Middle East And Africa Lyophilized Injectable Drugs Market

Taille du marché en milliards USD

TCAC :

%

USD

176.55 Million

USD

245.37 Million

2024

2032

USD

176.55 Million

USD

245.37 Million

2024

2032

| 2025 –2032 | |

| USD 176.55 Million | |

| USD 245.37 Million | |

|

|

|

|

Segmentation du marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique, par conditionnement (flacons, seringues à double chambre, cartouches à double chambre et autres), classe thérapeutique (anti-infectieux, antinéoplasiques, diurétiques, inhibiteurs de la pompe à protons, anesthésiques, anticoagulants, AINS, corticostéroïdes et autres), forme (poudre et liquide), indication (oncologie, maladies auto-immunes, troubles hormonaux, maladies respiratoires, troubles gastro-intestinaux, affections dermatologiques, maladies ophtalmiques et autres), voie d'administration (intraveineuse/perfusion, intramusculaire et autres), utilisateur final (hôpitaux, cliniques, soins à domicile et autres), canal de distribution (appels d'offres directs, vente au détail et autres) - Tendances du secteur et prévisions jusqu'en 2032

Taille du marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique

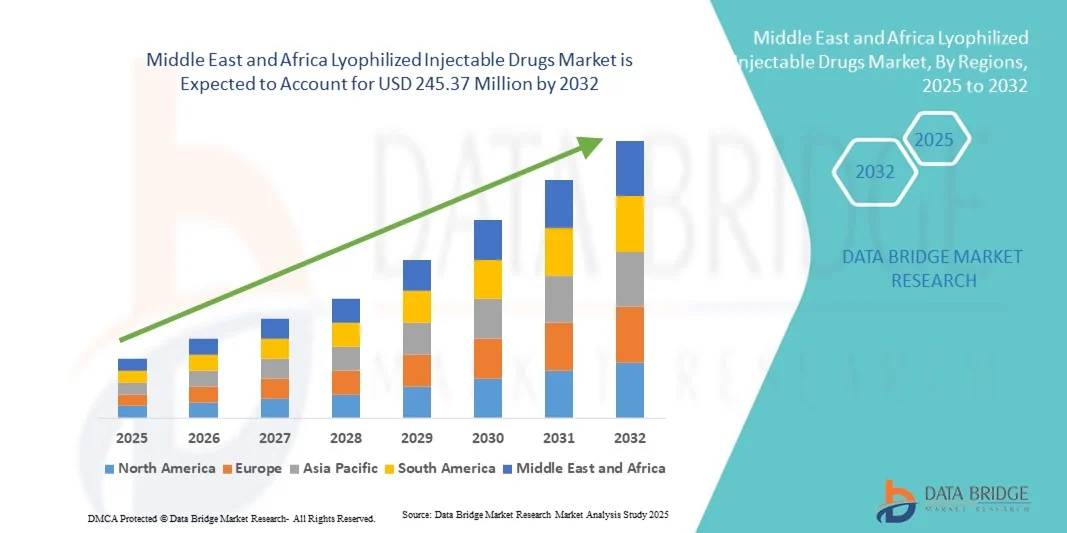

- Le marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique était évalué à 176,55 millions de dollars américains en 2024 et devrait atteindre 245,37 millions de dollars américains d'ici 2032 , soit un TCAC de 4,2 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par la prévalence croissante des maladies chroniques et infectieuses, la demande croissante de formulations à longue durée de conservation et l'expansion des capacités de fabrication biopharmaceutique dans toute la région.

- De plus, l'augmentation des investissements dans les infrastructures de santé, conjuguée à une sensibilisation accrue aux formulations injectables stériles et stables, favorise l'adoption des médicaments lyophilisés en milieu hospitalier et ambulatoire. L'ensemble de ces facteurs contribue à l'expansion du marché au Moyen-Orient et en Afrique.

Analyse du marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique

- Les médicaments injectables lyophilisés, qui utilisent la lyophilisation pour améliorer la stabilité et la durée de conservation du médicament, connaissent une adoption croissante au Moyen-Orient et en Afrique, les systèmes de santé privilégiant les formulations fiables, thermostables et stériles pour les produits biologiques et les thérapies à base de petites molécules.

