Marché de la liquéfaction au Moyen-Orient et en Afrique, par mode d'approvisionnement (soute/navire, pipeline, camion et train), application (produits chimiques et pétrochimiques , production d'électricité, matières premières industrielles et autres), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et perspectives du marché de la liquéfaction au Moyen-Orient et en Afrique

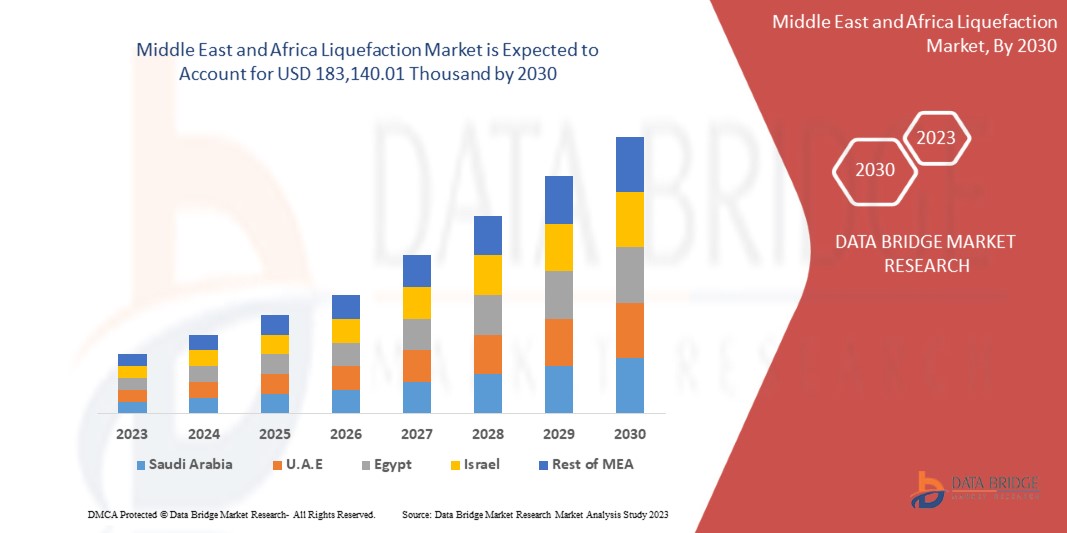

Le marché de la liquéfaction au Moyen-Orient et en Afrique devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 5,3 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 183 140,01 milliers de dollars d'ici 2030. Le principal facteur à l'origine de la croissance du marché est l'expansion des activités de construction offshore et onshore.

La liquéfaction est le processus de conversion d'un gaz en liquide. Cette variation est causée par des changements dans les variables physiques telles que la température, la pression et le volume. La liquéfaction du gaz est le processus de refroidissement du gaz à une température inférieure à son point d'ébullition afin qu'il puisse être stocké et livré sous forme liquide.

Le rapport sur le marché de la liquéfaction au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et localisé, des opportunités d'analyse en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par mode d'approvisionnement (avitaillement/navire, pipeline, camion et train), application (produits chimiques et pétrochimiques, production d'électricité, matières premières industrielles et autres). |

|

Pays couverts |

Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

Linde plc, Air Products and Chemicals, Inc., Baker Hughes Company, Shell plc, Honeywell International Inc., Siemens Gas and Power GmbH & Co. KG, ENGIE, Excelerate Energy, Inc., Eni SpA et Kunlun Energy Company Limited |

Définition du marché

La liquéfaction est un processus qui permet de produire du liquide à partir de composés gazeux et solides. Elle se produit de manière artificielle ou naturelle. Par exemple, la principale application commerciale de ce processus de liquéfaction est la liquéfaction de l'air, qui permet la séparation d'éléments tels que l'azote, l'oxygène et les gaz nobles.

