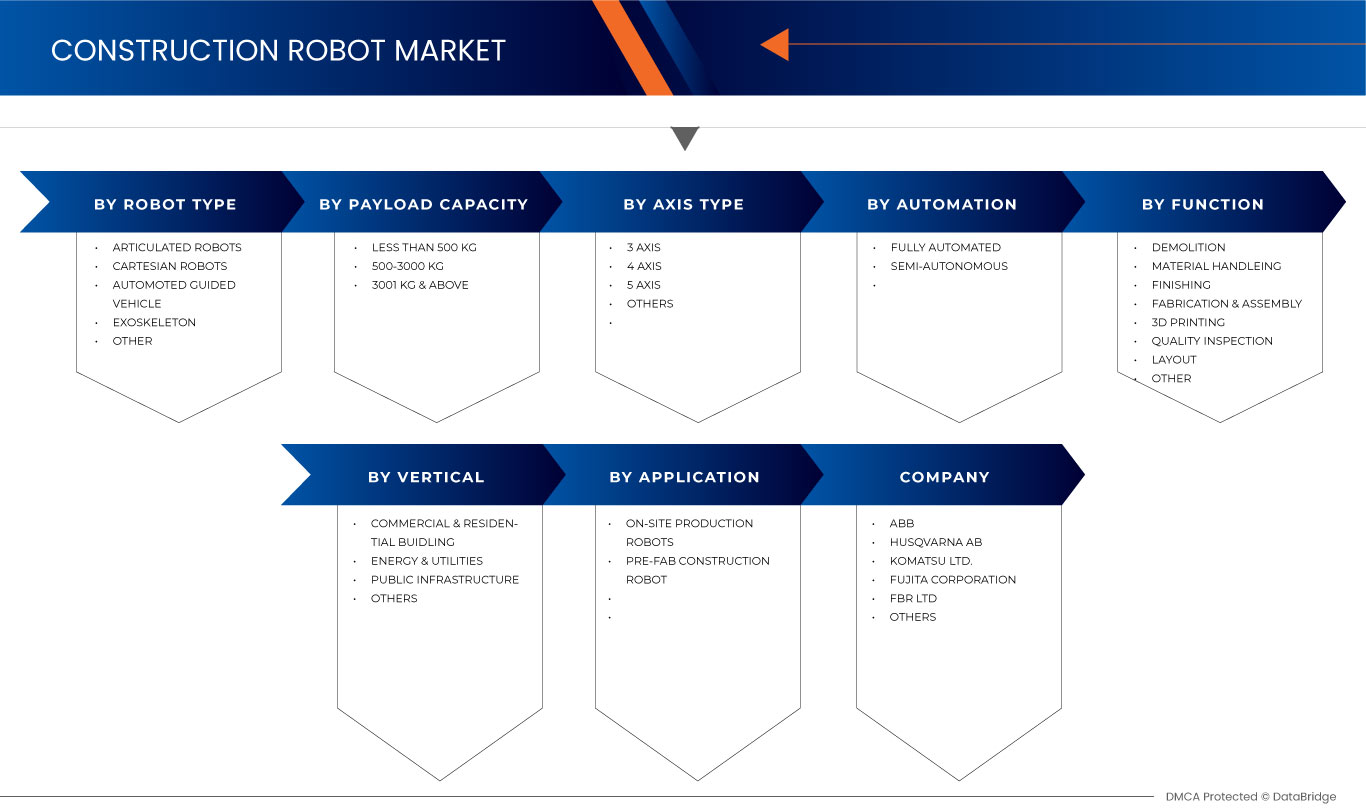

Marché des robots de construction au Moyen-Orient et en Afrique, par type de robots ( robots articulés , exosquelettes, robots cartésiens, véhicules à guidage automatique et autres), capacité de charge utile (moins de 500 kg, 500-3000 kg et 3001 kg et plus), type d’axe (3 axes, 4 axes et 5 axes), automatisation (entièrement autonome et semi-autonome), fonction (démolition, processus de structure, manutention de matériaux, finition et assemblage, impression 3D, contrôle de la qualité, aménagement et autres), vertical (infrastructures commerciales et résidentielles, infrastructures publiques, énergie et services publics et autres), type de produit (robot de production sur site et robot de construction préfabriqué) – Tendances et prévisions de l’industrie jusqu’en 2030.

