Middle East And Africa Ice Cream Freezers Market

Taille du marché en milliards USD

TCAC :

%

USD

313.70 Million

USD

519.18 Million

2025

2033

USD

313.70 Million

USD

519.18 Million

2025

2033

| 2026 –2033 | |

| USD 313.70 Million | |

| USD 519.18 Million | |

|

|

|

|

Segmentation du marché des congélateurs à crème glacée au Moyen-Orient et en Afrique, par type (congélateurs coffres, congélateurs verticaux, congélateurs à tiroirs, congélateurs portables, congélateurs vitrines, congélateurs à dégivrage automatique, congélateurs à production continue et congélateurs par lots), composants (compresseur, condenseur, filtre/déshydrateur, détendeur, évaporateur, accumulateur, moteur de ventilateur et autres), capacité (moins de 70 litres, 70-150 litres, 150-300 litres, 300-500 litres, 500-700 litres et plus de 700 litres), technologie (manuelle, semi-automatisée et entièrement automatisée), canal de distribution (en ligne, magasins spécialisés, points de vente au détail, distributeurs/revendeurs, magasins d'électronique, supermarchés/hypermarchés et autres), utilisateur final (résidentiel et commercial) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des congélateurs à crème glacée au Moyen-Orient et en Afrique

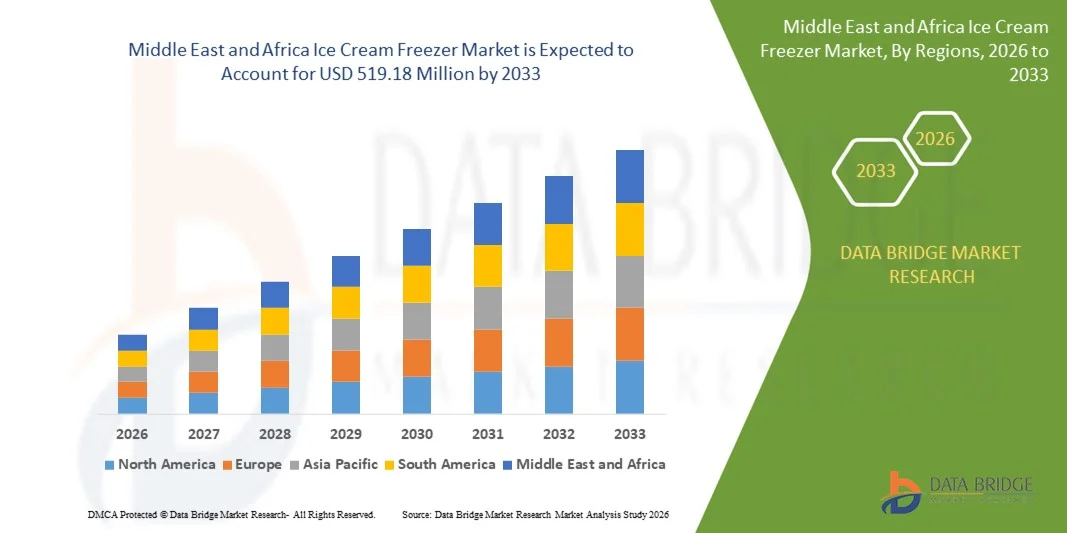

- Le marché des congélateurs à crème glacée au Moyen-Orient et en Afrique était évalué à 313,70 millions de dollars en 2025 et devrait atteindre 519,18 millions de dollars d'ici 2033 , avec un TCAC de 6,5 % au cours de la période de prévision.

- La croissance du marché est largement tirée par la demande croissante de solutions de congélation fiables, économes en énergie et performantes, tant dans les environnements résidentiels que commerciaux, soutenue par l'expansion rapide des glaciers, des chaînes de restauration rapide et des formats de vente au détail modernes.

- De plus, l'adoption croissante de technologies de congélation avancées, telles que des systèmes d'isolation améliorés, des compresseurs optimisés et des fluides frigorigènes écologiques, renforce l'expansion du marché, les utilisateurs finaux privilégiant un contrôle constant de la température et des coûts d'exploitation réduits, ce qui accélère en fin de compte l'adoption des congélateurs à crème glacée sur les marchés mondiaux.

