Marché des joints usinés au Moyen-Orient et en Afrique par type (joints de puissance fluide, joints de transmission de puissance et joints de grand diamètre), type de produit (joints de tige, joints de piston, joints racleurs, joints statiques, joints rotatifs, joints spéciaux, bagues de guidage et bagues d'appui), matériau ( polytétrafluoroéthylène (PTFE), Viton, polyuréthane (PU), caoutchouc, métal, élastomères, thermoplastiques et autres), application (aérospatiale et défense, industrie automobile, traitement chimique, outils usinés, construction, turbines industrielles, contrôle de débit, sciences de la vie, nouvelles énergies, industrie nucléaire, pétrole et gaz, pompes, semi-conducteurs, capteurs, vannes, emballages et matériaux, et aliments et boissons), canal de vente (fabricants, distributeurs et marché secondaire) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des joints usinés au Moyen-Orient et en Afrique

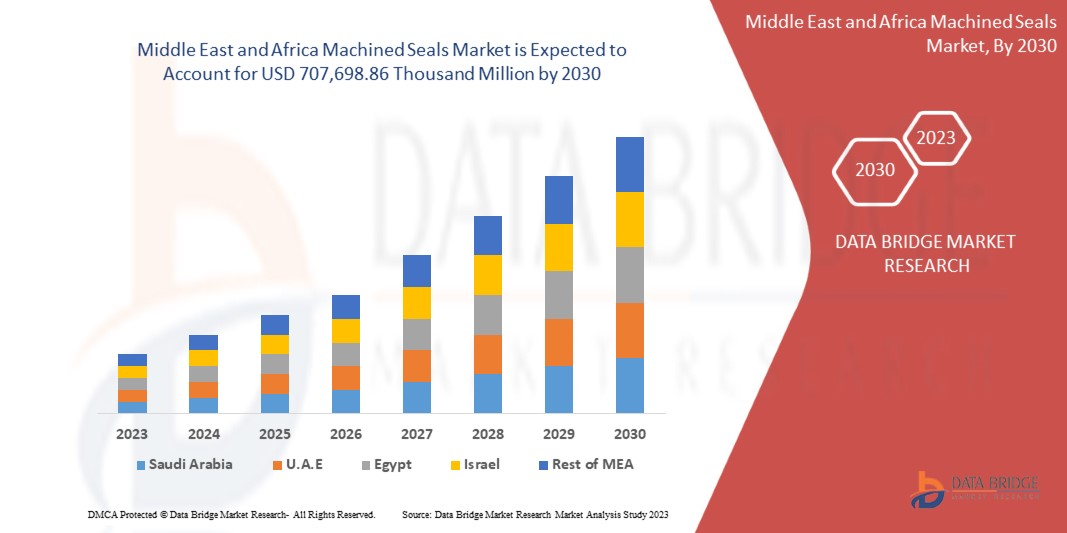

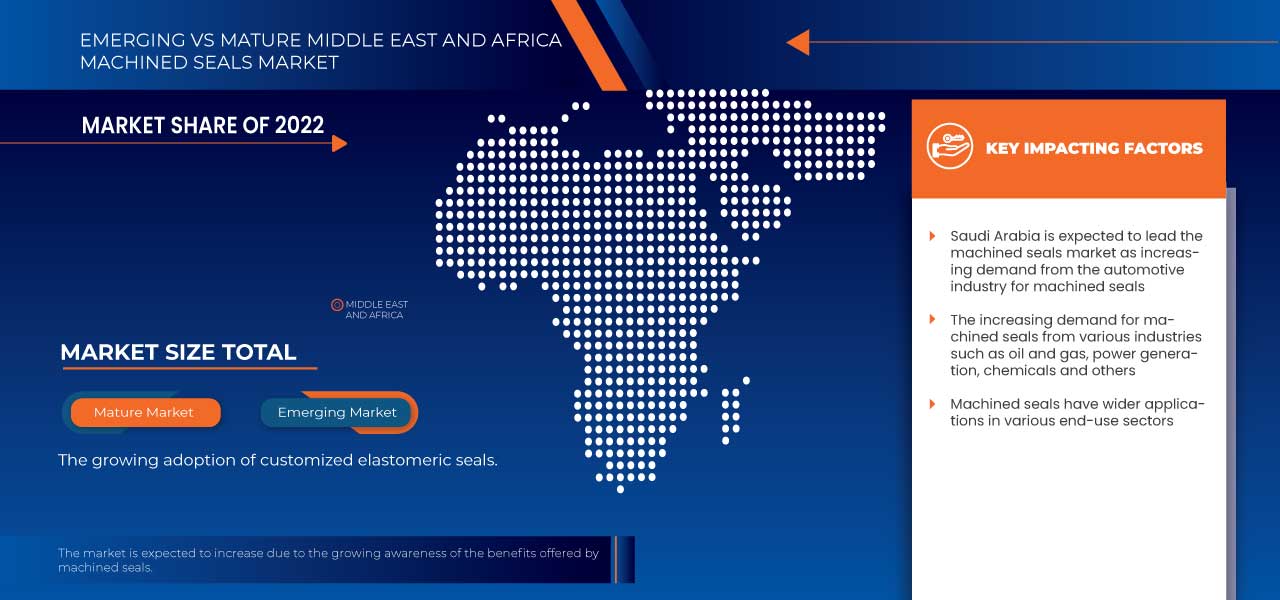

Le marché des joints usinés au Moyen-Orient et en Afrique devrait connaître une croissance significative de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,8 % de 2023 à 2030 et devrait atteindre 707 698,86 milliers USD d'ici 2030. Le principal facteur à l'origine de la croissance des joints usinés est l'adoption de joints élastomères personnalisés.

Le rapport sur le marché des joints usinés au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (joints de fluides, joints de transmission de puissance et joints de grand diamètre), type de produit (joints de tige, joints de piston, joints racleurs, joints statiques, joints rotatifs, joints spéciaux, bagues de guidage et bagues d'appui), matériau (polytétrafluoroéthylène (PTFE), Viton, polyuréthane (PU), caoutchouc, métal, élastomères, thermoplastiques et