Analyse et taille du marché des robots de construction au Moyen-Orient et en Afrique

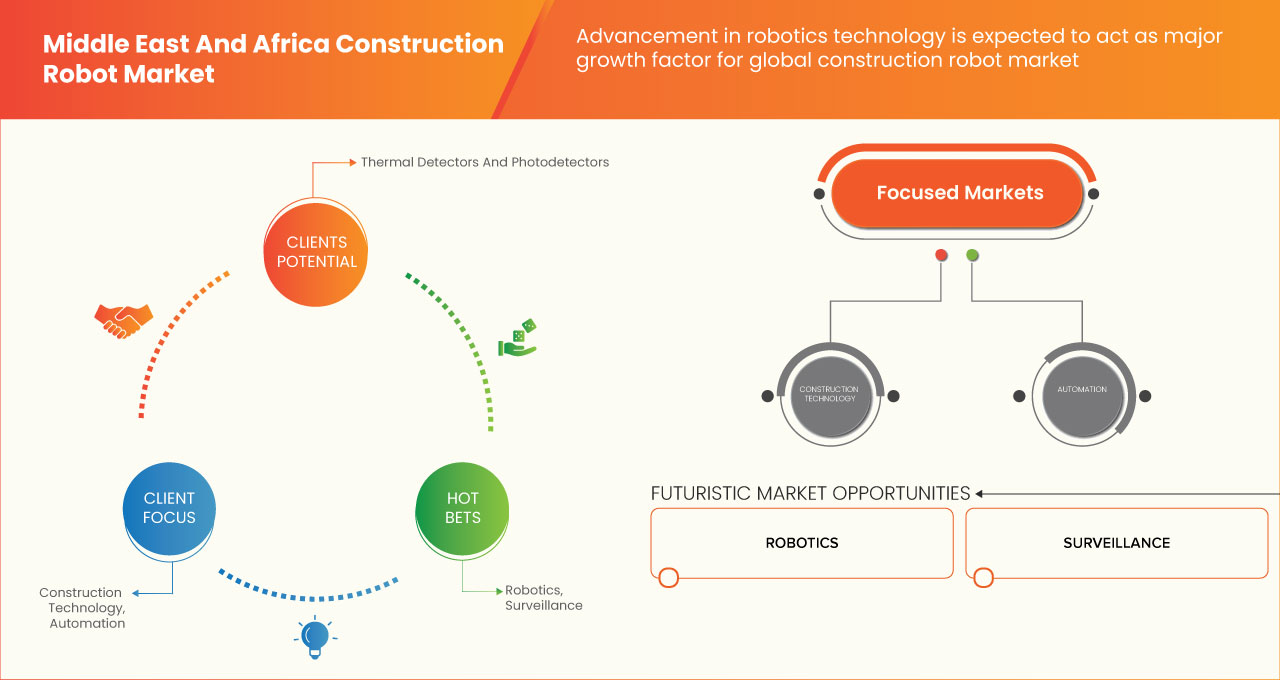

Les principaux facteurs qui devraient stimuler la croissance du marché des robots de construction au cours de la période de prévision sont l'augmentation de plusieurs applications industrielles, notamment l'aérospatiale, l'acier, l'énergie, la chimie et d'autres. En outre, la résistance accrue aux variations de charge est l'avantage du robot de construction, ce qui devrait encore propulser la croissance du marché des robots de construction.

