Middle East & Africa High Barrier Packaging Films Market, By Type (Non-Woven Metalized Films, Clear Films, Organic Coating Films, Inorganic Oxide Coating Films, Others), Material (Plastic, Aluminum, Oxides, Others), Packaging Type (Pouches, Bags, Lids, Shrink Films, Laminated Tubes, Others), End-User (Food, Beverages, Pharmaceuticals, Electronic Devices, Medical Devices, Agriculture, Chemicals, Others) Industry Trends and forecast to 2029.

Market Analysis and Insights

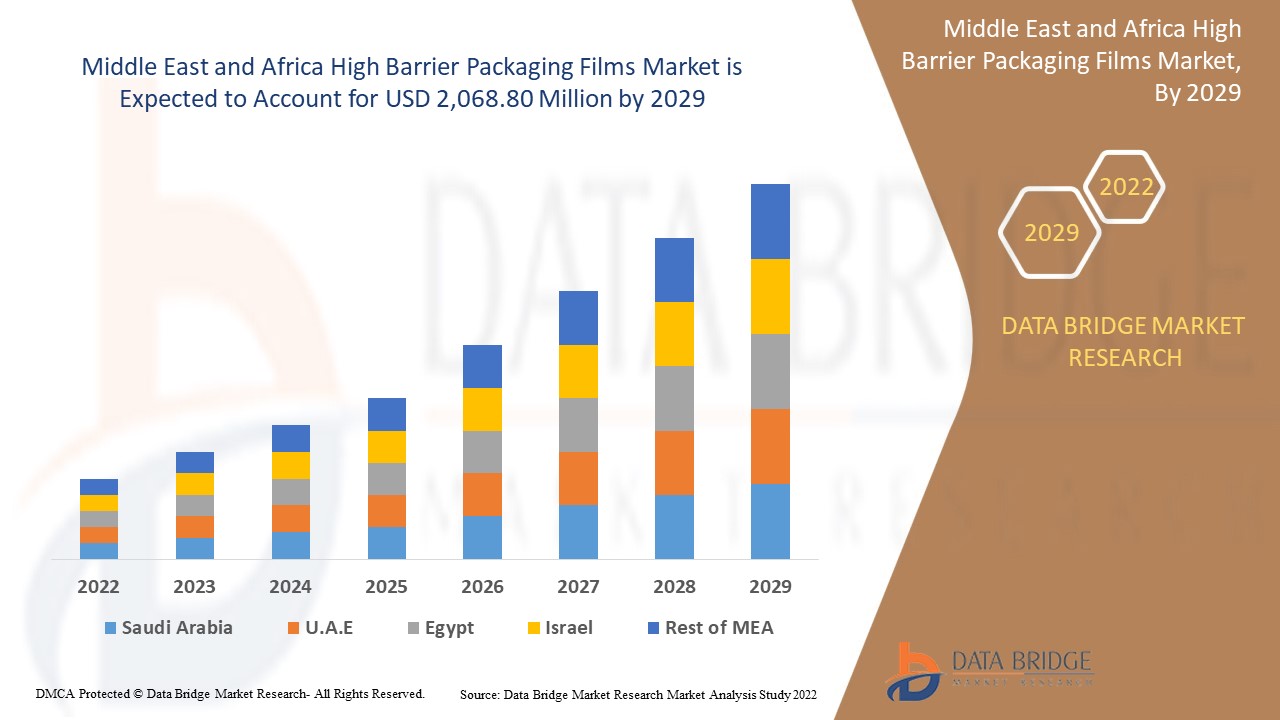

Middle East & Africa high barrier packaging films market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.8% in the forecast period of 2022 to 2029 and is expected to reach USD 2,068.80 million by 2029. The primary factor driving the growth of the high barrier packaging films market is the increasing demand for a multi-layer packaging for preventing oxygen and water permeation, the growing need for high barrier packaging films for longer shelf-life, shifting consumer preference toward the packaged food, and the rising adoption of high barrier packaging films in pharmaceutical and agriculture industry.

