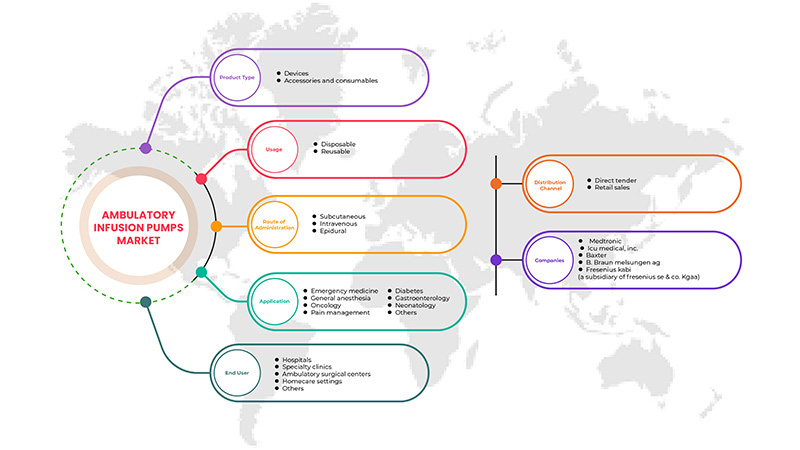

Marché des pompes à perfusion ambulatoires au Moyen-Orient et en Afrique, par type de produit (dispositifs, accessoires et consommables), utilisation (jetable et réutilisable), voie d'administration (sous-cutanée, intraveineuse et péridurale), application (médecine d'urgence, anesthésie générale, gestion de la douleur, oncologie, diabète, gastroentérologie, néonatologie, autres), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire , établissements de soins à domicile et autres), canal de distribution (appel d'offres direct et vente au détail) Tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché des pompes à perfusion ambulatoires au Moyen-Orient et en Afrique

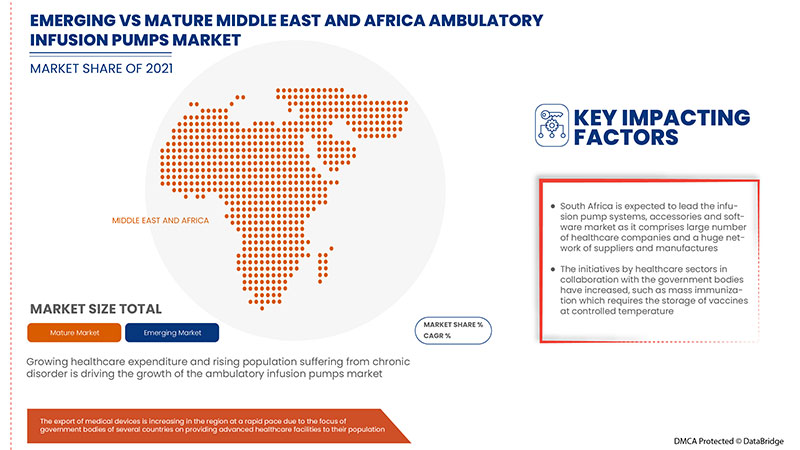

Les principaux facteurs à l’origine de la croissance de ce marché sont l’augmentation de la population gériatrique, la prévalence croissante de maladies chroniques telles que le cancer et le diabète, et les résultats positifs pour les patients dans un environnement domestique moins coûteux. Les développements technologiques continus et les nouvelles applications des pompes ambulatoires à domicile entraînent une augmentation de leur utilisation. Récemment, les pompes ambulatoires ont été utilisées pour administrer divers médicaments afin de traiter diverses maladies et affections, du diabète à la douleur chronique. Ce mode d’administration implique généralement l’utilisation d’une aiguille ou d’un cathéter sous la peau pour administrer des médicaments, des produits sanguins, des nutriments ou des solutions hydratantes par voie intraveineuse, sous-cutanée, péridurale/intrathécale, percutanée, intraplaie, intrahépatique ou d’autres voies parentérales.

Les principaux facteurs susceptibles d’entraver la croissance du marché sont le coût élevé associé aux systèmes de pompes à perfusion ambulatoires.