Dynamique du marché de la liquéfaction au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Les gens sont de plus en plus soucieux de l'environnement en ce qui concerne le diesel et l'essence

Les émissions de diesel ou d’essence ont un impact sur la santé humaine, l’environnement, le climat au Moyen-Orient et en Afrique et la justice environnementale. L’exposition à la pollution par le diesel peut provoquer des problèmes de santé majeurs tels que l’asthme et les infections respiratoires, ainsi qu’aggraver les maladies cardiaques et pulmonaires préexistantes, en particulier chez les enfants et les personnes âgées. Les émissions des moteurs diesel entraînent la formation d’ozone troposphérique, qui nuit aux cultures, aux arbres et à d’autres plantes. Ces émissions produisent également des pluies acides, qui affectent les terres, les lacs et les cours d’eau et pénètrent dans la chaîne alimentaire humaine par l’eau, produisant de la viande et du poisson.

Les conséquences néfastes du diesel et de l’essence incitent les gens à prendre conscience des problèmes environnementaux et à les sensibiliser à l’utilisation du diesel et de l’essence. Cela les aide dans leur recherche d’un carburant ayant un impact environnemental moindre que le diesel ou l’essence. Cela a incité les entreprises à adopter des solutions écologiques. Le gaz naturel liquéfié (GNL) a récemment été utilisé comme substitut au diesel et à l’essence. C’est un carburant propre qui offre aux clients une alternative rentable.

- Demande croissante de GNL pour le soutage, le transport routier et l'énergie hors réseau

Au cours de la dernière décennie, l'industrie et l'urbanisation ont connu une croissance importante, ce qui a entraîné une augmentation des émissions de carbone et de gaz à effet de serre au Moyen-Orient et en Afrique. Pour minimiser les émissions de carbone et de gaz à effet de serre, les gouvernements encouragent l'utilisation du gaz naturel dans la production d'électricité et dans les carburants automobiles.

En conséquence, les gouvernements mettent en œuvre diverses politiques pour encourager l’utilisation de véhicules fonctionnant au GNC et au GNL, notamment en offrant des subventions et des allégements fiscaux aux constructeurs automobiles et aux clients. En conséquence, la consommation de gaz naturel au Moyen-Orient et en Afrique a augmenté au cours de la dernière décennie. En conséquence, son utilisation dans le soutage, la production d’électricité et le transport routier est en hausse.

- Expansion des activités de recherche et développement (R&D)

Le GNL est utilisé pour transporter le gaz naturel vers des marchés éloignés. Cependant, les coûts élevés de production, de transport et de stockage ont limité l'expansion de la technologie du GNL à certaines circonstances, lorsqu'il n'existe pas d'autres moyens moins coûteux de transporter le GN. Cependant, les défis commerciaux et politiques entourant le GN suscitent un intérêt croissant pour cette technologie de transport alternative, qui présente l'avantage d'élargir les marchés potentiels pour les vendeurs et les fournisseurs potentiels pour les acheteurs. Cet intérêt croissant a entraîné des dépenses toujours croissantes dans la recherche et le développement du GNL, ainsi que dans ses utilisations.

Les prétraitements, l'élimination des gaz acides, la déshydratation et la liquéfaction sont les quatre étapes d'une usine de GNL. Les activités de R&D sont principalement axées sur l'étape de liquéfaction, dans le but d'introduire des technologies permettant de minimiser la consommation d'énergie et d'augmenter l'efficacité du processus de liquéfaction. Les principaux procédés de liquéfaction et les inventions comprennent la technique C3-MR, la méthode AP-X, la méthode Cascade et la méthode Double Mixed Refrigerant (DMR). Étant donné que toutes ces conceptions consomment une quantité importante d'énergie (principalement pour les compresseurs de réfrigération), des efforts croissants de R&D sont orientés vers l'optimisation des processus. Les principales activités de R&D sont axées sur la conception et l'optimisation des échangeurs de chaleur cryogéniques, l'amélioration des compresseurs de réfrigération et l'efficacité des moteurs de compresseur.