The high barrier packaging films help prevent contact with oxygen, carbon dioxide, or moisture while restricting the effect of mineral oil and UV light. The powerful barrier created using functional materials used in the packaging film also holds the qualities of food such as color, taste, texture, aroma, and flavor. High barrier films play a significant role in providing products with required properties and help extend the product's shelf life. It also helps make the structure recyclable with all layers relating to the same family of polymers. Moreover, high barrier films have an impermeable co-extruded & resilient structure. It is solvent-free and usually does not react with packaged food.

Moreover, the increasing popularity of ready-to-eat food influences the consumer shift toward packaged products. Hectic work-life balance and increasing workload also contribute to the rising demand for packaged foods by working professionals. Thus, with the growing demand for packaged food, the Middle East & Africa high barrier packaging films market is expected to propel the market's growth.

Le rapport sur le marché des films d'emballage à haute barrière au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (films métallisés non tissés, films transparents, films de revêtement organique, films de revêtement d'oxyde inorganique, autres), matériau (plastique, aluminium, oxydes, autres), type d'emballage (sachets, sacs, couvercles, films rétractables, tubes laminés, autres), utilisateur final (aliments, boissons, produits pharmaceutiques, appareils électroniques, appareils médicaux, agriculture, produits chimiques). |

|

Pays couverts |

Égypte, Arabie saoudite, Émirats arabes unis, Afrique du Sud, Israël et le reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Français Advanced Converting Works, Constantia Flexibles, HPM MIDDLE EAST & AFRICA INC, FLAIR Flexible Packaging Corporation, ClearBags, Perlen Packaging, OLIVER, Produits métallisés Celplast, Toray Plastics (America), Inc. (une filiale de Toray Industries Inc), ISOFlex Packaging, KREHALON, MULTIVAC, BERNHARDT Packaging & Process, Sonoco Products Company, Sealed Air, WINPAL LTD., Schur Flexibles Holding GesmbH, Amcor Ltd. |

Définition du marché

Les solutions d'emballage flexibles pour les films d'emballage à haute barrière comprennent des sachets, des sacs, des couvercles, des films rétractables, des tubes laminés, etc. Les sachets peuvent se refermer avec des fermetures à glissière et remplacer les emballages rigides, tels que les bocaux en verre et les boîtes métalliques, car les exigences croissantes des clients en matière de sécurité et de commodité des produits encouragent les sachets dans des types d'emballage à haute barrière. Les sachets protègent également le produit contre les influences extérieures, telles que l'humidité, la lumière, la contamination biologique, les gaz et les dommages mécaniques, affectant sa qualité ou son efficacité.

Dynamique du marché des films d'emballage à haute barrière au Moyen-Orient et en Afrique

Conducteurs

- Demande croissante d'emballages multicouches pour empêcher l'oxygène et l'eau

Les films d'emballage à haute barrière sont multicouches, ce qui permet d'éviter tout contact avec l'oxygène, l'humidité et d'autres gaz tels que le dioxyde de carbone et de limiter l'effet de l'huile minérale et des rayons UV. Cette puissante barrière créée à l'aide de matériaux fonctionnels permet de préserver l'intégrité des matériaux qui y sont stockés, tels que la qualité des aliments, comme leur couleur, leur goût, leur texture, leur arôme et leur saveur. Pour qu'un produit conserve son intégrité, il est très important de lui fournir des propriétés de barrière essentielles telles que l'humidité, le gaz et l'arôme. Les films à haute barrière jouent un rôle majeur pour fournir aux produits ces propriétés requises. De plus, les films à haute barrière ont une structure coextrudée et résiliente imperméable, ce qui les rend sans solvant et ne réagissent pas avec les articles emballés tels que les médicaments, les aliments et autres.

