Marché des chaussures au Moyen-Orient et en Afrique, par type (mocassins, chaussures, sandales/tongs, ballerines, bottes, compensées, chaussures de sport, chaussures de santé et autres), matériau des chaussures (plastique, cuir, caoutchouc, textile et autres), matériau de la semelle (plastique, caoutchouc, cuir et autres), canal de distribution (commerce électronique, magasin spécialisé, supermarchés-hypermarchés, supérette et autres), utilisateur final (femmes, hommes et enfants) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des chaussures au Moyen-Orient et en Afrique

La sensibilisation croissante des jeunes générations aux dernières tendances de la mode est un moteur important pour le marché de la chaussure au Moyen-Orient et en Afrique. L'augmentation des dépenses en chaussures sur les plateformes en ligne et la volonté croissante de payer un supplément pour des chaussures de haute qualité devraient propulser la croissance du marché de la chaussure au Moyen-Orient et en Afrique.

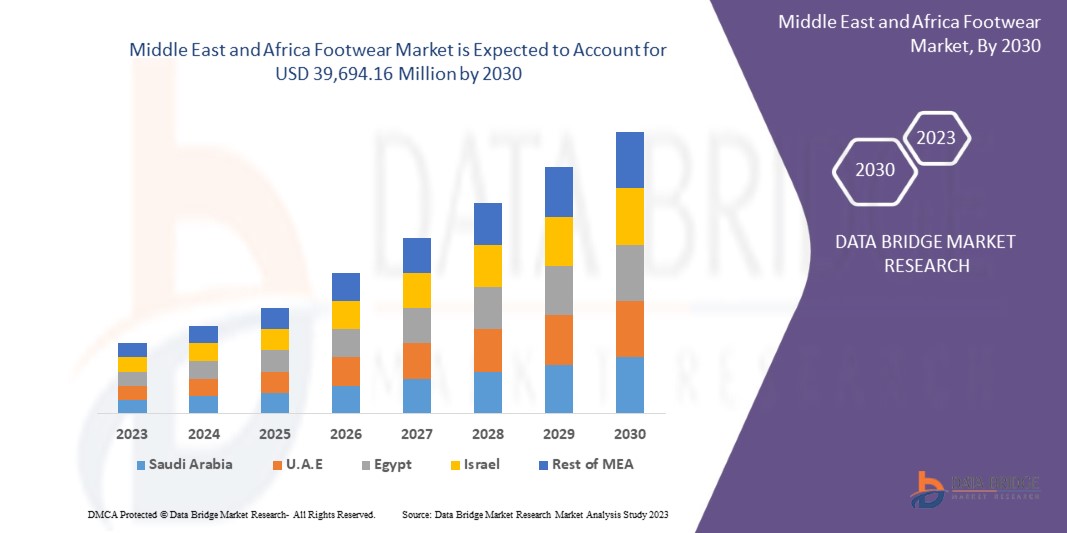

Data Bridge Market Research analyse que le marché des chaussures au Moyen-Orient et en Afrique devrait atteindre la valeur de 39 694,16 millions USD d'ici 2030, à un TCAC de 4,7 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (mocassins, chaussures, sandales/tongs, ballerines, bottes, chaussures compensées, chaussures de sport, chaussures de santé et autres), matériau de la chaussure (plastique, cuir, caoutchouc, textile et autres), matériau de la semelle (plastique, caoutchouc, cuir et autres), canal de distribution (commerce électronique, magasin spécialisé, supermarchés-hypermarchés, supérette et autres), utilisateur final (femmes, hommes et enfants) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Israël, Égypte et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Cross Inc., Adidas India Marketing Pt. Ltd., Skechers USA Inc., Nike Inc., Okabashi, Under Armour Inc., Asics Asia Pte., le groupe Aldo Inc., Kering, Quotemedia, Deichmann, Fila India, New Balance, Ecco Sko A/S et Burberry |

Définition du marché

L'industrie de la chaussure s'occupe de la conception, de la production, de la distribution et de la fourniture de chaussures. La matière première peut être naturelle ou synthétique, et peut être issue de produits de l'industrie chimique. L'industrie de la chaussure contribue de manière significative à l'économie nationale de nombreux pays.

