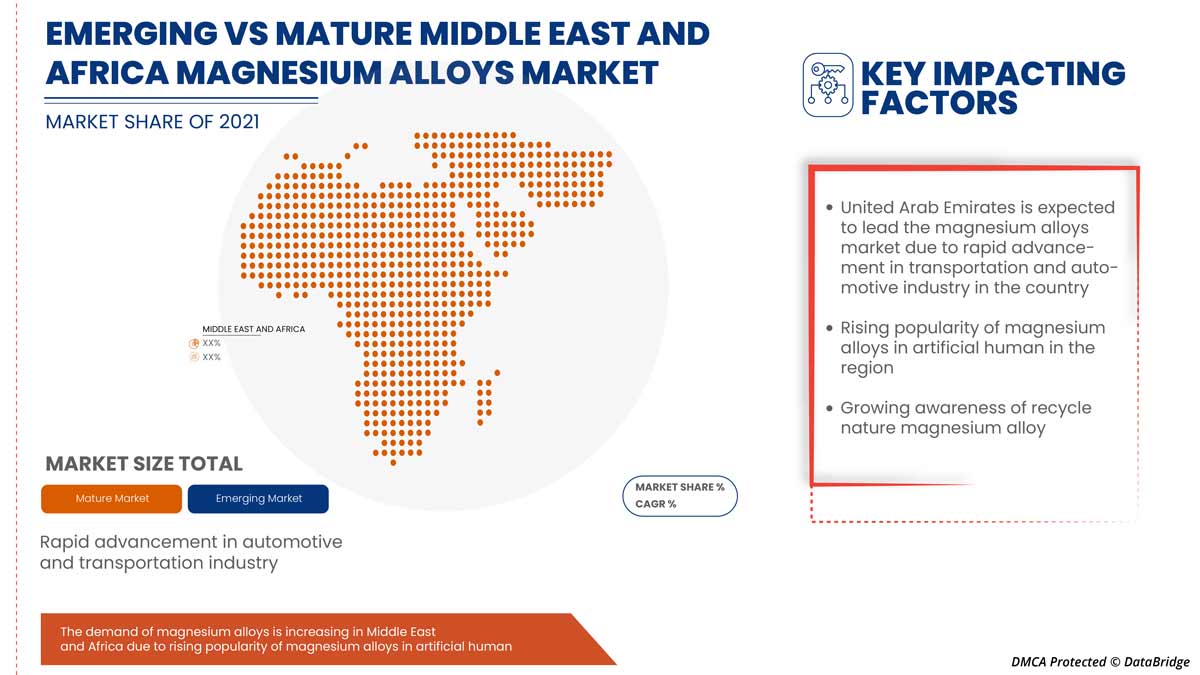

- Augmentation de la popularité des alliages de magnésium dans les implants humains artificiels et les dispositifs médicaux

La popularité croissante de l'alliage de magnésium dans les implants humains artificiels et les applications croissantes de ce matériau dans les dispositifs médicaux devraient propulser la croissance du secteur. Les fabricants de dispositifs et d'implants médicaux utilisent principalement des alliages de magnésium en raison de leur faible densité. Les alliages de magnésium sont utilisés dans la fabrication d'équipements médicaux portables et de fauteuils roulants en raison de leurs propriétés de légèreté.

Forts de ces avantages, divers fabricants d’implants et de dispositifs médicaux ont commencé à utiliser des alliages de magnésium comme matériau important dans leurs productions.

- Augmentation des applications du matériau dans les industries aérospatiales et de défense

La demande croissante de composants légers dans le secteur de l'aérospatiale et de la défense est un facteur clé du marché des alliages de magnésium au Moyen-Orient et en Afrique. Les alliages de magnésium sont utilisés dans la fabrication de carters de transmission d'hélicoptères, de moteurs d'avion, de carters de boîtes de vitesses, de moteurs à turbine, de châssis de soufflantes de moteurs à réaction, d'engins spatiaux et de missiles. Ainsi, l'augmentation des dépenses dans le secteur de la défense et la demande de nouveaux avions commerciaux devraient rester des facteurs clés de croissance pour le marché des alliages de magnésium au Moyen-Orient et en Afrique.

Par exemple:

- En 2019, le gouvernement américain a proposé un budget de 686 milliards de dollars pour le ministère de la Défense. Les principaux investissements du budget dans les avions comprenaient 77 chasseurs d'attaque interarmées F-35, 10 avions P-8A et 15 avions de ravitaillement KC-46 de remplacement.