- Demande croissante de films d'emballage à haute barrière pour une durée de conservation plus longue

Les ventes d'aliments transformés et surgelés augmentent également, car de nombreux consommateurs délaissent les aliments frais pour privilégier les aliments à longue durée de conservation. Le mode de vie de plus en plus actif des consommateurs et la demande conséquente d'emballages alimentaires pratiques entraînent un besoin de films à haute barrière sur le marché. Les consommateurs étant de plus en plus conscients de l'impact de leur comportement sur l'environnement, ils sont de plus en plus intéressés par des moyens concrets de réduire leur empreinte. Aujourd'hui plus que jamais, les consommateurs cherchent à acheter des produits qui reflètent leurs valeurs et qui sont issus, produits et emballés de la manière la plus durable possible. La longévité de la durée de conservation est le facteur clé que les consommateurs prennent en compte de nos jours.

- Changement de préférence des consommateurs en faveur des aliments emballés

Les films d'emballage à haute barrière sont de plus en plus demandés par l'industrie agroalimentaire en raison de la consommation et de la demande croissantes d'aliments transformés et prêts à consommer emballés. De plus, avec l'augmentation du revenu disponible, les professionnels et les étudiants sont prêts à dépenser plus d'argent pour des aliments emballés et des produits pratiques prêts à consommer, ce qui fait croître le marché des films d'emballage à haute barrière dans un avenir proche. Il existe une forte demande pour les plats préparés prêts à cuisiner et à consommer, les plats allant du congélateur au micro-ondes, les plats préparés emballés et les aliments transformés, qui sont faciles à transporter, à ouvrir et nécessitent moins de temps de préparation.

- Adoption croissante de films d'emballage à haute barrière dans l'industrie pharmaceutique et agricole

Le secteur pharmaceutique pose des exigences différentes en matière de solutions d'emballage, telles que l'isolation de l'environnement extérieur, des niveaux élevés de protection, la rentabilité et la facilité de manipulation. Ainsi, les films d'emballage à haute barrière sont largement utilisés car ces films ne permettent pas l'échange de gaz à travers l'emballage et contrôlent la température à l'intérieur de l'emballage, augmentant ainsi la croissance du marché. Les principaux matériaux d'emballage sont le plastique car il protège le produit pharmaceutique contre l'oxygène et les odeurs, la transmission de vapeur d'eau, l'humidité, la contamination et les bactéries. Ces propriétés font du polypropylène un bon choix pour les emballages à haute barrière. Les films à haute barrière en polypropylène ont un point de fusion élevé, ce qui les rend adaptés aux emballages bouillables et aux produits sérialisables.

Opportunités

- Adoption croissante des films d’emballage biodégradables à haute barrière

En raison des problèmes de recyclage et des solutions d'emballage innovantes biodégradables, le marché des films d'emballage à haute barrière devrait croître dans un avenir proche, car les producteurs de matériaux continuent de développer de nouveaux films plastiques et additifs améliorés pour la production d'emballages. Il s'agit notamment de films à haute barrière et de films de remplacement, de films d'étanchéité et de films plus facilement recyclables et dégradables naturellement. La réduction de l'utilisation de matériaux est une autre tendance clé dans l'industrie de l'emballage et de la fabrication de sachets, que ce soit par le biais de films plus fins ou de moins de couches de film.

- Augmentation de la demande d'emballages conviviaux

Les consommateurs doivent prendre en compte certains points clés avant de sélectionner les films d'emballage. Parmi ces points figurent l'hygiène et la sécurité alimentaire, la durée de conservation, la facilité d'utilisation, la durabilité, les informations sur l'étiquette, l'apparence et les impacts environnementaux. Les consommateurs sont plus intéressés par les emballages à base de fibres que l'on trouve dans les plastiques recyclés et recyclables. Par conséquent, avec la tendance et la demande croissantes en matière d'emballages conviviaux, le marché des films d'emballage à haute barrière a une énorme opportunité d'enregistrer une croissance significative à l'avenir. Cela peut être fait en lançant davantage de produits demandés par les clients, pratiques à utiliser, durables et respectueux de l'environnement.

