Middle East And Africa Explosion Proof Equipment Market

Taille du marché en milliards USD

TCAC :

%

USD

1.06 Billion

USD

1.92 Billion

2024

2032

USD

1.06 Billion

USD

1.92 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 1.92 Billion | |

|

|

|

|

Segmentation du marché des équipements antidéflagrants au Moyen-Orient et en Afrique, par offre (matériel, logiciels et services), classe de température (T1 ( 450 °C), T2 ( 300 °C à 200 °C à 135 °C à 100 °C à 85 °C à

Taille du marché des équipements antidéflagrants au Moyen-Orient et en Afrique

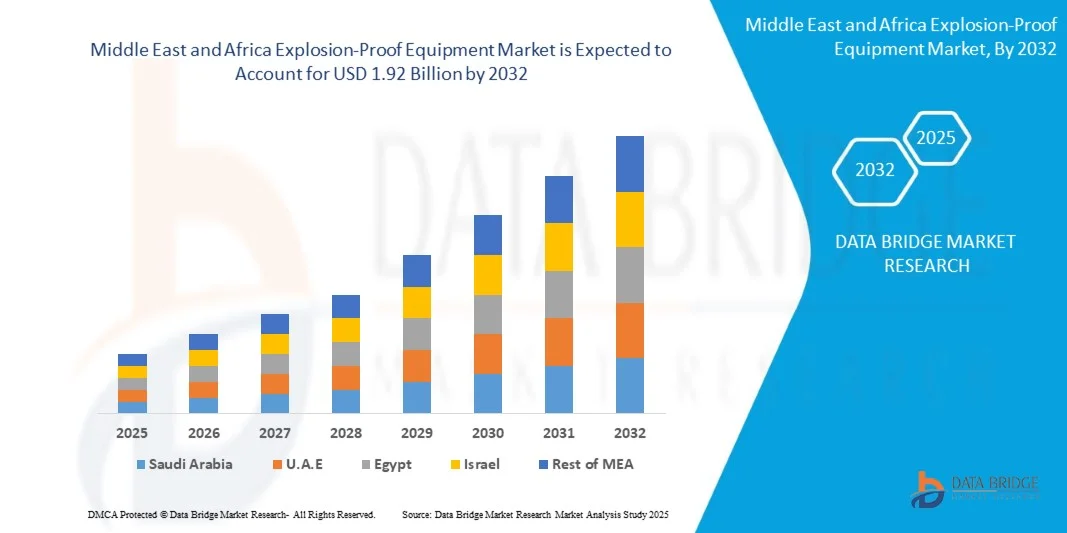

- La taille du marché des équipements antidéflagrants au Moyen-Orient et en Afrique était évaluée à 1,06 milliard USD en 2024 et devrait atteindre 1,92 milliard USD d'ici 2032 , avec un TCAC de 7,70 % au cours de la période de prévision.

- La croissance du marché est principalement tirée par l’industrialisation croissante, les réglementations de sécurité strictes et le besoin croissant de protection contre les risques dans les secteurs du pétrole et du gaz, des mines et de la chimie dans toute la région.

- De plus, l'adoption de technologies d'automatisation avancées et les investissements croissants dans les infrastructures créent une forte demande de solutions durables et antidéflagrantes, accélérant considérablement l'expansion du marché.

Analyse du marché des équipements antidéflagrants au Moyen-Orient et en Afrique

- Les équipements antidéflagrants, conçus pour empêcher l'inflammation dans des environnements dangereux, deviennent de plus en plus essentiels dans les secteurs industriels du Moyen-Orient et d'Afrique, en particulier dans les secteurs du pétrole et du gaz, des mines et du traitement chimique, en raison des exigences de sécurité accrues et des exigences de conformité réglementaire.

- La demande croissante de solutions antidéflagrantes est principalement alimentée par l'augmentation des activités industrielles, la sensibilisation croissante à la sécurité au travail et l'application plus stricte des réglementations de sécurité par les gouvernements régionaux.

- Les Émirats arabes unis ont dominé le marché des équipements antidéflagrants au Moyen-Orient et en Afrique avec la plus grande part de revenus de 33,4 % en 2024, grâce à leur vaste infrastructure pétrolière et gazière, à leurs mégaprojets en cours et à leurs investissements gouvernementaux visant à améliorer la sécurité industrielle et la modernisation.

- L'Arabie saoudite devrait être le pays connaissant la croissance la plus rapide sur le marché des équipements antidéflagrants au Moyen-Orient et en Afrique au cours de la période de prévision en raison de l'industrialisation rapide, de l'augmentation des investissements étrangers et de l'accent stratégique mis sur la protection des travailleurs dans les industries dangereuses.

