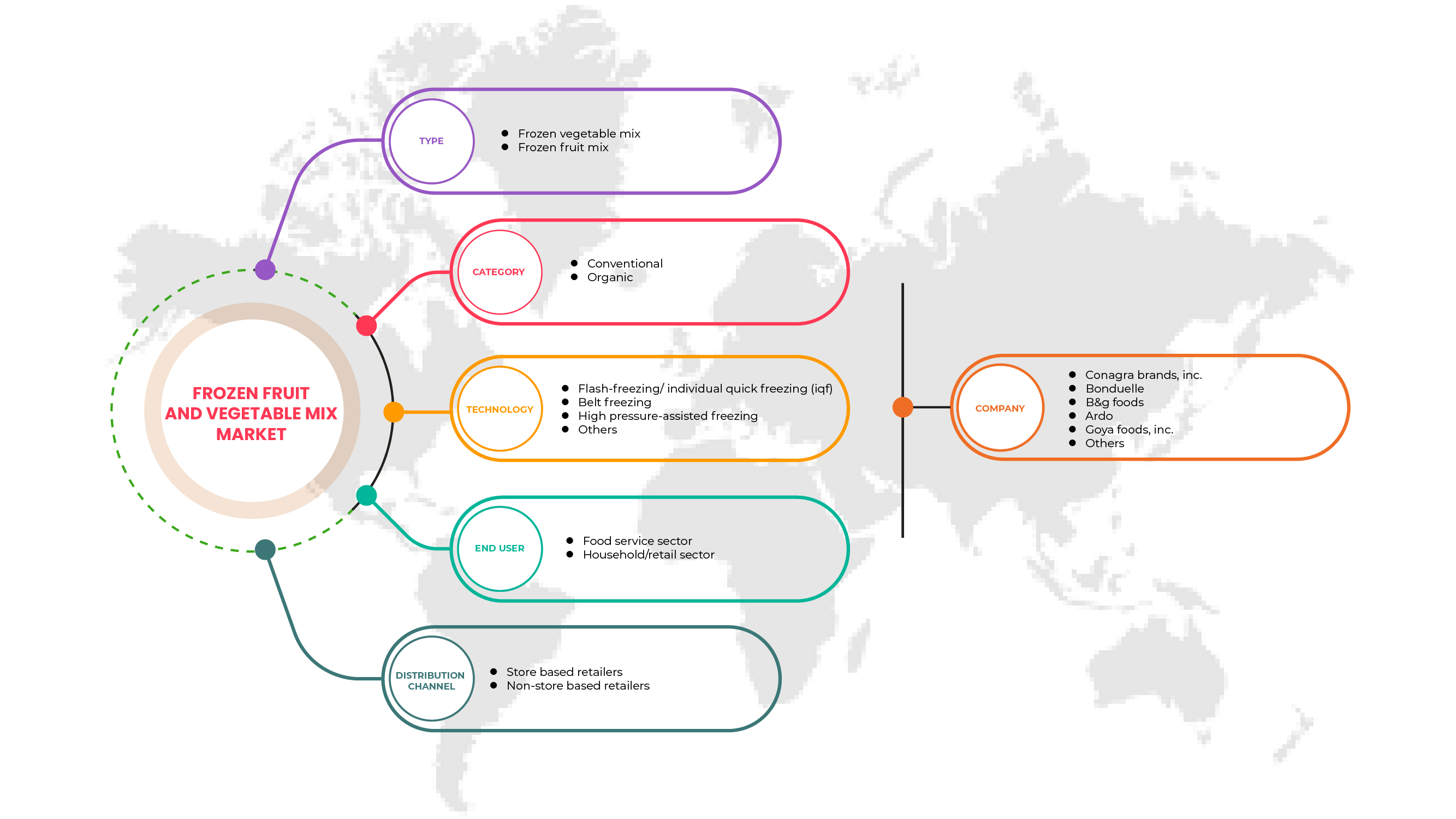

Marché des mélanges de fruits et légumes surgelés au Moyen-Orient et en Afrique, par type (mélange de légumes surgelés et mélange de fruits surgelés), catégorie (biologique et conventionnel), technologie (congélation instantanée/congélation rapide individuelle (IQF), congélation à bande, congélation assistée à haute pression et autres), utilisateur final (secteur de la restauration et secteur des ménages/de la vente au détail), canal de distribution (détaillants en magasin et détaillants hors magasin) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des mélanges de fruits et légumes surgelés au Moyen-Orient et en Afrique

