Marché des tests d'allergènes et d'intolérances alimentaires au Moyen-Orient et en Afrique, par type de test ( test d'allergène , test d'intolérance), méthode (in vitro, in vivo), utilisateur final (utilisateur final de test d'allergène, utilisateur final de test d'intolérance) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché

La sécurité et la qualité des aliments sont des préoccupations majeures pour la fabrication de produits alimentaires, le commerce de détail et l'hôtellerie. Elles ont un impact sur la productivité. Les allergies alimentaires augmentent à l'échelle mondiale, notamment le nombre d'allergènes, le taux de sensibilisation et le taux de prévalence. Pour protéger les personnes allergiques aux aliments dans la communauté, les allergies alimentaires doivent être gérées de manière appropriée, testées dans les aliments transformés et correctement étiquetées sur ceux-ci. La présence de tests d'allergènes a récemment augmenté et les laboratoires d'analyse peuvent aider à détecter ces allergènes. La fonction la plus importante des laboratoires d'allergènes alimentaires est de tester les aliments pour détecter la présence d'allergènes tels que le soja , les produits laitiers, les arachides et les noix, entre autres.

La demande de tests alimentaires augmente, et les fabricants s'impliquent dans le lancement de nouveaux produits, les promotions, les récompenses, la certification et la participation à des événements sur le marché. Ces décisions favorisent en fin de compte la croissance du marché.

Le rapport sur le marché des tests d'allergènes et d'intolérances alimentaires fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité. Les initiatives stratégiques telles que la collaboration, l'accord et la signature d'accords de vente pour inventer et innover dans les traitements pharmacologiques sont les principaux moteurs qui ont propulsé la demande du marché au cours de la période de prévision.

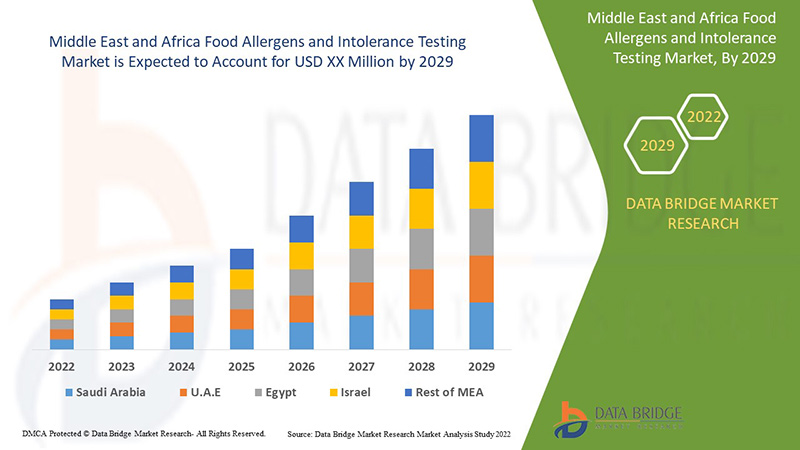

Le marché des tests d'allergènes et d'intolérances alimentaires est favorable et vise à réduire la progression de la maladie. Data Bridge Market Research analyse que le marché des tests d'allergènes et d'intolérances alimentaires connaîtra un TCAC de 5,8 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de test (test d'allergène, test d'intolérance), méthode (in vitro, in vivo), utilisateur final (utilisateur final de test d'allergène, utilisateur final de test d'intolérance) |

|

Pays couverts |

Arabie saoudite, Afrique du Sud, Émirats arabes unis, Oman, Qatar, Koweït, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Français SGS SA, Agilent Technologies, Inc., NEOGEN Corporation, ALS Limited, Mérieux NutriSciences, Eurofins Scientific, Intertek Group plc, TÜV SÜD, Bureau Veritas, Symbio Laboratories, RJ Hill Laboratories Limited, NSF International, Healthy Stuff Online Limited, QIMA, IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH, ADPEN LABORATORIES, INC., AsureQuality, Microbac Laboratories, Inc, Romer Labs Division Holding GmbH, FOOD SAFETY NET SERVICES, PCAS Labs, Element Materials Technology, OMIC USA Inc., entre autres. |