- Le segment du matériel a dominé le marché avec une part de 62,5 % en 2024, en grande partie grâce à l'utilisation généralisée de composants physiques robustes tels que des boîtiers, des capteurs et des systèmes de contrôle essentiels pour prévenir l'inflammation dans des environnements dangereux.

Portée du rapport et segmentation du marché des équipements antidéflagrants au Moyen-Orient et en Afrique

|

Attributs |

Informations clés sur le marché des équipements antidéflagrants au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande. |

Tendances du marché des équipements antidéflagrants au Moyen-Orient et en Afrique

« Intégration de l'IoT et de la surveillance intelligente dans les environnements dangereux »

- Une tendance clé qui transforme le marché des équipements antidéflagrants est l'intégration de systèmes de surveillance intelligents basés sur l'IoT, qui offrent des diagnostics en temps réel, une maintenance prédictive et un accès à distance dans les environnements à haut risque. Ces systèmes améliorent la sécurité opérationnelle, réduisent les temps d'arrêt et contribuent au respect des normes de sécurité mondiales.

- Par exemple, Pepperl+Fuchs a développé des capteurs intelligents et des interfaces antidéflagrantes qui permettent la communication dans les zones dangereuses tout en offrant des diagnostics et une surveillance des données de processus via des protocoles Ethernet industriels.

- Les équipements antidéflagrants compatibles IoT permettent aux opérateurs de surveiller en temps réel les conditions environnementales telles que la concentration de gaz, la température et la pression, garantissant ainsi des interventions proactives en matière de sécurité. Cette approche basée sur les données contribue également à réduire les fausses alarmes et à garantir une maintenance rapide.

- Les capacités de surveillance intelligente sont particulièrement cruciales dans les secteurs pétrolier et gazier, chimique et minier, où les risques de pannes d'équipement ou de dangers non détectés sont extrêmement élevés. En associant une construction robuste à des fonctionnalités intelligentes, les entreprises peuvent optimiser simultanément la sécurité et les performances.

- Cette tendance pousse des fabricants comme R. STAHL et BARTEC à innover en proposant des solutions antidéflagrantes prêtes à l'emploi, s'intégrant facilement à des systèmes d'automatisation et de contrôle industriels plus vastes. Ces systèmes permettent des mises à niveau évolutives tout en respectant les normes de certification spécifiques à chaque zone.

- Alors que les opérations industrielles continuent de se numériser et que la demande de solutions sûres et efficaces dans les zones dangereuses augmente, l'adoption de systèmes antidéflagrants intelligents et connectés devrait s'accélérer sur les marchés développés et émergents.

Dynamique du marché des équipements antidéflagrants au Moyen-Orient et en Afrique

Conducteur

« Règles de sécurité strictes et sensibilisation croissante aux risques industriels

- Les normes de sécurité strictes imposées par les organismes de réglementation tels que ATEX (Europe), IECEx (International) et NEC (États-Unis) constituent une force majeure qui stimule la demande d'équipements antidéflagrants dans les environnements industriels dangereux.

- Par exemple, les industries en Europe et au Moyen-Orient ont de plus en plus adopté des solutions antidéflagrantes certifiées conformément aux mandats de conformité régionaux visant à minimiser les risques d’explosion et à protéger les travailleurs.

- La prise de conscience croissante des risques industriels, associée à l'augmentation des investissements dans les infrastructures de sécurité, a stimulé la demande d'industries telles que le pétrole et le gaz, la pétrochimie, les produits pharmaceutiques et l'exploitation minière, où les atmosphères volatiles sont courantes.

- Les dispositifs antidéflagrants, notamment les boîtiers, les systèmes d'éclairage, les moteurs et les presse-étoupes, sont essentiels pour prévenir les sources d'inflammation et leur utilisation s'étend en raison d'une automatisation accrue et du déploiement de systèmes électriques dans les zones explosives.

- Des acteurs majeurs tels qu'ABB et Eaton lancent des produits certifiés conformes aux réglementations internationales de sécurité et offrant également des fonctionnalités numériques, permettant des opérations plus sûres et plus intelligentes dans des environnements exigeants.

Retenue/Défi

« Coûts d'installation élevés et complexité de maintenance »

- L’un des défis majeurs auxquels est confronté le marché des équipements antidéflagrants est le coût élevé de l’installation et la complexité continue de la maintenance en conformité avec les normes de sécurité mondiales.

- Par exemple, l’installation d’équipements certifiés dans des environnements de zone 0 ou de zone 1 nécessite une ingénierie spécialisée, des matériaux robustes et une main-d’œuvre qualifiée, ce qui augmente le coût global du projet et dissuade les petits opérateurs.

