Middle East And Africa Leak Detection Market

Taille du marché en milliards USD

TCAC :

%

USD

1.15 Billion

USD

2.17 Billion

2025

2033

USD

1.15 Billion

USD

2.17 Billion

2025

2033

| 2026 –2033 | |

| USD 1.15 Billion | |

| USD 2.17 Billion | |

|

|

|

|

Marché de la détection des fuites au Moyen-Orient et en Afrique, par type (en amont, intermédiaire et en aval), type de produit (détecteurs de gaz portables, détecteurs basés sur des drones, détecteurs d'aéronefs habités et détecteurs basés sur des véhicules), technologie (acoustique / ultrasons, fibre optique, méthodes de déviation pression-débit, modèle transitoire en temps réel étendu (E-RTTM), imagerie thermique, équilibre masse/volume, détection de vapeur, absorption laser et lidar, détection de fuite hydraulique, vannes à pression négative et autres), utilisateur final (pétrole et gaz, usine chimique, usines de traitement des eaux, centrale thermique, exploitation minière et boues et autres), pays (Afrique du Sud, Arabie saoudite, Émirats arabes unis, Israël, Égypte, reste du Moyen-Orient et de l'Afrique) Tendances et prévisions de l'industrie jusqu'en 2028

Analyse et perspectives du marché : marché de la détection des fuites au Moyen-Orient et en Afrique

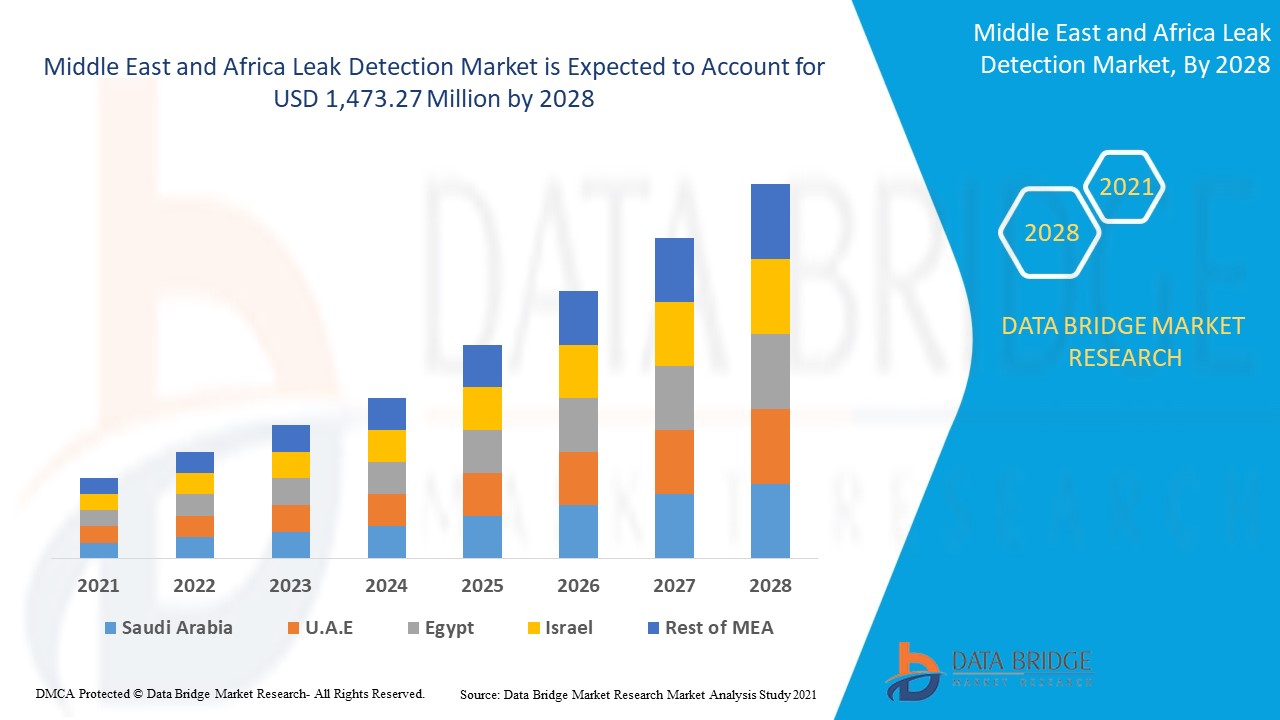

Le marché de la détection des fuites devrait connaître une croissance du marché au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,2 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 1 473,27 millions USD d'ici 2028. La croissance croissante des infrastructures de pipelines et d'usines de stockage de pétrole et de gaz constitue un facteur de croissance majeur pour le marché mondial de la détection des fuites

Le terme fuite ou fuite désigne une fissure, un trou ou une porosité involontaire dans une paroi ou un joint enveloppant des canalisations, des batteries, des produits scellés, des enceintes ou des conteneurs de stockage qui doivent contenir/transférer différents fluides et gaz. Ces fissures ou trous permettent l'échappement de fluides et de gaz d'un milieu fermé.

