Middle East And Africa E Bike Market

Taille du marché en milliards USD

TCAC :

%

USD

1.10 Billion

USD

2.24 Billion

2024

2032

USD

1.10 Billion

USD

2.24 Billion

2024

2032

| 2025 –2032 | |

| USD 1.10 Billion | |

| USD 2.24 Billion | |

|

|

|

|

Segmentation du marché des vélos électriques au Moyen-Orient et en Afrique, par type de batterie ( lithium -ion, lithium-ion polymère, nickel-métal-hydrure, plomb-acide , plomb-acide scellé et autres), emplacement du moteur de moyeu (moteur de moyeu central, moteur de moyeu arrière et moteur de moyeu avant), mode (assistance au pédalage et accélérateur), puissance de la batterie (moins de 750 W et plus de 750 W), classe (classe I (assistance au pédalage/Pedelec), classe II (accélérateur) et classe III (Pedelec rapide)), utilisation (vélos de ville/urbains, de croisière, de montagne/randonnée, de course, cargo et autres) - Tendances et prévisions du secteur jusqu'en 2032

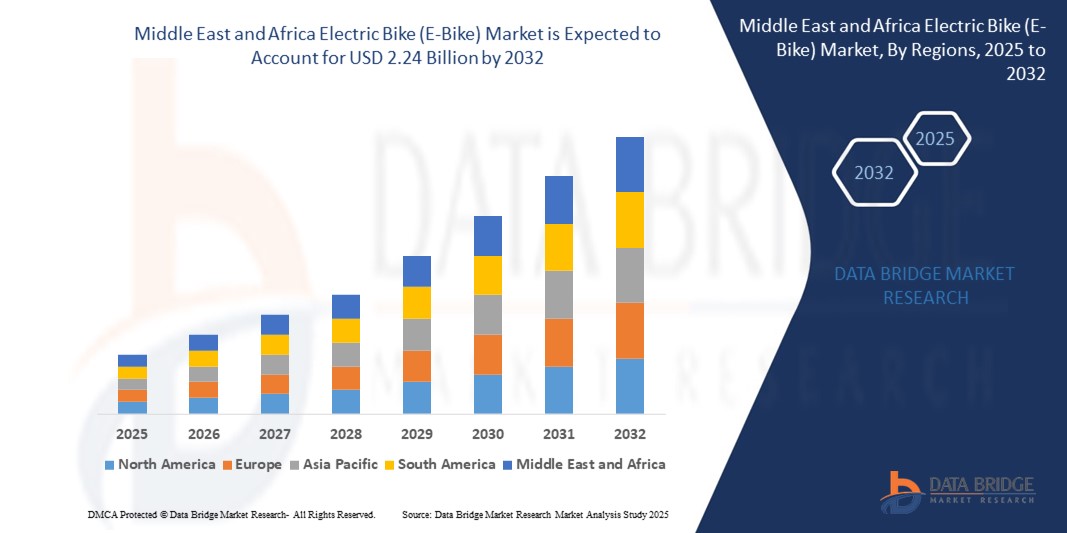

Quelle est la taille et le taux de croissance du marché des vélos électriques (E-Bike) au Moyen-Orient et en Afrique ?

- La taille du marché des vélos électriques (E-Bike) au Moyen-Orient et en Afrique était évaluée à 1,10 milliard USD en 2024 et devrait atteindre 2,24 milliards USD d'ici 2032 , à un TCAC de 9,30 % au cours de la période de prévision.

- La demande de vélos électriques au Moyen-Orient et en Afrique est principalement tirée par l'utilisation croissante de solutions de mobilité écologiques par la population urbaine de la région. L'abandon des énergies fossiles a conduit à une attention croissante portée au développement des véhicules électriques.

- Les vélos électriques sont devenus une option attractive pour les consommateurs de la région grâce à leur faible coût et à leur praticité croissante. Les moteurs moyeux, utilisés sur les vélos depuis plus de dix ans, sont devenus une technologie mature.

Quels sont les principaux points à retenir du marché des vélos électriques (E-Bike) ?

- La croissance démographique au Moyen-Orient et en Afrique est constante. Les villes deviennent alors de plus en plus peuplées, les frontières s'élargissent, les infrastructures s'étendent et la population s'étend en périphérie. Cette croissance démographique et cette extension des zones urbaines entraînent une augmentation du nombre de véhicules sur les routes. Les gens préfèrent se déplacer en voiture ou en moto plutôt qu'en transports en commun.

- Cela a entraîné d'importants embouteillages dans les villes, notamment aux heures de bureau. Les vélos électriques sont perçus comme la meilleure solution pour éviter ces embouteillages et atteindre sa destination plus rapidement et à moindre coût, ce qui stimule la croissance du marché.

