Middle East And Africa Digital Experience Platform Market

Taille du marché en milliards USD

TCAC :

%

USD

2,981.53 Million

USD

9,774.69 Million

2021

2029

USD

2,981.53 Million

USD

9,774.69 Million

2021

2029

| 2022 –2029 | |

| USD 2,981.53 Million | |

| USD 9,774.69 Million | |

|

|

|

|

Marché des plateformes d’expérience numérique au Moyen-Orient et en Afrique, par composant (plateforme, services), modèle de déploiement (cloud, sur site), taille de l’organisation (petite et moyenne entreprise, grande entreprise), application (entreprise à client, entreprise à entreprise), secteur vertical (vente au détail, BFSI , voyages et hôtellerie, informatique et télécommunications, soins de santé, fabrication, médias et divertissement, éducation) – Tendances et prévisions du secteur jusqu’en 2029

Analyse et taille du marché

L'évolution des logiciels de gestion de contenu et leur combinaison avec diverses technologies telles que l'IoT, la réalité virtuelle et les graphiques améliorés aident les entreprises à offrir des expériences vivantes aux clients. Des secteurs tels que BFSI ont intégré des DXP afin de fournir des expériences bancaires personnalisées à leurs clients via leur application officielle, leurs portails et leurs sites Web, facilitant ainsi les opérations bancaires.

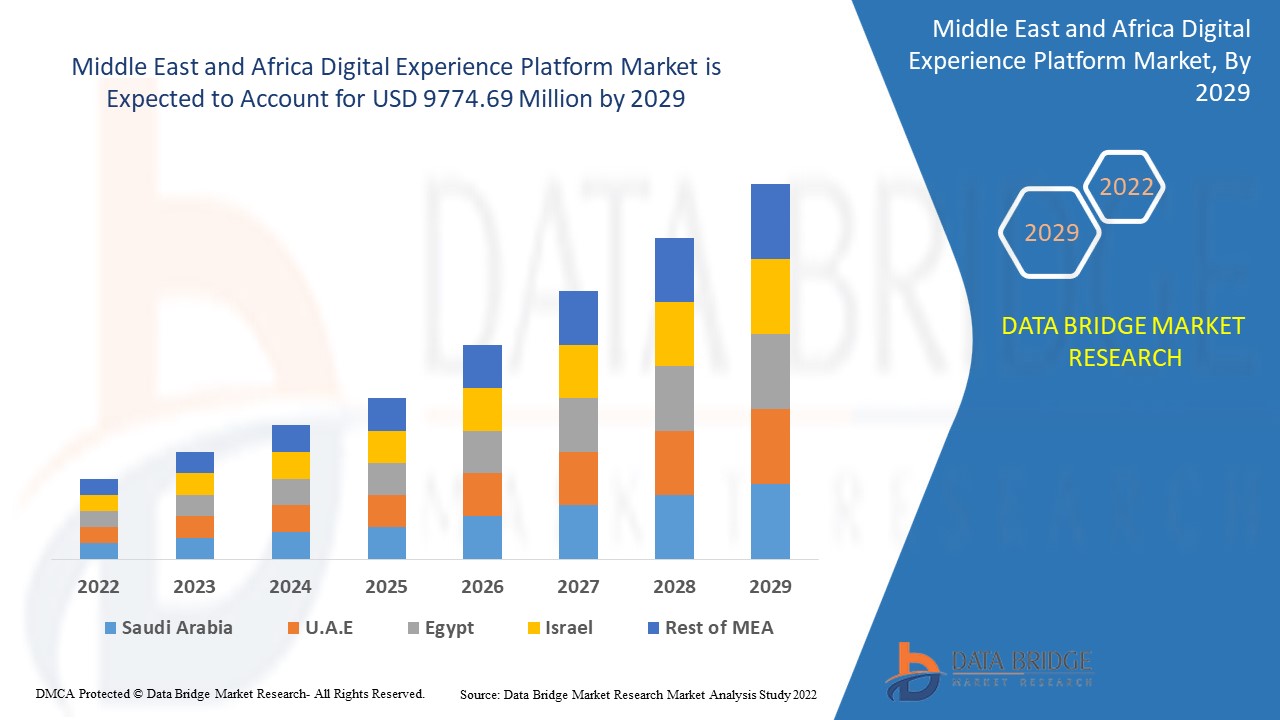

Data Bridge Market Research analyse que le marché des plateformes d'expérience numérique était évalué à 2 981,53 millions USD en 2021 et devrait atteindre la valeur de 9 774,69 millions USD d'ici 2029, à un TCAC de 16,00 % au cours de la période de prévision de 2022 à 2029.

