Middle East And Africa Gaskets And Seals Market

Taille du marché en milliards USD

TCAC :

%

USD

5.92 Billion

USD

8.75 Billion

2025

2033

USD

5.92 Billion

USD

8.75 Billion

2025

2033

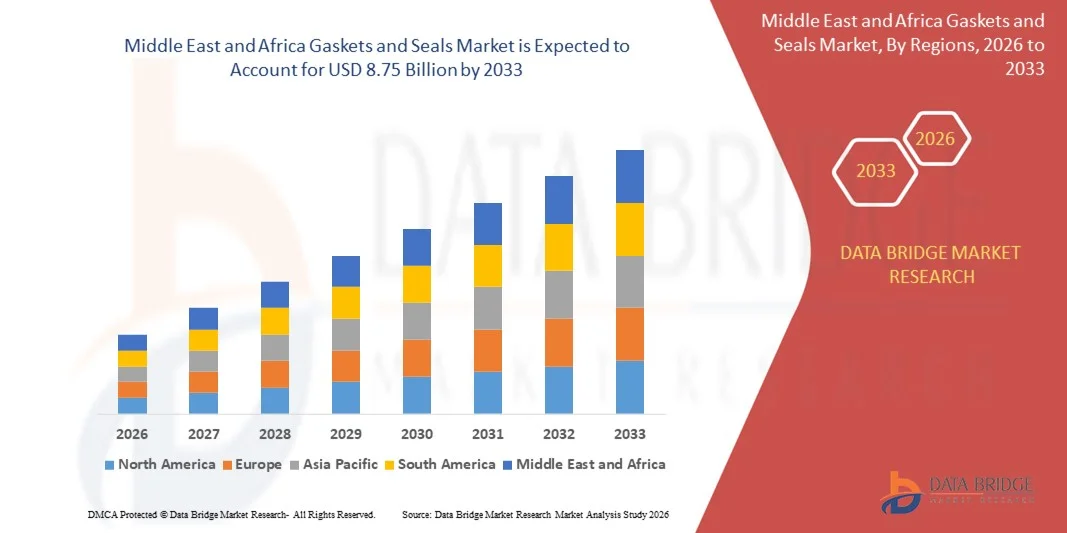

| 2026 –2033 | |

| USD 5.92 Billion | |

| USD 8.75 Billion | |

|

|

|

|

Segmentation du marché des joints d'étanchéité au Moyen-Orient et en Afrique, par type (joints d'étanchéité), application (échangeurs de chaleur, récipients sous pression, couvercles de regards, regards de visite, chapeaux de vannes, brides de tuyauterie et autres), canal de distribution (équipementiers et marché de la rechange), industrie (industrie du papier et de la pâte à papier, pétrole et gaz, électricité, automobile, aérospatiale, fabrication industrielle, marine et ferroviaire et autres) - Tendances et prévisions du secteur jusqu'en 2033

Taille du marché des joints d'étanchéité au Moyen-Orient et en Afrique

- Le marché des joints d'étanchéité au Moyen-Orient et en Afrique était évalué à 5,92 milliards de dollars en 2025 et devrait atteindre 8,75 milliards de dollars d'ici 2033 , avec un TCAC de 5,00 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante des secteurs de l'automobile, de l'aérospatiale, du pétrole et du gaz, et de la fabrication, pour une meilleure efficacité d'étanchéité et une prévention des fuites améliorée.

- L'importance croissante accordée à la fiabilité des équipements, à la sécurité opérationnelle et à la réduction des coûts de maintenance favorise encore davantage leur adoption.

Analyse du marché des joints d'étanchéité au Moyen-Orient et en Afrique

- Le marché connaît une croissance soutenue, alimentée par le besoin croissant de solutions d'étanchéité haute performance capables de résister à des pressions, des températures et des environnements corrosifs extrêmes.

- Les progrès réalisés dans le domaine des matériaux, tels que les élastomères, les composites et les joints renforcés par du métal, améliorent la durabilité et les performances.

- Les Émirats arabes unis ont dominé le marché des joints d'étanchéité au Moyen-Orient et en Afrique en 2025, grâce à d'importants investissements dans les infrastructures pétrolières et gazières, l'expansion pétrochimique et le développement industriel à grande échelle.

- L’Arabie saoudite devrait connaître le taux de croissance annuel composé (TCAC) le plus élevé du marché des joints d’étanchéité au Moyen-Orient et en Afrique, en raison de la multiplication des initiatives de diversification industrielle, de l’adoption croissante de solutions d’étanchéité avancées dans les projets énergétiques et pétrochimiques et des investissements continus du gouvernement dans le développement d’infrastructures à grande échelle.