Analyse du marché des congélateurs à crème glacée au Moyen-Orient et en Afrique

- Les congélateurs à crème glacée, conçus pour maintenir des températures ultra-basses et stables essentielles à la préservation de la texture et de la qualité de la crème glacée, sont devenus un élément crucial pour les détaillants, les services de restauration et les opérateurs de la chaîne du froid en raison de leur capacité à garantir la fraîcheur des produits, une conservation de longue durée et des performances fiables quelles que soient les variations de la demande.

- Le besoin croissant de systèmes de congélation efficaces est renforcé par la consommation croissante de crèmes glacées et de desserts glacés, l'expansion du commerce de détail organisé et la préférence grandissante pour les appareils économes en énergie qui réduisent les coûts d'exploitation des entreprises commerciales tout en offrant des capacités de congélation fiables aux particuliers.

- L'Arabie saoudite dominait le marché des congélateurs à crème glacée en 2025, grâce à l'expansion rapide des formats de vente au détail modernes, des chaînes de restauration rapide et des points de vente de desserts spécialisés qui nécessitent des équipements de congélation fiables et économes en énergie pour le stockage et la présentation de grands volumes.

- Les Émirats arabes unis devraient connaître la croissance la plus rapide sur le marché des congélateurs à crème glacée au cours de la période de prévision, grâce à l'expansion de son secteur hôtelier, à la vitalité de sa culture des cafés et au nombre croissant de marques de crèmes glacées et de gelato haut de gamme.

- Le segment des congélateurs coffres a dominé le marché en 2025 avec une part de 38,9 %, grâce à leur isolation performante et à leur capacité à maintenir des températures constantes, essentielles à la conservation des crèmes glacées. Ces congélateurs permettent un stockage en grande quantité et un refroidissement de longue durée, ce qui les rend idéaux pour les glaciers, les commerces de détail et les plateformes de distribution. Leur faible besoin d'entretien et leur conception écoénergétique contribuent à réduire les coûts d'exploitation des petites et moyennes entreprises. La polyvalence des congélateurs coffres leur permet de stocker de nombreuses références sans nécessiter de dégivrage fréquent. Leur large adoption dans les pays développés comme dans les pays émergents conforte leur position de leader.

Portée du rapport et segmentation du marché des congélateurs à crème glacée

|

Attributs |

Congélateurs de crème glacée : principales informations sur le marché |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une analyse des prix, une analyse des parts de marché des marques, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des congélateurs à crème glacée au Moyen-Orient et en Afrique

Demande croissante de congélateurs à faible consommation d'énergie

- Une tendance majeure du marché des congélateurs à crème glacée est la demande croissante de systèmes de congélation écoénergétiques, motivée par la nécessité de réduire les coûts d'exploitation et de répondre aux exigences de développement durable dans les secteurs de la vente au détail et du commerce. Cette évolution favorise l'adoption de congélateurs dotés d'une isolation améliorée, de compresseurs optimisés et de fluides frigorigènes écologiques, permettant de maintenir des températures basses et constantes tout en réduisant la consommation d'électricité.

- Par exemple, Blue Star et Haier continuent d'enrichir leurs gammes de congélateurs à haut rendement énergétique, permettant aux détaillants et aux professionnels de la restauration de préserver la qualité des crèmes glacées à température stable. Ces solutions contribuent à des économies à long terme et améliorent la fiabilité du stockage dans les zones à forte demande.

- La demande en congélateurs à faible consommation énergétique s'accélère en raison du nombre croissant de points de vente modernes, de glaciers et de chaînes de restauration rapide qui nécessitent un stockage frigorifique continu, stable et économique. Ceci incite les fabricants à développer des congélateurs alliant haute performance et faible impact environnemental.

- Les systèmes écoénergétiques sont de plus en plus privilégiés en raison des incitations gouvernementales à réduire les émissions de carbone et de la hausse des prix de l'électricité. Cette tendance influence les décisions d'achat sur les marchés émergents et établis.

- Les fabricants intègrent des technologies de refroidissement avancées pour garantir une meilleure homogénéité des produits et réduire les fluctuations de température. Cela renforce le marché des congélateurs innovants qui facilitent la manipulation des produits tout au long des cycles de stockage.

- Le marché connaît une croissance soutenue, l'adoption de congélateurs à haut rendement énergétique favorisant la durabilité à long terme et la fiabilité opérationnelle. Cette préférence croissante influence la conception des futurs produits et renforce la transition vers des infrastructures de stockage frigorifique plus efficaces dans l'ensemble du secteur.

