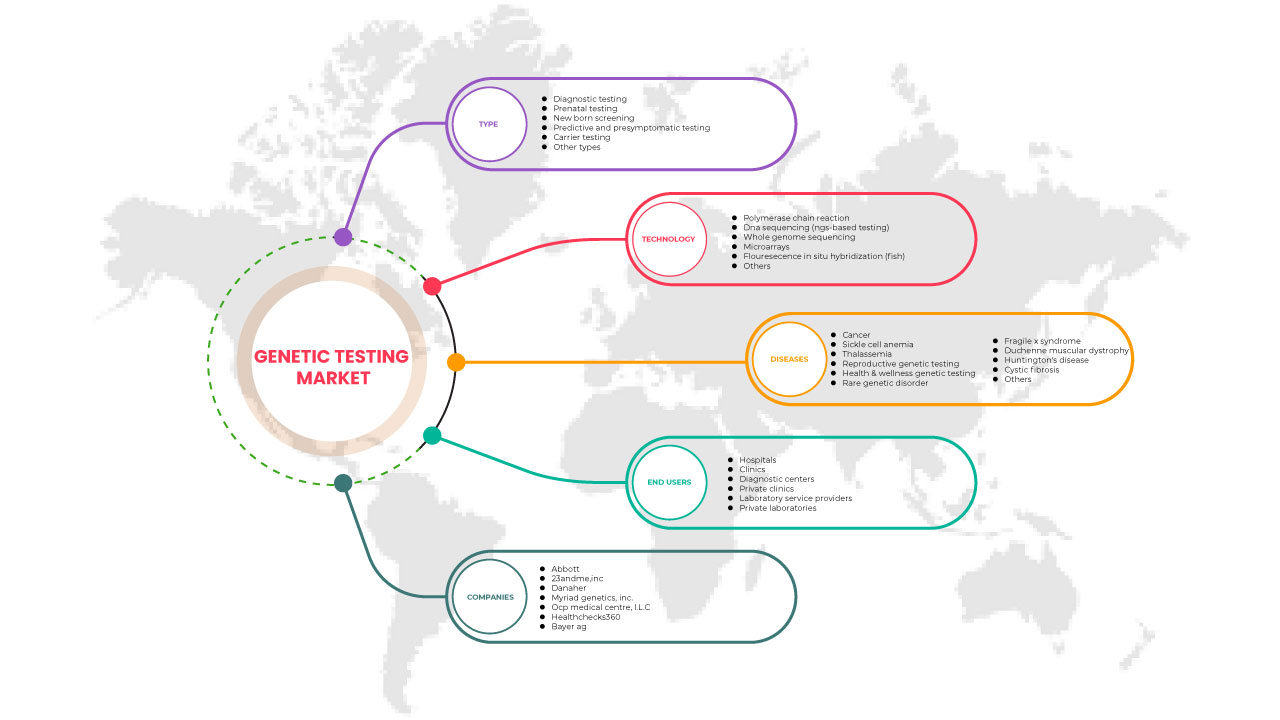

Middle East and Africa Genetic Testing Market, By Type (Carrier Testing, Diagnostic Testing, New-Born Screening, Predictive and Presymptomatic Testing, Prenatal Testing, Other Types), Technology (DNA Sequencing (NGS-Based Testing), Polymerase Chain Reaction, Microarrays, Whole Genome Sequencing, Fluorescence In Situ Hybridization (FISH), and Others), Diseases (Rare Genetic Disorder, Cancer, Cystic Fibrosis, Reproductive Genetic Testing, Health & Wellness Genetic Testing, Sickle Cell Anemia, Duchenne Muscular Dystrophy, Thalassemia, Huntington's Disease, Fragile X Syndrome, and Other), End User (Hospitals, Clinics, Diagnostic Centers, Private Clinics, Laboratory Service Providers, and Private Laboratories) Industry Trends and Forecast to 2030.

