Marché des appareils esthétiques au Moyen-Orient et en Afrique, par produits ( produits esthétiques pour le visage , appareils de remodelage corporel , implants cosmétiques, appareils esthétiques pour la peau, appareils d'épilation et autres), matières premières (polymères, biomatériaux et métaux), utilisateur final (hôpitaux, cliniques de dermatologie, cliniques, instituts de recherche universitaires et privés et autres), canal de distribution (appels d'offres directs et ventes au détail) Tendances de l'industrie et prévisions jusqu'en 2029

Analyse et perspectives du marché

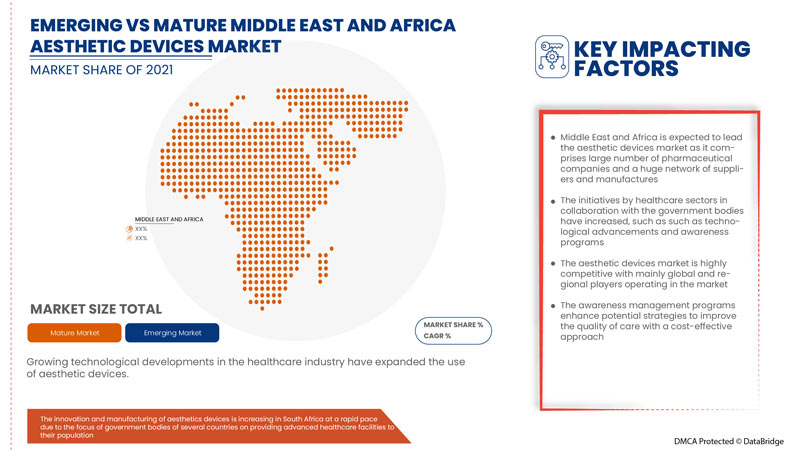

Le marché des dispositifs esthétiques au Moyen-Orient et en Afrique est stimulé par des facteurs tels que l'augmentation de la population gériatrique, l'augmentation de la prévalence des procédures mini-invasives et les avancées technologiques croissantes dans les dispositifs esthétiques qui augmentent sa demande ainsi que l'augmentation des investissements dans la recherche et le développement conduisent à la croissance du marché. Actuellement, les dépenses de santé ont augmenté dans les pays développés et émergents, ce qui devrait créer un avantage concurrentiel pour les fabricants qui souhaitent développer des dispositifs esthétiques nouveaux et innovants.

L'utilisation croissante de procédures mini-invasives a été décalée par rapport aux méthodes traditionnelles de chirurgie esthétique et cosmétique, notamment le laser et d'autres appareils à base d'énergie. Pour l'utilisation de procédures chirurgicales ou non chirurgicales, des instruments spécialement conçus ont été développés pour les procédures à usage minimal. Ces appareils anti-âge aident à réduire les effets visuels du vieillissement cutané en revitalisant et en resserrant la peau, ce qui donne une apparence plus jeune. Les traitements à base d'énergie mini-invasive pour le raffermissement de la peau, la réduction des rides, le remodelage du visage et le rajeunissement de la peau sont très demandés dans le monde. Cependant, le coût élevé associé à la procédure de chirurgie esthétique et les effets secondaires associés aux appareils de chirurgie esthétique devraient entraver la croissance du marché des appareils esthétiques.

Le rapport sur le marché des appareils esthétiques au Moyen-Orient et en Afrique fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et localisé, analyse les opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits, les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité. L'évolutivité et l'expansion commerciale des unités de vente au détail dans les pays en développement de diverses régions et le partenariat avec les fournisseurs pour une distribution sûre de machines et de produits pharmaceutiques sont les principaux moteurs qui ont propulsé la demande du marché au cours de la période de prévision.