- Le segment des joints d'étanchéité a représenté la plus grande part de revenus du marché en 2025, grâce à leur utilisation intensive dans les équipements rotatifs tels que les pompes, les compresseurs et les moteurs des industries manufacturières et automobiles. Leur capacité à assurer une étanchéité fiable dans les systèmes à haute pression et haute température les rend indispensables aux opérations industrielles.

Portée du rapport et segmentation du marché des joints d'étanchéité au Moyen-Orient et en Afrique

|

Attributs |

Aperçu du marché des joints d'étanchéité au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, les critères de sélection des fournisseurs, une analyse PESTLE, une analyse de Porter et le cadre réglementaire. |

Tendances du marché des joints d'étanchéité au Moyen-Orient et en Afrique

L'essor de l'intégration de matériaux avancés dans les joints d'étanchéité

- L'adoption croissante de matériaux avancés tels que les élastomères haute performance, les composites PTFE et les solutions d'étanchéité renforcées par du métal transforme le marché des joints d'étanchéité en améliorant leur durabilité, leur résistance chimique et leur stabilité thermique dans les applications industrielles. Ces matériaux offrent des performances supérieures dans les environnements d'exploitation difficiles où les composants d'étanchéité traditionnels sont mis à rude épreuve. Leur intégration généralisée contribue à une fiabilité et une efficacité accrues des systèmes de machines critiques.

- La demande croissante de composants d'étanchéité capables de résister à des températures extrêmes, à des fluides agressifs et à des environnements à haute pression accélère l'innovation en science des matériaux, notamment dans des secteurs comme le pétrole et le gaz, la chimie et l'automobile où la fiabilité opérationnelle est primordiale. Les fabricants s'attachent à développer des formulations offrant une plus grande résilience tout en réduisant les risques de fuite. Cette tendance favorise l'adoption de technologies d'étanchéité avancées, tant pour les nouvelles installations que pour les opérations de maintenance.

- L'évolution vers des machines légères et économes en énergie favorise l'utilisation de matériaux techniques aux propriétés mécaniques améliorées, permettant une durée de vie plus longue et des besoins de maintenance réduits. Ces matériaux contribuent à alléger les équipements tout en garantissant une étanchéité optimale. Leur adoption permet aux industries de réaliser des économies d'énergie, d'améliorer leur productivité et d'optimiser les performances de leurs systèmes.

- Par exemple, en 2023, plusieurs constructeurs automobiles ont intégré des joints d'étanchéité de pointe à base de fluorocarbone et de silicone afin d'améliorer le rendement des moteurs et de réduire les risques de fuite, ce qui a permis d'accroître les performances et de diminuer les demandes de garantie. Ces matériaux ont offert une meilleure résistance aux cycles thermiques et à l'exposition aux produits chimiques. L'intégration de telles solutions établit de nouvelles normes pour les systèmes d'étanchéité automobiles de nouvelle génération.

- Si les innovations en matière de matériaux améliorent les performances et élargissent le champ d'application, leur adoption dépend de la rentabilité, des tests de compatibilité et de la capacité de production à grande échelle. Les entreprises doivent investir dans des processus de validation rigoureux afin de garantir l'adéquation des matériaux à diverses conditions d'utilisation. Les fabricants doivent privilégier la production locale, les formulations sur mesure et les procédés rentables pour répondre efficacement à la demande croissante.

Dynamique du marché des joints d'étanchéité au Moyen-Orient et en Afrique

Conducteur

Automatisation industrielle croissante et demande accrue de fiabilité des actifs

- L'essor de l'automatisation industrielle pousse les fabricants de tous les secteurs à privilégier des solutions d'étanchéité de haute qualité afin de garantir un fonctionnement continu et de prévenir les pannes d'équipement. Les systèmes automatisés dépendent fortement de composants qui minimisent les fuites, maintiennent l'intégrité de la pression et supportent des cycles de fonctionnement longs. Cette tendance renforce le besoin de joints et de garnitures d'étanchéité durables et de haute précision dans les environnements industriels en forte croissance.

- Les industries sont de plus en plus conscientes des risques financiers importants liés aux arrêts de production, notamment les pertes de productivité, les risques pour la sécurité et les réparations coûteuses. Cette prise de conscience a conduit à l'adoption généralisée de joints et de garnitures d'étanchéité haut de gamme dans les machines critiques où la fiabilité est primordiale. Par conséquent, les stratégies de maintenance préventive se renforcent, stimulant ainsi la demande en composants d'étanchéité haute performance.

- Les initiatives gouvernementales et les normes de sécurité industrielle renforcent l'infrastructure de maintenance préventive et de certification des équipements, accentuant ainsi le besoin en composants d'étanchéité fiables. Les cadres réglementaires imposent aux industries de mettre en œuvre des solutions d'étanchéité capables de répondre à des critères opérationnels stricts. Ceci stimule les investissements dans les technologies d'étanchéité avancées pour les opérations de fabrication, de transformation et industrielles lourdes.

