Middle East And Africa Edible Oils Market

Taille du marché en milliards USD

TCAC :

%

USD

4,803.28 Million

USD

8,503.00 Million

2021

2029

USD

4,803.28 Million

USD

8,503.00 Million

2021

2029

| 2022 –2029 | |

| USD 4,803.28 Million | |

| USD 8,503.00 Million | |

|

|

|

Marché des huiles comestibles au Moyen-Orient et en Afrique, par type ( huile de palme , huile de soja, huile de colza, huile de tournesol, huile d’arachide, huile mélangée de spécialité, huile d’olive, huile de maïs, huile de lin, huile d’avocat, huile de noix, huile de pépins de citrouille, huile de pépins de raisin, autres), type d’emballage (contenants en fer blanc, contenants en PEHD (polyéthylène haute densité), bouteilles en PVC (polychlorure de vinyle), bouteilles en PET (polyéthylène téréphtalate), bouteilles en verre, contenants semi-rigides, sachets en plastique souple, autres), canal de distribution (direct, indirect), utilisateur final (domestique, industriel, restauration, autres) – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché

L'huile alimentaire occupe une place importante dans le secteur de l'alimentation et des boissons à travers le monde. Elle est consommée chaque jour par des millions de personnes dans les restaurants, les cafétérias et les hôtels, entre autres. Les fabricants travaillent au développement de ces huiles pour offrir des options plus saines aux consommateurs.