Middle East and Africa Genetic Testing Market Analysis and Insights

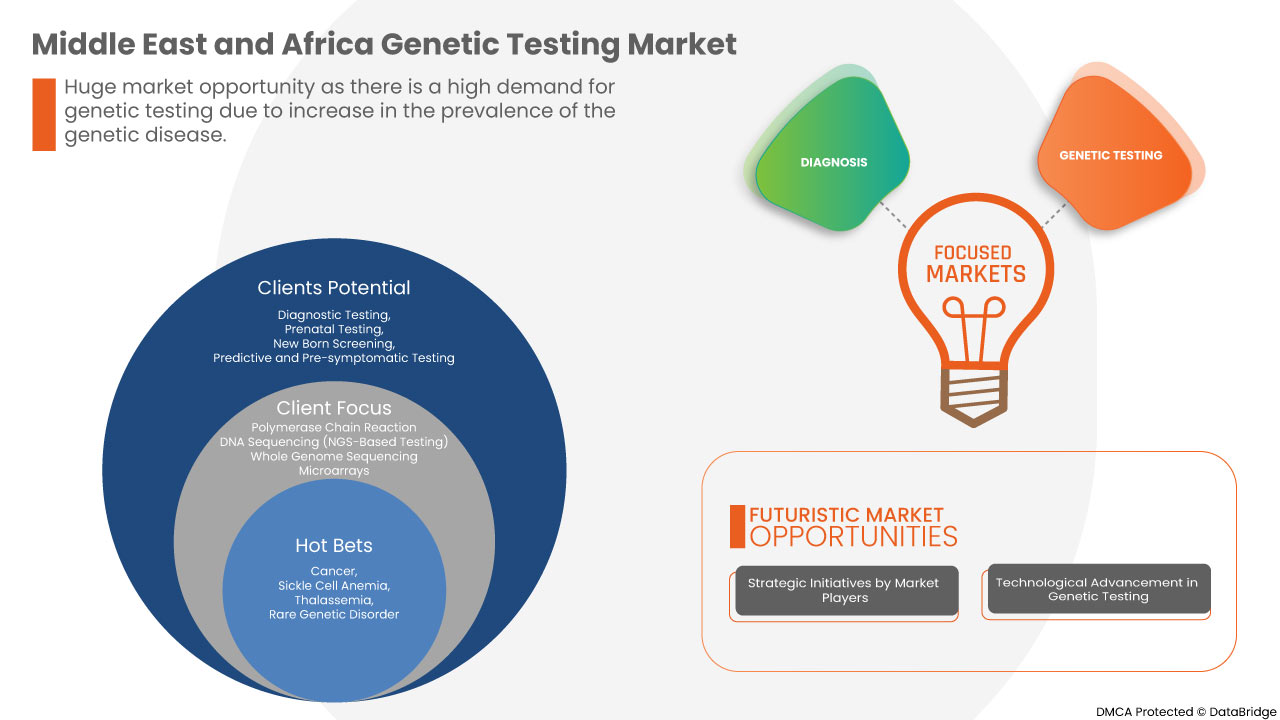

Middle East and Africa genetic testing market is driven by the factors such as the high prevalence of genetic disorders, growing technological advancements in the genetic testing market, which enhance its demand, as well as increasing investment in research and development, which leads to market growth. Currently, healthcare expenditure has increased across developed and emerging countries, which is expected to create a competitive advantage for manufacturers to develop new and innovative genetic testing markets.

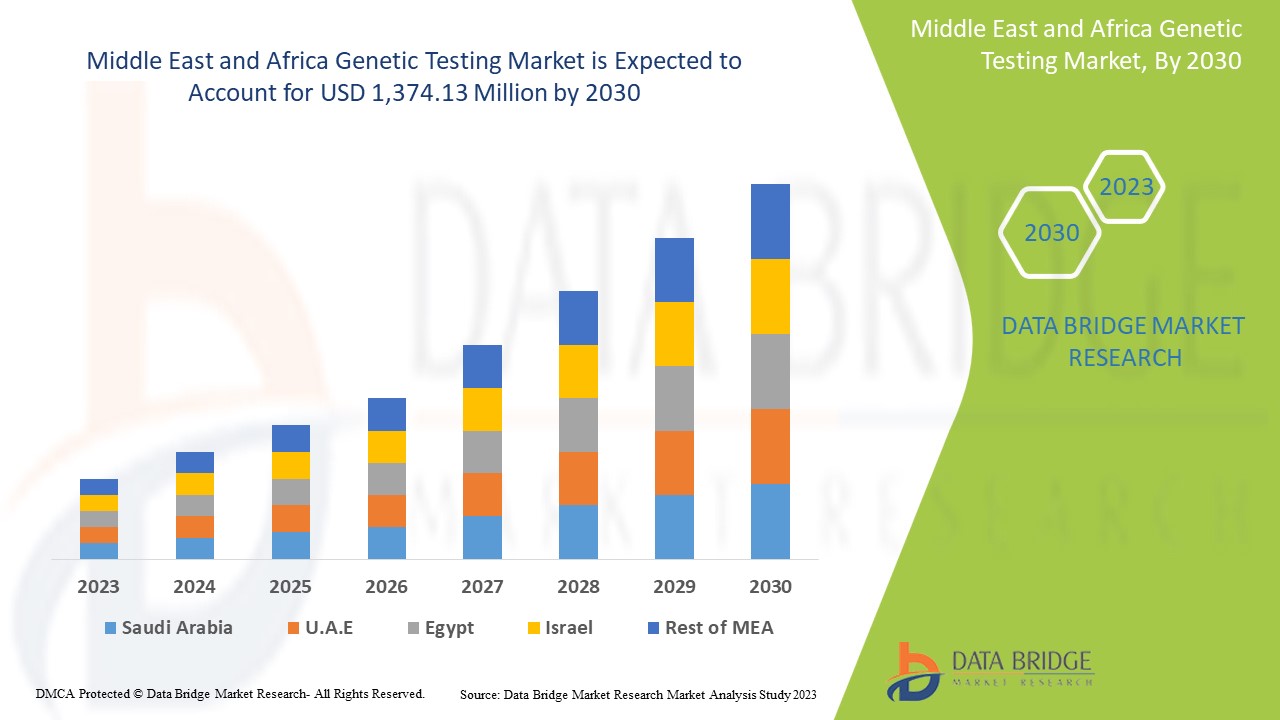

Middle East and Africa genetic testing market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 13.6% in the forecast period of 2023 to 2030 and is expected to reach USD 1,374.13 million by 2030.

