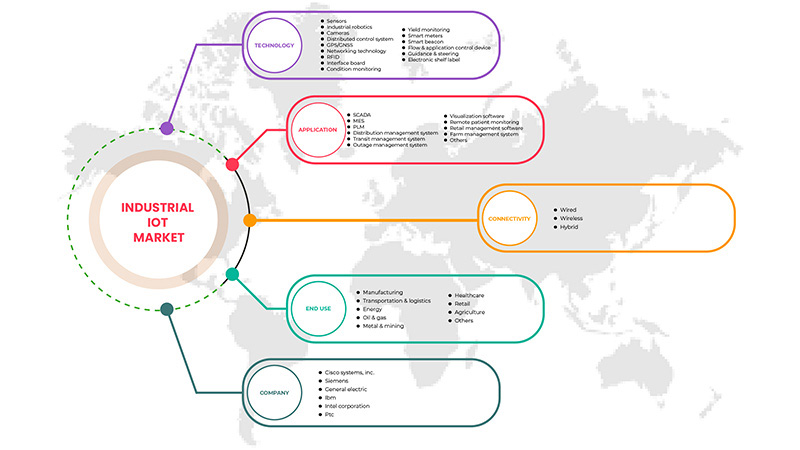

Marché de l’IoT industriel au Moyen-Orient et en Afrique, par technologie (capteurs, robotique industrielle, caméras, système de contrôle distribué, GPS/GNSS, technologie de mise en réseau, RFID, carte d’interface, surveillance de l’état, surveillance du rendement, compteurs intelligents, balise intelligente, dispositif de contrôle de flux et d’application, guidage et direction, et étiquette électronique de rayon ), application (SCADA, MES, PLM, système de gestion de la distribution, système de gestion du transit, système de gestion des pannes, logiciel de visualisation, surveillance à distance des patients, logiciel de gestion de la vente au détail, système de gestion agricole et autres), connectivité (filaire, sans fil et hybride), utilisation finale (fabrication, transport et logistique, énergie, pétrole et gaz, métaux et mines, soins de santé, vente au détail, agriculture et autres) – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché de l'IoT industriel au Moyen-Orient et en Afrique

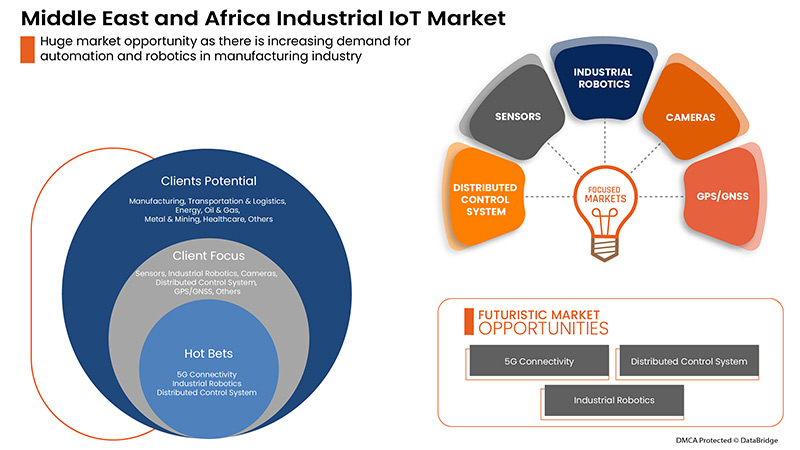

L'utilisation accrue du marché de l'IoT industriel en raison de l'adoption de l'intelligence artificielle (IA) et de l'apprentissage automatique (ML) dans l'industrie des utilisateurs finaux stimule également la croissance du marché. La probabilité accrue de vol d'appareils et de violations de données devrait restreindre le marché de l'IoT industriel. La pénétration croissante d'Internet et la numérisation à travers le monde sont une opportunité pour le marché de l'IoT industriel. Les coûts d'installation élevés et les difficultés d'intégration des appareils IoT constituent un défi pour le marché de l'IoT industriel au Moyen-Orient et en Afrique.