autres), application (aéronautique et défense, industrie automobile, traitement chimique, outils usinés, construction, turbines industrielles, contrôle de débit, sciences de la vie, nouvelles énergies, industrie nucléaire, pétrole et gaz, pompes, semi-conducteurs, capteurs, vannes, emballages et matériaux, et aliments et boissons), canal de vente (fabricants, distributeurs et marché secondaire) |

|

Pays couverts |

Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël, Koweït, Qatar, Oman, Bahreïn et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

SKF, FREUDENBERG SEALING TECHNOLOGIES, PARKER HANNIFIN CORP |

Définition du marché

Les joints usinés sont considérés comme des composants importants pour éviter les fuites dans plusieurs équipements. La protection contre les fuites réduit les émissions des équipements de pré-référencement. De plus, les utilisateurs finaux se concentrent sur l'amélioration des processus industriels et les économies d'énergie en utilisant moins de joints énergétiques. Les joints usinés sont spécialement conçus en fonction du type d'équipement et de la surface d'utilisation finale. Les joints usinés sont des dispositifs utilisés dans diverses industries pour assurer l'étanchéité et la protection contre l'entrée d'air, d'eau ou d'autres fluides. Ceux-ci sont généralement dotés d'excellentes caractéristiques anti-chimiques, de propriétés anti-compressibilité, de résistance aux températures élevées/basses et aux intempéries, ainsi que d'une résistance supérieure à la chaleur, à l'eau et à l'abrasion. L'utilisation accrue de joints usinés dans diverses applications telles que l'automobile, le pétrole et le gaz, l'alimentation et les boissons, l'électricité et l'électronique, les produits chimiques, l'aérospatiale et la défense, entre autres, devrait augmenter la demande dans le monde entier.