- En 2019, selon une étude publiée par Boeing, l’Amérique du Nord devrait connaître 9 130 livraisons d’avions neufs d’ici 2038, soit le deuxième chiffre le plus élevé après l’Asie-Pacifique. De plus, la préférence pour les véhicules économes en carburant devrait stimuler l’utilisation de ces matériaux légers, augmentant ainsi la demande de produits en alliages de magnésium

- Introduction de nouveaux procédés tels que le thixomoulage et le nouveau rhéomoulage

La coulée de composants à haute résistance, à la traction et à la pression à faible coût introduit les alliages de magnésium dans les applications hydrauliques et structurelles. De nombreux travaux de développement ont été entrepris sur les composants de coulée à des températures inférieures aux liquides - à l'état semi-solide ou sous une forme contenant une quantité importante de solide. Par conséquent, tous ces procédés nouvellement développés qui offrent des avantages dans le traitement des alliages de magnésium offriront des opportunités lucratives pour la croissance et le développement du marché des alliages de magnésium au Moyen-Orient et en Afrique.

Contraintes/défis rencontrés par le marché des alliages de magnésium au Moyen-Orient et en Afrique

- Fluctuation des prix du magnésium

Les fluctuations des prix du magnésium et de ses alliages devraient limiter dans une certaine mesure l'expansion du marché des alliages de magnésium au Moyen-Orient et en Afrique. Par le passé, divers facteurs tels que la réduction de l'offre de charbon, la fermeture et d'autres politiques ont fait grimper les prix du magnésium. Du côté de l'offre, le resserrement général a fait baisser la production de lingots de magnésium.

Face aux fluctuations violentes des prix du magnésium, les entreprises d'alliages de magnésium se positionnent activement dans l'industrie par le biais d'une expansion de la production, d'une modernisation des équipements et de projets à haute valeur ajoutée.

- Problèmes liés à la corrosion et au soudage des alliages de magnésium

L'utilisation des alliages de magnésium est limitée en raison de leur faible résistance à la corrosion et de leur faible flexibilité. Ces alliages ont à peu près la même résistance à la corrosion dans les environnements courants que l'acier doux, mais sont moins résistants à la corrosion que les alliages d'aluminium, qu'il s'agisse de corrosion générale ou galvanique.

En outre, l'une des plus grandes difficultés pour l'ingénieur de fabrication est de définir quel procédé produira des propriétés satisfaisantes des alliages de magnésium au moindre coût par le procédé de soudage. En général, le soudage des alliages de magnésium n'est pas une tâche facile car il nécessite l'utilisation de techniques et de procédures avancées et fiables, telles que l'arc au tungstène sous gaz inerte (TIG),

- Diverses disponibilités de matériaux alternatifs pour les alliages de magnésium

L'aluminium reste l'alliage le moins cher par pouce cube de tous les alliages couramment utilisés dans le moulage sous pression. Ainsi, la disponibilité de divers autres types d'alliages mettra à mal les ventes et la croissance du marché de l'alliage de magnésium au Moyen-Orient et en Afrique.

Portée du marché des alliages de magnésium au Moyen-Orient et en Afrique

Le marché des alliages de magnésium du Moyen-Orient et de l'Afrique est segmenté en fonction du produit et de l'application. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Alliage moulé

- Alliage forgé

Sur la base du produit, le marché est segmenté en alliage moulé et alliage forgé.

Application

- Automobile et transport

- Aérospatiale et défense

- Électronique

- Outils électriques

- Autres

Sur la base des applications, le marché est segmenté en automobile et transport, aérospatiale et défense, électronique, outils électriques et autres.

Analyse/perspectives régionales du marché des alliages de magnésium au Moyen-Orient et en Afrique

Le marché des alliages de magnésium au Moyen-Orient et en Afrique est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, produit et application, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des alliages de magnésium au Moyen-Orient et en Afrique sont l’Afrique du Sud, l’Égypte, l’Arabie saoudite, les Émirats arabes unis, Israël et le reste du Moyen-Orient et de l’Afrique.

