Middle East And Africa Foot Ankle Allograft Market

Taille du marché en milliards USD

TCAC :

%

USD

38.35 Million

USD

61.97 Million

2021

2029

USD

38.35 Million

USD

61.97 Million

2021

2029

| 2022 –2029 | |

| USD 38.35 Million | |

| USD 61.97 Million | |

|

|

|

Marché des allogreffes de pied et de cheville au Moyen-Orient et en Afrique , par type de produit (coins d'allogreffe, tendons d'allogreffe, matrice dermique acellulaire d'allogreffe, matrice d'allogreffe de cartilage, allogreffes cutanées, membranes amniotiques), type de chirurgie (reconstruction orthopédique, restauration du cartilage, réparation des tissus mous, tendons et ligaments, soins des plaies), procédure (procédures du médio-pied, procédures de l'arrière-pied), utilisateur final (hôpitaux, cliniques orthopédiques, centres de chirurgie ambulatoire, instituts universitaires et de recherche, autres utilisateurs finaux) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des allogreffes de pied et de cheville au Moyen-Orient et en Afrique

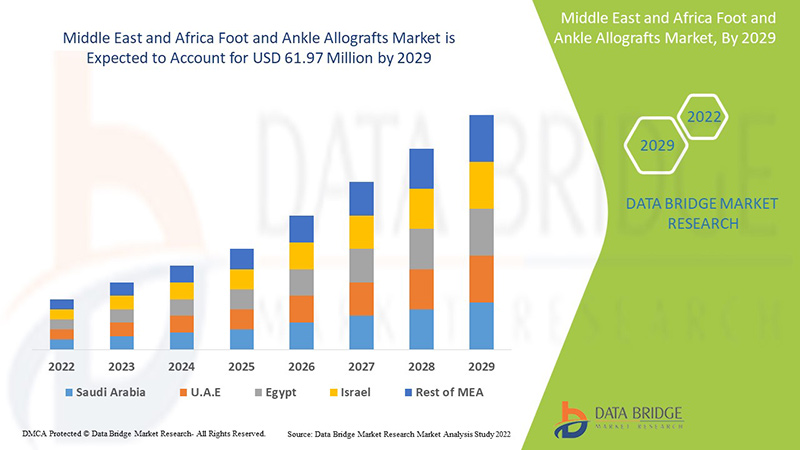

Le marché des allogreffes du pied et de la cheville devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché du Moyen-Orient et de l'Afrique connaît une croissance de 5,9 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 61,97 millions USD d'ici 2029 contre 38,35 millions USD en 2021. La prévalence croissante des maladies orthopédiques et des troubles du pied et de la cheville, ainsi que l'augmentation de la commercialisation continue des produits et l'augmentation de la population gériatrique sont les principaux moteurs qui ont propulsé la demande du marché au cours de la période de prévision.

Les coûts élevés associés aux dispositifs d'allogreffe du pied et de la cheville et le manque d'éducation et de formation formelles peuvent entraver la croissance future du marché des allogreffes du pied et de la cheville. Les partenariats et les acquisitions des principaux acteurs du marché constituent une opportunité pour la croissance du marché des allogreffes du pied et de la cheville.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Marché des allogreffes du pied et de la cheville, par type de produit (coins d'allogreffe, tendons d'allogreffe, matrice dermique acellulaire d'allogreffe, matrice d'allogreffe de cartilage, allogreffes cutanées, membranes amniotiques), type de chirurgie (reconstruction orthopédique, restauration du cartilage, réparation des tissus mous, tendons et ligaments, soins des plaies), par procédure (procédures du médio-pied, procédures de l'arrière-pied), utilisateur final (hôpitaux, cliniques orthopédiques, centres de chirurgie ambulatoire, instituts universitaires et de recherche, autres utilisateurs finaux) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

