Middle East And Africa Gene Synthesis Market

Taille du marché en milliards USD

TCAC :

%

USD

45.53 Million

USD

166.43 Million

2021

2029

USD

45.53 Million

USD

166.43 Million

2021

2029

| 2022 –2029 | |

| USD 45.53 Million | |

| USD 166.43 Million | |

|

|

|

Marché de la synthèse génétique au Moyen-Orient et en Afrique, par composant (synthétiseur, consommables et logiciels et services), type de gène (gène standard, gène express, gène complexe et autres), type de synthèse génétique (synthèse de bibliothèque de gènes et synthèse de gènes personnalisée), application (biologie synthétique, génie génétique, conception de vaccins, anticorps thérapeutiques et autres), méthode (synthèse en phase solide, synthèse d'ADN sur puce et synthèse enzymatique basée sur la PCR), utilisateur final (instituts universitaires et de recherche, laboratoires de diagnostic, sociétés biotechnologiques et pharmaceutiques, et autres), canal de distribution (appel d'offres direct, distribution en ligne et distributeurs tiers), tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché de la synthèse génétique au Moyen-Orient et en Afrique

La synthèse génétique est le processus de création de gènes artificiels en laboratoire à l'aide de la biologie synthétique. La génération de protéines recombinantes est l'une des nombreuses applications de la technologie de l'ADN recombinant, où la synthèse génétique apparaît comme un instrument clé. Les méthodes traditionnelles de clonage et de mutagenèse sont rapidement remplacées par la synthèse génétique de novo, qui permet également la production d'acides nucléiques pour lesquels il n'existe pas de modèle.