Dans le domaine des technologies de transport du GNL, deux technologies de navires sont utilisées : l'unité de stockage flottante (FSU) et l'unité de stockage et de regazéification flottante (FSRU). La R&D du secteur est principalement axée sur l'amélioration des performances des FSRU et la baisse des prix, ce qui fait de ces derniers une option de développement rapide attrayante pour les petits marchés et les pays émergents.

- Expansion des activités de construction offshore et onshore

Les opérations de construction offshore et onshore se développent à mesure que le nombre de projets augmente. De plus en plus de projets de liquéfaction sont en cours de développement.

Les systèmes de gaz naturel liquéfié flottant (FLNG) sont une technologie relativement récente de l'industrie du GNL. Ils sont utilisés pour liquéfier le gaz naturel généré à partir de champs offshore trop éloignés des côtes pour une liquéfaction à terre. Les systèmes FLNG sont des bateaux flottants placés au-dessus d'un champ de gaz naturel sous-marin. Les systèmes FLNG, en général, génèrent, traitent, liquéfient, stockent et transfèrent le GNL vers les marchés du Moyen-Orient et de l'Afrique par navire transporteur ou vers une infrastructure terrestre qui transfère le gaz vers les marchés intérieurs. Les FSRU sont des navires spécialisés ou des navires offshore qui collectent, stockent et évaporent le GNL pour fournir du carburant pour la production d'électricité, des matières premières pour les processus industriels, de la chaleur pour les bâtiments résidentiels et commerciaux et d'autres utilisations finales.

OPPORTUNITÉS

- Nouveaux projets de liquéfaction émergents

Ces dernières années, les investissements dans les usines de liquéfaction de GNL se sont multipliés, ouvrant la voie à une augmentation des capacités à l’échelle mondiale. Une grande partie de ces investissements a été alimentée par des tendances en matière de structure des contrats qui permettent aux développeurs de respecter les étapes des projets à un rythme plus rapide que par le passé. Cela est dû à une croissance soutenue de la demande générée par la croissance des économies, ainsi qu’à une augmentation du nombre d’acteurs sur le marché.

La confiance à long terme du marché a été essentielle pour soutenir ces décisions, car un projet de liquéfaction peut prendre dix ans ou plus entre la planification initiale et la mise sur le marché des premiers approvisionnements en gaz. Les étapes d’investissement sont cruciales pour les projets qui ont dépassé le stade de la planification s’ils visent à capter la demande à moyen terme et au-delà. Les investisseurs ont été désireux d’accélérer l’activité et d’autoriser des projets sur un marché où plusieurs projets sont en concurrence avant l’expiration de cette fenêtre d’opportunité.

Cette forte augmentation des investissements dans le GNL au cours des deux dernières années a également coïncidé avec un abandon des méthodes traditionnelles de mise en place d’usines de liquéfaction de GNL. Les développeurs prennent des décisions d’investissement dans le cadre de modèles d’achat classiques une fois que l’achat du projet est assuré par des contrats d’approvisionnement à long terme avec des tiers. Cette technique traditionnelle offre la confiance des investisseurs, mais l’organisation de l’achat pour l’ensemble d’un projet avec diverses contreparties prend du temps et coûte cher aux développeurs.