CONMED Corporation (États-Unis), Wright Medical Group NV (États-Unis), Arthrex (États-Unis), Integra LifeSciences (États-Unis), Smith+Nephew (Royaume-Uni), Zimmer Biomet (États-Unis), AlloSource (États-Unis), Amniox Medical, Inc. (États-Unis), RTI Surgical Holdings, Inc. (États-Unis), JRF Ortho (États-Unis), Bone Bank Allografts (États-Unis), Smith & Nephew. (Royaume-Uni), Paragon 28 (États-Unis), Bioventus, (États-Unis), NVision Biomedical Technologies (États-Unis), DePuy Synthes Companies (États-Unis) |

Dynamique du marché des allogreffes du pied et de la cheville

- Croissance de la population gériatrique

La population gériatrique est plus sujette aux pathologies qui fragilisent les os et les articulations. Chez ces patients, des allogreffes sont utilisées dans le cadre de la procédure pour leur apporter des bénéfices immédiats et efficaces associés à leur corps.

- Incidence croissante des troubles musculo-squelettiques

Les troubles musculo-squelettiques comprennent les fractures associées à une fragilité osseuse, à l'arthrose, aux blessures et aux maladies inflammatoires systémiques telles que la polyarthrite rhumatoïde. Les allogreffes ont été utilisées pour corriger ces déformations ou pour combler les défauts osseux secondaires à un traumatisme, à des lésions ostéochondrales ou à une arthrodèse intercalaire.

Retenue

- Directives réglementaires strictes

Les allogreffes sont réglementées par un ensemble de lois, de règles et de réglementations vastes et complexes visant à les protéger contre toute utilisation dans le cadre de traitements potentiellement nocifs. La nécessité de politiques et de réglementations de confidentialité plus strictes a limité la croissance de ce marché

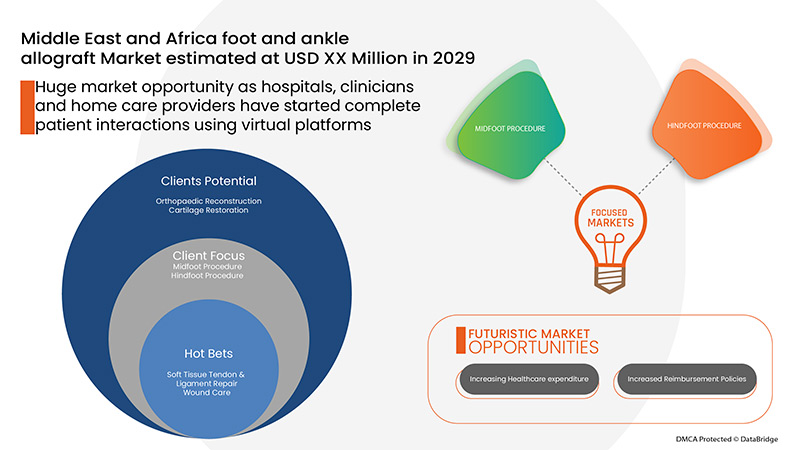

Opportunité

- Politiques de remboursement en hausse

Il est largement admis que l’augmentation de la couverture sanitaire universelle (CSU) favorisera une meilleure accessibilité des patients aux systèmes de santé. De plus, un certain nombre d’organisations ont lancé des politiques de remboursement. Les programmes de politiques visant à couvrir les besoins de santé de la population devraient créer une opportunité significative pour le marché.

Défi

- Manque de sensibilisation aux solutions pour les pieds et les chevilles

Un grand nombre de personnes souffrent de problèmes de pieds et de chevilles dans les pays sous-développés. Ces cas ont tendance à être négligés ou mal gérés, car l'orthopédie de la cheville n'est pas encore devenue la spécialité de l'orthopédie dans les pays en développement. De plus, le manque de connaissances sur la disponibilité des solutions pour les pieds et les chevilles dans la société ainsi que dans la population médicale constitue un défi majeur pour le marché.

