Middle East And Africa Gloves Market

Taille du marché en milliards USD

TCAC :

%

USD

576.77 Million

USD

971.83 Million

2021

2029

USD

576.77 Million

USD

971.83 Million

2021

2029

| 2022 –2029 | |

| USD 576.77 Million | |

| USD 971.83 Million | |

|

|

|

|

Marché des gants au Moyen-Orient et en Afrique, par type de produit (gants en nitrile, gants en latex, gants en vinyle, gants en polyéthylène , gants en tissu de coton, gants résistants aux perforations, gants en butyle, gants aluminisés, gants en néoprène, gants en Kevlar, gants en cuir et autres), type (jetable et réutilisable), application (biologique, chimique , mécanique, thermique, antistatique et autres), utilisateur final (médical et soins de santé, alimentation et boissons, protection contre les incendies, construction, industries manufacturières, fabrication de métaux, électronique et autres), canal de distribution (en ligne, hors ligne et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des gants au Moyen-Orient et en Afrique

Les gants offrent confort et protection aux mains contre les températures extrêmes, les maladies et les dommages causés par les produits chimiques, l'abrasion et la friction. Ils peuvent également servir de protection contre les objets que les mains nues ne doivent pas toucher. Les professionnels de la santé portent souvent des gants jetables en latex, en caoutchouc nitrile ou en vinyle par mesure de précaution contre la contamination et pour des raisons d'hygiène. Pour éviter de détruire des preuves sur les scènes de crime, le personnel de police les porte souvent pendant son travail. Ils permettent également d'éviter les brûlures lors des travaux électriques ainsi que lors de la manipulation de produits chimiques nocifs.