Dynamique du marché de la chaussure au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de chaussures pratiques, confortables et élégantes

Les chaussures et les vêtements sont une nécessité pour chaque besoin humain, et tout comme les vêtements protègent des éléments météorologiques tels que les rayons du soleil, le froid et la pluie, les chaussures nous protègent également de tous les éléments météorologiques. En plus de cela, elles fournissent également une barrière d'hygiène et de sécurité à nos pieds qui nous protègent des pierres et des grondements pendant la marche. Elles éloignent également les matières infectieuses et toxiques de nos pieds. Lorsqu'il s'agit de trouver une paire de chaussures parfaite, le confort et l'apparence sont les principaux objectifs du client. Les gens achètent une chaussure en fonction de leurs besoins et de leurs exigences. Différents types de chaussures sont portés pour différents événements et occasions. Par exemple, les chaussures de sport sont portées pour des activités physiques comme la course et le jeu associées à des tenues sportives, les chaussures formelles sont portées pour des événements formels associées à des tenues décontractées, et les chaussures fantaisie sont portées pour des événements fantaisie. Il ne faut pas nier le fait qu'au-delà de l'apparence, les gens recherchent également du confort.

- Augmentation des dépenses en chaussures sur les plateformes en ligne

Avec l’augmentation du revenu disponible des consommateurs, il est dans la nature humaine d’améliorer son niveau de vie et de s’offrir des choses qui vont au-delà des nécessités – acheter des chaussures de qualité, à la fois milieu de gamme et haut de gamme, dont les prix augmentent instantanément. L’industrie de la chaussure est de plus en plus interconnectée avec le monde numérique. Les plateformes numériques et les stratégies de marketing numérique sont devenues la plateforme la plus répandue pour que les clients achètent les chaussures de leur choix. Avec de plus en plus d’entreprises vendant leurs produits en ligne via leur propre site Web ou coopérant avec d’autres sociétés de commerce électronique, les clients se tournent davantage vers la plateforme en ligne où ils peuvent voir divers produits en un seul clic, quel que soit l’endroit où ils se trouvent.

- Augmenter les événements sportifs et l’implication des citoyens dans les activités physiques

Les chaussures sont l'équipement le plus important pour tout athlète, quels que soient les événements et les catégories auxquels il participe. Des sports comme le basket-ball, le football, la course à pied, le cyclisme et le cricket exigent des chaussures de haute qualité pour les athlètes afin d'assurer leur confort, de meilleures performances et, surtout, d'éviter les blessures. Le sport et les activités physiques intenses peuvent exercer une pression énorme sur les pieds, les chevilles et les jambes. Par exemple, sauter et courir peuvent générer trois à cinq fois plus de force que le poids du corps sur nos jambes. Des entreprises comme Nike, Adidas et Puma conçoivent spécifiquement des chaussures pour divers jeux et sports avec des technologies avancées qui offrent confort et hautes performances et empêchent les athlètes d'être sujets aux blessures.

Restrictions

- Impact des chaussures contrefaites sur les chaussures de marque

Avec l'amélioration de l'économie du Moyen-Orient et de l'Afrique, même le consommateur occasionnel peut se permettre de suivre les tendances de la mode. Parallèlement à l'essor du commerce électronique et à la vague de soutien des célébrités au produit et à l'engagement accru dans les activités physiques, l'industrie de la chaussure connaît une croissance massive ces dernières années. Par exemple, les chaussures de basket-ball connaissent actuellement la croissance la plus rapide du marché en raison de l'influence des médias sociaux et de divers événements sportifs. Le marché des chaussures authentiques connaissant le succès, les contrefaçons tentent également diverses manières possibles d'imiter les produits populaires originaux en copiant le design et le suivi des événements pour suivre les dates de sortie.

- Fluctuation des prix et indisponibilité des matières premières

Les prix du pétrole brut augmentent régulièrement pour répondre à la demande croissante des consommateurs, le pétrole brut étant la principale source de caoutchouc et de fibres synthétiques, ce qui entraîne une hausse des prix des matières premières pour la fabrication de chaussures. Cette guerre en cours a aggravé la situation, en faisant naître une méfiance à l'égard de la chaîne d'approvisionnement des produits finis et des matières premières. Les prix du pétrole brut sont en hausse en raison de l'augmentation des stocks de pétrole brut, des inondations généralisées et des pannes de courant dues aux fortes pluies dans les régions productrices de pétrole du monde.

