Marché des circuits intégrés spécifiques à l'application (ASIC) au Moyen-Orient et en Afrique, par type de conception (entièrement personnalisé, semi-personnalisé et programmable), par technologie de programmation (RAM statique, EPROM, EEPROM, antifusible et autres), par application ( électronique grand public , centre de données et informatique, informatique et télécommunications, médical, multimédia, automobile et industriel), par pays (Arabie saoudite, Émirats arabes unis, Israël, Afrique du Sud, Égypte et reste du Moyen-Orient et de l'Afrique), tendances du marché et prévisions jusqu'en 2029.

Analyse et perspectives du marché : Marché des circuits intégrés à application spécifique (ASIC) au Moyen-Orient et en Afrique

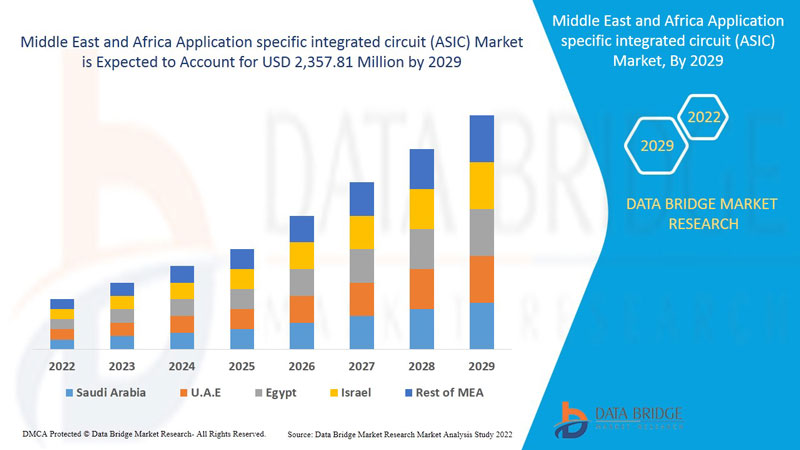

Le marché des circuits intégrés spécifiques aux applications (ASIC) du Moyen-Orient et de l'Afrique devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,9 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 2 357,81 millions USD d'ici 2029.

Un circuit intégré spécifique à une application (ASIC) est une puce CI qui est adaptée à une application spécifique plutôt que conçue pour une utilisation générale. Un ASIC est, par exemple, une puce qui fonctionne dans un enregistreur vocal numérique ou un encodeur vidéo à haute efficacité (tel que AMD VCE). Les puces ASSP (Application-specific standard product) sont un compromis entre les ASIC et les circuits intégrés standard de l'industrie tels que les séries 7400 ou 4000. En tant que puces de circuit intégré MOS, les puces ASIC sont généralement produites à l'aide de la technologie métal-oxyde-semiconducteur (MOS) qui comprend le FPGA. La plus grande complexité (et donc l'utilité) disponible dans un ASIC est passée de 5 000 portes logiques à plus de 100 millions à mesure que la taille des fonctionnalités a diminué et que les outils de conception se sont améliorés au fil du temps. Les microprocesseurs, les blocs de mémoire tels que la ROM, la RAM, l'EEPROM, la mémoire flash et d'autres blocs de construction importants sont fréquemment inclus dans les ASIC modernes. Un SoC est un surnom courant pour un tel ASIC (système sur puce). Un langage de description du matériel (HDL), tel que Verilog ou VHDL, est fréquemment utilisé par les concepteurs d'ASIC numériques pour définir le fonctionnement des ASIC.

Certains des facteurs qui stimulent le marché sont l'émergence des appareils IoT pilotés par ASIC et l'adoption croissante de la mécatronique pour les applications automobiles. Mais le coût élevé associé à la fabrication de circuits personnalisés peut être un facteur restrictif. De plus, le marché européen des circuits intégrés spécifiques à une application (ASIC) est également en pleine expansion en raison de l'utilisation croissante des technologies ASIC pour alimenter l'IA.

Ce rapport sur le marché des circuits intégrés spécifiques aux applications (ASIC) fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des circuits intégrés spécifiques aux applications (ASIC) au Moyen-Orient et en Afrique