The Middle East and Africa genetic testing market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief, our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Par type (tests de porteurs, tests de diagnostic, dépistage néonatal, tests prédictifs et présymptomatiques, tests prénatals, autres types), technologie (séquençage de l'ADN (tests basés sur le NGS), réaction en chaîne par polymérase, microarrays, séquençage du génome entier, hybridation in situ en fluorescence (FISH) et autres), maladies (troubles génétiques rares, cancer, fibrose kystique, tests génétiques de la reproduction, tests génétiques de santé et de bien-être, drépanocytose, dystrophie musculaire de Duchenne, thalassémie, maladie de Huntington, syndrome de l'X fragile et autres), utilisateur final (hôpitaux, cliniques, centres de diagnostic, cliniques privées, prestataires de services de laboratoire et laboratoires privés). |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël, reste du Moyen-Orient et de l’Afrique. |

|

Acteurs du marché couverts |

Abbott, 23ANDME, Inc., Danaher, Myriad Genetics, Inc., OCP Medical Centre, LLC, Healthchecks360, Bayer AG, BioReference Health, LLC (une filiale d'OPKO Health, Inc.), FREIBURG MEDICAL LABORATORY MIDDLE EAST (LLC), Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Biocartis, Eurofins Scientific, PerkinElmer Inc., ELITechGroup, F. Hoffmann-La Roche Ltd., Illumina, Inc., QIAGEN, BIO-HELIX et PacBio, entre autres. |

Définition du marché

Les tests génétiques sont des tests médicaux qui permettent d'identifier les changements dans les gènes, les chromosomes ou les protéines. Les résultats d'un test génétique peuvent confirmer ou infirmer une maladie génétique suspectée ou aider à déterminer le risque qu'une personne développe ou transmette une maladie génétique. Plus de 77 000 tests génétiques sont actuellement utilisés et d'autres sont en cours de développement.

Les innovations et technologies croissantes, le nombre croissant d’acteurs sur le marché et les lancements de nouveaux produits propulsent également la croissance du marché des tests génétiques au Moyen-Orient et en Afrique.

Dynamique du marché des tests génétiques au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Facteurs moteurs/opportunités

- Prévalence croissante des maladies génétiques

Les troubles génétiques peuvent entraîner des problèmes de santé graves, incompatibles avec la vie. Dans les cas les plus graves, ces maladies peuvent entraîner une fausse couche chez un embryon ou un fœtus atteint. La prévalence croissante des maladies génétiques et des malformations congénitales stimule la demande pour le marché des tests génétiques.

- Selon l’article de l’Organisation mondiale de la santé intitulé Troubles génétiques et anomalies congénitales : stratégies pour réduire la charge dans la région, 2022, les maladies génétiques et congénitales représentent une part importante de la mortalité périnatale et néonatale dans de nombreux pays de la région. Les malformations congénitales sont désormais considérées comme la principale cause de mortalité infantile aux Émirats arabes unis et la deuxième cause à Bahreïn, au Koweït, à Oman et au Qatar. Les rapports de l’Arabie saoudite indiquent qu’environ 25 à 35 % des décès prénatals dans les deux hôpitaux étaient dus à des malformations congénitales.

Par conséquent, cela augmente la demande pour le marché des tests génétiques.

- Augmentation de l’adoption du séquençage de nouvelle génération

Alors que la pharmacologie axée sur la génomique continue de jouer un rôle plus important dans le traitement de diverses maladies chroniques, en particulier le cancer, le séquençage de nouvelle génération (NGS) évolue comme un outil puissant pour fournir un aperçu plus approfondi et plus précis des fondements moléculaires des tumeurs individuelles et des récepteurs spécifiques.

Le NGS offre des avantages en termes de précision, de sensibilité et de rapidité par rapport aux méthodes traditionnelles, qui ont le potentiel d'avoir un impact significatif dans le domaine de l'oncologie. Étant donné que le NGS peut évaluer plusieurs gènes dans un seul test, il n'est plus nécessaire de commander plusieurs tests pour identifier la mutation causale.

Cela devrait donc servir de moteur à la croissance du marché des tests génétiques.

- Hausse du revenu disponible

Les dépenses consacrées par un pays aux soins de santé et son taux de croissance au fil du temps sont influencés par une grande variété de facteurs économiques et sociaux, notamment les modalités de financement et la structure de l'organisation du système de santé. En particulier, il existe une forte corrélation entre le niveau de revenu global d'un pays et le montant que la population de ce pays dépense en soins de santé.

