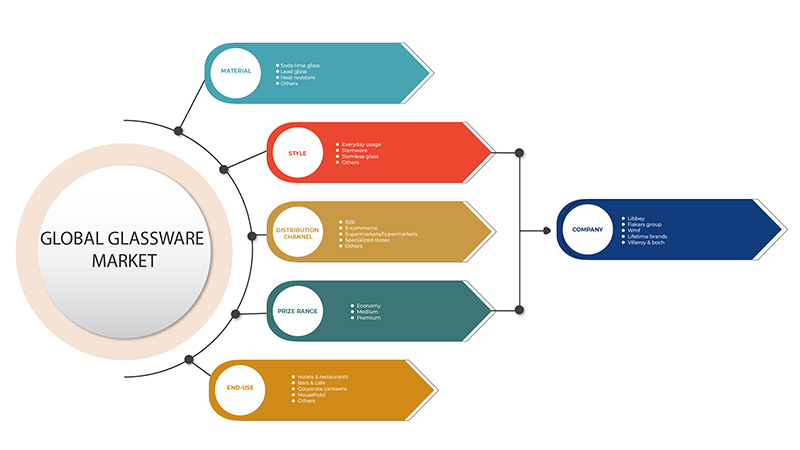

Marché de la verrerie au Moyen-Orient et en Afrique, par matériau (verre sodocalcique, verre au plomb, résistant à la chaleur et autres), style (verre sans pied, verres à pied, usage quotidien et autres), canal de distribution (B2B, magasins spécialisés, supermarchés/hypermarchés, commerce électronique et autres), gamme de prix (moyen, haut de gamme et économique), utilisation finale (hôtels et restaurants, bars et cafés, ménages, cantines d'entreprise et autres) Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et taille du marché

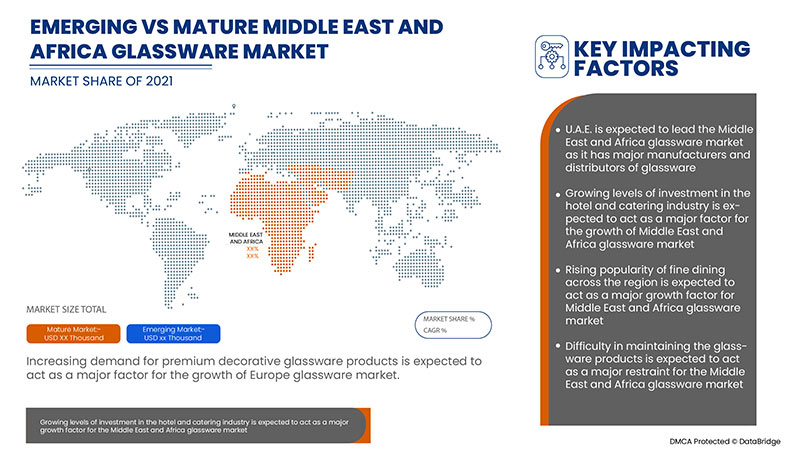

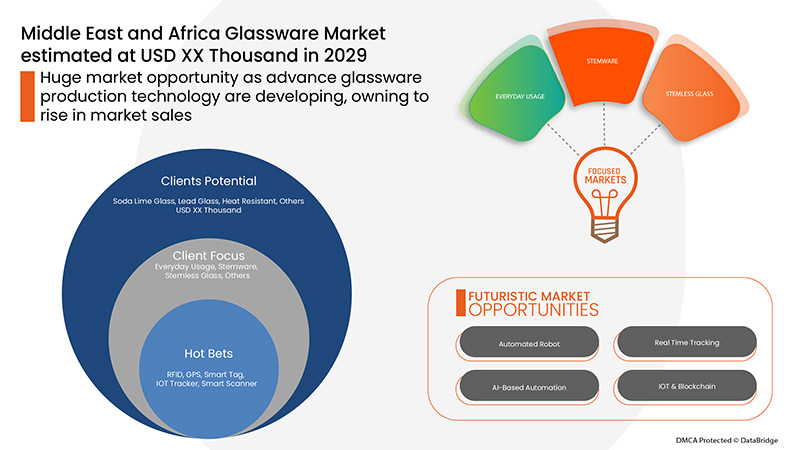

Les niveaux croissants d'investissement dans le secteur de l'hôtellerie et de la restauration devraient servir de moteur à la croissance du marché de la verrerie au cours de la période de prévision. Les changements dans le mode de vie des consommateurs devraient servir de moteur à la croissance du marché de la verrerie au cours de la période de prévision 2022-2029. Les progrès des technologies de production de verrerie devraient offrir des opportunités de croissance au marché de la verrerie à l'avenir.