Dynamique du marché des congélateurs à crème glacée au Moyen-Orient et en Afrique

Conducteur

Consommation croissante de crèmes glacées et de desserts glacés

- La consommation croissante de crèmes glacées et de desserts glacés est un facteur clé qui favorise l'installation de congélateurs à crème glacée performants dans les commerces de détail et les établissements professionnels. Cette demande grandissante incite les points de vente à augmenter leur capacité de stockage et à investir dans des congélateurs performants qui préservent la qualité et la texture des produits.

- Par exemple, les marques présentes dans les grandes chaînes de distribution et les pâtisseries spécialisées s'appuient sur des congélateurs haute capacité fournis par des entreprises comme AHT et Whirlpool pour gérer des volumes de vente plus importants et garantir un stockage frigorifique continu. Ces congélateurs permettent aux détaillants de préserver la qualité de leurs produits lors des pics de demande.

- La popularité croissante des crèmes glacées haut de gamme, artisanales et d'achat impulsif accentue le besoin de congélateurs spécialisés capables de maintenir une température stable à basse température. Cette diversification croissante des produits renforce la demande de congélateurs dans de multiples formats de distribution.

- La préférence croissante des consommateurs pour les desserts glacés, perçus comme des en-cas pratiques et gourmands, incite les détaillants à élargir leur offre, ce qui entraîne une augmentation des achats de congélateurs commerciaux. Cette tendance renforce directement la demande d'équipements dans les circuits de distribution et de restauration.

- La croissance soutenue de la consommation de desserts glacés devrait continuer à stimuler le marché, les opérateurs investissant dans des solutions de congélation avancées pour maintenir une qualité constante et répondre aux besoins en matière de stocks.

Retenue/Défi

Coûts énergétiques et d'entretien élevés

- Un défi majeur pour le marché des congélateurs à crème glacée réside dans la forte consommation d'énergie et les exigences de maintenance continue liées aux systèmes de congélation commerciaux. Ces systèmes fonctionnent en continu pour maintenir des normes de température strictes, ce qui engendre des dépenses énergétiques importantes pour les détaillants et les exploitants de services de restauration.

- Par exemple, les congélateurs grand format utilisés par les supermarchés et les hypermarchés nécessitent un entretien régulier, le remplacement de pièces et des contrôles techniques pour garantir une performance de refroidissement optimale. Ces dépenses de maintenance pèsent sur les budgets d'exploitation, notamment pour les entreprises possédant d'importants parcs de congélateurs.

- Le maintien de températures de congélation stables exige une utilisation continue du compresseur, ce qui augmente les coûts d'électricité et limite l'accessibilité pour les petites entreprises. Ce problème est particulièrement criant dans les régions où les tarifs d'électricité sont élevés.

- Les congélateurs commerciaux nécessitent souvent l'intervention de techniciens spécialisés pour les réparations et le calibrage du système. Ces interventions allongent les temps d'arrêt et complexifient les opérations pour les entreprises qui dépendent d'un stockage frigorifique continu.

- Ces exigences combinées en matière d'énergie et de maintenance freinent l'expansion du marché, incitant les fabricants à innover mais créant simultanément des barrières financières pour les utilisateurs finaux envisageant de nouvelles installations.

Étendue du marché des congélateurs à crème glacée au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type, des composants, de la capacité, de la technologie, du canal de distribution et de l'utilisateur final.

- Par type

Le marché des congélateurs à crème glacée se segmente selon le type d'appareil : congélateurs coffres, congélateurs verticaux, congélateurs à tiroirs, congélateurs portables, vitrines réfrigérées, congélateurs à dégivrage automatique, congélateurs à flux continu et congélateurs par lots. En 2025, le segment des congélateurs coffres dominait le marché avec une part de 38,9 %, grâce à leur isolation performante et à leur capacité à maintenir des températures constantes, essentielles à la conservation de la crème glacée. Ces congélateurs permettent un stockage en grande quantité et un refroidissement de longue durée, ce qui les rend adaptés aux glaciers, aux commerces de détail et aux plateformes de distribution. Leur faible besoin d'entretien et leur conception écoénergétique contribuent à réduire les coûts d'exploitation des petites et moyennes entreprises. La polyvalence des congélateurs coffres leur permet de stocker de nombreuses références sans dégivrage fréquent. Leur large adoption dans les pays développés comme dans les pays émergents conforte leur position de leader.

