Marché des plats préparés surgelés au Moyen-Orient et en Afrique, par type (mélanges de riz surgelés, mélanges d'aliments au quinoa surgelés, pizzas surgelées, pâtes surgelées, wraps et petits pains surgelés, collations surgeléesglaces surgelées , yaourts surgelés, gâteaux surgelés, sorbets et sorbets surgelés, crème anglaise surgelée, boissons surgelées, produits salés surgelés et soupes surgelées, produits laitiers surgelés , produits de poulet surgelés , produits de la mer surgelés et autres), catégorie (biologique et conventionnelle), technologie (congélation instantanée/ congélation rapide individuelle (IQF) , congélation à bande, congélation assistée à haute pression et autres), utilisateur final (secteur de la restauration et ménages), technique d'emballage (technique et équipement de congélation et emballage de plats préparés surgelés et canal de distribution (détaillants en magasin et hors magasin) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des plats cuisinés surgelés au Moyen-Orient et en Afrique

Le marché des plats préparés surgelés au Moyen-Orient et en Afrique connaît une croissance plus rapide en raison du mode de vie effréné des consommateurs. Le nombre croissant de personnes qui modifient leurs habitudes alimentaires et adoptent un régime alimentaire équilibré et un mode de vie actif est un élément majeur de la croissance du secteur des plats préparés surgelés. Les gens du monde entier ont des modes de vie trépidants et préfèrent donc les plats préparés pour économiser de l'énergie et du temps, ce qui profite à la croissance du marché. Cependant, les prix élevés des plats préparés surgelés peuvent freiner la croissance du marché.

De nombreuses entreprises prennent des décisions stratégiques, comme le lancement de plats préparés surgelés innovants et l'acquisition d'autres entreprises pour améliorer leur part de marché. En conséquence, le marché mondial des plats préparés surgelés connaît une croissance rapide. La consommation croissante de poulet, de bœuf et de fruits de mer surgelés ouvrira de nouvelles opportunités pour le marché mondial. En revanche, la concurrence entre les acteurs du marché pourrait remettre en cause la croissance du marché.

Data Bridge Market Research analyse que le marché des plats cuisinés surgelés au Moyen-Orient et en Afrique connaîtra un TCAC de 4,7 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (mélanges de riz surgelés, mélanges alimentaires de quinoa surgelés, pizzas surgelées, pâtes surgelées, wraps et petits pains surgelés, collations surgelées , crème glacée surgelée , yaourts surgelés , gâteaux surgelés, sorbets et sorbets surgelés, crème anglaise surgelée, boissons surgelées, produits salés surgelés et soupes surgelées, produits laitiers surgelés, produits de poulet surgelés , produits de la mer surgelés et autres), catégorie (biologique et conventionnelle), technologie (surgélation instantanée/ surgélation rapide individuelle (IQF) , surgélation par bande, surgélation assistée par haute pression et autres), utilisateur final (secteur de la restauration et ménages), technique d'emballage (technique et équipement de congélation et emballage de plats préparés surgelés et canal de distribution (détaillants en magasin et hors magasin) |

|

Régions couvertes |

Émirats arabes unis, Arabie saoudite, Afrique du Sud, Koweït, Qatar, Oman et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Gulf West Company, Sidco Foods Trading LLC, Al Kabeer Group ME, Global Food Industries LLC, Hakan Agro DMCC, Safco International Gen. Trading Co. LLC, JBS S/A, The Kraft Heinz Company, Dr. Oetker, BRF Global, General Mills Inc., Nestlé, Kellogg Co., Ajinomoto Co., Inc., McCain Foods Limited, entre autres |

Définition du marché

Les plats surgelés sont généralement préparés et emballés en usine. Ce processus consiste à chauffer les ingrédients et à les emballer dans des contenants. Une fois le plat préparé et placé au congélateur pour refroidir, ils sont populaires auprès des consommateurs car ils offrent un menu varié et sont faciles à préparer. Les plats surgelés peuvent contenir une entrée de viande, un légume et des aliments à base d'amidon comme des pâtes et de la sauce. Certains plats surgelés sont préparés spécifiquement pour les végétariens ou les personnes ayant des besoins alimentaires particuliers. La fabrication d'un tel produit nécessite une attention particulière de la part du transformateur alimentaire.

