Middle East And Africa Clinical Laboratory Services Market

Taille du marché en milliards USD

TCAC :

%

USD

12.71 Billion

USD

18.35 Billion

2025

2033

USD

12.71 Billion

USD

18.35 Billion

2025

2033

| 2026 –2033 | |

| USD 12.71 Billion | |

| USD 18.35 Billion | |

|

|

|

|

Segmentation du marché des services de laboratoires cliniques au Moyen-Orient et en Afrique, par spécialité (analyses de chimie clinique, d'hématologie, de microbiologie , d'immunologie, de dépistage de drogues, de cytologie et de génétique ), par prestataire (laboratoires indépendants et de référence, laboratoires hospitaliers et laboratoires en cabinet médical et infirmier), par application (services liés à la découverte de médicaments, services liés au développement de médicaments, services de bioanalyse et de chimie de laboratoire, services de toxicologie, services liés à la thérapie cellulaire et génique, services liés aux essais précliniques et cliniques et autres services de laboratoires cliniques), par type de service (analyses de routine, analyses spécialisées et analyses d'anatomopathologie) - Tendances du secteur et prévisions jusqu'en 2033

Taille du marché des services de laboratoires cliniques au Moyen-Orient et en Afrique

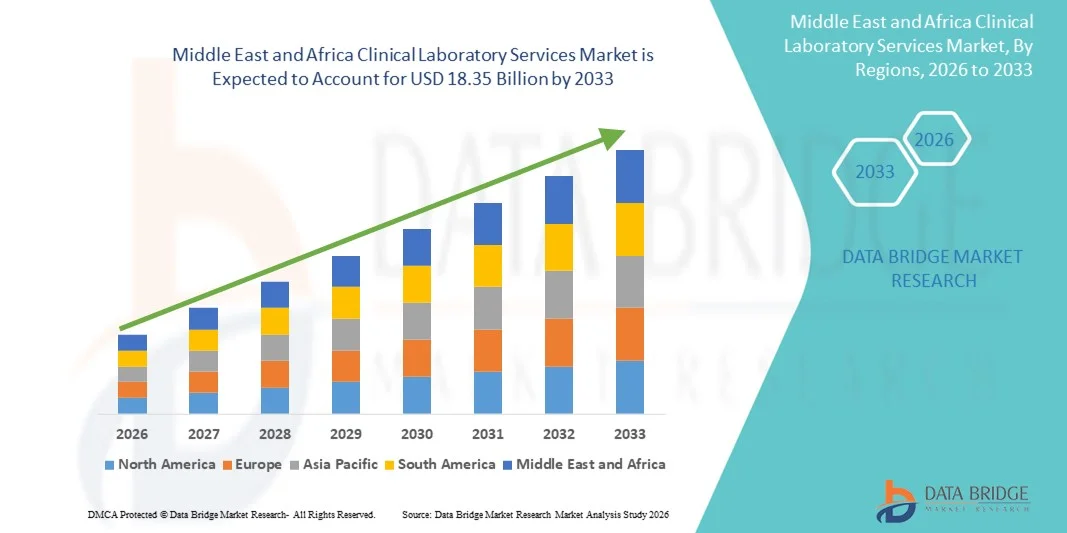

- Le marché des services de laboratoires cliniques au Moyen-Orient et en Afrique était évalué à 12,71 milliards de dollars en 2025 et devrait atteindre 18,35 milliards de dollars d'ici 2033 , avec un TCAC de 4,70 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par la demande croissante de tests de diagnostic précis, rapides et de haute qualité, elle-même stimulée par la prévalence croissante des maladies chroniques, des maladies infectieuses et des problèmes de santé liés au mode de vie à travers le monde.

- De plus, la sensibilisation croissante à la médecine préventive, les progrès des technologies de laboratoire, l'automatisation des diagnostics cliniques et l'expansion des infrastructures de santé accélèrent l'adoption des solutions de services de laboratoire clinique, stimulant ainsi considérablement la croissance globale du marché des services de laboratoire clinique.

Analyse du marché des services de laboratoires cliniques au Moyen-Orient et en Afrique

- Les services de laboratoire clinique, qui englobent les tests de diagnostic, l'anatomopathologie et d'autres analyses de laboratoire, sont de plus en plus essentiels dans les soins de santé modernes pour le dépistage précoce des maladies, le suivi des affections chroniques et le soutien des plans de traitement personnalisés.