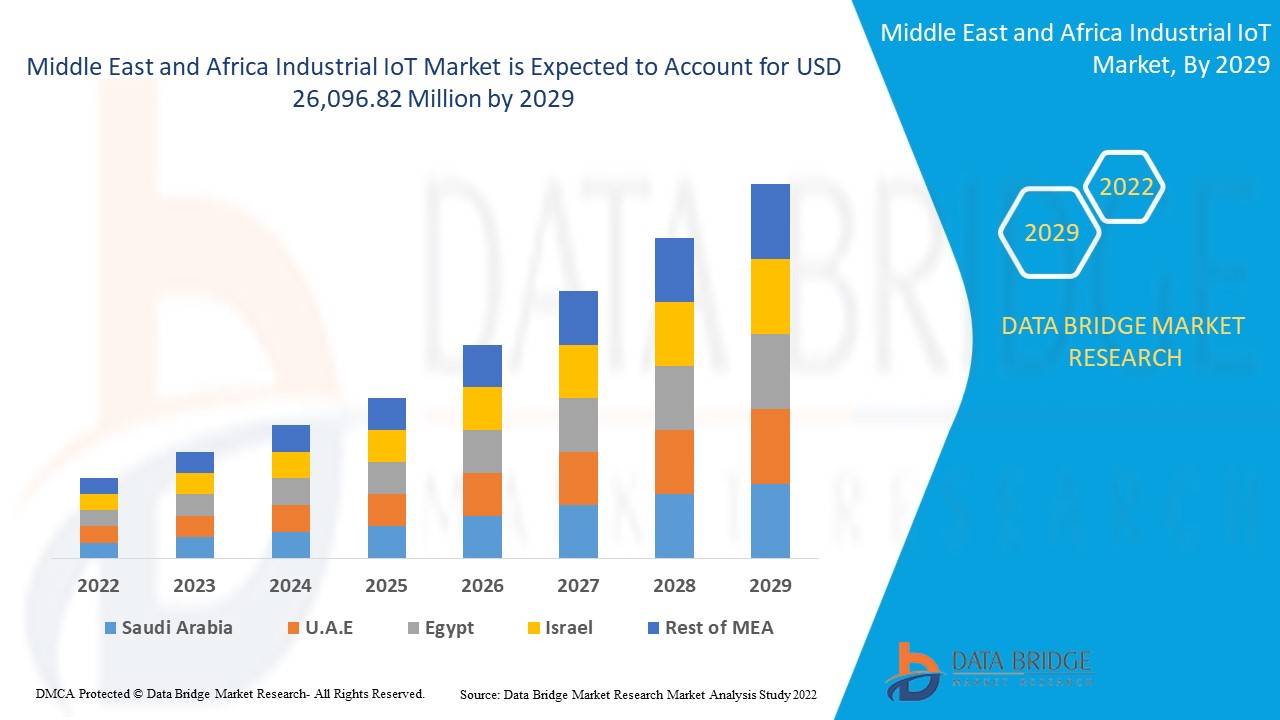

Data Bridge Market Research analyse que le marché de l'IoT industriel au Moyen-Orient et en Afrique devrait atteindre 26 096,82 millions USD d'ici 2029, à un TCAC de 8,5 % au cours de la période de prévision. Les « capteurs » représentent le segment technologique le plus important, car ce type de technologie est très demandé et constitue la meilleure option pour extraire des informations des composants industriels. Le rapport sur le marché de l'IoT industriel couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par technologie (capteurs, robotique industrielle, caméras, système de contrôle distribué, GPS/GNSS, technologie de réseau, RFID, carte d'interface, surveillance de l'état, surveillance du rendement, compteurs intelligents, balise intelligente, dispositif de contrôle de flux et d'application, guidage et pilotage, et étiquette électronique de rayon), application (SCADA, MES, PLM, système de gestion de la distribution, système de gestion du transit, système de gestion des pannes, logiciel de visualisation, surveillance à distance des patients, logiciel de gestion de la vente au détail, système de gestion agricole et autres), connectivité (filaire, sans fil et hybride), utilisation finale (fabrication, transport et logistique, énergie, pétrole et gaz, métallurgie et mines, soins de santé, vente au détail, agriculture et autres) - Tendances et prévisions de l'industrie jusqu'en 2029 |

