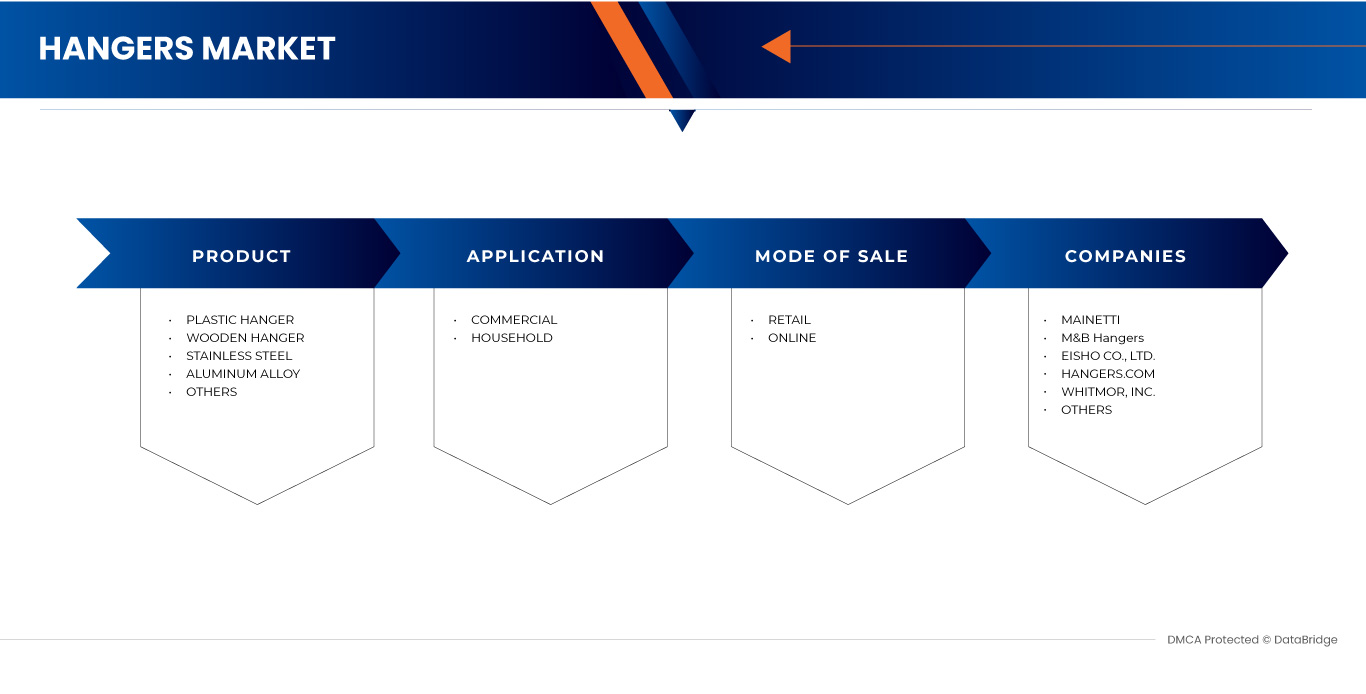

Marché des cintres au Moyen-Orient et en Afrique, par produit (cintre en plastique, cintre en bois, acier inoxydable , alliage d'aluminium et autres), application (commerciale et domestique), mode de vente (au détail et en ligne), tendances de l'industrie et prévisions jusqu'en 2030.

