Middle East And Africa Cbd Oil Market

Taille du marché en milliards USD

TCAC :

%

USD

8,817.44 Million

USD

73,265.26 Million

2021

2029

USD

8,817.44 Million

USD

73,265.26 Million

2021

2029

| 2022 –2029 | |

| USD 8,817.44 Million | |

| USD 73,265.26 Million | |

|

|

|

Marché de l’huile de cannabidiol (CBD) au Moyen-Orient et en Afrique, par type (huile de chanvre, huile de marijuana), type de produit (original, mélangé), catégorie de produit (sans saveur, aromatisé), application (aliments et boissons, soins personnels/cosmétiques, produits pharmaceutiques et nutraceutiques, application industrielle), canal de distribution (direct, indirect) – Tendances et prévisions de l’industrie jusqu’en 2029

Analyse et taille du marché

L'huile de cannabidiol (CBD) a largement gagné en popularité au fil des ans en raison de son utilisation efficace dans le traitement de la douleur résultant de blessures chroniques. De plus, elle est encore plus efficace pour lutter contre l'inflammation, l'anxiété et l'insomnie et contribue également à améliorer les fonctions physiologiques et cognitives d'un individu ainsi qu'à réguler l'humeur, la douleur et la mémoire. Le cannabidiol (CBD) est l'un des 113 cannabinoïdes identifiés dans les plantes de cannabis et représente jusqu'à 40 % de l'extrait de la plante. En conséquence, sa popularité croissante concernant ses avantages devrait favoriser la croissance du marché au cours de la période prévue.