Le rapport sur le marché des allogreffes du pied et de la cheville fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Impact post-COVID-19 sur le marché des allogreffes du pied et de la cheville

La COVID-19 a entraîné une augmentation substantielle de la demande de fournitures médicales, tant de la part des professionnels de la santé que du grand public, pour des raisons de précaution. Les fabricants de ces articles ont la possibilité de profiter de la demande accrue de fournitures médicales en garantissant un approvisionnement constant d'équipements de protection individuelle sur le marché. La COVID-19 devrait avoir un impact important sur le marché des allogreffes pour les pieds et les chevilles.

Portée et taille du marché des allogreffes du pied et de la cheville

Le marché des allogreffes du pied et de la cheville est segmenté en fonction du type de produit, du type de chirurgie, de la procédure et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type de produit

- Coins d'allogreffe

- Tendons allogreffes

- Allogreffe de matrice dermique acellulaire

- Matrice d'allogreffe de cartilage

- Allogreffes cutanées

- Membranes amniotiques

Sur la base du type de produit, le marché est segmenté en cales d'allogreffe, tendons d'allogreffe, matrice dermique acellulaire d'allogreffe, matrice d'allogreffe de cartilage, allogreffes cutanées, membranes amniotiques.

Type de chirurgie

- Reconstruction orthopédique

- Restauration du cartilage

- Réparation des tendons et ligaments des tissus mous

- Soins des plaies

Sur la base du type de chirurgie, le marché est segmenté en reconstruction orthopédique, restauration du cartilage, réparation des tendons et ligaments des tissus mous et soins des plaies.

Procédure

- Interventions au niveau du médio-pied

- Interventions sur l'arrière-pied

Sur la base de la procédure, le marché est segmenté en procédures du médio-pied et en procédures de l'arrière-pied.

Utilisateur final

- Hôpitaux

- Cliniques orthopédiques

- Centres de chirurgie ambulatoire

- Instituts universitaires et de recherche

- Autres utilisateurs finaux

Sur la base de l'utilisateur final, le marché est segmenté en hôpitaux, cliniques orthopédiques, centres de chirurgie ambulatoire, instituts universitaires et de recherche, autres utilisateurs finaux.

Analyse du marché des allogreffes du pied et de la cheville au niveau des pays

Le marché des allogreffes du pied et de la cheville est analysé et des informations sur la taille du marché sont fournies par type de produit, type de chirurgie, procédures et utilisateur final.

Les pays couverts dans le rapport sur le marché des allogreffes du pied et de la cheville sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, l’Égypte, Israël, le reste du Moyen-Orient et l’Afrique.

En 2022, le Moyen-Orient et l'Afrique dominent en raison de l'augmentation de la population gériatrique. L'Afrique du Sud devrait connaître une croissance en raison de l'augmentation de la commercialisation continue des produits.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Le marché des allogreffes du pied et de la cheville vous fournit également une analyse de marché détaillée pour chaque pays en termes de croissance de l'industrie du marché des allogreffes du pied et de la cheville. De plus, il fournit des informations détaillées sur les ventes du marché des allogreffes du pied et de la cheville, l'impact des scénarios réglementaires et les paramètres de tendance concernant le marché des allogreffes du pied et de la cheville. Les données sont disponibles pour la période historique de 2011 à 2020.

Analyse du paysage concurrentiel et des parts de marché des allogreffes du pied et de la cheville

Le paysage concurrentiel du marché des allogreffes du pied et de la cheville fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché des allogreffes du pied et de la cheville.