Le segment des vitrines réfrigérées devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par leur installation croissante dans les supermarchés, les hypermarchés et les glaciers spécialisés. Ces vitrines améliorent la visibilité des produits grâce à des panneaux transparents et un éclairage LED, favorisant ainsi les achats impulsifs et la promotion des marques. Par exemple, des marques comme Haier proposent des vitrines réfrigérées de pointe conçues pour garantir un refroidissement uniforme et une présentation attrayante des desserts glacés haut de gamme. Les distributeurs privilégient ces modèles pour leur capacité à capter l'attention des clients et à maintenir des températures constantes tout en mettant en valeur une offre diversifiée. Le développement des formats de vente au détail modernes soutient la multiplication des vitrines réfrigérées. Leur conception flexible et leur avantage promotionnel contribuent à la croissance rapide du marché.

- Par composants

Le marché des congélateurs à crème glacée est segmenté, selon leurs composants, en compresseur, condenseur, filtre/déshydrateur, détendeur, évaporateur, accumulateur, moteur de ventilateur et autres. Le segment des compresseurs a dominé le marché en 2025 grâce à son rôle crucial dans la fiabilité du refroidissement et la stabilité du fonctionnement. Les compresseurs à haut rendement maintiennent les basses températures précises nécessaires à la préservation de la texture et de la consistance de la crème glacée. Les fabricants privilégient de plus en plus les compresseurs durables et économes en énergie, réduisant ainsi la consommation d'électricité pour les utilisateurs professionnels et particuliers. Ces composants contribuent à un refroidissement rapide et à une durée de vie accrue des équipements. Leur rôle essentiel dans tous les types de congélateurs explique leur forte popularité auprès des détaillants et des exploitants commerciaux. La fiabilité et la durabilité des compresseurs garantissent leur position dominante.

Le segment des évaporateurs devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à son rôle essentiel dans les échanges thermiques et l'homogénéité de la température. L'amélioration de la conception des évaporateurs optimise la distribution du froid et réduit la formation de givre, contribuant ainsi au maintien de la qualité des produits. Par exemple, des entreprises comme Carrier ont introduit des serpentins d'évaporateur améliorés qui permettent des temps de congélation plus courts et des cycles de température plus constants. La demande croissante de congélateurs sans givre et à consommation énergétique optimisée accélère l'adoption des évaporateurs de pointe. Leur contribution à l'efficacité du refroidissement renforce l'efficience globale des systèmes de réfrigération. L'évolution vers des solutions modernes de stockage frigorifique commercial contribue également à la forte croissance de ce segment.

- Par capacité

Le marché des congélateurs à crème glacée est segmenté en fonction de la capacité : moins de 70 litres, 70 à 150 litres, 150 à 300 litres, 300 à 500 litres, 500 à 700 litres et plus de 700 litres. Le segment des 150 à 300 litres dominait le marché en 2025, car il offre un équilibre idéal entre volume de stockage et optimisation de l’espace. Les détaillants et les petits commerces privilégient cette gamme pour sa capacité à stocker efficacement plusieurs variétés de crèmes glacées. Ces congélateurs sont adaptés aux environnements à forte rotation sans nécessiter une surface au sol excessive. Leurs systèmes de refroidissement écoénergétiques garantissent des performances stables, quelle que soit la quantité de produits stockés. Les fabricants privilégient cette gamme de capacité en raison de la forte demande de remplacement sur les marchés émergents. Son adaptabilité aux utilisateurs commerciaux et résidentiels renforce sa position dominante.

Le segment des congélateurs de plus de 700 litres devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à l'augmentation des investissements dans le stockage à grande échelle pour la production et la distribution de crèmes glacées. Ces congélateurs répondent aux besoins des réseaux de la chaîne du froid, des chaînes de restauration rapide et des grands entrepôts de vente au détail. Par exemple, Blue Star propose des congélateurs commerciaux haute capacité dotés d'une isolation améliorée, garantissant une stabilité de température durable. Le stockage de grands volumes permet aux entreprises d'assurer la régularité de leurs approvisionnements et de réduire leurs coûts logistiques. L'expansion croissante des marques de crèmes glacées sur de nouveaux marchés accroît la demande en solutions de congélation à l'échelle industrielle. Ce segment bénéficie également de la croissance des opérations d'entreposage frigorifique centralisées.

