Middle East And Africa Geosynthetics Market

Taille du marché en milliards USD

TCAC :

%

USD

1.04 Billion

USD

1.89 Billion

2024

2032

USD

1.04 Billion

USD

1.89 Billion

2024

2032

| 2025 –2032 | |

| USD 1.04 Billion | |

| USD 1.89 Billion | |

|

|

|

|

Segmentation du marché des géosynthétiques au Moyen-Orient et en Afrique, par produit (géotextiles, géomembranes, géogrilles, géocellules, géofilets et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des géosynthétiques au Moyen-Orient et en Afrique

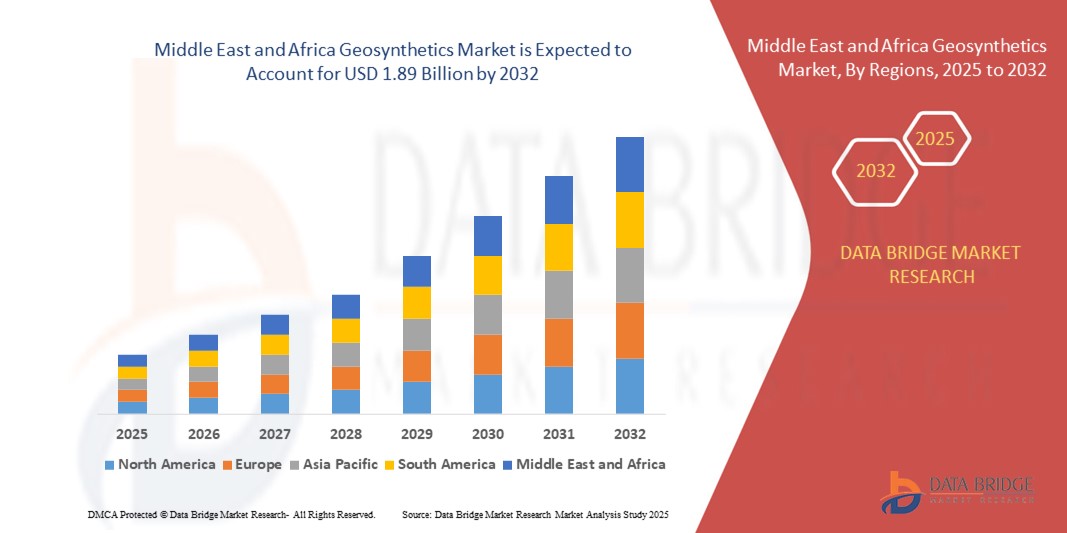

- La taille du marché des géosynthétiques au Moyen-Orient et en Afrique était évaluée à 1,04 milliard USD en 2024 et devrait atteindre 1,89 milliard USD d'ici 2032 , à un TCAC de 7,80 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'augmentation des investissements dans le développement des infrastructures, l'importance croissante accordée aux pratiques de construction durables et le besoin croissant de stabilisation des sols et de contrôle de l'érosion dans les régions arides.

- L'urbanisation rapide, ainsi que la nécessité de systèmes efficaces de gestion des déchets et de conservation de l'eau, contribuent à l'application croissante des géosynthétiques dans des secteurs tels que les transports, l'exploitation minière et l'agriculture dans la région.

Analyse du marché des géosynthétiques au Moyen-Orient et en Afrique

- Le marché connaît une dynamique importante en raison de l'expansion urbaine, des projets de réseaux routiers et ferroviaires et des initiatives de gestion des ressources en eau à grande échelle dans des pays comme les Émirats arabes unis, l'Arabie saoudite et l'Afrique du Sud.

- La demande de géosynthétiques, notamment de géotextiles, de géomembranes et de géogrilles, est également stimulée par la construction d'oléoducs et de gazoducs, de décharges et d'exploitations minières, où les solutions de renforcement, de filtration et de confinement sont essentielles.

- L'Arabie saoudite domine le marché des géosynthétiques au Moyen-Orient et en Afrique, représentant la plus grande part des revenus en 2024, en raison de ses initiatives agressives de développement des infrastructures dans le cadre de Vision 2030.