- La croissance du marché est principalement tirée par la prévalence croissante des maladies chroniques, la demande accrue de soins de santé préventifs, les progrès technologiques en matière d'automatisation des laboratoires et de plateformes de diagnostic, ainsi que par l'expansion des infrastructures de santé à travers le monde.

- L’Arabie saoudite a dominé le marché des services de laboratoire clinique, représentant environ 39,8 % des revenus régionaux en 2025. Cette domination s’explique par des initiatives gouvernementales fortes en matière de santé, des investissements dans des infrastructures de diagnostic de pointe et l’adoption généralisée des technologies de laboratoire modernes dans les hôpitaux, les cliniques et les centres de diagnostic spécialisés. La présence de prestataires de services de laboratoire régionaux de premier plan et la sensibilisation croissante des patients à la qualité des diagnostics renforcent encore la position dominante de l’Arabie saoudite sur ce marché.

- Les Émirats arabes unis devraient connaître la croissance la plus rapide, avec un TCAC estimé à 9,1 % entre 2026 et 2033. Cette croissance sera portée par le développement rapide des infrastructures de santé privées, la multiplication des initiatives gouvernementales en matière de prévention, l'essor du tourisme médical et l'adoption croissante de technologies de diagnostic et d'automatisation avancées dans les laboratoires cliniques.

- Le segment des laboratoires indépendants et de référence a dominé la plus grande part de revenus du marché, soit 45,1 %, en 2025, grâce à leurs vastes portefeuilles de services, leurs capacités de test de pointe et leur capacité à desservir de nombreux hôpitaux et cliniques.

Portée du rapport et segmentation du marché des services de laboratoire clinique

|

Attributs |

Principaux enseignements du marché des services de laboratoire clinique |

|

Segments couverts |

|

|

Pays couverts |

Moyen-Orient et Afrique

|

|

Acteurs clés du marché |

• LabCorp (États-Unis) |

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

En plus des informations sur les scénarios de marché tels que la valeur du marché, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché élaborés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, l'épidémiologie des patients, l'analyse du pipeline, l'analyse des prix et le cadre réglementaire. |

Tendances du marché des services de laboratoires cliniques au Moyen-Orient et en Afrique

Expansion des services de diagnostic avancés

- Une tendance majeure et croissante sur le marché des services de laboratoires cliniques au Moyen-Orient et en Afrique est le développement des services de diagnostic et d'analyse avancés, alimenté par la demande grandissante en médecine de précision et en capacités d'analyse spécialisées.

- Par exemple, en 2024, des fournisseurs de diagnostic de premier plan comme Al Borg Diagnostics ont étendu leurs services de tests moléculaires et génomiques aux Émirats arabes unis et en Arabie saoudite afin de répondre à la demande croissante des patients. L'adoption de plateformes de tests à haut débit et l'automatisation des laboratoires améliorent l'efficacité, réduisent les délais d'obtention des résultats et accroissent la précision des analyses.

- L'intégration des systèmes d'information de laboratoire (SIL) aux réseaux hospitaliers et cliniques permet une gestion et un partage fluides des données des patients. Les hôpitaux et les centres de diagnostic investissent de plus en plus dans des capacités de tests avancés en oncologie, en maladies infectieuses et en troubles métaboliques.

- La sensibilisation des patients et leur demande croissante de diagnostic précoce et de soins préventifs stimulent le recours aux tests cliniques spécialisés. Les initiatives gouvernementales favorisant le développement des infrastructures de santé et la surveillance de la santé publique accélèrent encore cette croissance.

- L’accréditation et les certifications de qualité telles que l’ISO et le CAP incitent les laboratoires à moderniser leurs technologies et leur offre de services. Les collaborations entre les prestataires de services de diagnostic et les institutions de recherche renforcent les capacités de dépistage et le soutien aux essais cliniques.

- L'adoption de services de tests intégrés sur plusieurs sites permet un accès plus large aux soins pour les patients et une efficacité opérationnelle accrue. Les programmes de formation du personnel de laboratoire garantissent la bonne manipulation des tests complexes et le respect des normes réglementaires.