- Par la technologie

Le marché des congélateurs à crème glacée se segmente, selon la technologie utilisée, en modèles manuels, semi-automatiques et entièrement automatisés. En 2025, le segment manuel dominait le marché grâce à son prix abordable, sa fiabilité à long terme et sa facilité d'utilisation, particulièrement appréciée dans les régions où les prix sont un facteur déterminant. Les petits commerces et les vendeurs de crème glacée indépendants privilégient les congélateurs manuels pour leur faible besoin d'entretien et leur robustesse face aux variations de tension électrique. Ces appareils sont dotés de commandes mécaniques simples qui garantissent un fonctionnement stable, même dans les zones reculées ou mal desservies. Leur longue durée de vie les rend idéaux pour les acheteurs soucieux des coûts et privilégiant la performance. Leur large disponibilité et leur faible investissement initial confortent leur position dominante.

Le segment entièrement automatisé devrait enregistrer la croissance la plus rapide entre 2026 et 2033, porté par la demande croissante de systèmes de refroidissement de précision et d'une efficacité opérationnelle accrue. Les congélateurs automatisés sont dotés d'une régulation numérique de la température, d'un dégivrage intelligent et de commandes optimisées en matière d'énergie. Par exemple, Panasonic propose des systèmes de congélation connectés (IoT) permettant un suivi en temps réel des performances pour les utilisateurs professionnels. Les grandes chaînes de distribution et les enseignes de restauration rapide privilégient ces appareils pour leur contrôle précis de la température et la réduction de la supervision manuelle. Les économies d'énergie réalisées contribuent à la réduction des coûts à long terme pour les opérations de stockage à haut volume. La transition vers des infrastructures de vente au détail technologiquement avancées renforce la croissance rapide de ce segment.

- Par canal de distribution

Selon le canal de distribution, le marché des congélateurs à crème glacée se segmente en vente en ligne, magasins spécialisés, points de vente au détail, distributeurs/revendeurs, magasins d'électronique, supermarchés/hypermarchés et autres. Le segment des supermarchés/hypermarchés dominait en 2025 grâce à une forte fréquentation et à la possibilité d'installer plusieurs congélateurs de présentation et de stockage. Ces points de vente s'appuient sur des congélateurs de grande capacité pour garantir une disponibilité continue des produits, toutes références confondues. Les chaînes de distribution privilégient les modèles économes en énergie afin d'optimiser leurs dépenses d'électricité tout en maintenant des volumes de stockage importants. Leur agencement structuré favorise une mise en valeur et une visibilité optimales des desserts glacés. L'expansion rapide des réseaux de distribution organisés renforce la position dominante de ce segment. Une rotation rapide des produits améliore l'utilisation des congélateurs.

Le segment en ligne devrait connaître la croissance la plus rapide entre 2026 et 2033, grâce à la commodité de la livraison d'électroménagers à domicile et à la disponibilité de fiches produits détaillées. Les consommateurs privilégient de plus en plus les canaux en ligne pour la transparence des prix, la possibilité de comparer un large choix de produits et les options de financement. Par exemple, Amazon propose un vaste catalogue de congélateurs à glace avec assistance à l'installation et avis clients vérifiés, encourageant ainsi l'adoption du numérique. Les fabricants développent leurs stratégies de vente directe en ligne afin de toucher un public plus large. La pénétration croissante d'Internet dans les marchés émergents renforce le commerce électronique comme mode d'achat privilégié. La facilité d'enregistrement des garanties et le service client en ligne accélèrent cette croissance.

- Par l'utilisateur final

Selon l'utilisateur final, le marché des congélateurs à crème glacée se divise en deux segments : résidentiel et commercial. Le segment commercial a dominé en 2025, porté par une forte demande des glaciers, cafés, restaurants, supérettes et entreprises de la chaîne du froid. Les établissements commerciaux exigent des congélateurs performants capables de maintenir des températures basses et constantes pendant de longues heures d'utilisation. Ces appareils permettent des cycles de congélation rapides, essentiels à la qualité des produits dans un contexte de forte activité. Les entreprises privilégient les modèles robustes et économes en énergie afin de réduire leurs coûts d'exploitation à long terme. Le développement des points de vente de desserts spécialisés et des chaînes de restauration rapide renforce le marché commercial. Leur besoin en refroidissement fiable et continu explique leur position dominante.