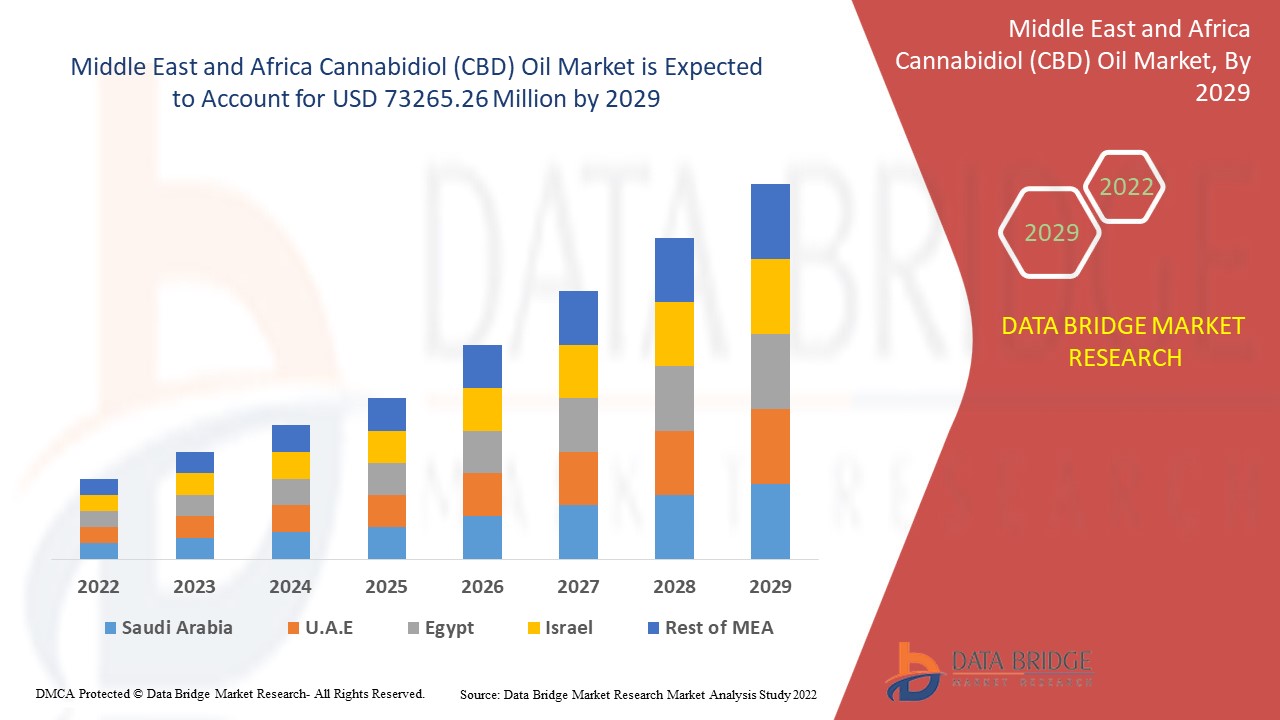

Français Le marché de l'huile de cannabidiol (CBD) au Moyen-Orient et en Afrique était évalué à 8 817,44 millions USD en 2021 et devrait atteindre 73 265,26 millions USD d'ici 2029, enregistrant un TCAC de 30,30 % au cours de la période de prévision 2022-2029. L'« huile de chanvre » devrait dominer le segment des types en raison de son adoption accrue car elle réduit considérablement le cholestérol total et les lipoprotéines de basse densité (LDL), ce qui réduit encore le risque d'accident vasculaire cérébral, d'hypertension artérielle et de maladie cardiaque. En plus des informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend également une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la production et de la consommation et un scénario de chaîne climatique.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2014 à 2019) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par type (huile de chanvre, huile de marijuana), type de produit (original, mélangé), catégorie de produit (sans saveur, aromatisé), application (aliments et boissons, soins personnels/cosmétiques, produits pharmaceutiques et nutraceutiques, application industrielle), canal de distribution (direct, indirect) |

|

Pays couverts |

Émirats arabes unis, Arabie saoudite, Égypte, Afrique du Sud, Israël, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Canopy Growth Corporation (Canada), The Cronos Group (Canada), Tilray (États-Unis), Hexo (Canada), CannTrust (Canada), Aurora Cannabis Inc. (Canada), GW Pharmaceuticals plc. (Royaume-Uni), VIVO Cannabis Inc. (Canada), Alkaline88, LLC. (États-Unis), NewAge Inc. (États-Unis), Cannara (Canada), Dixie Brands (États-Unis), KANNAWAY LLC. (États-Unis), The Supreme Cannabis Company, Inc. (Canada), CANNABIS Aphria (Canada), CURA CS, LLC. (États-Unis), KAZMIRA (États-Unis), Curaleaf (États-Unis) et CannazALL (États-Unis) |

|

Opportunités de marché |

|

Définition du marché

L'huile de cannabidiol (CBD) est un produit dérivé du cannabis. C'est un cannabinoïde, qui est un produit chimique présent naturellement dans les plantes de marijuana. Bien qu'il soit dérivé de plantes de marijuana, le cannabidiol ne produit pas de « high » ou de forme d'intoxication ; cela est causé par un autre cannabinoïde connu sous le nom de tétrahydrocannabinol (THC). Le cannabidiol (CBD) est utilisé dans un large éventail d'applications en raison de ses propriétés bénéfiques médicalement prouvées. Le cannabidiol (CBD) est le deuxième ingrédient actif le plus répandu dans la marijuana. Le cannabidiol est un phytocannabinoïde qui peut être utilisé dans une large gamme de produits de soins personnels et cosmétiques en tant qu'ingrédient actif.

Dynamique du marché de l'huile de cannabidiol (CBD)

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Prise de conscience croissante de ses avantages

L'huile de cannabidiol devient de plus en plus populaire dans le monde entier, en raison de la sensibilisation accrue aux bienfaits du cannabidiol et de ses propriétés médicinales. En outre, l'adoption massive de l'huile de chanvre dans les industries pharmaceutiques, car elle aide à résoudre divers problèmes de santé, renforce la croissance du marché. Elle est utilisée pour l'anxiété, le traitement de la douleur, les troubles musculaires (dystonie), la maladie de Parkinson , la maladie de Crohn et une variété d'autres conditions médicales. Ce facteur induit une demande et une application par les petites et moyennes entreprises.

En outre, des facteurs tels que l'augmentation du financement public-privé pour des activités de recherche ciblées, le revenu disponible élevé, l'urbanisation rapide, l'évolution des modes de vie et l'augmentation des innovations et du développement de produits résultant des avancées technologiques dans le monde entier augmentent la valeur marchande. En outre, la pénétration accrue d'Internet, le développement et la commercialisation continus de produits, les réglementations gouvernementales favorables à l'utilisation de produits liés au cannabis, en particulier dans les pays en développement, et l'augmentation des dépenses par habitant contribueront tous au taux de croissance futur du marché.

