Middle East And Africa Insoluble Sulfur Market For Automotive Sector

Taille du marché en milliards USD

TCAC :

%

USD

16,771.78 Thousand

USD

24,480.74 Thousand

2022

2030

USD

16,771.78 Thousand

USD

24,480.74 Thousand

2022

2030

| 2023 –2030 | |

| USD 16,771.78 Thousand | |

| USD 24,480.74 Thousand | |

|

|

|

Marché du soufre insoluble au Moyen-Orient et en Afrique pour le secteur automobile, par qualité (qualités régulières, qualités à haute dispersion, qualités à haute stabilité et qualités spéciales), produit (soufre insoluble rempli d'huile et soufre insoluble non rempli d'huile), application (pneu et non-pneu) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché du soufre insoluble pour le secteur automobile au Moyen-Orient et en Afrique

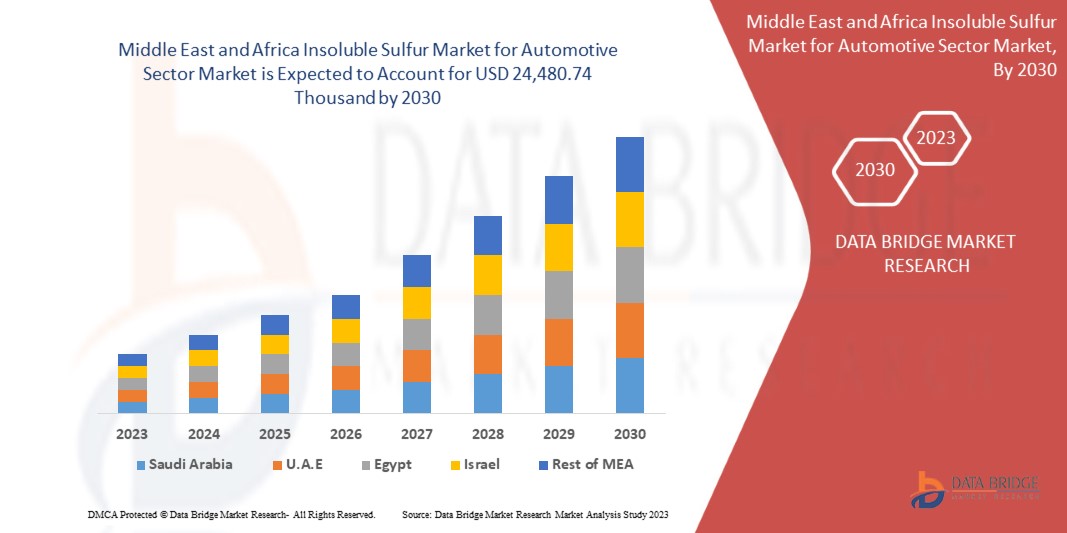

Data Bridge Market Research analyse que le marché du soufre insoluble pour le secteur automobile au Moyen-Orient et en Afrique devrait atteindre 24 480,74 milliers USD d'ici 2030, contre 16 771,78 milliers USD en 2022, avec un TCAC substantiel de 4,9 % au cours de la période de prévision de 2023 à 2030.

Le rapport sur le marché du soufre insoluble au Moyen-Orient et en Afrique pour le secteur automobile fournit des détails sur la part de marché, les nouveaux développements et l’impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d’approbations de produits, de décisions stratégiques, de lancements de produits, d’expansions géographiques et d’innovations technologiques sur le marché. Pour comprendre l’analyse et le scénario du marché, contactez-nous pour un briefing d’analyste. Notre équipe vous aidera à créer une solution d’impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Catégorie (catégories régulières, catégories à haute dispersion, catégories à haute stabilité et catégories spéciales), produit (soufre insoluble rempli d'huile et soufre insoluble non rempli d'huile), application (pneumatique et non-pneumatique) |

|

Pays couverts |

Arabie saoudite, Afrique du Sud, Égypte, Israël, Émirats arabes unis et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Grupa Azoty, SHIKOKU CHEMICALS CORPORATION (une filiale de SHIKOKU KASEI HOLDINGS CORPORATION), FLEXSYS, Lions Industries sro, China Sunsine Chemical Holdings, Oriental Carbon and Chemicals Limited, LANXESS, Joss Elastomers & Chemicals, SANSHIN CHEMICAL INDUSTRY CO., LTD., Leader Technologies Co., Ltd et WUXI HUASHENG RUBBER TECHNICAL CO., LTD entre autres |