Dynamique du marché des plats cuisinés surgelés au Moyen-Orient et en Afrique

Conducteurs

- La préférence pour les aliments biologiques prêts à consommer augmente

Les aliments prêts à consommer sont devenus l'un des segments les plus diversifiés du marché mondial des plats préparés ces dernières années. La croissance des habitudes de consommation et l'augmentation de la demande de repas biologiques ont entraîné un besoin croissant de plats surgelés biologiques emballés. Le secteur des aliments et boissons surgelés biologiques est un autre arrêt pour les consommateurs en déplacement, offrant de tout, des bonbons surgelés aux apéritifs et aux repas. Les plats préparés surgelés biologiques sont populaires auprès des consommateurs en raison de leur absence de contamination microbiologique et fongique. De plus, les avantages nutritionnels et sanitaires offerts par les plats préparés surgelés biologiques ont entraîné une croissance de la demande du marché. Ainsi, pour attirer un plus grand nombre de consommateurs à la recherche de santé et de saveur, les fabricants d'aliments surgelés emballés intègrent également les avantages nutritionnels au goût, ce qui conduit à la croissance du marché mondial des plats préparés surgelés. L'évolution des préférences des consommateurs pour les produits à base de plantes et végétaliens ouvre la voie à des produits alimentaires biologiques et pratiques, ce qui entraîne une demande accrue de plats préparés surgelés sur le marché mondial.

Ainsi, une augmentation de la demande en produits alimentaires surgelés biologiques présentant des avantages nutritionnels et en produits surgelés prêts à cuisiner ou prêts à consommer, facilement disponibles, stimulera le marché des plats préparés surgelés au cours de la période de prévision.

- L'évolution des modes de vie et des habitudes alimentaires des consommateurs

Dans un monde où tout va très vite, la moitié de la population préfère les plats cuisinés qui permettent aux consommateurs de gagner du temps et de faire des efforts dans la préparation des repas. En raison de la vie rapide et trépidante, le mode de consommation des consommateurs passe des aliments crus aux aliments prêts à l'emploi. De plus, l'urbanisation rapide et le changement de mode de vie des gens augmentent la demande de plats cuisinés surgelés. En raison de l'évolution constante du mode de consommation des consommateurs, les plats cuisinés ont connu une croissance substantielle à l'échelle mondiale en raison de la prise de conscience croissante des consommateurs en matière de santé et de l'augmentation du mode de vie urbain. Parallèlement, les consommateurs s'orientent vers une organisation d'entreprise en évolution rapide qui diversifie leurs habitudes alimentaires en raison d'une disponibilité réduite du temps et d'une charge de travail plus importante. Les plats cuisinés surgelés sont faciles à cuisiner, facilement disponibles, abordables et accessibles, ce qui en fait une solution intelligente pour répondre aux besoins nutritionnels quotidiens des consommateurs. La sensibilisation croissante des consommateurs à la santé et au bien-être accélère l'adoption d'un mode de vie sain, augmente l'acceptation des modes de vie positifs et la consommation d'aliments surgelés sains, qui ont conservé les nutriments, fait avancer le marché des plats cuisinés surgelés.

En outre, l'augmentation du revenu disponible influence également la demande de plats cuisinés dans les ménages. À l'échelle mondiale, le nombre de restaurants à service rapide augmente rapidement, ce qui accroît la demande de plats cuisinés. Par conséquent, la consommation croissante de plats cuisinés augmente la demande de produits alimentaires surgelés. En conséquence, elle améliore la croissance des aliments surgelés et stimule le marché mondial des plats cuisinés surgelés.

Opportunités

- Un nombre croissant d'initiatives prises par les fabricants d'acides aminés

L'augmentation du nombre d'initiatives prises par les fabricants de plats préparés surgelés, telles que le lancement de nouveaux produits, l'expansion, la levée de fonds et autres, créera une formidable opportunité pour la croissance du marché mondial des plats préparés surgelés. La demande de plats préparés surgelés augmente parmi les consommateurs en raison du calendrier chargé, de l'augmentation du revenu disponible et de la demande croissante de produits alimentaires prêts à consommer pour gagner du temps en cuisine. La demande croissante des consommateurs en plats préparés surgelés permet aux fabricants de lancer de nouveaux produits sur le marché, d'agrandir leur usine de fabrication et d'augmenter les investissements pour fabriquer différents produits de plats préparés surgelés pour divers utilisateurs finaux.

Par exemple,

- En avril 2022, Nomad Foods a lancé un portail d'innovation ouvert qui invite les partenaires à partager des solutions innovantes. Le lancement du nouveau portail a aidé l'entreprise à accroître l'évolutivité des moules surgelées et d'autres produits à base de bivalves.

Ainsi, l’augmentation du nombre de lancements de plats préparés surgelés, l’expansion, les investissements pour développer l’activité des aliments surgelés et d’autres initiatives des fabricants, associés à la demande croissante de plats préparés surgelés parmi les consommateurs et le secteur de la restauration, devraient créer une énorme opportunité pour les fabricants de plats préparés surgelés sur le marché mondial.