Opportunités

- Progrès récents en matière d'innovation avec de nouvelles fonctionnalités et un nouveau design

Avec l'évolution rapide et les changements de mode de vie de jour en jour, et avec l'augmentation du revenu disponible des consommateurs, les consommateurs sont de plus en plus enclins à acheter des produits à la mode. Les consommateurs améliorent leur niveau de vie en fonction de leur revenu disponible et consomment davantage de produits à la mode et branchés. Ces types d'inclinations des consommateurs créeront donc une opportunité pour les acteurs du marché opérant sur le marché de la maroquinerie au Moyen-Orient et en Afrique.

L'innovation croissante dans le domaine des chaussures, avec de nouvelles caractéristiques et de nouveaux designs, est le principal facteur qui permet d'offrir une multitude d'opportunités à une base de consommateurs croissante de produits de chaussures. Les consommateurs sont de plus en plus conscients des dernières tendances de la mode en raison de l'adoption croissante des médias sociaux, ce qui devrait créer un espace pour de nouvelles fonctionnalités et de nouveaux designs dans la production de différents types d' articles de maroquinerie .

- Collaboration avec des influenceurs sociaux et des superstars

La publicité et la promotion sont les principaux éléments qui permettent d'augmenter les ventes de tout produit. Les entreprises utilisent la publicité pour atteindre divers objectifs. Les entreprises dépensent des sommes considérables en promotion et en publicité pour promouvoir leurs marques et leurs produits afin d'atteindre le plus grand nombre de consommateurs. L'industrie de la chaussure ne fait pas exception, les entreprises de chaussures collaborent avec divers événements sportifs et athlètes de diverses catégories pour promouvoir leurs produits.

Défis

- Restriction dans la réglementation de l'autorité de contrôle de l'environnement et de la qualité

Aujourd'hui, les gens recherchent des « produits écologiques » partout. En ce qui concerne les chaussures, la décision d'achat des consommateurs était auparavant basée sur le confort, le style et l'esthétique des produits, mais elle est désormais davantage basée sur le caractère écologique des produits. De nombreuses entreprises de chaussures ont commencé à proposer des chaussures fabriquées à partir de tissus écologiques, et la demande pour ces produits écologiques augmente également.

Impact de la pandémie de COVID-19 sur le marché de la chaussure au Moyen-Orient et en Afrique

La COVID-19 a eu un impact majeur sur le marché de la chaussure, car la viabilité des industries du textile, de l’habillement, du cuir et de la chaussure s’effondre, les travailleurs étant invités à rester chez eux, les usines fermant et les chaînes d’approvisionnement du Moyen-Orient et de l’Afrique étant paralysées. L’annulation des commandes a particulièrement touché des milliers d’entreprises et des millions de travailleurs. L’OIT s’est engagée à aider les gouvernements à protéger la santé et le bien-être économique des travailleurs et des entreprises des industries du textile, de l’habillement, du cuir et de la chaussure. Le gouvernement a pris des mesures strictes, telles que l’arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d’autres pour empêcher la propagation de la COVID-19.

Développements récents

- En décembre 2022, Asics a développé une chaussure de tennis haute technologie Gel-Resolution 9 pour soutenir votre jeu de jambes dynamique le long de la ligne de fond. Les chaussures GEL-RESOLUTION™ 9 sont conçues pour offrir une excellente stabilité cinétique pour les mouvements latéraux lors des matchs de tennis rapides

- En septembre 2022, Under Armour a lancé sa première chaussure de course conçue sur une forme pour femme. UA Flow Synchronicity combine la technologie révolutionnaire UA Flow et les connaissances des consommateurs pour créer une chaussure conçue pour ELLE - sa forme, sa vitesse, son rythme, son parcours vers la compétition.