Définition du marché

Le soufre insoluble (IS) est une forme de polymère soufré qui est insoluble dans le CS2 et qui fonctionne bien comme agent de vulcanisation pour le caoutchouc. Il existe en deux types, à savoir rempli d'huile et non rempli d'huile. C'est un composant essentiel des additifs pour caoutchouc . Il augmente le niveau d'usure et de résistance à la fatigue et au vieillissement des produits. En plus d'être généralement reconnu comme le meilleur agent de vulcanisation, il est également utilisé dans la production de latex, de tous les types de composants en caoutchouc pour automobiles, de tuyaux en caoutchouc, de chaussures, de matériaux isolants pour câbles et fils et de pneus à ceinture. Par conséquent, l'IS, qui a la propriété de ne pas fleurir, est fréquemment utilisé dans la production de caoutchouc radial et d'autres produits en caoutchouc synthétique, ainsi que dans la production de produits en caoutchouc de couleur claire où le soufre commun est présent dans des proportions considérables.

Dynamique du marché du soufre insoluble pour le secteur automobile au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

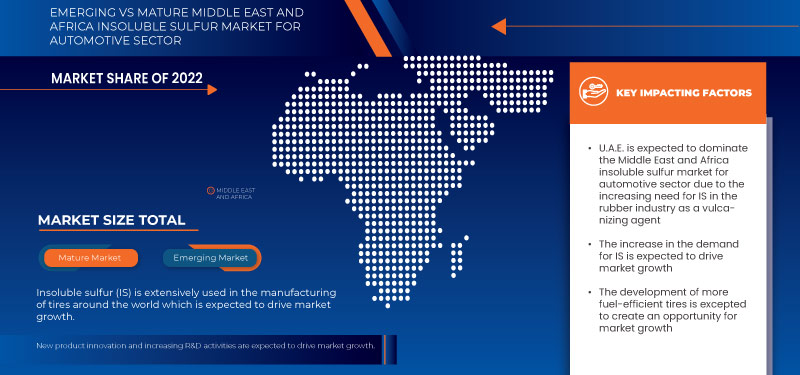

- La fabrication et la vente de pneus dans le monde entier font largement appel au soufre insoluble

La demande de pneus de rechange pratiques et nécessitant peu d'entretien a augmenté en raison du nombre croissant de véhicules routiers et de la distance qu'ils parcourent. En conséquence, la production, les ventes et la demande de pneus augmentent toutes à l'échelle mondiale. Par conséquent, il existe un besoin croissant de pneus efficaces. Dans l'industrie du caoutchouc, le soufre insoluble est principalement utilisé comme accélérateur et agent de vulcanisation. Il permet au caoutchouc d'adhérer plus fermement, empêche le caoutchouc de se désintégrer et augmente la résistance à la chaleur et à l'usure des pneus. Pour ces raisons, il s'agit d'une matière première essentielle dans la fabrication de pneus. Par conséquent, la production de pneus fait largement appel au soufre insoluble. En outre, la demande, la fabrication et les ventes de pneus ont le potentiel d'être une force motrice majeure dans l'expansion du marché.

- Augmentation mondiale du nombre de véhicules routiers utilisés

L'industrie automobile, un indicateur économique clé, est sur le point de réaliser des avancées technologiques importantes. L'industrie automobile est actuellement stimulée par les demandes des clients pour des caractéristiques distinctives et coûteuses. L'industrie automobile a le potentiel de stimuler l'activité et de créer des emplois dans divers domaines de l'économie, notamment la production d'automobiles, de pneus, d'accessoires, la logistique, le commerce et les services financiers. L'urbanisation croissante, la croissance démographique, l'augmentation du revenu disponible et la facilité d'obtention de crédit et de financement sont les principaux moteurs de l'expansion de l'industrie automobile. À l'échelle mondiale, les clients utilisent des véhicules polyvalents tels que des voitures particulières, des camions, des voitures électriques, des deux-roues et des trois-roues, ce qui propulse la croissance du marché. Le besoin de pneus neufs et de remplacements de pneus pratiques et nécessitant peu d'entretien a augmenté en raison de la hausse des ventes d'automobiles et du nombre croissant d'automobiles sur route dans le monde. En conséquence, cela stimulera considérablement la fabrication et la consommation de pneus. Le soufre insoluble étant le principal ingrédient de durcissement utilisé dans la production de caoutchouc et de pneus, l'industrie automobile a le potentiel d'être une force motrice majeure de l'expansion du marché.