Analyse et perspectives du marché des cintres au Moyen-Orient et en Afrique

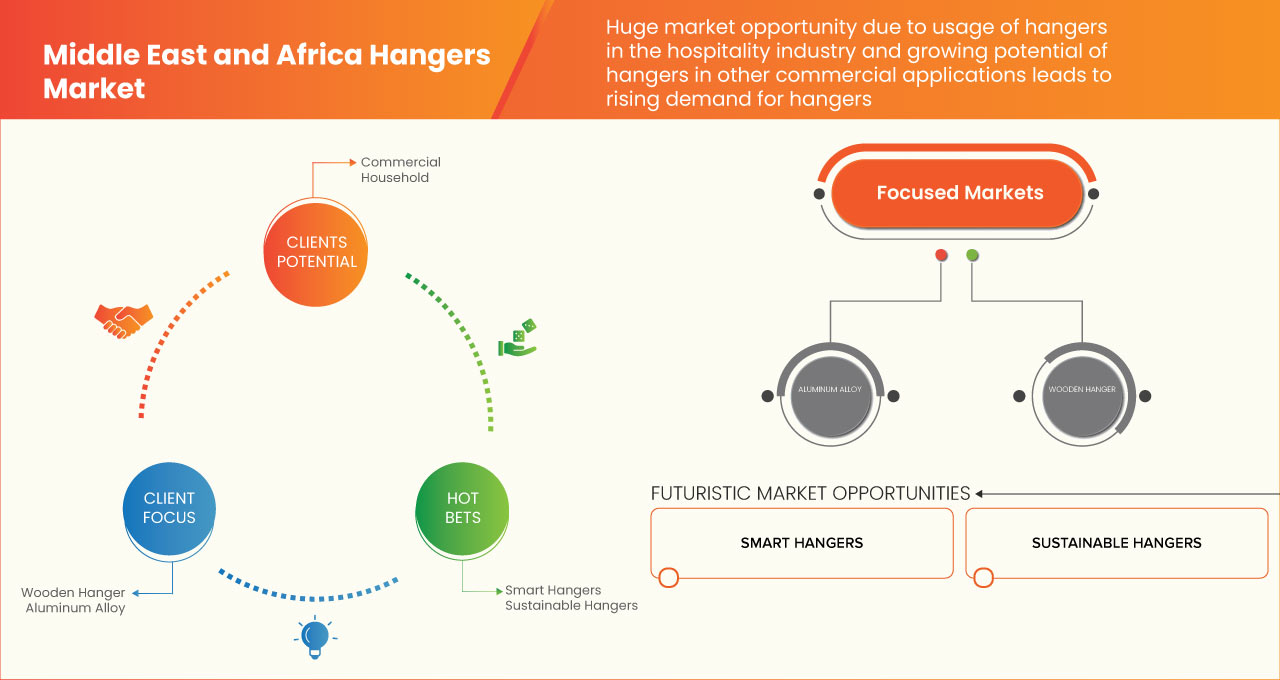

Le marché des cintres au Moyen-Orient et en Afrique devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 4,0 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 105 878,22 milliers de dollars d'ici 2030. Le principal facteur à l'origine de la croissance du marché des cintres au Moyen-Orient et en Afrique est un secteur de la vente au détail et de l'hôtellerie florissant menant à une croissance continue.

Un cintre, un cintre ou un porte-manteau est un dispositif de suspension construit selon la forme/le contour des épaules humaines pour permettre de suspendre un manteau, une veste, un pull, une chemise, un chemisier ou une robe sans plis avec une barre inférieure pour suspendre des pantalons ou des jupes.

Le rapport sur le marché des cintres au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et localisé, des opportunités d'analyse en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste ; notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Produit (cintre en plastique, cintre en bois, acier inoxydable, alliage d'aluminium et autres), application (commerciale et domestique), mode de vente (au détail et en ligne). |

|

Pays couverts |

Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et le reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

MAINETTI, M&B Hangers, EISHO CO., LTD., hangers.com, Whitmor, Inc., GUILIN IANGO HOME COLLECTION CO.,LTD., mawa-hangers.com., NAHANCO, Bend & Hook et Concept Mannequins entre autres. |

Définition du marché

Un cintre général est un type de cintre qui peut être utilisé pour suspendre des vêtements de différentes manières. Il peut être fabriqué en métal, en bois ou en plastique. Les cintres généraux ont de nombreuses utilisations. Ils peuvent être utilisés à des fins personnelles, comme pour suspendre des vêtements pour les faire sécher, ou à des fins commerciales, comme pour exposer des produits. Ils peuvent également être utilisés dans différentes applications, comme pour suspendre des rideaux ou des tentures.