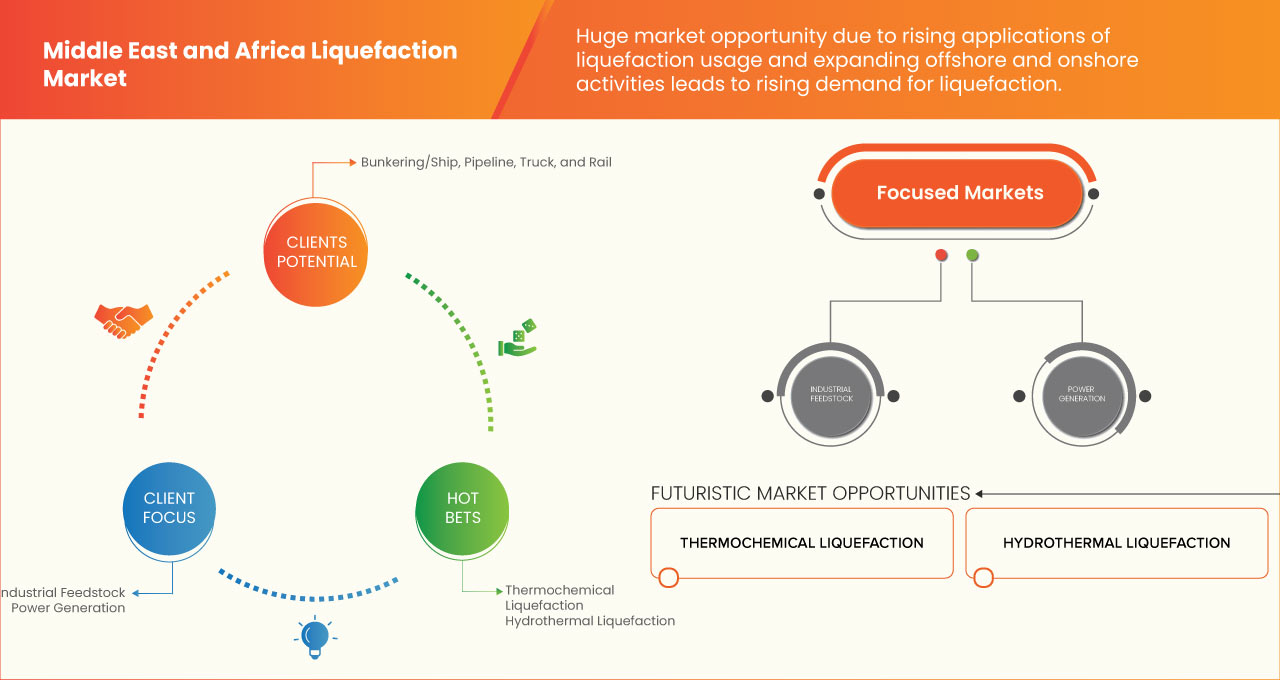

- Applications croissantes de la liquéfaction

Le processus de conversion d'un gaz en liquide est connu sous le nom de liquéfaction. La liquéfaction est un processus économique important car les produits chimiques liquides occupent beaucoup moins d'espace que les substances gazeuses. Les gaz liquéfiés sont le plus souvent utilisés dans le stockage compact et le transfert de combustibles utilisés pour le chauffage, la cuisine ou l'alimentation des véhicules à moteur. Pour cette raison, deux types de gaz liquéfiés sont fréquemment utilisés dans le commerce : le gaz naturel liquéfié (GNL) et le gaz de pétrole liquéfié (GPL). Le GPL est une combinaison à l'état liquide de gaz dérivés du gaz naturel ou du pétrole. La combinaison est conservée dans des conteneurs qui peuvent supporter des pressions extrêmement élevées. Le GNL est similaire au GPL dans la mesure où il a pratiquement toutes les compositions telles que le propane et le butane à l'exception du méthane. Le GNL et le GPL ont de nombreuses applications en commun.

Les gaz liquéfiés et les procédures de liquéfaction sont utilisés dans une gamme d'opérations dans diverses industries telles que la médecine, l'industrie, la science, etc. Conservation d'échantillons biologiques, comme la congélation du sperme à l'aide d'azote liquide, ou l'utilisation d'oxygène liquide dans les hôpitaux pour offrir aux patients souffrant de problèmes respiratoires une haleine plus saine. Les appareils Aqualung peuvent utiliser un mélange d'oxygène liquide et d'azote liquide.