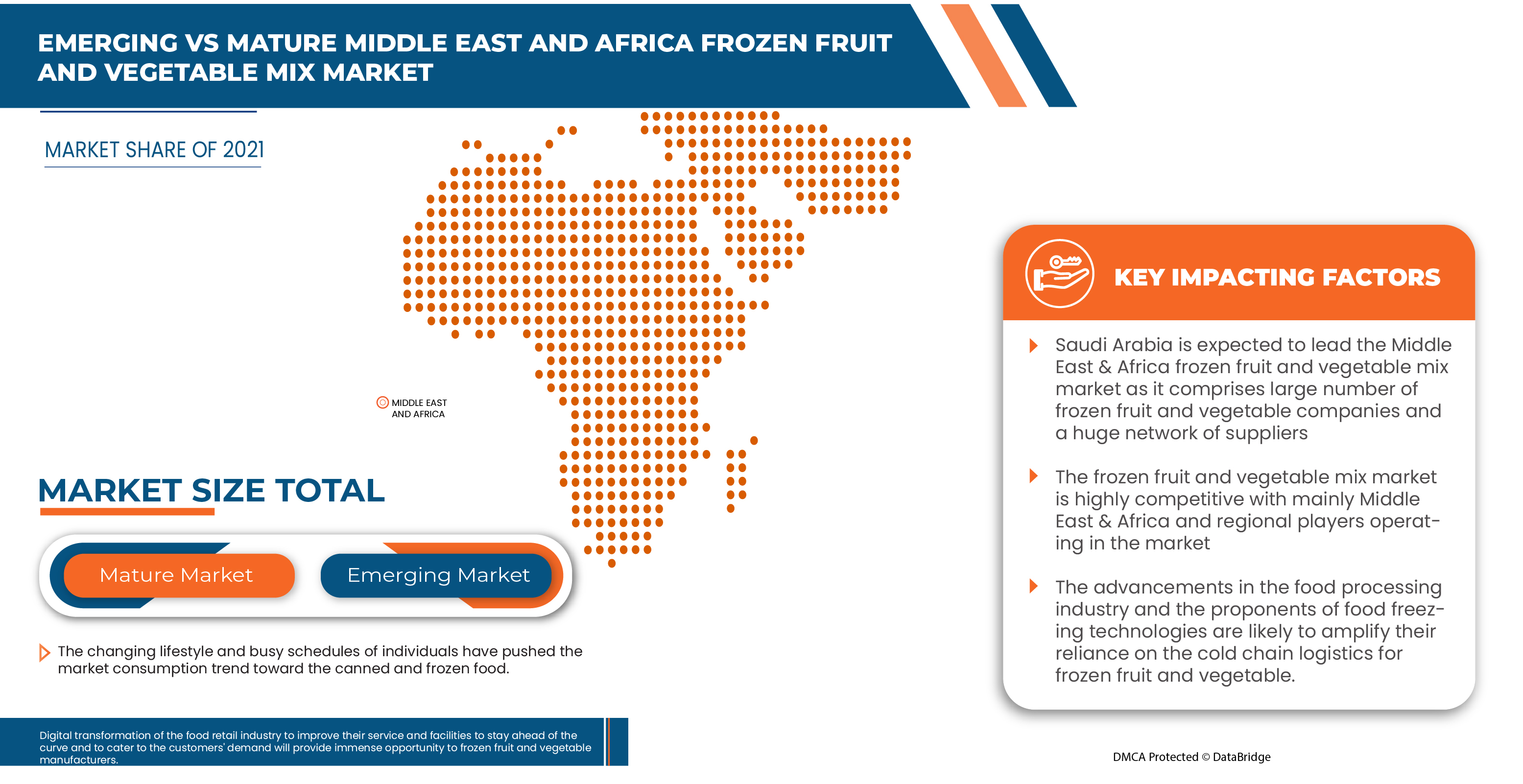

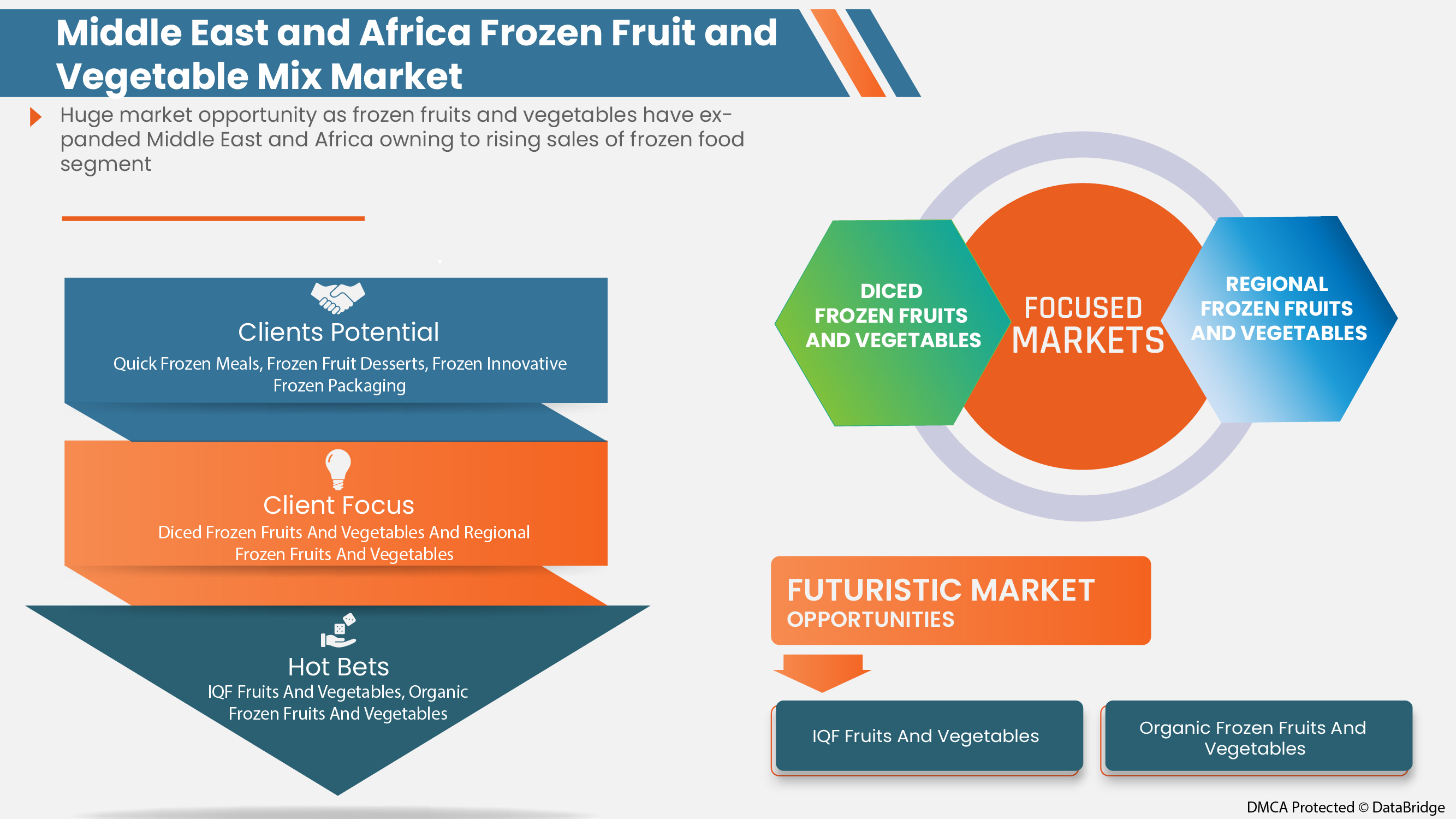

L'urbanisation croissante et l'adoption croissante d'un mode de vie sain stimulent la croissance du marché des mélanges de fruits et légumes surgelés au Moyen-Orient et en Afrique. En outre, la consommation croissante d'aliments en conserve et surgelés renforce encore la croissance du marché. De plus, la population végétalienne croissante stimule les ventes et les bénéfices des acteurs opérant sur le marché.

Le principal frein à la croissance du marché est la prise de conscience croissante de la consommation de fruits et légumes frais. En outre, le manque d'infrastructures de chaîne du froid freinera également la croissance du marché. D'autre part, la demande croissante de fruits et légumes ayant une durée de conservation plus longue devrait constituer une opportunité pour la croissance du marché des mélanges de fruits et légumes surgelés au Moyen-Orient et en Afrique. Le défi pour la croissance du marché est le coût d'investissement élevé pour la production de mélanges de fruits et légumes surgelés.