Dynamique du marché des cintres au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- UN SECTEUR DE LA VENTE AU DÉTAIL ET DE L'HÔTELLERIE PROSPÈRE CONDUIT À UNE CROISSANCE CONTINUE

Aujourd'hui, le commerce de détail est l'un des secteurs qui se développe le plus rapidement et joue un rôle essentiel dans la croissance économique croissante du pays. Les clients sont de plus en plus attirés par les marchés de détail ces dernières années. L'évolution de la structure des revenus, l'évolution des modes de vie et le commerce de détail organisé, soutenus en particulier par la hausse des revenus et du pouvoir d'achat des consommateurs dans les secteurs en pleine croissance de l'économie, tels que les technologies de l'information et l'externalisation des processus commerciaux, ne sont que quelques-uns des facteurs clés de la croissance du secteur de la vente au détail. Les grandes entreprises de vente au détail dominent l'environnement de la vente au détail en termes d'espace de vente, de catégories, de gamme, de marques et de volumes. Leurs tailles opérationnelles sont énormes, leurs marges bénéficiaires sont nettement plus importantes et elles opèrent dans une variété de formats, tels que les magasins discount, les entrepôts, les supermarchés, les grands magasins, les hypermarchés, les magasins de proximité et les magasins spécialisés. Le marché des vêtements de marque est celui qui connaît la croissance la plus rapide.

Le secteur de l'hôtellerie est un vaste sous-ensemble de l'industrie des services, dont les deux principales catégories sont les voyages et le tourisme et l'hébergement, allant des complexes hôteliers aux auberges de jeunesse. L'industrie hôtelière mondiale, comme l'ensemble de l'économie, a connu une expansion significative au cours de la dernière décennie. Cette croissance exceptionnelle a profité aux secteurs de l'hôtellerie et du tourisme en augmentant l'activité touristique au Moyen-Orient et en Afrique et en ajoutant d'innombrables nuitées pour les voyages d'agrément et d'affaires.

- LA PRÉFÉRENCE POUR LES CINTRES EN BOIS EST UNE TENDANCE SUR LE MARCHÉ DES CINTRES

Les gens utilisent des cintres tous les jours et ont tout intérêt à bien ranger leurs vêtements. C'est pourquoi il est très étrange qu'ils ne prêtent pas beaucoup d'attention au type de cintres dans leur garde-robe. La principale raison pour laquelle les cintres ne reçoivent pas l'attention qu'ils méritent est qu'ils sont souvent assez bon marché et simples à obtenir, comme le plastique, le métal et autres. Acheter et utiliser des cintres bon marché au lieu de cintres de meilleure qualité, comme les cintres en bois, est un inconvénient.

Bien que les cintres en fil de fer soient pratiques, ils ne constituent pas le choix idéal à long terme pour le rangement des vêtements. Les cintres en fil de fer ne durent pas très longtemps. Ces cintres se plient rapidement, ce qui entraîne des déformations qui créent des empreintes disgracieuses sur les vêtements. De plus, les cintres en fil de fer ne peuvent pas supporter des articles plus volumineux et se plieront simplement sous le poids accru. Par conséquent, les consommateurs qui choisissent des cintres en fil de fer devront les remplacer plus fréquemment. De même, les cintres en plastique, bien que faciles et abordables, présentent les mêmes problèmes que les cintres en fil de fer. De plus, les cintres en plastique manquent de traction et peuvent faire tomber des articles du cintre. Cela peut réduire la durée de vie du vêtement et avoir un impact sur l'environnement s'il est jeté.

Les cintres en bois sont la meilleure alternative pour organiser un placard et sont le choix privilégié pour diverses raisons. Tout d'abord, ils offrent une durabilité inégalée, résistant bien quel que soit le poids ou la taille de vos vêtements. Les cintres en bois, par exemple, fonctionnent bien comme cintres pour manteaux ou cintres pour costumes de luxe car ils peuvent supporter le poids accru de ces articles. De plus, ces cintres apportent une touche tendance au placard. Ces cintres élégants aident les consommateurs à concevoir une garde-robe haut de gamme en créant une esthétique unifiée.

- L'UTILISATION DE DIFFÉRENTS TYPES DE CINTRES DANS LES MÉNAGES EST EN CROISSANCE

Un cintre est un accessoire utilisé pour suspendre des vêtements. Ils étaient populaires parce qu'ils pouvaient contenir une grande quantité de vêtements. Les cintres sont désormais un élément indispensable dans chaque maison ; il est impossible d'imaginer la vie sans eux. Plusieurs types de cintres sont très utiles aux personnes qui voient leur ménage augmenter considérablement.