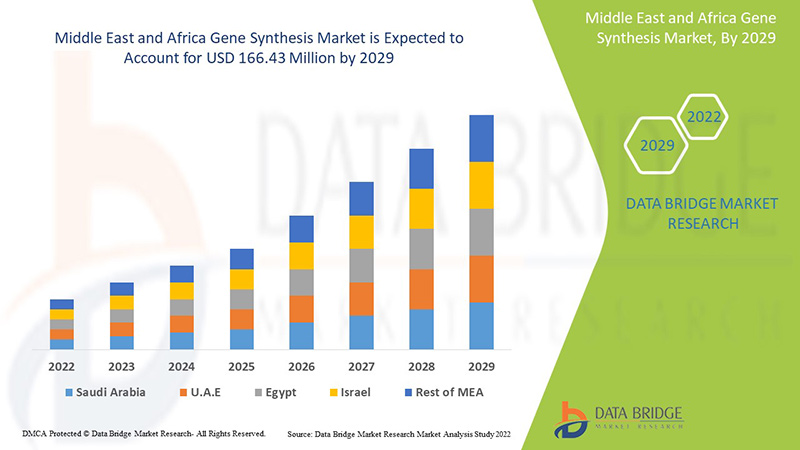

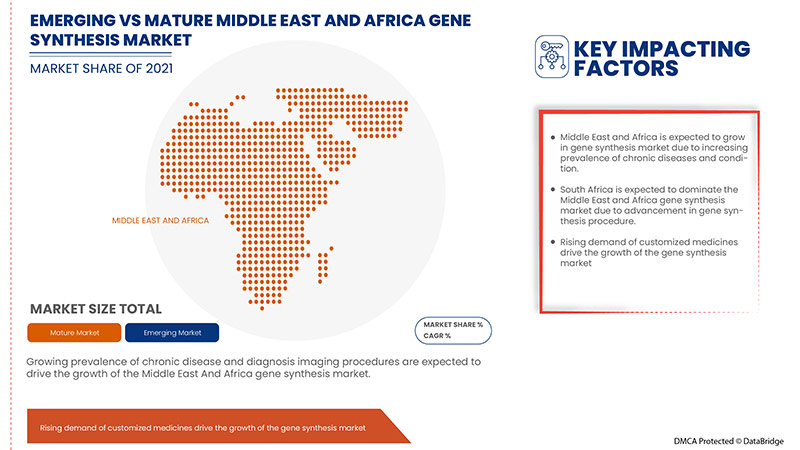

Le marché de la synthèse génétique au Moyen-Orient et en Afrique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 17,4 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 166,43 millions USD d'ici 2029 contre 45,53 millions USD en 2021.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par composant (synthétiseur, consommables et logiciels et services), type de gène (gène standard, gène express, gène complexe et autres), type de synthèse génique (synthèse de bibliothèque de gènes et synthèse de gènes personnalisés), application (biologie synthétique, génie génétique, conception de vaccins, anticorps thérapeutiques et autres), méthode (synthèse en phase solide, synthèse d'ADN sur puce et synthèse enzymatique basée sur la PCR), utilisateur final (instituts universitaires et de recherche, laboratoires de diagnostic, sociétés biotechnologiques et pharmaceutiques et autres), canal de distribution (appel d'offres direct, distribution en ligne et distributeurs tiers) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël, reste du Moyen-Orient et Afrique. |

|

Acteurs du marché couverts |

Genescript, Synbio Technologies, Proteogenix, Bio Basic Inc., ATG: biosynthetic GmbH, Merck KGaA, Ginkgo Bioworks, Evonetix, ProMab Biotechnologies, Inc., CSBio et Azenta US, Inc., entre autres. |

Définition du marché

La synthèse génique désigne la synthèse chimique d'un brin d'ADN base par base. Contrairement à la réplication de l'ADN qui se produit dans les cellules ou par réaction en chaîne par polymérase (PCR) , la synthèse génique ne nécessite pas de brin modèle. Au contraire, la synthèse génique implique l'ajout progressif de nucléotides à une molécule monocaténaire, qui sert ensuite de modèle pour la création d'un brin complémentaire. La synthèse génique est la technologie fondamentale sur laquelle s'appuie le domaine de la biologie synthétique.

Dynamique du marché de la synthèse génétique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- PRÉVALENCE AUGMENTÉE DES MALADIES INFECTIEUSES CHRONIQUES

Les maladies bactériennes et virales se développent rapidement en raison de la prévalence croissante des maladies infectieuses dans le monde. En conséquence, la demande de thérapies innovantes et efficaces a augmenté pour lutter contre ces maladies mortelles. Ces maladies peuvent être guéries en utilisant des médicaments chimiques et des thérapies biologiques, y compris la thérapie génique. L'application de la génomique a amélioré la gestion des maladies infectieuses et endémiques. Elle nous permet également de comprendre la résistance émergente aux médicaments et d'identifier des cibles pour de nouveaux traitements et vaccins. Pour le traitement des maladies infectieuses, la thérapie génique a attiré de nombreux chercheurs car elle peut être traitée en utilisant la technologie de l'ADN recombinant, le ribozyme ADN et ARN et les anticorps à chaîne unique.

La prévalence croissante des maladies infectieuses chroniques à l'échelle mondiale a entraîné une augmentation de la demande de vaccins et de thérapies géniques efficaces, ce qui a accru la demande de nouveaux gènes ayant une application significative pour les activités de recherche et la fabrication de médicaments et de vaccins. Ainsi, la prévalence croissante des maladies infectieuses agit comme un moteur de la croissance du marché de la synthèse génétique.