La liquéfaction des gaz est utilisée dans les systèmes de réfrigération. L'ammoniac liquide est utilisé pour refroidir les usines de glace. L'oxygène et l'hydrogène liquides générés par la technique de liquéfaction des gaz sont utilisés dans les propulseurs de fusée. Les gaz peuvent être facilement stockés et transportés grâce à cette méthode. Par exemple, dans les systèmes de climatisation où le gaz liquide stocké, tel que le R-290 ou le R-600A, est utilisé comme réfrigérant. Dans le secteur industriel, l'acétylène liquide et l'oxygène liquide peuvent être utilisés pour le soudage. La liquéfaction des gaz est également essentielle dans le domaine de la recherche en cryogénie. L'hélium liquide est couramment utilisé dans la recherche sur le comportement de la matière à des températures proches du zéro absolu, 0 K (zéro Kelvin).

Actuellement, l'hydrogène liquéfié est principalement utilisé dans les applications spatiales et dans le secteur des semi-conducteurs. Si les applications liées aux énergies renouvelables, comme le secteur automobile, ne répondent pour l'instant qu'à une infime partie de cette demande, leur besoin pourrait connaître une augmentation majeure dans les années à venir, la nécessité d'installations de liquéfaction à grande échelle dépassant largement la taille des installations existantes.

RESTRICTIONS/DÉFIS

- Réception limitée de gaz naturel liquéfié (GNL)

Le GNL joue un rôle de plus en plus essentiel sur le marché mondial du gaz naturel. La consommation de gaz naturel va augmenter au Moyen-Orient et en Afrique au cours des prochaines années. Les navires transfèrent le GNL vers les stations de déchargement des dépôts de stockage. Une partie du GNL s'évapore en phase gazeuse pendant les étapes de stockage. Le gaz d'évaporation est le nom donné au GNL évaporé (BOG). Le GNL est conservé dans un stockage cryogénique. Le processus d'évaporation est influencé par le flux de chaleur. Il montre qu'une petite proportion ou partie du GNL s'évapore continuellement en raison de la chaleur pendant la procédure de stockage. Une évaporation accrue peut avoir un impact négatif sur la stabilité et la sécurité du processus de stockage du GNL. En raison des problèmes de stockage du GNL, des emplacements éloignés et de l'augmentation des coûts, il existe une pénurie d'infrastructures de terminaux de réception du GNL.

- Réglementations et normes strictes en matière de liquéfaction

Le processus de conversion d'un gaz en liquide est connu sous le nom de liquéfaction. Les produits issus des gaz liquéfiés sont moins nocifs pour l'environnement. Il est également nécessaire de prendre en compte des aspects spécifiques tels que la manière dont ils sont fabriqués, stockés et transportés, ainsi que les dommages potentiels que les produits gazeux liquéfiés peuvent causer. Tous ces processus sont mis en œuvre par chaque gouvernement ou pays du monde, qui a établi des lois, des directives et des normes strictes pour leur utilisation réglementée sans nuire à l'environnement ou aux personnes.