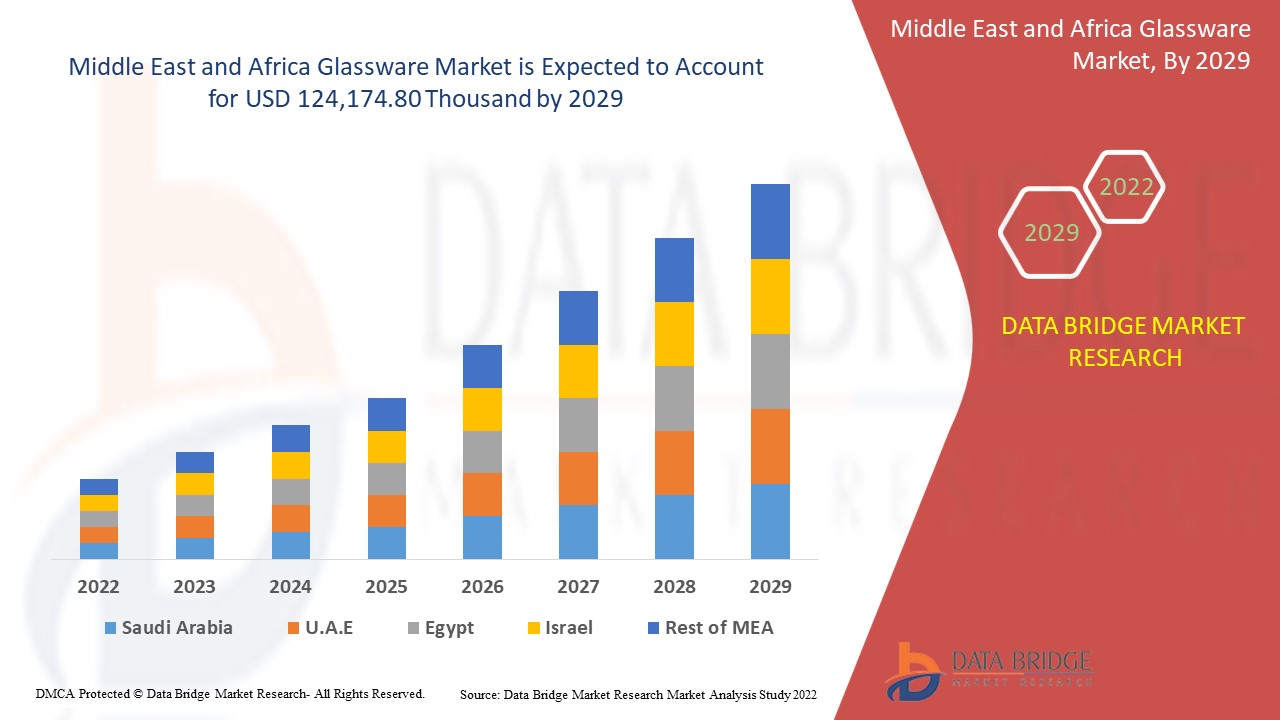

Selon les analyses de Data Bridge Market Research, le marché de la verrerie devrait atteindre la valeur de 124 174,80 milliers de dollars d'ici 2029, à un TCAC de 4,2 % au cours de la période de prévision. Le « soda lime » représente le segment de matériau le plus important car ce type de verre offre des surfaces résistantes aux rayures. Le rapport sur le marché de la verrerie couvre également l'analyse des prix, l'analyse des brevets et les avancées technologiques en profondeur.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volume en unités, prix en dollars américains |

|

Segments couverts |

Par matériau (verre sodocalcique, verre au plomb, verre résistant à la chaleur et autres), style (verre sans pied, verres à pied, usage quotidien et autres), canal de distribution (B2B, magasins spécialisés, supermarchés/hypermarchés, commerce électronique et autres), gamme de prix (moyen, haut de gamme et économique), utilisation finale (hôtels et restaurants, bars et cafés, ménages, cantines d'entreprise et autres) |

|

Pays couverts |

Émirats arabes unis, Arabie saoudite, Afrique du Sud, Égypte, Israël, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Hrastnik1860, Oneida, NoritakeUAE, Ocean Glass Public Company Limited, Lenox Corporation, Treo.in, Libbey Inc, Fiskars Group, WMF (une filiale du Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco SpA, Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne, Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware, entre autres |

