Marché des tuyaux au Moyen-Orient et en Afrique, par support (tuyaux hydrauliques, tuyaux à vapeur, tuyaux à air et à gaz, tuyaux de manutention, tuyaux alimentaires et autres), matériau (tuyaux en plastique/polymères, tuyaux en caoutchouc, tuyaux métalliques, tuyaux composites, tuyaux en silicone et autres), utilisateur final (industriel, automobile, commercial et résidentiel), canal de vente (direct et indirect) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des tuyaux flexibles au Moyen-Orient et en Afrique

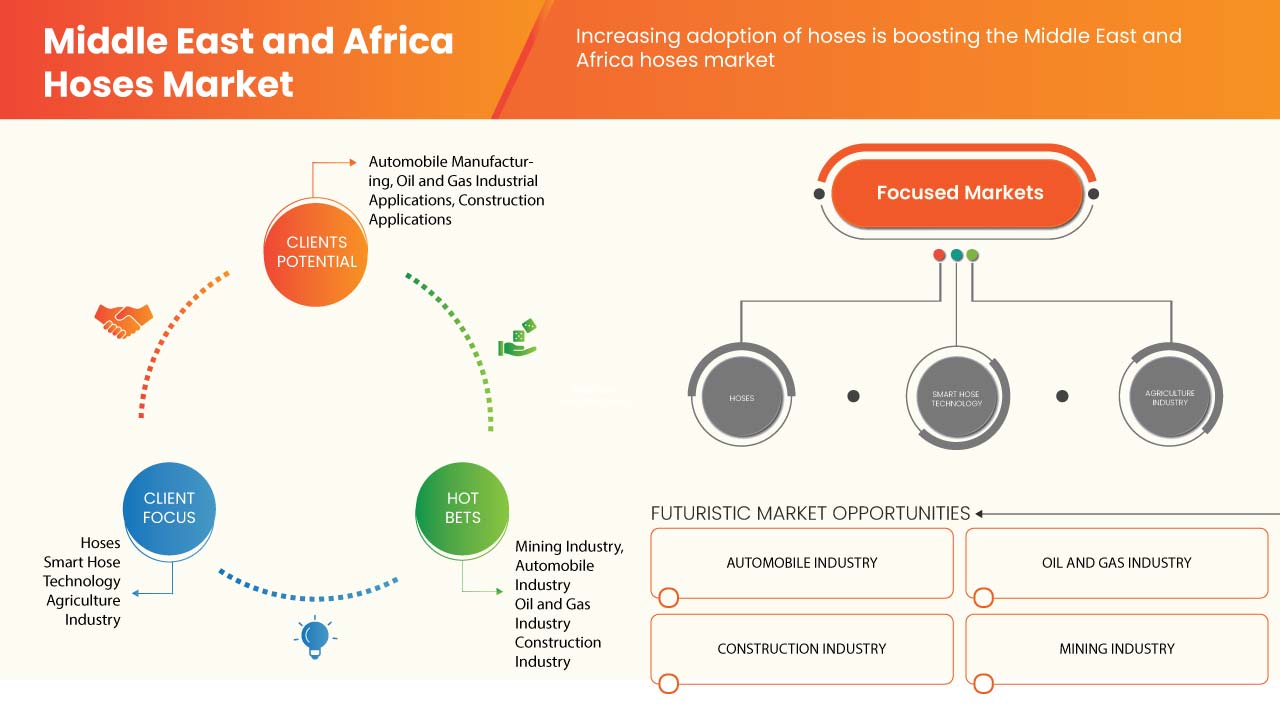

Le marché des tuyaux au Moyen-Orient et en Afrique est fragmenté par nature, car il se compose de nombreux acteurs du Moyen-Orient et d'Afrique, tels que Gates Corporation et PARKER HANNIFIN CORP, entre autres. La présence de ces entreprises produit des prix compétitifs, divers types de tuyaux et d'autres produits de tuyaux innovants avec des services dans le monde entier. En raison de la présence des acteurs aux niveaux régional et international, les fournisseurs et les fabricants proposent des produits et services avec des spécifications et des caractéristiques différentes pour tous les budgets. L'adoption croissante des tuyaux en polymère et le besoin croissant de tuyaux durables dans les applications critiques devraient stimuler la croissance du marché. En outre, les développements croissants liés aux infrastructures et le développement rapide des produits liés aux tuyaux devraient également stimuler le marché. Cependant, les préoccupations environnementales concernant les tuyaux, les normes et réglementations liées aux tuyaux et les limitations des tuyaux dans diverses applications devraient freiner la croissance du marché. De plus, les problèmes techniques liés aux tuyaux et les préoccupations croissantes concernant la sécurité au travail devraient remettre en cause la croissance du marché. Mais, l'adoption croissante des tuyaux dans le secteur automobile et la demande croissante de tuyaux durables devraient offrir des opportunités lucratives de croissance du marché à l'avenir.

