Marché des films multicouches bioplastiques au Moyen-Orient et en Afrique pour les emballages de restauration compostables, par matériau (mélanges d'amidon, polybutylène adipate téréphtalate, acide polylactique , PBS et autres), emballage d'utilisation finale (sachets et sachets, coquilles, gobelets, plateaux et autres), utilisateur final (chaînes de restaurants, restaurants hors chaîne, cafés de chaîne, cafés hors chaîne, livraison de repas, vendeurs indépendants et kiosques, et autres) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique

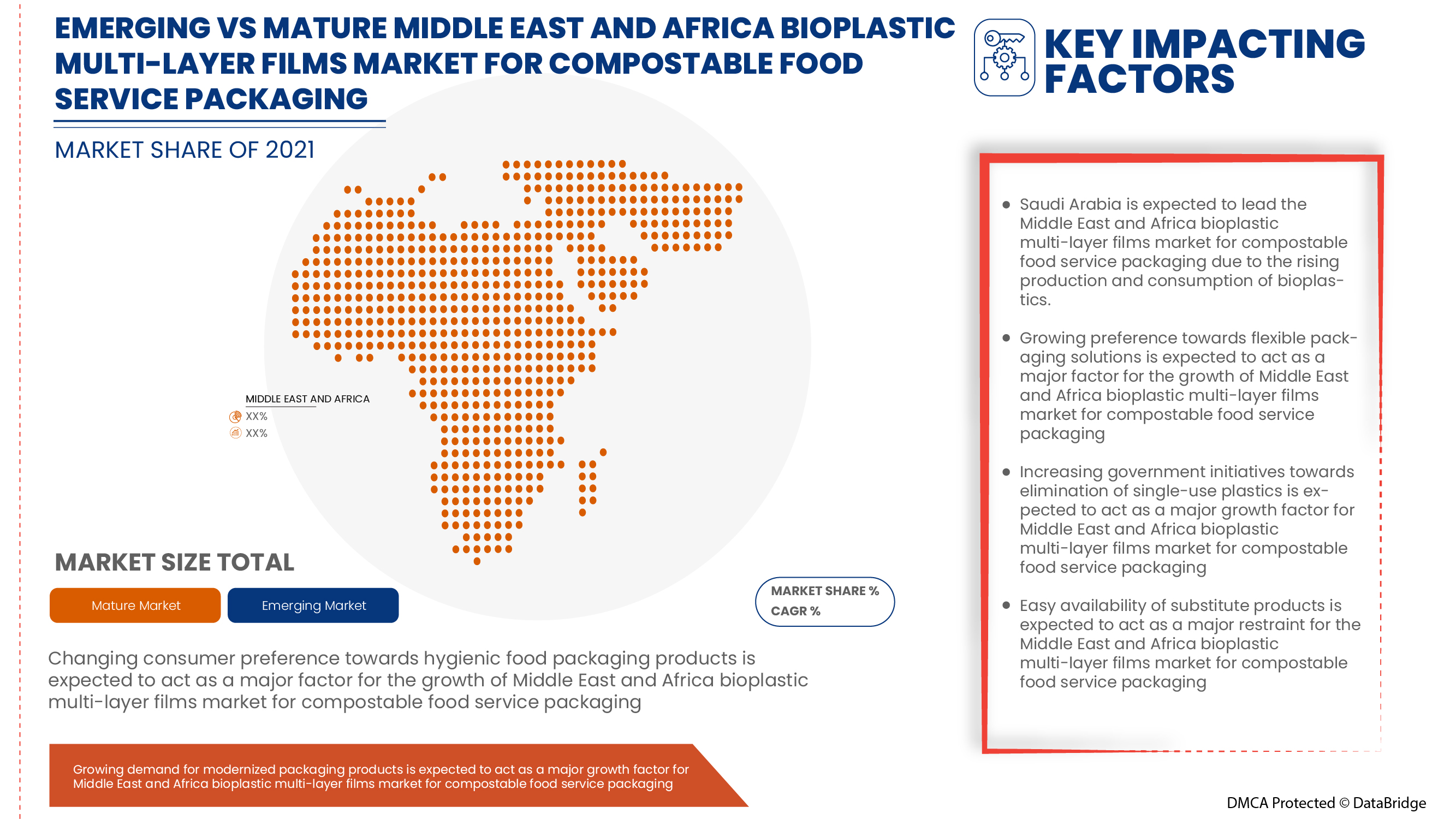

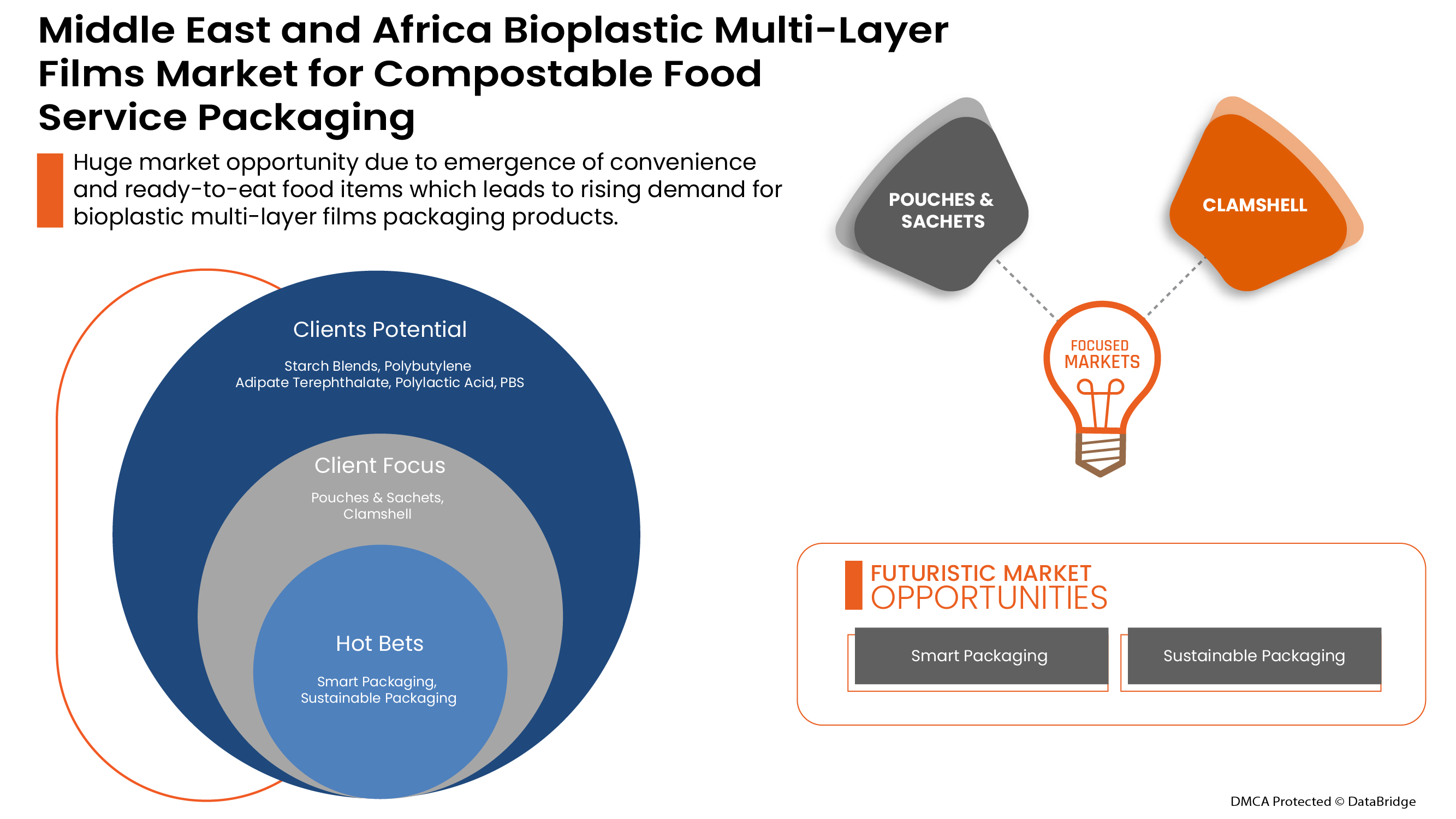

La tendance à la consommation de plats cuisinés et la popularité croissante des solutions d'emballage flexibles devraient stimuler la demande pour le marché des films multicouches bioplastiques pour les emballages de restauration compostables au Moyen-Orient et en Afrique. Cependant, les coûts élevés associés aux films biodégradables et la disponibilité de produits de substitution pourraient encore limiter la croissance du marché.