Opportunités

- Progrès technologiques croissants

En outre, le nombre croissant d’avancées technologiques axées sur la minimisation des coûts de production, couplé aux opérations de développement orientées vers le développement durable pour assurer une utilisation optimale et judicieuse des ressources, génère des opportunités lucratives pour les acteurs du marché au cours de la période de prévision de 2022 à 2029.

- Financement et activités de recherche et développement (R&D)

L'augmentation du financement du gouvernement fédéral en matière de recherche et développement devrait accroître la croissance future du marché de l'huile de cannabidiol (CBD). De plus, les diverses activités de recherche et développement (R&D) visant à réduire la teneur en THC, ainsi que l'accent croissant mis sur l'obtention d'une approbation réglementaire plus rapide, influenceront positivement la croissance du marché.

Contraintes/Défis

- Problèmes liés aux prix et à la disponibilité des matières premières

Les fluctuations ou la volatilité du coût des matières premières et des équipements mécaniques constituent un danger important pour la croissance du marché. En outre, l'expansion du marché mondial de l'huile de cannabidiol (CBD) est entravée par la disponibilité irrégulière des matières premières en un seul endroit.

- Normes, standards et règlements

L'imposition par le gouvernement de règles rigoureuses sur une grande variété d'applications industrielles liées aux activités industrielles ralentira encore davantage le rythme de croissance du marché. L'absence de règles de normalisation, le manque de sensibilisation des économies en retard aux avantages et aux coûts élevés des produits à base de cannabis, et un changement dans le spectre de l'offre et de la demande en raison du renforcement de la réglementation dans la zone Asie-Pacifique aggraveraient la position du marché. En conséquence, ces facteurs devraient remettre en cause le taux de croissance du marché de l'huile de cannabidiol (CBD).

En outre, la concurrence et l’offre croissantes pour répondre à la demande croissante, ainsi que le développement de produits de faible qualité en raison d’équipements de production insuffisants, freineraient davantage l’expansion du marché.

Ce rapport sur le marché de l'huile de cannabidiol (CBD) fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de l'huile de cannabidiol (CBD), contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché de l'huile de cannabidiol (CBD)

La récente épidémie de coronavirus a eu un impact négatif sur le marché de l'huile de cannabidiol (CBD). La pandémie a eu un impact sur plusieurs entreprises manufacturières au cours des années 2020-2021, entraînant la fermeture de lieux de travail, l'interruption des chaînes d'approvisionnement et des limitations de transit. Plusieurs économies de la région ont mis en place un confinement à cet effet, entraînant l'arrêt de la production et des installations industrielles. La chaîne d'approvisionnement de diverses unités de fabrication, ainsi que de plusieurs services publics de table dans le monde, ont été considérablement affectées au cours de cette période, entraînant une perte importante de revenus et de bénéfices.

Cependant, avec l'augmentation des assouplissements, une augmentation significative des importations et des exportations est attendue. Les autorités gouvernementales respectives commencent à lever ces mesures de confinement imposées, ce qui est un signe positif pour le marché.

Développement récent

- En janvier 2021, Next leaf a obtenu un brevet de l'Office américain des brevets et des marques pour un procédé qui s'ajoute au portefeuille de brevets américains dynamique et croissant de la société, résultant en un concentré de cannabis sans solvant.

- En janvier 2021, Nano Hydrate a dévoilé des services de marketing de produits exploitant des technologies avancées pour fournir une guérison naturelle grâce à des services de branding de cannabidiol (CBD) de qualité pharmaceutique. De plus, Nano Hydrate avait pour objectif de créer un programme collaboratif qui lui permettrait d'introduire des marques existantes sur le marché des produits CBD de niche tout en élargissant les options de boissons infusées au cannabis pour l'industrie du cannabis.

Portée du marché de l'huile de cannabidiol (CBD) au Moyen-Orient et en Afrique

Le marché de l'huile de cannabidiol (CBD) est segmenté en fonction du type, du type de produit, de la catégorie de produit, de l'application et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Huile de chanvre

- Huile de marijuana

Type de produit

- Original

- Mélangé

Catégorie de produit

- Sans saveur

- Parfumé

Application

- Alimentation et boissons

- Soins personnels/cosmétiques

- Produits pharmaceutiques et nutraceutiques

- Application industrielle

Canal de distribution

- Direct

- Indirect

Analyse/perspectives régionales du marché de l'huile de cannabidiol (CBD)

Le marché de l’huile de cannabidiol (CBD) est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, type de produit, catégorie de produit, application et canal de distribution comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de l'huile de cannabidiol (CBD) sont l'Arabie saoudite, les Émirats arabes unis, Israël, l'Égypte, l'Afrique du Sud, le reste du Moyen-Orient et de l'Afrique (MEA) dans le cadre du Moyen-Orient et de l'Afrique (MEA).