Portée du marché de la liquéfaction au Moyen-Orient et en Afrique

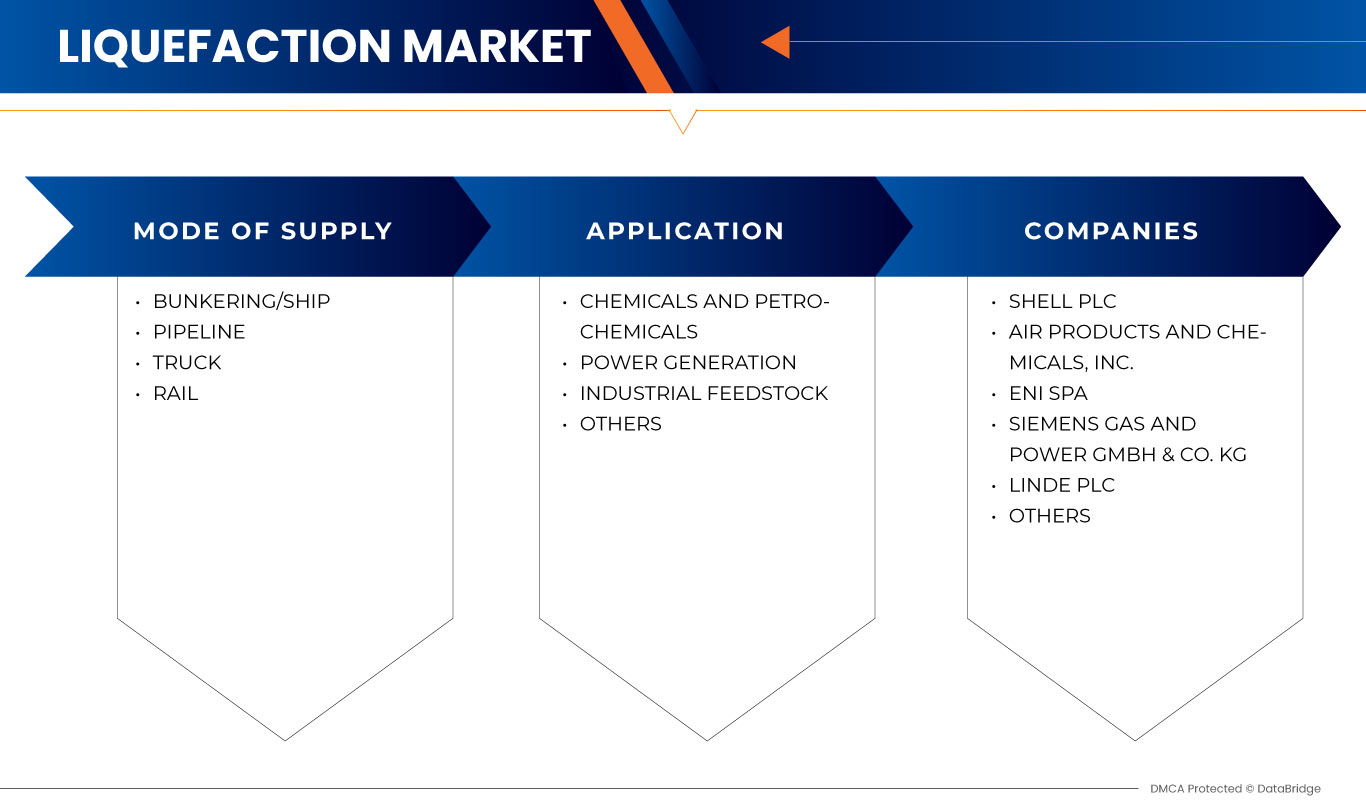

Le marché de la liquéfaction au Moyen-Orient et en Afrique est segmenté en deux segments notables en fonction du mode d'approvisionnement et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Mode de fourniture

- Soutage/Navire

- Pipeline

- Camion

- Rail

En fonction du mode d'approvisionnement, le marché est segmenté en soutage/navire, pipeline, camion et rail.

Application

- Produits chimiques et pétrochimiques

- Production d'énergie

- Matières premières industrielles

- Autres

En fonction des applications, le marché est segmenté en produits chimiques et pétrochimiques, production d’électricité, matières premières industrielles et autres.

Analyse/perspectives régionales du marché de la liquéfaction au Moyen-Orient et en Afrique

Le marché de la liquéfaction au Moyen-Orient et en Afrique est segmenté en deux segments notables en fonction du mode d’approvisionnement et d’application.