Définition du marché

L'allergie alimentaire est une réaction du système immunitaire qui survient peu de temps après la consommation d'un aliment particulier. Même une petite quantité de l'aliment allergène peut déclencher des signes et symptômes tels que des problèmes digestifs, de l'urticaire ou un gonflement des voies respiratoires. Chez certaines personnes, une allergie alimentaire peut provoquer des symptômes graves, voire une réaction potentiellement mortelle appelée anaphylaxie. Une intolérance alimentaire, en revanche, survient lorsqu'une personne a du mal à digérer un aliment particulier. Cela peut entraîner des symptômes tels que des gaz intestinaux, des douleurs abdominales ou une diarrhée. Les tests d'allergènes et d'intolérances alimentaires sont l'analyse scientifique des aliments et de leur contenu pour la détection des allergènes. Ils sont effectués pour fournir des informations sur les différents composants allergiques des aliments, notamment la structure, la composition et les propriétés physicochimiques de l'aliment. Les tests de produits alimentaires peuvent être effectués à l'aide de plusieurs méthodes très avancées pour fournir des informations précises sur la valeur nutritionnelle et la sécurité des aliments.

Les tests et analyses alimentaires sont essentiels pour garantir la sécurité alimentaire et la salubrité des aliments. Il s'agit notamment d'alimenter le réseau de laboratoires de tests alimentaires, de garantir la qualité des tests, d'investir dans les ressources humaines et de mener des activités de surveillance, ainsi que d'éduquer les consommateurs.

Dynamique du marché des tests d'allergènes et d'intolérances alimentaires

Conducteurs

- Prévalence croissante des allergies et des intolérances alimentaires

Selon l'Organisation mondiale de la santé, les allergies touchent jusqu'à 40 % de la population mondiale, et la proportion de personnes qui en souffrent dans les grandes villes et les pays industrialisés est en augmentation. Elles peuvent provoquer des maladies chroniques et, dans le cas de certaines allergies alimentaires, peuvent être mortelles. L'allergie alimentaire est devenue un problème de santé publique sérieux. La prévalence des allergies alimentaires est estimée à environ 2 à 4 % chez les adultes et 6 à 8 % chez les enfants. Dans les pays occidentaux, les allergies alimentaires diagnostiquées par provocation peuvent atteindre 10 %, la prévalence la plus élevée étant observée chez les jeunes enfants. Il existe également de plus en plus de preuves d'une prévalence croissante dans les pays en développement, les taux d'allergies alimentaires diagnostiquées par provocation en Chine et en Afrique étant similaires à ceux des pays occidentaux. Une observation intéressante est que les enfants d'origine est-asiatique ou africaine nés dans un environnement occidental présentent un risque plus élevé d'allergie alimentaire que les enfants caucasiens ; cette découverte intrigante souligne l'importance des interactions entre le génome et l'environnement et prédit une augmentation future des allergies alimentaires en Asie et en Afrique à mesure que la croissance économique se poursuit dans ces régions. Si l'allergie au lait de vache et à l'œuf est l'une des allergies alimentaires les plus courantes dans la plupart des pays, on observe des schémas d'allergie alimentaire divers dans certaines régions géographiques, déterminés par les habitudes alimentaires de chaque pays. De plus, avec les réactions indésirables non toxiques (hypersensibilité), le taux de prévalence des allergies alimentaires augmente de manière exponentielle. Le nombre croissant de cas d'allergie alimentaire a incité les autorités de santé publique du monde entier à prendre des mesures importantes pour limiter les réactions allergiques et leurs conséquences.

- Une variété d'aliments sensibles aux allergènes crée un besoin de tests

Des aliments pour bébés aux produits de boulangerie et de confiserie, en passant par les produits laitiers, les boissons, les produits de consommation courante et les produits carnés, tous sont susceptibles de provoquer des allergies, ce qui crée un vaste marché de tests d'allergènes alimentaires. De plus, en raison de la mauvaise qualité des aliments pour animaux, il existe toujours un risque que la viande provoque des allergies chez l'homme. Même si l'industrie alimentaire et des boissons observe une augmentation de la demande d'additifs pour l'alimentation animale capables d'améliorer la qualité des aliments, le marché des tests d'intolérance alimentaire reste important pour atténuer les allergies causées par la viande.

Bien que plus de 170 aliments aient été identifiés comme provoquant des allergies alimentaires chez les consommateurs sensibles, l'USDA et la FDA ont identifié huit aliments allergènes majeurs, sur la base du FALCPA de 2004 (Food Allergen Labeling and Consumer Protection Act).