Le nombre élevé d'incidents de fuites de pipelines constitue un facteur majeur de croissance du marché de la détection des fuites. Les complications techniques liées aux détecteurs de fuites constituent un frein majeur pour le marché de la détection des fuites. L'augmentation de la production mondiale de pétrole et de gaz constitue une fenêtre d'opportunité majeure pour le marché de la détection des fuites. Le défi associé aux pipelines de grand diamètre pour une détection efficace des fuites constitue un défi majeur pour la croissance du marché de la détection des fuites.

Ce rapport sur le marché de la détection des fuites fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché de la détection des fuites au Moyen-Orient et en Afrique

Le marché de la détection des fuites est segmenté en fonction du type, du type de produit, de la technologie et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type, le marché de la détection des fuites est segmenté en amont, intermédiaire et aval. En 2021, le segment intermédiaire a été considéré comme la plus grande part de marché, car ce segment traite essentiellement du transport de pétrole brut et de gaz naturel par divers modes de transport tels que les pipelines.

- Sur la base du type de produit, le marché de la détection des fuites est segmenté en détecteurs de gaz portables, détecteurs basés sur des drones, détecteurs d'avions habités et détecteurs basés sur des véhicules. En 2021, le segment des détecteurs basés sur des véhicules a représenté la plus grande part de marché car ils peuvent être facilement montés sur un véhicule et utilisés pour surveiller les canalisations via le véhicule en mouvement.

- Sur la base de la technologie, le marché de la détection des fuites est segmenté en acoustique/ultrasons, fibre optique , méthodes de déviation pression-débit, modèle transitoire en temps réel étendu (E-RTTM), imagerie thermique, bilan masse/volume, détection de vapeur, absorption laser et lidar, détection de fuite hydraulique, ondes de pression négative et autres. En 2021, le segment acoustique/ultrasons a été considéré comme la plus grande part de marché car il offre une détection plus rapide des fuites et constitue une solution à faible coût. De plus, il permet une détection précoce et la perte peut être évitée à un stade précoce.

- Sur la base de l'utilisateur final, le marché de la détection des fuites est segmenté en pétrole et gaz, usine chimique, usines de traitement des eaux, centrale thermique, exploitation minière et boues, etc. En 2021, le segment du pétrole et du gaz a représenté la plus grande part de marché, car cette industrie est un utilisateur majeur de systèmes de détection des fuites afin de prévenir les fuites de pétrole brut et de gaz et les émissions de méthane.

Analyse du marché de la détection des fuites au Moyen-Orient et en Afrique

Le marché de la détection des fuites est analysé et les informations sur la taille du marché sont fournies par pays, type, type de produit, technologie et utilisateur final comme référencé ci-dessus. Les pays couverts dans le rapport sur le marché de la détection des fuites au Moyen-Orient et en Afrique sont l'Afrique du Sud, l'Arabie saoudite, les Émirats arabes unis, Israël, l'Égypte, le reste du Moyen-Orient et de l'Afrique.

L'Arabie saoudite représente le deuxième plus grand marché en raison de la forte production de pétrole brut pour le segment intermédiaire du marché de la détection des fuites au Moyen-Orient et en Afrique. La section pays du rapport sur le marché de la détection des fuites fournit également des facteurs d'impact individuels sur le marché et des changements de réglementation sur le marché au niveau national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et l'analyse des importations et des exportations sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données du pays.

Les lancements de nouveaux produits par les fabricants créent de nouvelles opportunités pour les acteurs du marché de la détection des fuites

Le marché de la détection des fuites vous fournit également une analyse détaillée du marché pour chaque pays, la croissance de la base installée de différents types de produits, l'impact de la technologie utilisant des courbes de vie et les changements de scénarios réglementaires et leur impact sur le marché de la détection des fuites. Les données sont disponibles pour les années historiques 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché du secteur de la détection des fuites

Le paysage concurrentiel du marché de la détection des fuites fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de la détection des fuites.

Français Certains des principaux acteurs opérant sur le marché de la détection des fuites sont FLIR SYSTEMS, Inc., ABB, Honeywell International Inc., Siemens Energy, Pentair, ClampOn AS, Schneider Electric, Atmos International, Xylem, Emerson Electric Co., KROHNE Messtechnik GmbH, PERMA-PIPE International Holdings, Inc., TTK - Leak Detection System, MSA, HIMA, AVEVA Group plc, Yokogawa Electric Corporation, INFICON, Fotech Group Ltd., Hawk Measurement Systems et OptaSense Ltd. entre autres. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

De nombreux lancements de produits et accords sont également initiés par les entreprises du monde entier, ce qui accélère également le marché de la détection des fuites.

Par exemple,

- En novembre, Siemens Energy s'est associé à ProFlex Technologies, une société basée à Houston, pour fournir des services de détection de fuites spontanées aux exploitants de pipelines. En vertu de cet accord, Siemens Energy aura un accès exclusif à la technologie numérique avancée de détection de fuites Pipe-Safe de ProFlex Technologies. Grâce à ce partenariat, l'entreprise a élargi son portefeuille de produits.

Les partenariats, les coentreprises et d'autres stratégies permettent d'accroître la part de marché de l'entreprise grâce à une couverture et une présence accrues. Cela permet également à l'organisation d'améliorer son offre sur le marché de la détection des fuites grâce à une gamme de produits élargie.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.