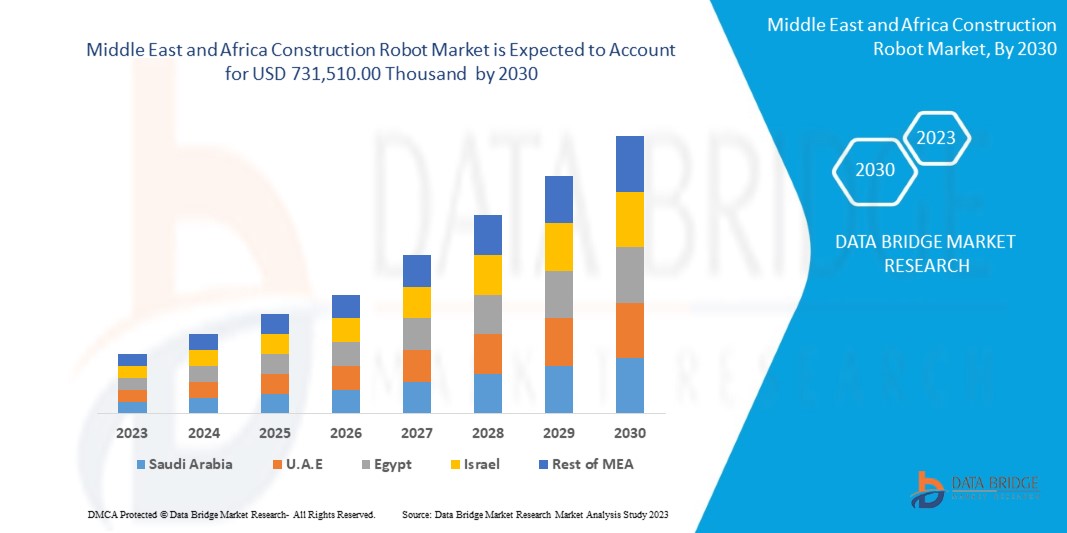

Data Bridge Market Research estime que le marché des robots de construction au Moyen-Orient et en Afrique devrait atteindre la valeur de 731 510 000 USD d'ici 2030, à un TCAC de 8,7 % au cours de la période de prévision. Le rapport sur le marché des robots de construction couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Par type de robot (robots articulés, exosquelettes, robots cartésiens, véhicules à guidage automatique et autres), capacité de charge utile (MOINS DE 500 KG, 500-3000 KG et 3001 KG ET PLUS), type d'axe (3 axes, 4 axes et 5 axes), automatisation (entièrement autonome et semi-autonome), fonction (démolition, processus de structure, manutention de matériaux, finition et assemblage, impression 3D, contrôle qualité, aménagement et autres), VERTICAL (infrastructures commerciales et résidentielles, infrastructures publiques, énergie et services publics et autres), type de produit (robot de production sur site et robot de construction préfabriqué) |

|

Pays couverts |

Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël et reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA) |

|

Acteurs du marché couverts |

Français ABB, Husqvarna AB, Komatsu Ltd., Fujita Corporation, FBR Ltd, Conjet, Contour Crafting Corporation, MX3D, CyBe Construction, KEWAZO BROKK GLOBAL, RobotWorx, Built Robotics, ICON Technology, inc., Dusty Robotics, MUDBOTS 3D CONCRETE PRINTING, LLC, Advanced Construction Robotics, Inc., NASKA.AI, nLink AS, Okibo entre autres. |

Définition du marché

Les robots de construction sont des machines automatisées conçues pour aider à diverses tâches sur les chantiers de construction. Ces robots sont équipés de capteurs, de caméras et d'autres technologies avancées qui leur permettent d'effectuer des tâches telles que la maçonnerie, le coulage du béton, le soudage et la démolition. Le marché des robots de construction au Moyen-Orient et en Afrique fait référence au marché de la technologie robotique utilisée dans le secteur de la construction. Ce marché comprend une large gamme de types de robots, notamment des robots industriels traditionnels, des robots exosquelettes et des robots mobiles conçus spécifiquement pour les applications de construction. Le marché des robots de construction a connu une croissance rapide ces dernières années, car les progrès de la technologie robotique ont permis aux robots d'effectuer un plus large éventail de tâches sur les chantiers de construction. Ces tâches comprennent des tâches telles que la démolition, la maçonnerie, le soudage, la peinture et la manutention de matériaux.

