Middle East And Africa Colorectal Surgical Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

449.73 Million

USD

784.84 Million

2021

2029

USD

449.73 Million

USD

784.84 Million

2021

2029

| 2022 –2029 | |

| USD 449.73 Million | |

| USD 784.84 Million | |

|

|

|

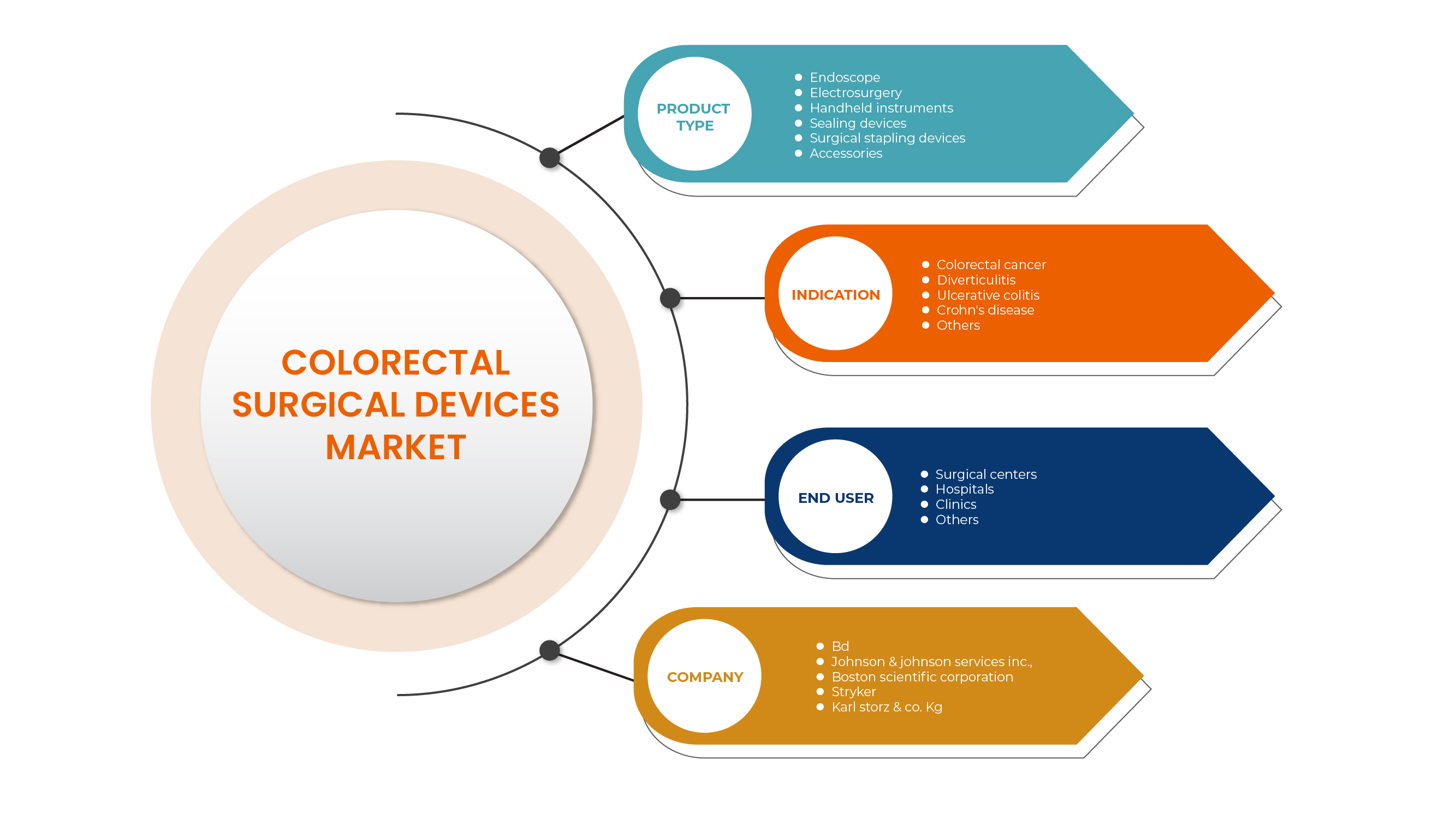

Marché des dispositifs chirurgicaux colorectaux au Moyen-Orient et en Afrique, par type de produit ( endoscope , électrochirurgie, instruments portatifs, dispositifs d'étanchéité, dispositifs d'agrafage chirurgical, accessoires), indication (cancer colorectal, diverticulite, colite ulcéreuse, maladie de Crohn , autres), utilisateur final (centres chirurgicaux, hôpitaux, cliniques, autres) Tendances et prévisions de l'industrie jusqu'en 2029