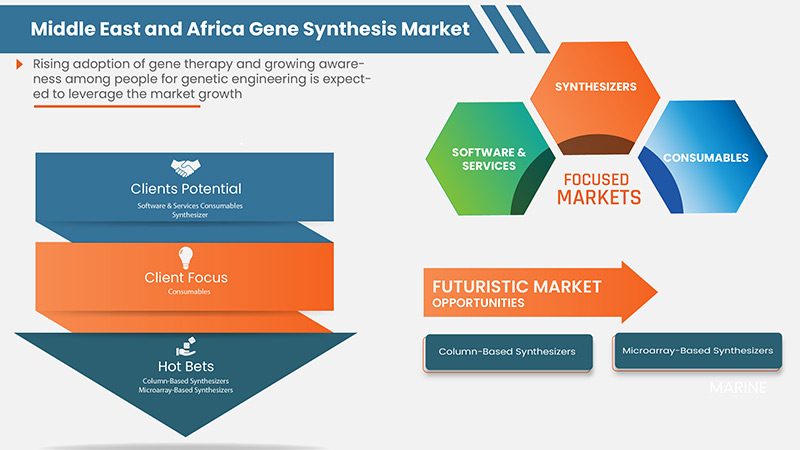

- ADOPTION AUGMENTANTE DE LA THÉRAPIE GÉNIQUE

La thérapie génique est une technique avancée qui consiste à utiliser plusieurs gènes pour prévenir un type particulier de maladie. Cette technique consiste à insérer des gènes dans les cellules du patient au lieu de recourir à des médicaments ou à une intervention chirurgicale. En raison de la demande croissante de résultats thérapeutiques nouveaux et durables, l'adoption de la thérapie génique est en hausse. Les thérapies géniques nécessitent des constructions génétiques synthétiques, entre autres produits géniques, pour accélérer le développement de la thérapie génique. En raison de l'augmentation des maladies génétiques, la demande d'un traitement approprié est un facteur majeur, et avec l'aide de la thérapie génique, un type particulier de maladie peut être guéri.

En raison de la demande croissante, les dirigeants se concentrent constamment sur la production de produits de thérapie génique, l’obtention d’approbations et d’autorisations de mise sur le marché.

Les médicaments et thérapies qui sauvent des vies sont très demandés pour offrir une vie de qualité à différents types de patients. Ce nombre croissant de patients dépend en grande partie des thérapies géniques disponibles pour parvenir à un traitement approprié. Pour fabriquer des thérapies géniques, des gènes synthétiques et nouveaux sont nécessaires, ce qui peut être obtenu par la technique de synthèse génique. Ainsi, l'adoption croissante de la thérapie génique devrait agir comme un moteur pour le marché de la synthèse génique.

- EXPANSION DE LA BIOLOGIE SYNTHÉTIQUE

L'intégration des principes d'ingénierie dans la biologie est appelée biologie synthétique. Le génome de l'ADN peut être réassemblé à l'aide de la biologie synthétique car elle implique la synthèse chimique de l'ADN en le combinant avec son génome. Les oligonucléotides peuvent être construits en peu de temps en intégrant l'utilisation de services de synthèse génétique, de logiciels et de consommables. Alors que la demande de produits de biologie synthétique augmente dans le monde entier, les produits et services de synthèse génétique augmentent également.

Ainsi, en raison de ses produits efficaces et innovants, la demande de produits de biologie synthétique augmente à l’échelle mondiale, ce qui devrait agir comme un facteur moteur pour le marché de la synthèse génétique.

Opportunités

-

AUGMENTATION DES DÉPENSES DE SANTÉ

Les dépenses de santé ont augmenté dans le monde entier en raison de l'augmentation du revenu disponible des citoyens dans divers pays. De plus, pour répondre aux besoins de la population, les organismes gouvernementaux et les organisations de santé prennent des initiatives en accélérant les dépenses de santé.

En outre, les initiatives stratégiques prises par les principaux acteurs du marché assureront l’intégrité structurelle et les opportunités futures du marché des tests de dispositifs médicaux au cours de la période de prévision 2022-2029.

Contraintes/Défis

COÛT ÉLEVÉ DU PROCESSUS DE SYNTHÈSE GÉNIQUE

Cependant, les obstacles aux techniques de synthèse génétique et le coût élevé du processus de synthèse génétique dans certaines régions peuvent entraver la croissance des procédures de synthèse génétique, ce qui freine la croissance du marché. En outre, la forte concurrence dans les industries de technologie médicale et les longs délais d'obtention de la qualification à l'étranger peuvent constituer des facteurs difficiles pour la croissance du marché.

Ce rapport sur le marché de la synthèse génétique fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de la synthèse génétique, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développement récent

- En décembre 2020, Twist Bioscience a lancé des fragments de gènes prêts à être clonés pour compléter l'offre de gènes. Les fragments lancés peuvent être utilisés avec des adaptateurs ou sans adaptateurs pour créer les clones parfaits. Les fragments de gènes prêts à être clonés sont compatibles avec les voies d'expression des protéines, l'ingénierie enzymatique et l'expression des gènes, entre autres.

- En 2020, selon un article publié dans la revue de l’ACS, on estime que 19,3 millions de nouveaux cas de cancer et près de 10,0 millions de décès par cancer ont été signalés dans le monde. Cela suggère que la couverture du cancer n’est pas optimale et qu’il est absolument nécessaire de mettre en œuvre une couverture élevée du cancer partout dans le monde.