Portée du marché des chaussures au Moyen-Orient et en Afrique

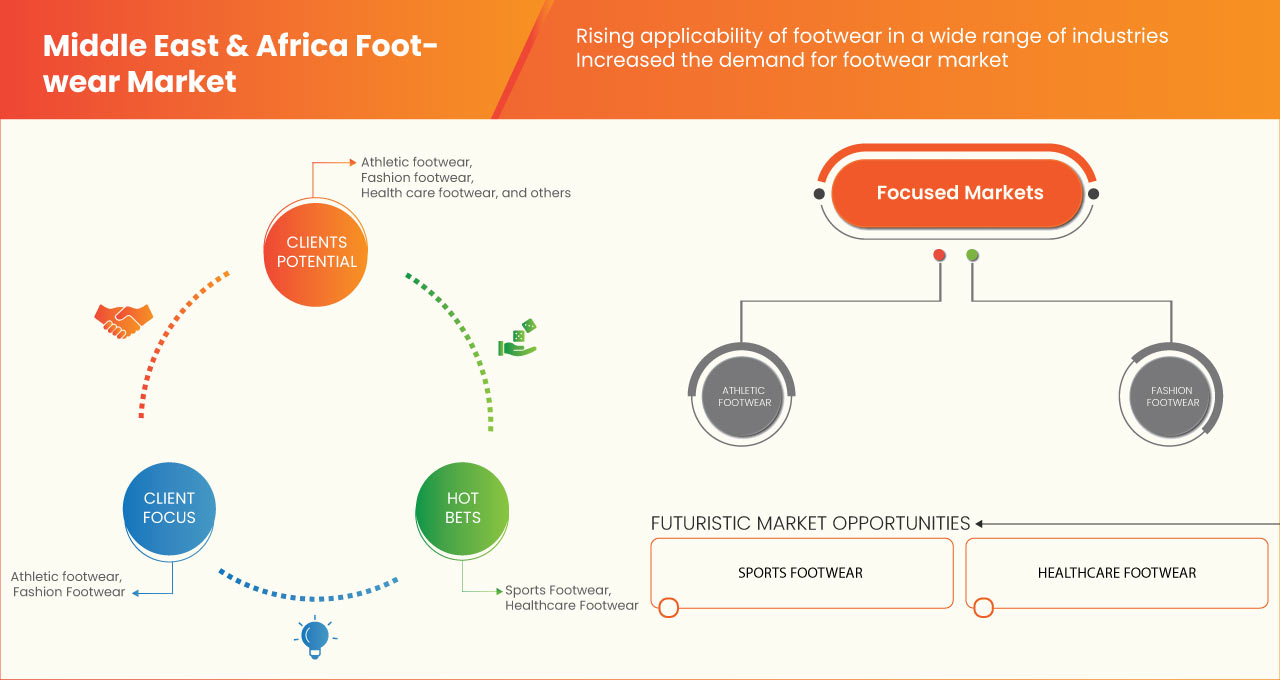

Le marché des chaussures au Moyen-Orient et en Afrique est segmenté en fonction du type, du matériau de la chaussure, du matériau de la semelle, du canal de distribution et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Flâneur

- Chaussures

- Sandales/tongs

- Ballerines

- Bottes

- Cales

- Athlétique

- Chaussures de santé

- Autres

Sur la base du type, le marché des chaussures du Moyen-Orient et de l'Afrique est segmenté en mocassins, chaussures, sandales/tongs, ballerines, bottes, compensées, chaussures de sport, chaussures de santé et autres.

Matériau de la chaussure

- Plastique

- Caoutchouc

- Cuir

- Textile

- Autres

Sur la base du matériau de la chaussure, le marché de la chaussure du Moyen-Orient et de l'Afrique a été segmenté en plastique, cuir, caoutchouc, textile et autres .

Matériau de la semelle

- Plastique

- Caoutchouc

- Cuir

- Autres

Au niveau de la catégorie, le marché des chaussures du Moyen-Orient et de l'Afrique a été segmenté en plastiques, caoutchouc, cuir et autres.

Canal de distribution

- Commerce électronique

- Magasins spécialisés

- Supermarchés/hypermarchés

- Magasins de proximité

- Autres

Sur le canal de distribution, le marché de la chaussure au Moyen-Orient et en Afrique a été segmenté en commerce électronique, magasins spécialisés, supermarchés-hypermarchés, magasins de proximité et autres.

Utilisateur final

- Femmes

- Hommes

- Enfants

Du côté de l’utilisateur final, le marché des chaussures du Moyen-Orient et de l’Afrique a été segmenté en femmes, hommes et enfants.

Analyse/perspectives régionales du marché des chaussures au Moyen-Orient et en Afrique

Le marché des chaussures au Moyen-Orient et en Afrique est analysé, et des informations sur la taille du marché et les tendances sont fournies par région, type, matériau de la chaussure, matériau de la semelle, canal de distribution et utilisateur final, comme référencé ci-dessus.