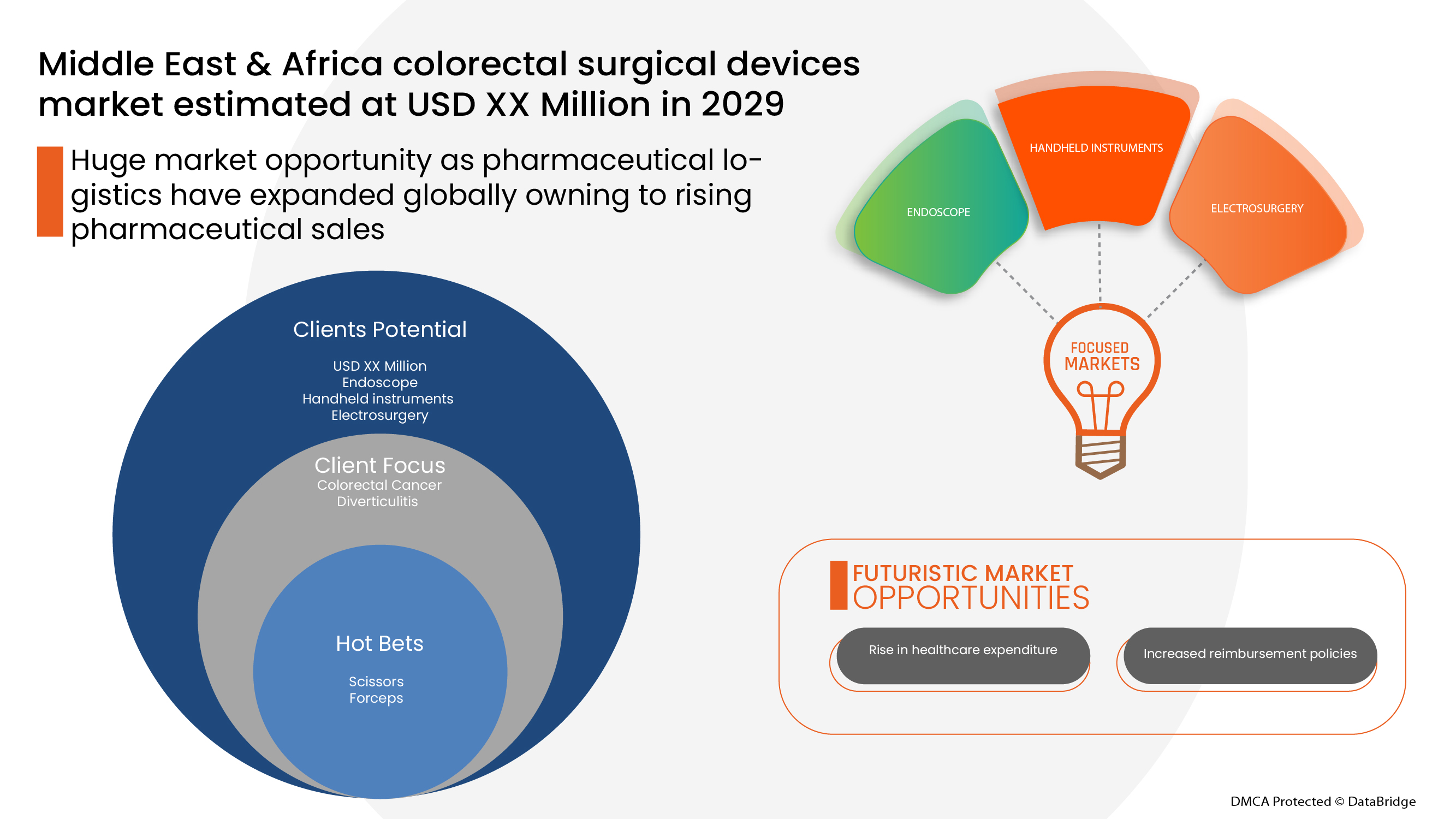

Analyse et perspectives du marché

Le marché des dispositifs chirurgicaux colorectaux au Moyen-Orient et en Afrique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché du Moyen-Orient et de l'Afrique croît avec un TCAC de 7,3% au cours de la période de prévision de 2022 à 2029 et devrait atteindre 784,84 millions USD d'ici 2029 contre 449,73 millions USD en 2021. L'augmentation du revenu par habitant du PIB et l'augmentation de la population gériatrique sont les principaux moteurs de la demande au cours de la période de prévision.

Cependant, le coût élevé et le manque de professionnels de santé qualifiés peuvent entraver la croissance future du marché des dispositifs chirurgicaux colorectaux. L'adoption d'alliances stratégiques telles que les partenariats et les acquisitions par des acteurs clés du marché constitue une opportunité pour la croissance du marché des dispositifs chirurgicaux colorectaux.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Année historique |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de produit (endoscope, électrochirurgie, instruments portatifs, dispositifs d'étanchéité, dispositifs d'agrafage chirurgical, accessoires), indication (cancer colorectal, diverticulite, rectocolite hémorragique, maladie de Crohn, autres), utilisateur final (centres chirurgicaux, hôpitaux, cliniques, autres) |

|

Pays couverts |

Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Israël, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Abbott (États-Unis), Johnson & Johnson Services, Inc. (États-Unis), B. Braun Melsungen AG (Allemagne), BD (États-Unis), Boston Scientific Corporation (États-Unis), Cardinal Health (États-Unis), CONMED Corporation (États-Unis), Cook (États-Unis), CooperSurgical, Inc. (États-Unis), Medtronic (Irlande), Smith & Nephew (Royaume-Uni), Stryker (États-Unis), WL Gore & Associates, Inc. (États-Unis), Richard Wolf GmbH (Allemagne), Olympus Corporation (Japon), KARL STORZ SE & Co. KG (Allemagne), Hebson (Inde), Teleflex Incorporated, PENTAX Medical (Japon) et autres |