- Les Émirats arabes unis ont capturé la plus grande part des revenus au sein de la région Moyen-Orient et Afrique en 2024, grâce à l'accent mis par le gouvernement sur la mobilité intelligente et les transports verts dans le cadre de la Vision 2030 des Émirats arabes unis.

- Le marché sud-africain connaît la croissance la plus rapide en raison du besoin croissant de transports urbains abordables et efficaces, en particulier dans les zones métropolitaines densément peuplées.

- Le segment Lithium-Ion a dominé le marché des vélos électriques (E-Bike) avec la plus grande part de revenus du marché de 65,4 % en 2024, attribuée à sa densité énergétique élevée, son cycle de vie plus long et son poids plus léger par rapport aux types de batteries conventionnelles.

Portée du rapport et segmentation du marché des vélos électriques

|

Attributs |

Aperçu du marché des vélos électriques |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Quelle est la tendance clé du marché des vélos électriques (E-Bike) ?

« Intégration de la connectivité intelligente et des fonctionnalités IoT »

- Une tendance majeure qui façonne le marché mondial des vélos électriques (E-Bike) est l'intégration croissante de fonctionnalités intelligentes, telles que le suivi GPS, la connectivité Bluetooth, les systèmes antivol et l'analyse des trajets, répondant aux besoins des navetteurs urbains férus de technologie.

- Les vélos électriques sont de plus en plus équipés d'écrans intelligents et d'applications mobiles, permettant aux utilisateurs de surveiller l'état de la batterie, le kilométrage, les performances et la navigation en temps réel, améliorant ainsi l'engagement de l'utilisateur et la sécurité de conduite.

- Des entreprises telles que Cowboy (Belgique) et VanMoof (Pays-Bas) ont été les pionniers des vélos électriques connectés avec des mises à jour logicielles automatiques, une détection de vol et des capacités de déverrouillage des smartphones.

- La popularité croissante des plateformes de mobilité partagée et des services de location de vélos électriques alimente également la demande de systèmes de gestion de flotte avec suivi et analyse d'utilisation basés sur l'IoT.

- Cette tendance s'inscrit dans les objectifs de mobilité urbaine, favorisant l'efficacité, la durabilité et la réduction des émissions de carbone. Alors que les villes se tournent vers des infrastructures de transport plus intelligentes, le rôle des vélos électriques connectés est appelé à se développer.

- En fin de compte, les technologies intelligentes des vélos électriques deviennent un élément différenciateur clé dans le positionnement de la marque, les consommateurs recherchant la commodité, la sécurité et une expérience de conduite intégrée à la technologie.

Quels sont les principaux moteurs du marché des vélos électriques (E-Bike) ?

- La forte demande de solutions de transport urbain respectueuses de l'environnement et à faible coût est un moteur essentiel, alors que les gouvernements et les consommateurs se tournent vers des alternatives de mobilité durable.

- Par exemple, en octobre 2023, le gouvernement indien a étendu les incitations FAME II pour soutenir l'adoption des deux-roues électriques, réduisant ainsi considérablement les coûts d'achat initiaux des vélos électriques.

- La sensibilisation croissante à la santé et à la forme physique encourage de plus en plus de personnes à choisir les vélos électriques à assistance électrique comme une forme d'exercice à faible impact combinée à la commodité de la mobilité.

- La hausse des prix du carburant et la congestion dans les zones urbaines ont également favorisé l'adoption des vélos électriques, qui offrent des alternatives économiques et rapides aux voitures et aux transports en commun.

- De plus, les progrès continus dans la technologie des batteries, tels que le développement de batteries à semi-conducteurs et interchangeables, améliorent l'autonomie et le temps de charge, rendant les vélos électriques plus pratiques pour une utilisation quotidienne.

- Ces facteurs contribuent collectivement à une plus grande accessibilité et font des vélos électriques une solution attrayante sur les marchés développés et en développement.

Quel facteur freine la croissance du marché des vélos électriques (E-Bike) ?

- L'un des principaux défis auxquels est confronté le marché des vélos électriques est le coût d'achat initial élevé, en particulier pour les modèles haut de gamme intégrés à des fonctionnalités intelligentes et à des batteries avancées.

- Par exemple, les vélos électriques haut de gamme équipés de moteurs à entraînement central et de batteries lithium-ion longue portée peuvent coûter plus de 3 000 USD, ce qui les rend moins accessibles aux consommateurs sensibles au prix.

- L’insuffisance des infrastructures de recharge dans de nombreuses zones urbaines et rurales, en particulier dans les économies émergentes, nuit à la commodité et entrave les déplacements longue distance.

- L'élimination et le recyclage des batteries posent des problèmes environnementaux et réglementaires supplémentaires, car l'utilisation généralisée des batteries lithium-ion soulève des questions sur la gestion de fin de vie.