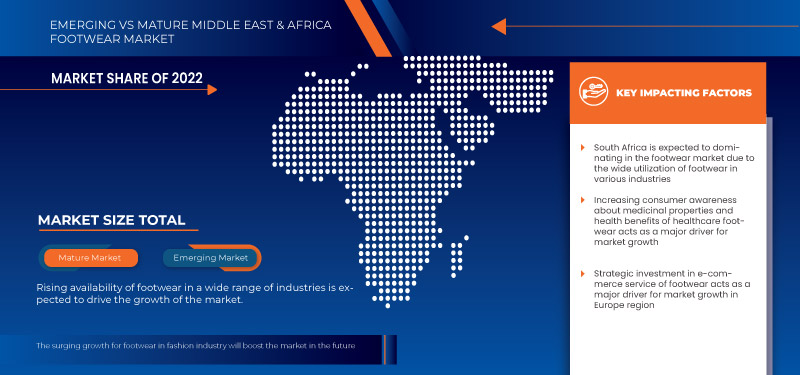

Les pays couverts dans le rapport sur le marché des chaussures au Moyen-Orient et en Afrique sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, Israël, l’Égypte et le reste du Moyen-Orient et de l’Afrique.

L'Afrique du Sud domine le marché des chaussures au Moyen-Orient et en Afrique en raison de la forte demande croissante de l'industrie de transformation pour les produits transformés de chaussures dans le monde entier, principale raison de la croissance du marché des chaussures.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du secteur des chaussures

Le paysage concurrentiel du marché de la chaussure fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché de la chaussure.

Certains des principaux acteurs opérant sur le marché de la chaussure sont Cross Inc., Adidas India marketing pt. ltd, Skechers USA Inc., Nike, Inc., Okabashi, Under Armour, Inc., Asics Asia pte, le groupe Aldo Inc., kering, Quotemedia, Deichmann, Fila India, New Balance, Ecco sko a/s et Burberry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA FOOTWEAR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS (CHANGE NEEDED)

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 CONSUMER-LEVEL TRENDS AND PREFERENCES – MIDDLE EAST & AFRICA FOOTWEAR MARKET