- L'Afrique du Sud devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché des géosynthétiques au Moyen-Orient et en Afrique, grâce à la hausse des investissements dans les infrastructures routières, l'exploitation minière et l'expansion urbaine. L'importance croissante accordée par le pays à la durabilité environnementale et l'adoption de matériaux de construction rentables et durables contribuent à l'utilisation croissante des géosynthétiques dans les projets des secteurs public et privé.

- Le segment des géotextiles a dominé le marché avec la plus grande part de chiffre d'affaires en 2024, principalement en raison de leur large application dans la construction de routes, les décharges et la lutte contre l'érosion. Leur rentabilité, leurs propriétés de filtration et leur capacité à stabiliser les sols en font un matériau privilégié pour les projets d'infrastructures et environnementaux en zones arides et semi-arides. L'augmentation du développement routier et de l'expansion urbaine dans la région soutient la forte demande pour ce segment.

Portée du rapport et segmentation du marché des géosynthétiques au Moyen-Orient et en Afrique

|

Attributs |

Informations clés sur le marché des géosynthétiques au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

• Mattex Group (Arabie saoudite) |

|

Opportunités de marché |

• Expansion des géosynthétiques dans les applications de gestion des déchets |

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des géosynthétiques au Moyen-Orient et en Afrique

Intégration croissante des géosynthétiques dans les projets d'infrastructure et environnementaux

- La région Moyen-Orient et Afrique connaît une demande croissante de géosynthétiques en raison de l'augmentation des investissements dans le développement d'infrastructures à grande échelle, telles que les autoroutes, les aéroports, les ports et les voies ferrées. Ces matériaux jouent un rôle crucial dans le renforcement, le drainage et la séparation des sols, contribuant ainsi à améliorer la durée de vie et la durabilité des ouvrages d'art. Des pays comme les Émirats arabes unis et l'Arabie saoudite contribuent largement à cette tendance, avec des mégaprojets en cours nécessitant des solutions géotechniques avancées.

- Les préoccupations environnementales motivent également l'intégration des géosynthétiques dans les applications de gestion des déchets et de conservation de l'eau. Les géomembranes et les géotextiles sont largement utilisés pour les revêtements de décharges, les systèmes de collecte des lixiviats et les réservoirs d'eau, notamment dans les régions confrontées à des pénuries d'eau. Leur capacité à assurer un confinement rentable et à réduire la dégradation environnementale les rend essentiels à la planification de projets durables.

- Par exemple, en 2023, le projet saoudien de la mer Rouge a intégré des géotextiles pour préserver l'écologie côtière lors de la construction d'un complexe hôtelier, établissant ainsi une référence en matière de développement d'infrastructures éco-responsables dans la région. Cette application a démontré la résilience environnementale et l'adaptabilité du matériau aux conditions climatiques extrêmes.

- L'urbanisation rapide en Afrique subsaharienne accroît également la demande de solutions géosynthétiques pour les projets de drainage et de lutte contre les inondations. Des villes comme Lagos et Nairobi investissent dans des systèmes de gestion des eaux pluviales à base de géotextiles pour lutter contre les inondations saisonnières et soutenir le développement d'infrastructures résilientes.

- Alors que les gouvernements mettent l'accent sur la durabilité et la construction résiliente au changement climatique, le marché des géosynthétiques devrait poursuivre son expansion. L'innovation dans les matériaux durables fabriqués localement et l'acceptation croissante des conceptions axées sur la performance sont essentielles à la croissance à long terme dans la région.

Dynamique du marché des géosynthétiques au Moyen-Orient et en Afrique

Conducteur

Développer les infrastructures et mettre l'accent sur la durabilité environnementale dans la réglementation

L'essor des programmes d'infrastructures gouvernementaux au Moyen-Orient et en Afrique stimule considérablement la demande de géosynthétiques. Des extensions de routes et de voies ferrées aux projets énergétiques et hydrauliques, les géosynthétiques sont essentiels pour garantir l'intégrité structurelle, réduire la consommation de matériaux et minimiser les coûts de maintenance. Leur utilisation pour le renforcement des fondations et la séparation des sols de fondation contribue à optimiser les performances des projets dans des conditions de sol difficiles.