|

Pays couverts |

Arabie saoudite, Afrique du Sud, Égypte, Israël, reste du Moyen-Orient et Afrique |

|

Acteurs du marché couverts |

Cisco Systems, Inc., Siemens, General Electric, IBM Corporation, Intel Corporation, PTC, Honeywell International Inc., NEC Corporation, Rockwell Automation, ABB, SAP SE, Texas Instruments Incorporated, Robert Bosch GmbH, Emerson Electric Co., Microsoft, KUKA AG, Sigfox Network Limited (une filiale d'UnaBiz), Wipro, Arm Limited (une filiale de Softbank Group Corp.) et Huawei Technologies Co., Ltd., entre autres |

Définition du marché

L'extension et l'application de l'Internet des objets (IoT) dans les secteurs et applications industriels sont appelées Internet industriel des objets (IIoT). L'Internet des objets machine à machine (M2M) (IIoT) permet aux entreprises et aux industries de fonctionner de manière plus efficace et plus fiable en raison de l'importance accordée à la connectivité M2M, au big data et à l'apprentissage automatique. Les applications industrielles telles que la robotique, la technologie médicale et les processus de production définis par logiciel sont toutes incluses dans l'IIoT.

Dynamique du marché de l'IoT industriel

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de l'adoption de l'intelligence artificielle (IA) et de l'apprentissage automatique (ML) dans l'industrie des utilisateurs finaux

La popularité de l’IA et du ML augmente d’année en année dans divers secteurs tels que la fabrication, la santé, l’énergie, le pétrole et le gaz, et bien d’autres. La plupart de ces secteurs adoptent la technologie pour accroître l’efficacité du travail, automatiser le processus de prestation de services et moderniser les offres, ce qui a joué un rôle important dans la concurrence avec les concurrents sur le marché. Ainsi, la tendance croissante de l’adoption de l’IA et du ML est un moteur majeur de la croissance du marché de l’IoT industriel au Moyen-Orient et en Afrique.

- Augmentation de la mise en œuvre de capteurs et de systèmes de contrôle distribués dans les opérations commerciales

L'adoption de capteurs et de systèmes de contrôle distribués permettra de contrôler et de gérer le processus de travail et d'automatiser le processus de gestion de tous les processus industriels. Ainsi, la demande de mise en œuvre de capteurs et de DCS dans diverses opérations commerciales augmentera chaque année. Ainsi, à l'échelle mondiale, le besoin de capteurs et de DCS augmente en raison de divers avantages associés à la mise en œuvre. Et favorise la croissance du marché de l'IoT industriel au Moyen-Orient et en Afrique et agit comme un moteur de la croissance du marché.

- Augmentation du besoin de solutions et de services de données en temps réel

Les solutions de données en temps réel nécessitent une large gamme d'appareils électroniques, et la demande en appareils IoT devrait augmenter en raison de la nécessité de prendre en charge l'analyse des données en temps réel dans les opérations commerciales, de favoriser la compréhension rapide des données et de guider les décisions de livraison de produits ou de services aux clients. Il existe donc une forte demande pour l'adoption de solutions en temps réel, qui impliquent directement l'utilisation d'appareils IoT pour les industries. Par conséquent, il est prévu qu'il s'agisse d'un moteur majeur de la croissance du marché.

Contraintes/Défis

- Manque de main d'oeuvre qualifiée et de sessions de formation

L'adoption de solutions IoT pour les industries n'est pas simple et rapide ; elle nécessite une visualisation détaillée et une méthode adéquate d'automatisation du secteur. Par conséquent, les utilisateurs finaux ont besoin de plus de temps et de travail pour adopter les solutions et former les employés à comprendre le fonctionnement et la maintenance.

- Probabilité accrue de vol d'appareils et de violations de données

La fiabilité du système informatique implique que les ressources, l'organisation et les informations de l'usine soient générées par ces dispositifs associés. La fiabilité est davantage responsable de l'adoption de la numérisation dans les opérations commerciales ; cependant, il existe une forte probabilité de désavantages en matière de sécurité.