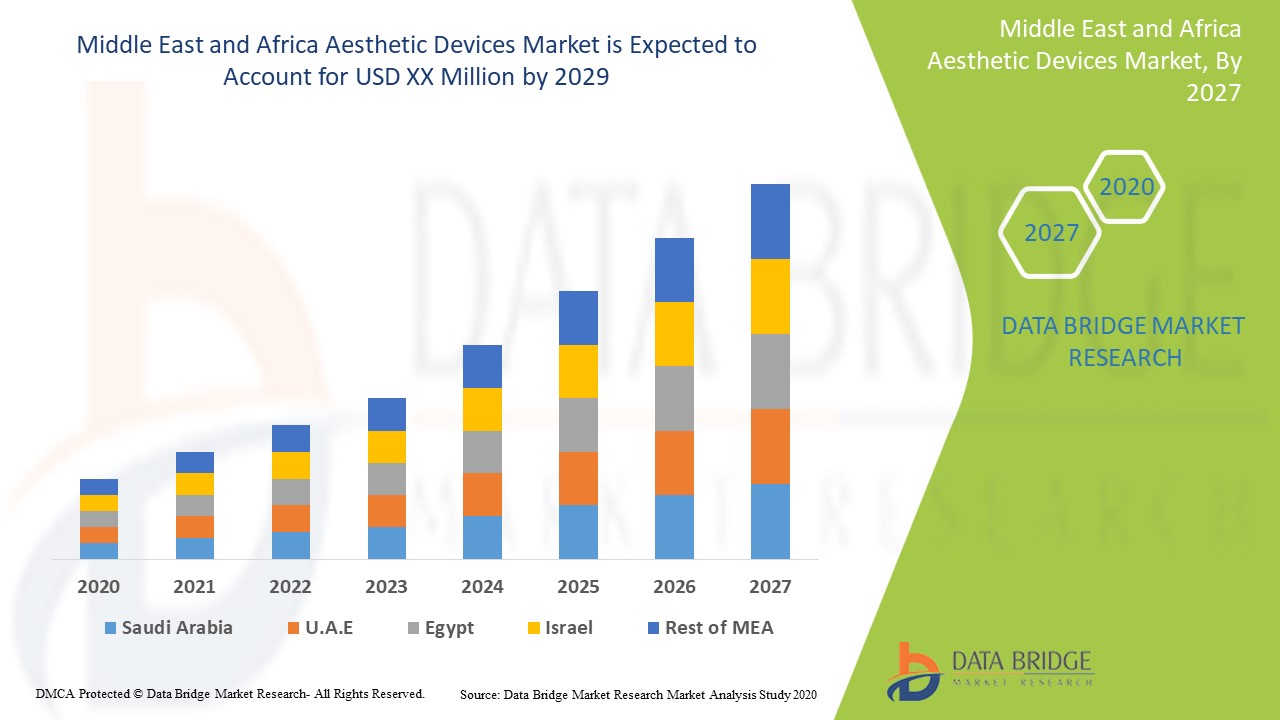

Le marché des appareils esthétiques au Moyen-Orient et en Afrique est favorable et vise à traiter les déficiences associées aux apparences esthétiques individuelles. Data Bridge Market Research analyse que le marché des appareils esthétiques au Moyen-Orient et en Afrique connaîtra un TCAC de 9,4 % au cours de la période de prévision de 2022 à 2029.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par produits (produits d'esthétique faciale, appareils de remodelage corporel, implants cosmétiques, appareils d'esthétique cutanée, appareils d'épilation et autres), matières premières (polymères, biomatériaux et métaux), utilisateur final (hôpitaux, cliniques de dermatologie, cliniques, instituts de recherche universitaires et privés et autres), canal de distribution (appel d'offres direct et vente au détail) |

|

Pays couverts |

Arabie saoudite, Afrique du Sud, Émirats arabes unis, Israël, Égypte, reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Allergan (une filiale d'AbbVie Inc.), Bausch Health Companies Inc, BTL, Lumenis Be Ltd., Venus Concept, Sientra, Inc, Merz North America, Inc., GC Aesthetics, entre autres |

Définition du marché :

Les procédures esthétiques sont utilisées pour traiter diverses affections telles que l'acné, les cicatrices d'acné, les rides, les taches brunes, les grains de beauté et bien d'autres problèmes. Ces produits peuvent améliorer la beauté du visage en réduisant le bronzage, la décoloration, l'acné, entre autres. Divers produits esthétiques pour le visage comprennent, entre autres, les produits de comblement dermique, la toxine botulique, la microdermabrasion et les peelings chimiques. De plus, ces implants sont utilisés pour améliorer les différentes parties du corps. Les implants comprennent, entre autres, les implants mammaires et les implants faciaux. Ils sont généralement fabriqués à partir de peau, d'os, de tissus, de métal, de plastique, de céramique et d'autres matériaux.

