Middle East And Africa Industrial Machine Vision Market

Taille du marché en milliards USD

TCAC :

%

USD

4.92 Billion

USD

1.83 Billion

2024

2032

USD

4.92 Billion

USD

1.83 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 1.83 Billion | |

|

|

|

|

Segmentation du marché de la vision industrielle au Moyen-Orient et en Afrique, par composant (matériel et logiciel), produit (système de vision par caméra intelligente/capteur intelligent, système de vision hybride par caméra intelligente et PC), type (systèmes de vision 2D, 3D et 1D), déploiement (cellule robotisée et général), applications (détection de défauts, inspection de produits, inspection de surface, inspection d'emballages, identification, OCR/OCV, reconnaissance de formes, calibrage, guidage et suivi des pièces, inspection de bandes, etc.), utilisateur final (automobile, électronique grand public, agroalimentaire et emballage, produits pharmaceutiques, métaux, imprimerie, aérospatiale, verre, caoutchouc et plastique, exploitation minière, textiles, bois et papier, machines, fabrication de panneaux solaires, etc.) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de la vision industrielle au Moyen-Orient et en Afrique

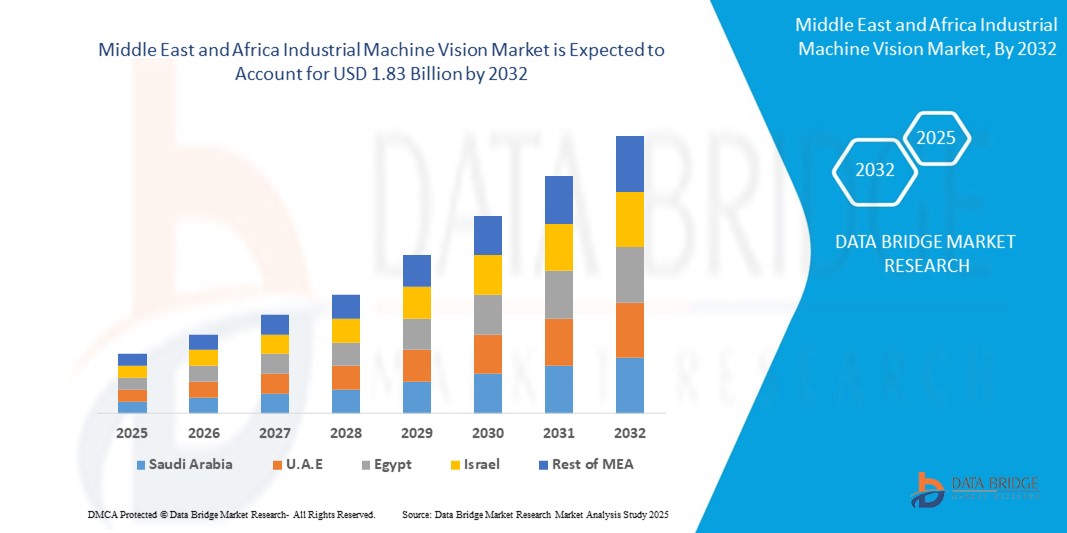

- La taille du marché de la vision industrielle au Moyen-Orient et en Afrique était évaluée à 4,92 milliards USD en 2024 et devrait atteindre 1,83 milliard USD d'ici 2032 , à un TCAC de 6,83 % au cours de la période de prévision.

- L'importance croissante accordée au contrôle qualité et à l'inspection est un moteur important du marché de la vision industrielle et joue un rôle crucial dans son expansion. Alors que les industries de divers secteurs s'efforcent de respecter des normes de qualité strictes et de maintenir leur avantage concurrentiel, la demande en systèmes de vision industrielle avancés a explosé. Ces systèmes sont essentiels à l'automatisation du processus d'inspection, garantissant cohérence, précision et efficacité du contrôle qualité, ce qui stimule in fine la croissance du marché.

Analyse du marché de la vision industrielle au Moyen-Orient et en Afrique

- L'importance croissante accordée au contrôle qualité et à l'inspection est un moteur important du marché de la vision industrielle et joue un rôle crucial dans son expansion. Alors que les industries de divers secteurs s'efforcent de respecter des normes de qualité strictes et de maintenir leur avantage concurrentiel, la demande en systèmes de vision industrielle avancés a explosé. Ces systèmes sont essentiels à l'automatisation du processus d'inspection, garantissant cohérence, précision et efficacité du contrôle qualité, ce qui stimule in fine la croissance du marché.