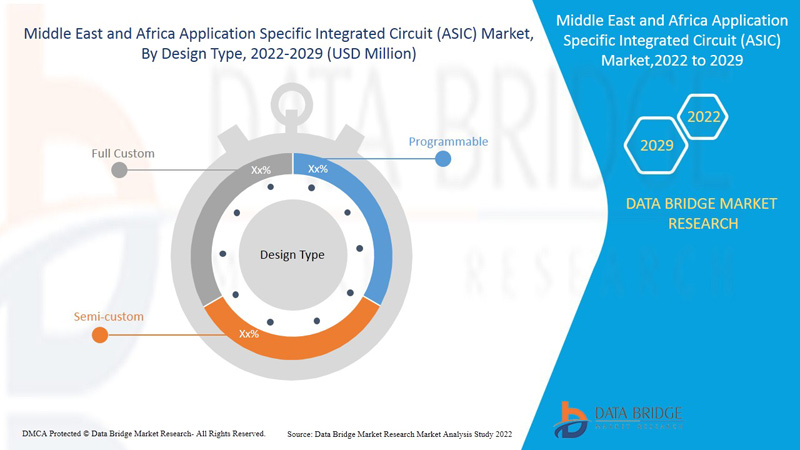

Le marché des circuits intégrés spécifiques aux applications (ASIC) du Moyen-Orient et de l'Afrique est segmenté en fonction du type de conception, de la technologie de programmation et de l'application. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base du type de conception, le marché des circuits intégrés spécifiques aux applications (ASIC) du Moyen-Orient et de l'Afrique a été segmenté en circuits entièrement personnalisés, semi-personnalisés et programmables. En 2022, le segment semi-personnalisé devrait dominer le marché des circuits intégrés spécifiques aux applications (ASIC) du Moyen-Orient et de l'Afrique, car la demande croissante de centres de données avancés afin de répondre à la demande croissante de données et de contenu par le consommateur augmente les exigences des technologies ASIC semi-personnalisées qui peuvent être utilisées pour diverses applications telles que l'automobile, la fabrication, la médecine, le multimédia et autres.

- Sur la base du segment de la technologie de programmation, le marché des circuits intégrés spécifiques aux applications (ASIC) du Moyen-Orient et de l'Afrique a été segmenté en RAM statique, EPROM, EEPROM, antifusible et autres. En 2022, le segment de la RAM statique devrait dominer le marché des circuits intégrés spécifiques aux applications (ASIC) du Moyen-Orient et de l'Afrique en raison de la hausse de la demande d'appareils électroniques portables intelligents et de la demande croissante d'appareils de santé axés sur les données, ce qui a augmenté la demande de technologies ASIC de RAM statique, car ces technologies jouent un rôle essentiel dans l'amélioration des capacités de traitement de ces appareils électroniques, ce qui peut stimuler la croissance du marché.

- Sur la base du segment d'application, le marché des circuits intégrés spécifiques aux applications (ASIC) du Moyen-Orient et de l'Afrique a été segmenté en électronique grand public, centre de données et informatique, informatique et télécommunications, médical, multimédia, automobile et industriel. En 2022, l'électronique grand public devrait dominer le marché des circuits intégrés spécifiques aux applications (ASIC) du Moyen-Orient et de l'Afrique en raison de la croissance du contenu en streaming et en diffusion grand public et de la disponibilité d'infrastructures à haut débit pour répondre à ces demandes, ce qui stimule les produits électroniques grand public intelligents. Les technologies ASIC permettent de fournir une transmission de contenu de données à haut débit à l'aide de circuits intégrés hautes performances.

Analyse du marché des circuits intégrés spécifiques aux applications (ASIC) au Moyen-Orient et en Afrique

Le marché des circuits intégrés spécifiques à l’application (ASIC) du Moyen-Orient et de l’Afrique est analysé et des informations sur la taille du marché sont fournies par type de conception, technologie de programmation et application.

Les pays couverts par le rapport sur le marché des circuits intégrés spécifiques aux applications (ASIC) au Moyen-Orient et en Afrique sont l'Afrique du Sud, l'Égypte, les Émirats arabes unis, l'Arabie saoudite, Israël et le reste du Moyen-Orient et de l'Afrique.

Israël domine le marché des circuits intégrés à application spécifique (ASIC) en raison de divers facteurs tels que l’émergence d’appareils IoT pilotés par ASIC parmi les consommateurs et la montée en puissance de l’adoption de la mécatronique pour les applications automobiles.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Demande croissante de circuits intégrés à application spécifique (ASIC).

Le marché des circuits intégrés spécifiques aux applications (ASIC) vous fournit également une analyse détaillée du marché pour chaque pays, la croissance de l'industrie avec les ventes, les ventes de composants, l'impact du développement technologique des circuits intégrés spécifiques aux applications (ASIC) et les changements dans les scénarios réglementaires avec leur soutien au marché des circuits intégrés spécifiques aux applications (ASIC). Les données sont disponibles pour la période historique de 2012 à 2020.

Analyse du paysage concurrentiel et des parts de marché des circuits intégrés à application spécifique (ASIC)

Le paysage concurrentiel du marché des circuits intégrés spécifiques aux applications (ASIC) fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des circuits intégrés spécifiques aux applications (ASIC) au Moyen-Orient et en Afrique.