Les Émirats arabes unis dominent le marché des alliages de magnésium en raison de l’utilisation accrue de ces matériaux légers, de véhicules économes en carburant et de la demande de produits dans la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui influencent les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Paysage concurrentiel et analyse des parts de marché des alliages de magnésium au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des alliages de magnésium au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Europe, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des alliages de magnésium au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des alliages de magnésium au Moyen-Orient et en Afrique sont Luxfer MEL Technologies, Shandong Feixian County Yinguang Magnesium Industry Co. Ltd., regal-mg, US Magnesium LLC, Namoalloy, Dead sea Magnesium, DSM, Amacor, Dynacast, RIMA INDUSTRIAL, Mag Specialties Inc., MAGONTEC Limited, Nanjing Yunhai Special Metal Co., Ltd entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 IMPORT EXPORT SCENARIO

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THE THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 RAW MATERIAL COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 REGULATORY COVERAGE

5 PRODUCTION CAPACITY OUTLOOK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE GROWING USE OF MAGNESIUM ALLOYS IN THE AUTOMOTIVE INDUSTRY

6.1.2 RISING POPULARITY OF MAGNESIUM ALLOYS IN ARTIFICIAL HUMAN IMPLANTS AND MEDICAL DEVICES

6.1.3 INCREASING APPLICATIONS OF THE MATERIAL IN AEROSPACE AND DEFENSE INDUSTRIES

6.1.4 RISING USES AS A REPLACEMENT OF PLASTICS IN ELECTRONIC APPLICATIONS

6.2 RESTRAINTS

6.2.1 FLUCTUATING MAGNESIUM PRICES

6.2.2 ISSUES ASSOCIATED WITH CORROSION AND WELDING OF MAGNESIUM ALLOYS

6.2.3 ENGINEERING BARRIERS SUCH AS FORMABILITY AT ROOM TEMPERATURE AND DIFFICULTY FORGING

6.3 OPPORTUNITIES

6.3.1 INTRODUCTION OF NEW PROCESSES SUCH AS THIXOMOLDING AND NEW RHEOCASTING

6.3.2 RECYCLABLE NATURE OF MAGNESIUM ALLOYS

6.3.3 HIGH ABUNDANCE OF MAGNESIUM ELEMENTS ACROSS THE GLOBE

6.4 CHALLENGES

6.4.1 VARIOUS AVAILABILITY OF ALTERNATIVE MATERIALS FOR MAGNESIUM ALLOYS

6.4.2 PROBLEMS RELATED TO PURITY OF MAGNESIUM ALLOYS

7 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CAST ALLOY

7.3 WROUGHT ALLOY

8 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE & TRANSPORTATION

8.2.1 CAST ALLOY

8.2.2 WROUGHT ALLOY

8.3 AEROSPACE & DEFENSE

8.3.1 CAST ALLOY

8.3.2 WROUGHT ALLOY

8.4 ELECTRONICS

8.4.1 CAST ALLOY

8.4.2 WROUGHT ALLOY

8.5 POWER TOOLS

8.5.1 CAST ALLOY

8.5.2 WROUGHT ALLOY

8.6 OTHERS

8.6.1 CAST ALLOY

8.6.2 WROUGHT ALLOY

9 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION

9.1 MIDDLE EAST AND AFRICA

9.1.1 UNITED ARAB EMIRATED

9.1.2 SAUDI ARABIA

9.1.3 SOUTH AFRICA

9.1.4 EGYPT

9.1.5 ISRAEL

9.1.6 REST OF MIDDLE EAST AND AFRICA

10 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

10.1.1 EXPANSIONS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 LUXFER MEL TECHNOLOGIES

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 SWOT

12.1.5 RECENT DEVELOPMENT

12.2 MAGNOTEC LIMITED

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY PROFILE

12.2.4 SWOT

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT UPDATES

12.3 RIMA INDUSTRIAL

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 SWOT

12.3.5 RECENT DEVELOPMENTS

12.4 NANJING YUNHAI SPECIAL METAL CO., LTD

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 SWOT

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATE

12.5 SHANDONG FEIXIAN COUNTY YINGUANG MAGNESIUM INDUSTRY CO. LTD.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT

12.5.5 RECENT DEVELOPMENT

12.6 AMACOR

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 SWOT

12.6.4 RECENT DEVELOPMENT

12.7 DEAD SEA MAGNESIUM, DSM

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 SWOT

12.7.4 RECENT DEVELOPMENTS

12.8 DYNACAST

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 SWOT

12.8.4 RECENT DEVELOPMENTS

12.9 MAG SPECIALITY INC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 SWOT

12.9.4 RECENT DEVELOPMENTS

12.1 NAMOALLOY

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 SWOT

12.10.4 RECENT DEVELOPMENT

12.11 REGAL-MG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 SWOT

12.11.4 RECENT DEVELOPMENTS

12.12 US MAGNESIUM LLC

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 SWOT

12.12.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF ARTICLES OF MAGNESIUM, N.E.S.; HS CODE – 810490 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF MAGNESIUM, N.E.S.; HS CODE – 810490 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 6 MIDDLE EAST & AFRICA CAST ALLOY IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA CAST ALLOY IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 MIDDLE EAST & AFRICA WROUGHT ALLOY IN MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA WROUGHT ALLOY IN MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 12 MIDDLE EAST & AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (TONS)