- Maintenir les performances et la conformité de ces équipements nécessite des inspections, des étalonnages et une documentation réguliers, ce qui peut être gourmand en ressources. Ceci est particulièrement complexe dans les zones reculées ou offshore où l'accès est limité.

- Le non-respect des conditions certifiées peut entraîner une non-conformité réglementaire ou un dysfonctionnement des équipements, augmentant ainsi les risques de responsabilité. Par conséquent, les entreprises doivent investir dans du personnel qualifié et des systèmes de surveillance sophistiqués.

- Pour résoudre ce problème, les fabricants s'efforcent de rationaliser la conception des produits, d'allonger les intervalles de maintenance et d'introduire des solutions modulaires qui réduisent les coûts totaux du cycle de vie sans compromettre la sécurité ou la conformité.

Portée du marché des équipements antidéflagrants au Moyen-Orient et en Afrique

Le marché est segmenté en fonction de l’offre, de la classe de température, de la zone, du service de connectivité, de l’emplacement, de la méthode de protection, de l’équipement et de l’utilisateur final.

- En offrant

Le marché des équipements antidéflagrants au Moyen-Orient et en Afrique est segmenté en matériel, logiciels et services. Le segment du matériel a dominé le marché avec une part de 62,5 % en 2024, principalement grâce à l'utilisation généralisée de composants physiques robustes, tels que des boîtiers, des capteurs et des systèmes de contrôle, essentiels pour prévenir les inflammations en environnements dangereux. Ces composants sont essentiels dans des secteurs tels que le pétrole, le gaz et la chimie, où la sécurité est primordiale.

Le secteur des services devrait enregistrer le TCAC le plus rapide, soit 21,3 % entre 2025 et 2032, grâce à la demande croissante de services d'installation, de maintenance, d'inspection et de conformité réglementaire. La complexité croissante des systèmes antidéflagrants et la nature critique de leur maintenance encouragent le recours à des services professionnels, garantissant la sécurité opérationnelle et le respect des normes industrielles strictes.

- Par classe de température

En fonction des classes de température, le marché est classé en T1 (> 450 °C), T2 (> 300 °C à < 450 °C), T3 (> 200 °C à < 300 °C), T4 (> 135 °C à < 200 °C), T5 (> 100 °C à < 135 °C) et T6 (> 85 °C à < 100 °C). Le segment T4 détenait la plus grande part de marché en 2024, avec 35,7 %. Il couvre une large gamme d'équipements industriels utilisés en atmosphères volatiles et offre des seuils de température de fonctionnement sûrs, idéaux pour les raffineries et les usines de transformation.

Le segment T6 devrait connaître le TCAC le plus élevé, soit 22,1 %, entre 2025 et 2032, grâce à la demande croissante des industries pharmaceutiques, agroalimentaires et poussiéreuses, où les températures d'inflammation sont basses et où le respect strict des normes de sécurité est obligatoire. Ces industries dépendent fortement des dispositifs classés T6 pour garantir la sécurité opérationnelle dans des conditions très sensibles.

- Par zone

Le marché des équipements antidéflagrants est segmenté en zones 0, 1, 2, 20, 21 et 22. La zone 1 dominait le marché avec 40,2 % de parts de marché en 2024, reflétant son exposition fréquente aux atmosphères explosives lors des opérations de routine, notamment dans les installations pétrolières et gazières en amont et les usines chimiques. Les équipements conçus pour la zone 1 sont conçus pour offrir une durabilité et une étanchéité optimales afin de résister aux sources d'inflammation.

Le segment de la Zone 21 devrait enregistrer le TCAC le plus rapide, soit 20,7 % entre 2025 et 2032, grâce à une adoption croissante dans les secteurs où les poussières explosives sont présentes par intermittence, notamment la minoterie alimentaire, la fabrication de produits pharmaceutiques et le stockage agricole. Ces environnements nécessitent des équipements spécialisés pour gérer les risques d'explosion liés aux poussières combustibles.

- Par service de connectivité

En termes de services de connectivité, le marché se divise en services filaires et sans fil. En 2024, le segment filaire détenait une part dominante de 70,1 %, privilégiant la fiabilité et la sécurité des communications dans les environnements industriels où la transmission de données critiques est essentielle. La connectivité filaire minimise les risques liés aux interférences électromagnétiques, fréquentes dans les zones à risque d'explosion.