Contraintes/Défis

- Sensibilité à la dégradation

L'exposition à la chaleur peut modifier le mécanisme d'oxydation des films plastiques. Cependant, la dégradation complète des polymères biodégradables n'est possible que dans des conditions contrôlées telles qu'une température et une pression accrues, qui ne se trouvent pas dans l'environnement naturel comme les habitats aquatiques et marins. Par conséquent, lorsqu'ils ne sont pas dans des conditions optimales, ces films d'emballage à haute barrière devraient se dégrader et détruire leurs propriétés. Cela pourrait freiner la croissance du marché des films d'emballage à haute barrière au Moyen-Orient et en Afrique.

- Fluctuation des prix des matières premières

Différents films d'emballage à haute barrière sont fabriqués à partir de diverses matières premières. Certaines de ces matières premières sont des matières plastiques comme le polyéthylène et le polypropylène, et des métaux comme l'aluminium, entre autres. Ces matériaux ne sont pas biodégradables, difficiles à recycler et nocifs pour l'environnement, notamment l'eau et la terre. Le choix de la matière première est principalement basé sur l'utilisation finale des films barrière. Certaines des principales matières premières utilisées dans les films d'emballage comprennent le LDPE, le LLDPE, le HDPE, le BOPP, le CPP, le BOPET, le PVC, l'EVOH, le PLA, le PVDC, le PVOH et bien d'autres.

- Problématique liée au recyclage des films multicouches

Si l’on tient compte des effets environnementaux, ces solutions d’emballage sont très efficaces, mais le problème est qu’elles sont rarement recyclées dans les infrastructures de gestion des déchets existantes. Comme en Europe, les unités de recyclage s’appuient largement sur des approches traditionnelles de recyclage mécanique dans les processus de dégranulation, qui effectuent un traitement combiné des matériaux. L’incompatibilité thermique des divers matériaux combinés est l’un des principaux obstacles au retraitement. Cependant, de nouvelles technologies telles que le recyclage chimique sont disponibles, avec des résultats prometteurs, mais elles nécessitent des recherches plus approfondies et une mise à l’échelle, ce qui prendra du temps et nécessitera d’énormes investissements en capital. Cela pose à son tour un défi majeur sur la voie du développement et de la croissance du marché des films d’emballage à haute barrière au Moyen-Orient et en Afrique.

- Réglementation gouvernementale stricte et préoccupations environnementales

Les films d'emballage à haute barrière sont principalement fabriqués à partir de matières plastiques, à savoir le polyéthylène, le polypropylène, etc. Ces matériaux ne sont pas biodégradables, difficiles à recycler et nocifs pour l'environnement, notamment l'eau et la terre. Par conséquent, les gouvernements, les organismes de réglementation et les écologistes ont sensibilisé le public aux dangers liés à l'utilisation de ces films. Dans le secteur de l'emballage, on utilise plus de 40 % de plastique. Le plastique met des années à se décomposer et, par conséquent, de nombreux pays ne favorisent pas sa consommation et son utilisation dans quelque secteur que ce soit.

Le COVID-19 a eu un impact minimal sur le marché des films d'emballage à haute barrière au Moyen-Orient et en Afrique

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, un impact significatif a été constaté sur le marché des films d'emballage à haute barrière. Les opérations et la chaîne d'approvisionnement des films d'emballage à haute barrière, avec plusieurs installations de fabrication, fonctionnaient toujours dans la région. Les prestataires de services ont continué à proposer des films d'emballage à haute barrière en suivant les mesures d'hygiène et de sécurité dans le scénario post-COVID.

Développement récent

- En mai 2021, la division Mobility & Materials de DuPont a investi 5 millions de dollars US en capital et en ressources opérationnelles dans ses usines de fabrication en Allemagne et en Suisse pour augmenter leur capacité.

Portée du marché des films d'emballage à haute barrière au Moyen-Orient et en Afrique

Le marché des films d'emballage à haute barrière du Moyen-Orient et de l'Afrique est classé en fonction du type, du matériau, du type d'emballage et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Films métallisés non tissés

- Films transparents

- Films de revêtement organiques

- Films de revêtement en oxyde inorganique

- Autres

En fonction du type, le marché des films d'emballage à haute barrière du Moyen-Orient et de l'Afrique est classé en cinq segments : films métallisés non tissés, films transparents, films de revêtement organique, films de revêtement d'oxyde inorganique et autres.