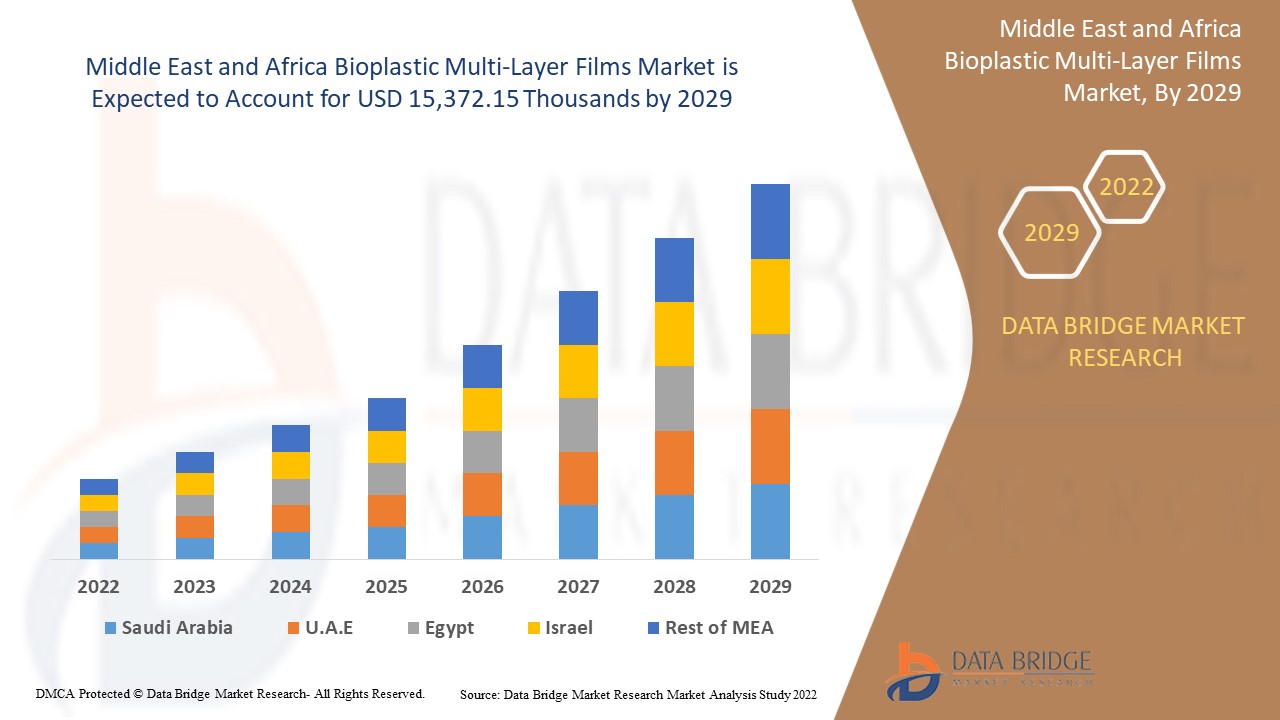

Selon les analyses de Data Bridge Market Research, le marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique devrait atteindre la valeur de 15 372,15 milliers de dollars d'ici 2029, à un TCAC de 6,8 % au cours de la période de prévision. « Les mélanges d'amidon représentent le segment de matériaux le plus important sur le marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique. Le rapport sur le marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en tonnes, prix en dollars américains |

|

Segments couverts |

Par matériau (mélanges d'amidon, polybutylène adipate téréphtalate, acide polylactique, PBS et autres), emballage d'utilisation finale (sachets et sachets, barquettes, gobelets, plateaux et autres), utilisateur final (chaînes de restaurants, restaurants hors chaîne, cafés de chaîne, cafés hors chaîne, services de livraison, vendeurs indépendants et kiosques, et autres) |

|

Pays couverts |

Afrique du Sud, Égypte, Arabie saoudite, Israël, Émirats arabes unis, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

BASF SE, TIPA LTD, entre autres |

Définition du marché

Les bioplastiques proviennent d'une ressource renouvelable, sont biodégradables ou les deux. Les matériaux dérivés de ressources renouvelables et de polymères biodégradables sont des bioplastiques, tels que les mélanges d'amidon, le polybutylène adipate téréphtalate , l'acide polylactique et le PBS, entre autres. Dans la technologie des films multicouches, deux ou plusieurs matériaux aux propriétés spécifiques et complémentaires sont combinés, améliorant ainsi les performances globales du bioplastique. Les matériaux offrent des performances compétitives en termes d'emballages flexibles et rigides tout en minimisant l'impact négatif des plastiques conventionnels à base de pétrole.

Dans les emballages de restauration, les films multicouches compostables offrent une excellente protection aux produits frais et aux aliments secs. Les produits d'emballage finaux fabriqués à partir de ce matériau peuvent être facilement imprimés à l'aide de technologies d'impression traditionnelles et numériques. Les films multicouches compostables permettent aux prestataires de services alimentaires de s'éloigner des emballages conventionnels et d'être à l'avant-garde de la création d'une économie circulaire.

Dynamique du marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique

Conducteurs

- Tendance à consommer des aliments prêts à consommer

Les aliments de commodité comprennent des aliments prélavés, cuits, généralement emballés et prêts à consommer. La culture occidentale influence fortement les consommateurs en raison de leurs horaires serrés. De plus, les changements rapides du mode de vie ont accru l'intérêt pour la santé et le bien-être, et l'évolution des besoins des consommateurs a fait augmenter la demande de plats cuisinés. Les gens veulent réduire le nombre de fois qu'ils se rendent dans les épiceries, ce qui les incite à acheter des produits alimentaires surgelés et différentes boissons en vrac et à les stocker dans des emballages souples pour maintenir la durée de conservation des produits alimentaires et des boissons. De plus, les aliments de commodité nécessitent une température parfaite pour protéger les aliments de la contamination biologique et des dommages physiques. Par conséquent, cela augmente la demande de produits d'emballage en film multicouche bioplastique.

- Popularité croissante des solutions d'emballage flexibles

L'industrie de l'emballage adopte des solutions intelligentes et durables pour rendre les emballages de produits plus respectueux des consommateurs, des marques et de l'environnement, ce qui permet à l'industrie de l'emballage de développer des emballages intelligents impliquant l'Internet des emballages, les emballages actifs et la nanotechnologie. Les produits d'emballage flexibles fabriqués à partir de films bioplastiques sont légers et pratiques, permettent un déplacement sans tracas et sont rentables. Les matériaux utilisés pour fabriquer des emballages flexibles permettent d'emballer des produits de toute forme, de tout design et de toute palette de couleurs, de toute taille et de tout volume. Les emballages flexibles compostables sont composés de cellulose ou d'autres matériaux d'origine végétale. Ces plastiques biosourcés, ou bioplastiques, sont des matériaux d'origine végétale qui remplacent les plastiques traditionnels dérivés du pétrole.

