Middle East And Africa Industrial Ethanol Market

Taille du marché en milliards USD

TCAC :

%

USD

7.87 Billion

USD

13.62 Billion

2025

2033

USD

7.87 Billion

USD

13.62 Billion

2025

2033

| 2026 –2033 | |

| USD 7.87 Billion | |

| USD 13.62 Billion | |

|

|

|

|

Segmentation du marché de l'éthanol industriel au Moyen-Orient et en Afrique, par matière première (biosourcée et synthétique), type (éthanol absolu, éthanol à 95 %, éthanol dénaturé et autres), application (peintures et revêtements, produits pharmaceutiques, agroalimentaire, encres d'imprimerie, agriculture, produits de nettoyage ménagers et industriels, cosmétiques et produits d'hygiène personnelle, adhésifs et autres) - Tendances du secteur et prévisions jusqu'en 2033

Quelle est la taille et le taux de croissance du marché de l'éthanol industriel au Moyen-Orient et en Afrique ?

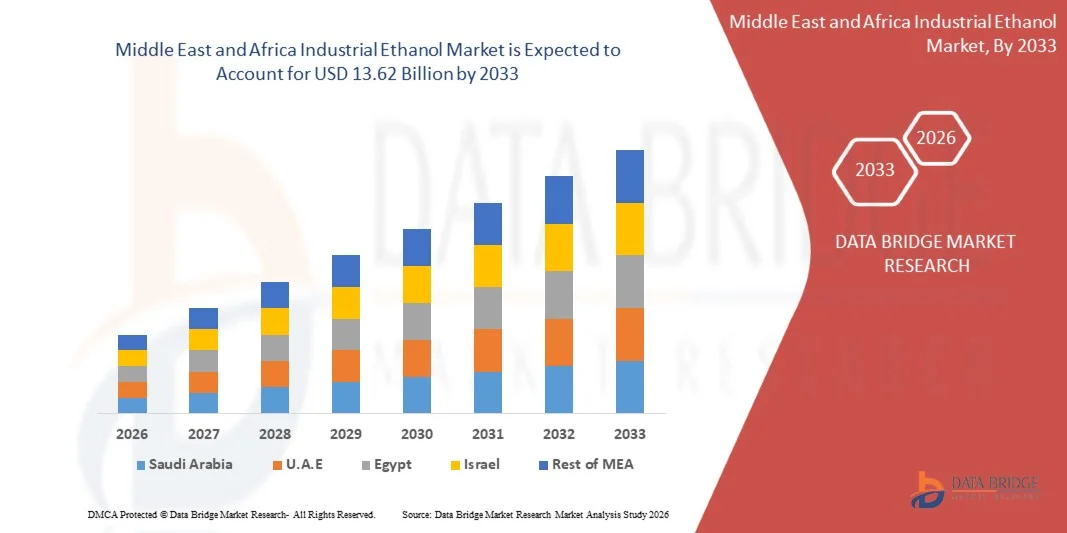

- Le marché de l'éthanol industriel au Moyen-Orient et en Afrique était évalué à 7,87 milliards de dollars en 2025 et devrait atteindre 13,62 milliards de dollars d'ici 2033 , avec un TCAC de 7,1 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante des industries manufacturières chimiques, pharmaceutiques, cosmétiques, de peintures et revêtements, et de soins personnels.

- En outre, l'adoption croissante de solvants biosourcés, l'intérêt grandissant pour les matières premières durables et renouvelables et l'utilisation accrue de l'éthanol comme matière première industrielle soutiennent l'expansion du marché.

Quels sont les principaux enseignements du marché de l'éthanol industriel ?

- Le marché est caractérisé par une forte demande d'éthanol en tant que solvant polyvalent, désinfectant et intermédiaire dans la production de produits chimiques, de polymères et de formulations pharmaceutiques.

- Les fabricants se concentrent de plus en plus sur la production d'éthanol biosourcé et à faible teneur en carbone afin de se conformer aux réglementations environnementales, aux objectifs de développement durable et aux stratégies de décarbonation des entreprises.

- L'Arabie saoudite a dominé le marché de l'éthanol industriel au Moyen-Orient et en Afrique avec une part de revenus estimée à 35,26 % en 2025, grâce à une demande croissante dans les secteurs de la fabrication pharmaceutique, du traitement chimique, des produits de soins personnels et des solvants industriels.