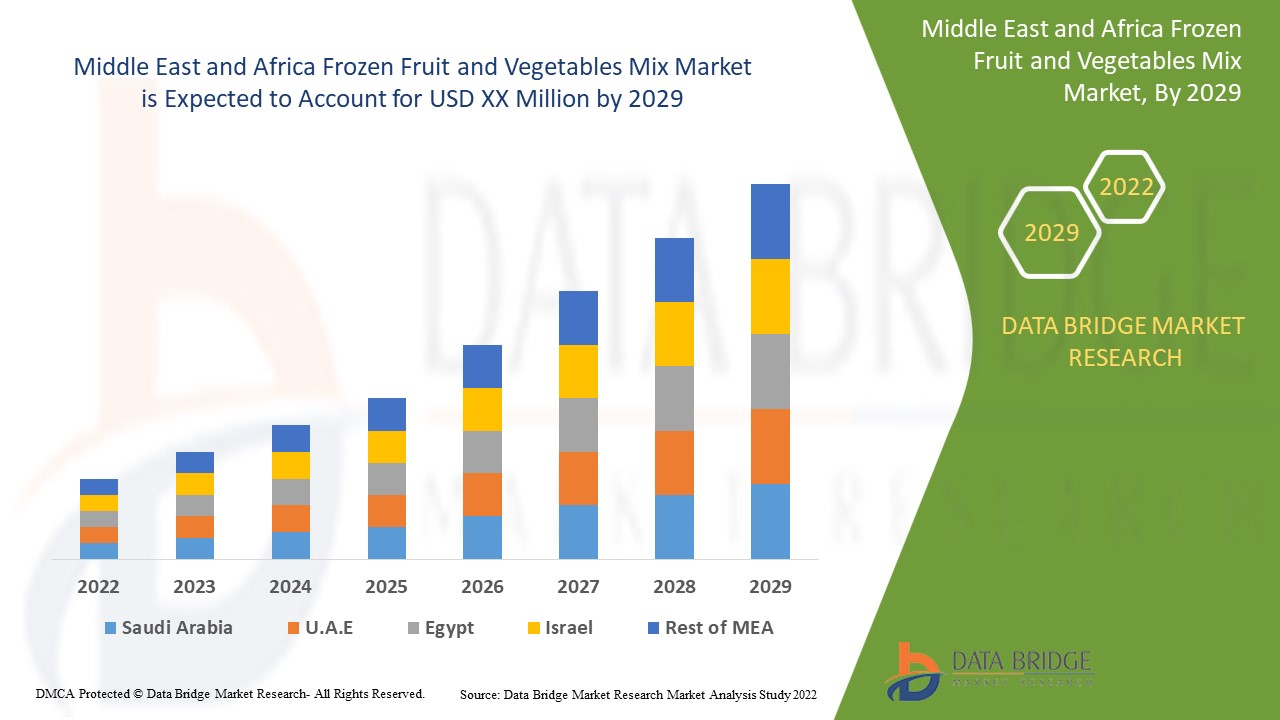

Data Bridge Market Research analyse que le marché des mélanges de fruits et légumes surgelés au Moyen-Orient et en Afrique connaîtra un TCAC de 5,8 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (mélange de légumes surgelés et mélange de fruits surgelés), catégorie (biologique et conventionnel), technologie (surgélation instantanée/surgélation rapide individuelle (IQF), surgélation à bande, surgélation assistée par haute pression et autres), utilisateur final (secteur de la restauration et secteur des ménages/de la vente au détail), canal de distribution (détaillants en magasin et détaillants hors magasin) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Oman, Qatar, Koweït et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Conagra Brands, Inc., Ardo, Bonduelle, Goya Foods, Inc., Hanover Foods, Grupo Virto, Alasko Foods Inc., Cascadian Farm Organic, Findus Sverige Ab, Healthy Pac Corp, SFI LLC, Stahlbush Island Farms, Sunopta, Axus International, Dole Packaged Food LLC, Frutex Asutralia, Coloma Frozen Foods, Shimlahills, Brecon Foods et B&G-Green Giant |

Définition du marché

Les fruits surgelés sont des fruits cueillis à maturité maximale et surgelés peu de temps après pour préserver leurs bienfaits nutritionnels optimaux. Les fruits surgelés se conservent souvent plusieurs mois et peuvent être plus économiques que l'achat de fruits frais qui se gâtent plus rapidement.