Dynamique du marché des robots de construction

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de l'urbanisation à travers le monde

Les robots de construction sont des machines automatisées conçues pour aider à diverses tâches sur les chantiers de construction. Ces robots sont équipés de capteurs, de caméras et d'autres technologies avancées qui leur permettent d'effectuer des tâches de maçonnerie, de coulage de béton, de soudage et de démolition. Les robots de construction se présentent sous de nombreuses formes différentes, des véhicules autonomes qui transportent des matériaux sur le chantier aux drones aériens qui peuvent surveiller l'avancement d'un projet d'en haut. Ils peuvent également être utilisés pour effectuer des tâches dangereuses ou difficiles pour les humains, comme travailler en hauteur ou dans des environnements dangereux. Les robots de construction deviennent de plus en plus populaires dans le secteur de la construction, car ils peuvent aider à augmenter la productivité, à améliorer la sécurité et à réduire les coûts de main-d'œuvre. L'urbanisation fait référence à la croissance des zones urbaines à mesure que les gens migrent des zones rurales vers les villes à la recherche de meilleures opportunités. Cette urbanisation rapide devrait stimuler le marché des robots de construction au Moyen-Orient et en Afrique à mesure que la demande de méthodes de construction efficaces, rentables et sûres augmente.

- Productivité et efficacité accrues grâce au robot de construction

Le robot de construction a le potentiel de réduire considérablement le temps et les coûts impliqués dans les projets de construction. Les robots de construction sont conçus pour effectuer des tâches répétitives et chronophages plus rapidement et avec plus de précision que les travailleurs humains. Ils peuvent travailler 24 heures sur 24 sans se fatiguer ni avoir besoin de pauses. Les robots de construction sont utiles dans une variété de tâches de construction, notamment la maçonnerie, le soudage, la peinture et la démolition.

Opportunités

- Augmentation de la demande et de l'utilisation de l'automatisation sur les chantiers de construction

Ces dernières années, la tendance à l’utilisation de robots sur les chantiers de construction s’est accrue. Plusieurs facteurs, notamment les progrès technologiques, l’augmentation des coûts de main-d’œuvre et la pénurie de main-d’œuvre qualifiée dans certains domaines, peuvent en témoigner. Les robots peuvent être utilisés pour diverses tâches sur les chantiers de construction, telles que l’excavation, la démolition, la manutention de matériaux et l’impression 3D. Ils peuvent travailler 24 heures sur 24, 7 jours sur 7, sans interruption, et peuvent être programmés pour effectuer des tâches avec précision et efficacité. Cela peut conduire à une productivité accrue, à une réduction des coûts de main-d’œuvre et à une amélioration de la sécurité sur le chantier. L’un des principaux exemples de robot de construction est le système de construction robotique autonome (ARCS), développé par des chercheurs du Massachusetts Institute of Technology (MIT). L’ARCS est un système autonome qui peut construire des structures de manière autonome sans intervention humaine.

Contraintes/Défis

- Coût élevé associé aux robots de construction

Les robots de construction sont généralement plus chers que les équipements de construction traditionnels et nécessitent une formation et une maintenance spécialisées. Cela peut entraîner des coûts initiaux plus élevés pour les entreprises de construction qui souhaitent adopter ces technologies. De plus, certaines entreprises de construction peuvent hésiter à investir dans de nouvelles technologies en raison de préoccupations concernant le retour sur investissement et les risques associés à la mise en œuvre de nouveaux processus et systèmes. L’un des facteurs qui pourraient freiner le marché des robots de construction au Moyen-Orient et en Afrique est le coût élevé associé aux robots de construction et l’investissement initial élevé requis pour adopter ces technologies. L’investissement initial pour la mise en œuvre de robots de construction peut être important, ce qui peut constituer un obstacle pour certaines entreprises, en particulier les plus petites. De plus, les coûts de maintenance et de réparation de ces robots peuvent également être élevés, ce qui augmente le coût total de possession.

Impact de la pandémie de COVID-19 sur le marché des robots de construction au Moyen-Orient et en Afrique

La COVID-19 a eu un impact négatif sur le marché des robots de construction en raison des réglementations et des règles de confinement dans les usines de fabrication.