- Le marché de la vision industrielle des Émirats arabes unis devrait dominer avec la plus grande part de marché de 53,12 %, soutenu par l'accent mis par le pays sur la fabrication intelligente, le développement des infrastructures et les industries axées sur l'innovation.

- Le marché de la vision industrielle en Arabie saoudite devrait croître à un TCAC le plus rapide de 13,67 % au cours de la période de prévision, propulsé par l'initiative Vision 2030 du pays, qui donne la priorité à la diversification industrielle et à l'adoption de technologies intelligentes.

- Le segment du matériel a dominé le marché avec la plus grande part de revenus de 67,4 % en 2024, stimulé par une forte demande de caméras, de capteurs, d'objectifs et de systèmes d'éclairage qui servent de base aux systèmes de vision

Portée du rapport et segmentation du marché de la vision industrielle au Moyen-Orient et en Afrique

|

Attributs |

Aperçu du marché de la vision industrielle au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de la vision industrielle au Moyen-Orient et en Afrique

Adoption croissante de l'inspection de la qualité et de l'automatisation basées sur l'IA

- Une tendance clé et croissante sur le marché de la vision industrielle au Moyen-Orient et en Afrique (MEA) est l'adoption croissante de systèmes de vision basés sur l'IA pour l'inspection automatisée, le contrôle qualité et la maintenance prédictive . L'intégration de l' intelligence artificielle à la vision industrielle améliore la précision, réduit les erreurs humaines et permet une prise de décision en temps réel dans les secteurs de la fabrication et de la logistique.

- Par exemple, des entreprises de la région déploient des systèmes de vision industrielle équipés d'algorithmes d'IA pour détecter les défauts sur les lignes de production, garantissant ainsi une meilleure homogénéité des produits et une réduction des pertes. Ce phénomène est particulièrement visible dans des secteurs comme l'automobile et l'agroalimentaire.

- L'utilisation de la vision artificielle pilotée par l'IA prend également en charge la maintenance prédictive en analysant les données visuelles des équipements pour identifier les premiers signes d'usure ou de pannes potentielles, minimisant ainsi les temps d'arrêt.

- En outre, les initiatives d'automatisation soutenues par les programmes de numérisation industrielle menés par le gouvernement aux Émirats arabes unis et en Arabie saoudite encouragent les entreprises à adopter des systèmes d'inspection et de surveillance plus intelligents.

- Des entreprises telles qu'OMRON et Cognex étendent leur présence dans la région MEA, en proposant des systèmes de vision industrielle basés sur l'IA et adaptés aux besoins locaux de fabrication et de logistique.

- Cette tendance reflète l'évolution croissante vers les pratiques de l'Industrie 4.0 sur le marché MEA, alors que les entreprises accordent de plus en plus la priorité à l'efficacité, à la sécurité et à l'intelligence opérationnelle.

Dynamique du marché de la vision industrielle au Moyen-Orient et en Afrique

Conducteur

Initiatives croissantes en matière d'automatisation industrielle et de fabrication intelligente

- L'expansion rapide de l'automatisation industrielle, soutenue par des stratégies de transformation nationales telles que les initiatives Saudi Vision 2030 et Industrie 4.0 des Émirats arabes unis, est un moteur majeur de l'adoption de systèmes de vision industrielle dans la région.

- Par exemple, en mai 2024, Cognex Corporation s'est associée à des distributeurs régionaux pour fournir des solutions de vision industrielle à travers le Moyen-Orient, permettant aux fabricants d'atteindre une productivité et une précision accrues.

- Les systèmes de vision industrielle sont déployés dans les secteurs de l'automobile, de l'emballage et de l'industrie pharmaceutique pour améliorer l'assurance qualité, rationaliser les opérations et réduire la dépendance à l'inspection manuelle.

- La demande croissante de contrôle qualité fiable, de traçabilité et de conformité aux normes de fabrication mondiales accélère la croissance du marché

- En outre, le besoin de transformation numérique et de compétitivité dans les chaînes d'approvisionnement mondiales incite les fabricants de la région MEA à adopter des technologies d'automatisation avancées, faisant de la vision industrielle un élément essentiel.