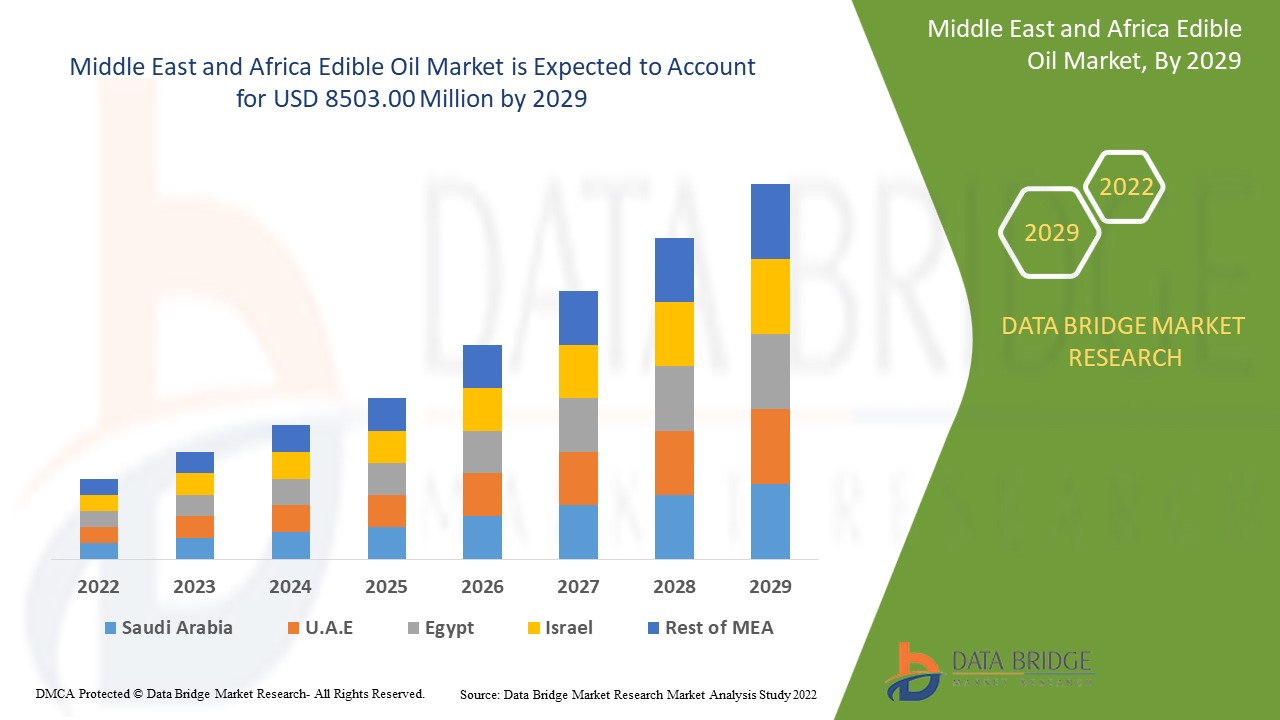

Français Le marché des huiles comestibles au Moyen-Orient et en Afrique était évalué à 4 803,28 millions USD en 2021 et devrait atteindre 8 503,00 millions USD d'ici 2029, enregistrant un TCAC de 7,40 % au cours de la période de prévision 2022-2029. Les nationaux représentent le plus grand segment d'utilisateurs finaux en raison de la forte consommation à des fins domestiques. En plus des informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario de marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend également une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production, une analyse des brevets et le comportement des consommateurs.

Définition du marché

L'huile comestible désigne un liquide extrait de plantes, de légumes et de graines. Ce type d'huiles contient des acides gras, des anti- oxydants et des phospholipides, entre autres. L'huile comestible est largement consommée par les humains et l'industrie de transformation des aliments . Cette huile est connue pour avoir une faible teneur en matières grasses, en calories et en cholestérol.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Type (huile de palme, huile de soja, huile de colza, huile de tournesol, huile d'arachide, huile mélangée spéciale, huile d'olive, huile de maïs, huile de lin, huile d'avocat, huile de noix, huile de pépins de courge, huile de pépins de raisin, autres), type d'emballage (contenants en fer blanc, contenants en PEHD (polyéthylène haute densité), bouteilles en PVC (polychlorure de vinyle), bouteilles en PET (polyéthylène téréphtalate), bouteilles en verre, contenants semi-rigides, sachets en plastique souple, autres), canal de distribution (direct, indirect), utilisateur final (domestique, industriel, restauration, autres) |

|

Pays couverts |

Émirats arabes unis, Arabie saoudite, Oman, Qatar, Koweït, Afrique du Sud, reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA) |

|

Acteurs du marché couverts |

Bunge Limited (États-Unis), ADM (États-Unis), Cargill, Incorporated (États-Unis), ACH Food Companies, Inc. (États-Unis), Adani Group (Inde), SALAD OILS INTERNATIONAL CORPORATION (États-Unis), American Vegetable Oils, Inc. (États-Unis), BORGES INTERNATIONAL GROUP, SL (Espagne), Hebany Group (Émirats arabes unis), NGO CHEW HONG EDIBLE OIL PTE LTD (Singapour), TITAN OILS Inc. (Canada), Ragasa - Derechos Reservados (Mexique), SOVENA (Thaïlande) et Sunora Foods (Canada), entre autres |

|

Opportunités de marché |

|

Dynamique du marché des huiles alimentaires au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Inclination vers un mode de vie sain

L'augmentation des préférences des consommateurs pour les améliorations alimentaires constitue l'un des principaux facteurs de croissance du marché des huiles alimentaires. La tendance croissante à adopter un mode de vie sain dans toutes les tranches d'âge, en s'orientant vers une approche saine et innovante, a un impact positif sur l'industrie.

- Prévalence de l'obésité

L'augmentation de la prévalence de l'obésité au sein de la population influence encore davantage le marché. Les personnes qui font appel à des diététiciens et des nutritionnistes pour leur proposer des régimes alimentaires personnalisés dans le but de perdre du poids contribuent à la croissance du marché.

- Sensibilisation à un mode de vie sain

La prise de conscience croissante de l'importance d'un mode de vie sain accélère la croissance du marché. La prévalence de diverses maladies chroniques, telles que le diabète et les maladies cardiovasculaires, entre autres, encourage les gens à adopter l'huile alimentaire.