- Augmentation des complexités techniques en raison des progrès technologiques quotidiens

La sécurité flexible est une idée pour fournir des soins médicaux, une formation et une aide au logement, que la personne soit officiellement employée ou non. En outre, les dossiers d'activité peuvent soutenir une formation approfondie et la reconversion des travailleurs. Quelle que soit la façon dont les gens décident d'investir leur temps, il doit y avoir des moyens pour que les gens puissent vivre une vie satisfaisante, même si la société a besoin de moins de professionnels. Ainsi, le progrès technologique continu entraînera une formation continue des employés et freinera la croissance du marché.

Impact post-COVID-19 sur le marché de l'IoT industriel

La COVID-19 a eu un impact considérable sur le marché de l'IoT industriel, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles produisant des biens essentiels. Le gouvernement a pris des mesures strictes, telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres, pour empêcher la propagation de la COVID-19. Les seules entreprises en activité dans cette situation de pandémie sont les services essentiels autorisés à ouvrir et à exécuter les processus.

La croissance du marché de l’IoT industriel est en hausse en raison de la numérisation des processus de production et des chaînes d’approvisionnement dans l’agriculture, les services publics d’électricité, l’exploitation minière, le pétrole et le gaz et les transports. De plus, l’adoption de l’IoT dans les industries a connu d’énormes progrès de 2020 à 2021, car la pandémie a démontré l’importance de l’IoT dans tous les types d’entreprises. L’augmentation de la demande d’automatisation pour éviter l’implication d’une main-d’œuvre maximale a favorisé l’adoption de l’IoT dans les industries. Cela reproduit l’impact positif de la COVID-19 sur le marché de l’IIoT, qui a encore plus catalysé l’activité grâce à l’adoption des technologies de l’industrie 4.0.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie sur le marché de l'IoT industriel. Les entreprises apporteront au marché des solutions avancées et précises.

Développement récent

- En mars 2022, Cisco Systems, Inc. a développé une plateforme avancée de centre de contrôle IoT pour améliorer la fiabilité du service et réduire les coûts opérationnels. Ce développement aidera l'entreprise à diversifier son portefeuille de solutions et à proposer des solutions de meilleure qualité

- En avril 2022, Arm Limited a lancé deux nouvelles solutions, Arm Cortex-M85 et Cortex-A. Ces nouveaux produits et solutions aideront l'entreprise à offrir de meilleures solutions aux clients, à attirer de nouveaux clients et à accélérer la croissance des revenus

Portée du marché de l'IoT industriel au Moyen-Orient et en Afrique

Le marché de l'IoT industriel est segmenté en fonction de la technologie, de l'application, de la connectivité et de l'utilisation finale. La croissance de ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par technologie

- Capteurs

- Robotique industrielle

- Caméras

- Système de contrôle distribué

- GPS/GNSS

- Technologie de mise en réseau

- RFID

- Carte d'interface

- Surveillance de l'état

- Suivi du rendement

- Compteurs intelligents

- Balise intelligente

- Dispositif de contrôle de flux et d'application

- Guidage et pilotage

- Étiquette électronique de gondole

Sur la base de la technologie, le marché de l'IoT industriel du Moyen-Orient et de l'Afrique est segmenté en capteurs, robotique industrielle, caméras, système de contrôle distribué, GPS/GNSS, technologie de réseau, RFID, carte d'interface, surveillance de l'état, surveillance du rendement, compteurs intelligents, balise intelligente, dispositif de contrôle de flux et d'application, guidage et direction, et étiquette électronique de rayon.

Par application

- SCADA

- Mes

- PLM

- Système de gestion de la distribution

- Système de gestion du transit

- Système de gestion des pannes

- Logiciel de visualisation

- Surveillance à distance des patients

- Logiciel de gestion de vente au détail

- Système de gestion agricole

- Autres

Sur la base des applications, le marché de l'IoT industriel du Moyen-Orient et de l'Afrique a été segmenté en SCADA, MES, PLM, système de gestion de la distribution, système de gestion du transit, système de gestion des pannes, logiciel de visualisation, surveillance à distance des patients, logiciel de gestion de détail, système de gestion agricole et autres.