Le rapport sur le marché des pompes à perfusion ambulatoires fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

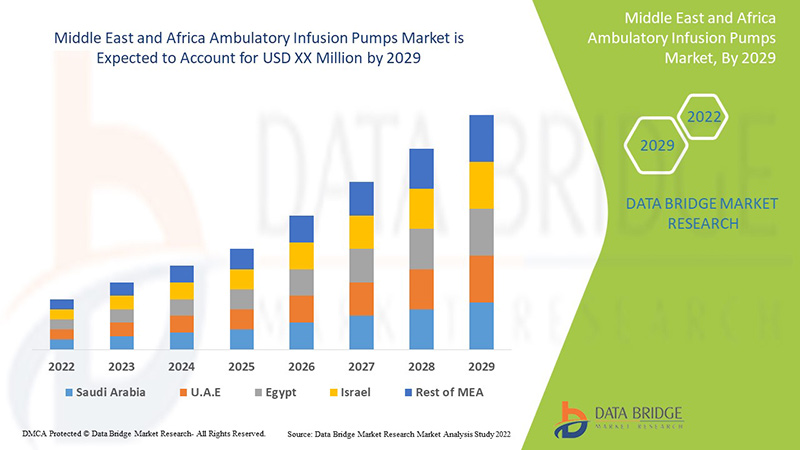

Data Bridge Market Research analyse que le marché des pompes à perfusion ambulatoires croîtra à un TCAC de 6,0 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de produit (dispositifs, accessoires et consommables), utilisation (jetable et réutilisable), voie d'administration (sous-cutanée, intraveineuse et péridurale), application (médecine d'urgence, anesthésie générale, gestion de la douleur, oncologie, diabète, gastroentérologie, néonatologie, autres), utilisateur final (hôpitaux, cliniques spécialisées, centres de chirurgie ambulatoire, établissements de soins à domicile et autres), canal de distribution (appel d'offres direct et vente au détail) |

|

Pays couverts |

Arabie saoudite, Afrique du Sud, Émirats arabes unis, Israël, Égypte, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

B. Braun Melsungen AG, Baxter, Moog, Inc., WalkMed, KORU Medical Systems, Intra Pump Infusion Systems., AVNS., ICU Medical, Inc., Eitan Medical, Fresenius Kabi (une filiale de Fresenius SE & Co. KGaA), Medtronic, Micrel Medical Devices, Ace-medical, entre autres. |

Définition du marché

Dispositif médical qui administre des liquides, tels que des nutriments et des médicaments, dans le corps d'un patient en quantités contrôlées. Les pompes à perfusion sont largement utilisées dans les milieux cliniques tels que les hôpitaux, les maisons de retraite et à domicile. Une pompe à perfusion est actionnée par un utilisateur formé, qui programme le débit et la durée de l'administration de liquide via une interface logicielle intégrée. Les pompes à perfusion offrent des avantages significatifs par rapport à l'administration manuelle de liquides, notamment la possibilité d'administrer des liquides en très petits volumes et la possibilité d'administrer des liquides à des débits programmés avec précision ou à des intervalles automatisés. Elles peuvent administrer des nutriments ou des médicaments, tels que l'insuline ou d'autres hormones, des antibiotiques, des médicaments de chimiothérapie et des analgésiques.

Les systèmes de pompe à perfusion sont un traitement actif visant à contrôler la médication en petites quantités dans différents contextes tels que les hôpitaux, les cliniques et même à domicile. Il est utilisé pour administrer une quantité contrôlée de médicaments très lentement dans la circulation sanguine sur une période donnée. Il peut être utilisé dans des environnements stationnaires et mobiles pour administrer des analgésiques, des antibiotiques, des médicaments de chimiothérapie et des liquides hydratants.

Dynamique du marché des pompes à perfusion ambulatoires

Conducteurs

- Augmentation de la population gériatrique

L'âge augmente avec l'augmentation du nombre de patients âgés admis dans les hôpitaux en raison de la prévalence croissante des maladies chroniques. L'âge est un facteur de risque important pour toute progression de la maladie, car l'âge est un paramètre essentiel qui affecte les mécanismes biologiques fondamentaux. Les maladies chroniques telles que le cancer surviennent énormément dans la population gériatrique, avec près de 60 % des cancers survenant dans la tranche d'âge de la population gériatrique de plus de 65 ans. Le cancer est un véritable défi dans la population gériatrique, car en raison des facteurs liés à l'âge, la population gériatrique souffre déjà de nombreux problèmes de santé. Cela indique la demande croissante de pompes à perfusion de la part de la population gériatrique.