Dynamique du marché des dispositifs esthétiques au Moyen-Orient et en Afrique

Conducteurs

- Augmentation de la population gériatrique

Le vieillissement de la population joue un rôle essentiel dans l'augmentation de la demande d'appareils esthétiques anti-âge à base d'énergie. La vieillesse est associée à une perte de tissu fibreux et à une réduction du réseau vasculaire et glandulaire dans les couches cutanées, ce qui entraîne des rides, une sécheresse, une altération pigmentaire et un affaissement de la peau. L'application de connaissances esthétiques qui retardent la détérioration physique et mentale associée à la sénescence jusqu'à la fin de vie absolue a été signalée comme étant attirée vers les appareils esthétiques au sein de la population gériatrique.

Le vieillissement croissant de la peau ou des tissus adipeux et conjonctifs sous-jacents, l'élastose dermique de la peau, la lipodystrophie du cou et le relâchement des ligaments faciaux contribuent tous aux stigmates des soins du visage vieillissants et aux préoccupations concernant l'apparence qui ont conduit à l'utilisation de procédures mini-invasives. Le besoin croissant de traitements non invasifs à base d'énergie pour le raffermissement de la peau, la réduction des rides, le remodelage du visage et le rajeunissement de la peau sont les facteurs responsables de l'augmentation de l'utilisation parmi la population gériatrique. Les appareils anti-âge aident à réduire les effets visuels du vieillissement cutané en revitalisant et en raffermissant la peau, ce qui donne une apparence plus jeune, c'est pourquoi ils sont de plus en plus utilisés par les personnes âgées. Ainsi, le taux croissant de la population gériatrique devrait stimuler la croissance du marché des appareils esthétiques au Moyen-Orient et en Afrique.

- Progrès technologiques dans les appareils esthétiques

Les progrès technologiques dans le domaine des soins de santé et des services cliniques sont de plus en plus accessibles. Les technologies innovantes avancées ont amélioré le traitement esthétique de la peau et d'autres parties du corps, partout où cela est nécessaire. Un intérêt croissant a été manifesté pour les systèmes laser et à lumière. Les systèmes laser CO2 et erbium YAG se sont révélés très avantageux par rapport aux techniques conventionnelles de thérapies de rajeunissement de la peau grâce à des techniques de resurfaçage et à d'autres dispositifs à base d'énergie ablative.

Les thérapies ablatives sont plus conventionnelles que les technologies non ablatives et fractionnées, qui sont associées à un temps de récupération plus court et à des taux de complications plus élevés. De plus, de nouveaux traitements sont également apparus pour l'acné vulgaire, la lipolyse et la cellulite, notamment des dispositifs innovants qui offrent des combinaisons de technologies ablatives et fractionnées, montrant des résultats significatifs. De nouvelles procédures de traitement au laser, à la lumière et à d'autres dispositifs énergétiques, offrant une sécurité pour le patient et une efficacité de traitement, sont autorisées pour la planification du traitement et l'évaluation précise de la zone d'ablation ciblée. Ainsi, cela signifie que les progrès technologiques dans les dispositifs esthétiques devraient stimuler la croissance du marché des dispositifs esthétiques au Moyen-Orient et en Afrique.