- Les Émirats arabes unis devraient enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, soit 8,25 %, au cours de la période de prévision, sous l'effet de la demande croissante des industries pharmaceutiques, désinfectantes, des soins personnels et de la transformation alimentaire.

- Le segment biosourcé a détenu la plus grande part de revenus de marché en 2025, grâce à la demande croissante de matières premières renouvelables et durables, aux incitations gouvernementales en faveur des produits chimiques verts et à l'adoption croissante de ces technologies dans les industries pharmaceutiques, des soins personnels et chimiques.

Portée du rapport et segmentation du marché de l'éthanol industriel

|

Attributs |

Principaux enseignements du marché de l'éthanol industriel |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Quelle est la tendance clé du marché de l'éthanol industriel ?

« Demande croissante d’intrants industriels biosourcés et durables »

- L'importance croissante accordée au développement durable et à la réduction des émissions de carbone influence fortement le marché de l'éthanol industriel, les industries recherchant des alternatives renouvelables et biosourcées aux produits chimiques d'origine fossile. L'éthanol industriel gagne du terrain grâce à sa polyvalence en tant que solvant, intermédiaire et désinfectant, tout en favorisant des procédés de production plus propres. Cette tendance renforce son adoption dans les secteurs de la chimie, de la pharmacie, des cosmétiques, des peintures et revêtements, ainsi que dans la fabrication industrielle, incitant les producteurs à accroître leurs capacités et leur efficacité.

- La prise de conscience croissante des enjeux environnementaux et de la conformité réglementaire a accéléré l'utilisation de l'éthanol industriel dans les applications de chimie verte. Les fabricants incorporent de plus en plus d'éthanol issu de matières premières renouvelables afin d'atteindre leurs objectifs de développement durable et d'améliorer le profil environnemental de leurs produits finis. Cette évolution stimule également les investissements dans les technologies de fermentation avancées et l'optimisation des matières premières pour améliorer les rendements et réduire les coûts de production.

- Les décisions d'achat axées sur le développement durable influencent les acheteurs industriels, qui privilégient la traçabilité de l'approvisionnement, la réduction des émissions sur l'ensemble du cycle de vie et le respect des normes environnementales. Ces facteurs permettent aux fournisseurs d'éthanol industriel biosourcé de différencier leurs offres, de consolider leurs contrats à long terme et d'instaurer un climat de confiance avec les industries en aval soucieuses des critères ESG.

- Par exemple, en 2024, BASF en Allemagne a accru l'utilisation d'éthanol biosourcé comme intermédiaire dans la fabrication de produits chimiques et de spécialités. Ces initiatives visaient à soutenir les engagements en matière de développement durable et à réduire la dépendance aux intrants pétrochimiques, contribuant ainsi à diminuer l'empreinte carbone et à améliorer l'efficacité des procédés.

- Alors que la demande d'éthanol industriel continue d'augmenter, la croissance durable du marché repose sur un approvisionnement stable en matières premières, des technologies de production efficaces et le maintien d'une compétitivité des coûts face aux alternatives pétrochimiques classiques. Les producteurs privilégient l'extensibilité, l'intégration de la chaîne d'approvisionnement et l'innovation des procédés pour soutenir l'expansion du marché à long terme.

Quels sont les principaux moteurs du marché de l'éthanol industriel ?

- La demande croissante d'intrants industriels renouvelables et respectueux de l'environnement est un moteur essentiel du marché de l'éthanol industriel. Les fabricants des secteurs de la chimie, de la pharmacie et des soins personnels utilisent de plus en plus l'éthanol comme solvant et intermédiaire biosourcé afin de se conformer aux réglementations en matière de développement durable et à leurs objectifs de décarbonation.

- L'expansion des applications dans les secteurs pharmaceutique, désinfectant, des revêtements, des encres et des produits chimiques industriels soutient la croissance du marché. L'éthanol industriel offre une pureté élevée, un pouvoir solvant efficace et une compatibilité avec diverses formulations, ce qui en fait un choix privilégié pour de nombreux procédés industriels. L'importance accrue accordée à l'hygiène et à l'assainissement renforce encore la demande.

- Les fabricants de produits chimiques et industriels promeuvent activement les formulations à base d'éthanol par le biais de l'innovation produit, de l'optimisation des procédés et du reporting en matière de développement durable. Ces efforts sont soutenus par des réglementations environnementales plus strictes et une préférence croissante des consommateurs pour les matériaux renouvelables et à faible empreinte carbone, encourageant ainsi les partenariats entre les producteurs d'éthanol et les industries utilisatrices.