En outre, les initiatives stratégiques prises par les principaux acteurs du marché assureront l’intégrité structurelle et les opportunités futures du marché des tests génétiques au cours de la période de prévision 2023-2030.

Contraintes/Défis

- Coût élevé des tests génétiques

Les tests génétiques peuvent être coûteux et ne pas être couverts par certains régimes d'assurance maladie. Les nombreux tests génétiques varient en termes de coût en fonction de la maladie ciblée.

- Selon Breastcancer.org, le coût des tests génétiques pour le cancer peut varier considérablement et se situer entre 300 et 5 000 USD. Le coût des tests génétiques peut dépendre du type de test ainsi que de sa complexité.

- Les tests génétiques peuvent coûter entre 100 et plus de 2 000 USD, selon la nature et la complexité du test. Si plusieurs tests sont nécessaires ou si de nombreux membres de la famille doivent être testés pour obtenir un résultat significatif, le coût augmente. Le coût du dépistage néonatal varie selon les États

Ainsi, le coût élevé des tests génétiques pourrait freiner la croissance du marché.

- Politique de réglementation stricte

Les affaires réglementaires (AR) jouent un rôle crucial dans le secteur des dispositifs médicaux, car elles concernent le cycle de vie des produits de santé. Elles servent les chemins tactiques, stratégiques et opérationnels et aident à fonctionner dans le cadre des réglementations pour accélérer la livraison et le développement de dispositifs et de produits de test de crachat du cancer sûrs et efficaces pour la population mondiale. Le rôle des affaires réglementaires est d'établir et d'exécuter une stratégie réglementaire.

De nombreux organismes de santé et agences gouvernementales élaborent des politiques réglementaires pour le lancement et l'approbation des dispositifs et produits de test de dépistage du cancer par crachat. L'approbation du produit par les organismes de réglementation régionaux joue un rôle essentiel pour l'équipe de développement de médicaments. L'approbation garantit les activités de développement de médicaments de l'entreprise et différencie l'entreprise de la concurrence.

Impact post-COVID-19 sur le marché des tests génétiques au Moyen-Orient et en Afrique

Le marché des tests génétiques a été gravement touché par le COVID-19. Les admissions à l'hôpital ont été limitées aux traitements non essentiels et les cliniques ont été temporairement fermées pendant la pandémie. La mise en œuvre de la distanciation sociale, le blocage de la population et l'accès limité aux cliniques ont grandement affecté le marché. Le ralentissement des flux de patients et des orientations a également affecté la croissance du marché. Cependant, le marché continuera de croître dans la période post-pandémique en raison de l'assouplissement des restrictions précédemment imposées.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de R&D et de lancement de produits, ainsi que des partenariats stratégiques pour améliorer la technologie et les résultats des tests impliqués dans le marché des tests génétiques.

Développement récent

- Le 10 novembre 2022, Myriad Genetics, Inc., leader dans le domaine des tests génétiques et de la médecine de précision, a annoncé UroSuite, une suite complète de tests d'évaluation des risques génétiques qui couvrent toutes les étapes du traitement du cancer de la prostate. UroSuite comprend le test de cancer de la prostate Prolaris de Myriad, le test de cancer héréditaire MyRisk, le test BRACAnalysis CDx et le test de profil moléculaire tumoral précis. La combinaison de ces tests fournit un aperçu génétique intégré et facilite le traitement et la sélection des essais cliniques pour les patients.

- En septembre 2022, Illumina, Inc., leader mondial du séquençage de l'ADN et des technologies basées sur des puces, a annoncé le lancement de la série NovaSeq X (NovaSeq X et NovaSeq X Plus). Il s'agit de nouveaux séquenceurs à l'échelle de la production qui repoussent les limites de la médecine génomique en permettant un séquençage plus rapide, plus efficace et plus durable. Grâce à une nouvelle technologie révolutionnaire, NovaSeq X Plus peut générer plus de 20 000 génomes entiers par an, soit 2,5 fois les performances des séquenceurs précédents, accélérant considérablement la découverte du génome et les connaissances cliniques pour comprendre la maladie et, à terme, transformer la vie des patients.

Portée du marché des tests génétiques au Moyen-Orient et en Afrique

Le marché des tests génétiques au Moyen-Orient et en Afrique est segmenté en type, technologie, maladies et utilisateur final. La croissance parmi ces segments vous aidera à analyser et à mesurer les segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Tests diagnostiques

- Test prénatal

- Dépistage des nouveau-nés

- Tests prédictifs et présymptomatiques

- Tests de transporteur

- Autres types

Sur la base du type, le marché des tests génétiques au Moyen-Orient et en Afrique est segmenté en tests de diagnostic, tests prénatals, dépistage néonatal, tests prédictifs et présymptomatiques, tests de porteur et autres types.

