Middle East And Africa Circulating Tumor Cells Ctc Liquid Biopsy Market

Taille du marché en milliards USD

TCAC :

%

USD

24.50 Million

USD

82.24 Million

2021

2029

USD

24.50 Million

USD

82.24 Million

2021

2029

| 2022 –2029 | |

| USD 24.50 Million | |

| USD 82.24 Million | |

|

|

|

Marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique, par technologie (méthodes de détection de CTC, méthodes d'enrichissement de CTC, sélection positive ex vivo, technologies moléculaires (ARN), test d'invasion cellulaire in vitro fonctionnel, modèles de xénotransplantation, micropuces, microcanal en spirale unique, sélection négative et technologies immunocytochimiques), application (recherche sur les cellules souches cancéreuses, anomalies chromosomiques multiples et autres), utilisateur final (instituts de recherche et universitaires, laboratoires de référence et hôpitaux et laboratoires médicaux), pays (Afrique du Sud, Arabie saoudite, Émirats arabes unis, Égypte, Koweït, Israël et reste du Moyen-Orient et de l'Afrique) - Tendances et prévisions de l'industrie - 2029

Analyse et perspectives du marché : marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique

Analyse et perspectives du marché : marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique

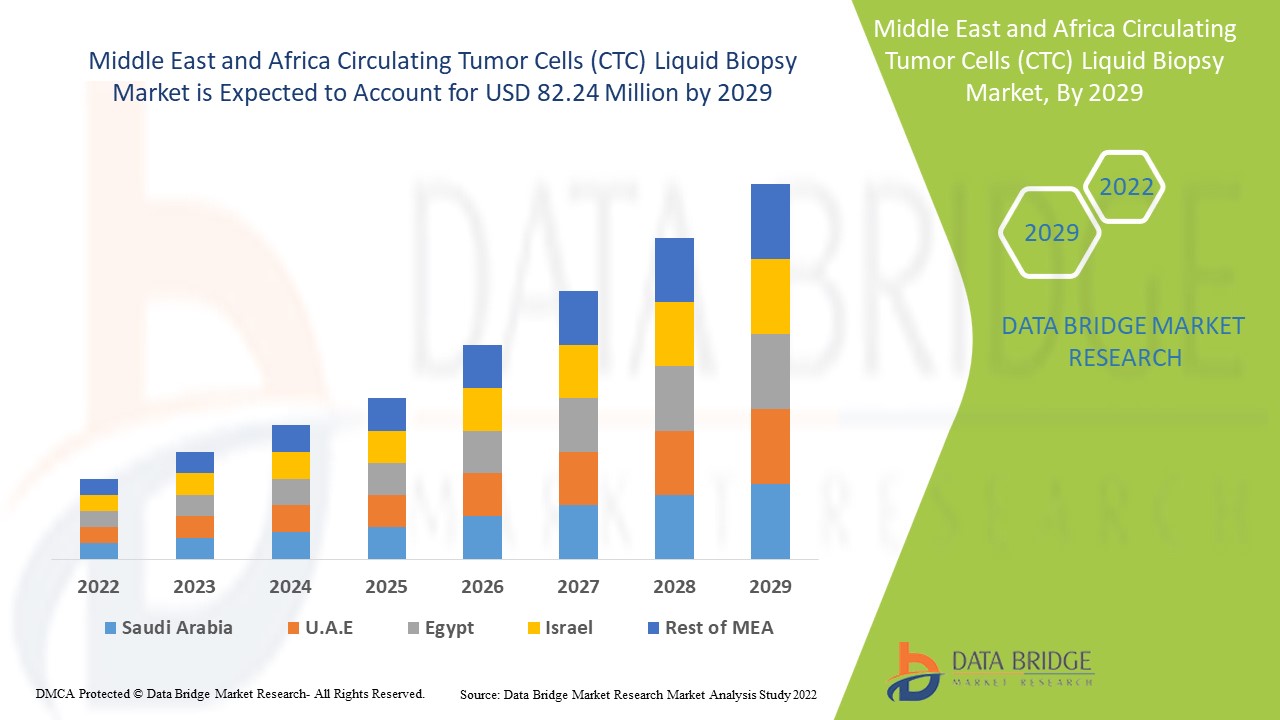

Le marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 16,7% au cours de la période de prévision de 2022 à 2029 et devrait atteindre 82,24 millions USD d'ici 2029 contre 24,50 millions USD en 2021. La forte prévalence des maladies chroniques et l'augmentation des activités de R&D pour son application efficace sont susceptibles d'être les principaux moteurs qui propulsent la demande du marché au cours de la période de prévision.