Les principaux acteurs couverts par le rapport sont Intel Corporation, Infineon Technologies AG, NXP Semiconductors, Qualcomm Technologies, Microchip Technology Inc., Analog Devices et d'autres. Les analystes de DBMR comprennent les atouts concurrentiels et fournissent une analyse concurrentielle pour chaque concurrent séparément. De nombreux développements de produits sont également initiés par les entreprises du monde entier qui accélèrent également la croissance du marché des circuits intégrés à application spécifique (ASIC).

Par exemple,

- En novembre 2021, Qualcomm Technologies, Inc. a lancé la plateforme de cockpit automobile Snapdragon pour le véhicule PEUGEOT 308. La principale caractéristique de ce lancement de produit était de fournir une technologie numérique et automobile pour offrir une expérience haut de gamme aux conducteurs et aux passagers. Ce processeur est spécialement conçu pour ce véhicule. Cela a aidé l'entreprise à accroître sa réputation dans l'automobile.

Les partenariats, les contrats, les coentreprises et d'autres stratégies permettent d'accroître la part de marché de l'entreprise grâce à une couverture et une présence accrues. Cela permet également aux organisations d'améliorer leur offre pour le marché des circuits intégrés à application spécifique (ASIC) grâce à une gamme de tailles élargie.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 DESIGN TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SMARTPHONES AND TABLETS

5.1.2 INCREASE IN DEMAND FROM SMART CONSUMER DEVICES

5.1.3 EMERGENCE OF ASIC DRIVEN IOT DEVICES

5.1.4 RISE IN DEMAND FOR MINIATURIZED ELECTRONICS DEVICE

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH MANUFACTURING CUSTOMIZED CIRCUITS