Opportunité

- Innovation de nouveaux produits et augmentation des activités de R&D

Le soufre insoluble empêche le caoutchouc de se déplacer dans la couche de caoutchouc environnante. La vitesse de migration du soufre ordinaire est particulièrement élevée dans les composés de caoutchouc à base de caoutchouc cis et de caoutchouc butyle ; toutefois, cela peut être évité en ajoutant du soufre insoluble. Le processus de durcissement est accéléré. Une étape appelée activation, ou dépolymérisation en chaîne, se produit lorsque la température de vulcanisation est atteinte. Cette étape accélère la vulcanisation et réduit la teneur en soufre.

Même si le soufre insoluble présente de nombreux avantages, il présente également certains inconvénients, tels que l'utilisation de produits chimiques dangereux, des processus compliqués et une quantité élevée de soufre et de sulfure de carbone. Les fabricants doivent accroître leurs investissements et leur expertise en R&D, développer de nouveaux produits pour les lignes existantes, construire de nouvelles installations, collaborer avec d'autres acteurs et lancer de nouveaux produits pour surmonter ces inconvénients.

En outre, l'entreprise peut investir de l'argent et faire de la R&D concernant les technologies vertes respectueuses de l'environnement et innover avec des produits plus efficaces, ce qui devrait créer une excellente opportunité de croissance du marché.

Retenue/Défi

- Des règles et réglementations strictes

L'inquiétude croissante concernant l'utilisation de produits chimiques dangereux dans le processus de fabrication a conduit à l'application de règles et de réglementations strictes au secteur du soufre insoluble. Ces directives et lois couvrent l'utilisation de produits chimiques spécifiques comme matières premières, notamment le soufre, le sulfure de carbone et l'huile d'hydrocarbures. En outre, les règles et réglementations établies pour les produits en caoutchouc tels que les pneus jouent également un rôle majeur en tant que facteurs restrictifs.

Bien que ces règles et réglementations strictes soient essentielles pour réduire les problèmes de santé environnementale, elles vont interférer avec l'utilisation des matières premières, des produits chimiques, des processus de production et des technologies. En conséquence, les fabricants seront obligés de prendre des mesures appropriées qui peuvent entraîner une augmentation du prix de production et des investissements nécessaires, ce qui, à son tour, affectera le marché des insolubles en augmentant le coût de son produit.

La fabrication et l'utilisation du caoutchouc synthétique ont un impact négatif sur l'environnement en raison de la consommation d'énergie, de l'utilisation de combustibles fossiles comme matières premières, des émissions de CO2 dans l'air et l'eau et des déchets. Ces substances ne sont pas facilement biodégradables. Par conséquent, lorsque les eaux usées sont déversées dans l'eau, elles peuvent épuiser la teneur en oxygène des océans et augmenter la quantité de poisons pouvant nuire à la vie marine.

Les pneus ne se dégradent pas. Ils peuvent laisser échapper dans l’air, le sol et l’eau des produits chimiques qui peuvent perturber l’écosystème lorsqu’ils s’accumulent dans des décharges ou des parcs à ferraille. En cas d’incendie, une fumée noire toxique peut être libérée dans l’atmosphère. De nombreux produits chimiques utilisés dans la fabrication des pneus sont transportés dans cette fumée. La majorité des matériaux utilisés pour les pneus proviennent de combustibles fossiles. Ils sont extrêmement combustibles et difficiles à éteindre une fois qu’ils ont pris feu. Un petit monticule de pneus en feu peut continuer à brûler pendant des mois avant de manquer de carburant.

Développements récents

- En octobre 2022, China Sunsine Chemical Holdings a lancé le projet MBT qui implique une nouvelle technologie qui les aide à augmenter leur production par phases pour répondre à leurs demandes.

- En mai 2022, les activités de FLEXSYS se sont rendues au « Tire Technology Expo 2022 » de Hanovre, en Allemagne. Cette manifestation a permis de démontrer les nouveaux développements technologiques sur le marché du soufre insoluble et d'améliorer la réputation de l'entreprise sur le marché.

- En décembre 2021, OCCL a entamé sa première phase d'expansion de la capacité de production de soufre insoluble, soit 5 500 MTPA. Ces produits IS sont vendus sous le nom de « DIAMOND SULF » principalement comme agents de vulcanisation dans l'industrie du pneumatique.

- En novembre 2021, One Rock Capital Partners, LLC, une société de capital-investissement axée sur la valeur et l'exploitation, a annoncé aujourd'hui que l'une de ses filiales a finalisé avec succès l'acquisition précédemment annoncée de l'activité d'additifs pour pneus d'Eastman Chemical Company, FLEXSYS. Eastman Chemical Company est un leader dans le domaine des produits chimiques spécialisés essentiels pour l'industrie du pneu, avec une présence mondiale sur ses actifs et des services techniques de premier ordre.