Dynamique du marché des services de laboratoires cliniques au Moyen-Orient et en Afrique

Conducteur

Demande croissante de tests spécialisés et de haute précision

- La prévalence croissante des maladies chroniques, des maladies infectieuses et des troubles génétiques au Moyen-Orient et en Afrique est un facteur majeur de la croissance du marché.

- Par exemple, en 2025, Al Borg Diagnostics a introduit des services de séquençage de nouvelle génération et de diagnostic moléculaire en Arabie saoudite, améliorant considérablement ses capacités de service.

- Les professionnels de santé recherchent des solutions de diagnostic précises, rapides et complètes pour orienter la prise en charge et les décisions thérapeutiques des patients.

- L'expansion des hôpitaux et des chaînes de diagnostic dans les zones urbaines et semi-urbaines favorise l'augmentation des volumes de tests.

- Les initiatives gouvernementales en matière de santé et les partenariats public-privé favorisent la modernisation des laboratoires et l'expansion de leurs capacités

- L'augmentation de la recherche clinique et de la participation aux études épidémiologiques régionales crée une demande supplémentaire pour les tests spécialisés.

- La préférence des patients pour le dépistage précoce, les soins de santé préventifs et les traitements personnalisés favorise l'adoption des services de laboratoire avancés.

- Les améliorations technologiques apportées aux équipements de laboratoire et l'adoption de plateformes automatisées garantissent un débit plus élevé et des taux d'erreur réduits.

- La collaboration entre les laboratoires et les entreprises pharmaceutiques pour les essais cliniques alimente la demande de tests spécialisés. La formation continue et le perfectionnement des compétences des professionnels de laboratoire améliorent la qualité et la précision des services.

- L'élargissement de la couverture d'assurance et le remboursement des tests diagnostiques favorisent leur accessibilité et leur utilisation. Globalement, la demande clinique croissante, les progrès technologiques et les politiques de santé favorables stimulent collectivement le marché des services de laboratoire clinique dans la région.

Retenue/Défi

Coûts opérationnels élevés et main-d'œuvre qualifiée limitée

- Le coût élevé de la mise en place et de l'entretien de laboratoires cliniques de pointe représente un défi important pour les petits centres de diagnostic.

- Par exemple, les investissements dans les plateformes de tests moléculaires automatisées et les analyseurs à haut débit peuvent se chiffrer en millions de dollars, limitant ainsi l'expansion des nouveaux entrants.

- Le manque de techniciens de laboratoire qualifiés et de pathologistes spécialisés limite la capacité d'adapter efficacement les services.

- Les processus de mise en conformité réglementaire et d'accréditation qualité peuvent être longs et coûteux. La maintenance des équipements de pointe et le contrôle qualité augmentent les dépenses opérationnelles.

- Les limitations des infrastructures dans les régions éloignées et rurales réduisent l'accès des patients aux services de laboratoire avancés.

- Le coût élevé des réactifs, des consommables et des kits de test peut encore augmenter les prix des services, affectant ainsi leur accessibilité.

- Le manque de sensibilisation et d'adoption des tests préventifs dans certaines populations peut limiter la pénétration du marché.

- Malgré la demande croissante, la pénurie de professionnels qualifiés demeure un obstacle majeur à la prestation constante de services de diagnostic de haute qualité.

- Les partenariats stratégiques, les programmes de formation et les modèles de partage des coûts sont essentiels pour surmonter ces difficultés.

- Le développement de solutions de laboratoire évolutives et rentables, ainsi que d'initiatives de formation régionales, peut atténuer les problèmes liés à la main-d'œuvre et aux coûts.

- Il est crucial de lever ces obstacles pour assurer une croissance durable du marché des services de laboratoires cliniques au Moyen-Orient et en Afrique.

Étendue du marché des services de laboratoires cliniques au Moyen-Orient et en Afrique

Le marché est segmenté en fonction de la spécialité, du fournisseur, de l'application et du type de service.

