Middle East And Africa Cpap Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

138.65 Million

USD

216.04 Million

2024

2032

USD

138.65 Million

USD

216.04 Million

2024

2032

| 2025 –2032 | |

| USD 138.65 Million | |

| USD 216.04 Million | |

|

|

|

|

Segmentation du marché des appareils CPAP au Moyen-Orient et en Afrique, par type de produit (appareil CPAP et consommable), modalité (autonome et portable), utilisateur final (soins à domicile, hôpitaux, cliniques privées et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché des appareils CPAP au Moyen-Orient et en Afrique

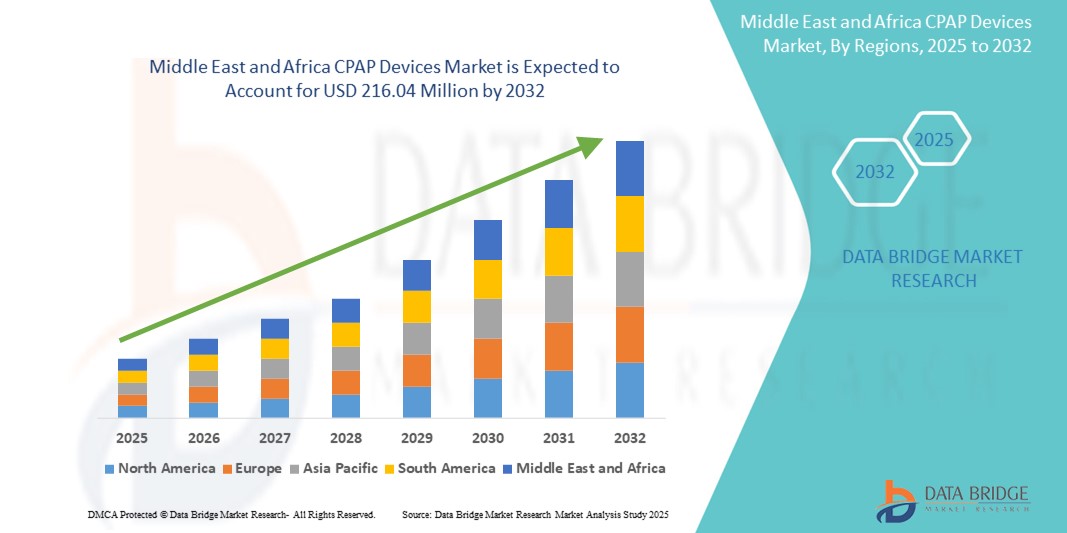

- La taille du marché des appareils CPAP au Moyen-Orient et en Afrique était évaluée à 138,65 millions USD en 2024 et devrait atteindre 216,04 millions USD d'ici 2032 , à un TCAC de 5,70 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante de l'apnée obstructive du sommeil (AOS) et par la sensibilisation croissante aux troubles liés au sommeil dans la région, ce qui entraîne une augmentation du nombre de diagnostics et d'adoption de traitements.

- De plus, l'amélioration des infrastructures de santé, la pénétration croissante des prestataires de soins privés et la disponibilité croissante d'appareils CPAP à la pointe de la technologie accélèrent la demande. Ces facteurs combinés stimulent considérablement l'expansion du marché au Moyen-Orient et en Afrique.

Analyse du marché des appareils CPAP au Moyen-Orient et en Afrique

- Les appareils CPAP, qui délivrent une pression positive continue des voies respiratoires pour maintenir les voies respiratoires ouvertes pendant le sommeil, deviennent de plus en plus essentiels dans la gestion de l'apnée obstructive du sommeil (AOS) au Moyen-Orient et en Afrique en raison de la sensibilisation croissante, de l'expansion des capacités de diagnostic et de la charge croissante des troubles liés au sommeil dans les secteurs de la santé publique et privée.

- La demande croissante d'appareils CPAP est principalement alimentée par l'augmentation des taux d'obésité, le vieillissement croissant de la population et l'adoption croissante de solutions de soins respiratoires à domicile, ainsi que par une disponibilité accrue d'appareils portables et conviviaux.