- La croissance du marché est stimulée par la prévalence croissante des maladies chroniques et infectieuses , l'expansion de la production de produits biologiques et l'intérêt grandissant pour les solutions avancées de gestion de la chaîne du froid afin de garantir l'efficacité des produits dans diverses conditions climatiques.

- L’Arabie saoudite a dominé le marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique en 2024, avec une part de marché de 32,8 %. Cette domination s’explique par d’importantes réformes du système de santé, des initiatives robustes en matière de production pharmaceutique dans le cadre de la Vision 2030 et le développement des infrastructures hospitalières.

- L’Afrique du Sud devrait être le marché à la croissance la plus rapide au cours de la période de prévision, grâce à l’augmentation des investissements dans les infrastructures de santé, au développement des collaborations public-privé et à une forte hausse de la demande de produits biologiques injectables et d’antibiotiques.

- Le segment des flacons a dominé le marché avec la plus grande part de marché (46,5 %) en 2024, grâce à la stabilité supérieure du produit, à sa large compatibilité avec les médicaments et à la préférence continue des hôpitaux et des milieux cliniques pour les formulations reconstituables.

Portée du rapport et segmentation du marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique

|

Attributs |

Médicaments injectables lyophilisés au Moyen-Orient et en Afrique : principales perspectives du marché |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research incluent également une analyse approfondie par des experts, des données épidémiologiques sur les patients, une analyse des projets en développement, une analyse des prix et un aperçu du cadre réglementaire. |

Tendances du marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique

Demande croissante de formulations thermostables et à longue durée de conservation

- Au Moyen-Orient et en Afrique, le marché des médicaments injectables lyophilisés connaît une tendance majeure et croissante : la demande accrue de formulations thermostables et à longue durée de conservation, répondant aux défis climatiques et aux infrastructures de chaîne du froid limitées de la région. Cette tendance redéfinit les stratégies de fabrication et de distribution pharmaceutiques.

- Par exemple, la Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO) a étendu ses capacités de lyophilisation afin d'améliorer la stabilité des médicaments et de répondre à la demande régionale croissante de produits biologiques et de vaccins thermosensibles. De même, Julphar (Gulf Pharmaceutical Industries) a modernisé ses lignes de production de produits injectables pour renforcer la durabilité et la sécurité de ses produits.

- L'intérêt croissant porté aux formulations lyophilisées permet d'améliorer l'efficacité de la manutention, du transport et du stockage au sein des réseaux hospitaliers et cliniques, notamment dans les zones rurales où l'accès à la réfrigération est irrégulier. Ceci garantit que les médicaments injectables vitaux conservent leur efficacité tout au long de leur chaîne d'approvisionnement.

- De plus, la lyophilisation soutient le secteur biopharmaceutique en pleine croissance dans la région en permettant aux entreprises de produire des produits biologiques et des vaccins à haute valeur ajoutée et à stabilité prolongée, facilitant ainsi une distribution plus large sur des marchés aux contraintes logistiques importantes.

- Cette tendance à privilégier la stabilité dans la fabrication encourage les entreprises pharmaceutiques internationales et locales à investir dans de nouvelles technologies de lyophilisation et des installations de production modernes. Par exemple, la société égyptienne Eva Pharma a mis en service des unités de lyophilisation avancées afin d'améliorer sa gamme de produits injectables.

- L'importance croissante accordée à la stabilité des formulations et à l'innovation en matière de fabrication devrait renforcer la résilience pharmaceutique de la région et réduire sa dépendance aux importations, stimulant ainsi la croissance du marché à long terme.

Dynamique du marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique

Conducteur

Développement de la production biopharmaceutique et investissements dans le secteur de la santé

- L'implantation croissante d'installations biopharmaceutiques et l'augmentation des investissements dans les infrastructures de santé au Moyen-Orient et en Afrique sont des facteurs majeurs de la croissance du marché des médicaments injectables lyophilisés.

- Par exemple, en mars 2024, le Fonds d'investissement public d'Arabie saoudite a annoncé de nouveaux partenariats avec des entreprises pharmaceutiques mondiales afin de localiser la production de produits biologiques et de produits injectables stériles, favorisant ainsi les capacités nationales de production de formulations lyophilisées.

- Alors que les gouvernements donnent la priorité à l'expansion et à l'autonomie des systèmes de santé, la demande de solutions injectables avancées à stabilité prolongée continue de croître, soutenant à la fois l'approvisionnement des hôpitaux et la préparation aux situations d'urgence.