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'huile de cannabidiol (CBD)

Le paysage concurrentiel du marché de l'huile de cannabidiol (CBD) fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de l'huile de cannabidiol (CBD).

Certains des principaux acteurs opérant sur le marché de l’huile de cannabidiol (CBD) sont

- Canopy Growth Corporation (Canada)

- Le Groupe Cronos (Canada)

- Tilray. (États-Unis)

- Hexo (Canada)

- CannTrust (Canada)

- Aurora Cannabis Inc. (Canada)

- GW Pharmaceuticals plc. (Royaume-Uni)

- VIVO Cannabis Inc. (Canada)

- Alkaline88, LLC. (États-Unis)

- NewAge Inc. (États-Unis)

- Cannara. (Canada)

- Dixie Brands (États-Unis)

- KANNAWAY LLC. (États-Unis)

- La Compagnie Suprême du Cannabis, Inc. (Canada)

- CANNABIS Aphria (Canada)

- CURA CS, LLC. (États-Unis)

- KAZMIRA (États-Unis)

- Curaleaf (États-Unis)

- CannazALL (États-Unis)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA CBD OIL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT CATEGORY LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 IMPACT OF COVID-19 PANDEMIC ON THE MIDDLE EAST AND AFRICA CBD OIL MARKET

5.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MIDDLE EAST AND AFRICA CBD OIL MARKET

5.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MIDDLE EAST AND AFRICA CBD OIL MARKET