- Par spécialité

Le marché des services de laboratoire clinique est segmenté, selon la spécialité, en analyses de chimie clinique, d'hématologie, de microbiologie, d'immunologie, de dépistage de drogues, de cytologie et de génétique. En 2025, le segment des analyses de chimie clinique représentait la plus grande part de marché (38,6 %), portée par la forte prévalence de maladies chroniques telles que le diabète, les troubles cardiovasculaires et les syndromes métaboliques au Moyen-Orient et en Afrique. Les bilans biochimiques de routine, les tests de la fonction hépatique et rénale sont fréquemment demandés dans les hôpitaux et les cliniques ambulatoires, faisant de la chimie clinique un service de laboratoire essentiel. Les progrès réalisés en matière d'analyseurs automatisés et de plateformes à haut débit ont permis d'accroître l'efficacité et la précision, de réduire les délais d'exécution et d'améliorer la fiabilité. Les établissements de santé privilégient les analyses de chimie clinique pour leur capacité à fournir des données diagnostiques rapides et complètes. L'adoption de systèmes d'information de laboratoire intégrés permet une gestion simplifiée des données des patients, garantissant une meilleure prise de décision clinique. Par ailleurs, les initiatives gouvernementales promouvant la médecine préventive et le diagnostic précoce encouragent la réalisation régulière d'analyses biochimiques. L'expansion des réseaux hospitaliers et des laboratoires indépendants dans les zones urbaines et périurbaines contribue également à la forte demande. Par ailleurs, les collaborations avec les entreprises pharmaceutiques et les organismes de recherche pour les essais cliniques favorisent le recours aux analyses de chimie clinique. L'accréditation et la normalisation des pratiques en laboratoire renforcent la confiance dans les résultats des tests. La sensibilisation croissante des patients à l'importance du suivi médical régulier consolide la position dominante du secteur. Les analyses de chimie clinique demeurent essentielles au diagnostic clinique en raison de leur rapport coût-efficacité, de leur accessibilité et de leur large applicabilité à diverses pathologies.

Le segment des analyses hématologiques devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 15,9 %, entre 2026 et 2033. Cette croissance est portée par la demande croissante d'hémogrammes complets, de bilans de coagulation et d'analyses hématologiques spécialisées dans les hôpitaux et les centres de diagnostic. L'augmentation des cas d'anémie, de leucémie et d'autres troubles sanguins stimule le volume des analyses. L'accroissement des capacités hospitalières, notamment en Arabie saoudite, aux Émirats arabes unis et en Égypte, contribue à cette croissance. L'automatisation des analyseurs d'hématologie réduit les erreurs et améliore les délais d'exécution. L'intégration croissante de ces analyses dans les programmes de soins préventifs, les bilans de santé et les tests pris en charge par l'assurance maladie accélère leur adoption. Les analyses hématologiques sont essentielles pour les évaluations préopératoires, la prise en charge des maladies chroniques et le suivi thérapeutique. Les partenariats stratégiques entre les laboratoires et les fournisseurs de technologies de diagnostic permettent l'introduction de solutions innovantes. Par ailleurs, l'accent mis sur la recherche et les essais cliniques pour les troubles hématologiques soutient la croissance du segment. La formation d'un personnel de laboratoire qualifié garantit la réalisation fiable des analyses complexes. L'intégration des analyses hématologiques dans des panels diagnostiques plus larges améliore l'efficacité des flux de travail. La sensibilisation accrue à la santé sanguine et au diagnostic précoce encourage des analyses plus fréquentes. Les programmes de santé publique régionaux, qui encouragent la surveillance de l'anémie et des maladies infectieuses, y contribuent également. De manière générale, les analyses hématologiques constituent le segment de spécialité dont la croissance est la plus rapide, en raison de leur importance clinique et de leur accessibilité croissante.

- Par fournisseur

Selon le type de prestataire, le marché se segmente en laboratoires indépendants et de référence, laboratoires hospitaliers et laboratoires de cabinets médicaux et infirmiers. En 2025, le segment des laboratoires indépendants et de référence représentait la plus grande part de marché (45,1 %), grâce à leur large gamme de services, leurs capacités d'analyse de pointe et leur aptitude à desservir de nombreux hôpitaux et cliniques. Ces laboratoires proposent des analyses spécialisées et des diagnostics à haut débit, intégrant souvent des tests moléculaires, génétiques et spécialisés. Les patients privilégient de plus en plus les laboratoires indépendants pour leur commodité, la rapidité des résultats et la diversité des options d'analyse. L'essor des centres de diagnostic centralisés en zones urbaines garantit une large couverture géographique. Les investissements dans l'automatisation et les systèmes d'information de laboratoire (SIL) améliorent l'efficacité opérationnelle et la précision des résultats. Les partenariats avec les entreprises pharmaceutiques pour les essais cliniques et les services de bioanalyse renforcent les sources de revenus. L'accréditation aux normes ISO et CAP garantit la qualité et la fiabilité, et attire les clients institutionnels. Les laboratoires indépendants proposent également des services de livraison et de prélèvement à domicile, facilitant ainsi l'accès aux soins pour les patients. L'expansion stratégique dans les zones périurbaines favorise la pénétration du marché. La collaboration avec les institutions de recherche facilite l'adoption de tests de pointe. La réputation du secteur en matière de précision, d'efficacité et de diversité des services renforce sa position dominante.