- Changement de préférence des consommateurs en faveur des produits d'emballage alimentaire hygiéniques

Les emballages alimentaires remplissent de multiples fonctions : ils protègent les aliments contre la contamination ou la détérioration, rendent l'emballage attrayant et permettent le transport des marchandises. L'emballage conserve la fraîcheur du produit et l'empêche d'être exposé à une contamination chimique ou biologique. Les emballages alimentaires utilisent divers matériaux tels que le bioplastique, les films et l'aluminium, qui protègent les aliments de différents types d'exposition, notamment la lumière du soleil, les gaz et l'humidité. Un matériau d'emballage composé de films bioplastiques protège les aliments des agents pathogènes et des produits chimiques. Les matériaux d'emballage biologiques comprennent le plastique et les matériaux de rembourrage, qui empêchent les aliments de se déloger et de s'écraser pendant l'emballage, le transport et la mise en rayon.

- Tendance croissante vers l’élimination du plastique à usage unique

La quantité croissante de plastiques non recyclables a créé une énorme quantité de décharges dans le monde. Ce type de déchets pollue les ressources naturelles de la planète à tel point que les écosystèmes aquatiques subissent ses effets néfastes, en plus des autres effets nocifs palpables des produits chimiques qu'ils contiennent. Les matériaux bioplastiques multicouches sont largement utilisés dans l'emballage des produits alimentaires afin que les produits puissent être transportés d'un endroit à un autre. Les matériaux bioplastiques multicouches sont utilisés pour les emballages flexibles, notamment les plastiques et les polymères à partir desquels différents types d'emballages flexibles sont fabriqués, tels que les sacs, les enveloppes, les sachets, la cellulose et les feuilles d'aluminium. L'augmentation de la population dans les régions et l'interdiction des produits en plastique à usage unique entraînent une demande croissante d'emballages en matériaux bioplastiques.

Opportunités

- Demande croissante du secteur du commerce électronique

Divers facteurs tels que la pénétration d'Internet, l'augmentation du nombre d'utilisateurs de smartphones, l'influence des médias sociaux et les initiatives gouvernementales ont stimulé le secteur du commerce électronique. L'adoption croissante des plateformes de commerce électronique souligne l'importance des ventes au détail en ligne pour l'économie moderne. Les cartons d'expédition des principaux détaillants en ligne et d'autres détaillants symbolisent le commerce électronique. Ils représentent également l'une des sources les plus importantes de croissance de la demande d'emballages en film multicouche bioplastique. On observe également une tendance croissante à rendre les emballages en film multicouche bioplastique attrayants et agréables pour améliorer l'expérience du consommateur sur les plateformes de commerce électronique.

- Augmentation des solutions d'emballage innovantes avec un nouveau design

Les nouvelles solutions d’emballage innovantes telles que l’impression numérique offrent un potentiel d’économies considérable par rapport aux autres procédés d’impression et de faibles coûts de configuration. Les fabricants peuvent se passer de commandes en gros grâce à de grands tirages et à la gestion de stocks. La solution d’emballage avancée offre aux emballeurs plus de liberté en termes de personnalisation et d’options de personnalisation que les procédés mécaniques tels que la composition typographique. De nombreuses grandes marques de produits ont exploré l’emballage personnalisé et ont constaté un retour sur investissement marketing significatif. Ainsi, l’adoption de nouvelles technologies d’impression avancées est en hausse pour offrir aux consommateurs des solutions d’emballage personnalisées. Cela a aidé les entreprises à accroître la valeur de leur marque sur le marché et à renforcer l’engagement des clients envers l’emballage du produit.

Contraintes/Défis

- Coûts élevés associés aux films biodégradables

Le coût de fabrication des produits à base de film bioplastique dépend de la quantité de matières premières utilisées pour la production, car les matières premières respectueuses de l'environnement sont plus chères que les matières conventionnelles. En outre, des facteurs tels que la taille et les caractéristiques des produits d'emballage influencent le prix des produits utilisés dans le secteur de l'emballage alimentaire. En raison de la quantité limitée d'emballages biodégradables de qualité dans le monde, tout produit d'emballage biodégradable sera un peu plus cher que les produits d'emballage standard. Les sacs en bioplastique sont plus chers que le plastique traditionnel car les matières premières sont plus chères, moins facilement disponibles et les processus de fabrication coûtent plus cher avec des lots plus petits.

- Disponibilité de produits de substitution

Les plastiques conventionnels sont le troisième dérivé du pétrole le plus utilisé qui peut être utilisé à la place des matières bioplastiques et sont connus sous le nom de plastiques à combustible fossile. En raison de son coût relativement faible, de sa facilité de fabrication, de sa polyvalence et de son imperméabilité à l'eau, il est utilisé dans de nombreux produits. Il a été un bon substitut au bois, au cuir et au papier, entre autres. D'autre part, les produits bioplastiques sont des matériaux produits à partir de sources de biomasse renouvelables, telles que les graisses et huiles végétales, l'amidon de maïs, la paille, les copeaux de bois et les déchets alimentaires recyclés, qui sont plus chers que les produits conventionnels. De plus, à basse température, la production de bioplastiques peut être affectée par l'utilisation de différents produits chimiques durs, ce qui perturbe la flexibilité des produits.