Dynamique du marché des joints usinés au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la demande de l'industrie automobile en joints usinés

La nouvelle technologie a rendu les joints automobiles plus sûrs et plus efficaces. Les composants légers des automobiles sont scellés par des joints à haute résistance pour supporter une chaleur et une pression élevées. Cela contribue indirectement à améliorer le rendement énergétique des véhicules avec l'utilisation croissante de matériaux légers. Ainsi, la demande croissante de véhicules économes en carburant devrait stimuler le marché des joints mécaniques. Les joints empêchent les lubrifiants de s'échapper des roulements. La nécessité pour l'industrie automobile d'atteindre un meilleur rendement énergétique et de meilleures performances des véhicules a un impact sur les joints pour que les acteurs du marché proposent de nouveaux joints usinés. Cela devrait stimuler davantage la croissance du marché.

- L'augmentation de la demande de joints usinés de diverses industries telles que le pétrole et le gaz, la production d'électricité, les produits chimiques et autres

Les joints usinés sont utilisés contre les gaz à haute pression et les produits chimiques liquides pour résister à la déformation mécanique. Les joints pour le pétrole et le gaz ont diverses applications, notamment le forage, le traitement, le raffinage, le transport et autres. Les joints sont usinés ou moulés et soigneusement conçus à l'aide d'un logiciel de simulation sophistiqué. Les joints sont fabriqués à partir de divers matériaux, tels que le polyuréthane, le caoutchouc ou le polytétrafluoroéthylène (PTFE). Les joints usinés sont de différents types, tels que les joints hydrauliques, les joints d'arbre rotatif, les joints d'huile, les garnitures, les joints et autres pièces en caoutchouc et en plastique hautes performances. De plus, les consommateurs attendent avec impatience d'adopter des joints capables de fonctionner à des températures élevées et offrant de meilleures performances que les joints traditionnels. Les utilisations extensives de divers joints de machines dans les industries et les performances des joints devraient stimuler le marché des joints usinés au Moyen-Orient et en Afrique au cours de la période de prévision.

Opportunités

- L'augmentation des investissements des principaux acteurs dans les activités de recherche et développement devrait se traduire par des innovations et des lancements de nouveaux produits

La recherche et le développement (R&D) sont la partie des opérations d'une entreprise qui recherche des connaissances pour développer, concevoir et améliorer ses produits, services, technologies ou processus. En plus de créer de nouveaux produits et d'ajouter des fonctionnalités aux anciens, l'investissement dans la recherche et le développement relie différentes parties de la stratégie d'une entreprise, telles que le marketing et la réduction des coûts. La R&D conduit souvent à un nouveau type de produit ou de service. Les progrès technologiques, associés à des activités de recherche et développement rapides, ont grandement contribué à la production de joints usinés. La R&D est importante pour la croissance de l'entreprise et votre capacité à être compétitive sur un marché. Une entreprise qui peut innover, adopter de nouvelles technologies et améliorer les processus existants a plus de chances de réussir à long terme. L'augmentation des investissements dans les activités de recherche et développement pour développer des joints usinés est estimée être un facteur clé dans la conduite du marché des joints usinés au cours de la période de prévision.

- La prise de conscience croissante des avantages offerts par les joints usinés

La popularité croissante des joints de machines réside dans leurs caractéristiques telles que la flexibilité de fabrication et la rapidité, une modification flexible du large éventail de méthodes de production pour les joints moulés standard. Les joints métalliques usinés sont conçus pour répondre aux applications avec des températures élevées ou cryogéniques, des pressions élevées, un vide complet, des produits chimiques très corrosifs et des niveaux de rayonnement pénétrant. Les joints usinés peuvent être d'une valeur inestimable pour les ingénieurs et les techniciens de maintenance. Obtenir un joint personnalisé fabriqué sur commande en un jour ou deux peut permettre de maintenir un projet sur la bonne voie lors du prototypage de nouvelles conceptions.