Avec la capacité d'administrer des liquides en très petite quantité dans un environnement contrôlé directement dans la circulation sanguine, la demande de systèmes de pompes à perfusion augmente dans le système de santé mondial. Le besoin croissant de traitements appropriés augmente proportionnellement la demande de soins, de services et de technologies pour prévenir et traiter des maladies, notamment les maladies cardiovasculaires, les accidents vasculaires cérébraux, le cancer, les maladies respiratoires chroniques et d'autres complications. Avec l'âge croissant et la prévalence croissante des maladies chroniques, la demande de diagnostic précoce des maladies augmente également. La demande de soins, de services et de technologies augmente pour traiter les maladies chroniques chez les personnes âgées. Ainsi, l'augmentation de la population gériatrique devrait stimuler la croissance du marché des pompes à perfusion ambulatoires.

- Progrès technologiques croissants dans le système de pompes à perfusion

Les progrès technologiques dans le domaine des soins de santé et des services cliniques sont désormais accessibles. Les avancées technologiques dans le domaine des pompes à perfusion permettent de prévenir les erreurs de médication et de réduire les préjudices causés aux patients. Ces avancées se traduisent par une amélioration des résultats cliniques grâce à une technologie de surveillance des patients qui permet d'informer et de guider les décisions de traitement des cliniciens.

La technologie se diversifie et joue un rôle dans presque tous les processus du secteur de la santé, comme la possibilité d'erreurs de médication en raison d'une augmentation de la charge de morbidité, l'enregistrement des patients pour la gestion des données et les tests de laboratoire pour les équipements d'auto-soins, ce qui en fait le prochain facteur de stimulation pour les systèmes de pompes à perfusion, les accessoires et le marché des logiciels. L'innovation et les progrès technologiques ont mis à niveau les systèmes de pompes à perfusion dans tous les domaines, y compris des fonctionnalités avancées telles qu'une précision, une mobilité, une flexibilité et un choix différents de canaux automatiques fluides. Les progrès technologiques apportent de nombreux avantages pour l'efficacité des procédures conduisant à une sécurité accrue des patients. Par conséquent, les avancées technologiques croissantes dans les systèmes de pompes à perfusion devraient stimuler le marché des pompes à perfusion ambulatoires.

Opportunités

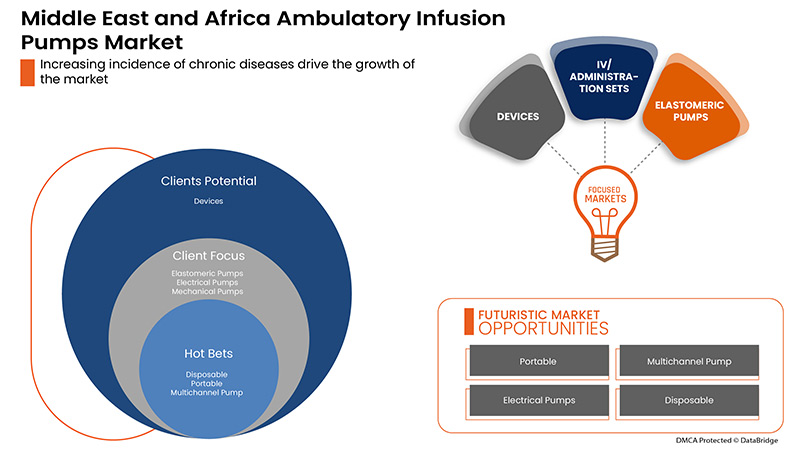

- Augmentation de l'incidence des maladies chroniques

La prévalence élevée des maladies chroniques due à la croissance rapide de la population et des infections est observée à l'échelle mondiale. Les facteurs de risque individuels, les facteurs environnementaux, le manque d'activité physique et les modes de vie humains sont les principaux facteurs qui contribuent à l'augmentation de l'incidence des maladies. L'évaluation des troubles entraînera en outre une forte demande d'études cliniques par différentes voies d'administration de médicaments dans le corps humain. L'augmentation de l'incidence de maladies telles que les maladies cardiovasculaires et le cancer a entraîné une augmentation de la demande de dispositifs de pompe à perfusion intraveineuse.