La pandémie de COVID-19 a eu un impact négatif sur le marché des robots de construction. Cependant, l'adoption croissante des robots de construction dans le secteur de l'aviation a aidé le marché à croître après la pandémie. En outre, la croissance a été élevée après l'ouverture du marché après la COVID-19, et on s'attend à ce qu'il y ait une croissance considérable dans le secteur.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans le robot de construction. Grâce à cela, les entreprises apporteront des technologies avancées sur le marché. En outre, les initiatives gouvernementales pour l'utilisation de la technologie d'automatisation ont conduit à la croissance du marché

Développement récent

- En mars 2023, FBR Ltd a annoncé un accord stratégique avec la société britannique M & G Investment Management, en vertu duquel elle fabriquera trois robots Hadrian X de la dernière génération pour les États-Unis. En utilisant la technologie de stabilisation dynamique principale de l'entreprise, ces robots sont conçus pour fonctionner à l'extérieur (DST). Un tel développement aide l'entreprise à acquérir une reconnaissance internationale.

- En septembre 2022, Conjet et Doornbos Equipment BV ont conclu un partenariat avec Doornbos Equipment BV, qui agit en tant que partenaire de distribution pour la Belgique, le Luxembourg et les Pays-Bas (BENELUX). Doornbos reprendra la concession d'Overmat Industries. De tels partenariats aident l'entreprise à accroître sa présence à l'échelle mondiale

Portée du marché des robots de construction

Le marché des robots de construction est segmenté en fonction du type de robot, de la capacité de charge utile, du type d'axe, de l'automatisation, de la fonction, de la verticale et du type de produit. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de robot

- Robots articulés

- Robots cartésiens

- Véhicule à guidage automatique

- Exosquelette

- Autres

Sur la base du type de robot, le marché des robots de construction est segmenté en robots articulés, robots cartésiens, véhicules à guidage automatique, exosquelettes et autres .

Capacité de charge utile

- Moins de 500 kg

- 500-3000 kg

- 3001 kg et plus

Sur la base de la capacité de charge utile, le marché des robots de construction est segmenté en moins de 500 kg, 500-3000 kg et 3001 kg et plus.

Type d'axe

- 3 axes

- 4 axes

- 5 axes

- Autres

Sur la base du type d'axe, le marché des robots de construction est segmenté en 3 axes, 4 axes, 5 axes et autres.

Automation

- Entièrement automatisé

- Semi-autonome

Sur la base de l’automatisation, le marché des robots de construction est segmenté en robots entièrement automatisés et semi-autonomes.

Fonction

- Démolition

- Processus structurel

- Manutention de matériaux

- Processus de finition

- Fabrication et assemblage

- Impression 3D

- Contrôle de qualité

- Mise en page

- Autre

Sur la base de la fonction, le marché des robots de construction est segmenté en démolition, processus structurel, manutention de matériaux, processus de finition, fabrication et assemblage, impression 3D, contrôle qualité, aménagement et autres.

Verticale

- Bâtiment commercial et résidentiel

- Énergie et services publics

- Infrastructures publiques

- Autres

Sur la base de la verticale, le marché des robots de construction est segmenté en bâtiments commerciaux et résidentiels, énergie et services publics, infrastructures publiques et autres.

Analyse/perspectives régionales du marché des robots de construction

Le marché des robots de construction est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type de robot, capacité de charge utile, type d'axe, automatisation, fonction, vertical et type de produit comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des robots de construction sont l'Afrique du Sud, l'Égypte, l'Arabie saoudite, les Émirats arabes unis, Israël et le reste du Moyen-Orient et de l'Afrique (MEA) dans le cadre du Moyen-Orient et de l'Afrique (MEA).

Les Émirats arabes unis dominent la région du Moyen-Orient et de l'Afrique en raison de l'augmentation des activités de recherche et développement, ainsi que des avancées technologiques. En outre, l'adoption croissante de l'automatisation dans la fabrication et la robotique industrielle.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des robots de construction

Le paysage concurrentiel du marché des robots de construction fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des ROBOTS DE CONSTRUCTION.