Définition du marché

La chirurgie colorectale est une discipline médicale qui traite des troubles de l'anus, du rectum et du côlon. Les différents dispositifs ou produits utilisés dans la chirurgie colorectale sont les suivants : endoscope, instruments manuels, instruments d'accès, électrochirurgie, dispositifs d'agrafage chirurgical, système de gestion des fluides, dispositifs d'étanchéité des vaisseaux et de l'énergie et accessoires.

Dynamique du marché des dispositifs chirurgicaux colorectaux

Conducteurs

- Augmentation de la population gériatrique

La prise en charge des patients gériatriques est devenue l'une des priorités de la chirurgie colorectale en raison de l'augmentation du nombre de patients âgés et de l'incidence du cancer colorectal. La population âgée présente un risque plus élevé de problèmes de santé et la croissance rapide de la population gériatrique la rend plus sujette à divers types de maladies et de troubles qui nécessitent des interventions chirurgicales.

- Augmentation du nombre de patients souffrant de diverticulite et de colite ulcéreuse

Vivre avec des maladies chroniques telles que la colite ulcéreuse et la diverticulite nécessite plusieurs approches de traitement, notamment des médicaments, des modifications alimentaires, des suppléments nutritionnels et une intervention chirurgicale telle que la chirurgie colorectale.

La demande en dispositifs chirurgicaux est élevée en raison de l’augmentation de la prévalence de la diverticulite et de la colite ulcéreuse, ce qui devrait stimuler la croissance du marché.

Retenue

-

Coût élevé des dispositifs de chirurgie colorectale

Ces dernières années, la Food and Drug Administration a autorisé un grand nombre de dispositifs médicaux avancés. Ces dispositifs médicaux approuvés ont fourni des alternatives de traitement médical avancées et ont contribué à améliorer la qualité de vie des patients.