Selon le matériau, les différents types de cintres sont les cintres en fil de fer, métalliques, en bois, en plastique, en tissu/satin/velours, en bambou, floqués, petits et câlins. Selon leur facilité d'utilisation, les différents types de cintres sont les cintres pour chemises, pantalons, costumes, jupes et lingerie, foulards, cravates, chaussures, pulls et voyages. Selon la conception/les caractéristiques, on trouve les cintres à clips, pivotants, fins, tubulaires, à sangles/encoches, à barre simple, gravés, personnalisés, combinés, à larges épaules, antidérapants et secs/humides. Les fabricants produisent également des cintres écologiques recyclés. Ce sont les différents types de cintres qui sont de plus en plus utilisés dans les ménages.

Opportunités

- LES INNOVATIONS DES CINTRES INTELLIGENTS SONT LE NOUVEAU CHOIX POUR SÉCHER LES VÊTEMENTS

Les innovations d'Intelligence Hangers sont une nouvelle alternative pour sécher les vêtements, développée à l'aide d'approches innovantes et esthétiques. Le produit électrique présente les caractéristiques inhabituelles d'une faible consommation d'énergie, d'un poste de travail pratique et d'un séchage efficace des vêtements. Les cintres traditionnels sont généralement utilisés pour suspendre et sécher les vêtements, mais les cintres intelligents fonctionnent sous la pluie et au soleil. Les cintres intelligents utilisent des capteurs de lumière et de gouttes de pluie pour faire la distinction entre les jours ensoleillés et pluvieux. Ces capteurs peuvent protéger les vêtements de la pluie et les garder aérés pendant que le soleil brille.

Le cintre intelligent est scientifique et innovant dans l'agencement du moteur mécanique et du circuit électronique. Cependant, avec la croissance rapide de la haute technologie, le cintre intelligent sera largement utilisé dans les années à venir. Les individus migrent vers des habitudes, des modes de vie et des niveaux de consommation de luxe, en fonction de l'environnement de marché actuel. De plus, les individus acceptent des inventions artificielles qui sont vraiment utiles et qui sont dans les limites de leur budget.

- AUGMENTATION DU SEGMENT COMMERCIAL ET DE L'ACCESSIBILITÉ DES PRODUITS

Le secteur commercial a continué de prospérer au cours des dernières années. Le secteur des affaires est en plein essor en raison de la forte demande de locaux de vente au détail et de gros. Le secteur en fait un pari attrayant, et ce scénario devrait se poursuivre dans les années à venir. Lorsque la population résidentielle d'une ville commence à croître, le secteur commercial commence à migrer. Des infrastructures sociales telles que des centres commerciaux, des centres commerciaux, des restaurants et des lieux de travail sont construites pour aider les gens. Cela se produira dans toutes les régions du monde qui se développent en fonction de l'essor de la civilisation locale. Cette infrastructure crée un potentiel pour les détaillants de vêtements de marque et sans marque, les grossistes et tous les autres articles. Cela offrira des perspectives de prospérité à l'industrie des cintres.

Contraintes/Défis

- LES VENTES EN LIGNE AURONT UN EFFET SUR LES VENTES DES GROSSISTES ET DES DÉTAILLANTS CONVENTIONNELS

Le secteur de la mode est un secteur en constante évolution, alimenté par les dernières tendances, technologies et idées. Il est toutefois indéniable que la technologie a porté préjudice au secteur de la mode. L'une des principales raisons est le shopping en ligne. L'arrivée d'Internet comme moyen de marketing a modifié les relations commerciales entre les fournisseurs et les clients.

Les gens achètent de plus en plus en ligne pour diverses raisons. C'est facile, les soldes et les remises sont fréquentes et tout le monde peut trouver tout ce qu'il veut en quelques clics. Cependant, cette commodité a un prix : les points de vente traditionnels. Avec la croissance des achats sur Internet et des réseaux sociaux et la hausse des ventes qui en résulte, de nombreuses entreprises physiques ont du mal à se maintenir. En effet, de nombreux magasins réputés ont dû déclarer faillite ces dernières années. Cela est dû au fait que les consommateurs ne font plus leurs achats dans des magasins physiques aussi souvent qu'avant. Les petites entreprises de mode indépendantes ont été dévastées par les achats en ligne et le développement rapide de la mode.