Le segment sans fil devrait connaître la croissance la plus rapide, avec un TCAC de 24,5 % entre 2025 et 2032, grâce à la numérisation des installations industrielles et à l'intégration de capteurs et de dispositifs de surveillance compatibles IoT. La connectivité sans fil améliore la collecte de données en temps réel, simplifie l'installation et offre des capacités de surveillance à distance, de plus en plus prisées dans les zones dangereuses.

- Par emplacement

Selon la localisation, le marché est segmenté en équipements d'intérieur et d'extérieur. Le segment extérieur était en tête du marché avec une part de marché de 55,6 % en 2024, grâce aux installations robustes requises pour les plateformes pétrolières, les gazoducs et les exploitations minières, qui nécessitent des dispositifs antidéflagrants résistants aux intempéries et durables pour prévenir les risques d'inflammation.

Le segment intérieur devrait connaître le TCAC le plus élevé entre 2025 et 2032, avec un taux de croissance annuel composé (TCAC) de 19,8 %, en raison du renforcement des normes de sécurité dans les espaces industriels clos tels que les laboratoires, les chaînes de production et les entrepôts. Les équipements intérieurs doivent gérer les risques liés à l'accumulation de gaz ou de poussières dans les zones confinées, ce qui accroît la demande de solutions antidéflagrantes avancées.

- Par méthode de protection

En fonction des méthodes de protection, le marché est segmenté en méthodes de protection antidéflagrantes, de prévention des explosions et de ségrégation des explosions. En 2024, la prévention des explosions représentait la plus grande part de chiffre d'affaires, soit 28,1 %, en raison du besoin croissant d'équipements de sécurité intrinsèque minimisant l'énergie pour prévenir l'inflammation, notamment dans les secteurs pharmaceutique et chimique qui privilégient la sécurité proactive.

La méthode antidéflagrante devrait connaître le taux de croissance le plus rapide, soit 22,6 % de TCAC entre 2025 et 2032, grâce à son efficacité à contenir les explosions dans des enceintes, une exigence cruciale dans les environnements à haut risque tels que les raffineries de pétrole et les usines à gaz. Ce segment bénéficie de réglementations de sécurité strictes exigeant des stratégies de confinement fiables.

- Par équipement

Le marché des équipements antidéflagrants comprend les presse-étoupes et accessoires, les instruments de process, les commandes industrielles, les moteurs, les feux stroboscopiques, les produits d'éclairage, les capteurs, les avertisseurs sonores et sonores, les avertisseurs/points d'appel incendie, les haut-parleurs et générateurs de sons, ainsi que les combinés visuels et sonores. Les presse-étoupes et accessoires détenaient la plus grande part de marché en 2024, avec 31,3 %, car ils sont essentiels au maintien de l'intégrité du boîtier et à la prévention de la propagation des flammes par les entrées de câbles.

Le segment des capteurs devrait connaître le TCAC le plus rapide de 25,0 % entre 2025 et 2032, grâce à l'adoption croissante de technologies de surveillance environnementale en temps réel et de maintenance prédictive, qui améliorent la sécurité et l'efficacité opérationnelle dans des conditions dangereuses.

- Par utilisateur final

En termes d'utilisateur final, le marché comprend les secteurs du pétrole et du gaz, de la chimie et de la pétrochimie, de l'énergie et de l'électricité, des mines, de la pharmacie, de l'agroalimentaire, de la marine et de la construction navale, de l'aérospatiale, de l'armée et de la défense, entre autres. Le secteur pétrolier et gazier détenait la plus grande part de marché, avec 34,5 % en 2024, en raison du besoin crucial de l'industrie en solutions antidéflagrantes pour atténuer les risques liés aux activités d'extraction, de raffinage et de distribution.

Le secteur pharmaceutique devrait enregistrer le TCAC le plus rapide de 21,9 % au cours de la période 2025-2032, propulsé par des mandats réglementaires stricts pour des environnements de fabrication sûrs, en particulier dans les processus impliquant des solvants volatils et des ingrédients pharmaceutiques actifs.

Analyse régionale du marché des équipements antidéflagrants au Moyen-Orient et en Afrique

- Les Émirats arabes unis dominent le marché des équipements antidéflagrants avec la plus grande part de revenus de 33,4 % en 2024, grâce à des réglementations strictes en matière de sécurité industrielle, à des investissements croissants dans les infrastructures pétrolières et gazières et à une forte présence d'industries dangereuses basées sur des emplacements

- La région bénéficie d'une adoption technologique avancée, d'une application réglementaire cohérente par des organismes tels que l'OSHA et le NEC, et d'une forte demande de solutions antidéflagrantes dans les secteurs de la transformation chimique et de l'énergie.