Définition du marché

Le verre est un matériau cassant et rigide, généralement transparent ou translucide. Il peut être constitué d'un mélange de sable, de soude, de chaux ou d'autres minéraux. La méthode de fabrication du verre la plus courante consiste à chauffer les ingrédients bruts jusqu'à ce qu'ils deviennent un liquide fondu, puis à refroidir rapidement le mélange pour fabriquer du verre trempé. Les variétés de verre peuvent être classées en fonction de leurs qualités mécaniques et thermiques afin d'identifier les applications les mieux adaptées.

Verre sodocalcique : Le verre sodocalcique est la forme de verre la plus courante utilisée pour les vitres et les récipients en verre tels que les bouteilles et les bocaux pour les boissons, la nourriture et certains produits de base.

Verre au plomb : Le verre au plomb est un verre contenant un pourcentage élevé d’oxyde de plomb avec une clarté et une luminosité exceptionnelles.

Résistant à la chaleur : Le verre résistant à la chaleur est conçu pour résister au stress thermique et est couramment utilisé dans les cuisines et les applications industrielles.

Dynamique du marché de la verrerie

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- Des investissements en hausse dans le secteur de l'hôtellerie et de la restauration

Le tourisme a stimulé l'activité du secteur de l'hôtellerie et de la restauration dans le monde entier et a offert de grandes perspectives à l'industrie hôtelière. L'industrie a prospéré principalement grâce au tourisme et en raison de la diversité des paysages, des croyances et des sociétés dans différents pays, qui ont constitué une grande attraction pour les touristes de différentes régions. Les secteurs de l'hôtellerie et de la restauration de nombreux pays se sont progressivement développés au cours des deux dernières décennies, et on prévoit un développement dans les années à venir, associé à une augmentation de la demande pour divers types de produits en verre.

- Changements dans le mode de vie des consommateurs

La vie des consommateurs évolue constamment. Les habitudes et les valeurs des consommateurs sont influencées par les tendances existantes et nouvelles, ainsi que par l’évolution constante de la composition démographique, les bouleversements culturels mondiaux et les développements rapides de la technologie. Les entreprises peuvent tirer parti de nouvelles possibilités en acquérant une compréhension approfondie des préférences des clients suite à l’évolution des comportements et des croyances. Ces derniers temps, les consommateurs de toutes les générations se concentrent davantage sur les produits de marque dans de nombreux domaines de leur vie quotidienne.

- La popularité croissante de la gastronomie à travers le monde

Un restaurant gastronomique est un établissement spécialisé ou multi-cuisine qui accorde une grande importance à la qualité des ingrédients, à la présentation et au service impeccable. Cette catégorie connaît une croissance appréciable de 15 %, ce qui a encouragé l'arrivée de restaurants étoilés Michelin et d'autres concurrents locaux. Par conséquent, la demande croissante de plats raffinés est principalement satisfaite par les opérations réussies de différents types de marques de produits de verrerie dans les hôtels et les restaurants.

- Disponibilité de produits de qualité bon marché

Le verre est l'un des matériaux les plus complexes et les plus adaptables, et il est utilisé dans presque tous les secteurs. L'utilisation intensive du verre contribue à la création d'une apparence très high-tech et moderne dans les structures résidentielles et commerciales. Le verre se décline dans une variété de formes et de tailles pour s'adapter à une variété d'applications et est utilisé dans une variété d'applications architecturales telles que les portes, les fenêtres et les cloisons. Le verre a parcouru un long chemin depuis ses humbles débuts en tant que vitre pour devenir un composant structurel sophistiqué de nos jours.