De plus, les joints usinés peuvent minimiser les temps d'arrêt et les pertes de production lorsqu'un composant critique tombe en panne et que le joint de remplacement standard n'est pas en stock. Ces capacités permettent une fabrication à la demande pour tout, des joints individuels à la production en série pour les applications de transmission, de manutention et de fluides. De plus, les joints usinés ne nécessitent pas de développement d'outillage, ce qui réduit les coûts et les délais associés.

Contraintes/Défis

- Difficultés rencontrées par les fabricants de produits personnalisés

Dans tous les secteurs industriels du monde, les clients exigent des produits personnalisés et les fabricants doivent relever les défis. La personnalisation de masse dans des volumes de production de masse est difficile, quelle que soit la simplicité ou la complexité du produit. L'augmentation du coût d'approvisionnement des composants en raison des exigences spécifiques des utilisateurs finaux est l'un des principaux défis du marché concerné. Les fabricants de joints usinés, en tenant compte des demandes des utilisateurs finaux, conçoivent des joints en utilisant les matériaux de la plus haute qualité disponible. Les exigences de livraison des produits plus élevées augmentent le coût de fabrication en termes d'approvisionnement en matières premières et de considérations de qualité. Les difficultés de personnalisation des produits augmentent le prix et le défi de fabrication de ce produit, ce qui devrait entraver le marché.

- L'augmentation de l'adoption d'arbres de transmission sans joint

La demande croissante d'arbres de transmission sans joint est due à leurs nombreux avantages. Les joints nécessitent en outre des moteurs et des arbres différents pour le transfert de puissance. D'autre part, la pompe à entraînement magnétique sans joint est entourée d'une série d'aimants qui aident à transférer le champ magnétique à l'arbre. En conséquence, tout fluide peut être totalement contenu dans le système. Une pompe sans joint a une extrémité humide entièrement fermée, éliminant tout besoin de joint et empêchant la possibilité de fuite de matériau. Plusieurs réglementations environnementales et de sécurité strictes obligent l'industrie à adopter des méthodes qui réduisent ou éliminent les émissions fugitives sur le lieu de travail. Ainsi, on s'attend à ce que l'adoption des arbres de transmission sans joint augmente sur le marché.

Portée du marché des joints usinés au Moyen-Orient et en Afrique

Le marché des joints usinés au Moyen-Orient et en Afrique est classé en fonction du type, du type de produit, du matériau, de l'application et du canal de vente. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et fournira aux utilisateurs un aperçu précieux du marché et des informations pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Joints hydrauliques

- Joints de transmission de puissance

- Joints de grand diamètre

En fonction du type, le marché des joints usinés au Moyen-Orient et en Afrique est classé en joints de transmission de puissance hydraulique, joints de transmission de puissance et joints de grand diamètre.

Type de produit

- Joints de tige

- Joints de piston

- Joints racleurs

- Joints statiques

- Joints rotatifs

- Sceaux spéciaux

- Anneaux de guidage

- Anneaux de secours

En fonction du type de produit, le marché des joints usinés au Moyen-Orient et en Afrique est classé en joints de tige, joints de piston, joints racleurs, joints statiques, joints rotatifs, joints spéciaux, bagues de guidage et bagues de secours.

Matériel

- Polytétrafluoroéthylène (PTFE)

- Viton

- Polyuréthane (PU)

- Caoutchouc

- Métal

- Élastomères

- Thermoplastiques

- Autres

En fonction du matériau, le marché des joints usinés du Moyen-Orient et de l'Afrique est classé en polytétrafluoroéthylène (PTFE), Viton, polyuréthane (PU), caoutchouc, métal, élastomères, thermoplastiques et autres.