Les principales entreprises présentes sur le marché des allogreffes du pied et de la cheville sont CONMED Corporation (États-Unis), Wright Medical Group NV (États-Unis), Arthrex (États-Unis), Integra LifeSciences (États-Unis), Smith+Nephew (Royaume-Uni), Zimmer Biomet (États-Unis), AlloSource (États-Unis), Amniox Medical, Inc. (États-Unis), RTI Surgical Holdings, Inc. (États-Unis), JRF Ortho (États-Unis), Bone Bank Allografts (États-Unis), Smith & Nephew. (Royaume-Uni), Paragon 28 (États-Unis), Bioventus, (États-Unis), NVision Biomedical Technologies (États-Unis), DePuy Synthes Companies (États-Unis), et d'autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché Europe vs région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 END USER LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

5 INDUSTRIAL INSIGHTS:

5.1 CONCLUSION:

6 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: REGULATIONS

6.1 U.S.

6.2 CANADA

6.3 EUROPE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING GERIATRIC POPULATION

7.1.2 INCREASE IN PREVALENCE OF MUSCULOSKELETAL DISORDER

7.1.3 INCREASE IN HEALTHCARE EXPENDITURE

7.1.4 INCREASE IN STRATEGIC INITIATIVES BY MAJOR MARKET PLAYERS

7.2 RESTRAINTS

7.2.1 STRINGENT REGULATORY

7.2.2 COMPLICATION AND RISK OF ALLOGRAFTS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN NUMBER OF SPORTS INJURIES

7.3.2 RISE IN AWARENESS INITIATIVES ABOUT THE ALLOGRAFT PROCEDURE:

7.3.3 INCREASING RISK OF OSTEOPOROSIS AND OSTEOARTHRITIS:

7.4 CHALLENGES

7.4.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET

7.4.2 ALLOGRAFT IS OFTEN CONSIDERED TOO EXPENSIVE IN LOW-INCOME TO MIDDLE-INCOME COUNTRIES:

7.4.3 HIGHER ADOPTION OF ALTERNATIVE THERAPIES FOR THE TREATMENT OF FOOT AND ANKLE DISORDERS:

8 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ALLOGRAFT WEDGES

8.3 ALLOGRAFT TENDONS

8.4 ALLOGRAFT ACELLULAR DERMAL MATRIX

8.5 CARTILAGE ALLOGRAFT MATRIX

8.6 SKIN ALLOGRAFTS

8.7 AMNIOTIC MEMBRANES

9 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE

9.1 OVERVIEW

9.2 ORTHOPEDIC RECONSTRUCTION

9.2.1 NON-UNIONS FRACTURES

9.2.2 ARTHRODESIS PROCEDURES

9.2.3 OSTEOTOMY PROCEDURES

9.3 CARTILAGE RESTORATION

9.3.1 TALAR DOME REPAIR

9.3.2 TIBIAL PLAFOND REPAIR

9.3.3 METATARSAL REPAIR

9.3.4 TALONAVICULAR JOINT REPAIR

9.3.5 SUBTALAR JOINT REPAIR

9.4 SOFT TISSUE TENDON & LIGAMENT REPAIR

9.4.1 TENDON AUGMENTATION

9.4.2 LIGAMENT REPAIR

9.4.3 FAT PAD REPLACEMENT

9.4.4 PLANTAR PLATE REPAIR

9.5 WOUND CARE

9.5.1 ANKLE ULCER TREATMENT

9.5.2 NEUROPATHIC FOOT ULCER TREATMENT

10 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 MIDFOOT PROCEDURES

10.2.1 CUBOID FRACTURE

10.2.2 FIRST TARSOMETATARSAL JOINT ARTHRODESIS

10.2.3 MEDIAL COLUMN ARTHRODESIS

10.2.4 LISFRANC

10.2.5 MEDIAL CUNEIFORM DORSAL OPENING WEDGE (COTTON) OSTEOTOMY

10.2.6 NAVICULAR CUNEIFORM ARTHRODESIS

10.2.7 NAVICULAR FRACTURE

10.2.8 OTHER MIDFOOT PROCEDURES

10.3 HIND-FOOT PROCEDURES

10.3.1 CALCANEAL FRACTURE

10.3.2 LATERAL COLUMN LENGTHENING

10.3.3 TALONAVICULAR JOINT ARTHRODESIS

10.3.4 TRIPLE ARTHRODESIS

10.3.5 OTHER HINDFOOT PROCEDURES

11 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 ORTHOPEDIC CLINICS

11.4 AMBULATORY SURGICAL CENTERS

11.5 ACADEMIC AND RESEARCH INSTITUTES

11.6 OTHER END USERS

12 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 U.A.E.