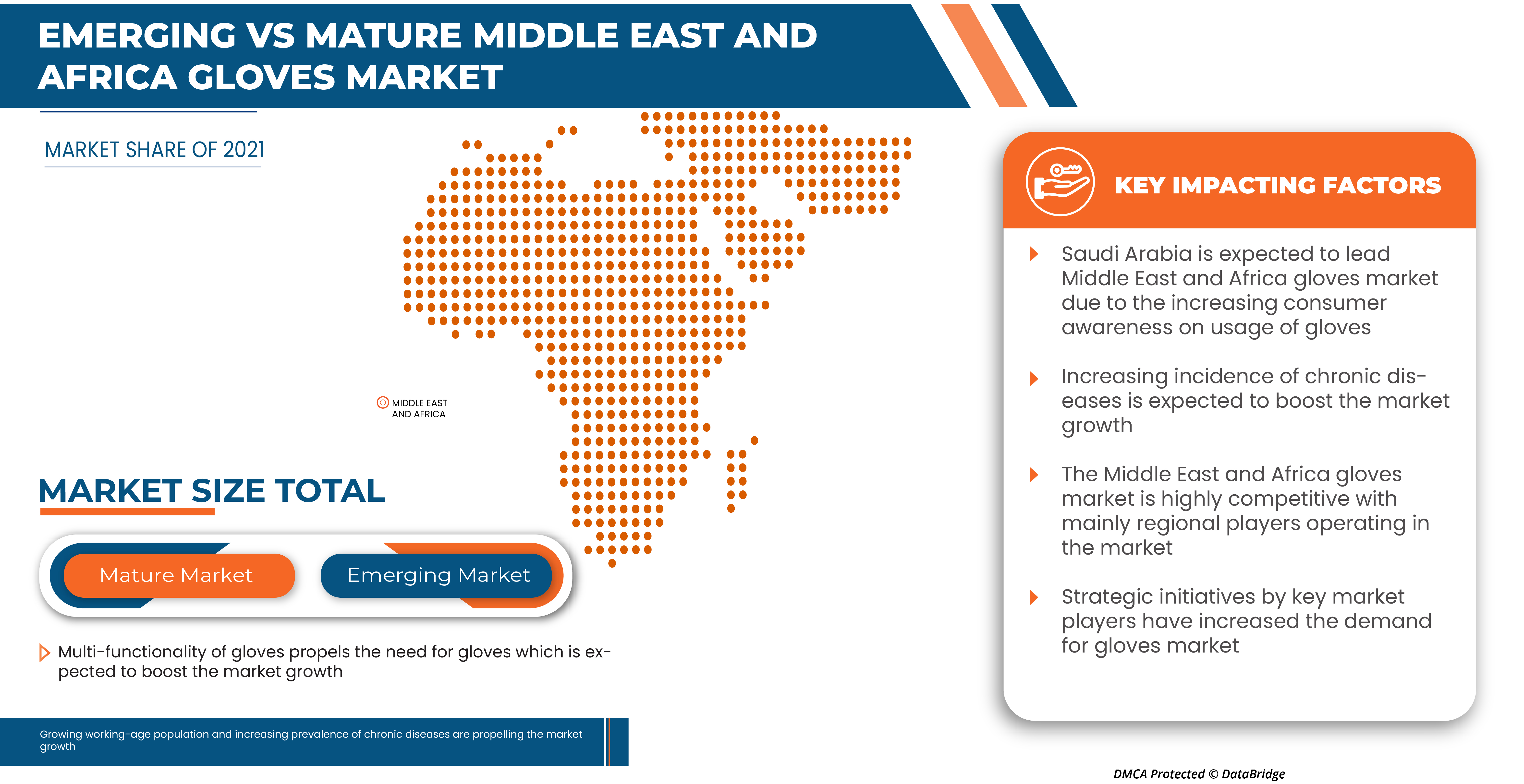

Le marché des gants au Moyen-Orient et en Afrique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,7% au cours de la période de prévision de 2022 à 2029 et devrait atteindre 971,83 millions USD d'ici 2029 contre 576,77 millions USD en 2021.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 (personnalisable jusqu'en 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de produit (gants en nitrile, gants en latex, gants en vinyle, gants en polyéthylène, gants en tissu de coton, gants résistants aux perforations, gants en butyle, gants aluminisés, gants en néoprène, gants en Kevlar, gants en cuir et autres), type (jetables et réutilisables), application (biologique, chimique, mécanique, thermique, antistatique et autres), utilisateur final (médical et soins de santé, alimentation et boissons, protection contre les incendies, construction, industries manufacturières, fabrication de métaux, électronique et autres), canal de distribution (en ligne, hors ligne et autres) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Tenacious Holdings, Inc., MCR Safety, Cardinal Health, Lakeland Inc., Shamrock Manufacturing Co. Inc, VIP GLOVE SDN BHD (Malaisie), Midas Safety, Superior Glove, Hartalega Holdings, Rubberex Corporation (M) Berhad, 3M, Kimberly-Clark Worldwide, Inc, ANSELL LTD., Honeywell International Inc, DuPont de Nemours Inc., Top Glove Corporation Bhd, Kossan Rubber Industries Bhd, Comfort Rubber Gloves Industries Sdn Bhd et DELTA PLUS, entre autres |

Définition du marché

Un gant est un vêtement qui recouvre la main. Le pouce et chaque doigt ont généralement leurs ouvertures ou gaines sur les gants. Le tissu, la laine tricotée ou feutrée, le cuir, le caoutchouc, le latex, le néoprène, la soie et le métal font partie des matériaux utilisés pour fabriquer des gants (comme la cotte de mailles). Les gants en Kevlar protègent le porteur des coupures. Dans les combinaisons pressurisées et les combinaisons spatiales comme l'Apollo/Skylab A7L qui a voyagé vers la lune, les gants et les gantelets sont des éléments essentiels. Les gants pour combinaisons spatiales combinent une certaine sensibilité et flexibilité avec une certaine dureté et une protection environnementale.

Dynamique du marché des gants

Les moteurs, opportunités et contraintes/défis du marché des gants au Moyen-Orient et en Afrique sont les suivants :

- SENSIBILISATION ACCRUE DES CONSOMMATEURS SUR L'UTILISATION DES GANTS

Pour les professionnels de santé qui tentent de se protéger et de protéger leurs patients contre l'exposition aux infections, l'utilisation prudente de gants ainsi qu'une réserve suffisante restent essentielles. Ces gants créent une barrière entre les microbes et les mains. Ils agissent comme un bouclier protégeant les professionnels de santé contre les infections contagieuses. Pendant les interventions chirurgicales, les chirurgiens et autres professionnels ainsi que les patients sont exposés à un risque potentiel d'infection. Les gants médicaux aident à protéger les médecins et les professionnels de santé contre la contamination croisée. En outre, il a été recommandé que le port de gants à l'hôpital contribue à prévenir la propagation des microbes dans l'environnement. De plus, au cours des dernières décennies, la demande d'aliments de haute qualité a augmenté en raison d'une plus grande sensibilisation à la question de la qualité des aliments en réponse à la pression du marché et à la réaction à d'autres facteurs tels que les préoccupations sanitaires et environnementales qui se sont manifestées dans le nombre croissant de maladies d'origine alimentaire. L'incidence croissante des troubles liés à l'alimentation a incité les consommateurs à apporter des changements vitaux à leur régime alimentaire et à leur mode de vie, les rendant plus soucieux que jamais de leur santé. La sécurité alimentaire est importante non seulement pour la santé des consommateurs, mais aussi pour l'ensemble de l'industrie alimentaire et les autorités réglementaires.

Par exemple,

- Selon l'Organisation des Nations Unies pour l'alimentation et l'agriculture (FAO), la Coopération italienne au développement a apporté une contribution supplémentaire de 14 millions d'euros au fonds fiduciaire de la FAO pour la sécurité alimentaire et la sûreté alimentaire.

Le nombre croissant d'initiatives prises par les autorités gouvernementales pour promouvoir la sécurité alimentaire, associé à une sensibilisation croissante des consommateurs à ce sujet, va propulser la croissance du marché. Ainsi, la modernisation de la sécurité alimentaire dans des pays comme l'Europe, les États-Unis et certains pays à revenu faible et intermédiaire, comme la Chine, l'Inde et le Vietnam, a été motivée par une combinaison d'attentes globales élevées des consommateurs en matière de sécurité alimentaire et d'épidémies importantes qui ont encore intensifié les demandes d'amélioration des consommateurs, ce qui devrait accroître la demande du marché.

- INCIDENCE AUGMENTANTE DES MALADIES CHRONIQUES

La prévalence élevée des maladies chroniques est due à la croissance rapide de la population et aux infections observées dans le monde entier. Ainsi, l'augmentation de la prévalence des maladies chroniques et aiguës chez la population âgée entraîne une augmentation des hospitalisations. Cela, à son tour, stimule la demande de gants sur le marché. La désinfection et la stérilisation par l'utilisation de désinfectants et de pratiques de stérilisation sont essentielles pour garantir que les instruments médicaux et chirurgicaux ne transmettent pas d'agents pathogènes infectieux aux patients. L'évaluation des troubles entraînera en outre une forte demande de gants médicaux utilisés dans les salles d'opération.

