Marché des batteries AGM pour voitures au Moyen-Orient et en Afrique, par type (stationnaire, motrice), tension (moins de 10 volts, de 10 volts à 12 volts et plus de 12 volts), type de moteur (moteurs à combustion interne, véhicules électriques), canal de vente (OEM, marché secondaire), type de véhicule (voitures particulières, voitures électriques) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des batteries AGM pour voitures au Moyen-Orient et en Afrique

Le marché des batteries AGM pour voitures au Moyen-Orient et en Afrique connaît une croissance substantielle en raison de la demande croissante de batteries AGM dans le secteur automobile. La demande croissante de batteries AGM dans le secteur automobile devrait stimuler la croissance du marché. Les caractéristiques supérieures des batteries AGM devraient stimuler la croissance du marché. D'autre part, le coût élevé associé aux batteries AGM devrait constituer un frein majeur à la croissance du marché. L'innovation dans la technologie des batteries devrait offrir une opportunité lucrative pour la croissance du marché. Cependant, le manque de professionnels qualifiés devrait constituer un défi majeur à la croissance du marché.

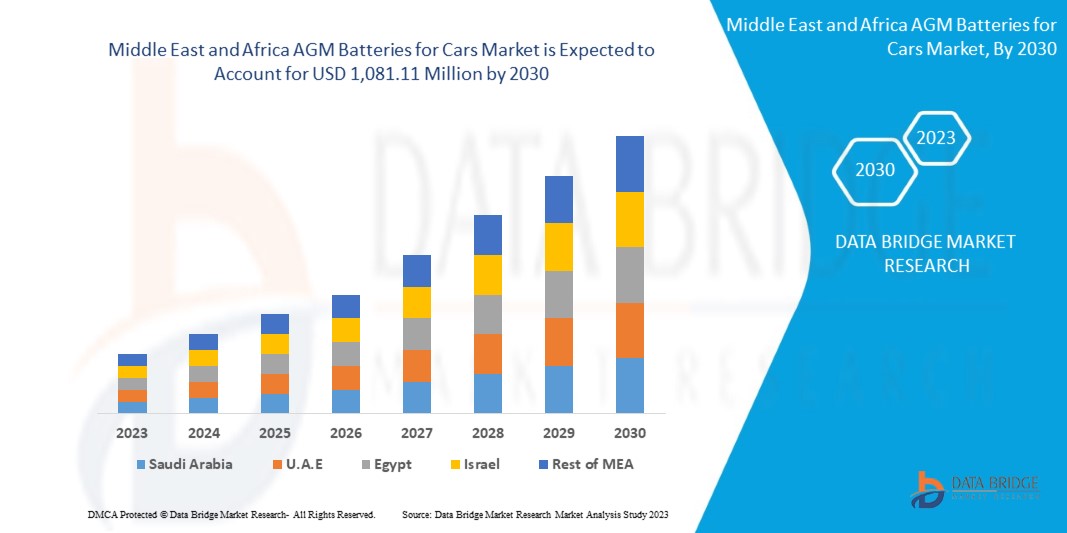

Selon les analyses de Data Bridge Market Research, le marché des batteries AGM pour voitures au Moyen-Orient et en Afrique devrait atteindre la valeur de 1 081,11 millions USD d'ici 2030, à un TCAC de 3,2 % au cours de la période de prévision. Le rapport sur le marché des batteries AGM pour voitures au Moyen-Orient et en Afrique couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par type (stationnaire, moteur), tension (moins de 10 volts, de 10 volts à 12 volts et plus de 12 volts), type de moteur (moteurs à combustion interne, véhicules électriques), canal de vente (OEM, marché secondaire), type de véhicule (voitures particulières, voitures électriques) |

|

Pays couverts |

Afrique du Sud, Égypte, Arabie saoudite, Émirats arabes unis, Israël, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

ENERSYS, leoch International Technology Limited Inc., Jiangxi JingJiu Power Science& Technology Co., LTD, FIAMM Energy Technology SpA, Guangdong Aokly Group Co., Ltd, ACDelco, Robert Bosch LLC et Duracell, entre autres |

Définition du marché

AGM ou Absorbent Glass Mat est une batterie plomb-acide avancée qui fournit une puissance supérieure pour répondre aux exigences électriques plus élevées des véhicules et des applications start-stop. Les batteries AGM sont extrêmement résistantes aux vibrations, sont totalement étanches, antidéversement et sans entretien. Les batteries AGM offrent de meilleures performances de cyclage, un dégagement gazeux minimal et des fuites d'acide par rapport aux batteries plomb-acide conventionnelles.