Définition du marché

Une plateforme d'expérience numérique (DXP) est un ensemble de technologies bien intégrées et cohérentes qui permet la création, la gestion, la diffusion et l'optimisation d'expériences numériques contextualisées dans des parcours clients multi-expériences. Une DXP peut fournir des expériences numériques optimales à un large éventail de parties prenantes, notamment les consommateurs, les partenaires, les employés, les citoyens et les étudiants, et contribuer à assurer la continuité tout au long du parcours client. Elle fournit une orchestration de présentation, qui connecte les capacités de diverses applications pour créer des expériences numériques transparentes. Grâce à des intégrations basées sur des API avec des technologies adjacentes, une DXP devient partie intégrante d'un écosystème commercial numérique.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Composant (plateforme, services), modèle de déploiement (cloud, sur site), taille de l'organisation (petite et moyenne entreprise, grande entreprise), application (entreprise à client, entreprise à entreprise), vertical (vente au détail, BFSI, voyages et hôtellerie, informatique et télécommunications, santé, fabrication, médias et divertissement, éducation) |

|

Pays couverts |

Arabie saoudite, Émirats arabes unis, Afrique du Sud, Israël, Égypte, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Xandr Inc. (États-Unis), Verizon (États-Unis), Kayzen (Chine), NextRoll, Inc. (États-Unis), Google (États-Unis), Adobe (États-Unis), Magnite, Inc (États-Unis), MediaMath (États-Unis), IPONWEB Limited (États-Unis), VOYAGE GROUP (Japon), Integral Ad Science Inc. (Danemark), The Trade Desk (États-Unis), Connexity (États-Unis), Centro, Incorporated (États-Unis), RhythmOne, LLC (États-Unis) |

|

Opportunités |

|

Dynamique du marché des plateformes d'expérience numérique

Conducteurs

- Augmentation du nombre de solutions basées sur le cloud dans diverses entreprises

L'un des principaux facteurs de croissance du marché des plateformes d'expérience numérique est le déploiement croissant de solutions basées sur le cloud dans diverses entreprises. La multiplication des initiatives des entreprises visant à offrir une expérience et un engagement utilisateur personnalisés, optimisés et intégrés sur plusieurs canaux marketing, ainsi que la demande accrue de plateformes permettant de comprendre les besoins immédiats des clients, stimulent la croissance du marché.

- Adoption croissante de plateformes d'expérience numérique pour atteindre la clientèle à plusieurs niveaux

L’adoption croissante des plateformes d’expérience numérique (DXP) par les spécialistes du marketing dans le but d’atteindre de manière transparente les clients sur plusieurs appareils numériques et de promouvoir les ventes croisées et les ventes incitatives, ainsi que l’utilisation élevée due aux données précises obtenues via les DXP utilisées pour le marketing et l’engagement client, ont toutes un impact sur le marché. En outre, l’utilisation pour réduire le taux de désabonnement des clients, l’augmentation de la demande d’analyses de big data, l’urbanisation et la numérisation, et la préférence pour l’approche omnicanal ont toutes un impact positif sur le marché des plateformes d’expérience numérique. En outre, l’augmentation de la demande d’expériences personnalisées pour chaque client en temps réel, ainsi que la mise en œuvre de technologies avancées telles que l’IA, l’analyse de données et le cloud computing, offriront des opportunités rentables aux acteurs du marché au cours de la période de prévision.