Les pays couverts par le marché de la liquéfaction au Moyen-Orient et en Afrique sont l'Afrique du Sud, l'Égypte, l'Arabie saoudite, les Émirats arabes unis, Israël et le reste du Moyen-Orient et de l'Afrique. L'Arabie saoudite domine le marché de la liquéfaction au Moyen-Orient et en Afrique en termes de part de marché et de chiffre d'affaires en raison de l'expansion des activités de construction offshore et onshore.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario du marché pour chaque pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du secteur de la liquéfaction au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché de la liquéfaction au Moyen-Orient et en Afrique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications et la courbe de durée de vie du produit. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Certains des principaux acteurs opérant sur le marché de la liquéfaction au Moyen-Orient et en Afrique sont Linde plc, Air Products and Chemicals, Inc., Baker Hughes Company, Shell plc, Honeywell International Inc., Siemens Gas and Power GmbH & Co. KG, ENGIE, Excelerate Energy, Inc., Eni SpA et Kunlun Energy Company Limited.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MODE OF SUPPLY LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.2 DBMR MARKET CHALLENGE MATRIX

2.3 DBMR VENDOR SHARE ANALYSIS

2.4 SECONDARY SOURCES

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 PEOPLE ARE BECOMING MORE ENVIRONMENTALLY CONSCIOUS ABOUT DIESEL AND GASOLINE

5.1.2 INCREASING LNG DEMAND IN BUNKERING, ROAD TRANSPORTATION, AND OFF-GRID POWER

5.1.3 EXPANSION OF RESEARCH AND DEVELOPMENT (R&D) ACTIVITIES

5.1.4 EXPANDING BOTH OFFSHORE AND ONSHORE BUILDING ACTIVITY

5.2 RESTRAINTS

5.2.1 LIMITED LIQUEFIED NATURAL GAS (LNG) RECEIVING

5.2.2 ENVIRONMENTAL IMPLICATIONS OF NATURAL GAS LIQUEFACTION

5.3 OPPORTUNITIES

5.3.1 EMERGING NEW PROJECTS OF LIQUEFACTION

5.3.2 RISING APPLICATIONS OF LIQUEFACTION

5.4 CHALLENGES

5.4.1 STRICT LIQUEFACTION REGULATIONS AND STANDARDS

5.4.2 KEY ISSUES AND CHALLENGES OF LIQUEFACTION

6 MIDDLE EAST & AFRICA LIQUEFACTION MARKET, BY MODE OF SUPPLY

6.1 OVERVIEW

6.2 BUNKERING/SHIP

6.3 PIPELINE

6.4 TRUCK

6.5 RAIL

7 MIDDLE EAST & AFRICA LIQUEFACTION MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 CHEMICALS AND PETROCHEMICALS

7.3 POWER GENERATION

7.4 INDUSTRIAL FEEDSTOCK

7.5 OTHERS

8 MIDDLE EAST & AFRICA LIQUEFACTION MARKET, BY REGION

8.1 MIDDLE EAST AND AFRICA

8.1.1 SAUDI ARABIA

8.1.2 SOUTH AFRICA

8.1.3 EGYPT

8.1.4 ISRAEL

8.1.5 UNITED ARAB EMIRATES

8.1.6 REST OF MIDDLE EAST AND AFRICA

9 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

9.2 PRODUCT LAUNCH

9.3 PARTNERSHIP

9.4 COLLABORATIONS

9.5 RECOGNITIONS

9.6 ACHIEVEMENTS

9.7 AGREEMENTS

9.8 INITIATE OPERATIONS

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 SHELL PLC

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT DEVELOPMENT

11.2 AIR PRODUCTS AND CHEMICLAS, INC.

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT DEVELOPMENTS

11.3 ENI SPA

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT DEVELOPMENTS

11.4 SIEMENS GAS AND POWER GMBH & CO. KG

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT DEVELOPMENTS

11.5 LINDE PLC

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 PRODUCT PORTFOLIO

11.5.5 RECENT DEVELOPMENT

11.6 BAKER HUGHES COMPANY

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 ENGIE

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT DEVELOPMENT

11.8 EXCELERATE ENERGY, INC.

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

11.9 HONEYWELL INTERNATIONAL INC. (2022)

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT DEVELOPMENT

11.1 KUNLUN ENERGY COMPANY LIMITED

11.10.1 COMPANY SNAPSHOT

11.10.2 REVENUE ANALYSIS

11.10.3 PRODUCT PORTFOLIO

11.10.4 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA LIQUEFACTION MARKET, BY MODE OF SUPPLY, 2021-2030 (USD THOUSAND)