Opportunité

-

Initiatives stratégiques prises par les acteurs du marché et le gouvernement

Les initiatives stratégiques telles que l'acquisition, le partenariat, la signature de contrats et la participation à des conférences offrent des opportunités d'élargir leur clientèle. De plus, grâce à de telles stratégies d'initiative, les entreprises peuvent étendre leur portée à de nouveaux marchés géographiques ou sectoriels et accéder à de nouveaux produits ou types de clients. Les deux acteurs du marché ouvrent la porte à des ressources supplémentaires ou nouvelles telles que la technologie et le talent.

Défi

- Complications liées à la procédure

La chirurgie colorectale ouverte ou laparoscopique comprend de nombreuses procédures différentes pour diverses maladies. En fonction de l'opération et des facteurs de risque modifiables et non modifiables, le taux de morbidité et de mortalité peropératoire et postopératoire varie.

Ces complications et facteurs de risque affectent la perception du patient quant à son choix de recourir à la chirurgie, ce qui devrait remettre en cause la croissance du marché.

Portée et taille du marché des dispositifs chirurgicaux colorectaux

Le marché des dispositifs chirurgicaux colorectaux est segmenté en fonction du type de produit, de l'indication et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type de produit

- Endoscope

- Électrochirurgie

- Instruments portatifs

- Dispositifs d'étanchéité

- Dispositifs d'agrafage chirurgical

- Accessoires

Sur la base du type de produit, le marché est segmenté en endoscope, électrochirurgie, instruments portables, dispositifs d'étanchéité, dispositifs d'agrafage chirurgical et accessoires.

Indication

- Cancer colorectal

- Diverticulite

- Rectocolite hémorragique

- Maladie de Crohn

- Autres

Sur la base de l'indication, le marché est segmenté en cancer colorectal, diverticulite, colite ulcéreuse, maladie de Crohn, autres.

Utilisateur final

- Centres chirurgicaux

- Hôpitaux

- Cliniques

- Autres

Sur la base de l'utilisateur final, le marché est segmenté en centres chirurgicaux, hôpitaux, cliniques et autres.