Contraintes/Défis

- Effets secondaires associés au système de pompes à perfusion

L'utilisation croissante des pompes à perfusion avec les progrès technologiques est devenue une pratique courante dans les hôpitaux pour administrer des liquides critiques aux patients. Cependant, il existe encore peu d'études de recherche visant à réduire les erreurs et à améliorer l'utilisation des pompes à perfusion qui entraînent des événements indésirables dans le système. Les divers problèmes qui y sont associés peuvent être des erreurs logicielles ou des erreurs humaines.

Les effets secondaires associés aux systèmes de pompe à perfusion comprennent des problèmes logiciels, une conception d'interface utilisateur inadéquate, des composants cassés, des erreurs d'alarme, des pannes de batterie et une carbonisation ou des chocs.

- Coût élevé lié au système de pompes à perfusion

Les patients atteints de maladies chroniques telles que le syndrome de détresse respiratoire aiguë doivent être hospitalisés pendant de longues périodes, avec une monétarisation et un recours régulier à la ventilation, ce qui nécessite une quantité importante de ressources de santé, ce qui fait que la plupart des patients qui ne peuvent pas se permettre un séjour à long terme et sortent de l'hôpital dès les premières étapes du traitement. Mais cela augmente les possibilités et les susceptibilités à de nouvelles complications en cas d'infections, ce qui exige des ressources de santé et des traitements supplémentaires.

Le coût élevé du traitement est dû aux différents points de contrôle du traitement ainsi qu'à l'utilisation de modalités de haute technologie pour effectuer ces procédures de traitement. Les soins hospitaliers augmentent encore le coût des interventions de pompe à perfusion. Le coût des pompes à perfusion innovantes et avancées étant élevé, le coût du traitement augmente proportionnellement, ce qui fait que le coût élevé associé à l'utilisation des systèmes de pompes à perfusion devrait restreindre le marché des pompes à perfusion ambulatoires.

Développements récents

- En mars 2022, Fresenius Kabi a annoncé l'acquisition d'Ivenix, Inc., une société de technologie médicale spécialisée dans les systèmes de perfusion de technologies avancées. Cela contribue à accélérer la croissance stratégique dans les domaines biopharmaceutiques et Medtech, ce qui se traduit par l'expansion du marché vaste et en pleine croissance de la thérapie par perfusion.

- En février 2022, le système de perfusion Plum 360 d'ICU Medical, Inc. a de nouveau reçu la distinction Best in KLAS en tant que pompe intelligente la plus performante intégrée au DME. Cette désignation Best in KLAS est basée sur les commentaires de milliers de prestataires de soins de santé aux États-Unis et au Canada et résulte de comparaisons côte à côte approfondies des performances des pompes intelligentes IV dans plusieurs catégories, notamment la culture, la fidélité, les opérations, le produit, la relation et la valeur.

Segmentation du marché des pompes à perfusion ambulatoires

Le marché des pompes à perfusion ambulatoires est classé en six segments notables qui sont basés sur le type de produit, l'utilisation, la voie d'administration, l'application, l'utilisateur final et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type de produit

- Appareils

- Accessoires et consommables

Sur la base du type de produit, le marché des pompes à perfusion ambulatoires est segmenté en appareils, accessoires et consommables.

Usage

- Jetable

- Réutilisable

Sur la base de l’utilisation, le marché des pompes à perfusion ambulatoires est segmenté en jetables et réutilisables.

Voie d'administration

- Intraveineux

- Sous-cutané

- Épidurale

Sur la base de la voie d’administration, le marché des pompes à perfusion ambulatoires est segmenté en intraveineuse, sous-cutanée et péridurale.