Dynamique du marché des batteries AGM pour voitures au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- La demande de batteries AGM augmente dans le secteur automobile

Les batteries AGM sont de plus en plus utilisées dans les nouveaux véhicules, non seulement en raison de leur longévité accrue, mais aussi parce qu'elles fonctionnent mieux avec des charges électriques élevées et des systèmes d'arrêt/démarrage. Au cours des deux prochaines années, jusqu'à 40 % des nouvelles voitures pourraient être équipées de systèmes d'arrêt/démarrage à économie de carburant et de batteries AGM. Les batteries AGM sont un excellent choix pour les véhicules haut de gamme et avancés à faible consommation de carburant ayant des besoins en énergie élevés et pour les personnes qui recherchent une plus grande fiabilité et une durée de vie plus longue des batteries automobiles. Les fonctions électroniques puissantes telles que le GPS, les sièges chauffants et les systèmes audio ajoutent toutes à la demande de puissance accrue de la batterie. Une batterie AGM peut supporter de longues périodes d'arrêt, car avec cette technologie, la stratification ne peut pas se produire dans l'électrolyte, qui est lié dans le séparateur, il y a donc moins de sulfuration. Cela suggère qu'une batterie AGM est plus facile à recharger qu'une batterie humide après une longue période d'arrêt. Ainsi, en raison de la longévité élevée et des bonnes performances des batteries AGM, la demande de batteries AGM dans le secteur automobile a considérablement augmenté.

- Caractéristiques supérieures des batteries AGM

Les batteries AGM sont résistantes aux vibrations, scellées, étanches et ne nécessitent aucun entretien. Elles offrent de meilleures performances de cyclage, un dégagement gazeux minimal et des fuites d'acide par rapport aux batteries plomb -acide conventionnelles. Le résultat de toutes les caractéristiques de la technologie AGM est une durée de vie supérieure. Au cours de leur durée de vie, les batteries AGM peuvent démarrer un moteur plus de 60 000 fois. C'est plus de trois fois plus de démarrages que l'on obtient avec une batterie conventionnelle, et les batteries AGM se rechargent plus rapidement que les batteries classiques. L'un des plus grands avantages des batteries AGM est qu'elles sont connues comme des batteries sans entretien. L'AGM a un taux d'autodécharge plus faible qui dure beaucoup plus longtemps que les batteries plomb-acide inondées. L'AGM a une durée de vie allant jusqu'à sept ans si elle est bien entretenue, ce qui est bien plus que les autres batteries qui durent de trois à cinq ans. Par conséquent, les AGM durent plus longtemps et serviront mieux que toutes les autres batteries

Opportunité

- Demande croissante de batteries AGM dans les systèmes audio

La batterie AGM est un excellent choix de batterie pour les systèmes électriques des voitures, et sa demande augmente parmi les gens, en particulier pour les systèmes audio des voitures. Elle est conçue pour contenir une grande quantité d'énergie, ce qui la rend idéale pour les voitures utilisées pour les voyages longue distance. Comme il y a deux choses à prendre en compte par les consommateurs lors de l'achat d'une nouvelle batterie pour un véhicule, à savoir la puissance de démarrage et la capacité de réserve, si un consommateur a besoin d'une batterie puissante et suffisamment performante pour toutes les applications électriques de la voiture (sièges climatisés, hayons élévateurs électriques et éclairage d'appoint, entre autres), il est recommandé de faire installer une batterie AGM par un expert.