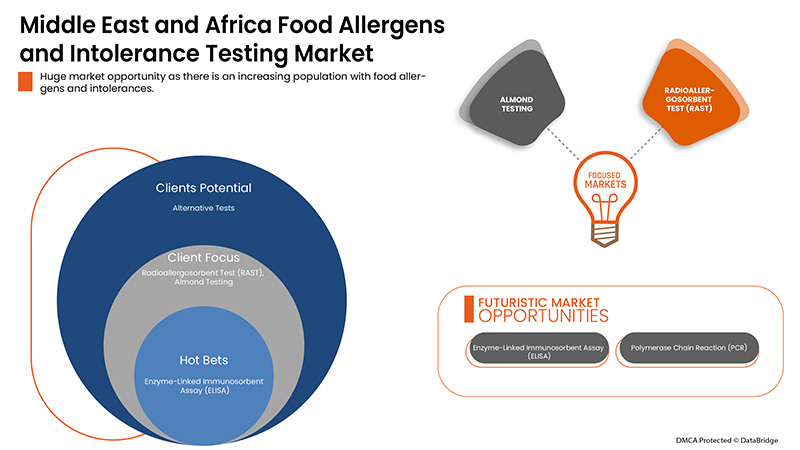

Opportunité

- Tests d'allergènes alimentaires dans les marchés émergents

Selon l'Organisation mondiale des allergies (WAO), les cas d'anaphylaxie aux urgences variaient entre 222, 300-350 et 3 000 épisodes par an en Hongrie, au Japon et en Chine respectivement. En outre, l'organisation estime que le taux de prévalence de l'anaphylaxie est de 2 %, 0,1 % et 0,6-1 % de la population aux États-Unis, en Corée et en Australie. La Food Drugs Administration (FDA) a fait de la sécurité alimentaire un aspect impératif de l'industrie alimentaire, ce qui agit comme un facteur moteur pour le marché. En outre, on constate une augmentation perceptible du nombre de personnes souffrant d'allergies alimentaires depuis les années 1990, ce qui fait du marché des tests d'allergènes alimentaires un segment important dans des pays comme l'Europe, les États-Unis et d'autres.

Contraintes/Défis

De nombreux obstacles entravent le diagnostic correct des allergies alimentaires (AA) dans les pays en développement, car il est prouvé que les connaissances des parents et des professionnels de santé sur les allergies alimentaires sont insuffisantes et que les tests de diagnostic in vitro ne sont pas facilement accessibles. Un diagnostic précoce des AA est important pour le pronostic et une gestion nutritionnelle appropriée. Cependant, même dans les pays développés, un retard de diagnostic de 4 mois est signalé, en particulier chez les nourrissons présentant des manifestations moins graves d'allergie au lait non médiée par les IgE. Cette situation est probablement pire dans les pays en développement ; Aguilar-Jasso et al. ont constaté un retard de 38 mois dans le diagnostic des AA dans le nord-ouest du Mexique.

Le manque d’infrastructures et de ressources de contrôle alimentaire dans les pays en développement et les difficultés techniques lors de l’échantillonnage, des tests et de l’identification des protéines devraient entraver la croissance du marché. Les pays du Moyen-Orient et d’Afrique et d’autres pays à faible revenu restent actuellement limités en raison d’une faible sensibilisation aux allergènes alimentaires et aux tests d’intolérance. Le manque d’initiative gouvernementale, la mauvaise économie et surtout le manque de sensibilisation des individus aux allergies liées aux aliments vont entraver le marché

Cependant, chaque pays est soumis à des directives réglementées par différentes autorités qui devraient constituer un défi à la croissance du marché des tests d'allergènes et d'intolérances alimentaires.

Développements récents

- En décembre 2020, Eurofins Scientific a lancé la gamme de produits SENSI Strip Allergen pour détecter les allergènes alimentaires dans les produits alimentaires emballés. Ce nouveau lancement de produit a aidé l'entreprise à améliorer son portefeuille de produits

- En octobre 2020, NEOGEN Corporation a lancé une nouvelle méthode d'extraction alimentaire pour étendre les capacités des tests d'allergènes alimentaires Reveal 3-D pour tester directement les produits alimentaires. Le nouveau produit Reveal 3-D permet le dépistage rapide d'échantillons d'aliments et d'ingrédients. Le tampon est disponible pour les tests sur les œufs, la noix de coco, la noisette, le soja, l'arachide et l'amande. Le lancement de ce nouveau produit a aidé l'entreprise à élargir son portefeuille de produits de sécurité alimentaire

Partage du marché des tests d'allergies et d'intolérances alimentaires

Le marché des tests d'allergies et d'intolérances alimentaires est classé en trois segments notables qui sont basés sur le type de test, la méthode et l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type d'allergène

- Tests d'allergènes

- Test d'intolérance

Sur la base du type de test, le marché des tests d’allergènes et d’intolérances alimentaires est segmenté en tests d’allergènes et tests d’intolérances.