Les réglementations en matière de protection de l'environnement se durcissent, notamment dans les pays du Conseil de coopération du Golfe (CCG), ce qui entraîne une utilisation accrue des géomembranes, des géotextiles et des géofilets dans les décharges, les exploitations minières et le confinement du pétrole et du gaz. Ces matériaux sont essentiels pour prévenir les infiltrations de lixiviats, préserver les eaux souterraines et soutenir les politiques zéro déchet.

Les appels d'offres gouvernementaux et les normes d'infrastructures précisent de plus en plus les géosynthétiques dans leurs cadres de conception et d'approvisionnement. Cette reconnaissance officielle accroît la visibilité du marché et encourage les investissements dans les capacités de production dans la région.

• Par exemple, en 2022, le gouvernement égyptien a lancé une initiative géotechnique nationale exigeant l'utilisation de géosynthétiques dans tous les grands projets de construction routière. Cette initiative a non seulement amélioré l'efficacité de la construction, mais a également réduit les dépenses d'entretien à long terme de plus de 20 %, selon les rapports du projet.

• Avec l'accélération des dépenses d'infrastructure et la priorité croissante accordée aux objectifs environnementaux, la demande de géosynthétiques devrait croître régulièrement. Les acteurs du secteur devront privilégier des solutions de produits localisées, la formation des ingénieurs et des entrepreneurs, et la collaboration avec les autorités réglementaires pour soutenir la dynamique du marché.

Retenue/Défi

Coûts d'installation élevés et expertise technique limitée dans les régions éloignées

Malgré leurs avantages à long terme, le coût initial des géosynthétiques et de leur installation demeure un défi, notamment dans les pays sensibles aux prix ou aux ressources limitées. Les contraintes budgétaires dans plusieurs pays africains freinent l'adoption de géosynthétiques haute performance, notamment pour les projets du secteur public sans financement international ni soutien des donateurs.

L'installation de géosynthétiques nécessite une main-d'œuvre qualifiée et des techniques précises pour garantir des performances optimales. Cependant, plusieurs régions du Moyen-Orient et d'Afrique sont confrontées à une pénurie de personnel qualifié, ce qui entraîne souvent des applications sous-optimales et des pannes prématurées des systèmes. Cela nuit à la confiance dans la technologie et freine la pénétration du marché.

• Les contraintes logistiques et d'approvisionnement affectent également la disponibilité des matériaux dans les zones reculées ou enclavées. Les coûts de transport élevés, les retards douaniers et l'instabilité des réseaux de distribution rendent difficile l'exécution des projets dans les délais et le budget impartis.

• Par exemple, en 2023, les entrepreneurs en infrastructures en Éthiopie et en Ouganda ont signalé des retards dans les projets de stabilisation des autoroutes en raison d'un manque d'installateurs qualifiés et de difficultés d'approvisionnement en géogrilles, ce qui a eu un impact sur les délais des projets et a fait grimper les coûts de plus de 15 %

Si les programmes de formation et la production locale peuvent résoudre ces problèmes, la collaboration industrielle est essentielle pour bâtir des chaînes d'approvisionnement durables et développer les connaissances techniques. La sensibilisation aux économies réalisées tout au long du cycle de vie et la création de pôles régionaux d'expertise en géosynthétiques seront essentielles pour surmonter ces obstacles.

Portée du marché des géosynthétiques au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type de produit en géotextiles, géomembranes, géogrilles, géocellules, géofilets et autres.

- Par produit

Au Moyen-Orient et en Afrique, le marché des géosynthétiques est segmenté en fonction des produits : géotextiles, géomembranes, géogrilles, géocellules, géofilets, etc. En 2024, le segment des géotextiles a dominé le marché, affichant la plus grande part de chiffre d'affaires, principalement grâce à leur large application dans la construction de routes, les décharges et la lutte contre l'érosion. Leur rentabilité, leurs propriétés de filtration et leur capacité à stabiliser les sols en font un matériau privilégié pour les projets d'infrastructure et environnementaux en zones arides et semi-arides. L'augmentation du développement routier et de l'urbanisation dans la région renforce la forte demande pour ce segment.