Pour cela, divers acteurs du marché introduisent de nouveaux produits et forment un partenariat pour développer leurs activités sur le marché des tuyaux au Moyen-Orient et en Afrique.

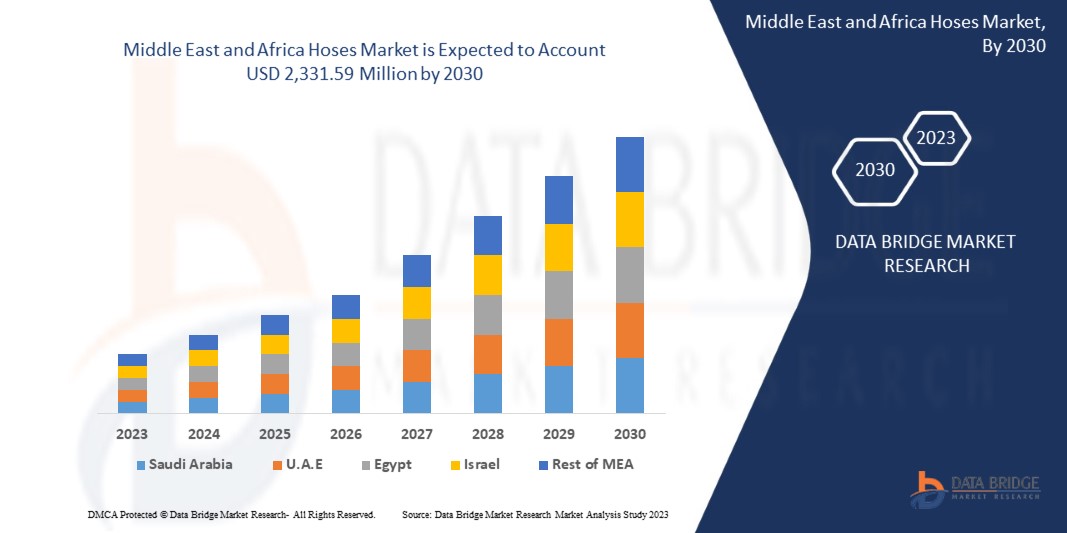

Selon les analyses de Data Bridge Market Research, le marché des tuyaux flexibles au Moyen-Orient et en Afrique devrait atteindre une valeur de 2 331,59 millions USD d'ici 2030, à un TCAC de 4,7 % au cours de la période de prévision. Le rapport sur le marché des tuyaux flexibles au Moyen-Orient et en Afrique couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2016-2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions, volumes en unités, prix en USD |

|

Segments couverts |

Médias (tuyaux hydrauliques, tuyaux à vapeur, tuyaux à air et à gaz, tuyaux de manutention, tuyaux alimentaires et autres), matériaux (tuyaux en plastique/polymères, tuyaux en caoutchouc, tuyaux métalliques, tuyaux composites, tuyaux en silicone et autres), utilisateur final (industriel, automobile, commercial et résidentiel), canal de vente (direct et indirect) |

|

Pays couverts |

Émirats arabes unis, Arabie saoudite, Égypte, Israël, Afrique du Sud, Oman, Bahreïn, Koweït, Qatar et le reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Gates Corporation, PARKER HANNIFIN CORP, ContiTech AG (filiale de Continental AG), Colex International Limited, Royaume-Uni, Danfoss, Kanaflex Corporation (qui fait partie de Kaizen Capital), NORRES (qui fait partie de Triton), Kurt, Robert Bosch Tool Corporation, ALFA GOMMA Spa, Polyhose, Dunlop Hiflex AB, Terraflex, PIRTEK et KURIYAMA OF AMERICA, INC. (filiale de Kuriyama Holdings Corp.) entre autres |