Les légumes surgelés sont des légumes dont la température a été abaissée et maintenue en dessous de leur point de congélation pour être stockés et transportés jusqu'à ce qu'ils soient prêts à être consommés. Ils peuvent être emballés dans un emballage commercial ou congelés à la maison.

Dynamique du marché des fruits et légumes surgelés au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

-

Croissance de l'urbanisation et adoption accrue d'un mode de vie sain

De nos jours, les gens sont de plus en plus conscients des bienfaits des fruits et légumes pour la santé, ce qui stimule la demande du marché. De plus, l'urbanisation croissante impliquant des revenus disponibles élevés déplace la préférence des consommateurs vers des alternatives alimentaires saines.

Les aliments végétariens tels que les légumes et les fruits sont plus adaptés en raison de leurs bienfaits pour la santé. Les gens sont plus soucieux du contenu des aliments, comme le faible taux de cholestérol et de calories, ce qui augmente la demande en légumes et en fruits.

Ainsi, les divers avantages pour la santé associés à la consommation de légumes et de fruits attirent de nombreux consommateurs soucieux de leur santé vers leur consommation et stimulent la croissance du marché.

-

Augmentation de la consommation d'aliments en conserve et surgelés

L'évolution du mode de vie et les horaires chargés des individus ont poussé la tendance de consommation du marché vers les aliments en conserve et surgelés. Cette consommation a encore augmenté en raison de la propagation malheureuse du coronavirus dans le monde entier, les consommateurs ayant rempli leur congélateur avec des articles à conservation plus longue pendant les confinements. De plus, l'augmentation de la consommation a incité les fabricants à développer de nouveaux lancements innovants et diverses alternatives saines. Parmi toutes les innovations, les légumes et les fruits sont utilisés exclusivement comme ingrédient dans divers aliments en conserve et surgelés

Ainsi, avec autant de lancements et d'expansion des fabricants vers l'innovation dans les légumes et les fruits surgelés et en conserve, le marché des légumes et des fruits va croître au Moyen-Orient et en Afrique. De plus, à mesure que le marché des aliments surgelés et en conserve se développe, l'industrie verra davantage de lancements et de développements nouveaux et innovants pour ces produits, poussant ainsi le marché vers une escalade positive.

Opportunité

-

La digitalisation du commerce de détail

La transformation numérique du secteur de la vente au détail de produits alimentaires, qui vise à améliorer ses services et ses installations pour rester à la pointe et répondre à la demande des clients, offrira d'immenses opportunités aux fabricants de fruits et légumes surgelés. L'augmentation de la propension des consommateurs à acheter des produits alimentaires en ligne en raison de sa commodité, associée à la disponibilité d'une grande variété de fruits et légumes surgelés sur les plateformes en ligne, crée une énorme opportunité pour le marché des fruits et légumes surgelés.

Les achats en ligne sont une tendance majeure qui devrait stimuler la croissance du marché. De plus, la plate-forme d'achat en ligne aide les fabricants à présenter leur large gamme de produits dans différentes catégories et à vendre leurs produits alimentaires. En plus de la pénétration croissante des smartphones et de l'utilisation d'Internet, les achats en ligne de produits alimentaires apparaissent comme l'une des plates-formes permettant aux fabricants de produits surgelés de se développer sur le marché. Le changement des habitudes d'achat des consommateurs et la demande croissante de produits d'épicerie pratiques devraient créer de grandes opportunités pour les fabricants de fruits et légumes surgelés.

L'augmentation des achats d'épicerie en ligne en raison des caractéristiques d'une grande variété d'options et de commodité devrait stimuler la croissance du marché et créera une excellente opportunité pour la croissance du marché des mélanges de fruits et légumes surgelés au Moyen-Orient et en Afrique.

Retenue/Défi

- Croissance de la sensibilisation à la consommation de fruits et légumes frais

Le changement et la stagnation du mode de vie ont rendu les consommateurs plus attentifs à leur santé, ce qui les a amenés à réfléchir à ce qu'ils mangent. Ce changement a entraîné une demande croissante d'aliments sains, sans gluten, hypocaloriques, sans sucre, sans produits laitiers et à base de plantes parmi les consommateurs. Ces aliments sont également liés à un risque moindre de dépression et d'anxiété, d'obésité et de maladies non transmissibles ; ils favorisent la santé intestinale ; et ils luttent contre les carences en micronutriments. Cela a attiré les consommateurs vers divers légumes et fruits frais, les encourageant à mener une vie meilleure et plus saine.