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 LIFENET HEALTH

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.1.4.1 CONFERENCE

15.1.4.2 PRODUCT LAUNCH

15.2 ZIMMER BIOMET

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 PARTNERSHIP

15.3 JOHNSON & JOHNSON SERVICES, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.3.5.1 EVENT

15.3.5.2 PRODUCT LAUNCH

15.4 INTEGRA LIFESCIENCES

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.4.5.1 POSITIVE CLINICAL OUTCOME

15.4.5.2 AGREEMENT

15.4.5.3 ACQUISITION

15.5 CONMED CORPORATION (2022)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.5.5.1 ACQUISITION

15.6 ALLOSOURCE

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.6.3.1 PRODUCT LAUNCH

15.7 ALON SOURCE GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AMNIOX MEDICAL INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.8.3.1 PARTNERSHIP

15.9 ARTHREX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.9.3.1 PRODUCT LAUNCH

15.1 BIOVENTUS

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.10.4.1 CO-DEVELOPMENT

15.11 BONE BANK ALLOGRAFTS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.11.3.1 PARTNERSHIP

15.12 GLOBUS MEDICAL

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.12.4.1 M&A

15.13 INSTITUT STRAUMANN

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 JRF ORTHO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 PARTNERSHIP

15.15 NVISION BIOMEDICAL TECHNOLOGIES.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 ACQUISITION

15.16 PARAGON28, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.16.4.1 ACQUISITION

15.17 ORGANOGENESIS INC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.17.4.1 CONFERENCE

15.17.4.2 ACQUISITION

15.18 SMITH + NEPHEW

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.18.4.1 EVENT

15.18.4.2 ACQUISITION

15.19 STRYKER

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 GENERAL AND MEDICAL INFLATION RATES

TABLE 2 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA ALLOGRAFT WEDGES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA ALLOGRAFT TENDONS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ALLOGRAFT ACELLULAR DERMAL MATRIX IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CARTILAGE ALLOGRAFT MATRIX IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA SKIN ALLOGRAFTS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA AMNIOTIC MEMBRANES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA WOUND CARE IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA WOUND CARE IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA HIND-FOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA HIND-FOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA HOSPITALS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA ORTHOPEDIC CLINICS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ACADEMIC AND RESEARCH INSTITUTES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHER END USERS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY COUNTRY 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 SOUTH AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 SOUTH AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 42 SOUTH AFRICA ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.A.E. WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 67 U.A.E. MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 ISRAEL FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 72 ISRAEL ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 ISRAEL CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 74 ISRAEL SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ISRAEL WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ISRAEL FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 77 ISRAEL MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 78 ISRAEL HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 79 ISRAEL FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 EGYPT FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 EGYPT FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 82 EGYPT ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 83 EGYPT CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 84 EGYPT SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 EGYPT WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 86 EGYPT FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 87 EGYPT MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 88 EGYPT HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 REST OF MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR FOOT AND ANKLE ALLOGRAFTS WORLDWIDE AND INCREASING GERIATRIC POPULATION IS DRIVING THE MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ALLOGRAFT WEDGES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFT MARKET

FIGURE 14 SPORTS INJURIES IN ADULTS

FIGURE 15 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY SURGERY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY SURGERY TYPE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PROCEDURE, 2021

FIGURE 24 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PROCEDURE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PROCEDURE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY END USER, 2021

FIGURE 28 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET: SNAPSHOT (2021)

FIGURE 32 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET: BY COUNTRY (2021)

FIGURE 33 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 36 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.