Contraintes/Défis

- Forte concurrence entre les acteurs du marché

La forte concurrence entre les acteurs du marché existants constitue un défi important pour les nouveaux acteurs qui souhaitent entrer sur le marché, car plusieurs d'entre eux proposent divers produits de plats préparés surgelés de haute qualité pour répondre à la demande des utilisateurs finaux. Les acteurs existants sur le marché, tels que Nestlé, General Mills Inc., Conagra Brands, Inc., The Kraft Heinz Company, Nomad Foods, JBS S/A et d'autres, proposent un grand nombre de produits de plats préparés surgelés différents et sont constamment engagés dans le lancement de nouveaux produits de haute qualité, provoquant ainsi une concurrence majeure sur le marché. De plus, les acteurs locaux et les petits fabricants proposent des produits de mauvaise qualité à des prix inférieurs, ce qui affecte le marché mondial des plats préparés surgelés. En outre, l'augmentation du nombre de fabricants proposant une large gamme de plats préparés surgelés entraînera une concurrence féroce pour les autres acteurs du marché.

L'augmentation du nombre d'acteurs proposant des plats préparés surgelés de haute qualité constitue un défi majeur pour les nouveaux acteurs sur le marché mondial des plats préparés surgelés. De plus, la présence d'un grand nombre d'acteurs majeurs proposant une large gamme de produits, notamment des pâtes surgelées, des pizzas, des produits à base de poulet, des produits de la mer et d'autres, pour répondre à la demande des consommateurs, rendra difficile la croissance des petits fabricants ou des acteurs locaux ou des nouveaux entrants sur le marché.

- Présence de matières grasses dans les plats cuisinés surgelés

Les gras trans, qui sont liés aux maladies cardiaques et aux artères obstruées, se trouvent dans les aliments emballés ou surgelés. Ce lipide augmente le mauvais cholestérol (LDL) tout en diminuant le bon cholestérol (HDL). Tout cela contribue aux maladies cardiaques. Ces aliments sont également riches en sodium, ce qui peut augmenter le taux de cholestérol dans l'organisme. De plus, les aliments surgelés sont incroyablement riches en matières grasses. Ces aliments ont un rapport lipides/glucides/protéines presque deux fois plus élevé, ce qui explique pourquoi ils sont riches en calories, ce qui limite la demande d'aliments surgelés chez les consommateurs soucieux de leur santé.

De plus, les plats surgelés contiennent une forte teneur en sel, ce qui peut augmenter la tension artérielle. Une consommation excessive de sel augmente également le risque de divers troubles médicaux tels que les accidents vasculaires cérébraux et les maladies cardiaques. De plus en plus de personnes sont conscientes des effets des aliments surgelés et préfèrent de plus en plus les aliments frais aux aliments surgelés, ce qui freine la croissance du marché des plats préparés surgelés.

Ainsi, comme mentionné ci-dessus, la présence de graisses excessives et nocives dans la plupart des plats préparés surgelés peut constituer un facteur limitant la croissance du marché mondial des plats préparés surgelés.

Impact post-COVID-19 sur le marché des plats cuisinés surgelés au Moyen-Orient et en Afrique

Après la pandémie, la demande de produits alimentaires surgelés a augmenté car il n'y aura plus de restrictions de mouvement ; par conséquent, l'approvisionnement en produits sera facile. La persistance du COVID-19 pendant une période plus longue a affecté la chaîne d'approvisionnement car elle a été perturbée, et il est devenu difficile de fournir les produits alimentaires aux consommateurs, ce qui a initialement augmenté la demande de produits. Cependant, après le COVID, la demande de produits alimentaires surgelés a augmenté de manière significative en raison de la durée de conservation plus longue des aliments surgelés, ce qui a augmenté la demande de produits alimentaires prêts à l'emploi.

Développements récents

- En avril 2022, Nomad Foods a lancé un portail d'innovation ouvert qui invite les partenaires à partager des solutions innovantes. Le lancement du nouveau portail a aidé l'entreprise à accroître l'évolutivité des moules surgelées et d'autres produits à base de bivalves.