Application

- Aérospatiale et Défense

- Industrie automobile

- Traitement chimique

- Outils usinés

- Construction

- Turbines industrielles

- Contrôle de flux

- Sciences de la vie

- Nouvelles Energies

- Industrie nucléaire

- Pétrole et gaz

- Pompes

- Semi-conducteurs

- Capteurs

- Vannes

- Alimentation et boissons

- Emballage et matériaux

En fonction de l'application, le marché des joints usinés au Moyen-Orient et en Afrique est classé en aérospatiale et défense, industrie automobile, traitement chimique, outils usinés, construction, turbines industrielles, contrôle de flux, sciences de la vie, nouvelles énergies, industrie nucléaire, pétrole et gaz, pompes, semi-conducteurs, capteurs, vannes, aliments et boissons et emballages, et matériaux.

Canal de vente

- Fabricants

- Distributeurs

- Pièces de rechange

En fonction de l’utilisateur final, le marché des joints usinés du Moyen-Orient et de l’Afrique est classé en fabricants, distributeurs et marché secondaire.

Analyse/perspectives régionales du marché des joints usinés au Moyen-Orient et en Afrique

Le marché des joints usinés au Moyen-Orient et en Afrique est segmenté en fonction du type, du type de produit, du matériau, de l'application et du canal de vente.

Les pays du marché des joints usinés au Moyen-Orient et en Afrique sont l'Afrique du Sud, l'Égypte, l'Arabie saoudite, les Émirats arabes unis, Israël, le Koweït, le Qatar, Oman, Bahreïn et le reste du Moyen-Orient et de l'Afrique.

L'Arabie saoudite domine le marché des joints usinés au Moyen-Orient et en Afrique en termes de part de marché et de revenus en raison de l'adoption de joints élastomères personnalisés.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse de la chaîne de valeur en aval et en amont, les tendances technologiques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des joints usinés au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des joints usinés au Moyen-Orient et en Afrique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché des joints usinés au Moyen-Orient et en Afrique.

Certains acteurs importants opérant sur le marché des joints usinés au Moyen-Orient et en Afrique sont SKF, FREUDENBERG SEALING TECHNOLOGIES et PARKER HANNIFIN CORP.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA MACHINED SEALS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.1.7 CONCLUSION

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 IMPORT EXPORT SCENARIO

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6 PRODUCTION AND CONSUMPTION ANALYSIS

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

4.11 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE DEMAND FROM THE AUTOMOTIVE INDUSTRY FOR MACHINED SEALS

5.1.2 THE INCREASE IN THE DEMAND FOR MACHINED SEALS FROM VARIOUS INDUSTRIES SUCH AS OIL AND GAS, POWER GENERATION, CHEMICALS, AND OTHERS

5.1.3 THE GROWTH IN THE ADOPTION OF CUSTOMIZED ELASTOMERIC SEALS

5.2 RESTRAINTS

5.2.1 THE RISE IN THE ADOPTION OF SEAL-LESS DRIVING SHAFTS

5.2.2 PRICE VOLATILITY OF RAW MATERIALS

5.3 OPPORTUNITIES

5.3.1 THE RISE IN THE INVESTMENTS BY KEY PLAYERS IN RESEARCH AND DEVELOPMENT ACTIVITIES ARE LIKELY TO RESULT IN INNOVATIONS AND NEW PRODUCT LAUNCHES