Avec cette tendance croissante, les consommateurs ont considérablement adopté des produits tels que les légumes et les fruits frais, car ils sont riches en nutriments et ont peu de calories, réduisant ainsi le risque de divers problèmes de santé par rapport aux fruits et légumes surgelés, limitant ainsi la croissance du marché au Moyen-Orient et en Afrique.

Impact de la pandémie de COVID-19 sur le marché des fruits et légumes surgelés au Moyen-Orient et en Afrique

L'épidémie de COVID-19 a eu un impact considérable sur le comportement des consommateurs. Les consommateurs accumulent des aliments de longue conservation, tels que des fruits et légumes surgelés. La pratique du stockage a entraîné une augmentation spectaculaire de la valeur marchande du marché mondial des fruits et légumes surgelés en 2020, qui se normalisera en l'absence d'épidémie. Comme on pense que les fruits surgelés renforcent le système immunitaire, la demande de fruits surgelés comme les baies surgelées a augmenté.

Développement récent

- En mars 2019, le Groupe a investi 49,5 millions de dollars sur cinq ans pour augmenter la capacité de l'usine de transformation de légumes du spécialiste belge des surgelés à Gourin, en Bretagne. Cela a permis à l'entreprise d'augmenter sa capacité de production

Portée du marché des fruits et légumes surgelés au Moyen-Orient et en Afrique

Le marché des mélanges de fruits et légumes surgelés du Moyen-Orient et de l'Afrique est segmenté en cinq segments notables en fonction du type, de la catégorie, de la technologie, de l'utilisateur final et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Mélange de légumes surgelés

- Mélange de fruits surgelés

En fonction du type, le marché des mélanges de fruits et légumes surgelés du Moyen-Orient et de l'Afrique est segmenté en mélange de légumes surgelés et en mélange de fruits surgelés.

Catégorie

- Conventionnel

- Organique

En fonction de la catégorie, le marché des mélanges de fruits et légumes surgelés du Moyen-Orient et de l'Afrique est segmenté en biologique et conventionnel.

Technologie

- Congélation instantanée/Congélation rapide individuelle (IQF)

- Congélation par ceinture

- Congélation assistée par haute pression

- Autres

Sur la base de la technologie, le marché des mélanges de fruits et légumes surgelés du Moyen-Orient et de l'Afrique est segmenté en surgélation/congélation rapide individuelle (IQF), congélation par bande, congélation assistée par haute pression et autres.

Utilisateur final

- Secteur de la restauration

- Secteur des ménages/de la vente au détail

En fonction de l’utilisateur final, le marché des mélanges de fruits et légumes surgelés du Moyen-Orient et de l’Afrique est segmenté en secteur de la restauration et en secteur des ménages/de la vente au détail.

Canal de distribution

- Détaillants en magasin

- Détaillants non basés dans des magasins

En fonction du canal de distribution, le marché des mélanges de fruits et légumes surgelés du Moyen-Orient et de l'Afrique est segmenté en détaillants en magasin et en détaillants hors magasin.

Analyse/perspectives régionales du marché des mélanges de fruits et légumes surgelés au Moyen-Orient et en Afrique

Le marché des mélanges de fruits et légumes surgelés du Moyen-Orient et de l’Afrique est analysé et des informations sur la taille du marché et les tendances sont fournies sur la base des références ci-dessus.

Les pays couverts par le rapport sur le marché des mélanges de fruits et légumes surgelés au Moyen-Orient et en Afrique sont l'Amérique du Sud, l'Afrique du Sud, l'Arabie saoudite, les Émirats arabes unis, Oman, le Qatar, le Koweït et le reste du Moyen-Orient et de l'Afrique.

Saudi Arabia is expected to dominate the Middle East and Africa Frozen fruit and vegetables mix market in terms of market share and market revenue and is estimated to maintain its dominance during the forecast period due to the increasing demand from food service and hospitality industries within Middle East and Africa.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Middle East and Africa brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Frozen Fruit and Vegetables Mix Market Share Analysis

The Middle East and Africa frozen fruit and vegetables mix market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on Middle East and Africa frozen fruit and vegetables mix market.