- Augmentation de la demande en aliments fonctionnels

L'augmentation des produits alimentaires fonctionnels influence également la croissance du marché. De plus, l'augmentation du nombre de consommateurs à la recherche d'options alimentaires saines et durables ainsi que le nombre croissant d'amateurs de sport et de salles de sport contribuent à l'expansion du marché.

De plus, le changement de mode de vie, l’augmentation du revenu disponible et la sensibilisation accrue aux avantages du régime nutritionnel ont un effet positif sur le marché des huiles comestibles.

Opportunités

En outre, l’augmentation de la demande de produits à base d’huile comestible propre offre des opportunités rentables aux acteurs du marché au cours de la période de prévision de 2022 à 2029. En outre, les activités de recherche et développement élargiront encore le marché.

Contraintes/Défis

D’autre part, le coût élevé des produits et la disponibilité limitée des matières premières devraient entraver la croissance du marché. En outre, l’utilisation d’ingrédients artificiels/synthétiques dans diverses applications entraînant des risques pour la santé et un manque de cohérence dans la réglementation devrait mettre à mal le marché des huiles alimentaires au cours de la période de prévision 2022-2029.

Ce rapport sur le marché des huiles comestibles fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des huiles comestibles, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché des huiles alimentaires au Moyen-Orient et en Afrique

La COVID-19 a eu un impact négatif sur plusieurs industries. Cependant, le marché des huiles alimentaires a connu une croissance significative au cours de cette période. Pendant le confinement imposé par le gouvernement pour limiter la propagation de la maladie à coronavirus, la plupart de la population s'est vivement intéressée à l'adoption de régimes alimentaires sains. Les gens adoptent des compléments alimentaires pour renforcer leur immunité face aux complications de santé croissantes. L'importance croissante accordée à la bonne santé va continuer à accroître la croissance du marché dans le scénario post-pandémique.

Portée et taille du marché des huiles alimentaires au Moyen-Orient et en Afrique

Le marché des huiles alimentaires est segmenté en fonction du type, du type d'emballage, du canal de distribution et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Huile de palme

- Huile de soja

- Huile de colza

- Huile de tournesol

- Huile d'arachide

- Huile mélangée de spécialité

- Huile d'olive

- Huile de maïs

- Huile de lin

- Huile d'avocat

- Huile de noix

- Huile de pépins de courge

- Huile de pépins de raisin

- Autres

Type de paquet

- Contenants en fer blanc

- Conteneurs en PEHD (polyéthylène haute densité)

- Bouteilles en PVC (polychlorure de vinyle)

- Bouteilles en PET (polyéthylène téréphtalate)

- Bouteilles en verre, contenants semi-rigides

- Sachets en plastique souple

- Autres

Canal de distribution

- Direct

- Indirect

Utilisateur final

- Domestiques

- Industriel

- Services de restauration

- Autres

Analyse/perspectives régionales du marché des huiles alimentaires au Moyen-Orient et en Afrique

Le marché des huiles comestibles est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type, type d’emballage, canal de distribution et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des huiles comestibles sont les Émirats arabes unis, l'Arabie saoudite, Oman, le Qatar, le Koweït, l'Afrique du Sud, le reste du Moyen-Orient et de l'Afrique (MEA) dans le cadre du Moyen-Orient et de l'Afrique (MEA).

La région du Moyen-Orient et de l'Afrique connaît le TCAC le plus élevé en raison des opportunités émergentes en Afrique du Sud pour le bien-être et la nutrition animale et une production et une consommation accrues d'aliments transformés en raison de la préférence des consommateurs qui ont stimulé le marché de la région du Moyen-Orient et de l'Afrique.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des huiles alimentaires au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des huiles comestibles fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des huiles comestibles.