5.3.2 THE GROWTH IN THE AWARENESS OF THE BENEFITS OFFERED BY MACHINED SEALS

5.4 CHALLENGES

5.4.1 IMPROPER INSTALLATION, START-UP, AND LACK OF MAINTENANCE WEAR DOWN SEALS

5.4.2 DIFFICULTIES FACED BY MANUFACTURERS IN CUSTOMIZED PRODUCTS

6 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY TYPE

6.1 OVERVIEW

6.2 FLUID POWER SEALS

6.3 POWER TRANSMISSION SEALS

6.4 LARGE DIAMETER SEALS

7 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 PISTON SEALS

7.3 ROTARY SEALS

7.4 ROD SEALS

7.5 STATIC SEALS

7.6 SPECIAL SEALS

7.7 GUIDE RINGS

7.8 BACKUP-UP RINGS

7.9 WIPER SEALS

8 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 RUBBER

8.3 POLYTETRAFLUORIETHYLENE (PTFE)

8.4 METAL

8.5 POLYURETHANE (PU)

8.6 VITON

8.7 THERMOPLASTICS

8.8 ELASTOMERS

8.9 OTHERS

9 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 MANUFACTURERS

9.3 DISTRIBUTORS

9.4 AFTERMARKET

10 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 AUTOMOTIVE INDUSTRY

10.2.1 TWO-WHEELERS

10.2.2 LIGHT VEHICLES

10.2.3 CARS

10.2.4 HEAVY VEHICLES

10.3 AEROSPACE & DEFENSE

10.3.1 COMMERCIAL AIRCRAFT

10.3.2 PASSENGER AIRCRAFT

10.3.3 DEFENSE & MILITARY

10.3.4 SPACE LAUNCH SYSTEM (SLS)

10.3.5 SPACE SHUTTLE

10.4 INDUSTRIAL TURBINES

10.5 MACHINED TOOLS

10.6 CHEMICAL PROCESSING

10.7 CONSTRUCTION

10.8 OIL & GAS

10.9 FOOD & BEVERAGES

10.1 PUMPS

10.11 NEW ENERGIES

10.12 NUCLEAR INDUSTRY

10.13 LIFE SCIENCES

10.14 SEMICONDUCTORS

10.15 SENSORS

10.16 FLOW CONTROL

10.17 VALVES

10.18 PACKAGING AND MATERIALS

11 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.2 UNITED ARAB EMIRATES

11.1.3 KUWAIT

11.1.4 QATAR

11.1.5 OMAN

11.1.6 BAHRAIN

11.1.7 EGYPT

11.1.8 ISRAEL

11.1.9 SOUTH AFRICA

11.1.10 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.2 MERGERS & ACQUISITIONS

12.3 EXPANSIONS

12.4 AGREEMENT

12.5 NEW PRODUCT DEVELOPMENTS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 SKF

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 PARKER HANNIFIN CORP

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 FREUDENBERG FST GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 SAINT-GOBAIN

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 TECHNETICS GROUP.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 HALLITE SEALS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 ACCROSEAL

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 AMPHORA INDUSTRIES PTY LTD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 ASHTON SEALS LTD

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 EVOLUTION SEALS LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 FRANCE JOINT

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 FPE SEALS LTD

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 GRIZZLY SUPPLIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 MARTIN FLUID POWER COMPANY, INC. AND MFP SEALS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 M.BARNWELL SERVICES LIMITED.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 OZ SEALS PTY LTD

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 PATRIOT FLUID POWER

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 PICARD TECHNOLOGIES

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SEALS & GASKET SUPPLIES

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 STACEM

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 BELOW ARE SOME EXAMPLES OF THE GROWTH STRATEGY ADOPTED BY KEY MARKET PLAYERS FOR THE MIDDLE EAST & AFRICA MACHINED SEALS MARKET.