Portée du marché des plats cuisinés surgelés au Moyen-Orient et en Afrique

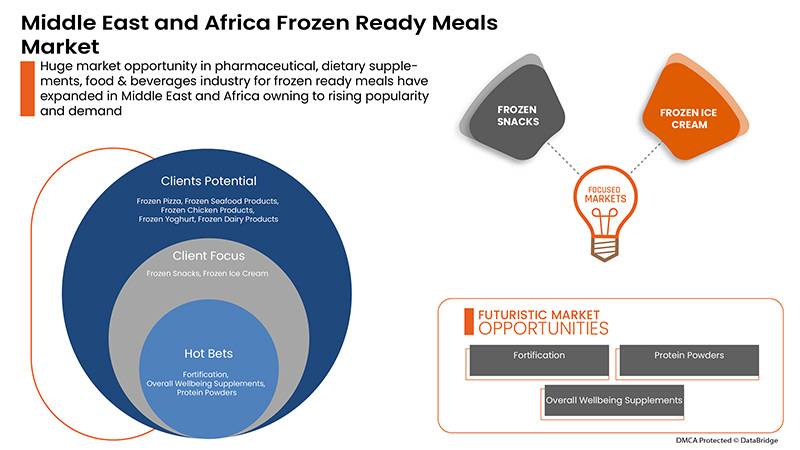

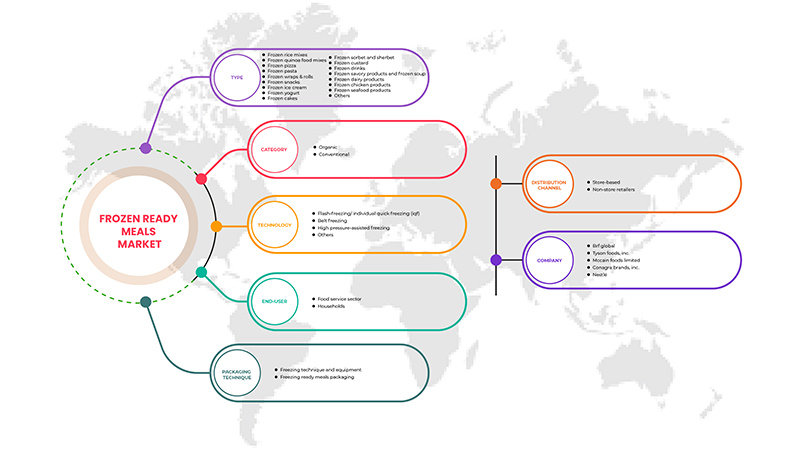

Le marché des plats préparés surgelés du Moyen-Orient et de l’Afrique est segmenté en six segments en fonction du type, de la catégorie, de la technologie, de l’utilisateur final, de la technique d’emballage et du canal de distribution.

La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Types

- Collations surgelées

- Pizza surgelée

- Crème glacée congelée

- Produits de la mer surgelés

- Produits de poulet surgelés

- Yaourt glacé

- Produits laitiers surgelés

- Pâtes surgelées

- Boissons glacées

- Plats végétariens surgelés

- Sorbet et sorbet glacés

- Gâteaux surgelés

- Wraps et petits pains surgelés

- Crème glacée

- Soupe surgelée

- Mélanges alimentaires surgelés à base de quinoa

- Mélanges de riz surgelés

- Autres

Sur la base du type, le marché mondial des plats préparés surgelés est segmenté en mélanges de riz surgelés, mélanges d'aliments au quinoa surgelés, pizzas surgelées, pâtes surgelées, wraps et petits pains surgelés, collations surgelées, glaces surgelées, yaourts surgelés, gâteaux surgelés, sorbets et sorbets surgelés, crèmes anglaises surgelées, boissons surgelées, produits salés surgelés et soupes surgelées, produits laitiers surgelés, produits de poulet surgelés, produits de la mer surgelés et autres.

Catégorie

- Organique

- Conventionnel

Sur la base de la catégorie, le marché mondial des plats préparés surgelés est segmenté en produits biologiques et conventionnels.

Technologie

- Congélation instantanée/Congélation rapide individuelle (IQF)

- Congélation par ceinture

- Congélation assistée par haute pression

- Autres

Sur la base de la technologie, le marché mondial des plats cuisinés surgelés est segmenté en surgélation/congélation rapide individuelle (IQF), congélation à bande, congélation assistée par haute pression et autres.

Utilisateur final

- Secteur des ménages/de la vente au détail

- Secteur de la restauration

Sur la base de l’utilisateur final, le marché mondial des plats cuisinés surgelés est segmenté en secteur de la restauration et des ménages.

Technique d'emballage

- Emballage de plats préparés surgelés

- Technique et équipement de congélation

Sur la base de la technique d'emballage, le marché mondial des plats préparés surgelés est segmenté en technique et équipement de congélation et en emballage de plats préparés surgelés.

Canal de distribution

- Détaillants en magasin

- Détaillants hors magasin

Sur la base du canal de distribution, le marché mondial des plats cuisinés surgelés est segmenté en détaillants en magasin et hors magasin.

Analyse/perspectives régionales du marché des plats cuisinés surgelés au Moyen-Orient et en Afrique

Le marché des plats préparés surgelés du Moyen-Orient et de l’Afrique est analysé, et des informations sur la taille du marché et les tendances sont fournies sur la base des références ci-dessus.

