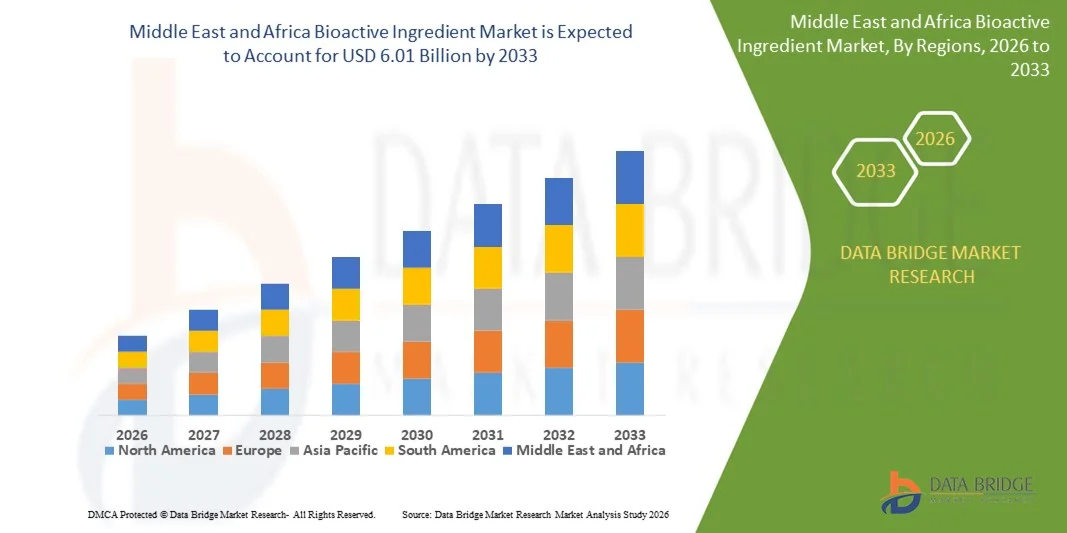

Middle East And Africa Bioactive Ingredient Market

Taille du marché en milliards USD

TCAC :

%

USD

3.55 Billion

USD

6.01 Billion

2025

2033

USD

3.55 Billion

USD

6.01 Billion

2025

2033

| 2026 –2033 | |

| USD 3.55 Billion | |

| USD 6.01 Billion | |

|

|

|

|

Middle East and Africa Bioactive Ingredient Market Segmentation, By Ingredient Type (Prebiotics, Probiotics, Amino Acid, Peptides, Omega 3 And Structured Lipi, Phytochemicals & Plant Extracts, Minerals, Vitamins, Fibers and Specialty Carbohydrates, Carotenoids and Antioxidants and Others), Application (Functional Food, Dietary Supplements, Gummy Supplements, Animal Nutrition, Personal Care and Others) and Source (Plant, Animal and Microbial)- Industry Trends and Forecast to 2033

Middle East and Africa Bioactive Ingredient Market Size

- The Middle East and Africa bioactive ingredient market size was valued at USD 3.55 billion in 2025 and is expected to reach USD 6.01 billion by 2033, at a CAGR of 6.80% during the forecast period

- The market growth is largely fuelled by rising consumer awareness regarding preventive healthcare, functional nutrition, and the role of bioactive compounds in managing lifestyle-related disorders

- Increasing incorporation of bioactive ingredients in functional foods, dietary supplements, nutraceuticals, and personal care formulations is further supporting sustained market expansion

Middle East and Africa Bioactive Ingredient Market Analysis

- The market is witnessing strong momentum due to continuous innovation in extraction, formulation, and delivery technologies that enhance bioavailability, stability, and efficacy of bioactive compounds

- In addition, growing preference for natural, plant-based, and clean-label ingredients, coupled with expanding applications across food, beverage, pharmaceutical, and cosmetic industries, is strengthening overall market attractiveness

- South Africa bioactive ingredient market dominated in 2025, supported by rising awareness of preventive healthcare and improving living standards. Growing middle-class population is driving demand for functional foods and supplements

- U.A.E. is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa bioactive ingredient market due to increasing health consciousness, high disposable incomes, growing demand for premium nutrition and wellness products, and government initiatives supporting the functional food and nutraceutical sectors

- The vitamins segment held the largest market revenue share in 2025 driven by widespread use in functional foods, dietary supplements, and fortified beverages, along with growing consumer focus on immunity, energy, and overall wellness. Vitamins are extensively incorporated due to their established health benefits, ease of formulation, and strong consumer awareness across age groups