- De plus, l’incohérence réglementaire entre les régions, comme les variations dans les limites de vitesse maximales et les exigences en matière de casque, crée une confusion pour les fabricants et les acheteurs.

- Pour surmonter ces obstacles, les acteurs du marché doivent proposer des modèles de tarification modulaires, investir dans des initiatives de recyclage des batteries et collaborer avec les gouvernements pour développer des politiques et des infrastructures standardisées pour une adoption plus large des vélos électriques.

Comment le marché du vélo électrique (E-Bike) est-il segmenté ?

Le marché est segmenté en fonction du type de batterie, de l'emplacement du moteur du moyeu, du mode, de la puissance de la batterie, de la classe et de l'utilisation.

• Par type de batterie

Le marché des vélos électriques est segmenté en fonction du type de batterie : lithium-ion, lithium-ion polymère, nickel-métal-hydrure, plomb-acide, plomb-acide scellé, etc. Le segment lithium-ion a dominé le marché des vélos électriques avec une part de marché de 65,4 % en 2024, grâce à sa densité énergétique élevée, sa durée de vie plus longue et son poids plus léger que les batteries conventionnelles.

Le segment des batteries lithium-ion polymère devrait connaître le TCAC le plus rapide de 2025 à 2032, grâce à sa conception compacte, ses performances de sécurité supérieures et son utilisation croissante dans les vélos électriques haut de gamme et axés sur les performances.

• Par emplacement du moteur de moyeu

Selon l'emplacement du moteur de moyeu, le marché est segmenté en moteurs de moyeu à entraînement central, moteurs de moyeu arrière et moteurs de moyeu avant. Le segment des moteurs de moyeu à entraînement central a représenté la plus grande part de chiffre d'affaires en 2024, grâce à sa répartition du poids optimale, son efficacité en montée et son couple élevé, ce qui le rend idéal pour les vélos de trekking, de montagne et cargo.

Le segment des moteurs de moyeu arrière devrait connaître la croissance la plus rapide, soutenue par la demande croissante d'options de moteurs rentables et nécessitant peu d'entretien pour les vélos électriques urbains et de banlieue.

• Par mode

Le marché des vélos électriques (E-Bike) est divisé en deux catégories : assistance au pédalage et accélérateur. Le segment de l'assistance au pédalage dominait le marché avec une part de marché de 72,1 % en 2024, grâce à son fonctionnement économe en énergie, à son acceptation réglementaire dans de nombreux pays et à un meilleur contrôle de la consommation de la batterie par l'utilisateur.

Le segment Throttle gagne en popularité en raison de son expérience de conduite sans effort et de son adoption croissante parmi les conducteurs âgés et les services de livraison en milieu urbain.

• Par batterie

En fonction de la puissance de la batterie, le marché se divise en deux catégories : moins de 750 W et plus de 750 W. Le segment des moins de 750 W détenait la plus grande part de marché en 2024, privilégié pour sa conformité aux réglementations mondiales sur les vélos électriques, son prix abordable et sa compatibilité avec la plupart des déplacements urbains et les loisirs légers.

Le segment des plus de 750 W devrait connaître une croissance rapide, en particulier dans les applications tout-terrain, de course et de fret où une puissance de sortie et une vitesse plus élevées sont requises.

• Par classe

Sur la base de sa catégorie, le marché des vélos électriques est segmenté en classe I (assistance au pédalage/Pedelec), classe II (accélérateur) et classe III (Pedelec rapide). La classe I a représenté la plus grande part de chiffre d'affaires en 2024, grâce à sa large acceptation légale, sa facilité d'utilisation et son efficacité énergétique.

Le segment de classe III est sur le point de croître rapidement, soutenu par la demande de vélos électriques à grande vitesse parmi les navetteurs urbains et les passionnés à la recherche d'options de transport en commun plus rapides.

• Par utilisation

En fonction de l'usage, le marché des vélos électriques est segmenté en vélos de ville, vélos de croisière, VTT/randonnée, vélos de course, vélos cargo et autres. En 2024, le segment des vélos de ville a dominé le marché avec la plus forte part de marché, grâce à l'urbanisation croissante, aux incitations gouvernementales en faveur de la mobilité propre et à la popularité croissante des services de mobilité partagée.

Le segment Montagne/Trekking devrait connaître la croissance la plus rapide, soutenue par les tendances en matière de loisirs et de fitness, ainsi que par les progrès réalisés dans la conception des vélos électriques tout-terrain et les technologies de suspension.

Quel pays détient la plus grande part du marché des vélos électriques (E-Bike) ?

- Les Émirats arabes unis ont capturé la plus grande part des revenus au sein de la région Moyen-Orient et Afrique en 2024, grâce à l'accent mis par le gouvernement sur la mobilité intelligente et les transports verts dans le cadre de la Vision 2030 des Émirats arabes unis.