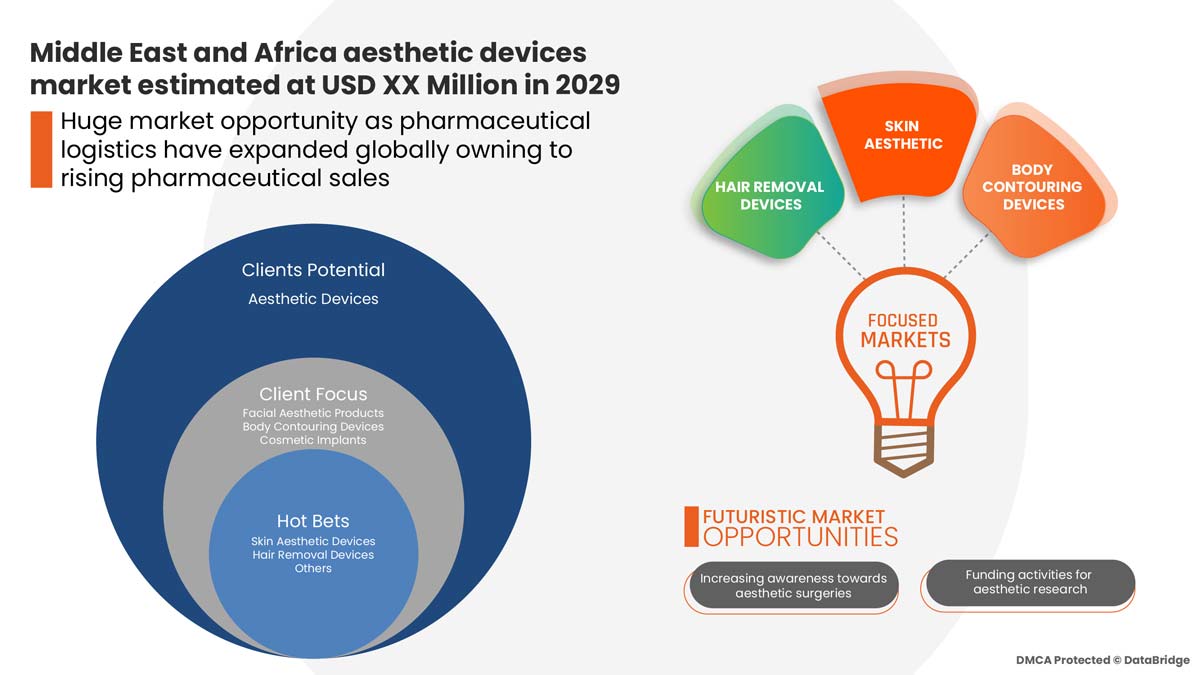

Opportunité

- Sensibilisation accrue aux chirurgies esthétiques

Les plateformes numériques favorisent la diffusion d'informations auprès des utilisateurs cibles. Ces plateformes ont une fonction essentielle à jouer pour faciliter les procédures esthétiques. La chirurgie esthétique fait référence aux procédures qui améliorent l'apparence du visage et du corps, réalisées de l'une des manières les plus brillantes. Ces procédures sont devenues de plus en plus populaires. Historiquement, les chirurgiens utilisaient leurs comptes Web privés pour se faire connaître, mais aujourd'hui, les chirurgiens modernes utilisent progressivement Instagram, LinkedIn, Snapchat, Twitter et d'autres sites de réseaux sociaux pour sensibiliser davantage à la détection et au traitement de l'attrait esthétique et de la symétrie de la partie du corps qui est conçue pour combattre les signes du vieillissement, rajeunir et rafraîchir la peau.

Les médias sociaux sont utilisés pour améliorer les contacts, la promotion et la sensibilisation des collègues et du grand public. De plus, les chercheurs ont remarqué qu'une participation accrue aux réseaux sociaux coïncidait avec une préoccupation accrue pour la chirurgie plastique, et plus encore pour l'utilisation de certaines applications. Cela entraînera une augmentation des ventes, une augmentation du portefeuille de produits et une expansion de la gamme de produits. Ainsi, une sensibilisation accrue à la détection et au traitement devrait constituer une opportunité pour la croissance du marché des appareils esthétiques au Moyen-Orient et en Afrique dans les années à venir.

Retenue/Défi

- Coût élevé des interventions chirurgicales esthétiques

Le coût du produit joue un rôle majeur sur le marché. Le coût associé à un traitement de longue durée est assez difficile à supporter pour une personne à revenu moyen. Le recours aux services de soins intensifs et de réanimation augmente dans le monde entier et son coût élevé constitue une préoccupation majeure dans le système de santé actuel. Les appareils à base d'énergie basés sur la technologie moderne aident à tonifier et à raffermir diverses parties du corps en réduisant la graisse à l'aide de modalités avancées telles que le plasma, le laser et autres.