- De plus, les initiatives en cours visant à renforcer les chaînes du froid pharmaceutiques et à améliorer l'accès aux produits biologiques favorisent l'adoption des médicaments lyophilisés, qui offrent des avantages pratiques dans les régions où les conditions de stockage sont limitées.

- L'accent accru mis sur la R&D, combiné à des incitations à la production locale et à la recherche clinique, positionne les pays du Moyen-Orient et d'Afrique comme des pôles émergents de production de médicaments injectables stériles.

- Le développement des collaborations entre les agences de santé publique et les acteurs pharmaceutiques privés devrait accélérer l'innovation et stimuler une croissance durable sur le marché des médicaments injectables lyophilisés dans toute la région.

- Des réformes réglementaires favorables, notamment des procédures d'approbation accélérées des médicaments et des politiques de substitution aux importations en Arabie saoudite et en Égypte, stimulent davantage la production locale de médicaments injectables lyophilisés et leur accessibilité au marché.

Retenue/Défi

Coûts de production élevés et infrastructure technologique limitée

- Le coût élevé des équipements de lyophilisation, combiné à une expertise régionale et à une infrastructure technologique limitées, constitue un défi majeur pour l'expansion du marché au Moyen-Orient et en Afrique.

- Par exemple, les petits fabricants des pays africains rencontrent souvent des difficultés à mettre en place des installations de production stériles conformes aux normes en raison des coûts d'investissement élevés liés à la technologie de lyophilisation et aux exigences de maintenance.

- L'accès limité aux équipements de lyophilisation de pointe et au personnel technique qualifié freine l'adoption à grande échelle et ralentit le transfert de technologie des leaders pharmaceutiques mondiaux.

- De plus, les coûts liés à la validation, à l'assurance qualité et à la conformité réglementaire augmentent les dépenses de production globales, dissuadant certaines entreprises locales d'entrer sur le marché.

- Relever ces défis grâce à des partenariats internationaux, à la formation de la main-d'œuvre et à des incitations gouvernementales en faveur du progrès technologique sera essentiel pour renforcer les capacités nationales de lyophilisation et favoriser le développement du marché à long terme.

- La disponibilité limitée de financements et de capitaux-risque pour l'innovation pharmaceutique dans plusieurs économies africaines continue de restreindre le développement des capacités de production de médicaments lyophilisés.

- Les retards dans l'obtention des autorisations réglementaires et l'hétérogénéité des normes de contrôle qualité entre les différents pays de la région entravent la bonne distribution des produits et découragent les investissements directs étrangers dans les installations de lyophilisation.

Portée du marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du conditionnement, de la classe thérapeutique, de la forme, de l'indication, de la voie d'administration, de l'utilisateur final et du canal de distribution.

- Par emballage

En fonction du conditionnement, le marché est segmenté en flacons, seringues à double chambre, cartouches à double chambre et autres. Le segment des flacons a dominé le marché en 2024, représentant la plus grande part de revenus (46,5 %). Cette domination s'explique par leur utilisation intensive pour le stockage des médicaments lyophilisés, grâce à une protection supérieure contre la contamination et l'exposition environnementale. Les flacons sont économiques, faciles à manipuler et adaptés à de multiples reconstitutions, ce qui les rend idéaux pour les pharmacies hospitalières. Leur durabilité et leur compatibilité avec diverses classes thérapeutiques, notamment les vaccins, les antibiotiques et les produits biologiques, renforcent leur position dominante. De plus, les fabricants pharmaceutiques d'Arabie saoudite et d'Égypte privilégient les flacons en raison de leurs mécanismes de fermeture simples et de leur compatibilité avec les lignes de remplissage automatisées. La croissance de ce segment est également alimentée par l'augmentation de la production de formulations injectables à grand volume pour le traitement des maladies chroniques.

Le segment des seringues à double chambre devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, portée par l'adoption croissante des formulations prêtes à l'emploi en milieu hospitalier et à domicile. Les seringues à double chambre permettent la reconstitution du médicament immédiatement avant l'administration, réduisant ainsi les risques de contamination et le temps de préparation. Par exemple, aux Émirats arabes unis, les entreprises pharmaceutiques introduisent des systèmes à double chambre pour améliorer la sécurité et le confort des patients. Leur facilité d'utilisation et leur conception à usage unique les rendent particulièrement adaptées aux produits biologiques et aux soins d'urgence. L'acceptation croissante des injectables auto-administrables par les cliniciens contribue également à la forte expansion de ce segment.