Les maladies chroniques comprennent les maladies cardiovasculaires, les accidents vasculaires cérébraux, le cancer, les maladies respiratoires chroniques et le diabète, les maladies cardiovasculaires étant la principale cause de décès dans le monde. Des gants chirurgicaux stériles sont nécessaires pour les interventions chirurgicales. Certaines procédures de soins non chirurgicales, telles que l'insertion d'un cathéter vasculaire central, nécessitent également l'utilisation de gants chirurgicaux. Le secteur de la santé est l'un des principaux utilisateurs finaux de gants en latex de caoutchouc naturel. Les gants en nitrile sans poudre sont les meilleurs pour les environnements médicaux. Le matériau poudré n'est pas recommandé, même lorsqu'une protection des mains sans latex est utilisée. Le nitrile passe par un processus spécial qui lui permet d'avoir les mêmes avantages que s'il était poudré, comme un retrait facile. Le produit est utilisé dans les blocs opératoires, en raison de sa capacité à réduire la possibilité de transfert d'infection pour les professionnels de la santé ainsi que pour les patients, ce qui a entraîné une augmentation de la demande de gants.

Les gants sont conçus pour être utilisés à des fins de soins ainsi que pour les activités d'entretien dans les établissements de santé. Les risques accrus de ces maladies infectieuses augmentent directement la demande de gants nécessaires pour réduire ces maladies. Ainsi, le nombre croissant de maladies chroniques devrait agir comme un moteur de croissance du marché.

- INITIATIVES GOUVERNEMENTALES ET RÉGLEMENTATIONS AMÉLIORÉES

Le gouvernement, en collaboration avec différentes organisations et entreprises de fabrication, a fourni au secteur de la santé des fournitures d'EPI comprenant des gants et des masques. Ainsi, les initiatives gouvernementales entreprises se traduiront par une augmentation des fournitures de gants pour la sécurité des travailleurs de la santé et de l'industrie. Il assurera également une collaboration avec les organisations de santé et les entreprises du secteur des EPI pour organiser des séminaires, des symposiums et présenter le portefeuille de produits afin de sensibiliser les individus, ce qui devrait servir de facteur moteur à la croissance du marché.

De plus, dans l’industrie alimentaire, les gants sont utilisés non seulement pour éviter le contact des mains avec les aliments ou les surfaces en contact avec les aliments, mais aussi pour protéger les travailleurs contre les blessures et la contamination et pour assurer confort et protection contre la chaleur, le froid et l’humidité. Selon les Centres pour le contrôle et la prévention des maladies, chaque année, environ un Américain sur six (soit 48 millions de personnes) tombe malade, 3 000 meurent et 128 000 sont hospitalisés à cause de maladies d’origine alimentaire. Les consommateurs peuvent avoir confiance dans la sécurité et la qualité des produits qu’ils achètent lorsque les entreprises respectent les normes. De plus, les importateurs peuvent être sûrs que les aliments qu’ils ont commandés répondront à leurs spécifications. Ainsi, de nos jours, la sécurité alimentaire est une préoccupation majeure. De nombreux gouvernements prennent des initiatives en faveur de la sécurité alimentaire, de la qualité et du commerce équitable.

Aux États-Unis, le réseau CORE (Coordinated Outbreak Response and Evaluation) de la FDA a été mis en place pour coordonner la surveillance des épidémies de maladies d'origine alimentaire, la réponse et les activités post-réponse liées aux incidents impliquant plusieurs maladies associées aux compléments alimentaires et aux aliments pour humains réglementés par la FDA. Ainsi, les gouvernements prennent diverses initiatives en matière de sécurité pour prévenir la propagation des maladies d'origine alimentaire, ce qui devrait contribuer à la croissance du marché.

Opportunité

MULTIFONCTIONNALITÉ DES GANTS

Il existe aujourd'hui de nombreux types de gants permettant de se protéger contre une grande variété de dangers. La multifonctionnalité des gants contribue à un grand nombre d'applications.

En général, les gants se répartissent en quatre groupes :

Gants en cuir, en toile ou en maille métallique

- Des gants robustes en maille métallique, en cuir ou en toile protègent contre les coupures et les brûlures. Les gants en cuir ou en toile protègent également contre la chaleur persistante.

- Les gants en cuir protègent contre les étincelles, la chaleur modérée, les coups, les éclats et les objets rugueux.

Gants en tissu et en tissu enduit

- Les gants en tissu et en tissu enduit sont fabriqués en coton ou autre tissu pour offrir différents degrés de protection.

- Les gants en tissu protègent contre la saleté, les éclats, les frottements et les abrasions. Ils n'offrent pas une protection suffisante pour une utilisation avec des matériaux rugueux, tranchants ou lourds. L'ajout d'un revêtement en plastique renforcera certains gants en tissu.

Gants résistants aux produits chimiques et aux liquides

- Les gants résistants aux produits chimiques sont fabriqués à partir de différents types de caoutchouc : naturel, butyle, néoprène, nitrile et fluorocarbone (Viton) ; ou de divers types de plastique : chlorure de polyvinyle (PVC), alcool polyvinylique et polyéthylène. Ces matériaux peuvent être mélangés ou laminés pour une meilleure performance. En règle générale, plus le matériau du gant est épais, plus la résistance aux produits chimiques est élevée, mais des gants épais peuvent nuire à la préhension et à la dextérité, ce qui a un impact négatif sur la sécurité.

- Les gants en butyle sont fabriqués en caoutchouc synthétique et protègent contre une grande variété de produits chimiques, tels que le peroxyde, les carburants pour fusées, les acides hautement corrosifs (acide nitrique, acide sulfurique, acide fluorhydrique et acide nitrique fumant rouge), les bases fortes, les alcools, les aldéhydes, les cétones, les esters et les composés nitrés. Les gants en butyle résistent également à l'oxydation, à la corrosion par l'ozone et à l'abrasion et restent flexibles à basse température.