Opportunité

L’utilisation généralisée de bornes en libre-service et interactives pour les services financiers tels que les services bancaires en ligne et les services bancaires mobiles devrait favoriser l’adoption de plateformes d’expérience numérique par les banques, les institutions financières et les sociétés financières non bancaires (SFNB). Alors que la plateforme d’expérience numérique élimine les systèmes cloisonnés, de nombreuses organisations ont commencé à déployer la DXP pour améliorer leurs stratégies d’interaction et d’engagement client afin de rivaliser avec les leaders du marché.

Restrictions

D’un autre côté, les difficultés d’intégration des données générées par les canaux multiples, ainsi que les inquiétudes concernant les données de retour sur investissement peu claires devraient freiner la croissance du marché. Les problèmes d’intégration avec divers logiciels devraient constituer un défi pour le marché des plateformes d’expérience numérique au cours de la période de prévision.

Ce rapport sur le marché des plateformes d'expérience numérique fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des plateformes d'expérience numérique, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché des plateformes d'expérience numérique

Les plateformes et technologies numériques ont connu une croissance inévitable pendant les années de pandémie de Covid-19. Ces mesures ont ouvert la voie à de nouveaux modèles de travail et de vie, donnant une impulsion significative à la numérisation de toutes les opérations commerciales. Pendant la période de confinement, la majorité des acteurs du marché dans tous les domaines se sont concentrés sur l'amélioration de l'expérience de leurs clients sur les plateformes numériques. Les investissements massifs dans la gestion de contenu DXP par les fournisseurs de services en ligne ont créé de nouvelles opportunités pour le développement et la croissance de la taille du marché des plateformes d'expérience numérique. Cependant, comme le succès de tout service d'engagement client dépend de la disponibilité des produits ou des services, Covid-19 a eu des effets négatifs sur les plateformes de gestion de l'expérience commerciale.

Développement récent

- Adobe a collaboré avec ServiceNow, une société leader dans le domaine du cloud computing, pour développer une solution inédite dans le secteur permettant d'intégrer les données d'expérience numérique aux données client. Les clients bénéficieront de flux de travail numériques fluides et d'expériences client personnalisées sur tous les points de contact.

- En mars 2019, Oracle s'est associé à TWINSET, une marque de vêtements italienne, pour fournir à l'entreprise la technologie moderne de point de service (POS) d'Oracle Retail. Cette technologie contribuerait à améliorer l'expérience client dans les magasins TWINSET en fournissant tous les détails transactionnels au personnel du magasin, leur permettant ainsi de recommander le style nécessaire et d'obtenir des informations sur les dernières marchandises, entre autres.

- SAP a acquis Qualtrics International, l'un des pionniers mondiaux des logiciels de gestion de l'expérience, en janvier 2019. Cette acquisition aiderait SAP à accélérer les solutions CX en combinant l'expérience et les données opérationnelles.

Portée du marché des plateformes d'expérience numérique au Moyen-Orient et en Afrique

Le marché des plateformes d'expérience numérique est segmenté en fonction du composant, du modèle de déploiement, de la taille de l'organisation, de l'application et du secteur vertical. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Composant

- Plate-forme

- Services

Type de produit

- Logiciel de gestion de l'identité client

- Logiciel de surveillance des transactions

- Logiciel de reporting des transactions en devises

- Logiciel de gestion de la conformité

- Autres

Taille de l'organisation

- Grande organisation

- Petites et moyennes organisations

Déploiement

- Sur site

- Nuage

Application

- Entreprise à client

- Entreprise à entreprise

Verticale

- Vente au détail

- BFSI

- Voyages et hospitalité

- Informatique et Télécoms

- Soins de santé

- Fabrication

- Médias et divertissement

- Éducation

Analyse/perspectives régionales du marché des plateformes d'expérience numérique

Le marché des plateformes d'expérience numérique est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, composant, modèle de déploiement, taille de l'organisation, application et vertical comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des plateformes d’expérience numérique sont l’Arabie saoudite, les Émirats arabes unis, l’Afrique du Sud, Israël, l’Égypte, le reste du Moyen-Orient et l’Afrique.