Retenue/Défi

Coûts de déploiement élevés et expertise technique limitée

- Malgré un intérêt croissant, le marché MEA est confronté à des défis liés aux investissements initiaux importants requis pour les systèmes de vision industrielle, notamment les caméras, les capteurs et les logiciels pilotés par l'IA. Pour de nombreuses PME, ces coûts constituent un frein à l'adoption.

- Par exemple, plusieurs fabricants locaux en Afrique restent dépendants de processus d’inspection manuels en raison de contraintes budgétaires, ce qui limite la pénétration de solutions avancées de vision industrielle.

- Un autre frein majeur est la pénurie de professionnels qualifiés capables d'intégrer et de maintenir les systèmes de vision industrielle. Le manque d'expertise technique interne accroît la dépendance à l'égard des fournisseurs externes, ce qui accroît les coûts opérationnels.

- Les préoccupations en matière de cybersécurité liées aux systèmes de vision connectés au cloud découragent davantage l’adoption dans certains secteurs où la sensibilité des données est élevée

- Des entreprises comme OMRON et SICK AG relèvent ces défis en proposant des solutions modulaires et économiques ainsi que des programmes de formation pour développer l'expertise locale. Cependant, l'accessibilité financière et la maturité technique demeurent des obstacles.

- Surmonter ces défis grâce à des partenariats régionaux, des incitations gouvernementales et la formation de la main-d'œuvre sera essentiel pour une adoption durable des technologies de vision artificielle au Moyen-Orient et en Afrique.

Portée du marché de la vision industrielle au Moyen-Orient et en Afrique

Le marché est segmenté sur la base du composant, du produit, du type, du déploiement, des applications et de l'utilisateur final.

- Par composant

En termes de composants, le marché de la vision industrielle est segmenté en matériel et en logiciel. Le segment matériel a dominé le marché avec une part de chiffre d'affaires de 67,4 % en 2024, portée par une forte demande de caméras, de capteurs, d'objectifs et de systèmes d'éclairage qui constituent la base des systèmes de vision. Le besoin de dispositifs d'acquisition d'images hautes performances dans les secteurs de l'automobile, de l'électronique et de l'emballage continue de stimuler l'adoption du matériel. De plus, les progrès des capteurs CMOS et des caméras haute résolution renforcent cette domination.

Le segment des logiciels devrait connaître le TCAC le plus rapide, soit 21,2 % entre 2025 et 2032, grâce à la demande croissante de traitement d'images basé sur l'IA, d'algorithmes d'apprentissage profond et d'analyse de données pour améliorer la précision et l'automatisation de la détection. L'évolution croissante vers des systèmes de vision intelligents et adaptatifs, nécessitant moins d'intervention humaine, fait des logiciels le moteur essentiel de l'expansion future du marché.

- Par produit

En termes de produits, le marché de la vision industrielle est segmenté en systèmes de vision par caméra/capteur intelligent, systèmes de vision hybrides par caméra intelligente et systèmes sur PC. Le segment des PC a représenté la plus grande part de chiffre d'affaires, avec 52,8 % en 2024, grâce à sa puissance de traitement supérieure, sa flexibilité et sa capacité à réaliser des tâches d'inspection complexes dans les secteurs de l'automobile, des semi-conducteurs et de l'aérospatiale. Sa capacité à gérer des configurations multi-caméras et des applications logicielles avancées justifie sa préférence continue.

Parallèlement, le segment des systèmes de vision par caméras et capteurs intelligents devrait enregistrer le TCAC le plus rapide, soit 22,6 % entre 2025 et 2032, en raison de la demande croissante de solutions compactes, économiques et conviviales. Les caméras intelligentes réduisent le câblage, nécessitent moins de maintenance et intègrent des fonctionnalités basées sur l'IA, ce qui les rend très attractives pour les PME des secteurs de l'agroalimentaire, de l'emballage et de l'électronique.