Définition du marché

Les tuyaux sont des tubes flexibles utilisés pour transporter des liquides, des gaz et d'autres matériaux dans une large gamme d'applications dans diverses industries telles que l'agriculture, la construction, l'automobile et le pétrole et le gaz. Les tuyaux peuvent être fabriqués à partir de divers matériaux tels que le caoutchouc, le plastique ou le métal et peuvent être conçus à des fins diverses, telles que le transport de fluides à haute pression, de produits chimiques corrosifs ou de vapeur. Le marché comprend à la fois des tuyaux industriels et grand public et est stimulé par des facteurs tels que la demande croissante de tuyaux de haute qualité, durables, fiables et capables de résister à des températures et des pressions extrêmes, ainsi que le besoin croissant de tuyaux faciles à utiliser, à entretenir et à transporter. Le marché des tuyaux du Moyen-Orient et de l'Afrique est très concurrentiel, avec un grand nombre d'acteurs opérant sur le marché, et devrait croître dans les années à venir en raison de la demande croissante de tuyaux de diverses industries d'utilisation finale.

Dynamique du marché des tuyaux flexibles au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Adoption croissante des tuyaux en polymère

Ces derniers jours, les tuyaux industriels en matériau polymère deviennent importants dans l'automobile, les produits pharmaceutiques, les infrastructures, le pétrole et le gaz, l'alimentation et les boissons, l'exploitation minière, l'eau, l'agriculture et d'autres industries pour la fabrication et l'utilisation de tubes et de tuyaux pour le transport de l'air, de l'eau, des produits chimiques et des fluides d'un bout à l'autre.

La demande augmente de jour en jour en raison de leur large gamme d'applications, telles que l'air, les produits abrasifs, les huiles minérales, l'eau, les gaz techniques et domestiques, la vapeur, les carburants et autres. Le développement technologique aide les produits de tuyaux industriels à compléter la croissance du marché.

- Besoin croissant de tuyaux durables dans les applications critiques

Les tuyaux industriels sont utilisés pour déplacer des fluides, des produits chimiques, de l'air, de l'eau, de l'huile et d'autres matériaux d'un endroit à un autre. Il existe une demande importante de tuyaux industriels robustes sur le marché dans des applications cruciales telles que les hautes températures, les hautes pressions, les réactions chimiques et le vide.

Avant de choisir les tuyaux, les clients doivent prendre en compte un certain nombre de critères importants, notamment la défaillance catastrophique, la perméabilité, la compatibilité chimique, la température, l'environnement extérieur, le vide, etc. Les principaux acteurs du marché des tuyaux au Moyen-Orient et en Afrique lancent des produits de pointe pour des utilisations critiques, ce qui alimente la demande de tuyaux durables dans l'industrie.

Opportunité

- Adoption croissante des tuyaux dans le secteur automobile

Les automobiles sont constituées de structures et de systèmes internes complexes avec divers composants intacts. L'intégration de ces systèmes et composants permet à l'automobile de fonctionner comme une machine efficace. Dans les automobiles, les tuyaux jouent un rôle important car ils sont utilisés comme système de refroidissement du moteur, dans un transporteur d'huile de frein, comme transporteur de carburant, dans la climatisation et dans d'autres parties du véhicule. Dans la conception d'un système de refroidissement du moteur, des tuyaux de différents types sont utilisés pour la circulation du liquide de refroidissement. Ces tuyaux ont des propriétés matérielles différentes car certains sont conçus pour résister à la chaleur du liquide de refroidissement, tandis que d'autres peuvent simplement prendre du liquide de refroidissement froid. Cela augmente l'importance des tuyaux dans les automobiles, et la croissance du marché des tuyaux au Moyen-Orient et en Afrique est directement affectée par la croissance de l'industrie automobile. Comme le secteur automobile dans l'industrie des véhicules électriques connaît une croissance énorme au fil des ans en raison de la demande croissante de véhicules et de véhicules électriques, cela devrait offrir des opportunités lucratives pour le marché.