Certains des principaux acteurs opérant sur le marché sont ABB, Husqvarna AB, Komatsu Ltd., Fujita Corporation, FBR Ltd, Conjet, Contour Crafting Corporation, MX3D, CyBe Construction, KEWAZO BROKK GLOBAL, RobotWorx, Built Robotics, ICON Technology, inc., Dusty Robotics, MUDBOTS 3D CONCRETE PRINTING, LLC, Advanced Construction Robotics, Inc., NASKA.AI, nLink AS, Okibo entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 ROBOTS TYPES CURVE

2.1 MARKET PLATFORM COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN URBANIZATION ACROSS THE GLOBE

5.1.2 ADDED PRODUCTIVITY AND EFFICIENCY BY CONSTRUCTION ROBOT

5.1.3 INCREASE IN SUSTAINABLE BUILDING PRACTICES

5.1.4 ADVANCEMENT IN ROBOTICS TECHNOLOGY

5.1.5 SAFETY OFFERED IN HARSH WORKING ENVIRONMENTS

5.2 RESTRAINT

5.2.1 HIGH COST ASSOCIATED WITH CONSTRUCTION ROBOTS

5.3 OPPORTUNITIES

5.3.1 SURGING DEMAND AND USAGE IN AUTOMATION AT CONSTRUCTION SITES

5.3.2 INCREASING STRATEGIC PARTNERSHIPS AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 ADOPTION OF 3D PRINTING IN THE CONSTRUCTION INDUSTRY

5.4 CHALLENGES

5.4.1 LACK OF SKILLED LABOR TO HANDLE CONSTRUCTION ROBOTS

5.4.2 LACK OF AWARENESS REGARDING CONSTRUCTION ROBOTICS

6 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE

6.1 OVERVIEW

6.2 ARTICULATED ROBOTS

6.3 EXOSKELETON

6.4 CARTESIAN ROBOTS

6.5 AUTOMATED GUIDED VEHICLE

6.6 OTHERS

7 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY PAYLOAD CAPACITY

7.1 OVERVIEW

7.2 LESS THAN 500 KG

7.3 500-3000 KG

7.4 3001 KG & ABOVE

8 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY AXIS TYPE

8.1 OVERVIEW

8.2 4 AXIS

8.3 5 AXIS

8.4 3 AXIS

8.5 OTHERS

9 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY AUTOMATION

9.1 OVERVIEW

9.2 SEMI-AUTONOMOUS

9.3 FULLY AUTOMATED

10 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 DEMOLITION

10.3 STRUCTURAL PROCESSES

10.3.1 BRICKLAYING

10.3.2 WELDING

10.3.3 FASTENING

10.3.4 CONCRETE STRUCTURAL ERECTION

10.3.5 OTHERS

10.4 MATERIAL HANDLING

10.5 FINISHING PROCESSES

10.5.1 DRILLING

10.5.2 PAINTING

10.5.3 CLEANING

10.5.4 OTHERS

10.6 FABRICATION & ASSEMBLING

10.7 3D PRINTING

10.8 QUALITY INSPECTION

10.9 LAYOUT

10.1 OTHERS

11 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 COMMERCIAL & RESIDENTIAL INFRASTRUCTURE

11.2.1 ARTICULATED ROBOTS

11.2.2 EXOSKELETON

11.2.3 CARTESIAN

11.2.4 AUTOMATED GUIDED VEHICLE

11.2.5 OTHERS

11.3 PUBLIC INFRASTRUCTURE

11.3.1 ARTICULATED ROBOTS

11.3.2 EXOSKELETON

11.3.3 CARTESIAN

11.3.4 AUTOMATED GUIDED VEHICLE

11.3.5 OTHERS

11.4 ENERGY & UTILITY

11.4.1 ARTICULATED ROBOTS

11.4.2 EXOSKELETON

11.4.3 CARTESIAN

11.4.4 AUTOMATED GUIDED VEHICLE

11.4.5 OTHERS

11.5 OTHERS

12 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 ON-SITE PRODUCTION ROBOTS

12.3 PRE-FAB CONSTRUCTION ROBOTS

13 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 U.A.E.