4.2.1 CONSUMER PREFERENCES

4.2.2 VARIOUS MARKET PARTICIPANTS' TRENDS

4.2.3 TRENDS IN SOCIAL MEDIA

4.2.4 ONLINE SHOPPING IS BECOMING MORE POPULAR

4.3 IMPORT EXPORT SCENARIO

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA FOOTWEAR MARKET

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 PRODUCT DESIGNING PROCESS

4.5.3 MANUFACTURING

4.5.4 MARKETING AND DISTRIBUTION

4.5.5 END USERS

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR CONVENIENT, COMFORTABLE AND FANCY FOOTWEAR

5.1.2 INCREASING SPENDING ON FOOTWEAR FROM ONLINE PLATFORMS

5.1.3 INCREASING SPORTS EVENTS AND INVOLVEMENT OF PEOPLE IN PHYSICAL ACTIVITIES

5.1.4 AWARENESS OF FOLLOWING UP LATEST FASHION TRENDS AMONG THE YOUNG GENERATION

5.2 RESTRAINTS

5.2.1 IMPACT OF FAKE COUNTERFEIT SHOES ON THE BRANDED COUNTERPART

5.2.2 FLUCTUATION IN PRICE AND UNAVAILABILITY OF RAW MATERIAL

5.2.3 USE OF HAZARDOUS CHEMICALS

5.3 OPPORTUNITIES

5.3.1 RECENT ADVANCEMENTS IN INNOVATION WITH NEW FEATURES AND DESIGN

5.3.2 COLLABORATION WITH SOCIAL INFLUENCERS AND SUPERSTARS

5.3.3 INTRODUCTION OF ECO-FRIENDLY SHOES MADE UP OF WASTE PRODUCT

5.4 CHALLENGES

5.4.1 RESTRICTION IN REGULATION FROM ENVIRONMENTAL AND QUALITY CONTROL AUTHORITY

5.4.2 RISING RAISING AWARENESS OF THE UNETHICAL PRACTICE DURING THE PRODUCTION OF LEATHER

5.4.3 RISING CASE OF DEFECT ARTICLE

6 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY TYPE

6.1 OVERVIEW

6.2 SANDALS/FLIP-FLOPS

6.3 WEDGES

6.4 SHOES

6.5 LOAFER

6.6 BALLERINAS

6.7 BOOTS

6.7.1 MILITARY BOOTS

6.7.2 WELLINGTON BOOTS

6.7.3 OTHERS

6.8 ATHLETIC

6.8.1 RUNNING SHOES

6.8.1.1 NEUTRAL SHOES

6.8.1.2 STABILITY SHOES

6.8.1.3 CUSHIONING SHOES

6.8.1.4 BAREFOOT RUNNING SHOES

6.8.1.5 MOTION CONTROL SHOES

6.8.1.6 MINIMALIST RUNNING SHOES

6.8.2 SPORT SHOES

6.8.2.1 CRICKET SHOES

6.8.2.2 BASKETBALL SHOES

6.8.2.3 TENNIS SHOES

6.8.2.4 BOXING SHOES

6.8.2.5 OTHERS

6.8.3 WALKING SHOES

6.8.4 AEROBICS SHOES

6.8.5 HIKING SHOES

6.8.5.1 OUTDOOR/RUGGED FOOTWEAR

6.8.5.2 TREKKING & WALKING BOOTS

6.8.5.3 SEASONAL BOOTS

6.8.5.4 SPECIALTY BOOTS

6.8.5.5 MOUNTAINEERING BOOTS

6.8.5.6 OTHERS

6.8.6 CLEATS

6.8.6.1 SOCCER CLEATS

6.8.6.2 FOOTBALL CLEATS

6.8.6.3 BASEBALL CLEATS

6.8.6.4 LACROSSE CLEATS

6.8.7 GYM SHOES

6.8.8 OTHERS

6.9 HEALTHCARE SHOES

6.9.1 ORTHOPEDIC

6.9.2 DIABETIC

6.9.3 NURSE CLOGS & SHOES

6.9.4 OTHERS

6.1 OTHERS

7 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY SHOE MATERIAL

7.1 OVERVIEW

7.2 RUBBER

7.2.1 SYNTHETIC RUBBER

7.2.2 NATURAL RUBBER

7.3 TEXTILE

7.3.1 COTTON

7.3.2 POLYESTER

7.3.3 WOOL

7.3.4 NYLON

7.3.5 OTHERS

7.4 PLASTIC

7.4.1 POLYURETHANE (PU) AND POLYURETHANE FOAM

7.4.2 ETHYLENE-VINYL ACETATE (EVA)

7.4.3 POLYVINYL CHLORIDE (PVC)

7.4.4 POLYESTER

7.4.5 OTHERS

7.5 LEATHER

7.5.1 SYNTHETIC LEATHER

7.5.2 GENUINE LEATHER

7.5.3 TAN GENUINE LEATHER

7.5.4 SUEDE LEATHER

7.5.5 OTHERS

7.6 OTHERS

8 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY SOLING MATERIAL

8.1 OVERVIEW

8.2 RUBBER

8.2.1 RUBBER

8.2.2 CREPE RUBBER

8.2.3 VULCANIZED RUBBER

8.2.4 RESIN RUBBER

8.3 PLASTIC

8.3.1 POLYURETHANE

8.3.2 THERMOPLASTIC POLYURETHANE (TPU)

8.3.3 PVC

8.3.4 EVA

8.4 LEATHER

8.5 OTHERS

9 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY END USER

9.1 OVERVIEW

9.2 WOMEN

9.2.1 SANDALS/FLIP-FLOPS

9.2.2 WEDGES

9.2.3 SHOES

9.2.4 LOAFER

9.2.5 BALLERINAS

9.2.6 BOOTS

9.2.7 ATHLETIC

9.2.8 HEALTHCARE SHOES

9.2.9 OTHERS

9.3 MEN

9.3.1 SHOES

9.3.2 LOAFER

9.3.3 SANDALS/FLIP-FLOPS

9.3.4 BOOTS

9.3.5 WEDGES

9.3.6 ATHLETIC

9.3.7 HEALTHCARE SHOES

9.3.8 BALLERINAS

9.3.9 OTHERS

9.4 CHILDREN

9.4.1 SANDALS/FLIP-FLOPS

9.4.2 SHOES

9.4.3 LOAFER

9.4.4 BOOTS

9.4.5 WEDGES

9.4.6 ATHLETIC

9.4.7 HEALTHCARE SHOES

9.4.8 BALLERINAS

9.4.9 OTHERS

10 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 CONVENIENCE STORES

10.3 SPECIALTY STORES

10.4 SUPERMARKETS/HYPERMARKETS

10.5 E-COMMERCE

10.6 OTHERS

11 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E.