Some of the major players operating in Middle East and Africa frozen fruit and vegetables mix market are Conagra Brands, Inc, Ardo, Bonduelle, Goya Foods, Inc., Hanover Foods, Grupo Virto, Alasko Foods Inc., Cascadian Farm Organic, Findus Sverige Ab, Healthy Pac Corp, SFI LLC, Stahlbush Island Farms, Sunopta, Axus International, Dole Packaged Food LLC, Frutex Asutralia, Coloma Frozen Foods, Shimlahills, Brecon Foods and B&G-Green Giant among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East and Africa Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP EXPORTING COMPANIES

4.1.1 MIDDLE EAST & AFRICA FROZEN FRUIT MIX MARKET

4.1.2 MIDDLE EAST & AFRICA FROZEN VEGETABLE MIX MARKET

4.2 EXPORT & IMPORT ANALYSIS- MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET

4.3 MARKET TRENDS – 2010-2022

4.4 PRODUCTION CAPACITY

4.5 PRODUCTION BY TOP MANUFACTURERS

4.6 RETAIL TRENDS

4.6.1 INCREASED INVESTMENT IN THE FREEZER

4.6.2 LAUNCH OF IN-STORE FROZEN FRUITS AND VEGETABLE BRANDS

4.6.3 STOCKING BESTSELLERS AND NEW LAUNCHES

4.7 PER CAPITA CONSUMPTION BY COUNTRY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLE

5.1.2 INCREASING CONSUMPTION OF CANNED AND FROZEN FOOD

5.1.3 THE INCREASING VEGAN POPULATION IS EXPECTED TO DRIVE THE MARKET GROWTH

5.1.4 EXPANSIONS OF CONVENIENCE STORES

5.2 RESTRAINTS

5.2.1 GROWING AWARENESS REGARDING THE CONSUMPTION OF FRESH VEGETABLES AND FRUITS

5.2.2 HIGHER AMOUNT OF VEGETABLE AND FRUIT WASTAGE

5.2.3 LACK OF COLD CHAIN INFRASTRUCTURE

5.3 OPPORTUNITIES

5.3.1 DIGITALIZATION OF THE RETAIL INDUSTRY

5.3.2 INCREASING NUMBER OF INITIATIVES TAKEN BY FROZEN FRUIT AND VEGETABLE MANUFACTURERS

5.3.3 INCREASING DEMAND FOR FRUITS AND VEGETABLES WITH LONGER SHELF-LIFE

5.3.4 ADVANCEMENTS IN FREEZING TECHNOLOGY TO RETAIN THE QUALITY OF FRUITS AND VEGETABLES

5.4 CHALLENGES

5.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

5.4.2 HIGH INVESTMENT COST FOR THE PRODUCTION OF CANNED AND FROZEN VEGETABLES AND FRUITS

6 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE

6.1 OVERVIEW

6.2 FROZEN VEGETABLE MIX

6.2.1 CARROTS, CORN AND BEANS

6.2.2 CARROTS, CORN, BEANS AND PEAS

6.2.3 BROCCOLI, CAULIFLOWER AND CARROT

6.2.4 PEAS, CAULIFLOWER AND CARROT

6.2.5 ONIONS, GREEN PEPPERS, RED PEPPERS AND YELLOW PEPPERS

6.2.6 AVOCADO WITH KALE

6.2.7 OTHER

6.3 FROZEN FRUIT MIX

6.3.1 BERRY MIX (RASPBERRIES, BLACKBERRIES, BLUEBERRIES AND STRAWBERRIES)

6.3.2 PINEAPPLE, STRAWBERRIES, PEACHES AND MANGO

6.3.3 PINEAPPLE, KIWI, MANGO, PAPAYA, STRAWBERRIES

6.3.4 BERRIES AND CHERRY

6.3.5 BERRIES AND MANGO

6.3.6 OTHERS

7 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 CONVENTIONAL

7.3 ORGANIC

8 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 FLASH-FREEZING/INDIVIDUAL QUICK FREEZING(IQF)