13.1.2 SAUDI ARABIA

13.1.3 SOUTH AFRICA

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 HUSQVARNA AB

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 KOMATSU LTD.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SOLUTION PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ABB

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 BROKK MIDDLE EAST & AFRICA

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 ICON TECHNOLOGY, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 SOLUTION PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 ADVANCED CONSTRUCTION ROBOTICS, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BUILT ROBOTICS

16.7.1 COMPANY SNAPSHOT

16.7.2 SOLUTION PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CONJET

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CONTOUR CRAFTING CORPORATION

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 CYBE CONSTRUCTION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 DUSTY ROBOTICS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FBR LTD

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 FUJITA CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 KEWAZO

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 MUDBOTS 3D CONCRETE PRINTING, LLC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 MX3D

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 NASKA.AI

16.17.1 COMPANY SNAPSHOT

16.17.2 SOLUTION PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 NLINK AS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 OKIBO

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 ROBOTWORX

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 MIDDLE EAST & AFRICA ARTICULATED ROBOTS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA EXOSKELETON IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA CARTESIAN ROBOTS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA AUTOMATED GUIDED VEHICLE IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA OTHERS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY PAYLOAD CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA LESS THAN 500 KG IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA 500-3000 KG IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA 3001 KG & ABOVE IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY AXIS TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA 4 AXIS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA 5 AXIS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA 3 AXIS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA SEMI-AUTONOMOUS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA FULLY AUTOMATED IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA DEMOLITION IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA STRUCTURAL PROCESSES IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA STRUCTURAL PROCESSES IN CONSTRUCTION ROBOT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA MATERIAL HANDLING IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA FINISHING PROCESSES IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA FINISHING PROCESSES IN CONSTRUCTION ROBOT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA FABRICATION & ASSEMBLING IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA 3D PRINTING IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA QUALITY INSPECTION IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA LAYOUT IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA COMMERCIAL & RESIDENTIAL INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA COMMERCIAL & RESIDENTIAL INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPES, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA PUBLIC INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA PUBLIC INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA ENERGY & UTILITY IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA ENERGY & UTILITY IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPES, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 41 MIDDLE EAST & AFRICA ON-SITE PRODUCTION ROBOTS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA PRE-FAB CONSTRUCTION ROBOTS IN CONSTRUCTION ROBOT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET, BY PAYLOAD CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET, BY AXIS TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA STRUCTURAL PROCESSES IN CONSTRUCTION ROBOT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA FINISHING PROCESSES IN CONSTRUCTION ROBOT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA COMMERCIAL & RESIDENTIAL INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA PUBLIC INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA ENERGY & UTILITY IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 57 U.A.E. CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 U.A.E. CONSTRUCTION ROBOT MARKET, BY PAYLOAD CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 59 U.A.E. CONSTRUCTION ROBOT MARKET, BY AXIS TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 U.A.E. CONSTRUCTION ROBOT MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 61 U.A.E. CONSTRUCTION ROBOT MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 62 U.A.E. STRUCTURAL PROCESSES IN CONSTRUCTION ROBOT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 U.A.E. FINISHING PROCESSES IN CONSTRUCTION ROBOT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 64 U.A.E. CONSTRUCTION ROBOT MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 65 U.A.E. COMMERCIAL & RESIDENTIAL INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 U.A.E. PUBLIC INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 U.A.E. ENERGY & UTILITY IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 U.A.E. CONSTRUCTION ROBOT MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 SAUDI ARABIA CONSTRUCTION ROBOT MARKET, BY PAYLOAD CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 70 SAUDI ARABIA CONSTRUCTION ROBOT MARKET, BY AXIS TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 SAUDI ARABIA CONSTRUCTION ROBOT MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 72 SAUDI ARABIA CONSTRUCTION ROBOT MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 73 SAUDI ARABIA STRUCTURAL PROCESSES IN CONSTRUCTION ROBOT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 SAUDI ARABIA FINISHING PROCESSES IN CONSTRUCTION ROBOT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 75 SAUDI ARABIA CONSTRUCTION ROBOT MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 76 SAUDI ARABIA COMMERCIAL & RESIDENTIAL INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 SAUDI ARABIA PUBLIC INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 SAUDI ARABIA ENERGY & UTILITY IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 SAUDI ARABIA CONSTRUCTION ROBOT MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 SOUTH AFRICA CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH AFRICA CONSTRUCTION ROBOT MARKET, BY PAYLOAD CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 82 SOUTH AFRICA CONSTRUCTION ROBOT MARKET, BY AXIS TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 SOUTH AFRICA CONSTRUCTION ROBOT MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 84 SOUTH AFRICA CONSTRUCTION ROBOT MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH AFRICA STRUCTURAL PROCESSES IN CONSTRUCTION ROBOT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 SOUTH AFRICA FINISHING PROCESSES IN CONSTRUCTION ROBOT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 87 SOUTH AFRICA CONSTRUCTION ROBOT MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 88 SOUTH AFRICA COMMERCIAL & RESIDENTIAL INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 SOUTH AFRICA PUBLIC INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 SOUTH AFRICA ENERGY & UTILITY IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 SOUTH AFRICA CONSTRUCTION ROBOT MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 EGYPT CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 EGYPT CONSTRUCTION ROBOT MARKET, BY PAYLOAD CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 94 EGYPT CONSTRUCTION ROBOT MARKET, BY AXIS TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 EGYPT CONSTRUCTION ROBOT MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 96 EGYPT CONSTRUCTION ROBOT MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 97 EGYPT STRUCTURAL PROCESSES IN CONSTRUCTION ROBOT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 EGYPT FINISHING PROCESSES IN CONSTRUCTION ROBOT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 99 EGYPT CONSTRUCTION ROBOT MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 100 EGYPT COMMERCIAL & RESIDENTIAL INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 EGYPT PUBLIC INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 EGYPT ENERGY & UTILITY IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 EGYPT CONSTRUCTION ROBOT MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 ISRAEL CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 ISRAEL CONSTRUCTION ROBOT MARKET, BY PAYLOAD CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 106 ISRAEL CONSTRUCTION ROBOT MARKET, BY AXIS TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 ISRAEL CONSTRUCTION ROBOT MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 108 ISRAEL CONSTRUCTION ROBOT MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 109 ISRAEL STRUCTURAL PROCESSES IN CONSTRUCTION ROBOT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 ISRAEL FINISHING PROCESSES IN CONSTRUCTION ROBOT MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 111 ISRAEL CONSTRUCTION ROBOT MARKET, BY VERTICAL, 2021-2030 (USD THOUSAND)