- Par type

Le marché de la vision industrielle est segmenté en systèmes de vision 1D, 2D et 3D. Le segment des systèmes de vision 2D a dominé le marché avec une part de chiffre d'affaires de 61,3 % en 2024, grâce à ses nombreuses applications dans la détection de défauts, la lecture de codes-barres, l'inspection d'emballages et la vérification d'assemblages. Leur rentabilité, leur facilité d'installation et leur fiabilité éprouvée confortent leur position de leader dans divers secteurs.

Le segment des systèmes de vision 3D devrait connaître le TCAC le plus rapide de 23,4 % entre 2025 et 2032, alimenté par une adoption croissante dans les secteurs de la robotique, de l'automobile et de l'électronique. Les systèmes 3D offrent une perception de la profondeur, une mesure spatiale précise et des capacités avancées de reconnaissance de formes, ce qui les rend essentiels pour des applications telles que le prélèvement de bacs, le guidage robotisé et l'inspection d'assemblages complexes.

- Par déploiement

En termes de déploiement, le marché de la vision industrielle est segmenté en cellules robotisées et en vision générale. Le segment du déploiement général détenait la plus grande part de chiffre d'affaires du marché, soit 68,9 % en 2024, grâce à une utilisation généralisée dans les postes d'inspection autonomes, le contrôle qualité et les lignes de conditionnement. Sa flexibilité et sa rentabilité en font un produit largement adopté par les PME et les grandes entreprises des secteurs de l'agroalimentaire, de l'impression et des biens de consommation.

Le segment des cellules robotisées devrait enregistrer le TCAC le plus rapide, soit 20,8 %, entre 2025 et 2032, grâce à l'accélération de l'intégration de la vision industrielle aux robots industriels. Les cellules robotisées permettent un guidage en temps réel, un assemblage précis et une détection automatisée des défauts, conformément aux initiatives de l'Industrie 4.0 et de la fabrication intelligente. La hausse des coûts de main-d'œuvre et la demande d'automatisation dans les secteurs de l'automobile et de l'électronique renforcent encore cette tendance.

- Par application

En fonction des applications, le marché de la vision industrielle est segmenté en détection de défauts, inspection de produits, inspection de surfaces, inspection d'emballages, identification, OCR/OCV, reconnaissance de formes, calibrage, guidage et suivi des pièces, inspection de bandes, etc. Le segment de l'inspection de produits a dominé avec une part de chiffre d'affaires de 26,5 % en 2024, l'assurance qualité restant un facteur essentiel dans les secteurs de l'automobile, de l'électronique et de la pharmacie. Sa capacité à réduire les rappels et à améliorer la conformité renforce la demande.

Le segment du guidage et du suivi des pièces devrait connaître une croissance annuelle composée (TCAC) record de 24,1 % entre 2025 et 2032, grâce à l'adoption croissante de systèmes de vision robotisée par les fabricants pour l'assemblage, le prélèvement en bacs et la manutention. L'essor des robots autonomes et collaboratifs dans le secteur manufacturier renforce la demande de suivi et de navigation précis des pièces.

- Par utilisateur final

En fonction de l'utilisateur final, le marché de la vision industrielle est segmenté en : automobile, électronique grand public, agroalimentaire et emballage, produits pharmaceutiques, métaux, imprimerie, aérospatiale, verre, caoutchouc et plastique, mines, textiles, bois et papier, machines, fabrication de panneaux solaires, etc. Le segment automobile a dominé avec la plus grande part de chiffre d'affaires (31,7 %) en 2024, porté par l'automatisation croissante des chaînes de montage, la demande d'inspection de précision et les exigences d'assurance qualité. Les systèmes de vision sont essentiels à la détection des défauts, au guidage robotique et à la vérification des pièces dans la fabrication automobile.

Le secteur pharmaceutique devrait connaître le TCAC le plus rapide, soit 22,9 % entre 2025 et 2032, grâce à des normes réglementaires strictes, à la demande de sérialisation et à la nécessité d'une inspection précise des emballages et des étiquetages de médicaments. L'adoption croissante de la vision industrielle pour garantir la conformité, réduire les erreurs et préserver la sécurité des produits fait de ce segment le secteur de croissance le plus dynamique.

Analyse régionale du marché de la vision industrielle

- Le marché de la vision industrielle des Émirats arabes unis devrait dominer avec la plus grande part de marché de 53,12 %, soutenu par l'accent mis par le pays sur la fabrication intelligente, le développement des infrastructures et les industries axées sur l'innovation.