Portée du marché du soufre insoluble pour le secteur automobile au Moyen-Orient et en Afrique

Le marché du soufre insoluble pour le secteur automobile au Moyen-Orient et en Afrique est segmenté en trois segments notables en fonction de la qualité, du produit et de l'application. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Grade

- Niveaux réguliers

- Nuances à haute dispersion

- Nuances à haute stabilité

- Catégories spéciales

Sur la base de la qualité, le marché est segmenté en qualités régulières, qualités à haute dispersion, qualités à haute stabilité et qualités spéciales.

Produit

- Soufre insoluble rempli d'huile

- Soufre insoluble non rempli d'huile

Sur la base du produit, le marché est segmenté en soufre insoluble rempli d’huile et en soufre insoluble non rempli d’huile.

Application

- Pneu

- Sans pneu

Sur la base de l'application, le marché est segmenté en pneumatiques et hors pneumatiques.

Analyse/perspectives régionales du marché du soufre insoluble pour le secteur automobile au Moyen-Orient et en Afrique

Le marché du soufre insoluble du Moyen-Orient et de l’Afrique pour le secteur automobile est segmenté en trois segments notables en fonction de la qualité, du produit et de l’application.

Les pays couverts dans ce rapport de marché sont l’Arabie saoudite, l’Arabie saoudite, l’Afrique du Sud, l’Égypte, Israël, les Émirats arabes unis et le reste du Moyen-Orient et de l’Afrique.

Les Émirats arabes unis devraient dominer le marché du soufre insoluble au Moyen-Orient et en Afrique pour le secteur automobile en raison du besoin croissant d'IS dans l'industrie du caoutchouc en tant qu'agent de vulcanisation.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse de la concurrence et des parts de marché du soufre insoluble pour le secteur automobile au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché du soufre insoluble pour le secteur automobile au Moyen-Orient et en Afrique fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications et la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Certains des principaux acteurs du marché opérant sur ce marché sont Grupa Azoty, SHIKOKU CHEMICALS CORPORATION (une filiale de SHIKOKU KASEI HOLDINGS CORPORATION), FLEXSYS, Lions Industries sro, China Sunsine Chemical Holdings, Oriental Carbon and Chemicals Limited, LANXESS, Joss Elastomers & Chemicals, SANSHIN CHEMICAL INDUSTRY CO., LTD., Leader Technologies Co., Ltd et WUXI HUASHENG RUBBER TECHNICAL CO., LTD entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THE THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTIC COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.6 IMPORT EXPORT SCENARIO

4.7 PRICE ANALYSIS

4.8 PRODUCTION CONSUMPTION ANALYSIS

4.9 RAW MATERIAL COVERAGE

4.1 TIRE MARKET- VOLUME DEMAND

4.11 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 WORLDWIDE INCREASE IN THE NUMBER OF ON-ROAD VEHICLES UTILIZATION