8.3 BELT FREEZING

8.4 HIGH-PRESSURE-ASSISTED FREEZING

8.5 OTHERS

9 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END USER

9.1 OVERVIEW

9.2 FOOD SERVICE SECTOR

9.2.1 RESTAURANTS

9.2.1.1 QUICK SERVICE RESTAURANTS

9.2.1.2 DINING RESTAURANTS

9.2.1.3 GHOST RESTAURANTS (DELIVERY ONLY RESTAURANTS)

9.2.1.4 OTHERS

9.2.2 CAFES

9.2.3 HOTEL

9.2.4 OTHERS

9.3 HOUSEHOLD/RETAIL SECTOR

10 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 STORE BASED RETAILER

10.2.1 SUPERMARKETS/HYPERMARKETS

10.2.2 CONVENIENCE STORES

10.2.3 FROZEN DAIRY PRODUCTS SHOPS/PARLORS

10.2.4 SPECIALITY STORES

10.2.5 WHOLESALERS

10.2.6 GROCERY RETAILERS

10.2.7 OTHERS

10.3 NON-STORE RETAILER

10.3.1 ONLINE

10.3.2 COMPANY WEBSITES

11 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.2 UAE

11.1.3 SOUTH AFRICA

11.1.4 KUWAIT

11.1.5 OMAN

11.1.6 QATAR

11.1.7 REST OF MIDDLE EAST AND AFRICA

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ARDO

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 BONDUELLE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 CONAGRA BRANDS, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 HANOVER FOODS

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 FINDUS SVERIGE AB

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 DOLE PLC

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUS ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 GOYA FOODS, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 SUNOPTA

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 B&G FOODS

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUS ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 STAHLBUSH ISLAND FARMS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 ALASKO FOODS INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 AXUS INTERNATIONAL, LLC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 BRECON FOODS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 CASCADIAN FARM ORGANIC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 COLOMA FROZEN FOODS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 FRUTEX AUSTRALIA

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 VIRTO GROUP

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 HEALTHY PAC CORP

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 SFI LLC.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 SHIMLAHILLS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA CONVENTIONAL IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA ORGANIC IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA FLASH-FREEZING/INDIVIDUAL QUICK FREEZING (IQF) IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA BELT FREEZING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA HIGH-PRESSURE-ASSISTED FREEZING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA OTHERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA RESTAURANTS IN FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA HOUSEHOLD/RETAIL SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA STORE BASED RETAILER IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA STORE BASED RETAILER IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA NON-STORE RETAILER IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA NON-STORE RETAILER IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 26 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 28 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 29 MIDDLE EAST AND AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 31 MIDDLE EAST AND AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 33 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 41 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 43 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 44 SAUDI ARABIA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 SAUDI ARABIA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 46 SAUDI ARABIA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SAUDI ARABIA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 48 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 58 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 59 U.A.E FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.A.E FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 61 U.A.E FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 63 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 64 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 65 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 66 U.A.E FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 67 U.A.E RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 68 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 69 U.A.E STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 U.A.E NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 74 SOUTH AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 76 SOUTH AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 78 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 88 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 89 KUWAIT FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 KUWAIT FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 91 KUWAIT FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 KUWAIT FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 93 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 94 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 95 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 96 KUWAIT FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 97 KUWAIT RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 98 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 99 KUWAIT STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 KUWAIT NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 103 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 104 OMAN FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 OMAN FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 106 OMAN FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 OMAN FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS

TABLE 108 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 109 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 110 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 111 OMAN FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 112 OMAN RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 114 OMAN STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 115 OMAN NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 118 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 119 QATAR FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 QATAR FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 121 QATAR FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 QATAR FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 123 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 124 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 125 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 126 QATAR FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 127 QATAR RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 128 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 QATAR STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 QATAR NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 REST OF MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 REST OF MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 133 REST OF MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA FRUIT AND VEGETABLE MIX MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA FROZEN FRUITS AND VEGETABLE MIX MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: SEGMENTATION

FIGURE 9 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLES COUPLED WITH INCREASING DEMAND FOR FRUITS AND VEGETABLES WITH LONGER SHELF-LIFE IS LEADING THE GROWTH OF THE MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 10 FROZEN VEGETABLE MIX SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET IN 2022 & 2029

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET

FIGURE 12 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY TYPE, 2021

FIGURE 13 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY CATEGORY, 2021

FIGURE 14 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY TECHNOLOGY, 2021

FIGURE 15 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY END USER (2021)

FIGURE 16 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 17 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: SNAPSHOT (2021)

FIGURE 18 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY COUNTRY (2021)

FIGURE 19 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY COUNTRY (2022 & 2029)

FIGURE 20 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY COUNTRY (2021 & 2029)

FIGURE 21 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY TYPE (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.