- Par classe de médicament

Le marché est segmenté par classe de médicaments en anti-infectieux, antinéoplasiques, diurétiques, inhibiteurs de la pompe à protons, anesthésiques, anticoagulants, AINS, corticostéroïdes et autres. Le segment des anti-infectieux a dominé le marché en 2024 en raison de la forte prévalence des infections bactériennes et virales au Moyen-Orient et en Afrique. Les anti-infectieux lyophilisés offrent une longue durée de conservation et une meilleure stabilité aux températures extrêmes, palliant ainsi les contraintes liées à la chaîne du froid dans plusieurs pays africains. Les hôpitaux d'Arabie saoudite, d'Égypte et du Kenya dépendent fortement de ces médicaments pour les soins intensifs et les urgences. La lutte croissante contre la résistance aux antimicrobiens a entraîné une utilisation accrue d'antibiotiques injectables sous forme de formulations contrôlées. Par ailleurs, les programmes d'achat publics d'anti-infectieux injectables essentiels ont encore renforcé la croissance de ce segment.

Le segment des antinéoplasiques devrait connaître la croissance la plus rapide au cours de la période de prévision, sous l'effet de l'augmentation de la prévalence du cancer et du développement des infrastructures de traitement en oncologie. Les médicaments antinéoplasiques lyophilisés sont privilégiés pour leur stabilité accrue et la précision de leur dosage. Par exemple, des centres d'oncologie égyptiens et sud-africains investissent dans des formulations lyophilisées afin de préserver l'efficacité des agents cytotoxiques. Les progrès des thérapies biologiques et des traitements ciblés reposent également largement sur les formes lyophilisées. Ce segment bénéficie d'une sensibilisation accrue des patients et d'un meilleur accès aux soins oncologiques, favorisés par les programmes nationaux de lutte contre le cancer.

- Par formulaire

Selon la forme, le marché est segmenté en poudre et liquide. Le segment des poudres a dominé le marché en 2024, générant la plus grande part de revenus grâce à son exceptionnelle stabilité et à sa longue durée de conservation. Les médicaments lyophilisés en poudre sont plus faciles à stocker et à transporter dans des conditions de température variables, un avantage crucial dans les régions où les capacités de réfrigération sont limitées. Les entreprises pharmaceutiques d'Arabie saoudite et d'Égypte utilisent largement les formulations en poudre pour les produits biologiques, les vaccins et les antibiotiques. Leur facilité de reconstitution et le faible risque de dégradation les rendent idéales pour les pharmacies hospitalières. De plus, leur rentabilité en production de masse contribue à une demande soutenue sur le marché.

Le segment des solutions liquides devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, porté par la préférence croissante pour les formulations injectables prêtes à l'emploi. Ces produits réduisent le temps de préparation et sont particulièrement utiles en situation d'urgence et en soins intensifs. Par exemple, les entreprises pharmaceutiques basées aux Émirats arabes unis produisent de plus en plus de solutions injectables lyophilisées pour les anesthésiques et les anticoagulants. Les progrès réalisés en matière de remplissage aseptique et de seringues préremplies contribuent à la croissance du marché. De plus, ce segment bénéficie de la tendance croissante vers des médicaments injectables faciles à administrer et auto-administrables.

- Par indication

Selon l'indication, le marché est segmenté en oncologie, maladies auto-immunes, troubles hormonaux, maladies respiratoires, troubles gastro-intestinaux, affections dermatologiques, maladies ophtalmiques et autres. Le segment de l'oncologie dominait le marché en 2024, avec la plus grande part de marché, grâce à l'incidence croissante du cancer et à un accès accru aux traitements de pointe. Les formulations lyophilisées garantissent la stabilité et l'efficacité des agents chimiothérapeutiques, souvent thermosensibles. Les principaux hôpitaux d'Arabie saoudite, d'Égypte et d'Afrique du Sud utilisent des injectables oncologiques lyophilisés pour assurer des résultats thérapeutiques constants. Ces formulations permettent également une gestion efficace des stocks dans les pharmacies hospitalières centralisées. Le développement continu des centres de traitement du cancer dans la région contribue à la croissance de ce segment.