Report Scope and Middle East and Africa Bioactive Ingredient Market Segmentation

|

Attributes |

Middle East and Africa Bioactive Ingredient Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Bioactive Ingredient Market Trends

Rising Demand For Preventive Healthcare And Functional Nutrition

- The increasing focus on health maintenance and disease prevention is significantly shaping the bioactive ingredient market, as consumers increasingly seek ingredients that offer physiological benefits beyond basic nutrition. Bioactive ingredients are gaining strong traction due to their proven role in supporting immunity, digestive health, cardiovascular wellness, and cognitive performance. This trend is strengthening their adoption across functional foods, dietary supplements, nutraceuticals, and personal care products, encouraging manufacturers to develop innovative formulations aligned with health-focused consumption patterns

- Growing awareness around lifestyle-related disorders, ageing populations, and long-term wellness has accelerated the demand for bioactive ingredients in functional foods, fortified beverages, supplements, and sports nutrition products. Health-conscious consumers are actively seeking products enriched with antioxidants, probiotics, omega fatty acids, polyphenols, and plant extracts, prompting brands to emphasize scientific validation, clean-label positioning, and functional efficacy in product development

- Preventive health and wellness trends are influencing purchasing decisions, with manufacturers highlighting clinically backed benefits, natural sourcing, and bioavailability enhancement. Transparent labeling, health claims supported by research, and sustainability credentials are helping brands differentiate products and build consumer trust, while also driving investments in R&D and advanced delivery systems

- For instance, in 2024, leading nutrition and wellness brands expanded their portfolios by introducing functional foods and supplements fortified with bioactive compounds such as probiotics, omega-3 fatty acids, and plant-based antioxidants. These launches were driven by rising consumer demand for immunity-boosting, gut-health, and energy-support products, with strong traction across retail, e-commerce, and health-focused distribution channels

- While demand for bioactive ingredients continues to rise, sustained market growth depends on continuous research, regulatory compliance, and ensuring consistent efficacy across formulations. Manufacturers are focusing on improving bioavailability, stability, and scalability while balancing cost, quality, and scientific substantiation to support broader adoption

Middle East and Africa Bioactive Ingredient Market Dynamics

Driver

Growing Focus On Preventive Healthcare And Functional Food Consumption

- Rising consumer emphasis on preventive healthcare is a key driver for the bioactive ingredient market. Consumers are increasingly turning to functional foods, supplements, and nutraceuticals enriched with bioactive compounds to support long-term health, manage chronic conditions, and enhance overall well-being. This shift is encouraging manufacturers to replace conventional ingredients with functional bioactives supported by scientific evidence

- Expanding applications across functional foods, beverages, dietary supplements, pharmaceuticals, and personal care products are contributing to market growth. Bioactive ingredients help enhance nutritional value, functional performance, and health positioning, enabling manufacturers to meet evolving consumer expectations for wellness-oriented products

- Food, supplement, and personal care manufacturers are actively promoting bioactive ingredient-based formulations through product innovation, clinical research, and health-focused marketing campaigns. These efforts are supported by increasing consumer preference for natural, science-backed, and multifunctional ingredients, encouraging partnerships between ingredient suppliers, research institutions, and brands

- For instance, in 2023, major global nutrition and supplement companies reported increased incorporation of probiotics, plant extracts, and omega fatty acids in functional food and supplement formulations. This expansion followed higher consumer demand for immunity, digestive health, and cognitive support solutions, driving product differentiation and repeat purchases

- Although preventive health trends strongly support market growth, long-term success depends on regulatory alignment, consistent ingredient quality, and ongoing investment in research and formulation technologies to meet global demand and maintain competitive positioning

Restraint/Challenge

High Development Costs And Regulatory Complexity

- The relatively high cost associated with developing and commercializing bioactive ingredients remains a key challenge, particularly due to extensive research, clinical validation, and advanced processing requirements. Extraction, purification, and stabilization processes often increase production costs, limiting adoption among price-sensitive manufacturers

- Regulatory complexity and varying approval requirements for health claims and functional ingredients pose additional challenges. Manufacturers must comply with stringent safety, efficacy, and labeling standards, which can delay product launches and increase compliance costs. Limited regulatory clarity around certain novel bioactive compounds further restricts market entry

- Supply chain and formulation challenges also impact market growth, as some bioactive ingredients are sensitive to heat, light, and oxidation. Ensuring stability, bioavailability, and consistent performance across different product formats increases formulation complexity and operational costs

- For instance, manufacturers introducing new bioactive-based functional foods and supplements in 2024 reported delays due to extended approval timelines and the need for additional clinical documentation to support health claims. These factors increased time-to-market and constrained innovation cycles

- Addressing these challenges will require streamlined regulatory frameworks, cost-efficient extraction technologies, and continued investment in scientific research. Collaboration between ingredient producers, regulatory bodies, and product manufacturers will be essential to unlock long-term growth opportunities and ensure sustainable expansion of the global bioactive ingredient market

Middle East and Africa Bioactive Ingredient Market Scope

The market is segmented on the basis of ingredient type, application, and source.