Par connectivité

- Câblé

- Sans fil

- Hybride

Sur la base de la connectivité, le marché de l’IoT industriel du Moyen-Orient et de l’Afrique a été segmenté en filaire, sans fil et hybride.

Par utilisation finale

- Fabrication

- Transport et logistique

- Énergie

- Pétrole et gaz

- Métallurgie et mines

- Soins de santé

- Vente au détail

- Agriculture

- Autres

Sur la base de l'utilisation finale, le marché de l'IoT industriel du Moyen-Orient et de l'Afrique a été segmenté en fabrication, transport et logistique, énergie, pétrole et gaz, métaux et mines, soins de santé, vente au détail, agriculture et autres.

Analyse/perspectives régionales du marché de l'IoT industriel

Le marché de l’IoT industriel est analysé et des informations sur la taille et les tendances du marché sont fournies par technologie, application, connectivité et utilisation finale, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des appareils de l'Internet des objets (IoT) sont l'Arabie saoudite, l'Afrique du Sud, l'Égypte, Israël, le reste du Moyen-Orient et l'Afrique.

L’Arabie saoudite domine le marché de l’IoT industriel au Moyen-Orient et en Afrique. L’Arabie saoudite est susceptible d’être le marché de l’IoT industriel qui connaîtra la croissance la plus rapide. L’Arabie saoudite développe des solutions et des services basés sur le cloud conçus pour améliorer la sécurité et apporter de nouveaux niveaux d’intelligence opérationnelle aux gouvernements, aux entreprises, aux transports et aux communautés. Cela stimulera les produits IoT industriels au Moyen-Orient et en Afrique.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'IoT industriel

Le paysage concurrentiel du marché de l'IoT industriel fournit des détails sur un concurrent. Les composants inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché de l'IoT industriel.

Certains des principaux acteurs opérant sur le marché de l'IoT industriel sont :

- Cisco Systems, Inc.

- Siemens

- Général Électrique

- Société IBM

- Société Intel

- PTC

- Honeywell International Inc.

- Société NEC

- Rockwell Automation, Inc.

- ABB

- SAP SE

- Texas Instruments Incorporated

- Robert Bosch GmbH

- Société d'Électricité Emerson

- Microsoft

- KUKA SA

- Réseau de partenaires Sigfox (une filiale d'UnaBiz)

- Wipro

- Arm Limited (une filiale de Softbank Group Corp.)

- Huawei Technologies Co., Ltd.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 USE CASE ANALYSIS