- L'Afrique du Sud a dominé le marché des appareils CPAP avec la plus grande part de revenus de 31,9 % en 2024, soutenue par une infrastructure de soins de santé bien établie, des campagnes actives de sensibilisation aux troubles du sommeil et une accessibilité croissante aux traitements dans les centres urbains.

- Les Émirats arabes unis devraient être le pays connaissant la croissance la plus rapide sur le marché des appareils CPAP au cours de la période de prévision en raison de l'augmentation du tourisme médical, de la numérisation des soins de santé et des investissements croissants dans les services de soins respiratoires spécialisés.

- Le segment des appareils CPAP a dominé le marché des appareils CPAP par type de produit avec une part de 67,2 % en 2024, grâce à l'augmentation des taux de diagnostic et à la disponibilité croissante d'unités de thérapie technologiquement avancées dans les établissements de santé et les environnements de soins à domicile.

Portée du rapport et segmentation du marché des appareils CPAP au Moyen-Orient et en Afrique

|

Attributs |

Aperçu du marché des appareils CPAP au Moyen-Orient et en Afrique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des appareils CPAP au Moyen-Orient et en Afrique

« Demande croissante d'appareils CPAP portables et intelligents »

- Une tendance significative et croissante sur le marché des appareils CPAP au Moyen-Orient et en Afrique est la préférence croissante pour les solutions CPAP compactes, portables et technologiquement avancées qui répondent aux besoins des environnements cliniques et de soins à domicile, en particulier dans les régions urbaines avec un meilleur accès aux soins de santé et une sensibilisation croissante à l'apnée du sommeil.

- Par exemple, la DreamStation Go de Philips et l'AirMini de ResMed ont gagné du terrain dans la région grâce à leurs conceptions légères et à leurs fonctionnalités intelligentes intégrées telles que la connectivité Bluetooth, la surveillance basée sur des applications et le partage de données dans le cloud avec les médecins, permettant une gestion thérapeutique plus personnalisée et plus pratique.

- Ces appareils CPAP intelligents permettent aux patients de suivre leurs habitudes de sommeil, de recevoir des commentaires en temps réel et de partager des rapports de conformité avec les prestataires de soins de santé à distance, améliorant ainsi considérablement l'adhésion aux plans de traitement.

- De plus, des innovations telles que le réglage automatique de la pression et les systèmes d'humidification améliorent encore le confort de l'utilisateur, tandis que les plateformes connectées au cloud telles que myAir de ResMed offrent un accompagnement et un soutien pour améliorer les résultats thérapeutiques.

- Cette évolution vers la portabilité et les fonctionnalités intelligentes est motivée par une population active croissante, des déplacements accrus et une demande croissante de soins de santé à domicile dans des pays comme l'Afrique du Sud, les Émirats arabes unis et l'Arabie saoudite.

- La demande d'appareils CPAP intelligents et portables augmente rapidement, car les patients recherchent le confort, la mobilité et l'intégration avec des écosystèmes de santé numérique plus larges, transformant le traitement de l'apnée du sommeil en une expérience plus centrée sur l'utilisateur et axée sur les données.

Dynamique du marché des appareils CPAP au Moyen-Orient et en Afrique

Conducteur

« Sensibilisation croissante à l'apnée du sommeil et développement des soins à domicile »

- La prévalence croissante de l'apnée obstructive du sommeil, conjuguée à une prise de conscience croissante de ses effets sur la santé, constitue un moteur majeur du marché des appareils CPAP au Moyen-Orient et en Afrique. Des campagnes menées par des organismes de santé et des prestataires privés encouragent le diagnostic et l'intervention précoce, en particulier auprès des groupes à risque comme les personnes âgées et obèses.

- Par exemple, les initiatives en Afrique du Sud et aux Émirats arabes unis visant à dépister les troubles du sommeil dans les établissements de soins primaires stimulent les taux de diagnostic précoce, alimentant ainsi la demande d'appareils thérapeutiques tels que les appareils CPAP.

- En outre, l’expansion des services de soins de santé à domicile crée des opportunités pour des solutions de thérapie du sommeil non invasives, soutenues par des systèmes CPAP portables et des plateformes de surveillance à distance

- À mesure que les investissements dans les soins de santé publics et privés augmentent dans la région, en particulier dans les centres urbains, la disponibilité et l'accessibilité des appareils CPAP s'améliorent, stimulant davantage la croissance du marché.