- FLUCTUATION DES PRIX DES MATIÈRES PREMIÈRES ET INTERDICTION D'UTILISATION DU PLASTIQUE

Ces derniers temps, il est devenu impossible de prévoir l’évolution des coûts des matières premières. Ils augmentent et baissent de manière erratique, sans qu’on puisse discerner de tendance. Les prix des différentes matières premières peuvent changer, augmenter ou diminuer, ce qui peut affecter les prix des biens qui les utilisent. Cinq facteurs principaux doivent être pris en compte : une offre en baisse, une demande en hausse, des difficultés de durabilité, une inflation excessive des prix dans les transports et le commerce, et une augmentation des taxes.

Le bois, le fil de fer, le métal et le plastique peuvent tous être utilisés pour fabriquer des cintres. Les coûts des matières premières qui fluctuent considérablement et une gestion inadéquate des prix peuvent compromettre le succès d'une entreprise. Les cintres en plastique sont peu coûteux et largement disponibles. Cependant, le prix du plastique est variable, non seulement parce que le prix du pétrole l'influence fortement, mais aussi parce que d'autres facteurs du marché l'influencent.

Les plastiques sont également interdits dans plusieurs pays en raison de leur impact négatif sur la santé et l'environnement. Chaque année, des millions de cintres en plastique sont livrés dans d'autres pays. La fabrication du plastique a un impact environnemental important et génère beaucoup de déchets plastiques une fois les vêtements achetés.

DÉVELOPPEMENTS RÉCENTS

- En juillet 2021, MAINETTI a lancé la gamme Paperform Hanger, qui offre aux commerçants un complément durable et renouvelable à leur inventaire de cintres. Le cintre est 100 % sans plastique, recyclable et fabriqué à partir de papier et d'acier recyclés sur demande. La collection révolutionnaire est disponible dans une variété de modèles de cintres conçus par le fournisseur de solutions de chaîne d'approvisionnement. Cela aide l'entreprise à gagner en notoriété et à augmenter sa production de produits.

- En novembre 2021, MAINETTI, fournisseur de solutions de vente au détail au Moyen-Orient et en Afrique, a annoncé une collaboration avec UBQ Materials Ltd. pour établir une nouvelle référence en matière d'innovation produit et de durabilité dans le secteur de la mode. Cette coopération utilisera le thermoplastique exclusif d'UBQ pour fabriquer des articles durables pour les détaillants du Moyen-Orient et d'Afrique en utilisant des matières premières à impact positif sur le climat. Cette collaboration permet à l'entreprise d'élargir sa gamme de produits, d'innover et de se développer.

Portée du marché des cintres au Moyen-Orient et en Afrique

Le marché des cintres au Moyen-Orient et en Afrique est classé en fonction du produit, de l'application et du mode de vente. La croissance de ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Cintre en plastique

- Cintre en bois

- Acier inoxydable

- Alliage d'aluminium

- Autres

En fonction du produit, le marché des cintres du Moyen-Orient et de l'Afrique est segmenté en cintres en plastique, cintres en bois, acier inoxydable, alliage d'aluminium et autres.

Application

- Commercial

- Ménage

En fonction des applications, le marché des cintres du Moyen-Orient et de l'Afrique est segmenté en commercial et domestique.

Mode de vente

- Vente au détail

- En ligne

En fonction du mode de vente, le marché des cintres du Moyen-Orient et de l’Afrique est segmenté en vente au détail et en ligne.

Analyse/perspectives régionales du marché des cintres au Moyen-Orient et en Afrique

Le marché des cintres au Moyen-Orient et en Afrique est segmenté en fonction du produit, de l’application et du mode de vente.

Le marché des cintres au Moyen-Orient et en Afrique est segmenté en Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et le reste du Moyen-Orient et de l'Afrique. Les Émirats arabes unis dominent le marché des cintres au Moyen-Orient et en Afrique en termes de part de marché et de chiffre d'affaires en raison de l'utilisation croissante de divers types de cintres dans les ménages.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces du porteur et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité de nouvelles marques et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des cintres au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des cintres au Moyen-Orient et en Afrique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de durée de vie du produit. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des cintres au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des cintres au Moyen-Orient et en Afrique sont MAINETTI, M&B Hangers, EISHO CO., LTD., hangers.com, Whitmor, Inc., GUILIN IANGO HOME COLLECTION CO.,LTD., mawa-hangers.com., NAHANCO, Bend & Hook et Concept Mannequins, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA HANGERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 BRAND SHARE ANALYSIS