TABLE 14 MIDDLE EAST & AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 16 MIDDLE EAST & AFRICA AEROSPACE & DEFENSE IN MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA AEROSPACE & DEFENSE IN MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 18 MIDDLE EAST & AFRICA AEROSPACE & DEFENSE IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA AEROSPACE & DEFENSE IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 20 MIDDLE EAST & AFRICA ELECTRONICS IN MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA ELECTRONICS IN MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 22 MIDDLE EAST & AFRICA ELECTRONICS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA ELECTRONICS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 24 MIDDLE EAST & AFRICA POWER TOOLS IN MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA POWER TOOLS IN MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 26 MIDDLE EAST & AFRICA POWER TOOLS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA POWER TOOLS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA OTHERS IN MAGNESIUM ALLOY MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 32 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY COUNTRY, 2020-2029 (TONS)

TABLE 34 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 36 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 40 MIDDLE EAST AND AFRICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 42 MIDDLE EAST AND AFRICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 44 MIDDLE EAST AND AFRICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 46 MIDDLE EAST AND AFRICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 48 UNITED ARAB EMIRATES MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 UNITED ARAB EMIRATES MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 50 UNITED ARAB EMIRATES MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 UNITED ARAB EMIRATES MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 UNITED ARAB EMIRATES AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 53 UNITED ARAB EMIRATES AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 54 UNITED ARAB EMIRATES AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 55 UNITED ARAB EMIRATES AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 56 UNITED ARAB EMIRATES ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 57 UNITED ARAB EMIRATES ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 58 UNITED ARAB EMIRATES POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 59 UNITED ARAB EMIRATES POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 60 UNITED ARAB EMIRATES OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 61 UNITED ARAB EMIRATES OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 62 SAUDI ARABIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 SAUDI ARABIA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 64 SAUDI ARABIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 SAUDI ARABIA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 68 SAUDI ARABIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 SAUDI ARABIA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 70 SAUDI ARABIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 SAUDI ARABIA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 72 SAUDI ARABIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 SAUDI ARABIA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 74 SAUDI ARABIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 75 SAUDI ARABIA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 76 SOUTH AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 78 SOUTH AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH AFRICA MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH AFRICA AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 82 SOUTH AFRICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 83 SOUTH AFRICA AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 84 SOUTH AFRICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 85 SOUTH AFRICA ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 86 SOUTH AFRICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 SOUTH AFRICA POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 88 SOUTH AFRICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 SOUTH AFRICA OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 90 EGYPT MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 EGYPT MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 92 EGYPT MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 93 EGYPT MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 94 EGYPT AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 EGYPT AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 96 EGYPT AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 97 EGYPT AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 98 EGYPT ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 EGYPT ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 100 EGYPT POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 101 EGYPT POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 102 EGYPT OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 103 EGYPT OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 104 ISRAEL MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 105 ISRAEL MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 106 ISRAEL MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 ISRAEL MAGNESIUM ALLOYS MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 108 ISRAEL AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 ISRAEL AUTOMOTIVE & TRANSPORTATION IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 110 ISRAEL AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 ISRAEL AEROSPACE & DEFENCE IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 112 ISRAEL ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 ISRAEL ELECTRONICS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 114 ISRAEL POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 ISRAEL POWER TOOLS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 116 ISRAEL OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 ISRAEL OTHERS IN MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 118 REST OF MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 119 REST OF MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET, BY PRODUCT, 2020-2029 (TONS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET

FIGURE 2 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: SEGMENTATION

FIGURE 14 THE GROWING USE OF MAGNESIUM ALLOYS IN THE AUTOMOTIVE INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET IN THE FORECAST PERIOD

FIGURE 15 CAST ALLOY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MAGNESIUM ALLOY MARKET IN 2022 & 2029

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET

FIGURE 18 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: BY PRODUCT, 2021

FIGURE 19 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: BY APPLICATION, 2021

FIGURE 20 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA MAGNESIUM ALLOYS MARKET: BY PRODUCT (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA MAGNESIUM ALLOYS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.