- Par exemple, en 2023, Bayer en Allemagne a signalé une augmentation de sa consommation d'éthanol industriel dans les procédés de fabrication et de formulation pharmaceutiques. Cette évolution était motivée par la demande de solvants de haute pureté et conformes aux normes, ainsi que par l'alignement sur les initiatives de développement durable, améliorant ainsi l'efficacité opérationnelle et la conformité réglementaire.

- Malgré une forte demande, la croissance à long terme dépend de la maîtrise des coûts des matières premières, de l'efficacité de la production et de la fiabilité des chaînes d'approvisionnement. Investir dans les technologies de fermentation avancées, les matières premières issues des déchets et l'optimisation logistique sera essentiel pour maintenir la compétitivité.

Quel facteur freine la croissance du marché de l'éthanol industriel ?

- La fluctuation des prix et de la disponibilité des matières premières agricoles telles que le maïs, la canne à sucre et les céréales demeure un défi majeur pour le marché de l'éthanol industriel. La variabilité des rendements agricoles, les conditions météorologiques et la demande concurrente d'éthanol carburant peuvent avoir une incidence sur les coûts de production et la stabilité des prix de l'éthanol de qualité industrielle.

- La complexité des réglementations relatives à la manipulation, à la taxation et à la conformité en matière d'alcool engendre des difficultés opérationnelles, notamment pour le commerce transfrontalier et la distribution industrielle. Des exigences strictes en matière de licences et des réglementations variables selon les marchés peuvent limiter la flexibilité et alourdir la charge administrative des fabricants et des distributeurs.

- Les difficultés liées à la chaîne d'approvisionnement et au stockage freinent également la croissance du marché, car l'éthanol industriel exige une manutention contrôlée, des infrastructures de stockage spécialisées et le respect des normes de sécurité. Ces exigences augmentent les coûts opérationnels et peuvent limiter son adoption par les petits utilisateurs industriels.

- Par exemple, en 2024, les distributeurs de produits chimiques européens approvisionnant les fabricants de revêtements et de produits pharmaceutiques ont fait état d'une pression sur leurs marges en raison de la hausse des coûts des matières premières agricoles, de l'augmentation des prix de l'énergie et du durcissement des exigences réglementaires. Ces facteurs ont influencé les stratégies de prix, accru les dépenses opérationnelles et entraîné des retards dans les décisions d'approvisionnement des utilisateurs finaux industriels.

- Pour relever ces défis, il faudra diversifier les sources de matières premières, améliorer l'efficacité de la chaîne d'approvisionnement et harmoniser la réglementation. Investir dans la production d'éthanol de deuxième génération et à partir de déchets, et renforcer la collaboration entre producteurs, organismes de réglementation et utilisateurs finaux, sera essentiel pour libérer le potentiel de croissance à long terme du marché mondial de l'éthanol industriel.

Comment le marché de l'éthanol industriel est-il segmenté ?

Le marché est segmenté en fonction de la matière première, du type et de l'application .

• Par matière première

Le marché européen de l'éthanol industriel est segmenté, selon la matière première utilisée, en éthanol biosourcé et éthanol de synthèse. En 2025, le segment de l'éthanol biosourcé détenait la plus grande part de marché en termes de chiffre d'affaires, porté par la demande croissante de matières premières renouvelables et durables, les incitations gouvernementales en faveur des produits chimiques verts et son adoption croissante dans les industries pharmaceutique, cosmétique et chimique. L'éthanol biosourcé est privilégié pour son faible impact carbone et sa conformité aux réglementations environnementales, ce qui en fait un choix populaire auprès des industriels.

Le segment de l'éthanol de synthèse devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à un approvisionnement régulier, des coûts de production réduits et son adéquation aux procédés chimiques et industriels à grande échelle. L'éthanol de synthèse est particulièrement prisé lorsque la production à grand volume et la rentabilité sont des critères essentiels.

• Par type

Le marché européen de l'éthanol industriel est segmenté, selon le type, en éthanol absolu, éthanol à 95 %, éthanol dénaturé et autres. Le segment de l'éthanol absolu dominait en 2025 grâce à sa grande pureté et à son utilisation répandue dans les secteurs pharmaceutique, de laboratoire et de la chimie de spécialité. L'éthanol absolu offre une qualité et des performances constantes, ce qui le rend essentiel pour les procédés industriels réglementés.