- Demande croissante de verres à base d'acier et de papier

Le papier et le plastique sont de plus en plus utilisés pour fabriquer des assiettes et des verres jetables, en raison de leurs excellentes performances environnementales et de la demande croissante de services de commerce électronique et de livraison. Les consommateurs, les marques et les détaillants ont tous des attentes élevées en matière de produits à base de papier recyclables. Le taux de recyclage des matériaux à base de papier est d'environ 85 % et la chaîne de valeur du papier s'améliore de jour en jour. Pour atteindre des objectifs de recyclage encore plus élevés tout en prolongeant l'utilité des emballages à base de papier, il est essentiel de commencer par la phase de conception, en tenant compte à la fois de l'usage prévu et de la fin de vie.

Impact post-COVID-19 sur le marché de la verrerie

La COVID-19 a eu un impact majeur sur le marché de la verrerie, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui doivent faire face à cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché de la verrerie est en hausse en raison des politiques gouvernementales visant à stimuler le commerce international après la COVID-19. En outre, la levée du confinement stimule l'industrie hôtelière, ce qui augmente la demande de verrerie sur le marché. Cependant, des facteurs tels que la congestion associée aux routes commerciales et les restrictions commerciales entre certains pays freinent la croissance du marché. La fermeture des installations de production pendant la pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans la verrerie. Grâce à cela, les entreprises apporteront au marché des solutions avancées et précises. En outre, les initiatives gouvernementales visant à stimuler le commerce international ont conduit à la croissance du marché.

Développements récents

- En octobre 2020, Libbey Inc. a annoncé la confirmation d'un plan de réorganisation et s'attendait à achever sa restructuration supervisée par le tribunal et à en sortir avec un bilan plus solide dans les semaines à venir. L'entreprise a fait cette annonce pour réussir dans l'environnement commercial actuel.

- En octobre 2021, Lenox Corporation a acquis Oneida Consumer LLC avec sa marque de produits de table, notamment des couverts, de la vaisselle et des couverts. Cette collaboration a été entreprise pour commercialiser un portefeuille de marques de premier plan et des produits innovants avec une notoriété client inégalée dans un large éventail de canaux de vente au détail.

Portée du marché de la verrerie au Moyen-Orient et en Afrique

Le marché de la verrerie est segmenté en fonction du matériau, du style, du canal de distribution, de la gamme de prix et de l'utilisation finale. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par matériau

- Verre sodocalcique

- Verre au plomb

- Résistant à la chaleur

- Autres

En fonction du matériau, le marché de la verrerie est segmenté en verre sodocalcique, verre au plomb, verre résistant à la chaleur et autres.

Par style

- Verre sans pied

- Verres à pied

- Utilisation quotidienne

- Autres

En fonction du style, le marché de la verrerie a été segmenté en verre sans pied, verres à pied, usage quotidien et autres.

Par canal de distribution

- B2B

- Magasins spécialisés

- Supermarchés/Hypermarchés

- Commerce électronique

- Autres

En fonction du canal de distribution, le marché de la verrerie a été segmenté en B2B, magasins spécialisés, supermarchés/hypermarchés, commerce électronique et autres.

Par gamme de prix

- Moyen

- Prime

- Économie

En fonction de la gamme de prix, le marché de la verrerie a été segmenté en moyen, haut de gamme et économique.

Par utilisation finale

- Hôtels et restaurants

- Bars et cafés

- Ménage

- Cantines d'entreprise

- Autres

En fonction de l'utilisation finale, le marché de la verrerie a été segmenté en hôtels et restaurants, bars et cafés, ménages, cantines d'entreprise et autres.

Analyse/perspectives régionales du marché de la verrerie

Le marché de la verrerie est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, matériau, style, canal de distribution, gamme de prix et utilisation finale, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de la verrerie sont les Émirats arabes unis, l’Arabie saoudite, l’Afrique du Sud, l’Égypte, Israël, le reste du Moyen-Orient et l’Afrique.

Les Émirats arabes unis dominent le marché de la verrerie du Moyen-Orient et de l'Afrique. Les Émirats arabes unis sont susceptibles d'être le marché de la verrerie qui connaîtra la croissance la plus rapide au Moyen-Orient et en Afrique. L'essor des infrastructures, du commerce et de l'industrie dans les pays émergents comme les Émirats arabes unis est à l'origine de la domination du marché. Avec le développement croissant du pays, le nombre de restaurants et de bars augmente, ce qui stimulera la demande de produits en verre dans la région du Moyen-Orient et de l'Afrique.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la verrerie

Le paysage concurrentiel du marché de la verrerie fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de la verrerie.