Application

- Gestion de la douleur

- Diabète

- Oncologie

- Néonatologie

- Gastroentérologie

- Anesthésie générale

- Médecine d'urgence

- Autres

Sur la base de l'application, le marché des pompes à perfusion ambulatoires est segmenté en gestion de la douleur, diabète, oncologie, néonatalogie, gastro-entérologie, anesthésie générale, médecine d'urgence et autres.

Utilisateur final

- Hôpitaux

- Cliniques spécialisées

- Centres de chirurgie ambulatoire

- Cadres de soins à domicile

- autres

Sur la base de l’utilisateur final, le marché des pompes à perfusion ambulatoires est segmenté en hôpitaux, milieux de soins à domicile, centres de chirurgie ambulatoire, cliniques spécialisées et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

Sur la base des canaux de distribution, le marché des pompes à perfusion ambulatoires est segmenté en appels d’offres directs et ventes au détail.

Analyse/perspectives régionales sur les pompes à perfusion ambulatoires

Les pompes à perfusion ambulatoires sont analysées et des informations sur la taille du marché et les tendances sont fournies par type de produit, utilisation, voie d'administration, application, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts par le rapport sur les pompes à perfusion ambulatoires sont l’Arabie saoudite, l’Afrique du Sud, les Émirats arabes unis, Israël, l’Égypte, le reste du Moyen-Orient et l’Afrique.

L’Afrique du Sud devrait dominer le marché en raison de la présence de grands acteurs du marché et d’un système de santé établi pour les pompes à perfusion.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des pompes à perfusion ambulatoires

Le paysage concurrentiel des pompes à perfusion ambulatoires fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des pompes à perfusion ambulatoires.

Certains des principaux acteurs opérant sur ce marché sont B. Braun Melsungen AG, Baxter, Moog, Inc., WalkMed, KORU Medical Systems, Intra Pump Infusion Systems., AVNS., ICU Medical, Inc., Eitan Medical, Fresenius Kabi (une filiale de Fresenius SE & Co. KGaA), Medtronic, Micrel Medical Devices, Ace-medical, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement de l'entreprise, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse MEA vs régionale et la part des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES

5 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: REGULATORY SCENARIO

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN THE GERIATRIC POPULATION

6.1.2 GROWING TECHNOLOGICAL ADVANCEMENTS IN INFUSION PUMPS SYSTEM

6.1.3 RISING DEMAND FOR AMBULATORY PUMPS IN HOME CARE SETTINGS

6.1.4 INCREASE IN THE NUMBER OF SURGERIES

6.2 RESTRAINS

6.2.1 HIGH COST LINKED WITH INFUSION PUMPS SYSTEM

6.2.2 SIDE-EFFECTS ASSOCIATED WITH INFUSION PUMPS SYSTEM

6.3 OPPORTUNITIES

6.3.1 INCREASING INCIDENCE OF CHRONIC DISEASES

6.3.2 RISING ARTIFICIAL INTELLIGENCE TO AUTOMATE DRUG INFUSIONS

6.3.3 RISING HEALTHCARE EXPENDITURE

6.3.4 INCREASED REIMBURSEMENT POLICIES

6.4 CHALLENGE

6.4.1 LACK OF SKILLED HEALTHCARE PROFESSIONALS

6.4.2 STRINGENT GOVERNMENT REGULATION

7 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 DEVICES

7.2.1 BY PRODUCT

7.2.1.1 ELASTOMERIC PUMPS

7.2.1.1.1 MULTICHANNEL PUMP

7.2.1.1.2 SINGLE CHANNEL PUMP

7.2.1.2 ELECTRICAL PUMPS

7.2.1.2.1 MULTICHANNEL PUMP

7.2.1.2.2 SINGLE CHANNEL PUMP

7.2.1.3 MECHANICAL PUMPS

7.2.1.3.1 MULTICHANNEL PUMP

7.2.1.3.2 SINGLE CHANNEL PUMP

7.2.1.4 OTHER PUMPS

7.2.2 BY MODALITY

7.2.2.1 PORTABLE

7.2.2.2 WEARABLE

7.3 ACCESSORIES AND CONSUMABLES

7.3.1 IV/ADMINISTRATION SETS

7.3.2 TUBING & EXTENSION

7.3.3 INFUSION CATHETERS

7.3.4 INSULIN RESERVOIR OR CARTRIDGES

7.3.5 CANNULAS

7.3.6 NEEDLELESS CONNECTORS

7.3.7 BATTERY

7.3.8 OTHERS

8 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY USAGE

8.1 OVERVIEW

8.1.1 DISPOSABLE

8.1.2 DEVICES

8.1.3 ACCESSORIES AND CONSUMABLES

8.2 REUSABLE

8.2.1 DEVICES

8.2.2 ACCESSORIES AND CONSUMABLES

9 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION

9.1 OVERVIEW

9.2 INTRAVENOUS

9.3 SUBCUTANEOUS

9.4 EPIDURAL

10 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 PAIN MANAGEMENT

10.2.1 DEVICES

10.2.2 ACCESSORIES AND CONSUMABLES

10.3 DIABETES

10.3.1 DEVICES

10.3.2 ACCESSORIES AND CONSUMABLES

10.4 ONCOLOGY

10.4.1 DEVICES

10.4.2 ACCESSORIES AND CONSUMABLES

10.5 NEONATOLOGY

10.5.1 DEVICES

10.5.2 ACCESSORIES AND CONSUMABLES

10.6 GASTROENTEROLOGY

10.6.1 DEVICES

10.6.2 ACCESSORIES AND CONSUMABLES

10.7 GENERAL ANESTHESIA

10.7.1 DEVICES

10.7.2 ACCESSORIES AND CONSUMABLES

10.8 EMERGENCY MEDICINE

10.8.1 DEVICES

10.8.2 ACCESSORIES AND CONSUMABLES

10.9 OTHERS

11 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 HOMECARE SETTINGS

11.4 AMBULATORY SURGICAL CENTERS

11.5 SPECIALTY CLINICS

11.6 OTHERS

12 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 UAE

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MEDTRONIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ICU MEDICAL

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 BAXTER

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 B. BRAUN MELSUNGEN AG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 FRESENIUS KABI AG (SUBSIDIARY OF FRESENIUS SE & CO.KGAA)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 BD

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ACE-MEDICAL

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 AVNS.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 EITAN MEDICAL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 INTRA PUMP INFUSION SYSTEMS.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 KORU MEDICAL SYSTEMS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 MOOG INC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 MICREL MEDICAL DEVICES SA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 WALKMED

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 WOODLEY EQUIPMENT COMPANY LTD

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 5 MIDDLE EAST & AFRICA ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 12 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA INTRAVENOUS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA SUBCUTANEOUS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA EPIDURAL IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA OTHERS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA HOSPITALS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA HOMECARE SETTINGS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA SPECIALTY CLINICS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA OTHERS IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA DIRECT TENDER IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA RETAIL SALES IN AMBULATORY INFUSION PUMPS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 50 MIDDLE EAST AND AFRICA ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 56 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 73 SOUTH AFRICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP, 2020-2029 (USD)

TABLE 74 SOUTH AFRICA ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 80 SOUTH AFRICA ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP, 2020-2029 (USD)

TABLE 81 SOUTH AFRICA AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 SOUTH AFRICA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH AFRICA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH AFRICA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 SOUTH AFRICA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH AFRICA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 SOUTH AFRICA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 SOUTH AFRICA AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 94 SOUTH AFRICA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 SAUDI ARABIA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 SAUDI ARABIA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 98 SAUDI ARABIA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP, 2020-2029 (USD)

TABLE 99 SAUDI ARABIA ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 SAUDI ARABIA DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 103 SAUDI ARABIA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 SAUDI ARABIA ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 105 SAUDI ARABIA ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP, 2020-2029 (USD)

TABLE 106 SAUDI ARABIA AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 107 SAUDI ARABIA DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 SAUDI ARABIA REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 SAUDI ARABIA AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 110 SAUDI ARABIA AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 SAUDI ARABIA PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 SAUDI ARABIA DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 SAUDI ARABIA ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 SAUDI ARABIA NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 SAUDI ARABIA GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 SAUDI ARABIA GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 SAUDI ARABIA EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 118 SAUDI ARABIA AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 SAUDI ARABIA AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 U.A.E AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 U.A.E DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 U.A.E DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 123 U.A.E DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP, 2020-2029 (USD)