TECHNOLOGIE

- Réaction en chaîne par polymérase

- Séquençage de l'ADN (test basé sur NGS)

- Séquençage du génome entier

- Microarrays

- Hybridation in situ en fluorescence (FISH)

- Autres

Sur la base de la technologie, le marché des tests génétiques du Moyen-Orient et de l'Afrique est segmenté en séquençage d'ADN, réaction en chaîne par polymérase, microarrays, séquençage du génome entier, hybridation in situ par fluorescence (FISH) et autres.

Maladies

- Cancer

- Anémie falciforme

- Thalassémie

- Maladie génétique rare

- Syndrome de l'X fragile

- Dystrophie musculaire de Duchenne

- Maladie de Huntington

- Fibrose kystique

- Tests génétiques de reproduction

- Tests génétiques pour la santé et le bien-être

- Autres

Sur la base des maladies, le marché des tests génétiques du Moyen-Orient et de l'Afrique est segmenté en troubles génétiques rares , cancer, fibrose kystique, anémie falciforme, dystrophie musculaire de Duchenne, thalassémie, maladie de Huntington, syndrome de l'X fragile, tests génétiques de la reproduction, tests génétiques de santé et de bien-être, et autres.

Utilisateur final

- Hôpitaux

- Cliniques

- Centres de diagnostic

- Cliniques privées

- Prestataires de services de laboratoire

- Laboratoires privés

Sur la base des utilisateurs finaux, le marché des tests génétiques du Moyen-Orient et de l’Afrique est segmenté en hôpitaux, cliniques, centres de diagnostic, cliniques privées, prestataires de services de laboratoire et laboratoires privés.

Analyse/perspectives régionales du marché des tests génétiques au Moyen-Orient et en Afrique

Le marché des tests génétiques au Moyen-Orient et en Afrique est analysé et des informations sur la taille du marché sont fournies par type, technologie, maladies et utilisateur final.

Les pays couverts dans ce rapport de marché sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, l’Égypte, Israël, le reste du Moyen-Orient et l’Afrique.

En 2023, l’Afrique du Sud devrait dominer en raison de l’augmentation des investissements dans la R&D qui devraient stimuler la croissance du marché.

La section pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des tests génétiques au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des tests génétiques au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des tests génétiques au Moyen-Orient et en Afrique.

Français Certains des principaux acteurs opérant sur le marché des tests génétiques au Moyen-Orient et en Afrique sont Abbott, 23ANDME, Inc., Danaher, Myriad Genetics, Inc., OCP Medical Centre, LLC, Healthchecks360, Bayer AG, BioReference Health, LLC (une filiale d'OPKO Health, Inc.), FREIBURG MEDICAL LABORATORY MIDDLE EAST (LLC), Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Biocartis, Eurofins Scientific, PerkinElmer Inc., ELITechGroup, F. Hoffmann-La Roche Ltd., Illumina, Inc., QIAGEN, BIO-HELIX et PacBio, entre autres.

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, le Moyen-Orient et l'Afrique par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA GENETIC TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELLING

2.6 TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL’S MODEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 STRATEGIC INITIATIVES:

5 INDUSTRY INSIGHTS

5.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.2 CANCER GENETICS RISK ASSESSMENT AND COUNSELING

5.3 GENETIC TESTS PRICING AND KEY PRICING STRATEGIES

5.3.1 LAUNCH OF NEW TECHNOLOGY GENETIC TESTING KITS

5.3.2 PARTNERSHIPS WITH MARKET PLAYERS

5.3.3 PRENATAL PRICING STRATEGY

5.4 KEY PATIENT ENROLLMENT STRATEGIES

5.4.1 AWARENESS OF THE PUBLIC TOWARDS GENETIC TESTING TECHNOLOGY

5.4.2 GENETIC COUNSELLORS' SCOPE OF PRACTICE

5.4.3 EDUCATION AND COMMUNICATION

6 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: REGULATIONS

7 EPIDEMIOLOGY

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 GROWING PREVALENCE OF GENETIC DISORDERS