11.1.4 ISRAEL

11.1.5 EGYPT

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THE ALDO GROUP INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENT

14.2 DEICHMANN

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 NEW BALANCE (2023)

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 ECCO SKO A/S

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENT

14.5 RELAXO FOOTWEARS LIMITED. (2022)

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 FILA HOLDINGS CORP. (2022)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 CROCS INC. (2023)

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 KERING (2023)

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 COMPANY SHARE ANALYSIS

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENT

14.9 VF CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 COMPANY SHARE ANALYSIS

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENTS

14.1 BURBERRY GROUP PLC

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 ADIDAS

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 COMPANY SHARE ANALYSIS

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENTS

14.12 SKECHERS USA INC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 NIKE, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 COMPANY SHARE ANALYSIS

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENTS

14.14 OKABASHI

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 BATA

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENTS

14.16 GEOX.SPA

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 PUMA

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 UNDER ARMOUR INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 WOLVERINE WORLD WIDE INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT UPDATES

14.2 ASICS CORPORATION

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF FOOTWEAR OUTER SOLE AND UPPER OF RUBBER OR PLASTIC WITH STRAP OR THROGS; HS CODE –640220 ( USD THOUSANDS)

TABLE 2 EXPORT DATA OF FOOTWEAR OUTER SOLE AND UPER OF RUBBER OR PLASTIC WITH STRAP OR THROGS ; HS CODE –640220 ( USD THOUSANDS)

TABLE 3 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA SANDALS/FLIP-FLOPS IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA WEDGES IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SHOES IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA LOAFER IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA BALLERINAS IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA BOOTS IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA BOOTS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA ATHLETIC IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA RUNNING SHOES IN ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SPORT SHOES IN ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA HIKING SHOES IN ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA CLEATS IN ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA HEALTHCARE SHOES IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA HEALTHCARE SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA RUBBER IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA RUBBER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA TEXTILE IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA TEXTILE IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PLASTIC IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PLASTIC IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA LEATHER IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA LEATHER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA RUBBER IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA RUBBER IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA PLASTIC IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA PLASTIC IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA LEATHER IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA OTHERS IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA WOMEN IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA WOMEN IN FOOTWEAR MARKET, BY END USER, BY TYPE 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA MEN IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA MEN IN FOOTWEAR MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA CHILDREN IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA CHILDREN IN FOOTWEAR MARKET, BY END USER, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA CONVENIENCE STORES IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA SPECIALTY STORES IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA SUPERMARKETS/HYPERMARKETS IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA E-COMMERCE IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA OTHERS IN FOOTWEAR MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA FOOTWEAR MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA BOOTS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA RUNNING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA SPORT SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA HIKING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA CLEATS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA HEALTHCARE SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA RUBBER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA TEXTILE IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA PLASTIC IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA LEATHER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA RUBBER IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA PLASTIC IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA FOOTWEAR MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA WOMEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA MEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA CHILDREN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 SOUTH AFRICA FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 SOUTH AFRICA BOOTS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 SOUTH AFRICA ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 SOUTH AFRICA RUNNING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 SOUTH AFRICA SPORT SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 SOUTH AFRICA HIKING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 SOUTH AFRICA CLEATS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 SOUTH AFRICA HEALTHCARE SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 SOUTH AFRICA FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 81 SOUTH AFRICA RUBBER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 82 SOUTH AFRICA TEXTILE IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 83 SOUTH AFRICA PLASTIC IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 84 SOUTH AFRICA LEATHER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 85 SOUTH AFRICA FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 86 SOUTH AFRICA RUBBER IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 87 SOUTH AFRICA PLASTIC IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 88 SOUTH AFRICA FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 89 SOUTH AFRICA FOOTWEAR MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 90 SOUTH AFRICA WOMEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 SOUTH AFRICA MEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 SOUTH AFRICA CHILDREN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 SAUDI ARABIA FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 SAUDI ARABIA BOOTS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 SAUDI ARABIA ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 SAUDI ARABIA RUNNING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 SAUDI ARABIA SPORT SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 SAUDI ARABIA HIKING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SAUDI ARABIA CLEATS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 SAUDI ARABIA HEALTHCARE SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 SAUDI ARABIA FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 102 SAUDI ARABIA RUBBER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 103 SAUDI ARABIA TEXTILE IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 104 SAUDI ARABIA PLASTIC IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 105 SAUDI ARABIA LEATHER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 106 AUDI ARABIA FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 107 SAUDI ARABIA RUBBER IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 108 SAUDI ARABIA PLASTIC IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 109 SAUDI ARABIA FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 110 SAUDI ARABIA FOOTWEAR MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 111 SAUDI ARABIA WOMEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 SAUDI ARABIA MEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 SAUDI ARABIA CHILDREN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 U.A.E. FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 U.A.E. BOOTS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 U.A.E. ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 U.A.E. RUNNING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 U.A.E. SPORT SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 U.A.E. HIKING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 U.A.E. CLEATS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 U.A.E. HEALTHCARE SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 U.A.E. FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 123 U.A.E. RUBBER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 124 U.A.E. TEXTILE IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 125 U.A.E. PLASTIC IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 126 U.A.E. LEATHER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 127 U.A.E. FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 128 U.A.E. RUBBER IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 129 U.A.E. PLASTIC IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 130 U.A.E. FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 131 U.A.E. FOOTWEAR MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 132 U.A.E. WOMEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 U.A.E. MEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 U.A.E. CHILDREN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 ISRAEL FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 ISRAEL BOOTS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 ISRAEL ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 138 ISRAEL RUNNING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 ISRAEL SPORT SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 140 ISRAEL HIKING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 ISRAEL CLEATS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 ISRAEL HEALTHCARE SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 143 ISRAEL FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 144 ISRAEL RUBBER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 145 ISRAEL TEXTILE IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 146 ISRAEL PLASTIC IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 147 ISRAEL LEATHER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 148 ISRAEL FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 149 ISRAEL RUBBER IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 150 ISRAEL PLASTIC IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 151 ISRAEL FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 152 ISRAEL FOOTWEAR MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 153 ISRAEL WOMEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 ISRAEL MEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 ISRAEL CHILDREN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 EGYPT FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 EGYPT BOOTS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 EGYPT ATHLETIC IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 EGYPT RUNNING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 EGYPT SPORT SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 EGYPT HIKING SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 EGYPT CLEATS IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 EGYPT HEALTHCARE SHOES IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 GYPT FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 165 EGYPT RUBBER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 166 EGYPT TEXTILE IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 167 EGYPT PLASTIC IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 168 EGYPT LEATHER IN FOOTWEAR MARKET, BY SHOE MATERIAL, 2021-2030 (USD MILLION)