- Gants isolants en caoutchouc

- Les gants en caoutchouc naturel (latex) sont confortables à porter, ce qui en fait des gants polyvalents populaires. Ils se caractérisent par une résistance à la traction, une élasticité et une résistance à la température exceptionnelles. En plus de résister aux abrasions causées par le meulage et le polissage, ces gants protègent les mains des employés de la plupart des solutions aqueuses d'acides, d'alcalis, de sels et de cétones.

- Les gants en néoprène sont fabriqués à partir de caoutchouc synthétique et offrent une bonne souplesse, une bonne dextérité des doigts, une densité élevée et une résistance à la déchirure. Ils protègent contre les fluides hydrauliques, l'essence, l'alcool, les acides organiques et les alcalis. Ils ont généralement des propriétés de résistance aux produits chimiques et à l'usure supérieures à celles des gants en caoutchouc naturel.

Cette large gamme de variétés et la multifonctionnalité des gants constituent une formidable opportunité de croissance du marché.

Retenue/Défi

Cependant, les obstacles au marché des gants sont les risques pour la santé causés par les gants et dans certaines régions, ils peuvent entraver la croissance du marché. En outre, la forte concurrence dans les industries et les longs délais de qualification à l'étranger peuvent constituer des facteurs difficiles à la croissance du marché.

Ce rapport de marché fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les analyses des opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des gants au Moyen-Orient et en Afrique, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développement récent

- En mars 2020, alors que la plupart des entreprises du pays commençaient à fermer en raison de la COVID-19, Luginbill et Matt Hayes, fondateur et propriétaire d’Unmanned Propulsion Development, ont reconnu qu’en tant qu’entrepreneurs de Tech Port, ils étaient dans une position idéale pour apporter leur aide. Ils ont d’abord créé des gants, des masques, des écrans et des blouses, mais ont rapidement réalisé que les matériaux seraient épuisés bien avant la fin de la pandémie. Ainsi, huit entreprises ont été contactées pour apporter leur aide et deux entreprises locales basées dans le sud du Maryland, Burch Oil et Triton Defense, où a été construite la boîte capable de désinfecter 24 000 masques N95 par jour, ou d’autres équipements de protection individuelle, la « boîte chaude » pourrait permettre au personnel de santé de réutiliser son équipement au moins 20 fois.