Les pays couverts dans le rapport sur le marché des plats préparés surgelés au Moyen-Orient et en Afrique sont les Émirats arabes unis, l'Arabie saoudite, l'Afrique du Sud, le Koweït, le Qatar, Oman et le reste du Moyen-Orient et de l'Afrique.

Les Émirats arabes unis dominent le marché des plats préparés surgelés au Moyen-Orient et en Afrique en termes de parts de marché et de revenus. Cela est dû à l'industrialisation du secteur de la restauration et à la croissance économique du pays. La demande de plats préparés et de plats cuisinés au Moyen-Orient et en Afrique augmente, ce qui stimule le marché des plats préparés surgelés de la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique, les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des plats préparés surgelés au Moyen-Orient et en Afrique

The competitive Middle East and Africa frozen ready meals market details the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, and application dominance. The above data points only relate to the companies' focus on the Middle East and Africa frozen ready meals market.

Some of the major players operating in the Middle East and Africa frozen ready meals market are Gulf West Company, Sidco Foods Trading L.L.C., Al Kabeer Group ME, Global Food Industries LLC, Hakan Agro DMCC, Safco International Gen. Trading Co. L.L.C., JBS S/A, The Kraft Heinz Company, Dr. Oetker, BRF Global, General Mills Inc., Nestlé, Kellogg Co., Ajinomoto Co., Inc., McCain Foods Limited, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.2.1 OVERVIEW

4.2.2 SOCIAL FACTORS

4.2.3 CULTURAL FACTORS

4.2.4 PSYCHOLOGICAL FACTORS

4.2.5 PERSONAL FACTORS

4.2.6 ECONOMIC FACTORS

4.2.7 PRODUCT TRAITS

4.2.8 MARKET ATTRIBUTES

4.2.9 CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

4.2.10 CONCLUSION

4.3 CONSUMER TYPE AND THEIR BUYING PERCEPTIONS

4.3.1 OVERVIEW

4.3.2 MILLENNIALS

4.3.3 GEN X

4.3.4 BABY BOOMERS

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 PRICING OF FROZEN READY MEALS PRODUCTS