L'Afrique du Sud domine le marché des plateformes d'expérience numérique au Moyen-Orient et en Afrique en raison de la croissance rapide du pays dans les secteurs de la vente au détail et de la fabrication, ainsi que de son taux d'adoption DXP élevé parmi tous les pays de la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des plateformes d'expérience numérique

Le paysage concurrentiel du marché des plateformes d'expérience numérique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives de marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des plateformes d'expérience numérique.

Certains des principaux acteurs opérant sur le marché des plateformes d’expérience numérique sont :

- Xandr Inc. (États-Unis)

- Verizon (États-Unis)

- Kayzen (Chine)

- NextRoll, Inc. (États-Unis)

- Google (États-Unis)

- Adobe (États-Unis)

- Magnite, Inc (États-Unis)

- MediaMath (États-Unis)

- IPONWEB Limited (États-Unis)

- GROUPE DE VOYAGE (Japon)

- Integral Ad Science Inc. (Danemark)

- Le Trade Desk (États-Unis)

- Connexité (États-Unis).

- Centro, Incorporated (États-Unis)

- RhythmOne, LLC (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 COMPONENT TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY OPERATING SYSTEMS

5 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: IMPACT ANALYSIS OF COVID-19

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING GROWTH IN DIGITALIZATION

6.1.2 RICH EXPERIENCE WITH TOUCHPOINT OPTIMIZATION

6.1.3 INCREASED CUSTOMER RETENTION THROUGH DXP

6.1.4 GROWTH IN CLOUD TECHNOLOGY AND IOT BASED DEVICES

6.1.5 GROWTH IN BIG DATA ANALYTICS

6.2 RESTRAINTS

6.2.1 LACK OF KNOWLEDGE REGARDING DIGITAL EXPERIENCE PLATFORM

6.2.2 ISSUE WITH CYBER SECURITY

6.2.3 MULTILINGUAL CONTENT AVAILABLE MIDDLE EAST AND AFRICALY

6.3 OPPORTUNITIES

6.3.1 INCREASING GROWTH IN ARTIFICIAL INTELLIGENCE TECHNOLOGY

6.3.2 GROWTH IN E-COMMERCE TRANSFORMING THE RETAIL MARKET

6.3.3 IMPLEMENTING BUSINESS INTELLIGENCE IN DXP

6.4 CHALLENGES

6.4.1 COMPLICATIONS INVOLVED IN INTEGRATION OF DIFFERENT PLATFORMS INVOLVED

6.4.2 TRACKING CROSS CHANNEL USER BEHAVIOUR

7 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 PLATFORM

7.3 SERVICES

7.3.1 PROFESSIONAL SERVICES

7.3.2 MANAGED SERVICES

8 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL

8.1 OVERVIEW

8.2 ON PREMISES

8.3 CLOUD

9 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISE

9.3 SMALL & MEDIUM ENTERPRISE

10 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BUSINESS TO CUSTOMER

10.2.1 ON PREMISES

10.2.2 CLOUD

10.3 BUSINESS TO BUSINESS

10.3.1 ON PREMISES

10.3.2 CLOUD

10.4 OTHERS

11 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 RETAIL

11.2.1 PLATFORM

11.2.2 SERVICES

11.3 BFSI

11.3.1 PLATFORM

11.3.2 SERVICES

11.4 IT & TELECOM

11.4.1 PLATFORM

11.4.2 SERVICES

11.5 TRAVEL & HOSPITALITY

11.5.1 PLATFORM

11.5.2 SERVICES

11.6 MEDIA AND ENTERTAINMENT

11.6.1 PLATFORM

11.6.2 SERVICES

11.7 EDUCATION

11.7.1 PLATFORM

11.7.2 SERVICES

11.8 HEALTHCARE

11.8.1 PLATFORM

11.8.2 SERVICES

11.9 MANUFACTURING

11.9.1 PLATFORM

11.9.2 SERVICES

11.1 OTHERS

12 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY GEOGRAPHY

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 ISRAEL

12.1.3 SAUDI ARABIA

12.1.4 U.A.E.

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: SWOT ANALYSIS

15 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: DBMR ANALYSIS

16 COMPANY PROFILE

16.1 ADOBE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SAP SE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANLYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ORACLE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SALESFORCE.COM, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 ACCENTURE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICE PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACQUIA, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BLOOMREACH INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CENSHARE AG