Le segment des maladies auto-immunes devrait enregistrer le taux de croissance annuel composé (TCAC) le plus rapide au cours de la période de prévision, en raison de l'augmentation des diagnostics de polyarthrite rhumatoïde, de psoriasis et de lupus. Les produits biologiques lyophilisés deviennent essentiels à la prise en charge de ces affections chroniques grâce à leur stabilité accrue et à leur moindre risque de dégradation. Par exemple, les professionnels de santé en Égypte et aux Émirats arabes unis ont de plus en plus recours aux anticorps monoclonaux lyophilisés pour le traitement des maladies auto-immunes. Les progrès technologiques dans le développement des médicaments biologiques et les systèmes de remboursement favorables contribuent également à la croissance de ce segment.

- Par voie d'administration

Selon la voie d'administration, le marché est segmenté en trois catégories : intraveineuse/perfusion, intramusculaire et autres. Le segment intraveineux/perfusion a dominé le marché en 2024, grâce à son utilisation répandue dans les hôpitaux pour l'administration d'antibiotiques, de chimiothérapies et de produits biologiques. L'administration intraveineuse garantit une biodisponibilité immédiate et un effet thérapeutique rapide, essentiels en soins intensifs. Les hôpitaux d'Arabie saoudite et des Émirats arabes unis utilisent largement les médicaments intraveineux lyophilisés pour leur stabilité et leur stérilité. Par ailleurs, la demande croissante de produits biologiques et de traitements d'urgence continue de consolider la position dominante de ce segment. Les investissements continus dans les infrastructures hospitalières et les centres de perfusion renforcent encore les perspectives de croissance.

Le segment des injections intramusculaires devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à sa facilité d'utilisation en ambulatoire et à domicile. Les formulations intramusculaires sont plus simples à administrer et nécessitent peu de matériel, ce qui les rend particulièrement adaptées aux contextes aux ressources limitées. Par exemple, le Kenya et l'Égypte développent leurs programmes de vaccination en utilisant des médicaments intramusculaires lyophilisés. La réduction du besoin de supervision médicale et la diminution du temps de récupération des patients expliquent la popularité croissante de cette voie d'administration. La sensibilisation accrue à l'auto-administration et aux injectables à action prolongée contribue également à cette croissance.

- Par l'utilisateur final

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux, cliniques, soins à domicile et autres. Le segment hospitalier détenait la part de marché la plus importante en 2024, grâce à la forte consommation de médicaments injectables en milieu hospitalier et aux urgences. Les hôpitaux constituent le principal lieu de prise en charge des cas d'oncologie, de maladies infectieuses et d'affections critiques nécessitant des médicaments lyophilisés. Leurs systèmes d'approvisionnement centralisés et leurs environnements de stockage contrôlés favorisent l'utilisation des formulations lyophilisées. Par exemple, des hôpitaux en Arabie saoudite et en Égypte ont mis en œuvre des solutions de chaîne du froid avancées pour la gestion à grande échelle des médicaments injectables. La disponibilité de personnel médical qualifié contribue également à la position dominante de ce segment.

Le secteur des soins de santé à domicile devrait connaître la croissance annuelle composée la plus rapide, portée par l'essor des thérapies injectables auto-administrées et du suivi à distance des patients. Ces derniers privilégient les injectables lyophilisés pour leur facilité de reconstitution et leur portabilité. Aux Émirats arabes unis et en Afrique du Sud, par exemple, les patients souffrant de troubles hormonaux et auto-immuns utilisent de plus en plus les kits d'injection à domicile. Le développement de la télémédecine et des plateformes de santé en ligne a facilité l'accès aux conseils pour l'administration à domicile. La hausse des coûts de santé incite également les patients à se tourner vers des options de traitement pratiques à domicile.

- Par canal de distribution

Selon le canal de distribution, le marché est segmenté en appels d'offres directs, vente au détail et autres. Le segment des appels d'offres directs a dominé le marché en 2024, les hôpitaux publics et les systèmes de santé gouvernementaux s'approvisionnant en médicaments lyophilisés en gros par le biais d'appels d'offres centralisés. Ceci garantit un approvisionnement constant et une maîtrise des coûts au sein du réseau de santé. Le système d'approvisionnement unifié de l'Arabie saoudite, géré par la National Unified Procurement Company (NUPCO), et les programmes d'achat groupé du ministère égyptien de la Santé confortent cette position dominante. Les appels d'offres directs garantissent également la qualité et la transparence des prix des médicaments essentiels. Ce segment bénéficie d'un soutien gouvernemental important en faveur de l'accès aux soins et de la production pharmaceutique locale.