4.4.2 CERTIFIED FROZEN READY MEALS PRODUCTS

4.4.3 QUALITY OF READY MEAL PRODUCTS

4.5 PRICING ANALYSIS FOR FROZEN READY MEALS MARKET

4.6 EXPORT & IMPORT ANALYSIS

4.7 LABELING AND CLAIMS

4.7.1 UNITED NATIONS ENVIRONMENT PROGRAMME SALE OF FROZEN FOODS REGULATIONS

4.7.2 DIRECTIVE 89/108/EEC ON QUICK-FROZEN FOODSTUFFS FOR HUMAN CONSUMPTION

4.7.3 FOOD CLAIMS ON LABELS – THE EUROPEAN PERSPECTIVE

4.8 LIST OF TOP EXPORTING COMPANIES OF MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET

4.9 LIST OF TOP IMPORTING COMPANIES FOR FROZEN READY MEALS MARKET

4.1 MARKET TRENDS

4.11 NEW PRODUCT LAUNCH STRATEGY

4.11.1 OVERVIEW

4.11.2 NUMBER OF PRODUCT LAUNCHES

4.11.2.1 Line extension

4.11.2.2 NEW PACKAGING

4.11.2.3 relaunched

4.11.2.4 new formulation

4.11.3 DIFFERENTIAL PRODUCT OFFERING

4.11.4 MEETING CONSUMER REQUIREMENT

4.11.5 PACKAGE DESIGNING

4.11.6 PRICING ANALYSIS

4.11.7 PRODUCT POSITIONING

4.11.8 CONCLUSION

4.12 BRAND LABEL

4.13 PROMOTIONAL ACTIVITIES

4.14 SHOPPING BEHAVIOUR AND DYNAMICS

4.14.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

4.14.2 RESEARCH

4.14.3 IMPULSIVE

4.14.4 ADVERTISEMENT

4.14.5 TELEVISION ADVERTISEMENT

4.14.6 ONLINE ADVERTISEMENT

4.14.7 IN-STORE ADVERTISEMENT

4.14.8 OUTDOOR ADVERTISEMENT

4.15 SUPPLY CHAIN ANALYSIS

4.15.1 RAW MATERIAL PROCUREMENT

4.15.2 MANUFACTURING PROCESS

4.15.3 INDIVIDUAL QUICK FREEZER

4.15.4 INSPECTION OF FROZEN FOOD

4.15.5 PACKING OF FROZEN FOOD

4.15.6 AUTOMATIC PACKAGING UNIT

4.15.7 MARKETING AND DISTRIBUTION

4.15.8 END-USERS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED USE OF FROZEN FOOD IN THE FOOD SERVICE INDUSTRY

6.1.2 RISING PREFERENCE FOR READY-TO-EAT ORGANIC FOODS

6.1.3 EXPANSIONS OF CONVENIENCE STORES

6.1.4 CHANGE IN LIFESTYLE AND EATING PATTERN OF CONSUMERS

6.2 RESTRAINTS

6.2.1 PRESENCE OF FATS IN FROZEN READY MEALS

6.2.2 LACK OF COLD CHAIN INFRASTRUCTURE

6.2.3 LIMITED SELF-LIFE OF FROZEN FOOD

6.3 OPPORTUNITIES

6.3.1 DIGITALIZATION OF THE RETAIL INDUSTRY

6.3.2 INCREASING NUMBER OF INITIATIVES TAKEN BY FROZEN READY MEALS MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 RISING PREFERENCE FOR FRESH AND NATURAL FOOD PRODUCTS