5.3 STRATERGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

5.4 PRICE IMPACT

5.5 IMPACT ON DEMAND

5.6 IMPACT ON SUPPLY CHAIN

5.7 CONCLUSION

6 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY TYPE

6.1 OVERVIEW

6.2 CBD DOMINANT

6.3 MARIJUANA BASED

6.4 THC DOMINANT

6.5 HEMP BASED

6.5.1 HEMP SEED OIL

6.5.2 HEMP FLOWER OIL

7 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 BLENDED

7.3 ORIGINAL

8 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY PRODUCT CATEGORY

8.1 OVERVIEW

8.2 UNFLAVOURED

8.3 FLAVOURED

8.3.1 VANILLA

8.3.2 MINT

8.3.3 CITRUS FLAVOUR

8.3.4 OTHERS

9 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PHARMA AND NUTRACEUTICALS

9.2.1 PHARMA AND NUTRACEUTICALS, BY PRODUCTS

9.2.1.1 PILLS

9.2.1.2 CAPSULE

9.2.1.3 OTHERS

9.2.2 PHARMA AND NUTRACEUTICALS, BY INDICATION

9.2.2.1 PAIN RELIEF

9.2.2.2 MENTAL HEALTH

9.2.2.3 SLEEP MANAGEMENT

9.2.2.4 NEUROLOGICAL

9.2.2.5 SKIN HEALTH

9.2.2.6 CARDIAC FUNCTION

9.2.2.7 HEART HEALTH

9.2.2.8 LOW METABOLISM

9.2.2.9 OTHERS

9.2.3 PHARMA AND NUTRACEUTICALS, BY TYPE

9.2.3.1 CBD DOMINANT

9.2.3.2 MARIJUANA BASED

9.2.3.3 THC DOMINANT

9.2.3.4 HEMP BASED

9.3 FOOD AND BEVERAGES

9.3.1 FOOD AND BEVERAGES, BY APPLICATION

9.3.1.1 FOOD PRODUCTS

9.3.1.1.1 Bakery Products

9.3.1.1.1.1 Cakes

9.3.1.1.1.2 Donuts

9.3.1.1.1.3 Cookies & Biscuits

9.3.1.1.1.4 Others

9.3.1.1.2 Dairy Products

9.3.1.1.3 Frozen Desserts

9.3.1.1.4 Processed Food

9.3.1.1.4.1 snacks

9.3.1.1.4.2 Soups

9.3.1.2 BEVERAGES

9.3.1.2.1 Alcoholic Beverages

9.3.1.2.1.1 Sparkling

9.3.1.2.1.2 Beer

9.3.1.2.1.3 Cocktails

9.3.1.2.1.4 Others

9.3.1.2.2 Non-Alcoholic Beverages

9.3.1.2.2.1 Energy Drinks

9.3.1.2.2.2 Soft Drinks

9.3.1.2.2.3 Flavoured Drinks

9.3.1.2.2.4 LEMON

9.3.1.2.2.5 Orange

9.3.1.2.2.6 Berries

9.3.1.2.2.7 Coconut

9.3.1.2.2.8 Others

9.3.1.2.2.9 Infused Water

9.3.1.2.2.10 RTD Coffee

9.3.1.2.2.11 Others

9.3.2 FOOD AND BEVERAGES, BY TYPE

9.3.2.1 CBD DOMINANT

9.3.2.2 MARIJUANA BASED

9.3.2.3 THC DOMINANT

9.3.2.4 HEMP BASED

9.4 PERSONAL CARE/ COSMETICS

9.4.1 PERSONAL CARE/ COSMETICS, BY APPLICATION

9.4.1.1 HAIR CARE PRODUCTS

9.4.1.2 LOTIONS

9.4.1.3 HAND CREAMS

9.4.1.4 LIP BALMS

9.4.1.5 SOAPS

9.4.1.6 SHOWER GELS

9.4.1.7 OTHERS

9.4.2 PERSONAL CARE/ COSMETICS, BY TYPE

9.4.2.1 CBD DOMINANT

9.4.2.2 MARIJUANA BASED

9.4.2.3 THC DOMINANT

9.4.2.4 HEMP BASED

9.5 INDUSTRIAL APPLICATION

9.5.1 INDUSTRIAL, BY APPLICATION

9.5.1.1 LUBRICANTS FOR MACHINERY

9.5.1.2 VARNISHES

9.5.1.3 PAINTS

9.5.1.4 SEALANTS

9.5.1.5 PRINTING INKS

9.5.1.6 OTHERS

9.5.2 INDUSTRIAL APPLICATION, BY TYPE

9.5.2.1 CBD DOMINANT

9.5.2.2 MARIJUANA BASED

9.5.2.3 THC DOMINANT

9.5.2.4 HEMP BASED

9.6 OTHERS

9.6.1 OTHERS SEGMENT, BY TYPE

9.6.1.1 CBD DOMINANT

9.6.1.2 MARIJUANA BASED

9.6.1.3 THC DOMINANT

9.6.1.4 HEMP BASED

10 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

10.3.1 STORE BASED RETAILER

10.3.1.1 PHARMACIES

10.3.1.2 SUPERMARKETS/HYPERMARKET

10.3.1.3 CONVENIENCE STORES

10.3.1.4 GROCERY STORES

10.3.1.5 OTHER

10.3.2 NON-STORE BASED RETAILER

10.3.2.1 ONLINE

10.3.2.2 VENDING

11 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA CBD OIL MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 AURORA CANNABIS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATE

14.2 ISODIOL INTERNATIONAL INC

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT UPDATE

14.3 IRIEHEMP

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATE

14.4 DIAMOND CBD

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATE

14.5 ENDOCA

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATE

14.6 APHRIA INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT UPDATE

14.7 CANOPY GROWTH CORPORATION

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT UPDATE

14.8 CBD AMERICAN SHAMAN

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CONNOILS LLC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 CURALEAF

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT UPDATE

14.11 CV SCIENCES, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 BRAND PORTFOLIO

14.11.4 RECENT UPDATE

14.12 ELIXINOL MIDDLE EAST AND AFRICA LIMITED

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 OPERATION PORTFOLIO

14.12.4 RECENT UPDATE

14.13 EMBLEM CANNABIS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUT PORTFOLIO

14.13.3 RECENT UPDATE

14.14 FOLIUM BIOSCIENCES

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATE

14.15 GAIA HERBS HEMP

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATE

14.16 JOY ORGANICS

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

14.17 KAZMIRA

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATE

14.18 MEDICAL MARIJUANA, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT UPDATE

14.19 NULEAF NATURALS, LLC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATE

14.2 PUREKANA

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATE

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

LIST OF TABLES

TABLE 1 IMPORT DATA OF TRUE HEMP "CANNABIS SATIVA L.", RAW OR PROCESSED, BUT NOT SPUN; TOW AND WASTE OF TRUE HEMP, INCL. YARN WASTE AND GARNETTED STOCK HS CODE - 5302 USD (THOUSAND)