Le coût des appareils à énergie varie considérablement selon leur qualité, leur durabilité et leur marque d'un endroit à l'autre. Les facteurs clés qui déterminent le coût des procédures esthétiques comprennent l'établissement médical ou la clinique choisi pour la procédure, la technologie utilisée, la zone affectée, la durée du séjour du patient et la complexité de l'opération, entre autres. Le coût élevé de la procédure est dû aux différents points de contrôle de la chirurgie ainsi qu'à l'utilisation de modalités de haute technologie pour effectuer ces procédures. Le coût des appareils de chirurgie esthétique technologiquement avancés étant élevé, le coût de la procédure augmente proportionnellement, ce qui devrait freiner la croissance du marché.

Développement récent

- En janvier 2021, Candela, une société leader dans le domaine des dispositifs médicaux esthétiques au Moyen-Orient et en Afrique, a annoncé la disponibilité du système Frax Pro, un dispositif de resurfaçage cutané fractionné non ablatif approuvé par la FDA avec les applicateurs Frax 1550 et Frax 1940. Cela a aidé l'entreprise à élargir le portefeuille de produits esthétiques sur le marché.

Segmentation du marché des dispositifs esthétiques au Moyen-Orient et en Afrique

Le marché des appareils esthétiques du Moyen-Orient et de l'Afrique est divisé en quatre segments notables basés sur les produits, les matières premières, l'utilisateur final et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Produits

- Produits d'esthétique pour le visage

- Appareils de remodelage corporel

- Implants cosmétiques

- Appareils d'épilation

- Appareils d'esthétique cutanée

- Autres

Sur la base des produits, le marché des appareils esthétiques du Moyen-Orient et de l'Afrique est segmenté en produits esthétiques pour le visage, appareils de remodelage corporel, implants cosmétiques, appareils d'épilation, appareils esthétiques de la peau et autres.

Matière première

- Polymères

- Métaux

- Biomatériaux

Sur la base du type, le marché des dispositifs esthétiques du Moyen-Orient et de l’Afrique est segmenté en polymères, métaux et biomatériaux.

Utilisateur final

- Hôpitaux

- Cliniques de dermatologie

- Cliniques

- Instituts de recherche universitaires et privés

- Autres

Sur la base de l'utilisateur final, le marché des appareils esthétiques du Moyen-Orient et de l'Afrique est segmenté en hôpitaux, cliniques de dermatologie, cliniques, universitaires et instituts de recherche privés et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

Sur la base du canal de distribution, le marché des appareils esthétiques du Moyen-Orient et de l'Afrique est segmenté en appels d'offres directs et ventes au détail.

Analyse/perspectives régionales du marché des dispositifs esthétiques

Le marché des appareils esthétiques est analysé et des informations sur la taille et les tendances du marché sont fournies par produits, matières premières, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts par le rapport sur les appareils esthétiques sont l’Arabie saoudite, l’Afrique du Sud, les Émirats arabes unis, Israël, l’Égypte, le reste du Moyen-Orient et l’Afrique.

L’Afrique du Sud devrait dominer en raison de l’augmentation des dépenses de santé et du revenu disponible.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques du Moyen-Orient et d'Afrique et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des appareils esthétiques

Le paysage concurrentiel du marché des appareils esthétiques au Moyen-Orient et en Afrique fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence au Moyen-Orient et en Afrique, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises sur le marché des appareils esthétiques.