Portée du marché de la synthèse génétique au Moyen-Orient et en Afrique

Le marché de la synthèse génétique au Moyen-Orient et en Afrique est segmenté en composants, types de gènes, types de synthèse génétique, applications, méthodes, utilisateurs finaux et canaux de distribution. La croissance de ces segments vous aidera à analyser les segments de croissance limités des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Composant

- Synthétiseurs

- Consommables

- Logiciels et services

Sur la base des composants, le marché de la synthèse génétique du Moyen-Orient et de l'Afrique est segmenté en synthétiseurs, consommables et logiciels et services.

Type de gène

- Gène standard

- Gène express

- Gène complexe

- Autres

Sur la base du type de gène, le marché de la synthèse des gènes du Moyen-Orient et de l'Afrique est segmenté en gène standard, gène express, gène complexe et autres.

Type de synthèse génétique

- Synthèse de la bibliothèque de gènes

- Synthèse génétique personnalisée

Sur la base du type de synthèse génétique, le marché de la synthèse génétique du Moyen-Orient et de l’Afrique est segmenté en synthèse de bibliothèque génétique et synthèse génétique personnalisée.

Application

- Biologie synthétique,

- Génie génétique,

- Conception de vaccins,

- Anticorps thérapeutiques

- Autres

Sur la base des applications, le marché de la synthèse génétique du Moyen-Orient et de l'Afrique est segmenté en biologie synthétique, génie génétique, conception de vaccins, anticorps thérapeutiques et autres.

Méthode

- Synthèse à base solide,

- Synthèse d'ADN à partir d'une puce

- Synthèse enzymatique basée sur la PCR

Sur la base de la méthode, le marché de la synthèse génétique du Moyen-Orient et de l’Afrique est segmenté en synthèse à base solide, synthèse d’ADN à base de puce et synthèse enzymatique à base de PCR.

Utilisateur final

- Instituts universitaires et de recherche,

- Laboratoires de diagnostic,

- Sociétés biotechnologiques et pharmaceutiques

- Autres

Sur la base des utilisateurs finaux, le marché de la synthèse génétique du Moyen-Orient et de l'Afrique est segmenté en instituts universitaires et de recherche, laboratoires de diagnostic, sociétés biotechnologiques et pharmaceutiques, et autres.

Canal de distribution

- Appel d'offres direct

- Distribution en ligne

- Distributeurs tiers

Sur la base des canaux de distribution, le marché de la synthèse génétique du Moyen-Orient et de l’Afrique est segmenté en appels d’offres directs, distribution en ligne et distributeurs tiers.

Analyse/perspectives régionales du marché de la synthèse génétique

The gene synthesis market is analyzed, and market size insights and trends are provided by the country, component, gene type, gene synthesis type, application, method, end user, and distribution channel, as referenced above.

Saudi Arabia dominates the gene synthesis market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the rising need for the verification and validation of gene synthesis processes in the region, and rapid research development is boosting the market

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Gene Synthesis Market Share Analysis

The gene synthesis market competitive landscape provides details by the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies focus on the gene synthesis market.

Some of the major players operating in the gene synthesis market are ATDBio Ltd (Subsidiary of Biotage), General Biosystems, Inc., MACROGEN CO., LTD., Boster Biological Technology, Creative Biogene, Bioneer Pacific, exonbio, trenzyme GmbH, Twist Bioscience, BioCat GmbH (Subsidiary of AddLife AB), OriGene Technologies, Inc., Integrated DNA Technologies, Inc. 9Subsidiary of Danaher Corporation), Eurofins Scientific, NZYTech, Lda. - Genes and Enzymes, Ansa Biotechnologies, Inc., Thermo Fisher Scientific, Genescript, Synbio Technologies, Proteogenix, Bio Basic Inc., ATG:biosynthetics GmbH, Merck KGaA, Kaneka Eurogentec S.A, Ginkgo Bioworks, Bbi-lifesciences, Evonetix, ProMab Biotechnologies, Inc., GCC Biotech (INDIA) Pvt. Ltd., CSBio, Azenta US, Inc., and among others.