Retenue/Défi

- Limitations des flexibles dans diverses applications

Les tuyaux industriels sont largement utilisés dans diverses industries pour une efficacité opérationnelle optimale et le transfert de carburant, de produits chimiques, de matériaux en vrac et d'air, entre autres. Bien que les applications industrielles des tuyaux industriels continuent de se développer, les utilisateurs finaux se concentrent de plus en plus sur les niveaux d'efficacité des tuyaux industriels. Cependant, les tuyaux industriels posent divers défis dans divers environnements de système, tels que la plage de température, ce qui a pour effet de nuire aux performances et à l'efficacité globales du système. La limitation caractéristique des tuyaux industriels devrait entraver la croissance du marché des tuyaux au Moyen-Orient et en Afrique. De nombreux utilisateurs finaux et entreprises se tournent vers des alternatives aux tuyaux en raison de leurs limitations.

Impact post-COVID-19 sur le marché des tuyaux flexibles au Moyen-Orient et en Afrique

Français L'industrie des tuyaux a noté une baisse progressive de la demande en raison du confinement et des lois gouvernementales COVID-19, car les installations de fabrication et les services ont été fermés. Même le développement privé et public a été annulé. De plus, l'industrie a également été affectée par l'arrêt de la chaîne d'approvisionnement, en particulier des matières premières utilisées dans le processus de fabrication des tuyaux industriels. Les réglementations gouvernementales strictes pour différentes industries et les restrictions sur le commerce et le transport ont été quelques-uns des principaux facteurs qui ont entraîné une brèche dans la croissance du marché des tuyaux industriels dans le monde en 2020 et au cours des deux premiers trimestres de 2021. La production de tuyaux industriels ayant ralenti en raison des restrictions imposées par les gouvernements du monde entier, la production n'a pas répondu à la demande au cours des trois premiers trimestres de 2020. De plus, une forte demande/exigence de produits de tuyaux industriels dans l'industrie chimique et pharmaceutique, dans le secteur agricole et dans les applications hydrauliques a été observée. La reprise de la production de l'industrie pétrolière et gazière et de l'automobile a encore alimenté la demande croissante de tuyaux industriels à travers le monde. Cela a non seulement entraîné une hausse de la demande, mais également une augmentation du coût du produit.

Développement récent

- En juillet 2021, NORRES Schlauchtechnik GmbH, fabricant, développeur et distributeur de solutions de systèmes de tuyaux flexibles, a acquis Baggerman Group (« Baggerman »), fabricant et distributeur de tuyaux, raccords et accessoires industriels. Cette acquisition a permis à l'entreprise d'accroître sa présence.

- En septembre 2020, la société KURIYAMA OF AMERICA a développé un nouveau produit appelé Tigerflex Tiger Aqua™ Tuyau d'aspiration et de refoulement. Ce nouvel ajout de produit a non seulement amélioré le portefeuille de produits de l'entreprise, mais a également contribué à stimuler les ventes globales.

Portée du marché des tuyaux flexibles au Moyen-Orient et en Afrique

Le marché des tuyaux flexibles du Moyen-Orient et de l'Afrique est segmenté en quatre segments notables basés sur le support, le matériau, l'utilisateur final et le canal de vente. La croissance parmi ces segments vous aidera à analyser les segments de croissance maigres dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Médias

- Hydraulique

- Tuyaux à vapeur

- Tuyaux d'air et de gaz

- Tuyaux de manutention

- Tuyaux alimentaires

- Autres

Sur la base des médias, le marché des tuyaux du Moyen-Orient et de l'Afrique est segmenté en tuyaux hydrauliques, tuyaux à vapeur, tuyaux à air et à gaz, tuyaux de manutention, tuyaux alimentaires et autres.

Matériel

- Tuyaux en plastique/polymères

- Tuyaux en caoutchouc

- Tuyaux métalliques

- Tuyaux composites

- Tuyaux en silicone

- Autres

Sur la base du matériau, le marché des tuyaux du Moyen-Orient et de l'Afrique est segmenté en tuyaux en plastique/polymères, tuyaux en caoutchouc, tuyaux métalliques, tuyaux composites, tuyaux en silicone et autres.

Utilisateur final

- Industriel

- Commercial

- Résidentiel

- Automobile

Sur la base de l’utilisateur final, le marché des tuyaux du Moyen-Orient et de l’Afrique est segmenté en secteurs industriel, automobile, commercial et résidentiel.

Canal de vente

- Direct

- Indirect

Sur la base du canal de vente, le marché des tuyaux du Moyen-Orient et de l'Afrique est segmenté en direct et indirect.