Le segment de l'éthanol dénaturé devrait connaître le taux de croissance le plus rapide entre 2026 et 2033, grâce à ses nombreuses applications dans les peintures, les revêtements, les solutions de nettoyage et les produits ménagers où un éthanol économique est requis sans qu'une pureté élevée soit nécessaire.

• Sur demande

Selon l'application, le marché européen de l'éthanol industriel se segmente en peintures et revêtements, produits pharmaceutiques, agroalimentaire, encres d'imprimerie, agriculture, solutions de nettoyage domestiques et industrielles, cosmétiques et produits d'hygiène personnelle, adhésifs et autres. Le segment pharmaceutique détenait la plus grande part de revenus en 2025, grâce à la demande croissante d'éthanol comme solvant, désinfectant et intermédiaire dans la formulation de médicaments.

Le segment des peintures et revêtements devrait connaître la croissance la plus rapide entre 2026 et 2033, sous l'effet de l'industrialisation croissante, de la croissance des activités de construction et de la demande grandissante de formulations de revêtements écologiques et biosourcés à travers l'Europe.

Quelle région détient la plus grande part du marché de l'éthanol industriel ?

- L'Arabie saoudite a dominé le marché de l'éthanol industriel au Moyen-Orient et en Afrique avec une part de marché estimée à 35,26 % en 2025, portée par la demande croissante dans les secteurs de la fabrication pharmaceutique, de la transformation chimique, des produits de soins personnels et des solvants industriels. L'accent mis sur la diversification industrielle, le développement des activités pétrochimiques en aval et l'utilisation accrue de l'éthanol comme solvant, désinfectant et intermédiaire continuent de soutenir la croissance régionale.

- La présence d'infrastructures de raffinage et de production chimique bien établies, conjuguée à des investissements croissants dans les produits chimiques biosourcés et la production d'éthanol industriel, a accéléré le développement du marché en Arabie saoudite. Les initiatives gouvernementales menées dans le cadre des programmes de diversification industrielle encouragent la production locale, la substitution des importations et l'adoption de l'éthanol dans de nombreuses applications industrielles.

- L'accent croissant mis sur le développement des soins de santé, les normes d'hygiène, la conformité réglementaire et la modernisation industrielle, ainsi que la hausse des investissements dans la fabrication de produits pharmaceutiques, de cosmétiques et de produits chimiques de spécialité, continuent de stimuler la demande d'éthanol industriel au Moyen-Orient et en Afrique.

Analyse du marché de l'éthanol industriel aux Émirats arabes unis

Les Émirats arabes unis devraient enregistrer le taux de croissance annuel composé (TCAC) le plus rapide, à 8,25 %, au cours de la période de prévision, grâce à la demande croissante des industries pharmaceutiques, désinfectantes, des soins personnels et agroalimentaires. Le développement rapide des infrastructures de santé, la vigueur des importations et des exportations, ainsi que l'adoption croissante de l'éthanol de haute pureté dans les applications industrielles et commerciales soutiennent la croissance soutenue du marché.

Analyse du marché de l'éthanol industriel en Afrique du Sud

L'Afrique du Sud connaît une croissance soutenue du marché de l'éthanol industriel, portée par une utilisation accrue dans les secteurs pharmaceutique, chimique, des boissons et de la fabrication industrielle. Les initiatives gouvernementales visant à promouvoir la production chimique locale, la demande croissante de désinfectants et de solvants, ainsi que le développement industriel en cours devraient favoriser une croissance durable du marché dans tout le pays.

Quelles sont les principales entreprises du marché de l'éthanol industriel ?

L'industrie de l'éthanol industriel est principalement dominée par des entreprises bien établies, notamment :

- Smiths Detection Group Ltd (Royaume-Uni)

- Westminster Group Plc (Royaume-Uni)

- QinetiQ (Royaume-Uni)

- OD Security (Pays-Bas)

- Rohde & Schwarz (Allemagne)

- VITRONIC (Allemagne)

- Artec Europe (Luxembourg)

- Metrasens (Royaume-Uni)

- Braun & Company Ltd (Royaume-Uni)

- Groupe LINEV (Royaume-Uni)

- Scan X Security Ltd (Royaume-Uni)

- ScioTeq (Royaume-Uni)

- CEIA SpA (Italie)

- Millivision Technologies (Royaume-Uni)

- 3F Advanced Systems (Royaume-Uni)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.