- Problématiques liées aux films biodégradables

Les bioplastiques sont de plus en plus utilisés pour créer des produits d'emballage plus performants que les plastiques traditionnels dans de nombreuses applications. Les bioplastiques finissent souvent dans des décharges et, en raison de l'absence d'oxygène, ils libèrent du méthane, qui est un gaz à effet de serre. Chaque fois que les bioplastiques ne sont pas éliminés correctement, ils contaminent les lots de plastique recyclé et nuisent au cadre de recyclage. Différents biopolymères utilisés pour les produits d'emballage présentent des inconvénients tels qu'une perméabilité élevée à la vapeur d'eau, une perméabilité à l'oxygène, une fragilité, une faible résistance thermique, de faibles propriétés mécaniques, une vulnérabilité à la dégradation et une faible aptitude au traitement. Ceux-ci, à leur tour, réduisent la demande de produits d'emballage à base de films bioplastiques. De plus, les films bioplastiques ont de faibles propriétés de barrière à l'air, à l'eau et à l'oxygène et une faible résistance à la chaleur par rapport aux films plastiques conventionnels.

- Incertitudes dans les processus de production et les options de fin de vie des bioplastiques

Les unités de fabrication de produits d'emballage en film bioplastique se caractérisent par des cycles de vie de produits courts avec des variations de produits plus importantes et des temps de réponse rapides aux demandes des clients. Pour répondre aux exigences des clients, les fabricants ont besoin d'une plus grande flexibilité dans leurs processus de production, ce qui entraîne des niveaux de complexité et d'incertitude plus élevés. Cela nécessite une planification et une programmation efficaces des différentes activités de production, et par conséquent, un plan rigide n'est plus valable pour répondre à toutes les contraintes et à tous les changements du processus de fabrication. De plus, le manque de développement technologique et la réduction des investissements en capital pour la fabrication de produits d'emballage en film bioplastique réduisent encore davantage la demande de ces produits dans les pays en développement.

Impact du COVID-19 sur le marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. En raison du confinement, le marché des films multicouches bioplastiques pour les emballages de restauration compostables a connu un impact significatif sur l'importation et l'exportation de produits en films multicouches bioplastiques au cours des dernières années.

Cependant, la croissance du marché des films multicouches bioplastiques pour les emballages de restauration compostables après la pandémie est attribuée à l'ouverture des restaurants et à l'augmentation des dépenses des consommateurs. Les fournisseurs de services alimentaires prennent diverses décisions stratégiques pour rebondir après le COVID-19. Les acteurs mènent de multiples activités de recherche et développement pour améliorer leurs services grâce à des produits d'emballage alimentaire hygiéniques.

Développements récents

- En juin 2022, BASF SE et Confoil (un fabricant australien d'emballages alimentaires) ont collaboré pour développer une barquette en papier certifiée compostable et pouvant aller au four double pour la préparation de repas prêts à consommer. Les barquettes prolongent les options de fin de vie des emballages à base de papier en étant recyclables de manière biologique. Elles peuvent être compostées commercialement avec les déchets organiques collectés dans les poubelles à déchets organiques. Cela aidera l'entreprise à se faire connaître sur le marché australien

- En novembre 2021, Transcontinental inc. a acquis HS Crocker Co., Inc., un important fabricant de couvercles découpés pour l'industrie alimentaire et d'étiquettes pour l'industrie pharmaceutique en Amérique du Nord. Cette acquisition renforcera le portefeuille de solutions d'emballage, notamment dans les marchés des produits laitiers, des couvercles pour café ainsi que des desserts réfrigérés et de longue conservation, et offrira d'importantes possibilités de ventes croisées.

Marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique

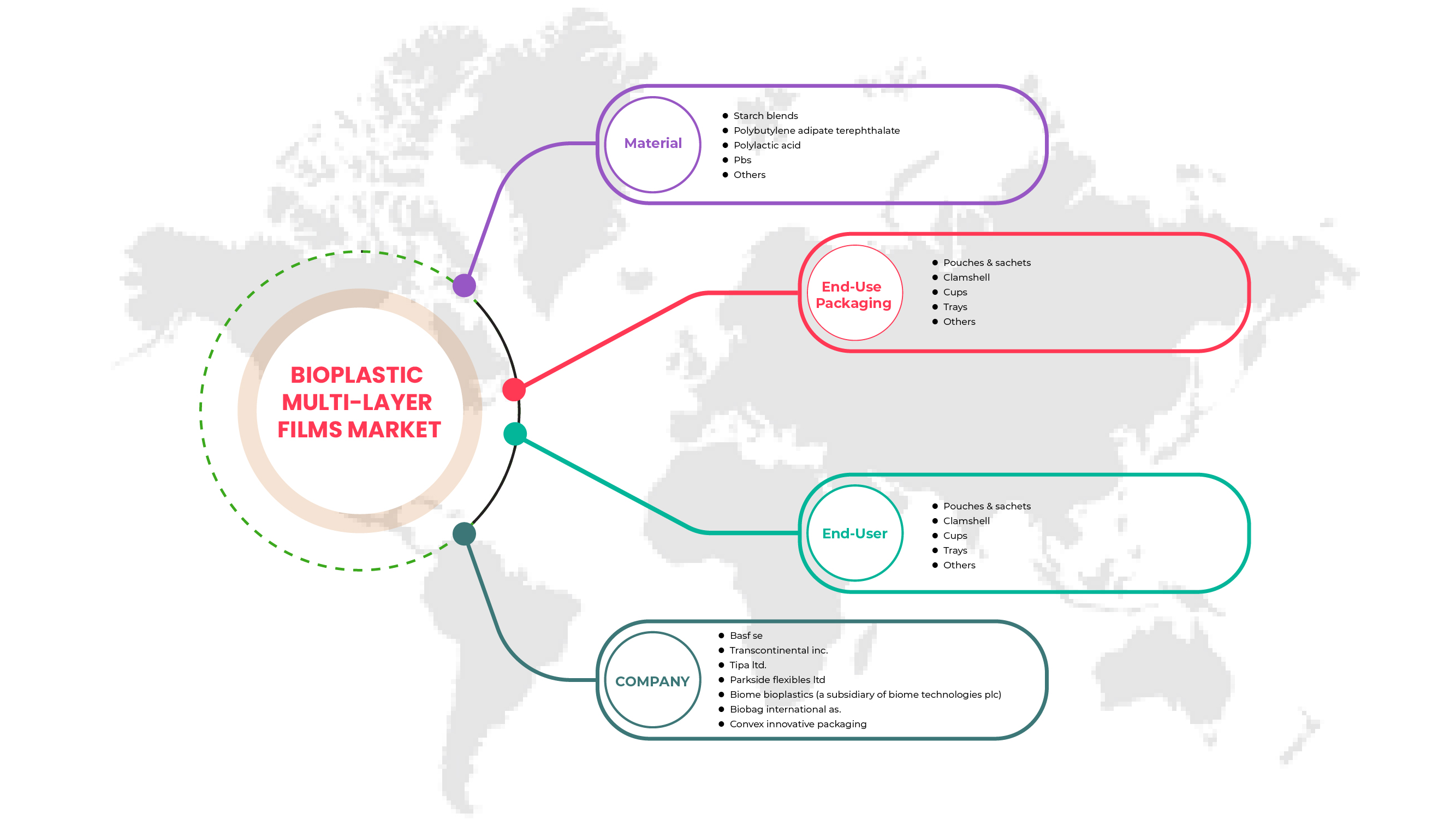

Le marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique est segmenté en fonction du matériau, de l'emballage d'utilisation finale et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Matériel

- Mélanges d'amidon

- Adipate de polybutylène téréphtalate

- Acide polylactique

- PBS

- Autres

Sur la base du matériau, le marché des films multicouches bioplastiques du Moyen-Orient et de l'Afrique pour les emballages de restauration compostables est segmenté en mélanges d'amidon, de polybutylène adipate téréphtalate, d'acide polylactique, de PBS et autres.

Emballage d'utilisation finale

- Pochettes et sachets

- À clapet

- Tasses

- Plateaux

- Autres

Sur la base de l'emballage d'utilisation finale, le marché des films multicouches bioplastiques du Moyen-Orient et de l'Afrique pour les emballages de restauration compostables est segmenté en pochettes et sachets, coquilles, gobelets, plateaux et autres.

Utilisateur final

- Chaînes de restaurants

- Restaurants hors chaîne

- Café de la chaîne

- Café non-chaîne

- Livraison de traiteur

- Vendeurs indépendants et kiosques

- Autres

Sur la base de l'utilisateur final, le marché des films multicouches bioplastiques du Moyen-Orient et de l'Afrique pour les emballages de restauration compostables est segmenté en chaînes de restaurants, restaurants hors chaîne, cafés en chaîne, cafés hors chaîne, restauration de livraison, vendeurs indépendants et kiosques, et autres.

Marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique

Le marché des films multicouches bioplastiques du Moyen-Orient et de l’Afrique pour les emballages de restauration compostables est analysé, et des informations et tendances sur la taille du marché sont fournies par pays, matériau, emballage d’utilisation finale et utilisateur final, comme référencé ci-dessus.

Le marché des films multicouches bioplastiques du Moyen-Orient et de l’Afrique pour les emballages de restauration compostables couvre des pays tels que l’Afrique du Sud, l’Égypte, l’Arabie saoudite, Israël, les Émirats arabes unis, le reste du Moyen-Orient et l’Afrique.

L'Arabie saoudite devrait dominer le marché des films multicouches bioplastiques pour les emballages de restauration compostables au Moyen-Orient et en Afrique, car le secteur de l'emballage se développe rapidement, ce qui contribue à stimuler la demande pour le marché des films multicouches bioplastiques pour les emballages de restauration compostables au Moyen-Orient et en Afrique.