TABLE 2 EXPORT DATA OF TRUE HEMP "CANNABIS SATIVA L.", RAW OR PROCESSED, BUT NOT SPUN; TOW AND WASTE OF TRUE HEMP, INCL. YARN WASTE AND GARNETTED STOCK HS CODE - 5302 USD (THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY TYPE, 2018-2027 (KG)

TABLE 4 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY PRODUCT, 2018-2027 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA CBD DOMINANT IN MIDDLE EAST AND AFRICA CBD OIL MARKET, BY REGION, 2018-2027 (KG)

TABLE 6 MIDDLE EAST AND AFRICA CBD DOMINANT IN MIDDLE EAST AND AFRICA CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA MARIJUANA BASED IN MIDDLE EAST AND AFRICA CBD OIL MARKET, BY REGION, 2018-2027 (KG)

TABLE 8 MIDDLE EAST AND AFRICA MARIJUANA BASED IN MIDDLE EAST AND AFRICA CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA THC DOMINANT IN MIDDLE EAST AND AFRICA CBD OIL MARKET, BY REGION, 2018-2027 (KG)

TABLE 10 MIDDLE EAST AND AFRICA THC DOMINANT IN MIDDLE EAST AND AFRICA CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA HEMP BASED IN CBD OIL MARKET, BY REGION, 2018-2027 (KG)

TABLE 12 MIDDLE EAST AND AFRICA HEMP BASED IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA HEMP BASED IN CBD OIL MARKET, BY HEMP BASED TYPE, 2018-2027 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY PRODUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA BLENDED IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA ORIGINAL IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY PRODUCT CATEGORY, 2018-2027 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA UNFLAVOURED IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA FLAVOURED IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA FLAVOURED IN CBD OIL MARKET, BY FLAVOURED TYPE, 2018-2027 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA PHARMA AND NUTRACEUTICALS IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA PHARMA AND NUTRACEUTICALS BY PRODUCTS IN CBD OIL MARKET, BY PHARMA AND NUTRACEUTICALS PRODUCTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA PHARMA AND NUTRACEUTICALS, BY INDICATION IN CBD OIL MARKET, BY PHARMA AND NUTRACEUTICALS INDICATION APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA PHARMA AND NUTRACEUTICALS IN CBD OIL MARKET, BY PHARMA AND NUTRACEUTICALS TYPE, 2018-2027 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN CBD OIL MARKET, BY FOOD AND BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA FOOD PRODUCTS IN CBD OIL MARKET, BY FOOD PRODUCTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN CBD OIL MARKET, BY BAKERY PRODUCTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA PROCESSED FOOD IN CBD OIL MARKET, BY PROCESSED FOOD APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA BEVERAGES IN CBD OIL MARKET, BY BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ALCOHOLIC BEVERAGES IN CBD OIL MARKET, BY ALCOHOLIC BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA NON-ALCOHOLIC BEVERAGES IN CBD OIL MARKET, BY NON-ALCOHOLIC BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND))

TABLE 34 MIDDLE EAST AND AFRICA FLAVOURED DRINKS IN CBD OIL MARKET, BY FLAVOURED DRINKS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN CBD OIL MARKET, BY FOOD AND BEVERAGES TYPE, 2018-2027 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA PERSONAL CARE/COSMETICS IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA PERSONAL CARE/ COSMETICS IN CBD OIL MARKET, BY PERSONAL CARE/ COSMETICS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA PERSONAL CARE/ COSMETICS IN CBD OIL MARKET, BY PERSONAL CARE/ COSMETICS TYPE, 2018-2027 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA INDUSTRIAL APPLICATION IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA INDUSTRIAL APPLICATION IN CBD OIL MARKET, BY INDUSTRIAL APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA INDUSTRIAL IN CBD OIL MARKET, BY INDUSTRIAL TYPE, 2018-2027 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA OTHERS IN CBD OIL MARKET, BY OTHERS TYPE, 2018-2027 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA OTHERS IN CBD OIL MARKET, BY OTHERS TYPE, 2018-2027 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA DISTRIBUTION CHANNEL CBD OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA DIRECT IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA INDIRECT IN CBD OIL MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA INDIRECT IN CBD OIL MARKET, BY INDIRECT DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA STORE BASED RETAILER IN CBD OIL MARKET, BY STORE BASED RETAILER TYPE, 2018-2027 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA NON-STORE BASED RETAILER IN CBD OIL MARKET, BY B NON-STORE BASED RETAILER TYPE, 2018-2027 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA CBD OIL MARKET, 2018-2027 (KG)