- La croissance est également soutenue par une base industrielle mature, une intégration rapide des solutions IoT industrielles dans les environnements dangereux et une importance accrue accordée à la conformité en matière de sécurité des travailleurs dans les installations industrielles existantes et nouvelles.

Aperçu du marché des équipements antidéflagrants en Arabie saoudite

L'Arabie saoudite a conquis la plus grande part de revenus, soit 40,01 %, sur le marché des équipements antidéflagrants au Moyen-Orient et en Afrique en 2024. Cette domination est due aux vastes opérations pétrolières et gazières du Royaume, à son infrastructure pétrochimique et à ses investissements continus dans le cadre des initiatives Vision 2030. Le strict respect de la réglementation dans les environnements dangereux, ainsi que les flux de capitaux importants vers les mégaprojets énergétiques et industriels, stimulent une demande soutenue d'équipements antidéflagrants, tant dans les opérations en amont qu'en aval.

Aperçu du marché des équipements antidéflagrants en Afrique du Sud

Le marché sud-africain des équipements antidéflagrants connaît un essor considérable, principalement grâce à l'augmentation des activités minières et manufacturières. Le secteur minier, bien établi dans le pays, et les efforts visant à réduire les accidents du travail favorisent le déploiement d'éclairages, d'enceintes et d'instruments antidéflagrants. De plus, les politiques gouvernementales favorisant la sécurité des travailleurs dans des environnements instables stimulent la demande d'équipements conformes et robustes sur les principaux sites industriels.

Part de marché des équipements antidéflagrants au Moyen-Orient et en Afrique

L'industrie des équipements antidéflagrants est principalement dirigée par des entreprises bien établies, notamment :

- R. STAHL AG (Allemagne)

- Extronics (Royaume-Uni)

- Honeywell International Inc (États-Unis)

- ABB (Suisse)

- BARTEC Top Holding GmbH (Allemagne)

- Eaton (Irlande)

- Pepperl+Fuchs (Allemagne)

- Bosch Rexroth AG (Allemagne)

- MaréchalElectric (France)

- Pelco (États-Unis)

- DEHN SE (Allemagne)

- Schneider Electric (France)

- nVent (Royaume-Uni)

- Axis Communications AB (Suède)

- ClearView Communications LTD (Royaume-Uni)

- Zenitel (Norvège)

- MIRETTI (Italie)

- Emerson Electric Co (États-Unis)

Quels sont les développements récents sur le marché des équipements antidéflagrants au Moyen-Orient et en Afrique ?

- En novembre 2024, Konecranes a élargi sa gamme d'équipements antidéflagrants avec le lancement du palan électrique à chaîne série EX C, conçu pour une utilisation dans les environnements dangereux des zones 1/2/21. Lancé dans les régions EMEA et APAC, ce palan intègre des fonctionnalités avancées de sécurité et d'efficacité, le rendant idéal pour les opérations en atmosphères explosives telles que les raffineries de pétrole, les usines chimiques et les installations gazières.

- En août 2022, ARCHON Industries, Inc. a lancé le luminaire antidéflagrant EX20100, spécialement conçu pour fournir un éclairage continu à divers équipements industriels en zones dangereuses et non dangereuses. Conçu pour une utilisation dans les zones de Classe I, Division I, Groupe C&D et Classe I, Division II, Groupe C&D, ce luminaire améliore la sécurité et la visibilité dans les environnements difficiles.

- En avril 2022, Mitsubishi Heavy Industries, Ltd., en partenariat avec ENEOS Corporation, a présenté le robot d'inspection d'usine « EX ROVR » de deuxième génération, doté de capacités antidéflagrantes. Grâce à la technologie de télémaintenance, il améliore la sécurité des travailleurs, accroît l'efficacité du travail et assure des inspections continues des installations en atmosphères potentiellement explosives, répondant ainsi aux exigences du marché des équipements antidéflagrants.

- En février 2022, Pyroban a réintroduit son service de conseil en solutions antidéflagrantes pour aider les fabricants à répondre à leurs besoins de conception et de certification Ex ou à pallier la pénurie de compétences. Ce service accélère la mise sur le marché des produits antidéflagrants, minimisant ainsi les coûts de certification Ex. Il constitue une ressource précieuse pour les fabricants confrontés aux complexités du marché des équipements antidéflagrants.

- En mai 2021, Zenitel et AMAG Technology ont collaboré pour fournir une solution de sécurité de pointe à un projet immobilier de West Los Angeles. D'une superficie de 18 000 m² répartie sur huit étages, le projet intègre des équipements antidéflagrants pour garantir la sécurité des bureaux et des appartements.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.