La biopsie liquide est un test sanguin non invasif qui détecte les cellules tumorales circulantes et les fragments d'ADN tumoral libérés dans le sang par les tumeurs primaires et les sites métastatiques. Il s'agit d'une alternative simple et précise à la biopsie chirurgicale, qui permet au chirurgien de détecter le cancer à un stade très précoce.

Les cellules tumorales circulantes sont un sous-ensemble rare de cellules qui fonctionnent comme germes de métastases. On les trouve dans le sang des patients qui ont développé des tumeurs solides. Le test des cellules tumorales circulantes permet la détection et la quantification des cellules tumorales dans le sang des patients atteints de cancer. Les différents types de phénotypes biologiques des cellules tumorales circulantes (CTC) comprennent les cellules souches ou mixtes, mésenchymateuses ou épithéliales. Ces phénotypes sont présents dans le sang en très petite quantité. C'est pourquoi leur détection nécessite une phase d'isolement-enrichissement. Ensuite, une deuxième phase de détection.

La demande croissante de biopsie liquide de cellules tumorales circulantes (CTC) en raison de leur efficacité et de la prévalence élevée du cancer sont les principaux facteurs qui propulsent la demande pour le marché de la biopsie liquide de cellules tumorales circulantes (CTC) au cours de la période de prévision. Cependant, le scénario réglementaire et de remboursement peu clair et la pénurie de personnel qualifié freinent la croissance du marché de la biopsie liquide de cellules tumorales circulantes (CTC) au cours de la période de prévision.

Le rapport sur le marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements et l’impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d’approbations de produits, de décisions stratégiques, de lancements de produits, d’expansions géographiques et d’innovations technologiques sur le marché. Pour comprendre l’analyse et le scénario du marché, contactez-nous pour un briefing d’analyste. Notre équipe vous aidera à créer une solution d’impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique

Portée et taille du marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique

Le marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique est classé en trois segments notables qui sont basés sur la technologie, l'application et l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base de la technologie, le marché de la biopsie liquide des cellules tumorales circulantes (CTC) est segmenté en méthodes de détection CTC, méthodes d'enrichissement CTC, sélection positive ex vivo, technologies moléculaires (ARN), test d'invasion cellulaire in vitro fonctionnel, méthodes de xénotransplantation , micropuces, microcanal en spirale unique, sélection négative et technologies immunohistochimiques. En 2021, le segment des méthodes de détection CTC devrait dominer le marché en raison de l'utilisation croissante de cette technologie dans les universités et les centres de recherche pour les tests de biopsie liquide.

- En fonction des applications, le marché de la biopsie liquide des cellules tumorales circulantes (CTC) est segmenté en recherche sur les cellules souches cancéreuses, les anomalies chromosomiques multiples et autres. En 2021, le segment de la recherche sur les cellules souches cancéreuses devrait dominer le marché en raison de la demande croissante de diagnostic et de traitement précoces du cancer.

- Sur la base de l'utilisateur final, le marché de la biopsie liquide des cellules tumorales circulantes (CTC) est segmenté en instituts de recherche et universitaires, laboratoires de référence et hôpitaux et laboratoires médicaux. En 2021, le segment des instituts universitaires et de recherche devrait dominer le marché car les instituts de recherche et universitaires jouent un rôle essentiel pour accélérer la recherche et le développement dans les différents domaines thérapeutiques liés aux biopsies liquides.

Analyse du marché des biopsies liquides de cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique

Le marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique est analysé et des informations sur la taille du marché sont fournies par pays, technologie, application et utilisateur final.