TABLE 2 MIDDLE EAST & AFRICA BUNKERING/SHIP IN LIQUEFACTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA PIPELINE IN LIQUEFACTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA TRUCK IN LIQUEFACTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA RAIL IN LIQUEFACTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA LIQUEFACTION MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA CHEMICALS AND PETROCHEMICALS IN LIQUEFACTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA POWER GENERATION IN LIQUEFACTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA INDUSTRIAL FEEDSTOCK IN LIQUEFACTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN LIQUEFACTION MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA LIQUEFACTION MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA LIQUEFACTION MARKET, BY MODE OF SUPPLY, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA LIQUEFACTION MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 SAUDI ARABIA LIQUEFACTION MARKET, BY MODE OF SUPPLY, 2021-2030 (USD THOUSAND)

TABLE 15 SAUDI ARABIA LIQUEFACTION MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 16 SOUTH AFRICA LIQUEFACTION MARKET, BY MODE OF SUPPLY, 2021-2030 (USD THOUSAND)

TABLE 17 SOUTH AFRICA LIQUEFACTION MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 18 EGYPT LIQUEFACTION MARKET, BY MODE OF SUPPLY, 2021-2030 (USD THOUSAND)

TABLE 19 EGYPT LIQUEFACTION MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 20 ISRAEL LIQUEFACTION MARKET, BY MODE OF SUPPLY, 2021-2030 (USD THOUSAND)

TABLE 21 ISRAEL LIQUEFACTION MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 22 UNITED ARAB EMIRATES LIQUEFACTION MARKET, BY MODE OF SUPPLY, 2021-2030 (USD THOUSAND)

TABLE 23 UNITED ARAB EMIRATES LIQUEFACTION MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 24 REST OF MIDDLE EAST AND AFRICA LIQUEFACTION MARKET, BY MODE OF SUPPLY, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: THE MODE OF SUPPLY LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: SEGMENTATION

FIGURE 14 PEOPLE ARE BECOMING MORE ENVIRONMENTALLY CONSCIOUS ABOUT DIESEL AND GASOLINE, WHICH IS EXPECTED TO DRIVE THE GROWTH OF THE MIDDLE EAST & AFRICA LIQUEFACTION MARKET IN THE FORECAST PERIOD

FIGURE 15 THE BUNKERING/SHIP SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE MIDDLE EAST & AFRICA LIQUEFACTION MARKET IN 2023 AND 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA LIQUEFACTION MARKET

FIGURE 17 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: BY MODE OF SUPPLY, 2022

FIGURE 18 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: BY APPLICATION, 2022

FIGURE 19 MIDDLE EAST AND AFRICA LIQUEFACTION MARKET, BY SNAPSHOT (2022)

FIGURE 20 MIDDLE EAST AND AFRICA LIQUEFACTION MARKET, BY COUNTRY (2022)

FIGURE 21 MIDDLE EAST AND AFRICA LIQUEFACTION MARKET, BY COUNTRY (2023 & 2030)

FIGURE 22 MIDDLE EAST AND AFRICA LIQUEFACTION MARKET, BY COUNTRY (2022 & 2030)

FIGURE 23 MIDDLE EAST AND AFRICA LIQUEFACTION MARKET, BY MODE OF SUPPLY (2023 - 2030)

FIGURE 24 MIDDLE EAST & AFRICA LIQUEFACTION MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.