Certains des principaux acteurs opérant sur le marché de l’huile comestible sont

- Bunge Limited (États-Unis)

- ADM (États-Unis)

- Cargill, Incorporated (États-Unis)

- ACH Food Companies, Inc. (États-Unis)

- Groupe Adani (Inde)

- SALAD OILS INTERNATIONAL CORPORATION (ÉTATS-UNIS)

- Huiles Végétales Américaines, Inc. (États-Unis)

- GROUPE BORGES INTERNATIONAL, SL (Espagne)

- Groupe Hebany (EAU)

- ONG CHEW HONG EDIBLE OIL PTE LTD (Singapour)

- TITAN OILS Inc., (Canada

- Ragasa - Derechos Reservados (Mexique)

- SOVENA (Thaïlande)

- Aliments Sunora (Canada)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA EDIBLE OIL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: LIST OF SUBSTITUTES

6 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: MARKETING STRATEGIES

7 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: REGULATORY FRAMEWORK

7.1 LABELLING REQUIREMENTS (NORTH AMERICA)

7.2 LABELLING REQUIREMENTS (EUROPEAN UNION)

7.3 DOSAGE RECOMMENDATIONS IN DIFFERENT PET ANIMALS

7.4 EDIBLE OILS CERTIFICATIONS

7.4.1 ORGANIC:

7.4.2 AGMARK CERTIFICATION

7.4.3 PLANT AND PLANT PRODUCTS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 EASY AVAILABILITY OF RAW MATERIALS

8.1.2 HEALTH BENEFITS ASSOCIATED WITH EDIBLE OILS

8.1.3 INCREASING DEMAND FOR FORTIFIED EDIBLE OILS

8.1.4 OIL PACKAGING INNOVATIONS

8.1.5 INCREASING DEMAND FOR ORGANIC EDIBLE OIL PRODUCTS

8.2 RESTRAINTS

8.2.1 INTERNATIONAL PRICES OF OILSEEDS AND VEGETABLE OILS

8.2.2 ADULTERATION IN EDIBLE OILS

8.2.3 OBESITY AND EDIBLE OILS

8.3 OPPORTUNITIES

8.3.1 INTRODUCTION OF CLEAN LABELLED EDIBLE OIL PRODUCTS

8.3.2 PREMIUM EDIBLE OIL PRODUCTS

8.3.3 E-COMMERCE CONTINUES TO CREATE OPPORTUNITIES

8.4 CHALLENGES

8.4.1 INCREASING COMPETITION

8.4.2 HEALTH ISSUES ASSOCIATED WITH THE CONSUMPTION OF EDIBLE OILS

9 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY TYPE

9.1 OVERVIEW

9.2 PALM OIL

9.3 OLIVE OIL

9.4 SOYBEAN OIL

9.5 SUNFLOWER OIL

9.6 SPECIALTY BLENDED OIL

9.7 CORN OIL

9.8 RAPESEED OIL

9.9 FLAXSEED OIL

9.1 AVOCADO OIL

9.11 PUMPKIN SEED OIL

9.12 WALNUT OIL

9.13 PEANUT OIL

9.14 GRAPESEED OIL

9.15 OTHER

10 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY PACKAGE TYPE

10.1 OVERVIEW

10.2 TIN PLATE CONTAINERS

10.3 GLASS BOTTLES

10.4 SEMI - RIGID CONTAINERS

10.5 HDPP (HIGH DENSITY POLYETHYLENE CONTAINERS) CONTAINERS

10.6 PET (POLYETHYLENE PTERAPTHALATE) BOTTLES

10.7 PVC (POLY VINYL CHLORIDE) BOTTLES

10.8 FLEXIBLE PLASTIC POUCHES

10.9 OTHERS

11 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

11.3.1 GROCERY STORE

11.3.2 SUPERMARKETS/HYPERMARKETS

11.3.3 CONVENIENCE STORES

11.3.4 SPECIALTY STORES

11.3.5 E-COMMERCE

11.3.6 OTHERS

12 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY END USER

12.1 OVERVIEW

12.2 DOMESTIC

12.3 FOOD SERVICE

12.3.1 RESTAURANTS

12.3.2 CANTEENS

12.3.3 OTHERS

12.4 INDUSTRIAL

12.5 OTHERS

13 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY REGION

13.1 MIDDLE EAST & AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E

13.1.4 OMAN

13.1.5 QATAR

13.1.6 KUWAIT

13.1.7 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15 SWOT

16 COMPANY PROFILE

16.1 ADANI GROUP

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 VENDOR SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 BUNGE LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 VENDOR SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ADM