4.3 CONSUMER BUYING BEHAVIOR

4.3.1 OVERVIEW

4.3.2 COMPLEX BUYING BEHAVIOR

4.3.3 DISSONANCE-REDUCING BUYING BEHAVIOR

4.3.4 HABITUAL BUYING BEHAVIOR

4.3.5 VARIETY SEEKING BEHAVIOR

4.3.6 CONCLUSION

4.4 FACTORS AFFECTING BUYING DECISION

4.4.1 ECONOMIC FACTOR

4.4.2 FUNCTIONAL FACTOR

4.5 CONSUMER PRODUCT ADSORPTION

4.5.1 OVERVIEW

4.5.2 PRODUCT AWARENESS

4.5.3 PRODUCT INTEREST

4.5.4 PRODUCT EVALUATION

4.5.5 PRODUCT TRIAL

4.5.6 PRODUCT ADOPTION

4.5.7 CONCLUSION

4.6 IMPACT OF ECONOMIC SLOWDOWN

4.6.1 IMPACT ON PRICE

4.6.2 IMPACT ON SUPPLY CHAIN

4.6.3 IMPACT ON SHIPMENT

4.6.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

4.7 IMPORT EXPORT SCENARIO

4.8 PRODUCTION CAPACITY OUTLOOK

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 RAW MATERIAL SOURCING ANALYSIS

4.10.1 METAL

4.10.2 PLASTICS

4.10.3 WOOD

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 A THRIVING RETAIL AND HOSPITALITY SECTOR LEADS TO CONTINUOUS GROWTH

6.1.2 THE PREFERENCE FOR WOODEN HANGERS IS TRENDING IN THE HANGERS MARKET

6.1.3 THE USE OF VARIOUS TYPES OF HANGERS IN HOUSEHOLDS IS INCREASING

6.2 RESTRAINTS

6.2.1 ONLINE SALES HAVE AN EFFECT ON CONVENTIONAL WHOLESALERS AND RETAILERS' SALES

6.2.2 A CHEAP AND EASY ALTERNATIVE FOR HANGERS

6.3 OPPORTUNITIES

6.3.1 INNOVATIONS OF INTELLIGENCE HANGERS ARE THE NEW CHOICE FOR DRYING CLOTHES

6.3.2 INCREASE IN THE COMMERCIAL SEGMENT AND PRODUCT ACCESSIBILITY

6.4 CHALLENGES

6.4.1 FLUCTUATING RAW MATERIAL PRICES AND PROHIBITION ON PLASTIC USAGE

6.4.2 PROBLEMS ASSOCIATED WITH THE DIFFERENT TYPES OF HANGERS

7 MIDDLE EAST & AFRICA HANGERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 PLASTIC HANGERS

7.3 WOODEN HANGER

7.4 STAINLESS STEEL

7.5 ALUMINUM ALLOY

7.6 OTHERS

8 MIDDLE EAST & AFRICA HANGERS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 COMMERCIAL

8.2.1 COMMERCIAL, BY PRODUCT

8.2.1.1 PLASTIC HANGER

8.2.1.2 WOODEN HANGER

8.2.1.3 STAINLESS STEEL

8.2.1.4 ALUMINUM ALLOY

8.2.1.5 OTHERS

8.3 HOUSEHOLD

8.3.1 HOUSEHOLD, BY PRODUCT

8.3.1.1 PLASTIC HANGER

8.3.1.2 WOODEN HANGER

8.3.1.3 STAINLESS STEEL

8.3.1.4 ALUMINUM ALLOY

8.3.1.5 OTHERS

9 MIDDLE EAST & AFRICA HANGERS MARKET, BY MODE OF SALE

9.1 OVERVIEW

9.2 RETAIL

9.3 ONLINE

10 MIDDLE EAST & AFRICA HANGERS MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 UNITED ARAB EMIRATES

10.1.2 SOUTH AFRICA

10.1.3 SAUDI ARABIA

10.1.4 EGYPT

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA HANGERS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

11.2 PRODUCT LAUNCH

11.3 PARTNERSHIP

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 MAINETTI

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 M&B HANGERS

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 EISHO CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 HANGERS.COM