Portée du marché des gants au Moyen-Orient et en Afrique

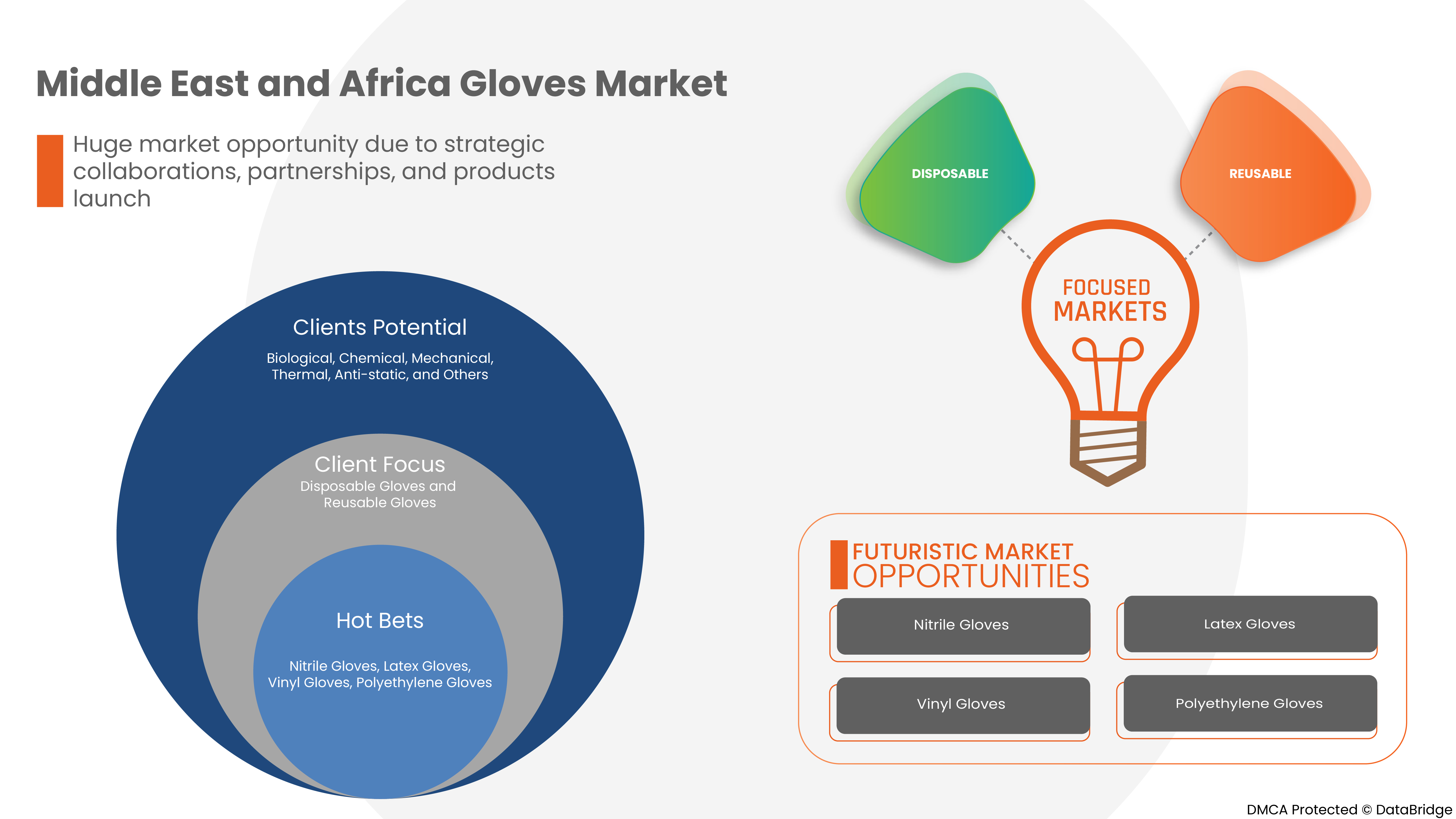

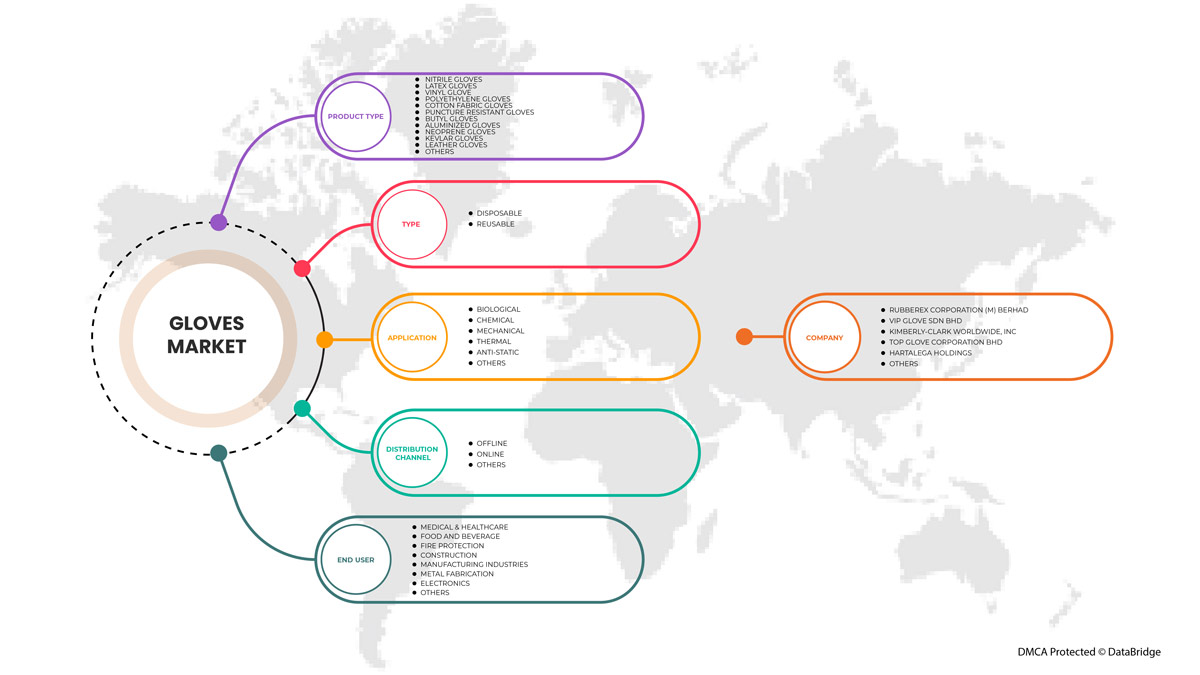

Le marché des gants du Moyen-Orient et de l'Afrique est segmenté en type de produit, type, application, utilisateur final et canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

PAR TYPE DE PRODUIT

- Gants en nitrile

- Gants en latex

- Gant en vinyle

- Gants en polyéthylène

- Gants en tissu de coton

- Gants résistants aux perforations

- Gants en butyle

- Gants aluminisés

- Gants en néoprène

- Gants en Kevlar

- Gants en cuir

- Autres

En fonction du type de produit, le marché est segmenté en gants en nitrile, gants en latex, gants en vinyle, gants en polyéthylène, gants en tissu de coton, gants résistants à la perforation, gants en butyle, gants aluminisés, gants en néoprène, gants en kevlar, gants en cuir et autres.

PAR TYPE

- Jetable

- Réutilisable

En fonction du type, le marché est segmenté en jetable et réutilisable.

SUR DEMANDE

- Biologique

- Chimique

- Mécanique

- Thermique

- Antistatique

- Autres

En fonction des applications, le marché est segmenté en biologique, chimique, mécanique, thermique, antistatique et autres.

PAR UTILISATEUR FINAL

- Médical et soins de santé

- Alimentation et boissons

- Protection contre l'incendie

- Construction

- Industries manufacturières

- Fabrication de métaux

- Électronique

- Autres

En fonction de l'utilisateur final, le marché est segmenté en secteurs médical et de la santé, de l'alimentation et des boissons, de la protection incendie, de la construction, des industries manufacturières, de la fabrication de métaux, de l'électronique et autres.

PAR CANAL DE DISTRIBUTION

- En ligne

- Hors ligne

- Autres

En fonction du canal de distribution, le marché est segmenté en en ligne, hors ligne et autres.

Analyse/perspectives régionales du marché des gants au Moyen-Orient et en Afrique

Le marché des gants au Moyen-Orient et en Afrique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de produit, type, application, utilisateur final et canal de distribution comme référencé ci-dessus.