TABLE 169 EGYPT FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 170 EGYPT RUBBER IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 171 EGYPT PLASTIC IN FOOTWEAR MARKET, BY SOLING MATERIAL, 2021-2030 (USD MILLION)

TABLE 172 EGYPT FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 173 EGYPT FOOTWEAR MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 174 EGYPT WOMEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 EGYPT MEN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 EGYPT CHILDREN IN FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 REST OF MIDDLE EAST AND AFRICA FOOTWEAR MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA FOOTWEAR MARKET

FIGURE 2 MIDDLE EAST & AFRICA FOOTWEAR MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA FOOTWEAR MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA FOOTWEAR MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA FOOTWEAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA FOOTWEAR MARKET: THE MATERIAL TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA FOOTWEAR MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA FOOTWEAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA FOOTWEAR MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA FOOTWEAR MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA FOOTWEAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST & AFRICA FOOTWEAR MARKET: SEGMENTATION

FIGURE 13 GROWING AWARENESS OF THE LATEST FASHION TRENDS AMONG THE YOUNG GENERATION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA FOOTWEAR MARKET IN THE FORECAST PERIOD

FIGURE 14 THE COTTON SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA FOOTWEAR MARKET IN 2022 & 2029

FIGURE 15 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA FOOTWEAR MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST & AFRICA FOOTWEAR MARKET

FIGURE 18 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY TYPE, 2022

FIGURE 19 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY SHOE MATERIAL, 2022

FIGURE 20 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY SOLING MATERIAL, 2022

FIGURE 21 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY END USER, 2022

FIGURE 22 MIDDLE EAST & AFRICA FOOTWEAR MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 23 MIDDLE EAST AND AFRICA FOOTWEAR MARKET: SNAPSHOT (2022)

FIGURE 24 MIDDLE EAST AND AFRICA FOOTWEAR MARKET: BY COUNTRY (2022)

FIGURE 25 MIDDLE EAST AND AFRICA FOOTWEAR MARKET: BY COUNTRY (2023 & 2030)

FIGURE 26 MIDDLE EAST AND AFRICA FOOTWEAR MARKET: BY COUNTRY (2022 & 2030)

FIGURE 27 MIDDLE EAST AND AFRICA FOOTWEAR MARKET: BY TYPE (2023-2030)

FIGURE 28 MIDDLE EAST & AFRICA FOOTWEAR MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.