Les pays couverts par le rapport sur le marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique sont l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, l’Égypte, le Koweït, Israël et le reste du Moyen-Orient et de l’Afrique.

L’Afrique du Sud devrait dominer le marché en raison de la forte prévalence de maladies chroniques telles que le cancer et de l’augmentation du revenu disponible.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

La présence de technologies avancées et d'initiatives stratégiques prises par les acteurs crée de nouvelles opportunités sur le marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique

Le marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique vous fournit également une analyse de marché détaillée pour la croissance de chaque pays dans une industrie particulière avec les ventes de produits, l'impact des progrès sur le marché et les changements dans les scénarios réglementaires avec leur soutien au marché de la biopsie liquide des cellules tumorales circulantes (CTC). Les données sont disponibles pour la période historique de 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché des biopsies liquides de cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché de la biopsie liquide des cellules tumorales circulantes (CTC) au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché de la biopsie liquide des cellules tumorales circulantes (CTC).

Français Les principales entreprises qui s'occupent du marché de la biopsie liquide des cellules tumorales circulantes (CTC) sont Eurofins Genomics (une filiale d'Eurofins Scientific), MDx Health, Guardant Health, IMMUCOR, Thermo Fisher Scientific, Inc., Menarini Silicon Biosystems, QIAGEN, Exact Sciences Corporation, Myriad Genetics, Inc., LungLife AI, Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., Natera Inc., ExoDx (une filiale de Bio-Techne Corporation), Biocept, Inc., F. Hoffman-La Roche Ltd., FOUNDATION MEDICINE, INC., Lucence Health, Inc., Inivata Ltd, Biolidics Limited, Vortex Biosciences entre autres.

Par exemple,

- En août 2021, Exact Sciences Corporation a annoncé la mise en œuvre du test de biopsie liquide hépatique Oncogurard, qui offre une sensibilité de 82 % à un stade précoce et une spécificité de 87 %. Cela aidera l'entreprise à faire progresser ses travaux visant à vaincre le cancer grâce à une détection précoce.

La collaboration, les coentreprises et d'autres stratégies des acteurs du marché améliorent le marché de l'entreprise sur le marché de la biopsie liquide des cellules tumorales circulantes (CTC), ce qui offre également l'avantage à l'organisation d'améliorer son offre pour le marché de la biopsie liquide des cellules tumorales circulantes (CTC).

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TECHNOLOGY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES

5 REGULATIONS: MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET

5.1 ROLE OF FDA

5.2 ROLE OF CDC AND HCFA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 HIGH PREVALENCE OF CANCER

6.1.2 ADVANTAGES OF LIQUID BIOPSY OVER SURGICAL BIOPSY

6.1.3 GOVERNMENT INITIATIVES TO SPREAD AWARENESS ABOUT EARLY DIAGNOSIS OF CANCER

6.1.4 RISE IN FDA APPROVAL

6.1.5 HEALTHCARE REIMBURSEMENT FOR LIQUID BIOPSY

6.2 RESTRAINTS

6.2.1 DOWNSIDES OF LIQUID BIOPSY

6.2.2 RAPID DEVELOPMENT OF ULTRASENSITIVE IMAGING TECHNOLOGIES SUCH AS MAGNETIC RESONANCE IMAGING

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE MARKET PLAYERS

6.3.2 RISE IN HEALTHCARE EXPENDITURE AND DISPOSABLE INCOME

6.3.3 INCREASE IN RESEARCH AND DEVELOPMENT ACTIVITIES

6.3.4 HUGE MARKET POTENTIAL IN DEVELOPING COUNTRIES

6.4 CHALLENGES

6.4.1 SHORTAGE OF SKILLED PERSONNEL

6.4.2 LACK OF ACCESSIBILITY

7 COVID-19 IMPACT ON MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY

7.4 KEY INITIATIVES BY MARKET PLAYER DURING COVID 19

7.5 CONCLUSION:

8 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 CTC DETECTION METHODS

8.3 CTC ENRICHMENT METHODS

8.4 EX VIVO POSITIVE SELECTION

8.5 MOLECULAR (RNA)-BASED TECHNOLOGIES

8.6 FUNCTIONAL IN VITRO CELL INVASION ASSAY

8.7 XENOTRANSPLANTATION MODELS

8.8 MICROCHIPS

8.9 SINGLE SPIRAL MICROCHANNEL

8.1 NEGATIVE SELECTION

8.11 IMMUNOCYTOCHEMICAL TECHNOLOGIES

9 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CANCER STEM CELL RESEARCH

9.3 MULTIPLE CHROMOSOME ABNORMALITIES

9.4 OTHERS

10 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY END USER

10.1 OVERVIEW

10.2 RESEARCH & ACADEMIC INSTITUTES

10.3 REFERENCE LABORATORIES

10.4 HOSPITALS AND PHYSICIAN LABORATORIES

11 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 GUARDANT HEALTH

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 EUROFINS GENOMICS (A SUBSIDIARY OF EUROFINS SCIENTIFIC)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 FOUNDATION MEDICINE, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 ILLUMINA, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 NATERA, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 BIO-RAD LABORATORIES, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 QIAGEN

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 THERMO FISHER SCIENTIFIC INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 BIOCEPT, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 BIOLIDICS LIMITED

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 EXACT SCIENCES CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 EXODX (A SUBSIDIARY OF BIO-TECHNE CORPORATION)

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 F. HOFFMANN-LA ROCHE LTD

14.13.1 COMPANY SNAPSHOT

14.13.2 RECENT FINANCIALS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 IMMUCOR

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 INIVATA LTD

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 LUCENCE HEALTH, INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 LUNGLIFE AI, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 MDXHEALTH

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 MENARINI SILICON BIOSYSTEMS

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 MYRIAD GENETICS, INC.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENTS

14.21 VORTEX BIOSCIENCES

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA CTC DETECTION METHODS IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA CTC ENRICHMENT METHODS IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA EX VIVO POSITIVE SELECTION IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA MOLECULAR (RNA)-BASED TECHNOLOGIES IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA FUNCTIONAL IN VITRO CELL INVASION ASSAY IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA XENOTRANSPLANTATION MODELS IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA MICROCHIPS IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SINGLE SPIRAL MICROCHANNEL IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA NEGATIVE SELECTION IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA IMMUNOCYTOCHEMICAL TECHNOLOGIES IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CANCER STEM CELL RESEARCH IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA MULTIPLE CHROMOSOME ABNORMALITIES IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA RESEARCH & ACADEMIC INSTITUTES IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA REFERENCE LABORATORIES IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA HOSPITALS AND PHYSICIAN LABORATORIES IN CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 SOUTH AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 25 SOUTH AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 SOUTH AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 27 SAUDI ARABIA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 28 SAUDI ARABIA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 SAUDI ARABIA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 U.A.E CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 31 U.A.E CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 U.A.E CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 33 EGYPT CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 34 EGYPT CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 EGYPT CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 36 ISRAEL CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 37 ISRAEL CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 ISRAEL CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 39 REST OF MIDDLE EAST AND AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET : MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: SEGMENTATION

FIGURE 11 THE HIGH PREVALENCE OF CANCER IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CTC DETECTION METHODS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET

FIGURE 15 PREVALENCE OF BREAST CANCER IN EUROPE, INDIA, AND IN THE U.S.

FIGURE 16 PREVALENCE OF LUNG CANCER IN VARIOUS COUNTRIES, WITH HUNGARY BEING THE HIGHEST PREVALENCE RATE IN WOMEN AND MEN

FIGURE 17 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY TECHNOLOGY, 2021

FIGURE 18 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY TECHNOLOGY, 2020-2029 (USD MILLION)

FIGURE 19 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 20 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 21 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY APPLICATION, 2021

FIGURE 22 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 23 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 25 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY END USER, 2021

FIGURE 26 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 27 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 28 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 MIDDLE EAST AND AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: SNAPSHOT (2021)

FIGURE 30 MIDDLE EAST AND AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY COUNTRY (2021)

FIGURE 31 MIDDLE EAST AND AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 MIDDLE EAST AND AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 MIDDLE EAST AND AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA CIRCULATING TUMOR CELLS (CTC) LIQUID BIOPSY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.