- La commodité de la thérapie à domicile et la préférence croissante pour les options de traitement hors hôpital accélèrent l'adoption des appareils CPAP dans les économies à revenu élevé et émergentes de la région.

Retenue/Défi

« Problèmes de sensibilisation et d'accessibilité financière limités dans les régions mal desservies »

- Malgré une adoption croissante dans les zones urbaines, la sensibilisation limitée à l'apnée du sommeil et à ses risques reste un obstacle important dans les zones rurales et mal desservies du Moyen-Orient et de l'Afrique

- De nombreuses personnes ne sont pas diagnostiquées en raison du manque de services spécialisés, de laboratoires du sommeil et de connaissances du public sur les options de traitement telles que la thérapie CPAP.

- De plus, le coût initial relativement élevé des appareils CPAP et les dépenses courantes liées aux consommables tels que les masques et les filtres peuvent être prohibitifs pour les populations sensibles au prix. Dans les régions où le remboursement ou la couverture d'assurance sont limités, l'accessibilité financière devient un obstacle majeur à une adoption généralisée.

- Par exemple, alors que les marques haut de gamme telles que ResMed et Philips dominent les marchés urbains, il existe toujours une pénurie d'alternatives rentables pour une accessibilité plus large.

- Combler ces lacunes grâce à des campagnes de sensibilisation soutenues par le gouvernement, des partenariats public-privé et l’introduction d’options CPAP à faible coût adaptées aux marchés africains et moyen-orientaux sera essentiel pour l’expansion du marché à long terme.

Portée du marché des appareils CPAP au Moyen-Orient et en Afrique

Le marché est segmenté en fonction du type de produit, de la modalité et de l’utilisateur final.

- Par type de produit

Au Moyen-Orient et en Afrique, le marché des appareils CPAP est segmenté en fonction du type de produit : appareils CPAP et consommables. Le segment des appareils CPAP a dominé le marché avec une part de chiffre d'affaires de 67,2 % en 2024, grâce à la prévalence croissante de l'apnée obstructive du sommeil (AOS), aux avancées technologiques et à la sensibilisation croissante aux thérapies du sommeil. Les appareils CPAP constituent le traitement principal de l'AOS modérée à sévère, et leur adoption croissante est soutenue par l'augmentation des taux de diagnostic et le nombre croissant de cliniques du sommeil dans la région.

Le segment des consommables, comprenant les masques, les tubulures, les filtres et les humidificateurs, devrait connaître la croissance la plus rapide entre 2025 et 2032, en raison des besoins récurrents de remplacement et d'entretien hygiénique. Avec la croissance du parc d'appareils CPAP installés, la demande de consommables associés augmentera régulièrement, soutenue par une attention accrue portée au confort et à l'observance des utilisateurs.

- Par modalité

Le marché des appareils CPAP se divise en appareils autonomes et portables. Le segment des appareils CPAP portables a représenté la plus grande part de chiffre d'affaires en 2024, avec 58,6 %, grâce à la préférence croissante pour les thérapies à domicile, à la praticité des appareils portables et à la demande croissante des professionnels et des voyageurs fréquents. Les modèles portables tels que ResMed AirMini et Philips DreamStation Go gagnent en popularité grâce à leur compacité, leurs fonctionnalités de connectivité intelligentes et leur simplicité d'utilisation.

Le segment des appareils CPAP autonomes, dominant en milieu clinique, devrait connaître une croissance modérée au cours de la période de prévision, principalement tirée par les hôpitaux et les laboratoires du sommeil. Ces appareils sont généralement plus volumineux et offrent des capacités de diagnostic avancées, mais sont moins prisés pour un usage personnel que leurs homologues portables.

- Par utilisateur final

En fonction de l'utilisateur final, le marché des appareils CPAP est segmenté entre soins à domicile, hôpitaux, cliniques privées et autres. Le segment des soins à domicile domine le marché avec une part de chiffre d'affaires de 46,9 % en 2024, grâce à une forte orientation vers le traitement de l'apnée du sommeil à domicile, à son rapport coût-efficacité et à la disponibilité d'appareils CPAP compacts et faciles à utiliser, adaptés à un usage personnel. Une sensibilisation accrue, des programmes d'accompagnement à l'observance thérapeutique et l'intégration d'applications mobiles renforcent encore la préférence des patients pour les solutions à domicile.