Certains acteurs majeurs du marché sont Allergan (une filiale d'AbbVie Inc.), Bausch Health Companies Inc, BTL, Lumenis Be Ltd., Venus Concept, Sientra, Inc, Merz North America, Inc., GC Aesthetics, entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse des parts de marché du Moyen-Orient et de l'Afrique par rapport aux régions et des fournisseurs. Veuillez demander un appel à un analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PESTEL ANALYSIS

5 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: REGULATIONS

5.1 U.S.

5.2 EUROPEAN UNION

5.3 CHINA

5.4 THAILAND

5.5 BRAZIL

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DESIRE TO IMPROVE ONE'S APPEARANCE

6.1.2 RISE IN PREFERENCE FOR MINIMALLY INVASIVE AND NON-INVASIVE PROCEDURES

6.1.3 ADVANCEMENT IN HEALTHCARE TECHNOLOGY & INFRASTRUCTURE

6.1.4 INCREASE IN AESTHETIC EXPENDITURE

6.2 RESTRAINTS

6.2.1 HIGH COST OF AESTHETIC SURGICAL PROCEDURES

6.2.2 SIDE EFFECTS RELATED TO AESTHETIC TREATMENTS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 INCREASE IN RESEARCH AND DEVELOPMENT

6.3.3 DECREASED DISPARITY BETWEEN MEN AND WOMEN FOR AESTHETIC PROCEDURES

6.3.4 GROW IN AWARENESS OF AESTHETIC PROCEDURES

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 LONG APPROVAL TIME ASSOCIATED WITH PRODUCT LAUNCH

7 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 MEDICINES

7.2.1 BOTOX

7.2.2 DERMAL FILLERS

7.2.3 OTHERS

7.3 DEVICES

7.3.1 ENERGY BASED DEVICE

7.3.1.1 LASER BASED DEVICE

7.3.1.1.1 NON-ABLATIVE

7.3.1.1.1.1 PULSE ENERGY LASER

7.3.1.1.1.2 ND:YAG

7.3.1.1.1.3 DIODE LASER

7.3.1.1.1.4 OTHERS

7.3.1.1.2 ABLATIVE

7.3.1.1.2.1 CARBON DIOXIDE LASER

7.3.1.1.2.2 ER:YAG LASER

7.3.1.1.2.3 COMBINED CO2 ER:YAG LASER

7.3.1.2 RADIOFREQUENCY (RF) BASED DEVICE

7.3.1.3 LIGHT BASED DEVICE

7.3.1.4 ULTRASOUND BASED DEVICE

7.3.1.5 OTHERS

7.3.2 NON-ENERGY BASED DEVICE

7.3.2.1 MICRODERMABRASION DEVICES

7.3.2.2 THREADS

7.3.2.3 CRYOTHERAPY DEVICES

7.3.2.4 OTHERS

8 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY SURGERY TYPE

8.1 OVERVIEW

8.2 MINIMALLY INVASIVE

8.3 NON-INVASIVE

9 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE

9.1 OVERVIEW

9.2 FACE TREATMENT

9.2.1 SKIN REJUVENATION

9.2.2 SKIN RESURFACING

9.2.3 SKIN TIGHTENING

9.2.4 HAIR REMOVAL

9.2.5 ACNE

9.2.6 PIGMENTED & VASCULAR LESIONS

9.2.7 TATTOO REMOVAL

9.2.8 SCAR

9.2.9 DYSCHROMIA

9.2.10 PSORIASIS

9.2.11 SKIN TAGS

9.2.12 WARTS

9.2.13 MOLES & FRECKLES

9.2.14 HYPERHIDROSIS

9.2.15 OTHERS

9.3 BODY TREATMENT

9.3.1 SKIN REJUVENATION

9.3.2 SKIN RESURFACING

9.3.3 SKIN TIGHTENING

9.3.4 HAIR REMOVAL

9.3.5 PIGMENTED & VASCULAR LESIONS

9.3.6 TATTOO REMOVAL

9.3.7 SCAR

9.3.8 SKIN TAGS

9.3.9 HYPERHIDROSIS

9.3.10 PSORIASIS

9.3.11 DYSCHROMIA

9.3.12 WARTS

9.3.13 MOLES & FRECKLES

9.3.14 ACNE

9.3.15 OTHERS

10 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SKIN REJUVENATION

10.3 SKIN RESURFACING

10.4 SKIN TIGHTENING

10.5 HAIR REMOVAL

10.6 PIGMENTED & VASCULAR LESIONS

10.7 TATTOO REMOVAL

10.8 SCAR

10.9 ACNE

10.1 DYSCHROMIA

10.11 SKIN TAGS

10.12 PSORIASIS

10.13 WARTS

10.14 HYPERHIDROSIS

10.15 MOLES & FRECKLES

10.16 OTHERS

11 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY GENDER

11.1 OVERVIEW

11.2 FEMALE

11.3 MALE