Le segment des géomembranes devrait connaître la croissance la plus rapide entre 2025 et 2032, grâce à leur adoption croissante dans les applications de confinement des eaux, d'exploitation minière et de gestion des déchets. Ces revêtements imperméables sont essentiels pour contrôler les infiltrations et la contamination, en particulier dans les environnements pauvres en eau où la protection des eaux souterraines est essentielle. Face au durcissement des réglementations environnementales et au besoin croissant d'infrastructures durables, la demande de géomembranes continue de croître sur les marchés du Moyen-Orient et d'Afrique.

Analyse régionale du marché des géosynthétiques au Moyen-Orient et en Afrique

- L'Arabie saoudite domine le marché des géosynthétiques au Moyen-Orient et en Afrique, représentant la plus grande part des revenus en 2024, en raison de ses initiatives agressives de développement des infrastructures dans le cadre de Vision 2030.

- L'accent mis par le pays sur les mégaprojets tels que NEOM, The Line et les corridors de transport à grande échelle stimule considérablement la demande de solutions géosynthétiques avancées dans le renforcement des sols, le drainage et le confinement environnemental.

- Le soutien du secteur public, combiné aux mandats réglementaires visant à intégrer des matériaux durables, encourage l'utilisation généralisée des géomembranes dans les décharges, des géotextiles dans les routes et des géofilets dans les systèmes de gestion de l'eau.

- En outre, les collaborations avec des sociétés d’ingénierie internationales et des fournisseurs de technologie améliorent les capacités d’exécution locales et l’innovation des produits.

- Alors que l'Arabie saoudite continue de donner la priorité à la durabilité écologique parallèlement à la transformation urbaine, le marché des géosynthétiques devrait jouer un rôle essentiel pour garantir la durabilité des infrastructures, réduire les risques environnementaux et améliorer l'efficacité des projets dans de nombreux secteurs.

Aperçu du marché des géosynthétiques en Afrique du Sud

L'Afrique du Sud devrait connaître le taux de croissance le plus rapide entre 2025 et 2032, porté par l'intensification de la réhabilitation des infrastructures, l'activité minière et les initiatives de protection de l'environnement. L'accent croissant mis par le gouvernement sur la modernisation des routes, des décharges et des systèmes de gestion de l'eau stimule la demande de géotextiles, de géomembranes et de géogrilles. De plus, l'adoption de pratiques de construction durables et le besoin croissant de lutte contre l'érosion et de stabilisation des sols dans les projets de développement urbain et rural devraient soutenir une forte croissance du marché en Afrique du Sud au cours de la période de prévision.

Part de marché des géosynthétiques au Moyen-Orient et en Afrique

L'industrie des géosynthétiques au Moyen-Orient et en Afrique est principalement dirigée par des entreprises bien établies, notamment :

• Mattex Group (Arabie saoudite)

• Fibertex Nonwovens A/S (Afrique du Sud)

• Africor Construction and Civils (Afrique du Sud)

• Geotextiles Africa (Afrique du Sud)

• TenCate Geosynthetics Middle East (EAU)

• Kaytech Engineered Fabrics (Afrique du Sud)

• Atarfil Middle East FZ-LLC (EAU)

• Naue GmbH & Co. KG – Division Moyen-Orient (EAU)

• Maccaferri Middle East (EAU)

• Solmax Middle East (Arabie saoudite)

Derniers développements sur le marché des géosynthétiques au Moyen-Orient et en Afrique

- En mars 2023, Maccaferri a joué un rôle clé dans l'achèvement de l'infrastructure ferroviaire majeure de la Tanzanie en fournissant une solution innovante de lutte contre l'érosion des sols. Ce développement améliore la connectivité régionale avec les marchés mondiaux et soutient les infrastructures durables. L'implication de l'entreprise devrait renforcer sa présence sur le marché et stimuler la croissance de son chiffre d'affaires dans le secteur des géosynthétiques au Moyen-Orient et en Afrique.

- En mars 2022, Freudenberg Performance Materials a annoncé une augmentation progressive des prix de ses produits de toiture destinés au secteur du bâtiment et de la construction. À compter du 1er avril 2022, les prix ont augmenté de 9 %, suivis d'une nouvelle hausse de 6 % le 1er mai 2022. Cet ajustement visait à compenser la hausse des coûts de production et à maintenir les normes de qualité, ce qui pourrait améliorer les marges bénéficiaires et soutenir la compétitivité à long terme de l'entreprise sur le marché.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.