- Méthode

- In vitro

- In vivo

Sur la base de la méthode, le marché des tests d'allergènes et d'intolérances alimentaires est segmenté en in vitro et in vivo

Utilisateur final

- Test d'allergènes pour l'utilisateur final

- Test d'intolérance pour l'utilisateur final

Sur la base de l'utilisateur final, le marché des tests d'allergènes et d'intolérances alimentaires est segmenté en utilisateur final de tests d'allergènes et utilisateur final de tests d'intolérances.

Analyse/perspectives régionales du marché des tests d'allergies et d'intolérances alimentaires

Le marché des tests d’allergènes et d’intolérances alimentaires est analysé et des informations sur la taille du marché et les tendances sont fournies par type de test, méthode et utilisateur final, comme référencé ci-dessus.

Les régions couvertes par le rapport sur le marché des tests d’allergènes et d’intolérances alimentaires sont l’Arabie saoudite, les Émirats arabes unis, l’Afrique du Sud, l’Égypte, Israël, le reste du Moyen-Orient et l’Afrique.

L'Afrique du Sud domine le marché des tests d'allergènes et d'intolérances alimentaires au Moyen-Orient et en Afrique en termes de part de marché et de revenus du marché et continuera de prospérer sa domination au cours de la période de prévision en raison de l'augmentation des investissements en R&D dans cette région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des tests d'allergènes et d'intolérances alimentaires

Le paysage concurrentiel du marché des tests d'allergènes et d'intolérances alimentaires fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des tests d'allergènes et d'intolérances alimentaires.

Français Certains des principaux acteurs opérant sur le marché des tests d'allergènes et d'intolérances alimentaires sont SGS SA, Agilent Technologies, Inc., NEOGEN Corporation, ALS Limited, Mérieux NutriSciences, Eurofins Scientific, Intertek Group plc, TÜV SÜD, Bureau Veritas, Symbio Laboratories, RJ Hill Laboratories Limited, NSF International, Healthy Stuff Online Limited, QIMA, IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH, ADPEN LABORATORIES, INC., AsureQuality, Microbac Laboratories, Inc, Romer Labs Division Holding GmbH, FOOD SAFETY NET SERVICES, PCAS Labs, Element Materials Technology, OMIC USA Inc., entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché du Moyen-Orient et de l'Afrique par rapport aux régions et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS-

4.1.1 BARGAINING POWER OF CUSTOMERS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 THE THREAT OF NEW ENTRANTS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 RIVALRY AMONG EXISTING COMPETITORS