Le segment résidentiel devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par la consommation croissante de desserts glacés dans les ménages et l'adoption grandissante des congélateurs compacts. Les consommateurs urbains privilégient les congélateurs dédiés pour conserver les crèmes glacées haut de gamme, artisanales et en vrac. Par exemple, LG propose des congélateurs compacts sans givre, parfaitement adaptés aux cuisines modernes et répondant ainsi aux nouvelles tendances de consommation. La sensibilisation accrue aux appareils électroménagers économes en énergie favorise leur adoption par les familles urbaines. Ces congélateurs permettent de stocker facilement une plus grande variété de produits surgelés. L'essor de la culture des produits surgelés haut de gamme accélère la croissance du marché résidentiel.

Analyse régionale du marché des congélateurs à crème glacée au Moyen-Orient et en Afrique

- L'Arabie saoudite a dominé le marché des congélateurs à crème glacée en 2025, détenant la plus grande part de revenus. Cette domination s'explique par l'expansion rapide des formats de vente au détail modernes, des chaînes de restauration rapide et des points de vente de desserts spécialisés, qui nécessitent des équipements de congélation fiables et économes en énergie pour le stockage et la présentation de grands volumes.

- La forte croissance des infrastructures de la chaîne du froid du pays et la préférence croissante des consommateurs pour les desserts glacés haut de gamme continuent de stimuler la demande de congélateurs commerciaux dans les supermarchés, les hypermarchés et les établissements de restauration. Les initiatives stratégiques du gouvernement, qui soutiennent la modernisation du commerce de détail et l'expansion du secteur de l'hôtellerie-restauration dans le cadre de la Vision 2030, accélèrent l'installation de congélateurs dans les régions urbaines et en développement.

- La présence de fabricants internationaux et régionaux de systèmes de réfrigération, conjuguée à l'adoption croissante de technologies de refroidissement avancées et respectueuses de l'environnement, renforce la position dominante de l'Arabie saoudite sur le marché régional tout en consolidant son leadership dans le domaine du stockage commercial des produits surgelés.

Analyse du marché des congélateurs à crème glacée aux Émirats arabes unis

Les Émirats arabes unis devraient enregistrer le taux de croissance annuel composé (TCAC) le plus rapide du marché des congélateurs à crème glacée au Moyen-Orient et en Afrique entre 2026 et 2033. Cette croissance est soutenue par le développement du secteur de l'hôtellerie-restauration, l'essor de la culture des cafés et la multiplication des marques de crèmes glacées et de gelatos haut de gamme. Par exemple, les collaborations entre les fabricants internationaux de congélateurs et les distributeurs basés aux Émirats arabes unis pour la fourniture de congélateurs vitrines économes en énergie et au design soigné renforcent la présence des produits dans les centres commerciaux, les complexes hôteliers et les points de vente à forte fréquentation. La demande croissante de desserts à emporter, les investissements importants dans les infrastructures de vente au détail modernes et l'adoption de systèmes de réfrigération à faible potentiel de réchauffement global (PRG) et économes en énergie accélèrent la pénétration du marché. Les initiatives de villes intelligentes, l'expansion du commerce de détail alimentaire liée au tourisme et la préférence croissante pour les congélateurs haute performance dotés d'un contrôle avancé de la température positionnent davantage les Émirats arabes unis comme le marché à la croissance la plus rapide de la région.

Analyse du marché des congélateurs à crème glacée en Afrique du Sud

L'Afrique du Sud devrait connaître une croissance soutenue entre 2026 et 2033, portée par le développement de son secteur de la grande distribution, la popularité croissante des desserts glacés et l'adoption accrue de congélateurs commerciaux dans les boulangeries, les commerces de proximité et les établissements de restauration. La modernisation des petits et moyens commerces et la préférence grandissante des consommateurs pour les crèmes glacées emballées stimulent la demande en congélateurs fiables, durables et économiques. Les partenariats entre les marques internationales de réfrigération et les distributeurs locaux, ainsi que la plus grande disponibilité de congélateurs à haut rendement énergétique et à variateur de fréquence, améliorent la couverture du marché dans les zones urbaines et périurbaines. Le soutien gouvernemental au renforcement de la chaîne du froid, associé à une attention accrue portée aux technologies de refroidissement durables et à faibles émissions, contribue à une croissance durable du marché sud-africain des congélateurs pour crèmes glacées.