Les laboratoires hospitaliers devraient connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 16,7 %, entre 2026 et 2033, sous l'effet de la multiplication des hôpitaux et des établissements de santé dans la région. Intégrant les analyses directement aux soins des patients, ces laboratoires garantissent des résultats rapides pour le diagnostic et le traitement. Le développement des hôpitaux multiservices en Arabie saoudite, aux Émirats arabes unis et en Égypte soutient la demande. L'adoption croissante des tests au chevet du patient, de l'automatisation et de l'intégration aux systèmes d'information de laboratoire (SIL) améliore l'efficacité des services. Les laboratoires hospitaliers jouent également un rôle clé dans les essais cliniques et les études pharmacogénomiques, contribuant ainsi à la croissance du segment. La sensibilisation accrue des médecins à l'importance des analyses réalisées en interne pour une prise de décision clinique rapide favorise leur adoption. Les investissements dans des équipements modernes d'hématologie, de diagnostic moléculaire et d'immunologie renforcent les capacités. La collaboration avec les assureurs santé améliore l'accessibilité financière des tests. Le développement des compétences du personnel hospitalier garantit la précision des analyses complexes. Ce segment bénéficie d'un débit de patients plus élevé et d'une offre de soins intégrée. Les programmes gouvernementaux encourageant le développement des infrastructures de laboratoire stimulent l'adoption du marché. En conclusion, les laboratoires hospitaliers se positionnent comme le segment de prestataires de soins connaissant la croissance la plus rapide.

- Sur demande

Selon l'application, le marché des services de laboratoire clinique est segmenté en services liés à la découverte de médicaments, services liés au développement de médicaments, services de bioanalyse et de chimie de laboratoire, services de toxicologie, services liés à la thérapie cellulaire et génique, services liés aux essais précliniques et cliniques, et autres services de laboratoire clinique. Le segment des services liés aux essais précliniques et cliniques a représenté la plus grande part de revenus du marché (39,8 %) en 2025, en raison du nombre croissant d'essais cliniques et d'études de recherche en oncologie, maladies infectieuses et troubles métaboliques. Les organismes de recherche sous contrat (CRO) et les entreprises pharmaceutiques collaborent avec des laboratoires régionaux pour soutenir le développement de médicaments. L'expansion des centres de recherche clinique aux Émirats arabes unis, en Arabie saoudite et en Égypte stimule les volumes d'analyses. L'adoption de protocoles standardisés et d'instruments de pointe garantit des données précises pour la conformité réglementaire. L'intégration de la bioinformatique et des plateformes de gestion des données améliore l'efficacité de la recherche. La croissance des établissements universitaires et de recherche génère une demande supplémentaire. Les services précliniques, notamment en toxicologie et en pharmacocinétique, complètent les activités des essais cliniques. Le recrutement important de patients dans les études entraîne des besoins d'analyses répétées. Les laboratoires proposant des analyses multisites sont privilégiés. La demande en analyses pharmacogénomiques et moléculaires soutient la croissance du segment. L'accent mis sur la conformité réglementaire garantit des revenus stables. Globalement, ce segment demeure essentiel au soutien de la recherche clinique et du développement de médicaments.