5.2.2 ASICS VULNERABILITY TOWARDS SECURITY ATTACKS/CYBER ATTACKS

5.3 OPPORTUNITIES

5.3.1 UTILIZING ASIC TECHNOLOGIES FOR POWERING AI

5.3.2 UPSURGE IN ADOPTION OF MECHATRONICS FOR AUTOMOTIVE APPLICATIONS

5.3.3 RISE IN DEPLOYMENT OF DATA CENTERS AND HIGH-PERFORMANCE COMPUTING

5.3.4 GROW IN PARTNERSHIP, ACQUISITIONS, AND MERGERS FOR ASIC

5.4 CHALLENGES

5.4.1 FUNCTIONAL RELIABILITY ISSUES FACED IN ASIA

5.4.2 COMPLEXITY INVOLVED IN DESIGNING AND FABRICATION OF APPLICATION SPECIFIC CIRCUITS

6 IMPACT OF COVID-19 PANDEMIC ON MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON PRICE

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE

7.1 OVERVIEW

7.2 SEMI-CUSTOM

7.2.1 STANDARD –CELL-BASED ASICS

7.2.2 GATE-ARRAY-BASED ASICS

7.2.2.1 CHANNEL LESS GATE ARRAYS

7.2.2.2 STRUCTURED GATE ARRAYS

7.2.2.3 CHANNELLED GATE ARRAYS

7.3 PROGRAMMABLE

7.3.1 FPGAS (FIELD PROGRAMMABLE GATE ARRAY)

7.3.1.1 BY TYPE

7.3.1.1.1 HIGH-END FPGAS

7.3.1.1.2 LOW-END FPGAS

7.3.1.1.3 MID-RANGE FPGAS

7.3.1.2 BY NODE SIZE

7.3.1.2.1 LESS THAN 28 NM

7.3.1.2.2 28-90 NM

7.3.1.2.3 MORE THAN 90 NM

7.3.1.3 BY APPLICATION

7.3.1.3.1 FILTERING AND COMMUNICATION

7.3.1.3.2 MEDICAL IMAGING

7.3.1.3.3 COMPUTER HARDWARE EMULATION

7.3.1.3.4 SOFTWARE-DEFINED RADIO

7.3.1.3.5 BIOINFORMATICS

7.3.1.3.6 DIGITAL SIGNAL PROCESSING

7.3.1.3.7 VOICE RECOGNITION

7.3.1.3.8 CRYPTOGRAPHY

7.3.1.3.9 INTEGRATING MULTIPLE SPLDS

7.3.1.3.10 ASIC PROTOTYPING

7.3.1.3.11 DEVICE CONTROLLERS

7.3.2 PLDS (PROGRAMMABLE LOGIC DEVICES)

7.3.2.1 BY TYPE

7.3.2.1.1 SIMPLE PROGRAMMABLE LOGIC DEVICE (SPLDS)

7.3.2.1.2 HIGH CAPACITY PROGRAMMABLE LOGIC DEVICE (HCPLDS)

7.4 FULL CUSTOM

8 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY

8.1 OVERVIEW

8.2 STATIC RAM

8.3 ANTIFUSE

8.4 EEPROM

8.5 EPROM

8.6 OTHERS

9 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CONSUMER ELECTRONICS

9.2.1 SMARTPHONES AND TABLETS

9.2.2 WIRELESS VIRTUAL REALITY DEVICES

9.2.3 OTHERS

9.3 IT & TELECOMMUNICATION

9.3.1 WIRELESS COMMUNICATION

9.3.2 WIRED COMMUNICATION

9.4 DATA CENTER & COMPUTING

9.5 MEDICAL

9.5.1 IMAGING DIAGNOSTICS

9.5.2 WEARABLE DEVICES

9.5.3 OTHERS

9.6 INDUSTRIAL

9.6.1 BY SECTOR

9.6.1.1 MILITARY, AEROSPACE & DEFENSE

9.6.1.2 SATELLITE & SPACE

9.6.1.3 AVIATION

9.6.1.4 POWER GENERATION

9.6.1.5 OIL & GAS

9.6.2 BY APPLICATION

9.6.2.1 MACHINE VISION

9.6.2.2 ROBOTICS

9.6.2.3 INDUSTRIAL SENSOR

9.6.2.4 INDUSTRIAL NETWORKING

9.6.2.5 INDUSTRIAL MOTOR CONTROL

9.6.2.6 VIDEO SURVEILLANCE

9.7 AUTOMOTIVE

9.7.1 ADAS

9.7.2 AUTOMOTIVE INFOTAINMENT & DRIVER INFORMATION SYSTEM

9.8 MULTIMEDIA

9.8.1 COMMUNICATIONS

9.8.2 VIDEO PROCESSING

9.8.3 AUDIO

10 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION

10.1 MIDDLE EAST & AFRICA

10.1.1 ISRAEL

10.1.2 U.A.E.

10.1.3 SAUDI ARABIA

10.1.4 SOUTH AFRICA

10.1.5 EGYPT

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 INTEL CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCTS PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 INFINEON TECHNOLOGIES AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCTS PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 ANALOG DEVICES, INC.

13.3.1 COMPANY SNAPHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 NXP SEMICONDUCTORS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCTS PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 MICROCHIP TECHNOLOGY INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 TEXAS INSTRUMENTS INCORPORATED

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ACHRONIX SEMICONDUCTOR CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCTS PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AVNET ASIC ISRAEL LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 COBHAM LIMITED

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 ENSILICA

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCTS PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 GOWIN SEMICONDUCTOR

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCTS PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 HONEYWELL INTERNATIONAL INC.

13.12.1 COMPANY SNAPHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 LATTICE SEMICONDUCTOR

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 MAXIM INTEGRATED

13.14.1 COMPANY SNAPHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 MEGACHIPS CORPORATION

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCTS PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 QUALCOMM TECHNOLOGIES, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCTS PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 QUICKLOGIC CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 RENESAS ELECTRONICS CORPORATION

13.18.1 COMPANY SNAPHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCTS PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 SOCIONEXT INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 XILINX

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 PRODUCTS PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA FULL CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA STATIC RAM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ANTIFUSE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA EEPROM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA EPROM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DATA CENTER & COMPUTING IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 202O-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 ISRAEL GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 ISRAEL PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 57 ISRAEL FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ISRAEL PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 ISRAEL INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 65 ISRAEL INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 ISRAEL AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYP APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 ISRAEL MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.A.E. GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.A.E. PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 U.A.E. APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 U.A.E. CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 U.A.E. IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 U.A.E. MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 U.A.E. INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 82 U.A.E. INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 U.A.E. AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.A.E. MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 94 SAUDI ARABIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 SAUDI ARABIA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SAUDI ARABIA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 99 SAUDI ARABIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH AFRICA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH AFRICA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH AFRICA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 SOUTH AFRICA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 111 SOUTH AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 SOUTH AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AFRICA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 SOUTH AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 120 EGYPT SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 EGYPT GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 EGYPT PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 125 EGYPT FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 EGYPT PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 128 EGYPT APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 EGYPT CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 EGYPT IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 EGYPT MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 EGYPT INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 133 EGYPT INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 EGYPT AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 EGYPT MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST AND AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DBMRMARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET:MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR SMARTPHONES AND TABLETS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SEMI-CUSTOM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

FIGURE 15 TOP 10 COUNTRIES WITH SMARTPHONES (IN MILLIONS)

FIGURE 16 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY PROGRAMMING TECHNOLOGY, 2021

FIGURE 18 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.