Le segment des ventes au détail devrait connaître la croissance la plus rapide au cours de la période prévisionnelle, grâce à la présence croissante de pharmacies spécialisées et de réseaux de distribution proposant des formulations injectables. Par exemple, les chaînes de pharmacies privées aux Émirats arabes unis et en Afrique du Sud augmentent leurs stocks de produits biologiques lyophilisés et d'injectables pour les maladies chroniques. La sensibilisation accrue des consommateurs et la facilité d'achat en pharmacie de proximité sont les principaux moteurs de cette croissance. Le développement des pharmacies en ligne et des distributeurs en ligne agréés contribue également à l'expansion de la distribution dans les zones urbaines et périurbaines.

Analyse régionale du marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique

- L’Arabie saoudite a dominé le marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique en 2024, avec une part de marché de 32,8 %. Cette domination s’explique par d’importantes réformes du système de santé, des initiatives robustes en matière de production pharmaceutique dans le cadre de la Vision 2030 et le développement des infrastructures hospitalières.

- Des pays comme l'Arabie saoudite, les Émirats arabes unis et l'Afrique du Sud sont à la pointe de cette adoption, grâce à l'expansion de leurs capacités de production pharmaceutique et aux investissements publics dans les infrastructures de santé.

- De plus, la prévalence croissante de maladies chroniques telles que le cancer, les maladies auto-immunes et les affections respiratoires a accru la demande de médicaments lyophilisés garantissant une durée de conservation prolongée et une efficacité constante.

Analyse du marché des médicaments injectables lyophilisés en Arabie saoudite

En 2024, le marché saoudien des médicaments injectables lyophilisés détenait la plus grande part de revenus au Moyen-Orient et en Afrique, grâce à d'importants investissements publics dans la production nationale de médicaments dans le cadre de la Vision 2030 et à une demande croissante de formulations parentérales avancées. Le développement du secteur biopharmaceutique du pays et l'accent mis sur l'autosuffisance en matière de produits de santé sont des facteurs clés de cette croissance. Par ailleurs, les partenariats stratégiques avec des acteurs pharmaceutiques internationaux visant à établir des unités de production locales renforcent l'approvisionnement en médicaments lyophilisés. Le développement des infrastructures hospitalières et l'intérêt croissant porté aux traitements en oncologie et en maladies infectieuses contribuent également à la croissance du marché.

Aperçu du marché des médicaments injectables lyophilisés aux Émirats arabes unis

Le marché des médicaments injectables lyophilisés aux Émirats arabes unis devrait connaître une croissance annuelle composée (TCAC) substantielle au cours de la période de prévision, grâce au développement des infrastructures de santé, à des cadres réglementaires solides et à l'accent mis par le gouvernement sur l'innovation dans les sciences de la vie. La préférence croissante pour les injectables lyophilisés dans les services de soins spécialisés et les investissements du pays dans des zones franches pharmaceutiques telles que le Parc scientifique de Dubaï accélèrent leur adoption. Par ailleurs, le renforcement des collaborations entre les distributeurs locaux et les fabricants multinationaux de médicaments améliore l'accès à des injectables stériles de haute qualité. Le rôle des Émirats arabes unis en tant que pôle médical dans la région du Golfe continue d'attirer les principaux acteurs désireux de consolider leur présence sur le marché.

Aperçu du marché des médicaments injectables lyophilisés en Afrique du Sud

Le marché sud-africain des médicaments injectables lyophilisés devrait connaître une croissance annuelle composée (TCAC) significative au cours de la période de prévision, sous l'effet de la prévalence croissante des maladies chroniques et infectieuses et de l'augmentation des dépenses publiques de santé. L'industrie pharmaceutique du pays s'attache à développer ses capacités de production stérile, notamment dans les domaines de l'oncologie et des anti-infectieux. Les initiatives gouvernementales visant à améliorer la production locale et à réduire la dépendance aux importations favorisent la croissance du marché. Par ailleurs, la prise de conscience croissante des avantages des formulations lyophilisées, qui garantissent la stabilité des médicaments et prolongent leur durée de conservation, encourage leur adoption dans les secteurs de la santé publique et privée.