Le segment des services liés au développement de médicaments devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, soit 17,3 %, entre 2026 et 2033. Cette croissance est portée par l'externalisation croissante des services analytiques, bioanalytiques et de laboratoire par les entreprises pharmaceutiques et biotechnologiques. L'augmentation des investissements dans le développement de nouveaux médicaments et la hausse des essais cliniques en oncologie, en immunologie et dans le domaine des maladies rares alimentent la demande. Les plateformes de tests avancées, les flux de travail à haut débit et les systèmes de qualité standardisés favorisent une adoption rapide. L'expansion des laboratoires régionaux grâce à des partenariats avec des CRO accélère la croissance. Les exigences réglementaires en matière de données pharmacocinétiques et de sécurité précises renforcent le potentiel du marché. L'intégration des services de tests précliniques, bioanalytiques et cliniques facilite la prise en charge complète du développement de médicaments. L'intérêt croissant pour la médecine personnalisée et le diagnostic moléculaire stimule la demande. Les collaborations stratégiques entre les entreprises pharmaceutiques et les laboratoires locaux optimisent la prestation de services. La formation et le perfectionnement du personnel de laboratoire qualifié garantissent la précision des tests. L'augmentation des incitations gouvernementales à la recherche et au développement favorise également l'adoption. La sensibilisation croissante des acteurs du secteur pharmaceutique à la production de données de qualité assure une croissance soutenue. Ce segment se positionne comme l'application à la croissance la plus rapide de la région.

- Par type de service

Le marché des services de laboratoire clinique est segmenté, selon le type de service, en analyses de routine, analyses spécialisées et analyses d'anatomopathologie. En 2025, le segment des analyses de routine représentait la plus grande part de marché (41,5 %), grâce au volume important d'examens diagnostiques standardisés tels que les numérations sanguines, les bilans métaboliques et les analyses d'urine, réalisés dans les hôpitaux et les centres de soins ambulatoires. Ces analyses sont largement utilisées pour les bilans de santé préventifs, le suivi des maladies chroniques et les bilans préopératoires. L'adoption d'analyseurs automatisés et de plateformes à haut débit garantit des délais d'exécution rapides et des résultats fiables. L'expansion des infrastructures de santé dans les zones urbaines et périurbaines favorise la prise en charge d'un grand nombre de patients. L'intégration aux systèmes d'information de laboratoire (SIL) et aux réseaux hospitaliers améliore l'efficacité des rapports et des flux de travail. La prise en charge des analyses de routine par l'assurance maladie encourage une plus grande participation des patients. Les initiatives gouvernementales en matière de santé préventive promeuvent les diagnostics de routine. Les laboratoires indépendants et hospitaliers développent activement leurs capacités d'analyses de routine pour répondre à la demande croissante. La formation et les mesures de contrôle qualité garantissent la précision des résultats, même avec des volumes d'analyses élevés. Les partenariats avec les instituts de recherche élargissent l'offre de services. L'accessibilité et l'abordabilité renforcent la position dominante de ce segment.

Le segment des services spécialisés devrait connaître le taux de croissance annuel composé (TCAC) le plus rapide, à 18,1 %, entre 2026 et 2033, porté par la demande croissante de tests moléculaires, génétiques et immunologiques spécialisés. Les techniques avancées telles que le séquençage de nouvelle génération, les tests PCR et l'analyse des biomarqueurs sont de plus en plus nécessaires à la médecine de précision et au diagnostic des maladies rares. Le développement des laboratoires indépendants et hospitaliers dotés de capacités de tests spécialisés accélère leur adoption. Les entreprises pharmaceutiques s'appuient sur ces services pour leurs essais cliniques et le développement de leurs médicaments. La sensibilisation croissante des patients aux tests génétiques et aux soins de santé personnalisés favorise leur utilisation. Les initiatives gouvernementales en faveur des diagnostics avancés contribuent à cette croissance. L'intégration aux plateformes de recherche et de bio-informatique améliore la précision des données et des rapports. La formation du personnel qualifié garantit la réalisation précise des tests complexes. Le renforcement de la collaboration entre les laboratoires et les instituts de recherche accroît les capacités. La forte rentabilité et la faible concurrence attirent de nouveaux acteurs sur le marché. En conclusion, les services spécialisés représentent le segment de services connaissant la croissance la plus rapide sur le marché des services de laboratoires cliniques au Moyen-Orient et en Afrique.

Analyse régionale du marché des services de laboratoires cliniques au Moyen-Orient et en Afrique

- Le marché des services de laboratoire clinique au Moyen-Orient et en Afrique devrait connaître une croissance annuelle composée (TCAC) substantielle tout au long de la période de prévision.

- Principalement impulsée par de fortes initiatives gouvernementales en matière de santé, des investissements dans des installations de diagnostic de pointe et l'adoption généralisée des technologies de laboratoire modernes dans les hôpitaux, les cliniques et les centres de diagnostic spécialisés.