Retenue/Défi

- Coût élevé associé aux batteries AGM

La batterie AGM a une tolérance plus faible à la surcharge et aux tensions élevées par rapport aux batteries inondées. Les batteries AGM sont plus chères que les batteries traditionnelles car elles coûtent cher à fabriquer. À mesure que la technologie progresse, les véhicules ont besoin de plus en plus d'énergie pour faire fonctionner toutes ces nouvelles fonctionnalités. Dans les évaluations de batterie de Consumer Reports, les batteries AGM coûtent 40 à 100 % de plus que les batteries traditionnelles. Le principal inconvénient d'une batterie AGM est le coût initial par rapport à une batterie plomb-acide inondée traditionnelle. Dans les batteries AGM, des tapis de verre sont utilisés. Les tapis de verre sont un revêtement de niveau supplémentaire sur les tiges d'ions lithium et les tiges d'acide de plomb. Ce revêtement supplémentaire représente un coût supplémentaire pour le fabricant de batteries AGM. Par conséquent, le coût des batteries AGM augmente. Ce coût plus élevé des batteries AGM, par rapport aux autres types de batteries, devrait constituer un frein pour le marché.

Impact de la pandémie de COVID-19 sur le marché des batteries AGM pour automobiles au Moyen-Orient et en Afrique

Le COVID-19 a eu un impact négatif sur le marché des batteries AGM pour automobiles au Moyen-Orient et en Afrique en raison de la fermeture du secteur manufacturier, de la logistique et du transport au Moyen-Orient et en Afrique, et du manque de tests pour le produit.

La pandémie de COVID-19 a eu un impact négatif sur le marché des batteries AGM pour automobiles au Moyen-Orient et en Afrique. Cependant, l'augmentation de la demande de solutions de stockage d'énergie pour les applications à courant élevé et l'innovation dans la technologie des batteries devraient agir comme un facteur moteur de la croissance du marché et ont également contribué à la croissance du marché pendant et après la pandémie. En outre, la croissance a été élevée depuis l'ouverture du marché après le COVID-19, et on s'attend à ce qu'il y ait une croissance considérable dans le secteur. Les acteurs du marché mènent de multiples activités de recherche et développement pour améliorer la technologie impliquée dans le produit. Grâce à cela, les entreprises apporteront des progrès et de l'innovation au marché. En outre, le financement gouvernemental des batteries AGM a stimulé la croissance du marché.

Développement récent

- En juillet 2022, Exide Technologies a lancé toutes les brochures de sa gamme de batteries automobiles. Cette brochure comprend toutes les informations relatives aux batteries automobiles et aux produits associés. Elle aidera les clients et les distributeurs à connaître les offres de l'entreprise. Par conséquent, elle devrait avoir un bon impact sur la croissance du marché des batteries AGM pour voitures au Moyen-Orient et en Afrique.

- En mai 2020, Power Sonic Corporation a lancé des modèles de petites batteries au lithium à haut rendement (PSL-SH) et 16 modèles de batteries au lithium capables de collecter des séries (PSL-SC). Cette nouvelle innovation de produit dans le segment des batteries a renforcé la croissance de l'entreprise ainsi que le marché des batteries AGM pour automobiles au Moyen-Orient et en Afrique.

Portée du marché des batteries AGM pour voitures au Moyen-Orient et en Afrique

Le marché des batteries AGM pour voitures au Moyen-Orient et en Afrique est segmenté en fonction du type, du type de moteur, du type de véhicule, du canal de vente et de la tension. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

PAR TYPE

- Stationnaire

- Motif

Sur la base du type, le marché est segmenté en stationnaire et mobile.

PAR TENSION

- Moins de 10 volts

- 10 volts à 12 volts

- Au-dessus de 12 volts

Sur la base de la tension, le marché est segmenté en moins de 10 volts, de 10 à 12 volts et au-dessus de 12 volts.

PAR TYPE DE MOTEUR

- Moteurs à combustion interne

- Véhicules électriques

Sur la base du type de moteur, le marché est segmenté en moteurs à combustion interne et véhicules électriques

PAR CANAL DE VENTE

- Fabricant d'équipement d'origine

- Pièces de rechange

Sur la base du canal de vente, le marché est segmenté en OEM et après-vente

PAR TYPE DE VÉHICULE

- Voitures particulières

- Voitures électriques

En fonction du type de véhicule, le marché est segmenté en voitures particulières et voitures électriques.

Analyses/perspectives régionales

Le marché des batteries AGM pour voitures au Moyen-Orient et en Afrique est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, type de moteur, type de véhicule, canal de vente et tension comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des batteries AGM pour voitures au Moyen-Orient et en Afrique sont l'Afrique du Sud, les Émirats arabes unis, l'Arabie saoudite, l'Égypte, Israël, Bahreïn, le Koweït, le Qatar, Oman, le reste du Moyen-Orient et l'Afrique.