- Par exemple, plusieurs installations industrielles ont modernisé leurs systèmes d'étanchéité pour applications haute pression afin d'améliorer la sécurité opérationnelle et de réduire les interruptions liées à la maintenance. Ces améliorations ont permis de réduire les arrêts imprévus et les pannes d'équipement. Cette démarche s'inscrit dans une tendance plus large vers des solutions d'étanchéité performantes et adaptées aux besoins industriels modernes.

- Si l'automatisation et l'accent mis sur la réglementation stimulent l'adoption, des améliorations continues en matière de conception, de validation des performances et d'intégration aux machines en constante évolution sont indispensables pour assurer une croissance durable du marché. Les fabricants doivent innover pour répondre à la complexité croissante des systèmes automatisés. Cela implique notamment de créer des joints offrant une durabilité accrue, une durée de vie plus longue et une compatibilité avec les architectures de systèmes avancées.

Retenue/Défi

Prix fluctuants des matières premières et coûts de production élevés

- Le coût élevé des matières premières essentielles telles que le caoutchouc synthétique, les fluoropolymères et les métaux spéciaux pose des problèmes de tarification aux fabricants, notamment aux petites et moyennes entreprises. La volatilité des prix du pétrole brut influe directement sur la disponibilité des élastomères, affectant la planification des approvisionnements et la stabilité des coûts. Ces fluctuations contraignent souvent les producteurs à ajuster leurs structures de prix, ce qui a un impact sur la compétitivité du marché.

- De nombreux secteurs industriels rencontrent des difficultés pour adopter des solutions d'étanchéité avancées en raison des coûts de production élevés et de la nécessité de technologies de fabrication de précision. Le recours à des machines spécialisées et à une main-d'œuvre qualifiée alourdit encore la facture. Ceci freine l'adoption de ces solutions dans les secteurs sensibles aux coûts, où les alternatives traditionnelles à bas prix restent dominantes malgré leurs performances limitées.

- Les perturbations des chaînes d'approvisionnement et la disponibilité irrégulière des matières premières constituent des obstacles à la production et à la livraison dans les délais, contraignant souvent à recourir à des solutions de moindre qualité et aux performances réduites. Les retards de transport, les contraintes d'approvisionnement mondiales et les pénuries de matériaux contribuent à l'allongement des délais de livraison. Ces problèmes impactent en définitive les utilisateurs finaux qui dépendent d'une étanchéité performante et constante pour la continuité de leurs opérations.

- Par exemple, plusieurs fabricants ont signalé des retards de production dus à des pénuries d'élastomères de haute qualité, affectant les délais d'approvisionnement pour les applications automobiles et de machines. Ces pénuries ont impacté les calendriers des équipementiers et la disponibilité des pièces de rechange, créant des goulots d'étranglement dans les chaînes d'approvisionnement. De tels incidents soulignent l'importance de stratégies d'approvisionnement robustes et d'une diversification des sources d'approvisionnement en matériaux.

- Si les progrès technologiques améliorent l'efficacité de la production, il demeure essentiel de lever les obstacles liés aux coûts et de garantir la stabilité des chaînes d'approvisionnement. Les fabricants doivent investir dans des cadres de production optimisés en termes de coûts et dans l'ingénierie des matériaux de pointe. L'approvisionnement local, les matériaux recyclables et les modèles de production évolutifs joueront un rôle central pour surmonter les défis à long terme en matière d'approvisionnement et de coûts.

Portée du marché des joints d'étanchéité au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type, de l'application, du canal de distribution et du secteur d'activité.

- Par type

Le marché des joints d'étanchéité au Moyen-Orient et en Afrique est segmenté en deux catégories principales : les joints d'étanchéité et les joints de dilatation. En 2025, le segment des joints de dilatation représentait la plus grande part du chiffre d'affaires, grâce à leur utilisation intensive dans les équipements rotatifs tels que les pompes, les compresseurs et les moteurs, tant dans le secteur manufacturier que dans l'industrie automobile. Leur capacité à garantir une étanchéité fiable dans les systèmes à haute pression et haute température les rend indispensables aux opérations industrielles.

Le segment des joints d'étanchéité devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par la demande croissante dans les systèmes de canalisations, les échangeurs de chaleur et les équipements de process. L'intérêt grandissant pour l'efficacité des équipements, la réduction des coûts de maintenance et l'amélioration de l'étanchéité accélère l'adoption de matériaux de joints de pointe dans divers environnements industriels.