Français Certains des principaux acteurs opérant sur le marché de la verrerie sont Hrastnik1860, Oneida, Noritake China, Ocean Glass Public Company Limited, Lenox Corporatio, Treo.in, Libbey Inc, Fiskars Group, WMF (Une filiale du Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco SpA, Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne. Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA GLASSWARE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TIME LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S MODEL

4.2 CONSUMER BEHAVIOUR PATTERN

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PSYCHOLOGICAL FACTORS

4.3.2 SOCIAL FACTORS

4.3.3 CULTURAL FACTORS

4.3.4 PERSONAL FACTORS

4.3.5 ECONOMIC FACTORS

4.4 KEY TRENDS

4.4.1 BOROSILICATE GLASSWARE IS A GAME-CHANGER

4.4.2 OMNI-CHANNEL STRATEGY USAGE IS ENCOURAGING THE GROWTH OF THE GLASSWARE MARKET

4.4.3 BEVERAGE INDUSTRY TO REGISTER SIGNIFICANT GROWTH

4.4.4 INCREASE IN TABLEWARE PRODUCTS

4.5 PRICING ANALYSIS

4.6 PRODUCT ADOPTION SCENARIO

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING LEVELS OF INVESTMENT IN THE HOTEL AND CATERING INDUSTRY

5.1.2 CHANGES IN LIFESTYLE OF THE CONSUMERS

5.1.3 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE

5.1.4 INCREASING DEMAND FOR PREMIUM DECORATIVE GLASSWARE PRODUCTS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAP QUALITY PRODUCTS

5.2.2 RISING DEMAND FOR STEEL AND PAPER BASE DRINKWARE

5.2.3 DIFFICULTY IN MAINTAINING THE GLASSWARE PRODUCTS

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN GLASSWARE PRODUCTION TECHNOLOGIES

5.3.2 RISING DEMAND FOR GLASSWARE PRODUCTS FOR CLINICAL USE IN HOSPITALS AND FORENSIC LABORATORIES

5.4 CHALLENGES

5.4.1 COMPLEXITY IN MANUFACTURING GLASSWARE PRODUCTS

5.4.2 RISING DIFFICULTY IN RECYCLING GLASSWARE PRODUCTS

6 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 SODA LIME GLASS

6.3 LEAD GLASS

6.4 HEAT RESISTANT

6.5 OTHERS

7 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE

7.1 OVERVIEW

7.2 STEMWARE

7.2.1 RED WINE GLASS

7.2.1.1 BORDEAUX

7.2.1.2 CABERNET

7.2.1.3 ZINFANDEL

7.2.1.4 BURGUNDY

7.2.1.5 PINOT NOIR

7.2.1.6 ROSE

7.2.2 WHITE WINE GLASS

7.2.2.1 SPARKLING

7.2.2.2 CHARDONNAY

7.2.2.3 VIOGNIER

7.2.2.4 SWEET WINE

7.2.2.5 VINTAGE

7.3 STEMLESS GLASS

7.3.1 LIQUOR GLASS

7.3.2 BEER GLASS

7.4 EVERYDAY USAGE

7.5 OTHERS

8 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 B2B

8.3 SPECIALIZED STORES

8.4 SUPERMARKETS/HYPERMARKETS

8.5 E-COMMERCE

8.6 OTHERS

9 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 MEDIUM

9.3 PREMIUM

9.4 ECONOMY

10 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE

10.1 OVERVIEW

10.2 HOTELS & RESTAURANTS

10.3 BARS & CAFE

10.4 HOUSEHOLD

10.5 CORPORATE CANTEENS

10.6 OTHERS

11 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E.