4.2 VALUE CHAIN ANALYSIS

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 TECHNOLOGY INNOVATIONS

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.6 FACTOR INFLUENCING PURCHASING DECISION OF END-USERS

4.6.1 QUALITY OF THE PRODUCTS:

4.6.2 AVAILABILITY OF A VARIETY OF TESTING TYPES:

4.6.3 WIDE USE IN VARIOUS INDUSTRIES:

4.7 UPCOMING TESTING TECHNOLOGIES

5 REGULATORY FRAMEWORK

5.1 MIDDLE EAST & AFRICA FOOD SAFETY INITIATIVE

5.2 INTERNATIONAL BODY FOR FOOD SAFETY STANDARDS AND REGULATIONS

5.3 FEDERAL LEGISLATION

5.3.1 EUROPEAN UNION

5.3.2 THE U.S.

5.3.3 CANADA

5.3.4 AUSTRALIA

5.4 FDA FOOD SAFETY MODERNIZATION ACT

5.5 FOOD SAFETY ON TRACEABILITY SYSTEMS AND FOOD DIAGNOSTICS

5.6 THE TOXIC SUBSTANCES CONTROL ACT OF 1976

5.7 REGULATORY IMPOSITIONS ON GM LABELING

5.8 RAPID ALERT SYSTEM FOR FOOD AND FEED (RASFF) TO REPORT FOOD SAFETY ISSUES

5.9 OTHERS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF FOOD ALLERGIES AND INTOLERANCE

6.1.2 INCREASED HEALTH CARE EXPENDITURE WORLDWIDE

6.1.3 A VARIETY OF FOODS SUSCEPTIBLE TO ALLERGENS CREATES A NEED FOR TESTING

6.1.4 GROWING AWARENESS OF FOOD ALLERGENS

6.1.5 LABELING COMPLIANCE IN SEVERAL FOOD INDUSTRIES

6.2 RESTRAINTS

6.2.1 UNAVAILABILITY OF FOOD CONTROL INFRASTRUCTURE & RESOURCES

6.2.2 LACK OF AWARENESS ABOUT LABELLING REGULATION

6.2.3 HIGH COST OF TREATMENT

6.3 OPPORTUNITIES

6.3.1 FOOD ALLERGEN TESTING IN EMERGING MARKETS

6.3.2 USE OF HEALTH IN ALLERGY DIAGNOSIS

6.4 CHALLENGES

6.4.1 DIAGNOSTIC CHALLENGES IN DEVELOPING WORLD

6.4.2 LACK OF STANDARDIZATION IN ALLERGEN TESTING PRACTICES

7 POST COVID-19 IMPACT ON FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

8 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 ALLERGEN TESTING

8.3 INTOLERANCE TESTING

9 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY METHOD

9.1 OVERVIEW

9.2 IN-VITRO

9.3 IN-VIVO

10 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET, BY END USER

10.1 OVERVIEW

10.2 ALLERGEN TESTING END USER

10.3 INTOLERANCE TESTING END USER

11 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E

11.1.4 OMAN

11.1.5 QATAR

11.1.6 KUWAIT

11.1.7 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA INHERITED RETINAL DISEASES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT

14 COMPANY PROFILE

14.1 EUROFINS SCIENTIFIC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.1.5.1 ACQUISITION

14.1.5.2 LAUNCH

14.2 SGS SA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SERVICES PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.2.5.1 BUISNESS EXPANSION

14.2.5.2 ACQUISITION

14.3 BUREAU VERITAS

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.5.1 AGREEMENTS

14.3.5.2 AWARD

14.4 TÜV SÜD

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 SERVICE PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.4.4.1 EVENT

14.4.4.2 PATNERSHIP

14.5 ALS LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SERVICE PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.5.5.1 ACQUISITION

14.5.5.2 AWARDS

14.6 NEOGEN CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICE PORTFOLIO

14.6.4 RECENT DEVELOPMENS

14.6.4.1 PRODUCT DEVELOPMENTS

14.6.4.2 AGREEMENT

14.7 INTERTEK GROUP PLC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 SERVICE PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.7.4.1 AWARD

14.7.5 ACQUISITION

14.8 ROMER LABS DIVISION HOLDING GMBH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 QIMA

14.9.1 COMPANY SNAPSHOT

14.9.2 SERVICES PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 MÉRIEUX NUTRISCIENCES

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICES PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 MICROBAC LABORATORIES, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 FOOD SAFETY NET SERVICES

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICES PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 ADPEN LABORATORIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 SERVICES PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 ASUREQUALITY

14.14.1 COMPANY SNAPSHOT

14.14.2 SERVICES PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ELEMENT MATERIALS TECHNOLOGY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 HEALTHY STUFF ONLINE LIMITED

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICES PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 NSF INTERNATIONAL

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.18.3.1 RELOCATION

14.19 OMIC USA INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 SERVICE PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 PCAS LABS

14.20.1 COMPANY SNAPSHOT

14.20.2 SERVICES PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 R J HILL LABORATORIES LIMITED

14.21.1 COMPANY SNAPSHOT

14.21.2 SERVICE PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

14.21.3.1 LAUNCH

14.22 SYMBIO LABORATORIES

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

14.22.3.1 EXPANSION

14.22.3.2 ACQUISITION

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 INCREASING CASES OF FOOD ALLERGIES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN THE FORECAST PERIOD

FIGURE 13 ALLERGEN TESTING IN TESTING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET IN 2022 & 2029

FIGURE 14 VALUE CHAIN OF MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET

FIGURE 16 SELF-REPORTED PREVALENCE OF FOOD ALLERGY IN THE UNITED STATES

FIGURE 17 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, 2022-2029 (USD MILLION)

FIGURE 19 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, CAGR (2022-2029)

FIGURE 20 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY TESTING TYPE, LIFELINE CURVE

FIGURE 21 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, 2021

FIGURE 22 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 23 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY METHOD, LIFELINE CURVE

FIGURE 25 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, 2021

FIGURE 26 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 27 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 28 MIDDLE EAST & AFRICA FOOD ALLERGEN AND INTOLERANCE TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: SNAPSHOT (2021)

FIGURE 30 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021)

FIGURE 31 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 MIDDLE EAST AND AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: BY TESTING TYPE (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA FOOD ALLERGENS AND INTOLERANCE TESTING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.