TABLE 51 MIDDLE EAST AND AFRICA CBD OIL MARKET, 2018-2027 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY TYPE, 2018-2027 (KG)

TABLE 53 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA HEMP BASED IN CBD OIL MARKET, BY HEMP BASED TYPE, 2018-2027 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA CBD OIL MARKET, BYPRODUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY PRODUCT CATEGORY, 2018-2027 (KG)

TABLE 57 MIDDLE EAST AND AFRICA FLAVOURED IN CBD OIL MARKET, BY FLAVOURED PRODUCT CATEGORY, 2018-2027 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN CBD OIL MARKET, BY FOOD AND BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA FOOD PRODUCTS IN CBD OIL MARKET, BY FOOD PRODUCTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA BAKERY PRODUCTS IN CBD OIL MARKET, BY BAKERY PRODUCTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA PROCESSED FOOD IN CBD OIL MARKET, BY PROCESSED FOOD APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA BEVERAGES IN CBD OIL MARKET, BY BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA ALCOHOLIC BEVERAGES IN CBD OIL MARKET, BY ALCOHOLIC BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA NON-ALCOHOLIC BEVERAGES IN CBD OIL MARKET, BY NON-ALCOHOLIC BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA FLAVOURED DRINKS IN CBD OIL MARKET, BY FLAVOURED DRINKS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA FOOD AND BEVERAGES IN CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA PERSONAL CARE/ COSMETICS IN CBD OIL MARKET, BY PERSONAL CARE/ COSMETICS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA PERSONAL CARE/ COSMETICS IN CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA PHARMA AND NUTRACEUTICALS IN CBD OIL MARKET, BY PHARMA AND NUTRACEUTICALS PRODUCTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA PHARMA AND NUTRACEUTICALS IN CBD OIL MARKET, BY PHARMA AND NUTRACEUTICALS INDICATION APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA PHARMA AND NUTRACEUTICALS IN CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA INDUSTRIAL IN CBD OIL MARKET, BY INDUSTRIAL APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA INDUSTRIAL IN CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA OTHERS IN CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA CBD OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA INDIRECT IN CBD OIL MARKET, BY INDIRECT DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA STORE BASED RETAILER IN CBD OIL MARKET, BY STORE BASED RETAILER DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA NON-STORE BASED RETAILER IN CBD OIL MARKET, BY NON-STORE BASED RETAILER DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSAND)

TABLE 80 SOUTH AFRICA CBD OIL MARKET, BY TYPE, 2018-2027 (KG)

TABLE 81 SOUTH AFRICA CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 82 SOUTH AFRICA HEMP BASED IN CBD OIL MARKET, BY HEMP BASED TYPE, 2018-2027 (USD THOUSAND)

TABLE 83 SOUTH AFRICA CBD OIL MARKET, BYPRODUCT TYPE, 2018-2027 (USD THOUSAND)

TABLE 84 SOUTH AFRICA CBD OIL MARKET, BY PRODUCT CATEGORY, 2018-2027 (KG)

TABLE 85 SOUTH AFRICA FLAVOURED IN CBD OIL MARKET, BY FLAVOURED PRODUCT CATEGORY, 2018-2027 (USD THOUSAND)