Aperçu du marché égyptien des médicaments injectables lyophilisés

Le marché égyptien des médicaments injectables lyophilisés devrait connaître une forte croissance au cours de la période prévisionnelle, portée par une population en expansion rapide, l'augmentation des dépenses de santé et la hausse des investissements dans la production pharmaceutique locale. Les efforts du gouvernement pour localiser la production pharmaceutique et les partenariats avec des acteurs internationaux visant à introduire des technologies de lyophilisation avancées renforcent le potentiel du marché. La forte demande en injectables oncologiques et anti-infectieux stimule également la croissance de ce segment. Par ailleurs, des politiques réglementaires favorables et des initiatives promouvant l'accès aux soins de santé dans les zones rurales favorisent une adoption plus large des formulations lyophilisées.

Part de marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique

L'industrie des médicaments injectables lyophilisés au Moyen-Orient et en Afrique est principalement dominée par des entreprises bien établies, notamment :

- Pfizer Inc. (États-Unis)

- Sanofi (France)

- GSK plc. (Royaume-Uni)

- F. Hoffmann-La Roche Ltd (Suisse)

- Novartis AG (Suisse)

- Merck & Co., Inc., (États-Unis)

- Services Johnson & Johnson, Inc. (États-Unis)

- Baxter (États-Unis)

- Fresenius Kabi AG (Allemagne)

- B. Braun SE (Allemagne)

- Teva Pharmaceutical Industries Ltd. (Israël)

- Hikma Pharmaceuticals PLC (Jordanie)

- Industries pharmaceutiques du Golfe (Émirats arabes unis)

- Aspen Pharmacare Holdings Limited (Afrique du Sud)

- Cipla (Inde)

- Viatris Inc. (États-Unis)

- Amgen Inc. (États-Unis)

- Novo Nordisk A/S (Danemark)

- Biocon Limited (Inde)

Quels sont les développements récents sur le marché des médicaments injectables lyophilisés au Moyen-Orient et en Afrique ?

- En février 2025, le CDC Afrique a fait état de progrès concrets lors de son « 2e Forum sur la fabrication de vaccins et autres produits de santé » (qui s'est tenu au Caire), où de nouveaux partenariats et des étapes opérationnelles importantes ont été annoncés sous l'égide de l'AVMA. Par exemple, la société égyptienne EVA Pharma s'est associée à des entreprises de biotechnologie européennes pour établir une plateforme de développement et de production de produits biologiques/ARNm en Afrique.

- En juin 2024, Gavi, l'Alliance du Vaccin, en collaboration avec les Centres africains de contrôle et de prévention des maladies (CDC Afrique) et l'Union africaine, a officiellement lancé l'Accélérateur de fabrication de vaccins en Afrique (AVMA), un mécanisme de financement qui devrait allouer jusqu'à 1 à 1,2 milliard de dollars américains sur dix ans au développement de la fabrication de vaccins (et de produits de santé) en Afrique.

- En septembre 2021, Sinovac Biotech a annoncé être en pourparlers pour établir une usine de fabrication en Afrique du Sud (ou nouer un partenariat avec une usine existante) qui couvrirait la production de vaccins pour l'Afrique, y compris la mise en bouteille, l'étiquetage et, à terme, la production complète.

- En août 2021, l'Égypte a annoncé que sa nouvelle usine VACSERA (surnommée « ville des vaccins » par les médias) serait opérationnelle vers novembre 2021 et visait une capacité annuelle d'environ un milliard de doses, positionnant ainsi l'Égypte comme plaque tournante de l'approvisionnement en vaccins pour l'Afrique.

- En juin 2021, VACSERA (Égypte) et Sinovac Biotech ont signé un accord pour lancer la production locale du vaccin Sinovac contre la COVID-19 en Égypte et dans l'ensemble du continent africain, marquant ainsi une première étape vers la régionalisation de la production de vaccins injectables. Selon Reuters, l'Égypte prévoyait de commencer la production de flacons vers la mi-juin, après avoir reçu les matières premières nécessaires à la fabrication d'une première série de doses.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.