16.3.1 COMPANY SNAPSHOT

1.2.1 REVENUE ANALYSIS

16.3.2 VENDOR SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 CARGILL, INCORPORATED.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 VENDOR SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 ACH FOOD COMPANIES, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 AJANTA SOYA LIMITED

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AMERICAN VEGETABLE OILS, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BASSO FEDELE & FIGLI

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BORGES INTERNATIONAL GROUP, S.L.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 EDIBLE OILS LTD

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 HEBANY GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 HENRY LAMOTTE OILS GMBH

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 NGO CHEW HONG EDIBLE OIL PTE LTD’S (A SUBSIDIARY OF MEWAH GROUP)

16.13.1 COMPANY SNAPSHOT

1.8.1 REVENUE ANALYSIS

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 OLENEX SÀRL

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 OLYMPIC OILS LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 RAGASA - DERECHOS RESERVADOS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 RUCHI SOYA INDUSTRIES LTD

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 SALAD OILS INTERNATIONAL CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SOVENA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 ,SUNORA FOODS

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 TITAN OILS INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 VALTRIS SPECIALTY CHEMICALS

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 APPROXIMATE FAT CONTENT OF MAJOR EDIBLE OILS

TABLE 2 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA PALM OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA OLIVE OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA SOYBEAN OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA SUNFLOWER OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA SPECIALTY BLENDED IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA CORN OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA RAPESEED OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA FLAXSEED OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA AVOCADO OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA PUMPKIN SEED OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA WALNUT OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA PEANUT OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA GRAPESEED OIL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA OTHERS IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA TIN PLATE CONTAINERS IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 19 MIDDLE EAST AND AFRICA GLASS BOTTLES IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 20 MIDDLE EAST AND AFRICA SEMI RIGID CONTAINERS IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 21 MIDDLE EAST AND AFRICA HDPE ( HIGH DENSITY POLYETHYLENE) CONTAINERS IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 22 MIDDLE EAST AND AFRICA PET(POLYETHYLENE TEREPHTHALATE)BOTTLES IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 23 MIDDLE EAST AND AFRICA PVC ( POLYVINYL CHLORIDE) IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 24 MIDDLE EAST AND AFRICA FLEXIBLE PLASTIC POUCHES IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 25 MIDDLE EAST AND AFRICA OTHERS IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 26 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA DIRECT IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA INDIRECT IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY END USER, 2018– 2027 (USD MILLION )

TABLE 31 MIDDLE EAST AND AFRICA PRODUCTION OF EDIBLE OIL 2018-19

TABLE 32 MIDDLE EAST AND AFRICA DOMESTIC IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 33 MIDDLE EAST AND AFRICA FOOD SERVICES IN EDIBLE OIL SMARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 34 MIDDLE EAST AND AFRICA FOOD SERVICE IN EDIBLE OIL MARKET,BY END USER, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA INDUSTRIAL IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 36 MIDDLE EAST AND AFRICA OTHERS IN EDIBLE OIL MARKET, BY REGION, 2018-2027 (USD MILLION )