Le marché des gants du Moyen-Orient et de l’Afrique comprend les pays d’Afrique du Sud, d’Arabie saoudite, des Émirats arabes unis, d’Égypte, d’Israël et du reste du Moyen-Orient et de l’Afrique.

South Africa dominates the Middle East and Africa gloves market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the rising need for gloves in the region and the rapid boosting of the market.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Middle East and Africa brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Gloves Market Share Analysis

The Middle East and Africa gloves market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the market are Tenacious Holdings, Inc., MCR Safety, Cardinal Health, Lakeland Inc., Shamrock Manufacturing Co. Inc, VIP GLOVE SDN BHD (Malaysia), Midas Safety, Superior Glove, Hartalega Holdings, Rubberex Corporation (M) Berhad, 3M, Kimberly-Clark Worldwide, Inc, ANSELL LTD., Honeywell International Inc, DuPont de Nemours Inc., Top Glove Corporation Bhd, Kossan Rubber Industries Bhd, Comfort Rubber Gloves Industries Sdn Bhd, and DELTA PLUS among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East and Africa vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA GLOVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 PREMIUM INSIGHTS

3.1 PORTER'S FIVE FORCES MODEL

3.2 BRAND COMPETITIVE ANALYSIS: MIDDLE EAST & AFRICA GLOVES MARKET

3.3 MIDDLE EAST & AFRICA GLOVES MARKET: BUYING BEHAVIOUR

3.3.1 RESEARCH

3.3.2 OCCUPATIONAL HEALTH AND ALLERGY CONCERNS

3.3.3 TYPE OF MATERIAL

3.3.4 APPLICATION IN VARIOUS INDUSTRIES

3.3.5 ENVIRONMENTAL ISSUES

3.4 FACTORS INFLUENCING BUYING DECISION

3.5 MIDDLE EAST & AFRICA GLOVES MARKET: PRODUCT ADOPTION SCENARIO

3.5.1 TYPE OF MATERIAL

3.5.2 SAFETY CONCERNS

3.6 IMPACT OF ECONOMIC SLOWDOWN

3.6.1 IMPACT ON PRICES

3.6.2 IMPACT ON SUPPLY CHAIN

3.6.3 IMPACT ON SHIPMENT

3.6.4 IMPACT ON DEMAND

3.6.5 IMPACT ON STRATEGIC DECISIONS

3.7 SUPPLY CHAIN: MIDDLE EAST & AFRICA GLOVES MARKET

3.7.1 RAW MATERIAL PROCUREMENT

3.7.2 MANUFACTURING

3.7.3 MARKETING & DISTRIBUTION

3.7.4 END USERS

3.7.5 LOGISTIC COST SCENARIO

3.7.6 IMPORTANCE OF LOGISTIC SERVICE PROVIDER

4 MIDDLE EAST & AFRICA GLOVES MARKET: REGULATIONS

4.1 CANADA REGULATION

4.1.1 MEDICAL GLOVES

4.1.2 NON-MEDICAL GLOVES

4.2 WORLD HEALTH ORGANIZATION STANDARDS

4.2.1 GLOVES EXAMINATION (NON-STERILE)-

4.2.2 GLOVES EXAMINATION (NON-STERILE)-

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING CONSUMER AWARENESS ON USAGE OF GLOVES