- Des villes comme Dubaï et Abou Dhabi déploient des systèmes de vélos électriques en libre-service et développent de vastes infrastructures cyclables. De plus, une population à revenus élevés et l'essor de la forme physique stimulent le segment des vélos électriques haut de gamme.

Aperçu du marché des vélos électriques en Arabie saoudite

Le marché saoudien connaît une croissance constante, soutenue par des initiatives environnementales croissantes et des investissements dans la mobilité durable dans le cadre de la Vision 2030. Les vélos électriques gagnent en popularité en milieu urbain pour les déplacements domicile-travail et les loisirs. Les projets d'infrastructures soutenus par le gouvernement, tels que les plans urbains favorables aux piétons et aux vélos à Riyad et à NEOM, devraient favoriser leur adoption.

Aperçu du marché des vélos électriques en Afrique du Sud

Le marché sud-africain connaît la croissance la plus rapide en raison du besoin croissant de transports urbains abordables et efficaces, notamment dans les zones métropolitaines densément peuplées. Les vélos cargo électriques sont également de plus en plus populaires auprès des petites entreprises pour les livraisons intra-urbaines. L'essor du e-commerce et de la logistique urbaine accélère la demande dans le segment des véhicules utilitaires légers.

Quelles sont les principales entreprises sur le marché des vélos électriques (E-Bike) ?

L'industrie du vélo électrique (E-Bike) est principalement dirigée par des entreprises bien établies, notamment :

- Vélos géants (Taïwan)

- Shimano Inc. (Japon)

- Robert Bosch GmbH (Allemagne)

- Trek Bicycle Corporation (États-Unis)

- Vélos Merida (Taïwan)

- Brose Fahrzeugteile SE & Co. KG (Allemagne)

- Specialized Bicycle Components, Inc. (États-Unis)

- eBee (Kenya)

- Koning (États-Unis)

- Amego Électrique (Canada)

Quels sont les développements récents sur le marché des vélos électriques (E-Bike) ?

- En septembre 2023, Specialized Bicycle Components, Inc. a lancé sa nouvelle gamme Globe de vélos cargo électriques, comprenant les modèles Haul ST et LT, réputés pour leur grande capacité de charge, leur système de fixation d'accessoires avancé et leurs impressionnantes caractéristiques de vélo électrique de classe 3. Cette expansion stratégique sur le segment des vélos cargo électriques a permis à Specialized Bicycles de répondre à la demande croissante de solutions de transport urbain durables et de diversifier son portefeuille de produits.

- En septembre 2023, Trek Bicycle Corporation a lancé avec succès le programme Red Barn Refresh, qui promeut le développement durable et l'économie circulaire en acceptant les vélos Trek d'occasion pour la remise à neuf et la revente, réduisant ainsi les déchets et promouvant le cyclisme. Ce programme s'inscrit dans l'engagement de Trek en faveur du développement durable, reflétant sa volonté de réduire les émissions de carbone et d'adopter une approche plus respectueuse de l'environnement, renforçant ainsi sa position de leader mondial de la conception et de la fabrication de vélos.

- En février 2023, Giant Bicycle a lancé le vélo électrique urbain Explorer E+, doté d'une batterie plus puissante et d'une suspension améliorée. Il a étendu ses capacités tout-terrain et amélioré son autonomie, répondant ainsi à l'évolution des préférences des consommateurs pour des vélos électriques polyvalents. Cette innovation a renforcé la position de Giant comme acteur fiable et innovant sur le marché du vélo électrique.

- En juillet 2022, Robert Bosch GmbH a enrichi son système intelligent d'innovations telles que l'ABS Trail, des commandes à distance minimalistes et le système Hill Hold, répondant ainsi aux besoins variés de la communauté des adeptes du VTTAE en matière d'aventures sportives. L'introduction du plus petit ABS au monde pour les adeptes du VTTAE, développé avec des athlètes professionnels, a renforcé la sécurité des cyclistes, les performances et le contrôle sur les sentiers difficiles, renforçant ainsi l'attrait de Bosch et sa position sur le marché du vélo électrique.

- En juillet 2022, Shimano Inc. a lancé avec succès le groupe CUES Di2, intégrant la technologie de changement de vitesse Di2 haut de gamme à ses systèmes pour vélos électriques. Ce groupe a introduit des modes de changement de vitesse automatiques avancés et la durabilité Linkglide, améliorant ainsi l'offre de transmissions pour vélos électriques, pour une expérience de conduite confortable et sans souci. Cette expansion stratégique de produits a consolidé la position de Shimano sur le marché des vélos électriques, répondant à la demande croissante de solutions pratiques et performantes.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.