TABLE 37 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA EDIBLE OIL MARKET, BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA FOOD SERVICE IN EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 44 SOUTH AFRICA EDIBLE OIL MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 45 SOUTH AFRICA EDIBLE OIL MARKET, BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 46 SOUTH AFRICA EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 47 SOUTH AFRICA INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 48 SOUTH AFRICA EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 49 SOUTH AFRICA FOOD SERVICE IN EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 50 SAUDI ARABIA EDIBLE OIL MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 51 SAUDI ARABIA EDIBLE OIL MARKET, BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 52 SAUDI ARABIA EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 53 SAUDI ARABIA INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 54 SAUDI ARABIA EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 55 SAUDI ARABIA FOOD SERVICE IN EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 56 U.A.E EDIBLE OIL MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 57 U.A.E EDIBLE OIL MARKET, BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 58 U.A.E EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 59 U.A.E INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 60 U.A.E EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 61 U.A.E FOOD SERVICE IN EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 62 OMAN EDIBLE OIL MARKET,BY TYPE, 2018-2027 (USD MILLION)

TABLE 63 OMAN EDIBLE OIL MARKET, BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 64 OMAN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 65 OMAN INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 66 OMAN EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 67 OMAN FOOD SERVICE IN EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 68 QATAR EDIBLE OIL MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 69 QATAR EDIBLE OIL MARKET, BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 70 QATAR EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 71 QATAR INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 72 QATAR EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 73 QATAR FOOD SERVICE IN EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 74 KUWAIT EDIBLE OIL MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 75 KUWAIT EDIBLE OIL MARKET,BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 76 KUWAIT EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 77 KUWAIT INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 78 KUWAIT EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 79 KUWAIT FOOD SERVICE IN EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 80 REST OF MIDDLE EAST & AFRICA EDIBLE OIL MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 81 REST OF MIDDLE EAST & AFRICA EDIBLE OIL MARKET, BY PACKAGE TYPE, 2018-2027 (USD MILLION)

TABLE 82 REST OF MIDDLE EAST & AFRICA EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 83 REST OF MIDDLE EAST & AFRICA INDIRECT IN EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 84 REST OF MIDDLE EAST & AFRICA EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 85 REST OF MIDDLE EAST & AFRICA FOOD SERVICE IN EDIBLE OIL MARKET, BY END USER, 2018-2027 (USD MILLION)

Liste des figures

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: SEGMENTATION

FIGURE 10 EASY AVAILABILITY OF RAW MATERIALS AND DEMAND FOR ORGANIC EDIBLE OILS PRODUCTS ARE DRIVING THE MIDDLE EAST AND AFRICA EDIBLE OIL MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 SOYBEAN OIL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA EDIBLE OIL MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST AND AFRICA EDIBLE OIL MARKET

FIGURE 13 AVERAGE PRODUCTION OF OILSEEDS (EXCLUDING SOYBEAN) IN 2015 TO 2017

FIGURE 14 ORGANIC RETAIL SALES, IN 2018

FIGURE 15 INTERNATIONAL PRICES OF VEGETABLE OILS

FIGURE 16 E-COMMERCE SALES: TOP TEN ECONOMIES, IN 2018

FIGURE 17 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR EDIBLE OIL MANUFACTURERS IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 18 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY TYPE, 2019

FIGURE 1 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY PACKAGE TYPE, 2019

FIGURE 2 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY DISTRIBUTION CHANNEL, 2019

FIGURE 3 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET, BY END USER, 2019

FIGURE 4 MIDDILE EAST & AFRICA SUNFLOWER SEED MARKET: SNAPSHOT (2019)

FIGURE 5 MIDDLE EAST & AFRICA SUNFLOWER SEEDSMARKET: BY COUNTRY (2019)

FIGURE 6 MIDDLE EAST & AFRICA SUNFLOWER SEEDSMARKET: BY COUNTRY (2020&2027)

FIGURE 7 MIDDLE EAST & AFRICA SUNFLOWER SEEDSMARKET: BY COUNTRY (2019&2027)

FIGURE 8 MIDDLE EAST & AFRICA SUNFLOWER SEEDSMARKET: BY CATEGORY (2020&2027)

FIGURE 9 MIDDLE EAST AND AFRICA EDIBLE OIL MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.