7 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FROZEN SNACKS

7.2.1 FRENCH FRIES

7.2.2 NUGGETS

7.2.3 BITES

7.2.4 WEDGES

7.2.5 OTHERS

7.3 FROZEN PIZZA

7.3.1 FROZEN VEG PIZZA

7.3.1.1 WITH CHEESE

7.3.1.2 WITHOUT CHEESE

7.3.2 FROZEN NON-VEG PIZZA

7.3.2.1 FROZEN NON-VEG PIZZA, BY MEAT TYPE

7.3.2.1.1 PEPPERONI PIZZA

7.3.2.1.2 CHICKEN PIZZA

7.3.2.1.3 BEEF PIZZA

7.3.2.1.4 OTHERS

7.3.2.2 FROZEN NON-VEG PIZZA, BY BASE TYPE

7.3.2.2.1 WITH CHEESE

7.3.2.2.2 WITHOUT CHEESE

7.4 FROZEN ICE CREAM

7.4.1 FROZEN SOFT SERVE

7.4.2 FROZEN GELATO

7.4.3 OTHERS

7.5 FROZEN SEAFOOD PRODUCTS

7.5.1 FROZEN FISH FILLETS

7.5.2 FROZEN SHRIMP POPCORN

7.5.3 FROZEN FISH NUGGETS

7.5.4 FROZEN FISH BITES

7.5.5 OTHERS

7.6 FROZEN CHICKEN PRODUCTS

7.6.1 FROZEN CHICKEN NUGGETS

7.6.2 FROZEN CHICKEN STRIPS

7.6.3 FROZEN CHICKEN BITES

7.6.4 FROZEN CHICKEN WINGS

7.6.5 FROZEN CHICKEN POPCORN

7.6.6 OTHERS

7.7 FROZEN YOGHURT

7.7.1 LOW FAT

7.7.2 FAT FREE

7.7.3 FULL FAT

7.8 FROZEN DAIRY PRODUCTS

7.8.1 FROZEN DAIRY PRODUCTS, BY SOURCE

7.8.1.1 ANIMAL-BASED DAIRY

7.8.1.2 PLANT-BASED DAIRY

7.8.1.2.1 ALMOND MILK

7.8.1.2.2 SOY MILK

7.8.1.2.3 COCONUT MILK

7.8.1.2.4 OAT MILK

7.8.1.2.5 OTHERS

7.8.2 FROZEN DAIRY PRODUCTS, BY FLAVOR

7.8.2.1 REGULAR

7.8.2.2 FLAVOR

7.8.2.2.1 CHOCOLATES

7.8.2.2.2 VANILLA

7.8.2.2.3 STRAWBERRY

7.8.2.2.4 CARAMEL

7.8.2.2.5 BLACKBERRY

7.8.2.2.6 NUTS

7.8.2.2.7 BUTTERSCOTCH

7.8.2.2.8 PEPPERMINT

7.8.2.2.9 MOCHA

7.8.2.2.10 BLUEBERRY

7.8.2.2.11 BANANA

7.8.2.2.12 CHERRY

7.8.2.2.13 PEACH

7.8.2.2.14 AMARETTO

7.8.2.2.15 POMEGRANATE

7.8.2.2.16 PUMPKIN

7.8.2.2.17 COTTON CANDY

7.8.2.2.18 ORCHARD CHERRY

7.8.2.2.19 COCONUT

7.8.2.2.20 HONEY

7.8.2.2.21 HERBAL

7.8.2.2.22 OTHERS

7.9 FROZEN PASTA

7.9.1 SPAGHETTI

7.9.2 PENNE

7.9.3 RAVIOLI

7.9.4 MACARONI / MACCHERONI / ELBOW

7.9.5 LASAGNA

7.9.6 FETTUCCINE

7.9.7 GNOCCHI

7.9.8 OTHERS

7.1 FROZEN DRINKS

7.11 FROZEN VEGETARIAN MEALS

7.11.1 POWER BOWL

7.11.2 BUDDHA BOWL

7.11.3 SOUP BOWL

7.11.4 CURRY BOWL

7.12 FROZEN SORBET AND SHERBET

7.13 FROZEN CAKES

7.13.1 FLAVORED CAKES

7.13.2 PLUM CAKES

7.13.3 SPONGE CAKES

7.13.4 CHEESE CAKES

7.13.5 CUP CAKES

7.13.6 OTHERS

7.14 FROZEN WRAPS & ROLLS

7.14.1 FROZEN VEG WRAPS & ROLLS

7.14.2 FROZEN NON-VEG WRAPS & ROLLS

7.15 FROZEN CUSTARD

7.16 FROZEN SOUP

7.17 FROZEN QUINOA FOOD MIXES

7.17.1 QUINOA WITH VEGETABLES

7.17.2 QUINOA WITH CHICKEN

7.17.3 QUINOA WITH PORK

7.17.4 QUINOA WITH SEAFOOD

7.17.5 OTHERS

7.18 FROZEN RICE MIXES

7.18.1 FROZEN RICE MIXES, BY TYPE

7.18.1.1 WHITE RICE

7.18.1.2 BROWN RICE

7.18.1.3 BLACK RICE

7.18.1.4 WILD RICE

7.18.1.5 OTHERS

7.18.2 FROZEN RICE MIXES, BY RICE MIX CATEGORY

7.18.2.1 RICE WITH CHICKEN

7.18.2.1.1 WHITE RICE

7.18.2.1.2 BROWN RICE

7.18.2.1.3 BLACK RICE

7.18.2.1.4 WILD RICE

7.18.2.1.5 OTHERS

7.18.2.2 RICE WITH BEEF

7.18.2.2.1 WHITE RICE

7.18.2.2.2 BROWN RICE

7.18.2.2.3 BLACK RICE

7.18.2.2.4 WILD RICE

7.18.2.2.5 OTHERS

7.18.2.3 RICE WITH PORK

7.18.2.3.1 WHITE RICE

7.18.2.3.2 BROWN RICE

7.18.2.3.3 BLACK RICE

7.18.2.3.4 WILD RICE

7.18.2.3.5 OTHERS

7.18.2.4 RICE WITH SEAFOOD

7.18.2.4.1 WHITE RICE

7.18.2.4.2 BROWN RICE

7.18.2.4.3 BLACK RICE

7.18.2.4.4 WILD RICE

7.18.2.4.5 OTHERS

7.18.2.5 RICE WITH VEGETABLES

7.18.2.5.1 WHITE RICE

7.18.2.5.2 BROWN RICE

7.18.2.5.3 BLACK RICE

7.18.2.5.4 WILD RICE

7.18.2.5.5 OTHERS

7.18.2.6 OTHERS

7.19 OTHERS

8 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 ORGANIC

8.3 CONVENTIONAL

9 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY PACKAGING TECHNIQUE

9.1 OVERVIEW

9.2 FROZEN READY MEALS PACKAGING

9.2.1 FROZEN READY MEALS PACKAGING, BY TYPE

9.2.1.1 OXYGEN SCAVENGERS

9.2.1.2 MOISTURE CONTROL

9.2.1.3 ANTIMICROBIALS

9.2.1.4 TIME TEMPERATURE INDICATORS

9.2.1.5 EDIBLE FILMS

9.3 FREEZING TECHNIQUE & EQUIPMENT

9.3.1 FREEZING TECHNIQUE & EQUIPMENT, BY TYPE

9.3.1.1 AIR BLAST FREEZERS

9.3.1.2 TUNNEL FREEZERS

9.3.1.3 BELT FREEZERS

9.3.1.4 CONTACT FREEZERS

10 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 FLASH-FREEZING/ INDIVIDUAL QUICK FREEZING (IQF)