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA FLUID POWER SEALS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA POWER TRANSMISSION SEALS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA LARGE DIAMETER SEALS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA PISTON SEALS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA ROTARY SEALS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA ROD SEALS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA STATIC SEALS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA SPECIAL SEALS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA GUIDE RINGS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA BACKUP RINGS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA WIPER SEALS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA RUBBER IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA POLYTETRAFLUORIETHYLENE (PTFE) IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA METAL IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA POLYURETHANE (PU) IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA VITON IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA THERMOPLASTICS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA ELASTOMERS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA OTHERS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA MANUFACTURERS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA DISTRIBUTORS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA AFTERMARKET IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA INDUSTRIAL TURBINES IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA MACHINED TOOLS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA CHEMICAL PROCESSING IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA CONSTRUCTION IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA OIL & GAS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA PUMPS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA NEW ENERGIES IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA NUCLEAR INDUSTRY IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA LIFE SCIENCES IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA SEMICONDUCTORS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA SENSORS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA FLOW CONTROL IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA VALVES IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA PACKAGING AND MATERIALS IN MACHINED SEALS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA MACHINED SEALS MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 57 SAUDI ARABIA MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 SAUDI ARABIA MACHINED SEALS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 SAUDI ARABIA MACHINED SEALS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 60 SAUDI ARABIA MACHINED SEALS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 61 SAUDI ARABIA AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 SAUDI ARABIA AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 SAUDI ARABIA MACHINED SEALS MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 64 UNITED ARAB EMIRATES MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 UNITED ARAB EMIRATES MACHINED SEALS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 UNITED ARAB EMIRATES MACHINED SEALS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 67 UNITED ARAB EMIRATES MACHINED SEALS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 68 UNITED ARAB EMIRATES AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 UNITED ARAB EMIRATES AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 UNITED ARAB EMIRATES MACHINED SEALS MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 71 KUWAIT MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 KUWAIT MACHINED SEALS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 KUWAIT MACHINED SEALS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 74 KUWAIT MACHINED SEALS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 75 KUWAIT AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 KUWAIT AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 KUWAIT MACHINED SEALS MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 78 QATAR MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 QATAR MACHINED SEALS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 QATAR MACHINED SEALS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 81 QATAR MACHINED SEALS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 82 QATAR AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 QATAR AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 QATAR MACHINED SEALS MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 85 OMAN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 OMAN MACHINED SEALS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 OMAN MACHINED SEALS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 88 OMAN MACHINED SEALS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 89 OMAN AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 OMAN AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 OMAN MACHINED SEALS MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 92 BAHRAIN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 BAHRAIN MACHINED SEALS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 BAHRAIN MACHINED SEALS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 95 BAHRAIN MACHINED SEALS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 96 BAHRAIN AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 BAHRAIN AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 BAHRAIN MACHINED SEALS MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 99 EGYPT MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 EGYPT MACHINED SEALS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 EGYPT MACHINED SEALS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 102 EGYPT MACHINED SEALS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 103 EGYPT AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 EGYPT AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 EGYPT MACHINED SEALS MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 106 ISRAEL MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 ISRAEL MACHINED SEALS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 ISRAEL MACHINED SEALS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 109 ISRAEL MACHINED SEALS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 110 ISRAEL AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 ISRAEL AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 ISRAEL MACHINED SEALS MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 113 SOUTH AFRICA MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 SOUTH AFRICA MACHINED SEALS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 SOUTH AFRICA MACHINED SEALS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 116 SOUTH AFRICA MACHINED SEALS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 117 SOUTH AFRICA AUTOMOTIVE INDUSTRY IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 SOUTH AFRICA AEROSPACE & DEFENSE IN MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 SOUTH AFRICA MACHINED SEALS MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 120 REST OF MIDDLE EAST AND AFRICA MACHINED SEALS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA MACHINED SEALS MARKET

FIGURE 2 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: SEGMENTATION

FIGURE 14 THE GROWING ADOPTION OF CUSTOMIZED ELASTOMERIC SEALS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA MACHINED SEALS MARKET IN THE FORECAST PERIOD

FIGURE 15 THE FLUID POWER SEALS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MACHINED SEALS MARKET IN 2023 & 2030

FIGURE 16 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2021-2023 (USD THOUSAND)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA MACHINED SEALS MARKET

FIGURE 19 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: BY TYPE, 2022

FIGURE 20 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: BY PRODUCT TYPE, 2022

FIGURE 21 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: BY MATERIAL, 2022

FIGURE 22 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: SALES CHANNEL, 2022

FIGURE 23 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: BY APPLICATION, 2022

FIGURE 24 MIDDLE EAST AND AFRICA MACHINED SEALS MARKET: SNAPSHOT (2022)

FIGURE 25 MIDDLE EAST AND AFRICA MACHINED SEALS MARKET: BY COUNTRY (2022)

FIGURE 26 MIDDLE EAST AND AFRICA MACHINED SEALS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 MIDDLE EAST AND AFRICA MACHINED SEALS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 MIDDLE EAST AND AFRICA MACHINED SEALS MARKET: BY TYPE (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA MACHINED SEALS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.