- Sur demande

Le marché des joints d'étanchéité au Moyen-Orient et en Afrique est segmenté, selon l'application, en échangeurs de chaleur, appareils à pression, couvercles de regards, regards de visite, chapeaux de vannes, brides de tuyauterie et autres. Le segment des brides de tuyauterie détenait la plus grande part de chiffre d'affaires en 2025, grâce à leur utilisation généralisée dans les infrastructures pétrolières et gazières, pétrochimiques et de traitement de l'eau. Leur rôle essentiel dans la garantie de connexions sûres et étanches sur les pipelines assure une demande soutenue.

Le segment des échangeurs de chaleur devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par l'expansion industrielle, le développement du secteur chimique et les exigences croissantes en matière d'efficacité énergétique. L'augmentation des investissements dans les systèmes de chauffage, de ventilation et de climatisation, les centrales électriques et les installations de production contribue également à l'adoption accélérée des solutions d'étanchéité dans les échangeurs de chaleur.

- Par canal de distribution

Selon le canal de distribution, le marché des joints d'étanchéité au Moyen-Orient et en Afrique se divise en deux segments : les équipementiers (OEM) et le marché de la rechange. En 2025, le segment des équipementiers détenait la plus grande part de chiffre d'affaires, grâce à la production croissante de machines industrielles, de composants automobiles et d'équipements lourds dans la région. Les fabricants intègrent de plus en plus de composants d'étanchéité de haute qualité dès l'assemblage initial afin d'améliorer la fiabilité et la durée de vie des équipements.

Le segment de l'après-vente devrait connaître la croissance la plus rapide entre 2026 et 2033, porté par l'augmentation des activités de maintenance, la remise à neuf des machines et le remplacement des pièces d'étanchéité usées. L'importance croissante accordée à la maintenance préventive et à la rentabilité des opérations dans tous les secteurs d'activité stimule davantage la demande sur ce marché.

- Par secteur d'activité

Le marché des joints d'étanchéité au Moyen-Orient et en Afrique est segmenté par secteur d'activité : industrie du papier et de la pâte à papier, pétrole et gaz, électricité, automobile, aérospatiale, fabrication industrielle, secteur maritime et ferroviaire, et autres. Le segment automobile détenait la plus grande part de chiffre d'affaires en 2025, grâce à l'important parc automobile de la région et à l'utilisation généralisée des solutions d'étanchéité dans les moteurs, les transmissions, les systèmes de freinage et les unités de gestion thermique.

Le secteur de la fabrication industrielle devrait connaître la croissance la plus rapide entre 2026 et 2033, portée par une industrialisation rapide, l'expansion des sites de production et l'adoption croissante de machines automatisées. Les industries investissent de plus en plus dans des composants d'étanchéité durables afin d'améliorer la sécurité, de minimiser les temps d'arrêt et d'optimiser l'efficacité opérationnelle dans des environnements de production complexes.

Analyse régionale du marché des joints d'étanchéité au Moyen-Orient et en Afrique

- Les Émirats arabes unis ont dominé le marché des joints d'étanchéité au Moyen-Orient et en Afrique en 2025, grâce à d'importants investissements dans les infrastructures pétrolières et gazières, l'expansion pétrochimique et le développement industriel à grande échelle.

- L'accent mis par le pays sur les équipements haute performance, le respect strict des normes de sécurité et une fiabilité opérationnelle accrue stimule une forte demande en composants d'étanchéité avancés.

- La modernisation continue des infrastructures énergétiques, manufacturières et de transformation renforce encore la position des Émirats arabes unis en tant que marché leader dans la région.

Analyse du marché des joints d'étanchéité en Arabie saoudite

L'Arabie saoudite devrait connaître la croissance la plus rapide sur le marché des joints d'étanchéité au Moyen-Orient et en Afrique entre 2026 et 2033. Cette croissance est portée par la diversification croissante de son industrie, l'adoption accrue de machines modernes et des initiatives gouvernementales fortes en faveur de la production à grande échelle. L'accent mis par le pays sur l'efficacité de la maintenance, l'amélioration des performances des actifs et le renforcement de la sécurité opérationnelle accélère la demande en solutions d'étanchéité haut de gamme, positionnant ainsi l'Arabie saoudite comme le marché à la croissance la plus rapide de la région.

Part de marché des joints d'étanchéité au Moyen-Orient et en Afrique

L'industrie des joints d'étanchéité au Moyen-Orient et en Afrique est principalement dominée par des entreprises bien établies, notamment :

• Klinger Moyen-Orient (Émirats arabes unis)

• Delta Gaskets (Émirats arabes unis)

• Sealmech Trading LLC ( Émirats

arabes unis) • Afron Seals (Afrique du Sud)

• Dual Valves Africa (Afrique du Sud)

• Blue Seal Africa (Afrique du Sud)

• Sondel Gaskets (Afrique du Sud)

• Rubseal Gaskets (Afrique du Sud)

• Sunflex Moyen-Orient (Émirats arabes unis)

• Al Zerwa Trading (Émirats arabes unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.