10.3 BELT FREEZING

10.4 HIGH PRESSURE-ASSISTED FREEZING

10.5 OTHERS

11 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY END-USER

11.1 OVERVIEW

11.2 HOUSEHOLD/RETAIL SECTOR

11.3 FOOD SERVICE SECTOR

11.3.1 RESTAURANTS

11.3.2 QUICK SERVICE RESTAURANTS

11.3.3 DINING RESTAURANTS

11.3.4 GHOST RESTAURANTS (DELIVERY ONLY RESTAURANTS)

11.3.5 OTHERS

11.3.6 CAFES

11.3.7 HOTEL

11.3.8 OTHERS

12 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 GROCERY RETAILERS

12.2.2 SUPERMARKETS/HYPERMARKETS

12.2.3 FROZEN DAIRY PRODUCTS SHOPS/PARLORS

12.2.4 CONVENIENCE STORES

12.2.5 SPECIALTY STORES

12.2.6 WHOLESALERS

12.2.7 OTHERS

12.3 NON- STORE BASED RETAILERS

12.3.1 ONLINE RETAILERS

12.3.2 COMPANY WEBSITE

13 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET BY GEOGRAPHY

13.1 MIDDLE EAST AND AFRICA

13.1.1 UAE

13.1.2 SAUDI ARABIA

13.1.3 SOUTH AFRICA

13.1.4 KUWAIT

13.1.5 QATAR

13.1.6 OMAN

13.1.7 REST OF MIDDLE EAST AND AFRICA

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BRF MIDDLE EAST & AFRICA

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 TYSON FOODS, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MCCAIN FOODS LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 CONAGRA BRANDS, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 NESTLÉ

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ADVANCE PIERRE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AJINOMOTO CO., INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 AL KABEER GROUP ME

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AMY’S KITCHEN

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DR. OETKER

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL MILLS INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 MIDDLE EAST & AFRICA FOOD INDUSTRIES LLC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 VIRTO GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GULF WEST COMPANY

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 HAKAN AGRO DMCC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 JBS S/A

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 KELLOGG CO. (2021)

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 MOSAIC FOODS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NOMAD FOODS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 SAFCO INTERNATIONAL GEN. TRADING CO. L.L.C.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SCHWAN'S HOME DELIVERY

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SIDCO FOODS TRADING L.L.C.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 THE KRAFT HEINZ COMPANY

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 WAWONA

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE:

18 RELATED REPORTS

LIST OF TABLES

TABLE 1 MIDDLE EAST & AFRICA AVERAGE SELLING PRICES OF FROZEN READY MEALS:

TABLE 2 IMPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 3 EXPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 4 IMPORT OF CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 5 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 6 IMPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 7 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 8 IMPORT OF FROZEN CRABS (2020)

TABLE 9 EXPORT OF FROZEN CRABS (2020)

TABLE 10 IMPORT OF FROZEN VEGETABLES (2020)

TABLE 11 EXPORT OF FROZEN VEGETABLES (2020)

TABLE 12 IMPORT OF FROZEN EELS, WHOLE (2020)

TABLE 13 EXPORT OF FROZEN EELS, WHOLE (2020)

TABLE 14 IMPORT OF FROZEN FISH FILLETS (2020)

TABLE 15 EXPORT OF FROZEN FISH FILLETS (2020)

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA AVERAGE SELLING PRICES OF FROZEN READY MEALS:

TABLE 2 IMPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 3 EXPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 4 IMPORT OF CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 5 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 6 IMPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 7 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 8 IMPORT OF FROZEN CRABS (2020)

TABLE 9 EXPORT OF FROZEN CRABS (2020)

TABLE 10 IMPORT OF FROZEN VEGETABLES (2020)

TABLE 11 EXPORT OF FROZEN VEGETABLES (2020)

TABLE 12 IMPORT OF FROZEN EELS, WHOLE (2020)

TABLE 13 EXPORT OF FROZEN EELS, WHOLE (2020)

TABLE 14 IMPORT OF FROZEN FISH FILLETS (2020)

TABLE 15 EXPORT OF FROZEN FISH FILLETS (2020)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA FROZEN READY MEALS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: SEGMENTATION

FIGURE 10 EUROPE IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 INCREASED USE OF FROZEN FOOD IN THE FOOD SERVICE INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET IN 2022 & 2029

FIGURE 13 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 14 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 15 SUPPLY CHAIN ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET

FIGURE 17 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY TYPE

FIGURE 18 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY CATEGORY

FIGURE 19 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY PACKAGING TECHNIQUE

FIGURE 20 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY TECHNOLOGY

FIGURE 21 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY END USER

FIGURE 22 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET, BY DISTRIBUTION CHANNEL

FIGURE 23 MIDDLE EAST AND AFRICA FROZEN READY MEALS MARKET: SNAPSHOT (2021)

FIGURE 24 MIDDLE EAST AND AFRICA FROZEN READY MEALS MARKET: BY COUNTRY (2021)

FIGURE 25 MIDDLE EAST AND AFRICA FROZEN READY MEALS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 MIDDLE EAST AND AFRICA FROZEN READY MEALS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA FROZEN READY MEALS MARKET: BY TYPE (2022 & 2029)

FIGURE 28 MIDDLE EAST & AFRICA FROZEN READY MEALS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.