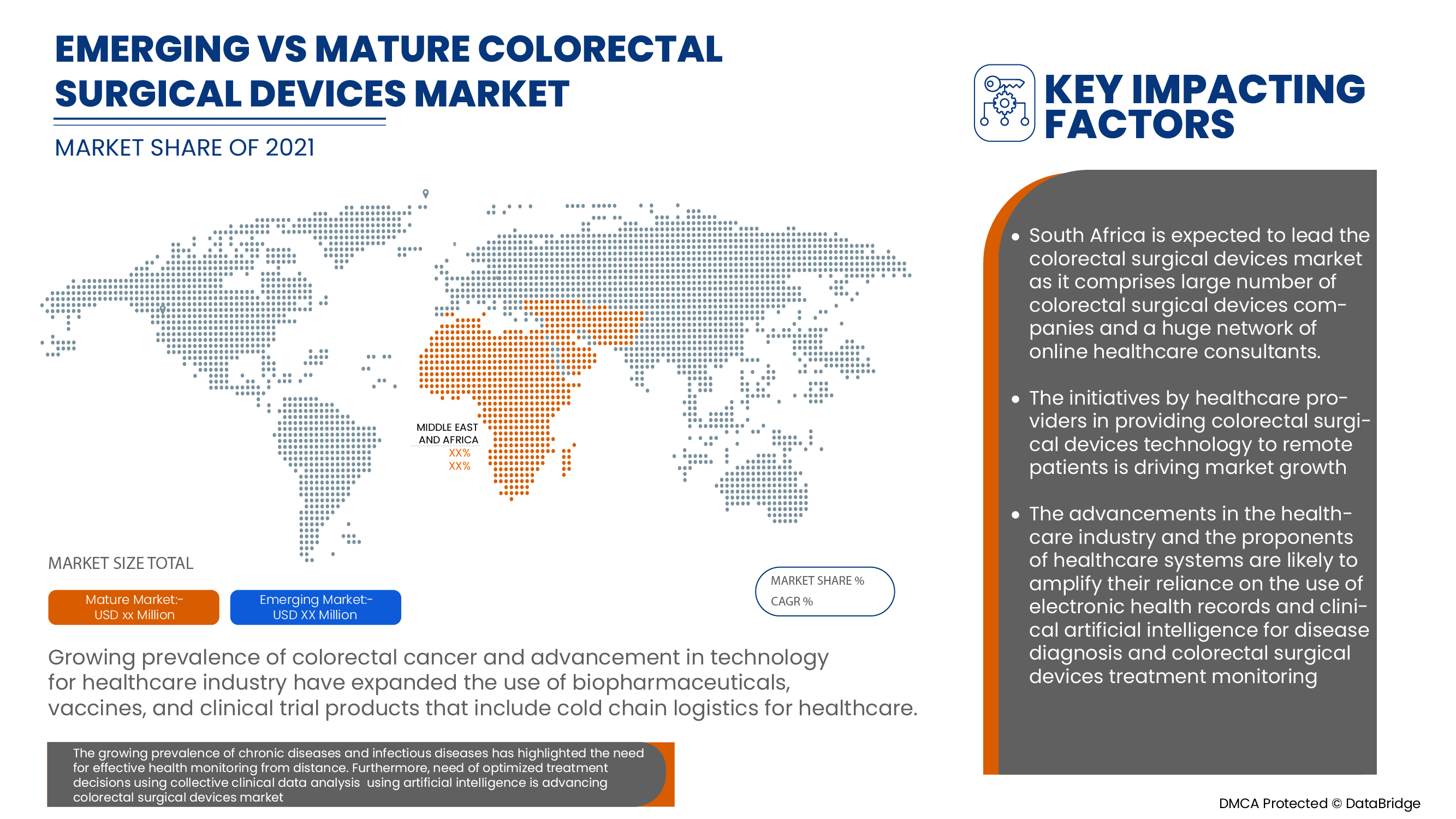

Analyse du marché des dispositifs chirurgicaux colorectaux au niveau des pays

Le marché des dispositifs chirurgicaux colorectaux est analysé et des informations sur la taille du marché sont fournies par type de produit, indication et utilisateur final.

Les pays couverts dans le rapport sur le marché des dispositifs chirurgicaux colorectaux sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, l’Égypte, Israël, le reste du Moyen-Orient et l’Afrique.

En 2022, le Moyen-Orient et l'Afrique devraient dominer en raison de l'augmentation de la population gériatrique. L'Afrique du Sud devrait connaître une croissance en raison de l'augmentation de la commercialisation continue des produits.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Le marché des dispositifs chirurgicaux colorectaux vous fournit également une analyse de marché détaillée pour chaque pays en termes de croissance de l'industrie du marché des dispositifs chirurgicaux colorectaux. De plus, il fournit des informations détaillées sur les ventes du marché des dispositifs chirurgicaux colorectaux, l'impact des scénarios réglementaires et les paramètres de tendance concernant le marché des dispositifs chirurgicaux colorectaux. Les données sont disponibles pour la période historique de 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché des dispositifs chirurgicaux colorectaux

Le paysage concurrentiel du marché des dispositifs chirurgicaux colorectaux fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des dispositifs chirurgicaux colorectaux.

Certaines des principales entreprises qui s'occupent du marché des dispositifs chirurgicaux colorectaux sont Abbott (États-Unis), Johnson & Johnson Services, Inc. (États-Unis), B. Braun Melsungen AG (Allemagne), BD (États-Unis), Boston Scientific Corporation (États-Unis) et d'autres.

Les alliances stratégiques telles que les fusions, les acquisitions et les accords entre les principaux acteurs du marché devraient encore accélérer la croissance du marché des dispositifs chirurgicaux colorectaux.

Par exemple,

- En mai 2021, The Cooper Companies Inc. a annoncé l'acquisition d'obp Medical pour se concentrer sur la fourniture de solutions efficaces qui répondent aux besoins des prestataires de soins. Cette acquisition a aidé l'entreprise à accroître le portefeuille de produits du segment chirurgical.