- En 2023, l’Arabie saoudite devrait dominer le marché, car la région a une demande plus élevée en matière d’automobile et d’automatisation dans l’industrie manufacturière par rapport aux autres pays.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des batteries AGM pour voitures au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché des batteries AGM pour voitures au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché des batteries AGM pour voitures au Moyen-Orient et en Afrique.

Certains des principaux acteurs opérant sur le marché des batteries AGM pour voitures au Moyen-Orient et en Afrique sont ENERSYS, leoch International Technology Limited Inc., Jiangxi JingJiu Power Science& Technology Co., LTD, FIAMM Energy Technology SpA, Guangdong Aokly Group Co., Ltd, ACDelco, Robert Bosch LLC et Duracell, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGY ANALYSIS

4.2 VALUE CHAIN ANALYSIS

4.3 PRICING ANALYSIS

4.4 PORTER’S FIVE FORCE ANALYSIS

4.5 BENEFITS AND FUTURE OF AGM BATTERIES FOR CARS

4.6 EVOLUTION OF AUTOMOTIVE BATTERY

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR AGM BATTERIES IN THE AUTOMOBILE SECTOR

6.1.2 INCREASING MOTORSPORT EVENTS ACROSS GLOBE

6.1.3 SUPERIOR CHARACTERISTIC OF AGM BATTERIES

6.1.4 RISE IN DEMAND OF ENERGY STORAGE SOLUTIONS FOR HIGH CURRENT APPLICATION

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH AGM BATTERIES

6.2.2 ENVIRONMENTAL CONCERNS REGARDING THE PRODUCTION OF AGM BATTERIES

6.3 OPPORTUNITIES

6.3.1 INNOVATION IN BATTERY TECHNOLOGY

6.3.2 RISING INVESTMENT IN EV SECTOR

6.3.3 GROWING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

6.3.4 INCREASING DEMAND FOR AGM BATTERIES IN SOUND SYSTEM

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PERSONNE

6.4.2 AVAILABILITY OF ALTERNATIVES TO AGM

7 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY TYPE

7.1 OVERVIEW

7.2 STATIONARY

7.3 MOTIVE

8 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY VOLTAGE

8.1 OVERVIEW

8.2 ABOVE 12 VOLTS

8.3 10 VOLTS TO 12 VOLTS

8.4 LESS THAN 10 VOLTS

9 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE

9.1 OVERVIEW

9.2 ELECTRIC VEHICLES

9.3 IC ENGINES

9.3.1 DIESEL

9.3.2 PETROL

10 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 OEM

10.3 AFTERMARKET

11 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 ELECTRIC CARS

11.3 PASSENGER CARS

11.3.1 HATCHBACK

11.3.2 SEDAN

11.3.3 SUV

11.3.4 MPV

11.3.5 CROSSOVER

11.3.6 COUPE

11.3.7 CONVERTIBLE

11.3.8 OTHERS

12 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 U.A.E.

12.1.3 EGYPT

12.1.4 SOUTH AFRICA

12.1.5 ISRAEL

12.1.6 BAHRAIN

12.1.7 KUWAIT

12.1.8 QATAR

12.1.9 OMAN

12.1.10 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CLARIOS

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 EAST PENN MANUFACTURING COMPANY

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ENERSYS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 LEOCH INTERNATIONAL TECHNOLOGIES LIMITED INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 JIANXI JINGJIU POWER SCIENCE AND TECHNOLOGY CO.,LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ACDELCO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 BRAILLE BATTERY

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 DURACELL AUTOMOBILE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 EXIDE TECHNOLOGIES

15.9.1 COMPANY SNAPSHOT

15.9.2 SOLUTION PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 FIAMM ENERGY TECHNOLOGY S.P.A.

15.10.1 COMPANY SNAPSHOT

15.10.2 SOLUTION PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 FULLRIVER BATTERY

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 GUANGDONG AOKLY GROUP CO., LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MIGHTY MAX BATTERY

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 POWER SONIC CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 RENOGY

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 ROBERT BOSCH LLC

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 UNIVERSAL POWER GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 VMAX USA