Research Methodology

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché du Moyen-Orient et de l'Afrique par rapport aux régions et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 COMPONENT SEGMENT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 THE CATEGORY VS TIME GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF CHRONIC INFECTIOUS DISEASES

6.1.2 RISING ADOPTION OF GENE THERAPY

6.1.3 EXPANSION OF SYNTHETIC BIOLOGY

6.1.4 RISING INTEREST OF GENE SYNTHESIS IN THE FIELD OF MOLECULAR BIOLOGY

6.2 RESTRAINTS

6.2.1 LACK OF TRAINED PROFESSIONALS

6.2.2 ETHICAL ISSUES

6.2.3 LONG APPROVAL PROCESS

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 RISING DEMAND FOR CUSTOMIZED MEDICATIONS

6.4 CHALLENGES

6.4.1 TECHNICAL LIMITATIONS ACROSS PRODUCTION PROCESS

6.4.2 LACK OF WELL DEFINED PATENT SYSTEM

7 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SOFTWARE & SERVICES

7.3 CONSUMABLES

7.3.1 REAGENTS

7.3.2 ASSAYS

7.3.3 PROBES & DYES

7.3.4 OTHERS

7.4 SYNTHESIZER

7.4.1 COLUMN-BASED SYNTHESIZERS

7.4.2 MICROARRAY-BASED SYNTHESIZERS

8 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY GENE TYPE

8.1 OVERVIEW

8.2 STANDARD GENE

8.3 COMPLEX GENE

8.4 EXPRESS GENE

8.5 OTHERS

9 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE

9.1 OVERVIEW

9.2 CUSTOM GENE SYNTHESIS

9.2.1 STANDARD GENE

9.2.2 COMPLEX GENE

9.2.3 EXPRESS GENE

9.2.4 OTHERS

9.3 GENE LIBRARY SYNTHESIS

9.3.1 STANDARD GENE

9.3.2 COMPLEX GENE

9.3.3 EXPRESS GENE

9.3.4 OTHERS

10 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SYNTHETIC BIOLOGY

10.2.1 CUSTOM GENE SYNTHESIS

10.2.2 GENE LIBRARY SYNTHESIS

10.3 GENETIC ENGINEERING

10.3.1 CUSTOM GENE SYNTHESIS

10.3.2 GENE LIBRARY SYNTHESIS

10.4 THERAPEUTIC ANTIBODIES

10.4.1 CUSTOM GENE SYNTHESIS

10.4.2 GENE LIBRARY SYNTHESIS

10.5 VACCINE DESIGN

10.5.1 CUSTOM GENE SYNTHESIS

10.5.2 GENE LIBRARY SYNTHESIS

10.6 OTHERS

11 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY METHOD

11.1 OVERVIEW

11.2 PCR-BASED ENZYME SYNTHESIS

11.3 CHIP-BASED DNA SYNTHESIS

11.4 SOLID BASED SYNTHESIS

12 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY END USER

12.1 OVERVIEW

12.2 ACADEMIC & RESEARCH INSTITUTE

12.3 BIOTECH & PHARMACEUTICAL COMPANIES

12.4 DIAGNOSTIC LABORATORIES

12.5 OTHERS

13 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 ONLINE DISTRIBUTION

13.4 THIRD PARTY DISTRIBUTORS

14 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY REGION

14.1 MIDDLE EAST &AFRICA

14.1.1 SAUDI ARABIA

14.1.2 SOUTH AFRICA

14.1.3 U.A.E.

14.1.4 ISRAEL

14.1.5 EGYPT

14.1.6 REST OF MIDDLE EAST & AFRICA

15 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 INTEGRATED DNA TECHNOLOGIES, INC. (A SUBSIDIARY OF DANAHER)

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 THERMO FISHER SCIENTIFIC INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 EUROFINS SCIENTIFIC

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 SERVICE PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 MERCK KGAA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 KANEKA EUROGENTEC S.A.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ANSA BIOTECHNOLOGIES, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ATD BIO LTD

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 ATG:BIOSYNTHETICS GMBH

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 AZENTUS US, INC (2021)

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 BBI LIFESCIENCES CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BIO BASIC INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 BIOCAT GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 BIONEER PACIFIC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 BOSTER BIOLOGICAL TECHNOLOGY

17.14.1 COMPANY SNAPSHOT

17.14.2 SERVICE PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 CSBIO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 CREATIVE BIOGENE