- La présence de prestataires de services de laboratoire régionaux de premier plan et la sensibilisation croissante des patients à la qualité des diagnostics contribuent également à la croissance du marché dans toute la région.

Analyse du marché des services de laboratoires cliniques en Arabie saoudite

Le marché des services de laboratoire clinique en Arabie saoudite a dominé celui du Moyen-Orient et de l'Afrique du Nord (MEA), représentant environ 39,8 % des revenus régionaux en 2025. Cette domination s'explique par des initiatives gouvernementales solides en matière de santé, des investissements importants dans des infrastructures de diagnostic de pointe et l'adoption généralisée des technologies de laboratoire modernes. La présence de prestataires de services de laboratoire de premier plan et la sensibilisation croissante des patients à l'importance de diagnostics de qualité renforcent encore sa position dominante sur le marché.

Analyse du marché des services de laboratoires cliniques aux Émirats arabes unis

Le marché des services de laboratoires cliniques des Émirats arabes unis devrait être le pays à la croissance la plus rapide de la région, enregistrant un TCAC estimé à 9,1 % de 2026 à 2033, grâce à l'expansion rapide des infrastructures de soins de santé privées, à l'augmentation des initiatives gouvernementales en matière de santé préventive, à la hausse du tourisme médical et à l'adoption croissante de technologies de diagnostic et d'automatisation avancées dans les laboratoires cliniques.

Part de marché des services de laboratoires cliniques au Moyen-Orient et en Afrique

Le secteur des services de laboratoires cliniques est principalement dominé par des entreprises bien établies, notamment :

• LabCorp (États-Unis)

• Quest Diagnostics (États-Unis)

• Eurofins Scientific (Luxembourg)

• Synlab (Allemagne)

• Cerba Healthcare (France)

• SRL Diagnostics (Inde)

• Unilabs (Suisse)

• Acibadem Labmed (Turquie)

• Dr. Lal PathLabs (Inde)

• NMC Healthcare Labs (Émirats arabes unis)

• PathCare (Afrique du Sud)

• BioReference Laboratories (États-Unis)

• Aspen Medical Laboratories (Australie)

• Maccabi Healthcare Services Labs (Israël)

• Al Mokhtabar Labs (Égypte)

• HealthHub Laboratories (Émirats arabes unis)

Dernières évolutions du marché des services de laboratoires cliniques au Moyen-Orient et en Afrique

- En mai 2025, Laboratory Corporation of America (LabCorp) a inauguré un nouveau centre de diagnostic régional à Chantilly, en Virginie. Il s'agit de son plus grand centre à ce jour, doté d'une équipe de plus de 200 professionnels et capable de traiter plus de 26 000 échantillons de patients par jour. Ce centre a permis d'étendre ses services en histologie et en cytologie afin d'améliorer ses capacités de diagnostic.

- En février 2025, Myriad Genetics, Inc. a conclu un partenariat avec INTERLINK Care Management et CancerCARE for Life afin d'étendre l'accès à son test de dépistage du cancer héréditaire MyRisk avec RiskScore à plus d'un million de personnes, améliorant ainsi les services de dépistage génétique et de prédiction du risque de cancer.

- En avril 2025, Scientist.com a lancé Clinical Labs Navigator™, une plateforme d'approvisionnement conçue pour simplifier la recherche et la gestion des services d'essais cliniques, et ainsi améliorer l'efficacité et la collaboration entre les promoteurs et les laboratoires.

- En mars 2025, IQVIA Laboratories a lancé la suite Site Lab Navigator, comprenant une solution de demande électronique permettant aux sites de soumettre des demandes de tests et de gérer les échantillons numériquement, réduisant ainsi les erreurs manuelles et améliorant les flux de travail des laboratoires d'essais cliniques.

- En février 2025, SK pharmteco a inauguré un laboratoire d'analyses modernisé, spécialisé dans les principes actifs pharmaceutiques à haute activité (HPAPI), renforçant ainsi ses capacités de service pour l'analyse de substances médicamenteuses complexes.

- En août 2024, LEAP Consulting Group a lancé un service d'accompagnement des laboratoires cliniques en matière de conformité, notamment en leur fournissant des conseils sur la réglementation de la FDA concernant les tests développés en laboratoire (LDT), témoignant ainsi de l'importance accordée par le secteur à la préparation réglementaire.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.