Analyse/perspectives régionales du marché des tuyaux flexibles au Moyen-Orient et en Afrique

Le marché des tuyaux au Moyen-Orient et en Afrique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, média, matériau, utilisateur final et canal de vente, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des tuyaux au Moyen-Orient et en Afrique sont les Émirats arabes unis, l’Arabie saoudite, l’Égypte, Israël, l’Afrique du Sud, Oman, Bahreïn, le Koweït, le Qatar et le reste du Moyen-Orient et de l’Afrique.

Les Émirats arabes unis devraient dominer le marché des tuyaux au Moyen-Orient et en Afrique en raison de la forte demande de matériaux de tuyaux en PVC, ce qui devrait constituer un facteur moteur de la croissance du marché.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui affectent les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, ainsi que des études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données régionales.

Analyse du paysage concurrentiel et des parts de marché des tuyaux flexibles au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des tuyaux flexibles au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des tuyaux flexibles au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des tuyaux au Moyen-Orient et en Afrique sont Gates Corporation, PARKER HANNIFIN CORP, ContiTech AG (filiale de Continental AG), Colex International Limited, UK, Danfoss, Kanaflex Corporation (partie de Kaizen Capital), NORRES (partie de Triton), Kurt, Robert Bosch Tool Corporation, ALFA GOMMA Spa, Polyhose, Dunlop Hiflex AB, Terraflex, PIRTEK et KURIYAMA OF AMERICA, INC. (filiale de Kuriyama Holdings Corp.) entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA HOSES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 MEDIA TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 COMPANY COMPARATIVE ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.4 CASE STUDIES

4.4.1 FLEXIBLE WATER HOSE FAILURES

4.4.1.1 CHALLENGES

4.4.1.2 SOLUTIONS

4.4.2 A HYDRAULIC HOSE FAILURE

4.4.2.1 CHALLENGES

4.4.2.2 SOLUTIONS

4.4.3 HOSE HEAT WRAP

4.4.3.1 CHALLENGES

4.4.3.2 SOLUTIONS

4.5 REGULATORY STANDARDS

4.5.1 SAE STANDARDS FOR HYDRAULIC HOSES –

4.5.2 API STANDARDS FOR TUBULAR

4.5.3 ISO STANDARDS

4.6 TECHNOLOGY TRENDS

4.6.1 SMART HOSES

4.6.2 COMPOSITE HOSES

4.6.3 3D PRINTING

4.6.4 NANOTECHNOLOGY

4.6.5 IOT INTEGRATION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF POLYMER HOSES

5.1.2 INCREASING NEED FOR DURABLE HOSES IN CRITICAL APPLICATIONS

5.1.3 GROWING INFRASTRUCTURE RELATED DEVELOPMENTS

5.1.4 RAPID PRODUCT DEVELOPMENT RELATED TO HOSES

5.2 RESTRAINTS

5.2.1 ENVIRONMENTAL CONCERN REGARDING HOSES

5.2.2 LIMITATIONS OF HOSES IN VARIOUS APPLICATIONS

5.2.3 STANDARDS AND REGULATIONS RELATED TO THE HOSES

5.3 OPPORTUNITIES

5.3.1 GROWING ADOPTION OF HOSES IN AUTOMOBILE SECTOR

5.3.2 RISING DEMAND FOR DURABLE HOSES

5.3.3 INCREASING PARTNERSHIP AND ACQUISITION AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 TECHNICAL ISSUES RELATED TO THE HOSES