La section pays du rapport sur le marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique fournit également des facteurs d'impact individuels sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et de l'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse des parts de marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché des films multicouches bioplastiques pour emballages de restauration compostables au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des films multicouches bioplastiques au Moyen-Orient et en Afrique pour les emballages de restauration compostables sont BASF SE, TIPA LTD, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 WESTERN FOOD MARKET

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 LEGAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 PORTER'S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 CLIMATE CHANGE SCENARIO

4.4.1 CLIMATE CHANGE SCENARIO

4.5 BUYER'S LIST

4.6 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING

4.6.1 REGULATION COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT

4.7.2 MANUFACTURING AND PACKING

4.7.3 MARKETING AND DISTRIBUTION

4.7.4 END USERS

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 PRODUCTION AND CONSUMPTION ANALYSIS

4.9.1 OVERVIEW

4.1 VENDOR SELECTION CRITERIA

5 REGIONAL SUMMARY

5.1 MIDDLE EAST & AFRICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 SOUTH AMERICA

5.6 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCLINATION TOWARDS THE CONSUMPTION OF CONVENIENCE FOOD

6.1.2 RISING POPULARITY OF FLEXIBLE PACKAGING SOLUTIONS

6.1.3 SHIFTING CONSUMER PREFERENCE TOWARD THE HYGIENIC FOOD PACKAGING PRODUCTS

6.1.4 GROWING TREND TOWARD THE ELIMINATION OF THE SINGLE-USE PLASTIC

6.2 RESTRAINTS

6.2.1 HIGH COSTS ASSOCIATED WITH BIODEGRADABLE FILMS

6.2.2 AVAILABILITY OF SUBSTITUTE PRODUCTS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FROM THE E-COMMERCE SECTOR

6.3.2 SURGE IN INNOVATIVE PACKAGING SOLUTIONS WITH NEW DESIGN

6.4 CHALLENGES

6.4.1 ISSUES RELATED TO BIODEGRADABLE FILMS

6.4.2 UNCERTAINTIES IN PRODUCTION PROCESSES AND END-OF-LIFE OPTIONS FOR BIOPLASTICS

7 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL

7.1 OVERVIEW

7.2 STARCH BLENDS

7.3 POLYBUTYLENE ADIPATE TEREPHTHALATE

7.4 POLYLACTIC ACID

7.5 PBS

7.6 OTHERS

8 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING

8.1 OVERVIEW

8.2 POUCHES & SACHETS

8.3 CLAMSHELL

8.4 CUPS

8.5 TRAYS

8.6 OTHERS

9 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER

9.1 OVERVIEW

9.2 DELIVERY CATERING

9.2.1 DELIVERY CATERING, BY END-USE PACKAGING

9.2.1.1 POUCHES & SACHETS

9.2.1.2 CLAMSHELL

9.2.1.3 CUPS

9.2.1.4 TRAYS

9.2.1.5 OTHERS

9.3 CHAIN RESTAURANTS

9.3.1 CHAIN RESTAURANTS, BY END-USE PACKAGING

9.3.1.1 POUCHES & SACHETS

9.3.1.2 CLAMSHELL

9.3.1.3 CUPS

9.3.1.4 TRAYS

9.3.1.5 OTHERS

9.4 CHAIN CAFÉ

9.4.1 CHAIN CAFÉ, BY END-USE PACKAGING

9.4.1.1 POUCHES & SACHETS

9.4.1.2 CLAMSHELL

9.4.1.3 CUPS

9.4.1.4 TRAYS

9.4.1.5 OTHERS

9.5 NON-CHAIN RESTAURANTS

9.5.1 NON-CHAIN RESTAURANTS, BY END-USE PACKAGING

9.5.1.1 POUCHES & SACHETS

9.5.1.2 CLAMSHELL

9.5.1.3 CUPS

9.5.1.4 TRAYS

9.5.1.5 OTHERS

9.6 NON-CHAIN CAFÉ

9.6.1 NON-CHAIN CAFÉ, BY END-USE PACKAGING

9.6.1.1 POUCHES & SACHETS

9.6.1.2 CLAMSHELL

9.6.1.3 CUPS

9.6.1.4 TRAYS

9.6.1.5 OTHERS

9.7 INDEPENDENT SELLERS & KIOSKS

9.7.1 INDEPENDENT SELLERS & KIOSKS, BY END-USE PACKAGING

9.7.1.1 POUCHES & SACHETS

9.7.1.2 CLAMSHELL

9.7.1.3 CUPS

9.7.1.4 TRAYS

9.7.1.5 OTHERS

9.8 OTHERS

9.8.1 OTHERS, BY END-USE PACKAGING

9.8.1.1 POUCHES & SACHETS

9.8.1.2 CLAMSHELL

9.8.1.3 CUPS

9.8.1.4 TRAYS

9.8.1.5 OTHERS

10 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 EGYPT

10.1.3 SAUDI ARABIA

10.1.4 UNITED ARAB EMIRATES

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

11.1.1 COLLABORATION

11.1.2 ACQUISITIONS

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 BASF SE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATES

13.2 TRANSCONTINENTAL INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATES

13.3 TIPA LTD

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATE

13.4 PARKSIDE FLEXIBLES LTD

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 BIOME BIOPLASTICS (A SUBSIDIARY OF BIOME TECHNOLOGIES PLC)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT UPDATES

13.6 BIOBAG INTERNATIONAL AS.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 CONVEX INNOVATIVE PACKAGING

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF POLY LACTIC ACID, IN PRIMARY FORMS; HS CODE – 39077000 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLY LACTIC ACID, IN PRIMARY FORMS; HS CODE – 39077000 (USD THOUSAND)