Le segment des hôpitaux devrait connaître la croissance la plus rapide au cours de la période de prévision, en raison du besoin de soins intensifs et de diagnostics professionnels dans les cas graves d'AOS. Les cliniques privées, quant à elles, adoptent de plus en plus les services de thérapie CPAP pour répondre à la demande croissante de patients ambulatoires. La catégorie « Autres », comprenant les laboratoires du sommeil et les centres de rééducation, représente également un groupe d'utilisateurs finaux en pleine croissance, grâce à l'amélioration de la sensibilisation et du diagnostic dans la région.

Analyse régionale du marché des appareils CPAP au Moyen-Orient et en Afrique

- L'Afrique du Sud a dominé le marché des appareils CPAP avec la plus grande part de revenus de 31,9 % en 2024, soutenue par une infrastructure de soins de santé bien établie, des campagnes actives de sensibilisation aux troubles du sommeil et une accessibilité croissante aux traitements dans les centres urbains.

- Les consommateurs de la région reconnaissent de plus en plus l’importance d’un diagnostic précoce et d’un traitement continu de l’apnée obstructive du sommeil, avec une évolution notable vers les soins à domicile et l’utilisation d’appareils CPAP portables.

- Cette adoption est également soutenue par l'amélioration de l'accès aux soins respiratoires, l'augmentation des taux d'obésité et la présence de prestataires de soins de santé internationaux, positionnant l'Afrique du Sud comme un leader régional dans l'adoption de la thérapie CPAP dans les contextes cliniques et de santé personnelle.

Aperçu du marché des appareils CPAP en Afrique du Sud

En 2024, le marché sud-africain des appareils CPAP a représenté la plus grande part de chiffre d'affaires au Moyen-Orient et en Afrique, avec 31,4 %, grâce à une forte sensibilisation aux troubles du sommeil, à l'accès aux services de diagnostic et à de solides partenariats public-privé dans le secteur de la santé. La croissance de la population gériatrique et la prévalence croissante de l'obésité accentuent le besoin de traitements efficaces contre l'apnée du sommeil. De plus, l'évolution vers les solutions de soins à domicile et l'intérêt croissant des consommateurs pour les plateformes de santé numériques soutiennent la croissance des appareils CPAP intelligents et portables sur le marché.

Aperçu du marché des appareils CPAP en Arabie saoudite

Le marché saoudien des appareils CPAP devrait connaître une forte croissance annuelle composée (TCAC) au cours de la période de prévision, stimulé par les initiatives gouvernementales en matière de santé (Vision 2030) et l'importance croissante accordée à l'amélioration de la qualité de vie. La prévalence croissante de maladies chroniques telles que le diabète et l'obésité , ainsi que l'augmentation des investissements dans les infrastructures hospitalières et les cliniques du sommeil, créent des conditions favorables à l'adoption des appareils CPAP. L'expansion du secteur privé de la santé et le recours croissant à la télésanté pour le suivi des soins soutiennent également la croissance du marché.

Aperçu du marché des appareils CPAP aux Émirats arabes unis

Le marché des appareils CPAP aux Émirats arabes unis devrait connaître une croissance annuelle moyenne (TCAC) remarquable au cours de la période de prévision, soutenue par une urbanisation rapide, une population à revenus élevés et un intérêt croissant pour la santé numérique. Les consommateurs émiratis se tournent de plus en plus vers les soins à domicile et les solutions de télésurveillance, ce qui rend les appareils CPAP portables et intelligents très attractifs. De plus, l'essor du tourisme médical et la modernité des infrastructures de santé du pays favorisent la disponibilité et l'utilisation d'équipements de pointe pour la thérapie du sommeil.

Aperçu du marché des appareils CPAP en Égypte

Le marché égyptien des appareils CPAP devrait connaître une croissance modérée, porté par des campagnes de sensibilisation accrues et une amélioration progressive de l'accès aux soins. Bien que le marché en soit encore à ses débuts, l'augmentation du nombre de diagnostics de troubles du sommeil et le soutien des organisations internationales de santé contribuent à l'adoption croissante des appareils CPAP. Avec l'amélioration de l'accessibilité financière et l'arrivée de nouveaux acteurs sur le marché proposant des solutions économiques, l'Égypte devrait devenir un contributeur important à la croissance régionale.