- Les solutions de vision industrielle sont intégrées aux chaînes de logistique, d'emballage et d'assemblage automobile, reflétant la volonté des Émirats arabes unis d'automatiser et d'assurer une qualité de pointe. Dubaï et Abou Dhabi sont à la pointe des investissements dans la transformation numérique et les technologies basées sur l'IA, renforçant ainsi les perspectives de croissance du marché.

- En outre, le rôle des Émirats arabes unis en tant que plaque tournante du commerce régional alimente la demande de systèmes d’inspection fiables pour soutenir les exportations et la conformité réglementaire.

Aperçu du marché de la vision industrielle en Arabie saoudite

Le marché saoudien de la vision industrielle devrait connaître une croissance annuelle composée (TCAC) record de 13,67 % au cours de la période de prévision, grâce à l'initiative Vision 2030 du pays, qui privilégie la diversification industrielle et l'adoption de technologies intelligentes. Le secteur manufacturier intègre de plus en plus de systèmes d'inspection avancés pour répondre aux normes de qualité mondiales, notamment dans les secteurs de l'automobile, de l'agroalimentaire et des produits pharmaceutiques. L'urbanisation rapide et les projets de développement des infrastructures stimulent également la demande de solutions de vision industrielle pour les contrôles d'emballage, d'identification et de sécurité. Les programmes de transformation numérique soutenus par le gouvernement et les investissements étrangers dans les industries intelligentes accélèrent encore leur adoption.

Aperçu du marché de la vision industrielle en Afrique du Sud

Le marché sud-africain de la vision industrielle est voué à une croissance soutenue, porté par les besoins croissants en automatisation des secteurs minier, automobile et agroalimentaire. Les industries locales adoptent des systèmes de vision pour améliorer leur efficacité opérationnelle, réduire les erreurs et garantir leur conformité aux normes internationales de qualité. La demande croissante de systèmes d'inspection des emballages, de détection des défauts et de guidage est particulièrement forte dans les secteurs des biens de consommation et de l'exportation. Par ailleurs, les efforts déployés par le gouvernement pour moderniser les opérations industrielles et l'adoption croissante de la robotique et des pratiques de fabrication intelligente stimulent la demande de solutions de vision industrielle dans tout le pays.

Part de marché de la vision industrielle au Moyen-Orient et en Afrique

L'industrie de la vision industrielle est principalement dirigée par des entreprises bien établies, notamment :

- OMRON Corporation (Japon)

- Sony Semiconductor Solutions Corporation (Japon)

- Cognex Corporation (États-Unis)

- SICK AG (États-Unis)

- Teledyne FLIR LLC (États-Unis)

- NATIONAL INSTRUMENTS CORP. (États-Unis)

- Intel Corporation (États-Unis)

- Cadence Design Systems, Inc. (États-Unis)

Quels sont les développements récents sur le marché de la vision industrielle au Moyen-Orient et en Afrique ?

- En mars 2024, Cognex a lancé la série DataMan 8700, un lecteur de codes-barres portable de nouvelle génération basé sur une plateforme entièrement nouvelle. Cet appareil offre des performances avancées, une grande simplicité d'utilisation et ne nécessite aucun réglage préalable ni formation de l'opérateur. Cette version renforce l'engagement de Cognex à simplifier les opérations tout en proposant des solutions de lecture hautes performances aux industries.

- En février 2024, OMRON Automation a lancé en Inde les robots collaboratifs de la série TM S, équipés d'articulations plus rapides et de fonctions de sécurité renforcées. Ces innovations améliorent considérablement l'efficacité des usines dans les espaces de travail partagés. Ce lancement souligne l'engagement d'OMRON à promouvoir une robotique collaborative sûre et productive pour l'automatisation industrielle.

- En mars 2023, KEYENCE CORPORATION a dévoilé son système de vision série VS, conçu pour améliorer l'automatisation industrielle grâce à un traitement d'image avancé, une inspection à grande vitesse et une utilisation intuitive. Ce système est particulièrement adapté à l'amélioration du contrôle qualité et de l'efficacité de la production. Ce lancement témoigne de l'engagement de Keyence à fournir une technologie de vision de pointe pour un large éventail d'applications industrielles.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.