Matériel

- Plastique

- Aluminium

- Oxydes

- Autres

En fonction du matériau, le marché des films d'emballage à haute barrière du Moyen-Orient et de l'Afrique est classé en quatre segments : plastique, aluminium, oxydes et autres.

Type d'emballage

- Pochettes

- Sacs

- Couvercles

- Films rétractables

- Tubes laminés

- Autres

En fonction du type d’emballage, le marché des films d’emballage à haute barrière du Moyen-Orient et de l’Afrique est classé en six segments : sachets, sacs, couvercles, films rétractables, tubes laminés et autres.

Utilisateur final

- Nourriture

- Boissons

- Médicaments

- Appareils électroniques

- Dispositifs médicaux

- Agriculture

- Produits chimiques

- Autres

En fonction de l’utilisateur final, le marché des films d’emballage à haute barrière du Moyen-Orient et de l’Afrique est segmenté en aliments, boissons, produits pharmaceutiques, appareils électroniques, appareils médicaux, agriculture, produits chimiques et autres.

Analyse/perspectives régionales du marché des films d'emballage à haute barrière au Moyen-Orient et en Afrique

Le marché des films d’emballage à haute barrière du Moyen-Orient et de l’Afrique est segmenté en fonction du type, du matériau, du type d’emballage et de l’utilisateur final.

Les pays du marché des films d'emballage à haute barrière au Moyen-Orient et en Afrique sont l'Égypte, l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, Israël et le reste du Moyen-Orient et de l'Afrique. L'Afrique du Sud domine le marché des films d'emballage à haute barrière au Moyen-Orient et en Afrique, en termes de part de marché et de chiffre d'affaires, et continuera de faire prospérer sa domination au cours de la période de prévision. Cela est dû à l'augmentation de la fréquentation des hôpitaux et des centres de diagnostic.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tests techniques et l'analyse des cinq forces du porteur, ainsi que les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse de la concurrence et des parts de marché des films d'emballage à haute barrière au Moyen-Orient et en Afrique

Middle East & Africa high barrier packaging films market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the Middle East & Africa Highhbarrier packaging films market.

Some of the prominent participants operating in the Middle East & Africa High barrier packaging films market are Advanced Converting Works, Constantia Flexibles, HPM MIDDLE EAST & AFRICA INC, FLAIR Flexible Packaging Corporation, ClearBags, Perlen Packaging, OLIVER, Celplast Metallized Products, Toray Plastics (America), Inc. (a subsidiary of Toray Industries Inc), ISOFlex Packaging, KREHALON, MULTIVAC, BERNHARDT Packaging & Process, Sonoco Products Company, Sealed Air, WINPAL LTD., Schur Flexibles Holding GesmbH, Amcor Ltd.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Middle East & Africa Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 KEY PATENT LAUNCHED

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING AND PACKING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 TECHNOLOGY ADVANCEMENTS

4.7 VENDOR SELECTION CRITERIA

4.8 REGULATORY COVERAGE

5 REGIONAL SUMMARY

5.1 MIDDLE EAST & AFRICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 MIDDLE EAST AND AFRICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN DEMAND FOR MULTI-LAYER PACKAGING FOR PREVENTING OXYGEN AND WATER

6.1.2 GROW IN DEMAND FOR HIGH BARRIER PACKAGING FILMS FOR LONGER SHELF-LIFE

6.1.3 SHIFTING CONSUMER PREFERENCE TOWARD THE PACKAGED FOOD

6.1.4 RISE IN ADOPTION OF HIGH BARRIER PACKAGING FILMS IN PHARMACEUTICAL AND AGRICULTURE INDUSTRY

6.2 RESTRAINTS

6.2.1 SUSCEPTIBILITY TO DEGRADATION

6.2.2 FLUCTUATION IN PRICES OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROW IN ADOPTION OF BIODEGRADABLE HIGH BARRIER PACKAGING FILMS