- En septembre 2018, Stryker a annoncé avoir finalisé l'acquisition de K2M Group Holdings, Inc., un leader mondial des solutions complexes pour la colonne vertébrale et des solutions mini-invasives. Cette acquisition a permis à l'entreprise d'élargir son portefeuille de solutions mini-invasives.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché des dispositifs chirurgicaux colorectaux, ce qui offre également l'avantage de la croissance des bénéfices de l'organisation.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 INDUSTRIAL INSIGHTS:

CONCLUSION: 45

6 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: REGULATIONS

6.1 REGULATION IN U.S

6.2 REGULATION IN EUROPE

6.3 REGULATION IN CANADA

6.4 REGULATION IN SOUTH AFRICA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN GERIATRIC POPULATION

7.1.2 RISE IN NUMBER OF PATIENTS SUFFERING FROM DIVERTICULITIS AND ULCERATIVE COLITIS

7.1.3 INCREASE IN HEALTHCARE EXPENDITURE

7.1.4 RISE IN PREVALENCE OF COLORECTAL CANCER

7.2 RESTRAINTS

7.2.1 HIGH COST OF COLORECTAL SURGERY DEVICES

7.2.2 STRICT REGULATIONS

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES TAKEN BY MARKET PLAYERS AND GOVERNMENT

7.3.2 INCREASE IN MINIMAL INVASIVE SURGERY PROCEDURE

7.3.3 RISING DISPOSABLE INCOME

7.4 CHALLENGES

7.4.1 COMPLICATIONS ASSOCIATED WITH PROCEDURE

1.4.1 SHORTAGE OF SKILLED PERSONNEL

8 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ENDOSCOPE

8.2.1 LAPAROSCOPE

8.2.2 COLONSCOPE

8.3 ELECTROSURGERY

8.3.1 INSTRUMENTS

8.3.2 ACCESSORIES

8.4 HANDHELD INSTRUMENTS

8.4.1 SCISSORS

8.4.2 FORCEPS

8.4.3 OTHERS

8.5 SEALING DEVICES

8.6 SURGICAL STAPLING DEVICES

8.7 ACCESSORIES

9 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY INDICATION

9.1 OVERVIEW

9.2 COLORECTAL CANCER

9.3 DIVERTICULITIS

9.4 ULCERATIVE COLITIS

9.5 CROHN'S DISEASE

9.6 OTHERS

10 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY END USER

10.1 OVERVIEW

10.2 SURGICAL CENTERS

10.3 HOSPITALS

10.4 CLINICS

10.5 OTHERS

11 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E.

11.1.4 ISRAEL

11.1.5 EGYPT

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 COMPANY PROFILE

13.1 MEDTRONIC

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.1.5.1 PRODUCT LAUNCH

13.2 STRYKER

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.2.5.1 ACQUISITION

13.3 JOHNSON & JOHNSON SERVICES, INC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.3.5.1 FDA CLEARANCE

13.3.5.2 STUDY RESULTS

13.4 BOSTON SCIENTIFIC CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.4.5.1 PRODUCT LAUNCH

13.4.5.2 AGREEMENT

13.5 KARL STORZ SE & CO. KG

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.5.4.1 CONTRACT

13.5.4.2 INVESTMENT

13.6 BD

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.6.4.1 ACQUISITION

13.7 BIPAD SURGICAL, INC

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.7.3.1 FDA APPROVAL

13.8 CARDINAL HEALTH

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.8.4.1 NEW DISTRIBUTION CENTER

13.8.4.2 NEW DISTRIBUTION CENTER

13.9 COOK GROUP

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.9.3.1 ISO CERTIFICATION

13.9.3.2 INVESTMENT

13.1 CONMED CORPORATION

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.10.4.1 CONFERENCE

13.11 HALLMARK SURGICAL

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 HEBSON

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 OLYMPUS CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.13.4.1 PRODUCT LAUNCH