8.1.2 INCREASE IN THE ADOPTION OF NEXT GENERATION SEQUENCING

8.1.3 WIDE PRODUCT PORTFOLIO OFFERED BY MAJOR PLAYER

8.1.4 INCREASE TREND TOWARD PERSONALIZED MEDICATION

8.2 RESTRAINT

8.2.1 HIGH COST OF GENETIC TESTING

8.2.2 CYBER SECURITY CONCERN IN GENOMICS

8.3 OPPORTUNITIES

8.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

8.3.2 TECHNOLOGICAL ADVANCEMENTS IN GENETIC TESTING

8.3.3 INCREASING RESEARCH AND DEVELOPMENT

8.3.4 RISING DISPOSABLE INCOME

8.4 CHALLENGES

8.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM GENETIC TESTING

8.4.2 STRINGENT REGULATION POLICY

9 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY TYPE

9.1 OVERVIEW

9.2 DIAGNOSTIC TESTING

9.3 PRENATAL TESTING

9.3.1 NON-INVASIVE SCREENING

9.3.1.1 BY SCREENING METHOD

9.3.1.1.1 WHOLE GENOME SEQUENCING

9.3.1.1.2 COUNTING OF CFDNA FRAGMENTS

9.3.1.1.3 OTHERS

9.3.1.2 BY CONDITION

9.3.1.2.1 TRISOMY 21

9.3.1.2.2 KLINEFELTER SYNDROME

9.3.1.2.3 JACOBS SYNDROME

9.3.1.2.4 CYSTIC FIBROSIS

9.3.1.2.5 TURNER SYNDROME

9.3.1.2.6 TRISOMY 18

9.3.1.2.7 HEMOPHILIA

9.3.1.2.8 TRISOMY 13

9.3.1.2.9 MICRODELETION SYNDROME

9.3.1.2.10 FETAL GENDER

9.3.1.2.11 OTHERS

9.3.1.3 BY SCREENING TYPE

9.3.1.3.1 CARRIER SEQUENCING

9.3.1.3.2 SEQUENTIAL SEQUENCING

9.3.2 MATERNAL SERUM QUAD SCREENING

9.4 NEW BORN SCREENING

9.4.1 SICKLE CELL DISEASE

9.4.2 CONGENITAL HYPOTHYROIDISM

9.4.3 PHENYLKETONURINA (PKU)

9.4.4 GALACTOSEMIA

9.4.5 MAPLE SYRUP URINE DISEASE

9.4.6 OTHERS

9.5 PREDICTIVE AND PRESYMPTOMATIC TESTING

9.6 CARRIER TESTING

9.6.1 BY TEST TYPE

9.6.1.1 MOLECULAR SCREENING TEST

9.6.1.2 BIOCHEMICAL SCREENING TEST

9.6.2 BY TYPE

9.6.2.1 EXPANDED CARRIER SCREENING

9.6.2.1.1 PREDESIGNED PANEL TESTING

9.6.2.1.2 CUSTOM-MADE PANEL TESTING

9.6.2.2 TARGETED DISEASE CARRIER SCREENING

9.6.3 BY MEDICAL CONDITION

9.6.3.1 HEMATOLOGICAL CONDITIONS

9.6.3.2 PULMONARY CONDITIONS

9.6.3.3 NEUROLOGICAL CONDITIONS

9.6.3.4 OTHER CONDITIONS

9.7 OTHER TYPES

10 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 POLYMERASE CHAIN REACTION

10.2.1 REAL-TIME PCR (QPCR)

10.2.2 DIGITAL PCR (DPCR)

10.2.3 REVERSE TRANSCRIPTION PCR (RT-PCR)

10.2.4 HOT-START PCR

10.2.5 MULTIPLEX PCR

10.2.6 OTHER PCR

10.3 DNA SEQUENCING (NGS-BASED TESTING)

10.3.1 NEXT GENERATION SEQUENCING (NGS)

10.3.2 SANGER SEQUENCING (SINGLE GENE)

10.3.3 OTHER

10.4 WHOLE GENOME SEQUENCING

10.5 MICROARRAYS

10.5.1 DNA MICROARRAYS

10.5.2 PROTEIN MICROARRAYS

10.5.3 OTHER MICROARRAYS

10.6 FLUORESCENCE IN SITU HYBRIDIZATION (FISH)

10.7 OTHERS

11 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY DISEASES

11.1 OVERVIEW

11.2 CANCER

11.2.1 BREAST

11.2.2 COLON

11.2.3 LUNG

11.2.4 PROSTATE

11.2.5 OTHERS

11.3 REPRODUCTIVE GENETIC TESTING

11.4 HEALTH AND WELLNESS GENETIC TESTING

11.5 SICKLE CELL ANEMIA

11.6 THALASSEMIA

11.7 RARE GENETIC DISORDER

11.7.1 TRISOMY 21

11.7.2 MONOSOMY X

11.7.3 TRISOMY 13

11.7.4 MICRODELETION SYNDROME

11.7.5 TRISOMY 18

11.7.6 OTHERS

11.8 FRAGILE X SYNDROME

11.9 DUCHENNE MUSCULAR DYSTROPHY

11.1 HUNTINGTON'S DISEASE

11.11 CYSTIC FIBROSIS

11.12 OTHERS

12 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 CLINICS

12.4 DIAGNOSTIC CENTERS

12.5 PRIVATE CLINICS

12.6 LABORATORY SERVICE PROVIDERS

12.7 PRIVATE LABORATORIES

13 SUMMARY WRITE-UP (MIDDLE EAST AND AFRICA)

13.1 OVERVIEW

13.2 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY COUNTRY

13.2.1 SOUTH AFRICA

13.2.2 SAUDI ARABIA

13.2.3 U.A.E.

13.2.4 ISRAEL

13.2.5 EGYPT

13.2.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BAYER AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 ABBOTT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 ILLUMINA, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 THERMO FISHER SCIENTIFIC INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 F.HOFFAMANN-LA ROCHE LTD.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 BIOREFERNCE HEALTH INC. (SUBSIDIARY OPKO HEALTH, INC.)