5.1.2 INCREASING INCIDENCE OF CHRONIC DISEASES

5.1.3 GOVERNMENT INITIATIVES AND IMPROVED REGULATIONS

5.1.4 RISE IN NUMBER OF MANUFACTURING UNIT

5.2 RESTRAINTS

5.2.1 UNREGULATED DISPOSAL AND WASTAGE OF PERSONAL PROTECTIVE EQUIPMENT (PPE)

5.2.2 HEALTH HAZARDS ASSOCIATED WITH GLOVES

5.3 OPPORTUNITIES

5.3.1 GROWING WORKING-AGE POPULATION

5.3.2 WORK PLACE SAFETY REGULATIONS

5.3.3 MULTI-FUNCTIONALITY OF GLOVES

5.4 CHALLENGES

5.4.1 MANUFACTURING OF POOR QUALITY GLOVES

5.4.2 SHIPMENT DELAYS

6 MIDDLE EAST & AFRICA GLOVES MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 NITRILE GLOVES

6.2.1 DISPOSABLE

6.2.2 REUSABLE

6.3 LATEX GLOVES

6.3.1 DISPOSABLE

6.3.2 REUSABLE

6.4 VINYL GLOVES

6.4.1 DISPOSABLE

6.4.2 REUSABLE

6.5 POLYETHYLENE GLOVES

6.5.1 DISPOSABLE

6.5.2 REUSABLE

6.6 COTTON FABRIC GLOVES

6.6.1 DISPOSABLE

6.6.2 REUSABLE

6.7 PUNCTURE RESISTANT GLOVES

6.7.1 DISPOSABLE

6.7.2 REUSABLE

6.8 BUTYL GLOVES

6.8.1 DISPOSABLE

6.8.2 REUSABLE

6.9 ALUMINIZED GLOVES

6.9.1 DISPOSABLE

6.9.2 REUSABLE

6.1 NEOPRENE GLOVES

6.10.1 DISPOSABLE

6.10.2 REUSABLE

6.11 KEVLAR GLOVES

6.11.1 DISPOSABLE

6.11.2 REUSABLE

6.12 LEATHER GLOVES

6.12.1 DISPOSABLE

6.12.2 REUSABLE

6.13 OTHERS

6.13.1 DISPOSABLE

6.13.2 REUSABLE

7 MIDDLE EAST & AFRICA GLOVES MARKET, BY TYPE

7.1 OVERVIEW

7.2 DISPOSABLE

7.3 REUSABLE

8 MIDDLE EAST & AFRICA GLOVES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIOLOGICAL

8.3 CHEMICAL

8.4 MECHANICAL

8.4.1 AUTOMOTIVE

8.4.2 CHEMICAL

8.4.3 OIL & GAS

8.4.4 OTHERS

8.5 THERMAL

8.6 ANTI-STATIC

8.7 OTHERS

9 MIDDLE EAST & AFRICA GLOVES MARKET , BY END USER

9.1 OVERVIEW

9.2 MEDICAL & HEALTHCARE

9.2.1 BY END USE

9.2.1.1 HOSPITALS

9.2.1.2 AMBULATORY SURGERY

9.2.1.3 DIAGNOSTIC CENTERS

9.2.1.4 CLINICS

9.2.1.5 REHABILITATION CENTERS

9.2.1.6 OTHERS

9.2.2 BY PRODUCT TYPE

9.2.2.1 NITRILE GLOVES

9.2.2.2 LATEX GLOVES

9.2.2.3 VINYL GLOVES

9.2.2.4 POLYETHYLENE GLOVES

9.2.2.5 COTTON FABRIC GLOVES

9.2.2.6 PUNCTURE RESISTANT GLOVES

9.2.2.7 BUTYL GLOVES

9.2.2.8 ALUMINIZED GLOVES

9.2.2.9 NEOPRENE GLOVES

9.2.2.10 KEVLAR GLOVES

9.2.2.11 LEATHER GLOVES

9.2.2.12 OTHERS

9.3 FOOD AND BEVERAGE

9.3.1 NITRILE GLOVES

9.3.2 LATEX GLOVES

9.3.3 VINYL GLOVES

9.3.4 POLYETHYLENE GLOVES

9.3.5 COTTON FABRIC GLOVES

9.3.6 PUNCTURE RESISTANT GLOVES

9.3.7 BUTYL GLOVES

9.3.8 ALUMINIZED GLOVES

9.3.9 NEOPRENE GLOVES

9.3.10 KEVLAR GLOVES

9.3.11 LEATHER GLOVES

9.3.12 OTHERS

9.4 FIRE PROTECTION

9.4.1 NITRILE GLOVES

9.4.2 LATEX GLOVES

9.4.3 VINYL GLOVES

9.4.4 POLYETHYLENE GLOVES

9.4.5 COTTON FABRIC GLOVES

9.4.6 PUNCTURE RESISTANT GLOVES

9.4.7 BUTYL GLOVES

9.4.8 ALUMINIZED GLOVES

9.4.9 NEOPRENE GLOVES

9.4.10 KEVLAR GLOVES

9.4.11 LEATHER GLOVES

9.4.12 OTHERS

9.5 CONSTRUCTION

9.5.1 NITRILE GLOVES

9.5.2 LATEX GLOVES

9.5.3 VINYL GLOVES

9.5.4 POLYETHYLENE GLOVES

9.5.5 COTTON FABRIC GLOVES

9.5.6 PUNCTURE RESISTANT GLOVES

9.5.7 BUTYL GLOVES

9.5.8 ALUMINIZED GLOVES

9.5.9 NEOPRENE GLOVES

9.5.10 KEVLAR GLOVES

9.5.11 LEATHER GLOVES

9.5.12 OTHERS

9.6 MANUFACTURING INDUSTRIES

9.6.1 NITRILE GLOVES

9.6.2 LATEX GLOVES

9.6.3 VINYL GLOVES

9.6.4 POLYETHYLENE GLOVES

9.6.5 COTTON FABRIC GLOVES

9.6.6 PUNCTURE RESISTANT GLOVES

9.6.7 BUTYL GLOVES

9.6.8 ALUMINIZED GLOVES

9.6.9 NEOPRENE GLOVES

9.6.10 KEVLAR GLOVES

9.6.11 LEATHER GLOVES

9.6.12 OTHERS

9.7 METAL FABRICATION

9.7.1 NITRILE GLOVES

9.7.2 LATEX GLOVES

9.7.3 VINYL GLOVES

9.7.4 POLYETHYLENE GLOVES

9.7.5 COTTON FABRIC GLOVES

9.7.6 PUNCTURE RESISTANT GLOVES

9.7.7 BUTYL GLOVES

9.7.8 ALUMINIZED GLOVES

9.7.9 NEOPRENE GLOVES

9.7.10 KEVLAR GLOVES

9.7.11 LEATHER GLOVES

9.7.12 OTHERS

9.8 ELECTRONICS

9.8.1 NITRILE GLOVES

9.8.2 LATEX GLOVES

9.8.3 VINYL GLOVES

9.8.4 POLYETHYLENE GLOVES

9.8.5 COTTON FABRIC GLOVES

9.8.6 PUNCTURE RESISTANT GLOVES

9.8.7 BUTYL GLOVES

9.8.8 ALUMINIZED GLOVES

9.8.9 NEOPRENE GLOVES

9.8.10 KEVLAR GLOVES

9.8.11 LEATHER GLOVES

9.8.12 OTHERS

9.9 OTHERS

9.9.1 NITRILE GLOVES

9.9.2 LATEX GLOVES

9.9.3 VINYL GLOVES

9.9.4 POLYETHYLENE GLOVES

9.9.5 COTTON FABRIC GLOVES

9.9.6 PUNCTURE RESISTANT GLOVES

9.9.7 BUTYL GLOVES

9.9.8 ALUMINIZED GLOVES

9.9.9 NEOPRENE GLOVES

9.9.10 KEVLAR GLOVES

9.9.11 LEATHER GLOVES

9.9.12 OTHERS

10 MIDDLE EAST & AFRICA GLOVES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.2.1 DIRECT SALES

10.2.2 SUPERMARKETS/HYPERMARKETS

10.2.3 MEDICAL STORES

10.2.4 OTHERS

10.3 ONLINE

10.3.1 E-COMMERCE

10.3.2 BRAND WEBSITES

10.3.3 OTHERS

10.4 OTHERS

11 MIDDLE EAST & AFRICA GLOVES MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA GLOVES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 RUBBEREX CORPORATION (M) BERHAD (2021)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 VIP GLOVE SDN BHD (MALAYSIA) (2021)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 KIMBERLY-CLARK WORLDWIDE, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 TOP GLOVE CORPORATION BHD

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 HARTALEGA HOLDINGS BERHAD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 DUPONT DE NEMOURS INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 HONEYWELL INTERNATIONAL INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 KOSSAN RUBBER INDUSTRIES BHD

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 ANSELL LTD

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 CARDINAL HEALTH

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 3M

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 COMFORT RUBBER GLOVES INDUSTRIES SDN BHD

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 DELTA PLUS

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 SUPERIOR GLOVE.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 MCR SAFETY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 TENACIOUS HOLDINGS, INC. (DBA ERGODYNE)

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 MIDAS SAFETY

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 LAKELAND INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 SHAMROCK MANUFACTURING CO. INC.,