13.14 OVESCO ENDOSCOPY AG

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.14.3.1 MARKET APPROVAL

13.15 PENTAX MEDICAL

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.15.4.1 JOINT VENTURE

13.16 RICHARD WOLF GMBH

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.16.3.1 NEW SUBSIDIARY

13.17 SAFEHEAL

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.17.3.1 PARTNERSHIP

13.18 SMITH + NEPHEW

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.18.4.1 FDA APPROVAL

13.19 SUMMIT HILL LABORATORIES

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 SYMMETRY SURGICAL, INC

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.20.3.1 ACQUISITION

13.21 TELEFLEX INCORPORATED

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 PRODUCT PORTFOLIO

13.21.4 RECENT DEVELOPMENT

13.21.4.1 CONFERENCE

13.22 THE COOPER COMPANIES INC.

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 PRODUCT PORTFOLIO

13.22.4 RECENT DEVELOPMENTS

13.22.4.1 ACQUISITION

13.23 W. L. GORE & ASSOCIATES, INC

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA ENDOSCOPE IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA ENDOSCOPE IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA ELECTROSURGERY IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ELECTROSURGERY IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA HANDHELD INSTRUMENTS IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HANDHELD INSTRUMENTS IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SEALING DEVICES IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SURGICAL STAPLING DEVICES IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ACCESSORIES IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA COLORECTAL CANCER IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA DIVERTICULITIS IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ULCERATIVE COLITIS IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA CROHN'S DISEASE IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA OTHERS IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA SURGICAL CENTERS IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA HOSPITALS IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CLINICS IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN COLORECTAL SURGICAL DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA ENDOSCOPE IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA ELECTROSURGERY IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA HANDHELD INSTRUMENTS IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 29 SOUTH AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 SOUTH AFRICA ENDOSCOPE IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 SOUTH AFRICA ELECTROSURGERY IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 SOUTH AFRICA HANDHELD INSTRUMENTS IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 SOUTH AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 34 SOUTH AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 35 SAUDI ARABIA COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 SAUDI ARABIA ENDOSCOPE IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 37 SAUDI ARABIA ELECTROSURGERY IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 SAUDI ARABIA HANDHELD INSTRUMENTS IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 39 SAUDI ARABIA COLORECTAL SURGICAL DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 40 SAUDI ARABIA COLORECTAL SURGICAL DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 41 U.A.E. COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.A.E. ENDOSCOPE IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.A.E. ELECTROSURGERY IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.A.E. HANDHELD INSTRUMENTS IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.A.E. COLORECTAL SURGICAL DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 46 U.A.E. COLORECTAL SURGICAL DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 ISRAEL COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 ISRAEL ENDOSCOPE IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 ISRAEL ELECTROSURGERY IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 ISRAEL HANDHELD INSTRUMENTS IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 ISRAEL COLORECTAL SURGICAL DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL COLORECTAL SURGICAL DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 53 EGYPT COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 EGYPT ENDOSCOPE IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 EGYPT ELECTROSURGERY IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 EGYPT HANDHELD INSTRUMENTS IN COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 57 EGYPT COLORECTAL SURGICAL DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 58 EGYPT COLORECTAL SURGICAL DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 REST OF MIDDLE EAST AND AFRICA COLORECTAL SURGICAL DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASE IN DEMAND FOR COLORECTAL SURGICAL DEVICES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ENDOSCOPE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET

FIGURE 14 MEDICAL DEVICE SPENDING VS NATIONAL HEALTH EXPENDITURES, 2016

FIGURE 15 TOP COUNTRIES COLORECTAL CANCER INCIDENCE RATE, 2020

FIGURE 16 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 18 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 19 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY INDICATION , 2021

FIGURE 21 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY INDICATION, 2022-2029 (USD MILLION)

FIGURE 22 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 23 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 24 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY END USER, 2021

FIGURE 25 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 26 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 28 MIDDLE EAST AND AFRICA COLORECTAL SURGICAL DEVICES MARKET: SNAPSHOT (2021)

FIGURE 29 MIDDLE EAST AND AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY COUNTRY (2021)

FIGURE 30 MIDDLE EAST AND AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 MIDDLE EAST AND AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 MIDDLE EAST AND AFRICA COLORECTAL SURGICAL DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA COLORECTAL SURGICAL DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.