11.1.2 SAUDI ARABIA

11.1.3 SOUTH AFRICA

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIBBEY, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 FISKARS GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATE

14.3 WMF (A SUBSIDIARY OF GROUPE SEB)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATE

14.4 LIFETIME BRANDS, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 VILLEROY & BOCH

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADDRESSHOME

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BORMIOLI ROCCO S.P.A.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELLO WORLD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CUMBRIA CRYSTAL

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 DEGRENNE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 EAGLE GLASS DECO (P.) LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 GARBO GLASSWARE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HRASTNIK1860

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 JIANGSU RONGTAI GLASS PRODUCTS CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 LENOX CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATE

14.16 MYBOROSIL

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT UPDATE

14.17 NORITAKECHINA

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT UPDATE

14.18 OCEAN GLASS PUBLIC COMPANY LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT UPDATE

14.19 ONEIDA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATE

14.2 SHANDONG HIKINGPAC CO., LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATE

14.21 STÖLZLE LAUSITZ GMBH

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 TREO.IN

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATE

14.23 THE ZRIKE COMPANY, INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT UPDATE

14.24 WONDERCHEF HOME APPLIANCES PVT. LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 TYPE OF REUSABLE CUPS CONSUMERS WOULD PREFER FOR DRINKWARE IN U.S, 2015

TABLE 2 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 4 MIDDLE EAST & AFRICA SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 6 MIDDLE EAST & AFRICA LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 8 MIDDLE EAST & AFRICA HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 12 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA STEMWARE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA EVERYDAY USAGE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA B2B IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SPECIALIZED STORES IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA SUPERMARKETS/HYPERMARKETS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA E-COMMERCE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA MEDIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA PREMIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA ECONOMY IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA HOTELS & RESTAURANTS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA BARS & CAFÉ IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA HOUSEHOLD IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA CORPORATE CANTEENS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY COUNTRY, 2016-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY COUNTRY, 2016-2029 (THOUSAND UNITS)

TABLE 39 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 41 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 49 U.A.E. GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 50 U.A.E. GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 51 U.A.E. GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 52 U.A.E. STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 53 U.A.E. RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 54 U.A.E. WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 55 U.A.E. STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 56 U.A.E. GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 57 U.A.E. GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 58 U.A.E. GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 59 SAUDI ARABIA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 60 SAUDI ARABIA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 61 SAUDI ARABIA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 62 SAUDI ARABIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 63 SAUDI ARABIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 64 SAUDI ARABIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 65 SAUDI ARABIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 68 SAUDI ARABIA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 69 SOUTH AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 70 SOUTH AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 71 SOUTH AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 72 SOUTH AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 73 SOUTH AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 74 SOUTH AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 76 SOUTH AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 79 EGYPT GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 80 EGYPT GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 81 EGYPT GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 82 EGYPT STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 83 EGYPT RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 84 EGYPT WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 85 EGYPT STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 86 EGYPT GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 87 EGYPT GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 88 EGYPT GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 89 ISRAEL GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 90 ISRAEL GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 91 ISRAEL GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 92 ISRAEL STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 93 ISRAEL RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 94 ISRAEL WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 95 ISRAEL STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 96 ISRAEL GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 97 ISRAEL GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 98 ISRAEL GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 99 REST OF MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 100 REST OF MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA GLASSWARE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA GLASSWARE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA GLASSWARE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA GLASSWARE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA GLASSWARE MARKET: MATERIAL TIME LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA GLASSWARE MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA GLASSWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA GLASSWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA GLASSWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA GLASSWARE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA GLASSWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA GLASSWARE MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA GLASSWARE MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE IS DRIVING THE MIDDLE EAST & AFRICA GLASSWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SODA LIME GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA GLASSWARE MARKET IN 2022 & 2029

FIGURE 17 FACTOR INFLUENCING PURCHASE OF PRODUCT

FIGURE 18 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMLESS GLASSES

FIGURE 19 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMWARE GLASSES

FIGURE 20 PRICE RANGE COMPARISON OF KEY PLAYERS BY EVERYDAY USAGE GLASSES

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA GLASSWARE MARKET

FIGURE 22 MIDDLE EAST & AFRICA LUXURY HOTEL COUNT, IN LUXURY CLASS, 2002-2018 (APPROXIMATE)

FIGURE 23 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2021

FIGURE 24 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE, 2021

FIGURE 25 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2021

FIGURE 27 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE, 2021

FIGURE 28 MIDDLE EAST AND AFRICA GLASSWARE MARKET: SNAPSHOT (2021)

FIGURE 29 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2021)

FIGURE 30 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY MATERIAL (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.