6.1.2 MANUFACTURING AND SALES OF TIRES AROUND THE WORLD MAKES USE OF INSOLUBLE SULFUR EXTENSIVELY

6.1.3 INCREASING NEED FOR INSOLUBLE SULFUR FROM THE RUBBER INDUSTRY AS A VULCANIZING AGENT

6.2 RESTRAINTS

6.2.1 VOLATILITY IN RAW MATERIAL PRICES AFFECTING THE COST OF PRODUCTS

6.2.2 STRINGENT RULES AND REGULATIONS

6.3 OPPORTUNITIES

6.3.1 NEW PRODUCT INNOVATION AND INCREASING R&D ACTIVITIES

6.3.2 DEVELOPMENT OF MORE FUEL-EFFICIENT TIRES

6.4 CHALLENGE

6.4.1 ENVIRONMENTAL AND ECONOMIC ISSUES

7 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY REGION

7.1 MIDDLE EAST AND AFRICA

7.1.1 UNITED ARAB EMIRATES

7.1.2 SAUDI ARABIA

7.1.3 EGYPT

7.1.4 SOUTH AFRICA

7.1.5 ISRAEL

7.1.6 REST OF MIDDLE EAST AND AFRICA

8 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

8.2 FACILITY EXPANSION

8.3 ACQUISITION

8.4 EVENT

9 COMPANY PROFILES

9.1 ORIENTAL CARBON AND CHEMICALS LIMITED

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 COMPANY SHARE ANALYSIS

9.1.4 PRODUCT PORTFOLIO

9.1.5 SWOT ANALYSIS

9.1.6 RECENT DEVELOPMENT

9.2 SHIKOKU CHEMICALS CORPORATION. (SUBSIDIARY OF SHIKOKU KASEI HOLDINGS CORPORATION.)

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 SWOT ANALYSIS

9.2.5 PRODUCT PORTFOLIO

9.2.6 RECENT DEVELOPMENTS

9.3 LANXESS

9.3.1 COMPANY SNAPSHOT

9.3.2 COMPANY SHARE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 REVENUE ANALYSIS

9.3.5 SWOT ANALYSIS

9.3.6 RECENT DEVELOPMENTS

9.4 JOSS ELASTOMERS AND CHEMICALS

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 SWOT

9.4.5 RECENT DEVELOPMENTS

9.5 LEADER TECHNOLOGIES CO., LTD

9.5.1 COMPANY SNAPSHOT

9.5.2 COMPANY SHARE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 SWOT

9.5.5 RECENT DEVELOPMENTS

9.6 ALBEMARLE CORPORATION

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 SWOT ANALYSIS

9.6.4 RECENT DEVELOPMENT

9.7 MIDDLE EAST & AFRICA SUNSINE CHEMICAL HOLDINGS.

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 SWOT ANALYSIS

9.7.5 RECENT DEVELOPMENT

9.8 FLEXSYS

9.8.1 COMPANY SNAPSHOT

9.8.2 SWOT ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 RECENT DEVELOPMENTS

9.9 GRUPA AZOTY.

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 SWOT ANALYSIS

9.9.4 PRODUCT PORTFOLIO

9.9.5 RECENT DEVELOPMENTS

9.1 LIONS INDUSTRIES S.R.O.

9.10.1 COMPANY SNAPSHOT

9.10.2 SWOT ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENTS

9.11 NYNAS AB

9.11.1 COMPANY SNAPSHOT

9.11.2 REVENUE ANALYSIS

9.11.3 SWOT ANALYSIS

9.11.4 RECENT DEVELOPMENTS

9.12 SANSHIN CHEMICAL INDUSTRY CO., LTD.

9.12.1 COMPANY SNAPSHOT

9.12.2 PRODUCT PORTFOLIO

9.12.3 SWOT

9.12.4 RECENT DEVELOPMENTS

9.13 WUXI HUASHENG RUBBER TECHNICAL CO., LTD

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 SWOT

9.13.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY COUNTRY, 2021-2030 (TONS)

TABLE 4 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 6 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 8 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 9 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 10 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 11 UNITED ARAB EMIRATES INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 13 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 14 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 SAUDI ARABIA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 16 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 17 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 18 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 19 EGYPT INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 20 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 21 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 22 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 SOUTH AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 24 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 25 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

TABLE 26 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 ISRAEL INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 REST OF MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (USD THOUSAND)

TABLE 29 REST OF MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR, BY GRADE, 2021-2030 (TONS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR

FIGURE 2 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: THE GRADE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: SEGMENTATION

FIGURE 14 WORLDWIDE INCREASE IN THE NUMBER OF ON-ROAD VEHICLES UTILIZATION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR IN THE FORECAST PERIOD

FIGURE 15 THE REGULAR GRADES IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR IN 2023 AND 2030

FIGURE 16 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 PRICE ANALYSIS FOR THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR (USD/KG)

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR

FIGURE 20 NUMBER OF CAR SALES IN THE U.S. FROM 2018 TO 2022 (IN MILLION)

FIGURE 21 NUMBER OF PASSENGER CAR SALES IN EUROPE FROM 2017 TO 2021 (IN MILLION)

FIGURE 22 REVENUE OF THE MIDDLE EAST & AFRICA TOP TIRE MANUFACTURING COMPANIES (IN USD MILLION)

FIGURE 23 MIDDLE EAST & AFRICA SUNSINE CHEMICAL HOLDINGS LTD. INSOLUBLE SULFUR SALES VOLUME (IN TONS)

FIGURE 24 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: SNAPSHOT (2022)

FIGURE 25 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BY COUNTRY (2022)

FIGURE 26 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BY COUNTRY (2023 & 2030)

FIGURE 27 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BY COUNTRY (2022 & 2030)

FIGURE 28 MIDDLE EAST AND AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: BYGRADE (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA INSOLUBLE SULFUR MARKET FOR AUTOMOTIVE SECTOR: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.