TABLE 3 BUYER’S LIST MIDDLE EAST & AFRICALY (POTENTIAL BUYERS/CURRENT BUYERS)

TABLE 4 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 6 MIDDLE EAST & AFRICA STARCH BLENDS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA STARCH BLENDS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 8 MIDDLE EAST & AFRICA POLYBUTYLENE ADIPATE TEREPHTHALATE IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA POLYBUTYLENE ADIPATE TEREPHTHALATE IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 10 MIDDLE EAST & AFRICA POLYLACTIC ACID IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA POLYLACTIC ACID IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 12 MIDDLE EAST & AFRICA PBS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA PBS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 16 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 18 MIDDLE EAST & AFRICA POUCHES & SACHETS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA POUCHES & SACHETS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 20 MIDDLE EAST & AFRICA CLAMSHELL IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA CLAMSHELL IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 22 MIDDLE EAST & AFRICA CUPS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA CUPS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 24 MIDDLE EAST & AFRICA TRAYS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA TRAYS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 28 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 30 MIDDLE EAST & AFRICA DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 32 MIDDLE EAST & AFRICA DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 35 MIDDLE EAST & AFRICA CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 38 MIDDLE EAST & AFRICA CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 41 MIDDLE EAST & AFRICA NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 44 MIDDLE EAST & AFRICA NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA INDEPENDENT SELLERS & KIOSKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA INDEPENDENT SELLERS & KIOSKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 47 MIDDLE EAST & AFRICA INDEPENDENT SELLERS & KIOSKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY REGION, 2020-2029 (TONS)

TABLE 50 MIDDLE EAST & AFRICA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY COUNTRY, 2020-2029 (TONS)

TABLE 53 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 55 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 57 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 59 MIDDLE EAST AND AFRICA DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 66 SOUTH AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 67 SOUTH AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 68 SOUTH AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 69 SOUTH AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 70 SOUTH AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 71 SOUTH AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 72 SOUTH AFRICA DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH AFRICA CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 74 SOUTH AFRICA CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 76 SOUTH AFRICA NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 79 EGYPT BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 80 EGYPT BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 81 EGYPT BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 82 EGYPT BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 83 EGYPT BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 84 EGYPT BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 85 EGYPT DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 86 EGYPT CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 87 EGYPT CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 88 EGYPT NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 89 EGYPT NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 90 EGYPT INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 91 EGYPT OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 92 SAUDI ARABIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 93 SAUDI ARABIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 94 SAUDI ARABIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 95 SAUDI ARABIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 96 SAUDI ARABIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 97 SAUDI ARABIA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 98 SAUDI ARABIA DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 99 SAUDI ARABIA CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 100 SAUDI ARABIA CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 101 SAUDI ARABIA NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 102 SAUDI ARABIA NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 103 SAUDI ARABIA INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 104 SAUDI ARABIA OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 105 UNITED ARAB EMIRATES BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 106 UNITED ARAB EMIRATES BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 107 UNITED ARAB EMIRATES BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 108 UNITED ARAB EMIRATES BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 109 UNITED ARAB EMIRATES BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 110 UNITED ARAB EMIRATES BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 111 UNITED ARAB EMIRATES DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 112 UNITED ARAB EMIRATES CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 113 UNITED ARAB EMIRATES CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 114 UNITED ARAB EMIRATES NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 115 UNITED ARAB EMIRATES NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 116 UNITED ARAB EMIRATES INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 117 UNITED ARAB EMIRATES OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 118 ISRAEL BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 119 ISRAEL BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

TABLE 120 ISRAEL BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 121 ISRAEL BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (TONS)

TABLE 122 ISRAEL BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 123 ISRAEL BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USER, 2020-2029 (TONS)

TABLE 124 ISRAEL DELIVERY CATERING IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 125 ISRAEL CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 126 ISRAEL CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 127 ISRAEL NON-CHAIN RESTAURANTS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 128 ISRAEL NON-CHAIN CAFÉ IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 129 ISRAEL INDEPENDENT SELLERS & KISOKS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 130 ISRAEL OTHERS IN BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY END-USE PACKAGING, 2020-2029 (USD THOUSAND)

TABLE 131 REST OF MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 132 REST OF MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING, BY MATERIAL, 2020-2029 (TONS)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: THE MATERIAL LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: SEGMENTATION

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING AND EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 14 INCREASING FOCUS OF THE CONSUMERS ON HYGIENIC FOOD PACKAGING PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING IN THE FORECAST PERIOD

FIGURE 15 STARCH BLENDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS – MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING

FIGURE 17 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: PRODUCTION AND CONSUMPTION ANALYSIS, 2020-2022 (TONS)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING

FIGURE 19 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY MATERIAL, 2021

FIGURE 20 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY END-USE PACKAGING, 2021

FIGURE 21 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY END-USER, 2021

FIGURE 22 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST AND AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: BY MATERIAL (2022 - 2029)

FIGURE 27 MIDDLE EAST & AFRICA BIOPLASTIC MULTI-LAYER FILMS MARKET FOR COMPOSTABLE FOOD SERVICE PACKAGING: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.