Part de marché des congélateurs à crème glacée au Moyen-Orient et en Afrique

L'industrie des congélateurs à crème glacée est principalement dominée par des entreprises bien établies, notamment :

- AHT Cooling Systems GmbH (Autriche)

- Panasonic Corporation (Japon)

- Groupe Haier (Chine)

- Whirlpool Corporation (États-Unis)

- Robert Bosch GmbH (Allemagne)

- Scandomestic A/S (Danemark)

- Groupe Midea (Chine)

- Siemens (Allemagne)

- Miele (Allemagne)

- Electrolux (Suède)

- Solutions Metalfrio (Brésil)

- AHT (Autriche)

- Liebherr-International Deutschland GmbH (Allemagne)

- Solutions Vestfrost (Danemark)

- Ugur Sogutuma AS (Turquie)

- Qingdao Hiron Commercial Cold Chain Co., Ltd. (Chine)

- Viessmann (Allemagne)

Dernières évolutions du marché des congélateurs à crème glacée au Moyen-Orient et en Afrique

- En novembre 2025, Elanpro a élargi sa gamme de congélateurs à couvercle vitré pour le secteur des crèmes glacées et des desserts glacés, renforçant ainsi le marché grâce à une disponibilité accrue de congélateurs de vente au détail à haute visibilité et à faible consommation d'énergie. Cet élargissement répond aux besoins modernes du merchandising et permet aux détaillants d'adopter des solutions d'affichage améliorées qui mettent en valeur les produits et améliorent l'expérience client. Ce portefeuille de produits plus complet permet également à l'entreprise de conquérir une part de marché plus importante dans le secteur des congélateurs commerciaux, à mesure que les points de vente de marque et les commerces de proximité continuent de se développer.

- En mars 2024, Blue Star Ltd a lancé une nouvelle gamme de congélateurs à haut rendement énergétique, d'une capacité de 60 à 600 litres, confirmant ainsi la tendance du secteur vers des systèmes de réfrigération à consommation énergétique optimisée. Ce lancement facilite l'accès à ces solutions pour les petites et grandes entreprises à la recherche de solutions de congélation économiques, tout en réduisant leurs coûts d'exploitation. La variété des capacités proposées renforce la présence de la marque auprès des distributeurs, des restaurateurs et des opérateurs de la chaîne du froid, contribuant ainsi à une plus grande compétitivité sur le marché.

- En mai 2022, Unilever a lancé deux programmes pilotes pour tester des congélateurs à crème glacée plus chauds, visant à réduire la consommation d'énergie et les émissions de gaz à effet de serre d'environ 20 à 30 % par unité, et à soutenir la transition du marché vers une réfrigération durable. Cette initiative encourage les fabricants de congélateurs à innover en matière de conception à haute efficacité thermique, tout en maintenant les normes de qualité des produits. Elle incite également les distributeurs à envisager des équipements plus écologiques, accélérant ainsi l'adoption de congélateurs respectueux de l'environnement sur les marchés mondiaux.

- En février 2022, True Manufacturing a modernisé sa gamme de congélateurs à crème glacée commerciaux avec des systèmes de réfrigération haute performance conçus pour réduire la consommation d'énergie et accélérer la récupération de la température, stimulant ainsi la demande pour les congélateurs de nouvelle génération. Cette modernisation permet aux professionnels de la restauration de maintenir une texture de produit homogène malgré les ouvertures fréquentes des portes, un facteur essentiel dans les commerces de détail à forte affluence. Les systèmes améliorés permettent également de réduire les coûts d'exploitation globaux, favorisant ainsi une transition plus large vers des unités commerciales à consommation énergétique optimisée.

- En octobre 2021, Haier a renforcé sa présence sur le marché des congélateurs pour crèmes glacées en lançant de nouveaux modèles de vitrines réfrigérées équipés d'un éclairage LED de pointe et d'une technologie de refroidissement uniforme, optimisant ainsi la présentation des produits pour les détaillants. Ces améliorations permettent aux magasins de stimuler les achats impulsifs en améliorant la visibilité et la présentation des desserts glacés. L'accent mis sur une conception adaptée au commerce de détail contribue également à dynamiser la demande de vitrines réfrigérées modernes dans les supermarchés, les hypermarchés et les points de vente spécialisés.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.