12 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 DERMATOLOGY CLINICS

12.4 SURGICAL CENTERS

12.5 SPA CLINICS

12.6 OTHERS

13 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

14 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E

14.1.4 ISRAEL

14.1.5 EGYPT

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ABBVIE INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 RECENT FINANCIALS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 BAUSCH HEALTH COMPANIES INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 RECENT FINANCIALS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 HENRY SCHEIN, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 RECENT FINANCIALS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 MERZ PHARMA

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 CANDELA MEDICAL

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 AEROLASE CORP.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 AESTHETIC TECHNOLOGY LIMITED

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 AESTHETIC BIOMEDICAL

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ALMA LASERS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BIOTECH ITALIA SRL

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 CUTERA

17.11.1 COMPANY SNAPSHOT

17.11.2 RECENT FINANCIALS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 CYNOSURE. INC. (A SUBSIDIARY OF HOLOGIC, INC.)

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 DELEO

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 EL. EN. S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 RECENT FINANCIALS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 EVOLUS, INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 RECENT FINANCIALS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 FOTONA

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 HAOHAI BIOLOGICAL TECHNOLOGY

17.17.1 COMPANY SNAPSHOT

17.17.2 RECENT FINANCIALS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 HUGEL, INC.

17.18.1 COMPANY SNAPSHOT

17.18.2 RECENT FINANCIALS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 IMAGE DERM, INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 LUMENIS BE LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 LUTRONIC

17.21.1 COMPANY SNAPSHOT

17.21.2 RECENT FINANCIALS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENT

17.22 MEDENCY

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 MEDYTOX

17.23.1 COMPANY SNAPSHOT

17.23.2 RECENT FINANCIALS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 PHOTOMEDEX

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 R2 TECHNOLOGIES, INC. (A SUBSIDIARY OF INNOVATE CORP.)

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

17.26 REVANCE THERAPEUTICS

17.26.1 COMPANY SNAPSHOT

17.26.2 RECENT FINANCIALS

17.26.3 PRODUCT PORTFOLIO

17.26.4 RECENT DEVELOPMENTS

17.27 SCITON

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 SENSUS HEALTHCARE, INC.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 THERMIGEN, LLC.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENTS

17.3 VENUS CONCEPT

17.30.1 COMPANY SNAPSHOT

17.30.2 RECENT FINANCIALS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 DEVICES WITH AESTHETIC PURPOSE LISTED IN FDA MEDICAL DEVICE CLASSIFICATION DATABASE