6.3.2 UPSURGE IN THE DEMAND FOR CUSTOMER-FRIENDLY PACKAGING

6.4 CHALLENGES

6.4.1 ISSUE RELATED TO RECYCLING OF MULTI-LAYER FILMS

6.4.2 STRICT GOVERNMENT REGULATION AND ENVIRONMENTAL CONCERNS

7 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-WOVEN METALIZED FILMS

7.3 CLEAR FILMS

7.4 ORGANIC COATING FILMS

7.5 INORGANIC OXIDE COATING FILMS

7.6 OTHERS

7.6.1 ALUMINIUM FOIL

7.6.2 REST OF OTHERS

8 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE (PE)

8.2.2 POLYPROPYLENE (PP)

8.2.3 POLYETHYLENE TEREPHTHALATE (PET)

8.2.4 ETHYLENE VINYL ALCOHOL (EVOH)

8.2.5 POLYETHYLENE NAPHTHALATE (PEN)

8.2.6 POLYVINYLIDENE CHLORIDE (PVDC)

8.2.7 POLYAMIDE (NYLON)

8.2.8 OTHERS (LCD, PS, PVC, PLA, PA)

8.3 ALUMINIUM

8.4 OXIDES

8.4.1 SILICON OXIDE

8.4.2 ALUMINUM OXIDE

8.5 OTHERS

9 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 POUCHES

9.3 BAGS

9.4 LIDS

9.5 SHRINK FILMS

9.6 LAMINATED TUBES

9.7 OTHERS

10 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER

10.1 OVERVIEW

10.2 FOOD

10.2.1 MEAT, SEA FOOD & POULTRY

10.2.2 READY TO EAT MEALS

10.2.3 SNACKS

10.2.4 DAIRY FOODS

10.2.5 BAKERY & CONFECTIONARY

10.2.6 BABY FOOD

10.2.7 PET FOOD

10.2.8 OTHER FOOD

10.3 BEVERAGES

10.3.1 NON-ALCOHOLIC BEVERAGES

10.3.2 ALCOHOLIC BEVERAGES

10.4 PHARMACEUTICALS

10.5 ELECTRONIC DEVICES

10.6 MEDICAL DEVICES

10.7 AGRICULTURE

10.8 CHEMICALS

10.9 OTHERS

11 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 EGYPT

11.1.3 SAUDI ARABIA

11.1.4 UNITED ARAB EMIRATES

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.2 ACQUISITION

12.3 PRODUCT LAUNCH

12.4 AWARD

12.5 CONFERENCE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 AMCOR PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 DUPONT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 SONOCO PRODUCTS COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATES

14.4 BERRY MIDDLE EAST & AFRICA INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 SEALED AIR

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADVANCED CONVERTING WORKS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BERNHARDT PACKAGING & PROCESS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELPLAST METALLIZED PRODUCTS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CLEARBAGS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 CONSTANTIA FLEXIBLES

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 FLAIR FLEXIBLE PACKAGING CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 HPM MIDDLE EAST & AFRICA INC

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 ISOFLEX PACKAGING

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 KREHALON

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT UPDATES

14.15 MULTIVAC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 OLIVER

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 PERLEN PACKAGING

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATE

14.18 SCHUR FLEXIBLES HOLDING GESMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 TORAY PLASTICS (AMERICA), INC. (SUBSIDIARY OF TORAY INDUSTRIES INC)

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT UPDATES

14.2 WINPAK LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING 3901 TO 3914, N.E.S; HS CODE – 392690 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING 3901 TO 3914, N.E.S; HS CODE – 392690 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 5 MIDDLE EAST & AFRICA NON-WOVEN METALIZED FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA NON-WOVEN METALIZED FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 MIDDLE EAST & AFRICA CLEAR FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CLEAR FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 MIDDLE EAST & AFRICA ORGANIC COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ORGANIC COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 MIDDLE EAST & AFRICA INORGANIC OXIDE COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA INORGANIC OXIDE COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 17 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 19 MIDDLE EAST & AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 21 MIDDLE EAST & AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 23 MIDDLE EAST & AFRICA ALUMINIUM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA ALUMINIUM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 MIDDLE EAST & AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 27 MIDDLE EAST & AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 31 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 33 MIDDLE EAST & AFRICA POUCHES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA POUCHES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS )

TABLE 35 MIDDLE EAST & AFRICA BAGS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA BAGS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 37 MIDDLE EAST & AFRICA LIDS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA LIDS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 39 MIDDLE EAST & AFRICA SHRINK FILM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA SHRINK FILM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 41 MIDDLE EAST & AFRICA LAMINATED TUBES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA LAMINATED TUBES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 43 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 45 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 47 MIDDLE EAST & AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 49 MIDDLE EAST & AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 51 MIDDLE EAST & AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 53 MIDDLE EAST & AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 55 MIDDLE EAST & AFRICA PHARMACEUTICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA PHARMACEUTICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 57 MIDDLE EAST & AFRICA ELECTRONIC DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA ELECTRONIC DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 59 MIDDLE EAST & AFRICA MEDICAL DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA MEDICAL DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 61 MIDDLE EAST & AFRICA AGRICULTURE IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA AGRICULTURE IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 63 MIDDLE EAST & AFRICA CHEMICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA CHEMICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 65 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 67 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 69 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 71 MIDDLE EAST AND AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 75 MIDDLE EAST AND AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 77 MIDDLE EAST AND AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 79 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 81 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 83 MIDDLE EAST AND AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 85 MIDDLE EAST AND AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 87 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 89 SOUTH AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH AFRICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 91 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 93 SOUTH AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 SOUTH AFRICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 95 SOUTH AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 97 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 99 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 SOUTH AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 101 SOUTH AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 SOUTH AFRICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 103 SOUTH AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 105 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 107 EGYPT OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 EGYPT OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 109 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 110 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 111 EGYPT PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 EGYPT PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 113 EGYPT OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 EGYPT OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 115 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 116 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 117 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 EGYPT HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 119 EGYPT FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 120 EGYPT FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 121 EGYPT BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 122 EGYPT BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 123 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 125 SAUDI ARABIA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 127 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 129 SAUDI ARABIA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SAUDI ARABIA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 131 SAUDI ARABIA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SAUDI ARABIA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 133 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 134 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 135 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 SAUDI ARABIA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 137 SAUDI ARABIA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 SAUDI ARABIA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 139 SAUDI ARABIA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 SAUDI ARABIA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 141 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 143 UNITED ARAB EMIRATES OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 UNITED ARAB EMIRATES OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 145 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 146 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 147 UNITED ARAB EMIRATES PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 UNITED ARAB EMIRATES PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 149 UNITED ARAB EMIRATES OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 UNITED ARAB EMIRATES OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 151 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 152 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 153 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 154 UNITED ARAB EMIRATES HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 155 UNITED ARAB EMIRATES FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 156 UNITED ARAB EMIRATES FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 157 UNITED ARAB EMIRATES BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 UNITED ARAB EMIRATES BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 159 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 161 ISRAEL OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 ISRAEL OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 163 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 164 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 165 ISRAEL PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 ISRAEL PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 167 ISRAEL OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 ISRAEL OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 169 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 170 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 171 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 ISRAEL HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 173 ISRAEL FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 ISRAEL FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 175 ISRAEL BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 ISRAEL BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 177 REST OF MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 REST OF MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 2 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SHIFTING CONSUMER PREFERENCE TOWARDS THE PACKAGED FOOD IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET FROM 2022 TO 2029

FIGURE 16 NON-WOVEN METALIZED FILMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET IN 2022 & 2029

FIGURE 17 SUPPLY CHAIN ANALYSIS- MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 20 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY MATERIAL, 2021

FIGURE 22 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY PACKAGING TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY END USER, 2021

FIGURE 24 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET: SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA HIGH BARRIER PACKAGING FILMS MARKET: BY TYPE (2022 - 2029)

FIGURE 29 MIDDLE EAST & AFRICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.