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 ELITECHGROUP

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 23ANDME, INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 BIOCARTIS

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 BIO-HELIX

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 BIO-RAD LABORATORIES, INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 DANAHER

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 EUROFINS SCIENTIFIC

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 FREIBURG MEDICAL LABORATORY MIDDLE EAST (L.L.C)

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 HEALTHCHECKS360

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MYRIAD GENETICS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 OCP MEDICAL CENTER L.L.C

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 PACBIO

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 PERKINELMER ONC.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 QIAGEN

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 3 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 4 MIDDLE EAST AND AFRICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 6 MIDDLE EAST AND AFRICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 7 MIDDLE EAST AND AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (UNITS)

TABLE 9 MIDDLE EAST AND AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (ASP)

TABLE 10 MIDDLE EAST AND AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (UNITS)

TABLE 13 MIDDLE EAST AND AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (ASP)

TABLE 14 MIDDLE EAST AND AFRICA NEW BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (UNITS)

TABLE 17 MIDDLE EAST AND AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (UNITS)

TABLE 18 MIDDLE EAST AND AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 20 MIDDLE EAST AND AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (UNITS)

TABLE 21 MIDDLE EAST AND AFRICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 23 MIDDLE EAST AND AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (UNITS)

TABLE 24 MIDDLE EAST AND AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA DNA SEQUENCING (NGS-BASED TESTING) IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET , BY DISEASES, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 33 IDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY COUNTRY 2021-2030 (USD MILLION)

TABLE 34 SOUTH AFRICA GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 SOUTH AFRICA GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 36 SOUTH AFRICA GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 37 SOUTH AFRICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 SOUTH AFRICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 39 SOUTH AFRICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 40 SOUTH AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (USD MILLION)

TABLE 41 SOUTH AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (UNITS)

TABLE 42 SOUTH AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (ASP)

TABLE 43 SOUTH AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2021-2030 (USD MILLION)

TABLE 44 SOUTH AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (USD MILLION)

TABLE 45 SOUTH AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (UNITS)

TABLE 46 SOUTH AFRICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (ASP)

TABLE 47 SOUTH AFRICA NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 SOUTH AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 49 SOUTH AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (UNITS)

TABLE 50 SOUTH AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 51 SOUTH AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 SOUTH AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 53 SOUTH AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 54 SOUTH AFRICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 SOUTH AFRICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 56 SOUTH AFRICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 57 SOUTH AFRICA CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2021-2030 (USD MILLION)

TABLE 58 SOUTH AFRICA GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 59 SOUTH AFRICA POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 60 SOUTH AFRICA DNA SEQUENCING (NGS-BASED TESTING) IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 61 SOUTH AFRICA MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 62 SOUTH AFRICA GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 63 SOUTH AFRICA RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 64 SOUTH AFRICA CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 65 SOUTH AFRICA GENETIC TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 66 SAUDI ARABIA GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 68 SAUDI ARABIA GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 69 SAUDI ARABIA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 SAUDI ARABIA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 71 SAUDI ARABIA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 72 SAUDI ARABIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (USD MILLION)

TABLE 73 SAUDI ARABIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (UNITS)

TABLE 74 SAUDI ARABIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (ASP)

TABLE 75 SAUDI ARABIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2021-2030 (USD MILLION)

TABLE 76 SAUDI ARABIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (USD MILLION)

TABLE 77 SAUDI ARABIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (UNITS)

TABLE 78 SAUDI ARABIA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (ASP)

TABLE 79 SAUDI ARABIA NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 SAUDI ARABIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 81 SAUDI ARABIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (UNITS)

TABLE 82 SAUDI ARABIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 83 SAUDI ARABIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 SAUDI ARABIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 85 SAUDI ARABIA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 86 SAUDI ARABIA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 SAUDI ARABIA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 88 SAUDI ARABIA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 89 SAUDI ARABIA CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2021-2030 (USD MILLION)

TABLE 90 SAUDI ARABIA GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 91 SAUDI ARABIA POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 92 SAUDI ARABIA DNA SEQUENCING (NGS-BASED TESTING) IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 93 SAUDI ARABIA MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 94 SAUDI ARABIA GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 95 SAUDI ARABIA RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 96 SAUDI ARABIA CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 97 SAUDI ARABIA GENETIC TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 98 U.A.E. GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 U.A.E. GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 100 U.A.E. GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 101 U.A.E. PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 U.A.E. PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 103 U.A.E. PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 104 U.A.E. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (USD MILLION)

TABLE 105 U.A.E. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (UNITS)

TABLE 106 U.A.E. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (ASP)

TABLE 107 U.A.E. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2021-2030 (USD MILLION)

TABLE 108 U.A.E. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (USD MILLION)

TABLE 109 U.A.E. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (UNITS)

TABLE 110 U.A.E. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (ASP)

TABLE 111 U.A.E. NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 U.A.E. CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 113 U.A.E. CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (UNITS)