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 XINFU TECHNOLOGY (CHINA) CO., LIMITED

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 XS POWER BATTERIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 ZEUS BATTERY PRODUCTS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 PRICES OF AGM BATTERIES WITH SPECIFICATIONS FROM VARIOUS ONLINE DISTRIBUTORS AND MANUFACTURERS (IN USD)

TABLE 2 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA STATIONARY IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA MOTIVE IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA ABOVE 12 VOLTS IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA 10 VOLTS TO 12 VOLTS IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA LESS THAN 10 VOLTS IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ELECTRIC VEHICLES IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA IC ENGINES IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 15 MIDDLE EAST & AFRICA OEM IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA AFTERMARKET IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ELECTRIC CARS IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PASSENGER CARS IN AGM BATTERIES FOR CARS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 28 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 30 SAUDI ARABIA AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 32 SAUDI ARABIA AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 34 SAUDI ARABIA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 36 SAUDI ARABIA AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.A.E. AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.A.E. AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 40 U.A.E. AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 41 U.A.E. IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.A.E. AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 43 U.A.E. AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 44 U.A.E. AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.A.E. PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 46 EGYPT AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 EGYPT AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 48 EGYPT AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 49 EGYPT IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 50 EGYPT AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 51 EGYPT AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 52 EGYPT AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 53 EGYPT PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 54 SOUTH AFRICA AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 SOUTH AFRICA AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 56 SOUTH AFRICA AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 57 SOUTH AFRICA IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 58 SOUTH AFRICA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 59 SOUTH AFRICA AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 60 SOUTH AFRICA AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 61 SOUTH AFRICA PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 62 ISRAEL AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 ISRAEL AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 64 ISRAEL AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 65 ISRAEL IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 66 ISRAEL AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 67 ISRAEL AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 68 ISRAEL AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 69 ISRAEL PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 70 BAHRAIN AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 BAHRAIN AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 72 BAHRAIN AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 73 BAHRAIN IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 74 BAHRAIN AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 75 BAHRAIN AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 76 BAHRAIN AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 77 BAHRAIN PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 78 KUWAIT AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 KUWAIT AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 80 KUWAIT AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 81 KUWAIT IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 82 KUWAIT AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 83 KUWAIT AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 84 KUWAIT AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 85 KUWAIT PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 86 QATAR AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 QATAR AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 88 QATAR AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 89 QATAR IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 90 QATAR AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 91 QATAR AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 92 QATAR AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 93 QATAR PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 94 OMAN AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 OMAN AGM BATTERIES FOR CARS MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 96 OMAN AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 97 OMAN IC ENGINE AGM BATTERIES FOR CARS MARKET, BY ENGINE TYPE, 2021-2030 (USD MILLION)

TABLE 98 OMAN AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 99 OMAN AGM BATTERIES FOR CARS MARKET, BY SALES CHANNEL, 2021-2030 (THOUSAND UNIT)

TABLE 100 OMAN AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 101 OMAN PASSENGER CARS AGM BATTERIES FOR CARS MARKET, BY VEHICLE TYPE, 2021-2030 (USD MILLION)

TABLE 102 REST OF MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET :DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: SEGMENTATION

FIGURE 10 THE INHERENT ADVANTAGES OF AGM BATTERIES & RISING ADOPTION OF HIGH-PERFORMANCE ENGINE STARTER BATTERIES IN VEHICLES ARE BOOSTING THE GROWTH OF AGM BATTERIES FOR CARS MARKET IN THE FORECAST PERIOD OF 2023 -2030

FIGURE 11 STATIONARY IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET IN 2023 - 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET

FIGURE 13 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: BY TYPE, 2022

FIGURE 14 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: BY VOLTAGE, 2022

FIGURE 15 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: BY ENGINE TYPE, 2022

FIGURE 16 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: BY SALES CHANNEL, 2022

FIGURE 17 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: BY VEHICLE TYPE, 2022

FIGURE 18 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET: BY COUNTRY (2022)

FIGURE 20 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 MIDDLE EAST AND AFRICA AGM BATTERIES FOR CARS MARKET: BY TYPE (2023-2030)

FIGURE 23 MIDDLE EAST & AFRICA AGM BATTERIES FOR CARS MARKET: COMPANY SHARE 2022(%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.