TABLE 112 ISRAEL COMMERCIAL & RESIDENTIAL INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 ISRAEL PUBLIC INFRASTRUCTURE IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 ISRAEL ENERGY & UTILITY IN CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 ISRAEL CONSTRUCTION ROBOT MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 REST OF MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET, BY ROBOTS TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: MULTIVARIATE MODELLING

FIGURE 10 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: MULTIVARIATE MODELLING

FIGURE 11 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 12 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 INCREASE IN SUSTAINABLE BUILDING PRACTICES IS EXPECTED TO BE KEY DRIVER FOR THE MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 ARTICULATED ROBOT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET IN 2023 TO 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET

FIGURE 17 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: BY ROBOTS TYPE, 2022

FIGURE 18 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: BY PAYLOAD CAPACITY, 2022

FIGURE 19 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: BY AXIS TYPE, 2022

FIGURE 20 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: BY AUTOMATION, 2022

FIGURE 21 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: BY FUNCTION, 2022

FIGURE 22 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: BY VERTICAL, 2022

FIGURE 23 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: BY PRODUCT TYPE, 2022

FIGURE 24 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET: SNAPSHOT (2022)

FIGURE 25 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET: BY COUNTRY (2022)

FIGURE 26 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 MIDDLE EAST AND AFRICA CONSTRUCTION ROBOT MARKET: BY ROBOTS TYPE (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA CONSTRUCTION ROBOT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.