5.4.2 GROWING CONCERN ABOUT WORKPLACE SAFETY

6 MIDDLE EAST & AFRICA HOSES MARKET, BY MEDIA

6.1 OVERVIEW

6.2 HYDRAULIC

6.2.1 OIL HOSES

6.2.2 WATER HOSES

6.2.3 CHEMICAL HOSES

6.3 AIR AND GAS HOSES

6.4 MATERIAL HANDLING HOSES

6.5 FOOD HOSES

6.6 STEAM HOSES

6.7 OTHERS

7 MIDDLE EAST & AFRICA HOSES MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 RUBBER HOSES

7.3 PLASTIC/POLYMER HOSES

7.3.1 POLYVINYL CHLORIDE HOSES

7.3.2 POLYURETHANE HOSES

7.3.3 OTHERS

7.4 METAL HOSES

7.5 COMPOSITE HOSES

7.6 SILICON HOSES

7.7 OTHERS

8 MIDDLE EAST & AFRICA HOSES MARKET, BY END USER

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.2.1 ENGINE COOLING HOSES

8.2.2 OTHERS

8.3 INDUSTRIAL

8.3.1 BY MATERIAL TYPE

8.3.1.1 RUBBER INDUSTRIAL HOSES

8.3.1.2 METAL FLEXIBLE HOSES

8.3.1.3 COMPOSITE HOSES

8.3.1.4 SILICONE HOSES

8.3.1.5 POLYVINYL CHLORIDE HOSES

8.3.1.6 POLYURETHANE HOSES

8.3.1.7 OTHERS

8.3.2 BY INDUSTRY

8.3.2.1 OIL & GAS

8.3.2.2 CHEMICAL

8.3.2.3 FOOD & BEVERAGE

8.3.2.4 HEALTHCARE & MEDICAL / PHARMA

8.3.2.5 MANUFACTURING & MACHINE TOOLS

8.3.2.6 CONSTRUCTION

8.3.2.7 MINING

8.3.2.8 MATERIAL HANDLING

8.3.2.9 MARINE EQUIPMENT

8.3.2.10 AGRICULTURE

8.3.2.11 RENEWABLE ENERGY & POWER GENERATION

8.3.2.12 OTHERS

8.4 COMMERCIAL

8.5 RESIDENTIAL

9 MIDDLE EAST & AFRICA HOSES MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 INDIRECT

9.3 DIRECT

10 MIDDLE EAST & AFRICA HOSES MARKET, BY GEOGRAPHY

10.1 MIDDLE EAST AND AFRICA

10.1.1 U.A.E

10.1.2 SAUDI ARABIA

10.1.3 SOUTH AFRICA

10.1.4 EGYPT

10.1.5 ISRAEL

10.1.6 OMAN

10.1.7 BAHRAIN

10.1.8 KUWAIT

10.1.9 QATAR

10.1.10 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA HOSES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 CONTITECH AG

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 ROBERT BOSCH TOOL CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 GATES CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 PARKER HANNIFIN CORP

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 MANULI HYDRAULICS

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALFA GOMMA SPA

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 COLEX INTERNATIONAL LIMITED, UK

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 COPELY DEVELOPMENTS LTD

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 DANFOSS

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 DUNLOP HIFLEX AB

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 FLEXHAUST INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 FLEXONHOSE.COM

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 GOODALL

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 HBD THERMOID

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENTS

13.15 KANAFLEX CORPORATION

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 KINGDAFLEX HOSE

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 KURIYAMA OF AMERICA, INC.

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 KURT

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 NORRES

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 PACIFIC ECHO

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 PIRTEK

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

13.22 POLYHOSE

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 SALEM-REPUBLIC RUBBER COMPANY