TABLE 86 SOUTH AFRICA CBD OIL MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 87 SOUTH AFRICA FOOD AND BEVERAGES IN CBD OIL MARKET, BY FOOD AND BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 88 SOUTH AFRICA FOOD PRODUCTS IN CBD OIL MARKET, BY FOOD PRODUCTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 89 SOUTH AFRICA BAKERY PRODUCTS IN CBD OIL MARKET, BY BAKERY PRODUCTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 90 SOUTH AFRICA PROCESSED FOOD IN CBD OIL MARKET, BY PROCESSED FOOD APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 91 SOUTH AFRICA BEVERAGES IN CBD OIL MARKET, BY BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 92 SOUTH AFRICA ALCOHOLIC BEVERAGES IN CBD OIL MARKET, BY ALCOHOLIC BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 93 SOUTH AFRICA NON-ALCOHOLIC BEVERAGES IN CBD OIL MARKET, BY NON-ALCOHOLIC BEVERAGES APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 94 SOUTH AFRICA FLAVOURED DRINKS IN CBD OIL MARKET, BY FLAVOURED DRINKS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 95 SOUTH AFRICA FOOD AND BEVERAGES IN CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 96 SOUTH AFRICA PERSONAL CARE/ COSMETICS IN CBD OIL MARKET, BY PERSONAL CARE/ COSMETICS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 97 SOUTH AFRICA PERSONAL CARE/ COSMETICS IN CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 98 SOUTH AFRICA PHARMA AND NUTRACEUTICALS IN CBD OIL MARKET, BY PHARMA AND NUTRACEUTICALS PRODUCTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 99 SOUTH AFRICA PHARMA AND NUTRACEUTICALS IN CBD OIL MARKET, BY PHARMA AND NUTRACEUTICALS INDICATION APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 100 SOUTH AFRICA PHARMA AND NUTRACEUTICALS IN CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 101 SOUTH AFRICA INDUSTRIAL IN CBD OIL MARKET, BY INDUSTRIAL APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 102 SOUTH AFRICA INDUSTRIAL IN CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 103 SOUTH AFRICA OTHERS IN CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 104 SOUTH AFRICA CBD OIL MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSAND)

TABLE 105 SOUTH AFRICA INDIRECT IN CBD OIL MARKET, BY INDIRECT DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSAND)

TABLE 106 SOUTH AFRICA STORE BASED RETAILER IN CBD OIL MARKET, BY STORE BASED RETAILER DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSAND)

TABLE 107 SOUTH AFRICA NON-STORE BASED RETAILER IN CBD OIL MARKET, BY NON-STORE BASED RETAILER DISTRIBUTION CHANNEL, 2018-2027 (USD THOUSAND)

TABLE 108 REST OF MIDDLE EAST AND AFRICA CBD OIL MARKET, BY TYPE, 2018-2027 (KG)

TABLE 109 REST OF MIDDLE EAST AND AFRICA CBD OIL MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

Liste des figures

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA CBD OIL MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA CBD OIL MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA CBD OIL MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA CBD OIL MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA CBD OIL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA CBD OIL MARKET: THE PRODUCT CATEGORY LIFE LINE CURVE

FIGURE 7 MIDDLE EAST AND AFRICA CBD OIL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA CBD OIL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA CBD OIL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA CBD OIL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST AND AFRICA CBD OIL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST AND AFRICA CBD OIL MARKET: SEGMENTATION

FIGURE 13 INCREASING AWARENESS ABOUT THE THERAPEUTIC BENEFITS OF CBD OIL IS DRIVING THE MIDDLE EAST AND AFRICA CBD OIL MARKET IN THE FORECAST PERIOD 2020 TO 2027

FIGURE 14 CBD DOMINANT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA CBD OIL MARKET IN 2020 & 2027

FIGURE 15 MIDDLE EAST AND AFRICA CBD OIL MARKET: BY TYPE, 2019

FIGURE 16 MIDDLE EAST AND AFRICA CBD OIL MARKET: BY PRODUCT TYPE, 2019

FIGURE 17 MIDDLE EAST AND AFRICA CBD OIL MARKET: BY PRODUCT CATEGORY, 2019

FIGURE 18 MIDDLE EAST AND AFRICA CBD OIL MARKET: BY APPLICATION, 2019

FIGURE 19 MIDDLE EAST AND AFRICA CBD OIL MARKET: BY DISTRIBUTION CHANEL, 2019

FIGURE 20 MIDDLE EAST AND AFRICA CBD OIL MARKET: SNAPSHOT (2019)

FIGURE 21 MIDDLE EAST AND AFRICA CBD OIL MARKET: BY COUNTRY (2019)

FIGURE 22 MIDDLE EAST AND AFRICA CBD OIL MARKET: BY COUNTRY (2020 & 2027)

FIGURE 23 MIDDLE EAST AND AFRICA CBD OIL MARKET: BY COUNTRY (2019 & 2027)

FIGURE 24 MIDDLE EAST AND AFRICA CBD OIL MARKET: BY TYPE (2020-2027)

FIGURE 25 MIDDLE EAST AND AFRICA CBD OIL MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.