TABLE 124 U.A.E ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 U.A.E ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 U.A.E MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 U.A.E DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 128 U.A.E ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 U.A.E ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 130 U.A.E ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP, 2020-2029 (USD)

TABLE 131 U.A.E AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 132 U.A.E DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 U.A.E REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 U.A.E AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 135 U.A.E AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 U.A.E PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 U.A.E DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.A.E ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 U.A.E NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 140 U.A.E GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 141 U.A.E GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 142 U.A.E EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 U.A.E AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 144 U.A.E AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 145 EGYPT AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 EGYPT DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 EGYPT DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 148 EGYPT DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP, 2020-2029 (USD)

TABLE 149 EGYPT ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 EGYPT ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 151 EGYPT MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 152 EGYPT DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 153 EGYPT ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 EGYPT ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 155 EGYPT ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP, 2020-2029 (USD)

TABLE 156 EGYPT AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 157 EGYPT DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 158 EGYPT REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 159 EGYPT AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 160 EGYPT AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 161 EGYPT PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 162 EGYPT DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 EGYPT ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 EGYPT NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 165 EGYPT GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 166 EGYPT GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 167 EGYPT EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 EGYPT AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 169 EGYPT AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 ISRAEL AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 ISRAEL DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 ISRAEL DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 173 ISRAEL DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP, 2020-2029 (USD)

TABLE 174 ISRAEL ELASTOMERIC PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 175 ISRAEL ELECTRICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 176 ISRAEL MECHANICAL PUMPS IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 177 ISRAEL DEVICES IN AMBULATORY INFUSION PUMPS MARKET, BY MODALITY, 2020-2029 (USD MILLION)

TABLE 178 ISRAEL ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 179 ISRAEL ACCESSORIES AND CONSUMABLES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, BY VOLUME, 2020-2029 (UNITS)

TABLE 180 ISRAEL ACCESSORIES AND CONSUMABLES INFUSION AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, ASP, 2020-2029 (USD)

TABLE 181 ISRAEL AMBULATORY INFUSION PUMPS MARKET, BY USAGE, 2020-2029 (USD MILLION)

TABLE 182 ISRAEL DISPOSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 183 ISRAEL REUSABLE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 184 ISRAEL AMBULATORY INFUSION PUMPS MARKET, BY ROUTE OF ADMINISTRATION, 2020-2029 (USD MILLION)

TABLE 185 ISRAEL AMBULATORY INFUSION PUMPS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 ISRAEL PAIN MANAGEMENT IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 187 ISRAEL DIABETES IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 188 ISRAEL ONCOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 189 ISRAEL NEONATOLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 190 ISRAEL GASTROENTEROLOGY IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 191 ISRAEL GENERAL ANESTHESIA IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 192 ISRAEL EMERGENCY MEDICINE IN AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 193 ISRAEL AMBULATORY INFUSION PUMPS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 194 ISRAEL AMBULATORY INFUSION PUMPS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 195 REST OF MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: SEGMENTATION

FIGURE 10 THE RISING PREVALENCE OF CHRONIC DISEASES, AS WELL AS GROWING GERIATRIC POPULATION, IS DRIVING THE MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND, CHALLENGES OF MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET

FIGURE 13 RECENT YEAR HEALTHCARE EXPENDITURE (% OF GDP) 2018-2019-

FIGURE 14 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, 2021

FIGURE 19 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, 2022-2029 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, CAGR (2022-2029)

FIGURE 21 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY USAGE, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, 2021

FIGURE 23 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, 2021

FIGURE 27 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, 2021

FIGURE 31 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET: SNAPSHOT (2021)

FIGURE 39 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET: BY COUNTRY (2021)

FIGURE 40 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 MIDDLE EAST AND AFRICA AMBULATORY INFUSION PUMPS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 43 MIDDLE EAST & AFRICA AMBULATORY INFUSION PUMPS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.