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT & SERVICE PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CROWNPEAK TECHNOLOGY, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 EPISERVER

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 HCL TECHNOLOGIES LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 INFOSYS LIMITED

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 JAHIA SOLUTIONS GROUP SA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 KENTICO SOFTWARE

16.14.1 COMPANY SNAPSHOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 LIFERAY INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 OPEN TEXT CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT & SOLUTION PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SDL PLC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SOFTWARE PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 SITECORE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 SQUIZ

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 WIPRO LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 SERVICE PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: DIGITAL EXPERIENCE PLATFORM REVIEW BASED ON CUSTOMER FEEDBACK

TABLE 2 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA PLATFORM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA ON PREMISES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA CLOUD IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA LARGE ENTERPRISE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA SMALL & MEDIUM ENTERPRISE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA OTHERS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA OTHERS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 53 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 54 SOUTH AFRICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 55 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 56 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 57 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 58 SOUTH AFRICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 59 SOUTH AFRICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 60 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 61 SOUTH AFRICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 62 SOUTH AFRICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 63 SOUTH AFRICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 64 SOUTH AFRICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 65 SOUTH AFRICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 66 SOUTH AFRICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 67 SOUTH AFRICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 68 SOUTH AFRICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 69 ISRAEL DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 70 ISRAEL SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 71 ISRAEL DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 72 ISRAEL DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 73 ISRAEL DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 74 ISRAEL BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 75 ISRAEL BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 76 ISRAEL DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 77 ISRAEL RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 78 ISRAEL BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 79 ISRAEL IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 80 ISRAEL TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 81 ISRAEL MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 82 ISRAEL EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 83 ISRAEL HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 84 ISRAEL MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 85 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 86 SAUDI ARABIA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 87 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 88 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 89 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 90 SAUDI ARABIA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 91 SAUDI ARABIA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 92 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 93 SAUDI ARABIA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 94 SAUDI ARABIA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 95 SAUDI ARABIA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 96 SAUDI ARABIA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 97 SAUDI ARABIA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 98 SAUDI ARABIA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 99 SAUDI ARABIA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 100 SAUDI ARABIA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 101 U.A.E. DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 102 U.A.E. SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 103 U.A.E. DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 104 U.A.E. DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 105 U.A.E. DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 106 U.A.E. BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 107 U.A.E. BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 108 U.A.E. DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 109 U.A.E. RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 110 U.A.E. BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 111 U.A.E. IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 112 U.A.E. TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 113 U.A.E. MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 114 U.A.E. EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 115 U.A.E. HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 116 U.A.E. MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 117 EGYPT DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 118 EGYPT SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 119 EGYPT DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 120 EGYPT DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 121 EGYPT DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 122 EGYPT BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 123 EGYPT BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 124 EGYPT DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 125 EGYPT RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 126 EGYPT BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 127 EGYPT IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 128 EGYPT TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 129 EGYPT MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 130 EGYPT EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 131 EGYPT HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 132 EGYPT MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 133 REST OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

Liste des figures

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: MULTIVARIATE MODELING

FIGURE 11 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: SEGMENTATION

FIGURE 12 INCREASED CUSTOMER RETENTION THROUGH DXP IS EXPECTED TO DRIVE MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 PLATFORM IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET IN 2020 & 2027

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET

FIGURE 15 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COMPONENT, 2019

FIGURE 16 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY DEPLOYMENT MODEL, 2019

FIGURE 17 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY ORGANISATION SIZE, 2019

FIGURE 18 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY APPLICATION, 2019

FIGURE 19 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY VERTICAL, 2019

FIGURE 20 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: SNAPSHOT (2019)

FIGURE 21 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COUNTRY (2019)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.