Part de marché des appareils CPAP au Moyen-Orient et en Afrique

L'industrie des appareils CPAP au Moyen-Orient et en Afrique est principalement dirigée par des entreprises bien établies, notamment :

- ResMed Inc. (États-Unis)

- Koninklijke Philips NV (Pays-Bas)

- Fisher & Paykel Healthcare Limited (Nouvelle-Zélande)

- BMC Medical Co., Ltd. (Chine)

- Apex Medical Corp. (Taïwan)

- Löwenstein Medical GmbH & Co. KG (Allemagne)

- Drive DeVilbiss Healthcare LLC (États-Unis)

- 3B Medical, Inc. (États-Unis)

- Breas Medical AB (Suède)

- Somnetics International, Inc. (États-Unis)

- SLS Medical Technology (Chine)

- Resvent Medical Technology Co., Ltd. (Chine)

- Teijin Pharma Limited (Japon)

- Koike Medical Co., Ltd. (Japon)

- Nidek Medical India Pvt. Ltd. (Inde)

- Medtronic (Irlande)

- Cardinal Health, Inc. (États-Unis)

- Smiths Medical, Inc. (Royaume-Uni)

- Fosun Pharma (Chine)

- Elmaslar Medikal Sistemleri (Turquie)

Quels sont les développements récents sur le marché des appareils CPAP au Moyen-Orient et en Afrique ?

- En mai 2024, ResMed Inc., leader mondial des soins du sommeil et des soins respiratoires, s'est associé à des distributeurs de produits de santé sud-africains de premier plan pour élargir l'accès à ses appareils CPAP portables dans les zones urbaines et semi-urbaines. Cette collaboration stratégique vise à répondre à la demande croissante de traitement de l'apnée du sommeil à domicile et à sensibiliser le public grâce à des campagnes de sensibilisation ciblées, soulignant ainsi l'engagement de ResMed à améliorer la santé du sommeil dans la région.

- En mars 2024, Philips Respironics a lancé une initiative régionale de formation et d'accompagnement aux Émirats arabes unis afin de favoriser l'adoption clinique de ses systèmes CPAP avancés, dont le DreamStation 2 Auto CPAP. Ce programme vise à doter les professionnels de santé des outils et des connaissances les plus récents pour une prise en charge efficace de l'apnée du sommeil, soutenant ainsi les efforts de Philips pour accroître la pénétration du traitement CPAP et garantir de meilleurs résultats pour les patients au Moyen-Orient.

- En février 2024, BMC Medical Co., Ltd., fournisseur chinois de soins respiratoires, a étendu sa présence au Moyen-Orient grâce à de nouveaux accords de distribution en Égypte et en Arabie saoudite. L'entreprise a lancé une gamme de solutions CPAP abordables et portables, adaptées aux besoins du marché local, notamment des appareils avec humidificateur intégré et des applications de surveillance mobile. Cette expansion reflète la stratégie de BMC visant à répondre aux besoins des segments sensibles aux coûts tout en favorisant l'adoption de la thérapie à domicile.

- En janvier 2024, Löwenstein Medical, entreprise allemande de technologies médicales, a inauguré un centre d'assistance régional en Afrique du Sud pour assurer le service après-vente et la formation produit de ses systèmes CPAP PrismaLINE. Cette initiative renforce l'engagement client et le support opérationnel, consolidant ainsi la présence de Löwenstein sur le marché africain et son engagement en faveur de soins respiratoires de haute qualité.

- En décembre 2023, Fisher & Paykel Healthcare a mené une campagne de sensibilisation au bien-être du sommeil en partenariat avec des hôpitaux privés au Kenya et au Nigéria. Cette initiative s'est concentrée sur le diagnostic précoce du SAOS et a présenté la gamme d'appareils CPAP de l'entreprise, équipés d'une technologie d'humidification avancée. Cette campagne souligne les efforts continus de Fisher & Paykel pour sensibiliser aux troubles du sommeil et promouvoir des options thérapeutiques accessibles et confortables dans les régions mal desservies.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.