TABLE 114 U.A.E. CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 115 U.A.E. CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 U.A.E. CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 117 U.A.E. CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 118 U.A.E. EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 U.A.E. EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 120 U.A.E. EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 121 U.A.E. CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2021-2030 (USD MILLION)

TABLE 122 U.A.E. GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 123 U.A.E. POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 124 U.A.E. DNA SEQUENCING (NGS-BASED TESTING) IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 125 U.A.E. MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 126 U.A.E. GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 127 U.A.E. RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 128 U.A.E. CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 129 U.A.E. GENETIC TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 130 ISRAEL GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 ISRAEL GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 132 ISRAEL GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 133 ISRAEL PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 ISRAEL PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 135 ISRAEL PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 136 ISRAEL NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (USD MILLION)

TABLE 137 ISRAEL NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (UNITS)

TABLE 138 ISRAEL NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (ASP)

TABLE 139 ISRAEL NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2021-2030 (USD MILLION)

TABLE 140 ISRAEL NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (USD MILLION)

TABLE 141 ISRAEL NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (UNITS)

TABLE 142 ISRAEL NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (ASP)

TABLE 143 ISRAEL NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 ISRAEL CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 145 ISRAEL CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (UNITS)

TABLE 146 ISRAEL CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (ASP)

TABLE 147 ISRAEL CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 ISRAEL CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 149 ISRAEL CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 150 ISRAEL EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 ISRAEL EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 152 ISRAEL EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 153 ISRAEL CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2021-2030 (USD MILLION)

TABLE 154 ISRAEL GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 155 ISRAEL POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 156 ISRAEL DNA SEQUENCING (NGS-BASED TESTING) IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 157 ISRAEL MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 158 ISRAEL GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 159 ISRAEL RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 160 ISRAEL CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 161 ISRAEL GENETIC TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 162 EGYPT GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 EGYPT GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 164 EGYPT GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 165 EGYPT PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 EGYPT PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 167 EGYPT PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 168 EGYPT NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (USD MILLION)

TABLE 169 EGYPT NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (UNITS)

TABLE 170 EGYPT NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2021-2030 (ASP)

TABLE 171 EGYPT NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2021-2030 (USD MILLION)

TABLE 172 EGYPT NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (USD MILLION)

TABLE 173 EGYPT NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (UNITS)

TABLE 174 EGYPT NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2021-2030 (ASP)

TABLE 175 EGYPT NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 EGYPT CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 177 EGYPT CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2021-2030 (UNITS)

TABLE 178 EGYPT CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 179 EGYPT CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 180 EGYPT CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 181 EGYPT EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 EGYPT EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (UNITS)

TABLE 183 EGYPT EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 184 EGYPT CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2021-2030 (USD MILLION)

TABLE 185 EGYPT GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 186 EGYPT POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 187 EGYPT DNA SEQUENCING (NGS-BASED TESTING) IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 188 EGYPT MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 189 EGYPT GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 190 EGYPT RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 191 EGYPT CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2021-2030 (USD MILLION)

TABLE 192 EGYPT GENETIC TESTING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 193 REST OF MIDDLE EAST AND AFRICA GENETIC TESTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET:DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET :COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET : DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET : MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: SEGMENTATION

FIGURE 11 THE INCREASING PREVALENCE OF GENETIC DISEASES AND RISING HEALTHCARE EXPENDITURE ARE EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA GENETIC TESTING MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 DIGANOSTIC TESTING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA GENETIC TESTING MARKET IN 2023 & 2030

FIGURE 13 EPIDEMIOLOGY

FIGURE 14 INCIDENCE OF ALL GENDER-SOUTH AFRICA AND SAUDI ARABIA

FIGURE 15 INCIDENCE OF ALL GENDER-UAE AND EGYPT

FIGURE 16 INCIDENCE OF ALL GENDER-ISRAEL

FIGURE 17 MORTALITY RATE- SOUTH AFRICA AND SAUDI ARABIA

FIGURE 18 MORTALITY RATE-UAE AND EGYPT

FIGURE 19 MORTALITY RATE-ISRAEL

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA GENETIC TESTING MARKET

FIGURE 21 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY TYPE, 2022

FIGURE 22 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 23 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 24 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY TYPE, LIFELINE CURVE

FIGURE 25 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 26 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 27 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 28 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 29 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY DISEASES, 2022

FIGURE 30 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY DISEASES, 2023-2030 (USD MILLION)

FIGURE 31 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY DISEASES, CAGR (2023-2030)

FIGURE 32 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY DISEASES, LIFELINE CURVE

FIGURE 33 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY END USER, 2022

FIGURE 34 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 35 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 36 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 37 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: SNAPSHOT (2022)

FIGURE 38 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY COUNTRY (2022)

FIGURE 39 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 40 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 41 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: BY TYPE (2023-2030)

FIGURE 42 MIDDLE EAST AND AFRICA GENETIC TESTING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.