4.1.1 OVERVIEW

4.1.2 PREDICTIVE MAINTENANCE

4.1.3 LOCATION TRACKING

4.1.4 WORKPLACE ANALYTICS

4.1.5 REMOTE QUALITY MONITORING

4.1.6 ENERGY OPTIMIZATION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY

5.1.2 SURGE IN IMPLEMENTATION OF SENSORS AND DISTRIBUTED CONTROL SYSTEMS IN BUSINESS OPERATIONS

5.1.3 INCREASE IN THE NEED FOR REAL-TIME DATA SOLUTIONS AND SERVICES

5.1.4 INCREASE IN THE PENETRATION OF INDUSTRY 4.0 IN AUTOMOTIVE AND MANUFACTURING INDUSTRIES

5.2 RESTRAINTS

5.2.1 LACK OF SKILLED LABOR AND TRAINING SESSIONS

5.2.2 HIGHER PROBABILITY OF DEVICE THEFT AND DATA BREACHES

5.2.3 RISE IN THE TECHNICAL COMPLEXITIES DUE TO DAY-BY-DAY TECHNOLOGICAL ADVANCEMENT

5.3 OPPORTUNITIES

5.3.1 RISE IN INTERNET PENETRATION ACROSS THE GLOBE

5.3.2 RISE IN THE DIGITALIZATION TREND

5.3.3 PROGRESSION IN SMART TECHNOLOGIES

5.3.4 HIGH ADOPTION OF CLOUD-BASED DEPLOYMENT MODEL

5.4 CHALLENGES

5.4.1 HIGH INSTALLATION COST

5.4.2 DIFFICULTIES IN INTEGRATION OF IOT DEVICES

6 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 SENSORS

6.3 INDUSTRIAL ROBOTICS

6.4 CAMERAS

6.5 DISTRIBUTED CONTROL SYSTEM

6.6 GPS/GNSS

6.7 NETWORKING TECHNOLOGY

6.8 RFID

6.9 INTERFACE BOARD

6.1 CONDITION MONITORING

6.11 YIELD MONITORING

6.12 SMART METERS

6.13 SMART BEACON

6.14 FLOW & APPLICATION CONTROL DEVICE

6.15 GUIDANCE & STEERING

6.16 ELECTRONIC SHELF LABEL

7 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SCADA

7.3 MES

7.4 PLM

7.5 DISTRIBUTED CONTROL SYSTEM

7.6 TRANSIT MANAGEMENT SYSTEM

7.7 OUTAGE MANAGEMENT SYSTEM

7.8 VISUALIZATION SOFTWARE

7.9 REMOTE PATIENT MONITORING

7.1 RETAIL MANAGEMENT SOFTWARE

7.11 FARM MANAGEMENT SYSTEM

7.12 OTHERS

8 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY

8.1 OVERVIEW

8.2 WIRED

8.3 WIRELESS

8.4 HYBRID

9 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY END USE

9.1 OVERVIEW

9.2 MANUFACTURING

9.3 TRANSPORTATION & LOGISTICS

9.4 ENERGY

9.5 OIL & GAS

9.6 METAL & MINING

9.7 HEALTHCARE

9.8 RETAIL

9.9 AGRICULTURE

9.1 OTHERS

10 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SAUDI ARABIA

10.1.2 SOUTH AFRICA

10.1.3 EGYPT

10.1.4 ISRAEL

10.1.5 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 CISCO SYSTEMS, INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SIEMENS

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 GENERAL ELECTRIC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 IBM CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 INTEL CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ARM LIMITED (A SUBSIDIAIRY OF SOFTBANK GROUP)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EMERSON ELECTRIC CO.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HONEYWELL INTERNATIONAL INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 HUAWEI TECHNOLOGIES CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KUKA AG

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 MICROSOFT

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 NEC CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 PTC

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 ROBERT BOSCH GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 ROCKWELL AUTOMATION, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SAP SE

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 SIGFOX PARTNER NETWORK

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 TEXAS INSTRUMENTS INCORPORATED

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 WIPRO

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SENSORS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA INDUSTRIAL ROBOTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CAMERAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA GPS/GNSS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA NETWORKING TECHNOLOGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA RFID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA INTERFACE BOARD IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA CONDITION MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA YIELD MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SMART METERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SMART BEACON IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA FLOW & APPLICATION CONTROL DEVICE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA GUIDANCE & STEERING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA ELECTRONIC SHELF LABEL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA SCADA IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MES IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PLM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA TRANSIT MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OUTAGE MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA VISUALIZATION SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA REMOTE PATIENT MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA RETAIL MANAGEMENT SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FARM MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA WIRED IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA WIRELESS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA HYBRID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA MANUFACTURING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA TRANSPORTATION & LOGISTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA ENERGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA OIL & GAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA METAL & MINING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA HEALTHCARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA RETAIL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA AGRICULTURE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 48 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 56 EGYPT INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 57 EGYPT INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 EGYPT INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 59 EGYPT INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 64 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 11 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SCADA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET IN 2022 AND 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET

FIGURE 14 AI ADOPTION RATES AROUND THE GLOBE

FIGURE 15 COMPANIES GETTING BENEFITS FROM ANALYTICAL SOLUTIONS

FIGURE 16 GROWING INTERNET USERS WORLDWIDE

FIGURE 17 UNEMPLOYMENT RATE IN THE MIDDLE EAST AND NORTH AFRICA REGION

FIGURE 18 RESEARCH AND DEVELOPMENT EXPENDITURE (% OF GDP)

FIGURE 19 WORLDWIDE CLOUD INVESTMENT, 2019 – 2025

FIGURE 20 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2021

FIGURE 21 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2021

FIGURE 22 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2021

FIGURE 23 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2021

FIGURE 24 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.