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

13.24 SEMPERIT AG HOLDINGS

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT DEVELOPMENTS

13.25 TERRAFLEX

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCT PORTFOLIO

13.25.3 RECENT DEVELOPMENTS

13.26 TITEFLEX (A SUBSIDIARY OF SMITHS GROUP PLC)

13.26.1 COMPANY SNAPSHOT

13.26.2 REVENUE ANALYSIS

13.26.3 PRODUCT PORTFOLIO

13.26.4 RECENT DEVELOPMENTS

13.27 TRANSFER OIL S.P.A.

13.27.1 COMPANY SNAPSHOT

13.27.2 PRODUCT PORTFOLIO

13.27.3 RECENT DEVELOPMENTS

13.28 TRELLEBORG GROUP

13.28.1 COMPANY SNAPSHOT

13.28.2 REVENUE ANALYSIS

13.28.3 PRODUCT PORTFOLIO

13.28.4 RECENT DEVELOPMENTS

13.29 TRICOFLEX SAS

13.29.1 COMPANY SNAPSHOT

13.29.2 PRODUCT PORTFOLIO

13.29.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA HYDRAULIC IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA AIR AND GAS HOSES IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA MATERIAL HANDLING HOSES IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA FOOD HOSES IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA STEAM HOSES IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA OTHERS IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA RUBBER HOSES IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PLASTIC/POLYMER HOSES IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA METAL HOSES IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA COMPOSITE HOSES IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SILICON HOSES IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA OTHERS IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA AUTOMOTIVE IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA INDUSTRIAL IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA COMMERCIAL IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA RESIDENTIAL IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA INDIRECT IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA DIRECT IN HOSES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA HOSES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 38 U.A.E HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 39 U.A.E HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.A.E HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 41 U.A.E PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.A.E HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 U.A.E AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 44 U.A.E INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.A.E INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 46 U.A.E HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 SAUDI ARABIA HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 48 SAUDI ARABIA HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 SAUDI ARABIA HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 50 SAUDI ARABIA PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 SAUDI ARABIA HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 SAUDI ARABIA AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 53 SAUDI ARABIA INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 54 SAUDI ARABIA INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 55 SAUDI ARABIA HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 56 SOUTH AFRICA HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 57 SOUTH AFRICA HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SOUTH AFRICA HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 59 SOUTH AFRICA PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 SOUTH AFRICA HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 61 SOUTH AFRICA AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 62 SOUTH AFRICA INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 63 SOUTH AFRICA INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 64 SOUTH AFRICA HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 65 EGYPT HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 66 EGYPT HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 EGYPT HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 68 EGYPT PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 EGYPT HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 70 EGYPT AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 EGYPT INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 72 EGYPT INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 73 EGYPT HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 74 ISRAEL HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 75 ISRAEL HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 ISRAEL HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 77 ISRAEL PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 ISRAEL HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 ISRAEL AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 80 ISRAEL INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 81 ISRAEL INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 82 ISRAEL HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 83 OMAN HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 84 OMAN HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 OMAN HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 86 OMAN PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 OMAN HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 88 OMAN AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 89 OMAN INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 90 OMAN INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 91 OMAN HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 92 BAHRAIN HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 93 BAHRAIN HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 BAHRAIN HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 95 BAHRAIN PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 BAHRAIN HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 97 BAHRAIN AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 BAHRAIN INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 99 BAHRAIN INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 100 BAHRAIN HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 101 KUWAIT HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 102 KUWAIT HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 KUWAIT HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 104 KUWAIT PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 KUWAIT HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 106 KUWAIT AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 KUWAIT INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 108 KUWAIT INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 109 KUWAIT HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 110 QATAR HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

TABLE 111 QATAR HYDRAULIC IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 QATAR HOSES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 113 QATAR PLASTIC/POLYMER HOSES IN HOSES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 QATAR HOSES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 115 QATAR AUTOMOTIVE IN HOSES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 116 QATAR INDUSTRIAL IN HOSES MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 117 QATAR INDUSTRIAL IN HOSES MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 118 QATAR HOSES MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 119 REST OF MIDDLE EAST AND AFRICA HOSES MARKET, BY MEDIA, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA HOSES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA HOSES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HOSES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HOSES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HOSES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HOSES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA HOSES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA HOSES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA HOSES MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA HOSES MARKET: SEGMENTATION

FIGURE 11 AN INCREASE IN THE ADOPTION OF POLYMER HOSES IS EXPECTED TO BE KEY DRIVER FOR THE MIDDLE EAST & AFRICA HOSES MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 HYDRAULIC IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA HOSES MARKET IN 2023 TO 2030

FIGURE 13 VALUE CHAIN FOR PROGRAMMABLE LOGICAL CONTROLLER MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET

FIGURE 15 MIDDLE EAST & AFRICA HOSES MARKET: BY MEDIA, 2022

FIGURE 16 MIDDLE EAST & AFRICA HOSES MARKET: BY MATERIAL, 2022

FIGURE 17 MIDDLE EAST & AFRICA HOSES MARKET: BY END USER, 2022

FIGURE 18 MIDDLE EAST & AFRICA HOSES MARKET: BY SALES CHANNEL, 2022

FIGURE 19 MIDDLE EAST AND AFRICA HOSES MARKET: SNAPSHOT (2022)

FIGURE 20 MIDDLE EAST AND AFRICA HOSES MARKET: BY COUNTRY (2022)

FIGURE 21 MIDDLE EAST AND AFRICA HOSES MARKET: BY COUNTRY (2023-2030)

FIGURE 22 MIDDLE EAST AND AFRICA HOSES MARKET: BY COUNTRY 2022-2030)

FIGURE 23 MIDDLE EAST AND AFRICA HOSES MARKET: BY MEDIA (2023-2030)

FIGURE 24 MIDDLE EAST & AFRICA HOSES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.