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA GLOVES MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA GLOVES MARKET, BY PRODUCT TYPE, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 3 MIDDLE EAST & AFRICA NITRILE GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA NITRILE GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA LATEX GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA LATEX GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA VINYL GLOVE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA VINYL GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA POLYETHYLENE GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA POLYETHYLENE GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA COTTON FABRIC GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA COTTON FABRIC GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA PUNCTURE RESISTANT GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA PUNCTURE RESISTANT GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA BUTYL GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA BUTYL GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA ALUMINIZED GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ALUMINIZED GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA NEOPRENE GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA NEOPRENE GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA KEVLAR GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA KEVLAR GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA LEATHER GLOVES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA LEATHER GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA OTHERS GLOVES IN GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA GLOVES MARKET, BY TYPE, 2015-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA GLOVES MARKET, BY TYPE, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 29 MIDDLE EAST & AFRICA DISPOSABLE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA REUSABLE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA GLOVES MARKET, BY APPLICATION, 2015-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA GLOVES MARKET, BY APPLICATION, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 33 MIDDLE EAST & AFRICA BIOLOGICAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA CHEMICAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA MECHANICAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA MECHANICAL IN GLOVES MARKET, BY APPLICATION, 2015-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA THERMAL IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ANTI-STATIC IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA GLOVES MARKET , BY END USER, 2015-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA GLOVES MARKET , BY END USER, VOLUME,2015-2029 (UNITS,KILO TONNES)

TABLE 42 MIDDLE EAST & AFRICA MEDICAL & HEALTHCARE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA MEDICAL & HEALTHCARE IN GLOVES MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA MEDICAL & HEALTHCARE IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA FOOD AND BEVERAGE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA FOOD AND BEVERAGE IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA FIRE PROTECTION IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA FIRE PROTECTION IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA CONSTRUCTION IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA CONSTRUCTION IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA MANUFACTURING INDUSTRIES IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA MANUFACTURING INDUSTRIES IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA METAL FABRICATION IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA METAL FABRICATION IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA ELECTRONICS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA ELECTRONICS IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA OTHERS IN GLOVES MARKET, BY PRODUCT TYPE, 2015-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA GLOVES MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA GLOVES MARKET, BY PRODUCT TYPE, VOLUME, 2015-2029 (UNITS,KILO TONNES)

TABLE 61 MIDDLE EAST & AFRICA OFFLINE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA OFFLINE IN GLOVES MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA ONLINE IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA ONLINE IN GLOVES MARKET, BY DISTRIBUTION CHANNEL, 2015-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA OTHERS IN GLOVES MARKET, BY REGION, 2015-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA GLOVES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA GLOVES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA GLOVES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA GLOVES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA GLOVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA GLOVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA GLOVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA GLOVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA GLOVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA GLOVES MARKET: SEGMENTATION

FIGURE 11 RISING MANUFACTURING UNITS AND INCREASING CHRONIC DISEASES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA GLOVES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 NITRILE GLOVES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA GLOVES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA GLOVES MARKET

FIGURE 14 MIDDLE EAST & AFRICA GLOVES MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 MIDDLE EAST & AFRICA GLOVES MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA GLOVES MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 MIDDLE EAST & AFRICA GLOVES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA GLOVES MARKET: BY TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA GLOVES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA GLOVES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 MIDDLE EAST & AFRICA GLOVES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA GLOVES MARKET: BY APPLICATION, 2021

FIGURE 23 MIDDLE EAST & AFRICA GLOVES MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA GLOVES MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA GLOVES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA GLOVES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 31 MIDDLE EAST & AFRICA GLOVES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA GLOVES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA GLOVES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 MIDDLE EAST AND AFRICA GLOVES MARKET: SNAPSHOT (2021)

FIGURE 35 MIDDLE EAST AND AFRICA GLOVES MARKET: BY COUNTRY (2021)

FIGURE 36 MIDDLE EAST AND AFRICA GLOVES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 MIDDLE EAST AND AFRICA GLOVES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA GLOVES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 39 MIDDLE EAST & AFRICA GLOVES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.