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATE

13.5 WHITMOR, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 BEND & HOOK

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 CONCEPT MANNEQUINS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATE

13.8 GUILIN IANGO HOME COLLECTION CO., LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT UPDATES

13.9 MAWA-HANGERS.COM.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 NAHANC0

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORT

Liste des tableaux

TABLE 1 IMPORT DATA OF CLOTHES HANGERS OF WOOD; HS CODE – 442110 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CLOTHES HANGERS OF WOOD; HS CODE – 442110 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 MIDDLE EAST & AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 6 MIDDLE EAST & AFRICA PLASTIC HANGERS IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA WOODEN HANGERS IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA STAINLESS STEEL IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA ALUMINIUM ALLOY IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 13 MIDDLE EAST & AFRICA COMMERCIAL IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA HOUSEHOLD IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA RETAIL IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA ONLINE IN HANGERS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA HANGERS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA HANGERS MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 22 MIDDLE EAST AND AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 24 MIDDLE EAST AND AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 26 MIDDLE EAST AND AFRICA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 29 UNITED ARAB EMIRATES HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 30 UNITED ARAB EMIRATES HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 31 UNITED ARAB EMIRATES HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 32 UNITED ARAB EMIRATES HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 33 UNITED ARAB EMIRATES COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 34 UNITED ARAB EMIRATES HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 35 UNITED ARAB EMIRATES HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 36 SOUTH AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 37 SOUTH AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 38 SOUTH AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 39 SOUTH AFRICA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 40 SOUTH AFRICA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 41 SOUTH AFRICA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 42 SOUTH AFRICA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 43 SAUDI ARABIA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 44 SAUDI ARABIA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 45 SAUDI ARABIA HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 46 SAUDI ARABIA HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 47 SAUDI ARABIA COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 SAUDI ARABIA HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 SAUDI ARABIA HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 50 EGYPT HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 EGYPT HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 52 EGYPT HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 53 EGYPT HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 54 EGYPT COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 55 EGYPT HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 56 EGYPT HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 57 ISRAEL HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 58 ISRAEL HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

TABLE 59 ISRAEL HANGERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 ISRAEL HANGERS MARKET, BY APPLICATION, 2021-2030 (THOUSAND UNITS)

TABLE 61 ISRAEL COMMERCIAL IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 62 ISRAEL HOUSEHOLD IN HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 63 ISRAEL HANGERS MARKET, BY MODE OF SALE, 2021-2030 (USD THOUSAND)

TABLE 64 REST OF MIDDLE EAST AND AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 65 REST OF MIDDLE EAST AND AFRICA HANGERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND UNITS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA HANGERS MARKET

FIGURE 2 MIDDLE EAST & AFRICA HANGERS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HANGERS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HANGERS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HANGERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HANGERS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA HANGERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA HANGERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA HANGERS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA HANGERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA HANGERS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA HANGERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA HANGERS MARKET: SEGMENTATION

FIGURE 14 THRIVING RETAIL AND HOSPITALITY SECTOR LEAD TO CONTINUOUS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA HANGERS MARKET IN THE FORECAST PERIOD

FIGURE 15 PLASTIC HANGER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA HANGERS MARKET IN 2023 & 2030

FIGURE 16 MIDDLE EAST & AFRICA HANGERS MARKET: TYPES OF CONSUMER BUYING BEHAVIOUR

FIGURE 17 MIDDLE EAST & AFRICA HANGERS MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST & AFRICA HANGERS MARKET

FIGURE 20 MIDDLE EAST & AFRICA HANGERS MARKET, BY PRODUCT, 2022

FIGURE 21 MIDDLE EAST & AFRICA HANGERS MARKET, BY APPLICATION, 2022

FIGURE 22 MIDDLE EAST & AFRICA HANGERS MARKET, BY MODE OF SALE, 2022

FIGURE 23 MIDDLE EAST AND AFRICA HANGERS MARKET: BY SNAPSHOT (2022)

FIGURE 24 MIDDLE EAST AND AFRICA HANGERS MARKET: BY COUNTRY (2022)

FIGURE 25 MIDDLE EAST AND AFRICA HANGERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 26 MIDDLE EAST AND AFRICA HANGERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 27 MIDDLE EAST AND AFRICA HANGERS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 28 MIDDLE EAST & AFRICA HANGERS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.