17.16.1 COMPANY SNAPSHOT

17.16.2 RODUCTPORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 EVONETIX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 EXONBIO

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 GCC BIOTECH (INDIA) PVT. LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 GINKGO BIOWORKS (2021)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 GENERAL BIOSYSTEMS INC

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 GENSCRIPT

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 MACROGEN CO., LTD. (A SUBSIDIARY OF MACROGEN, INC)

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 NZYTECH, LDA. - GENES AND ENZYMES.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 ORIGENE TECHNOLOGIES, INC

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

17.26 PROMAB BIOTECHNOLOGIES

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 PROTEOGENIX

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 SYNBIO TECHNOLOGIES

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENTS

17.29 TRENZYME GMBH

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENTS

17.3 TWIST BIOSCIENCE

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SOFTWARE & SERVICES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA CONSUMABLES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA STANDARD GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA COMPLEX GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA EXPRESS GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA PCR-BASED ENZYME SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CHIP-BASED DNA SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA SOLID BASED SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA ACADEMIC & RESEARCH INSTITUTES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA BIOTECH & PHARMACEUTICAL COMPANIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA DIAGNOSTIC LABORATORIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA DIRECT TENDER IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ONLINE DISTRIBUTION IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA THIRD PARTY DISTRIBUTORS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 63 SAUDI ARABIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 SAUDI ARABIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 65 SAUDI ARABIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 66 SAUDI ARABIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 67 SAUDI ARABIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 68 SAUDI ARABIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 69 SAUDI ARABIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 U.A.E GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 87 U.A.E CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.A.E SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.A.E GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.A.E GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.A.E CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.A.E GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 U.A.E SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.A.E GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.A.E THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.A.E VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.A.E GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 99 U.A.E GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 U.A.E GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 ISRAEL GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 102 ISRAEL CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 105 ISRAEL GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 107 ISRAEL GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 108 ISRAEL GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 110 ISRAEL GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 112 ISRAEL VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 113 ISRAEL GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 114 ISRAEL GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 ISRAEL GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 EGYPT GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 117 EGYPT CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 EGYPT SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 EGYPT GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 120 EGYPT GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 121 EGYPT CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 122 EGYPT GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 123 EGYPT GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 EGYPT SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 125 EGYPT GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 126 EGYPT THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 127 EGYPT VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 128 EGYPT GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 129 EGYPT GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 EGYPT GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 REST OF MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: GEOGRAPHIC SCOPE

FIGURE 3 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: DATA TRIANGULATION

FIGURE 4 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: SNAPSHOT

FIGURE 5 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BOTTOM UP APPROACH

FIGURE 6 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: TOP DOWN APPROACH

FIGURE 7 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: END USER COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: THE CATEGORY VS TIME GRID

FIGURE 12 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET SEGMENTATION

FIGURE 13 GROWING PREVALENCE OF CHRONIC INFECTIOUS DISEASES , EXPANSION OF SYNTHETIC BIOLOGY AND RISING ADOPTION OF GENE THERAPY ARE EXPECTED TO DRIVE THE MARKET FOR MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 SYNTHESIZER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET

FIGURE 16 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY COMPONENT, 2021

FIGURE 17 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 18 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 19 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 20 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY GENE TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY GENE TYPE, 2022-2029 (USD MILLION)

FIGURE 22 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY GENE TYPE, CAGR (2022-2029)

FIGURE 23 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY GENE TYPE, LIFELINE CURVE

FIGURE 24 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, 2021

FIGURE 25 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, 2022-2029 (USD MILLION)

FIGURE 26 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, CAGR (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, LIFELINE CURVE

FIGURE 28 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY APPLICATION, 2021

FIGURE 29 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 30 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 31 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY METHOD, 2021

FIGURE 33 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 34 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 35 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY METHOD, LIFELINE CURVE

FIGURE 36 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY END USER, 2021

FIGURE 37 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY END USER, 2021-2029 (USD MILLION)

FIGURE 38 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: SNAPSHOT (2021)

FIGURE 45 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY COUNTRY (2021)

FIGURE 46 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: BY COMPONENT (2022-2029)

FIGURE 49 MIDDLE EAST & AFRICA GENE SYNTHESIS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.