- By Ingredient Type

On the basis of ingredient type, the Middle East and Africa bioactive ingredient market is segmented into Prebiotics, Probiotics, Amino Acid, Peptides, Omega 3 And Structured Lipids, Phytochemicals & Plant Extracts, Minerals, Vitamins, Fibers and Specialty Carbohydrates, Carotenoids and Antioxidants, and Others. The vitamins segment held the largest market revenue share in 2025 driven by widespread use in functional foods, dietary supplements, and fortified beverages, along with growing consumer focus on immunity, energy, and overall wellness. Vitamins are extensively incorporated due to their established health benefits, ease of formulation, and strong consumer awareness across age groups.

The probiotics segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing awareness of gut health, digestive wellness, and immune support. Rising consumption of fermented foods, functional beverages, and probiotic supplements is supporting rapid adoption, with manufacturers investing in strain innovation and improved stability for broader application.

- By Application

On the basis of application, the Middle East and Africa bioactive ingredient market is segmented into Functional Food, Dietary Supplements, Gummy Supplements, Animal Nutrition, Personal Care, and Other. The dietary supplements segment accounted for the largest market share in 2025 supported by growing health consciousness, preventive healthcare trends, and rising demand for convenient nutrition formats. Bioactive ingredients are widely used in capsules, tablets, and powders to address immunity, energy, and lifestyle-related health concerns.

The functional food segment is expected to register the highest growth rate from 2026 to 2033, driven by increasing consumption of fortified foods and beverages that offer added health benefits. Manufacturers are focusing on incorporating bioactive ingredients into everyday food products to align with evolving consumer preferences for nutrition-rich and wellness-oriented diets.

- By Source

On the basis of source, the Middle East and Africa bioactive ingredient market is segmented into Plant, Animal, and Microbial. The plant-based segment dominated the market in 2025 driven by strong consumer preference for natural, clean-label, and sustainably sourced ingredients. Plant-derived bioactives such as polyphenols, fibers, and plant extracts are widely used across food, supplement, and personal care applications due to their perceived safety and functional benefits.

The microbial segment is expected to register the highest growth rate from 2026 to 2033, supported by increasing use of probiotics, enzymes, and fermentation-derived ingredients. Advances in biotechnology and fermentation processes are enabling scalable production and consistent quality, making microbial sources increasingly attractive for bioactive ingredient manufacturers.

Middle East and Africa Bioactive Ingredient Market Regional Analysis

- South Africa bioactive ingredient market dominated in 2025, supported by rising awareness of preventive healthcare and improving living standards. Growing middle-class population is driving demand for functional foods and supplements

- Urbanization and changing dietary patterns are influencing consumption of bioactive ingredients

- Expansion of modern retail and pharmacy networks is enhancing market reach. Increasing interest in immunity and wellness products is sustaining demand

U.A.E. Bioactive Ingredient Market Insight

The U.A.E. bioactive ingredient market is expected to witness the fastest growth rate from 2026 to 2033, driven by high disposable incomes and strong health awareness. Consumers are increasingly adopting premium nutrition and wellness products. Demand for functional foods, supplements, and fortified beverages is rising. Government focus on health and wellness initiatives supports market development. Growing investment in nutraceutical innovation is accelerating adoption

Middle East and Africa Bioactive Ingredient Market Share

The Middle East and Africa bioactive ingredient industry is primarily led by well-established companies, including:

• Saudi Basic Industries Corporation (Saudi Arabia)

• Savola Group (Saudi Arabia)

• Almarai Company (Saudi Arabia)

• National Food Products Company (U.A.E.)

• IFFCO Group (U.A.E.)

• Al Ain Farms (U.A.E.)

• Aspen Pharmacare Holdings Limited (South Africa)

• Adcock Ingram Holdings Limited (South Africa)

• RCL Foods Limited (South Africa)

• Tiger Brands Limited (South Africa)

• Clover Industries Limited (South Africa)

• Zamil Industrial Investment Co. (Saudi Arabia)

• Julphar Gulf Pharmaceutical Industries (U.A.E.)

• Nutrivita Food Industries (Egypt)

• Pharco Pharmaceuticals (Egypt)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.