TABLE 2 GOVERNMENT PROCESSING FEE

TABLE 3 AMERICAN SOCIETY FOR AESTHETIC PLASTIC SURGERY PROCEDURE FACTS

TABLE 4 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 6 MIDDLE EAST & AFRICA MEDICINES IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MEDICINES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ENERGY BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA LASER BASED DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA NON-ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA NON-ENERGY BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA MINIMALLY INVASIVE IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA NON-INVASIVE IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA FACE TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA FACE TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BODY TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA BODY TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA SKIN REJUVENATION IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA SKIN RESURFACING IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SKIN TIGHTENING IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA HAIR REMOVAL IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA PIGMENTED & VASCULAR LESION IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA TATTOO REMOVAL IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA SCAR IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA ACNE IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA DYSCHROMIA IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA SKIN TAGS IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA PSORIASIS IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA WARTS IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA HYPERHIDROSIS IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA MOLES & FRECKLES IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA FEMALE IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA MALE IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA HOSPITALS IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA DERMATOLOGY CLINICS IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA SURGICAL CENTERS IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA SPA CLINICS IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA OTHERS IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA DIRECT TENDER IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA RETAIL SALES IN AESTHETIC DERMATOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 54 MIDDLE EAST AND AFRICA MEDICINES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA ENERGY BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA LASER BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA NON-ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA NON-ENERGY BASED DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA FACE TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA BODY TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 71 SOUTH AFRICA MEDICINES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA ENERGY BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA LASER BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA NON-ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA NON-ENERGY BASED DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA AESTHETIC DERMATOLOGY MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA FACE TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA BODY TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA AESTHETIC DERMATOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA AESTHETIC DERMATOLOGY MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA AESTHETIC DERMATOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA AESTHETIC DERMATOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 88 SAUDI ARABIA MEDICINES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SAUDI ARABIA ENERGY BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 SAUDI ARABIA LASER BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 SAUDI ARABIA NON-ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 SAUDI ARABIA ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 SAUDI ARABIA NON-ENERGY BASED DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 SAUDI ARABIA AESTHETIC DERMATOLOGY MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 97 SAUDI ARABIA FACE TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA BODY TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 99 SAUDI ARABIA AESTHETIC DERMATOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA AESTHETIC DERMATOLOGY MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA AESTHETIC DERMATOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 SAUDI ARABIA AESTHETIC DERMATOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 U.A.E AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.A.E AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 105 U.A.E MEDICINES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.A.E DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.A.E ENERGY BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.A.E LASER BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.A.E NON-ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.A.E ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.A.E NON-ENERGY BASED DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.A.E AESTHETIC DERMATOLOGY MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.A.E AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.A.E FACE TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.A.E BODY TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.A.E AESTHETIC DERMATOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 U.A.E AESTHETIC DERMATOLOGY MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 118 U.A.E AESTHETIC DERMATOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 U.A.E AESTHETIC DERMATOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 ISRAEL AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 ISRAEL AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 122 ISRAEL MEDICINES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 ISRAEL DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 ISRAEL ENERGY BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 ISRAEL LASER BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 ISRAEL NON-ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 ISRAEL ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 ISRAEL NON-ENERGY BASED DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 ISRAEL AESTHETIC DERMATOLOGY MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 130 ISRAEL AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 131 ISRAEL FACE TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 132 ISRAEL BODY TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 133 ISRAEL AESTHETIC DERMATOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 ISRAEL AESTHETIC DERMATOLOGY MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 135 ISRAEL AESTHETIC DERMATOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 ISRAEL AESTHETIC DERMATOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 137 EGYPT AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 EGYPT AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (UNITS)

TABLE 139 EGYPT MEDICINES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 140 EGYPT DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 141 EGYPT ENERGY BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 142 EGYPT LASER BASED DEVICE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 EGYPT NON-ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 EGYPT ABLATIVE IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 EGYPT NON-ENERGY BASED DEVICES IN AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 EGYPT AESTHETIC DERMATOLOGY MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 147 EGYPT AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 148 EGYPT FACE TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 149 EGYPT BODY TREATMENT IN AESTHETIC DERMATOLOGY MARKET, BY TREATMENT TYPE, 2020-2029 (USD MILLION)

TABLE 150 EGYPT AESTHETIC DERMATOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 151 EGYPT AESTHETIC DERMATOLOGY MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 152 EGYPT AESTHETIC DERMATOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 153 EGYPT AESTHETIC DERMATOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 REST OF MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: END USER COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: SEGMENTATION

FIGURE 11 GROWING DESIRE TO IMPROVE ONE'S APPEARANCE AND RISE IN PREFERENCE FOR MINIMALLY INVASIVE AND NON-INVASIVE PROCEDURES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET FROM 2021 TO 2029

FIGURE 12 MEDICINES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET

FIGURE 15 NUMBER OF AESTHETIC PROCEDURES PERFORMED, U.S., 2020

FIGURE 16 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 18 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 19 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY SURGERY TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY SURGERY TYPE, 2022-2029 (USD MILLION)

FIGURE 22 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 23 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 24 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY TREATMENT TYPE, 2021

FIGURE 25 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY TREATMENT TYPE, 2022-2029 (USD MILLION)

FIGURE 26 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY TREATMENT TYPE, CAGR (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 28 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY APPLICATION, 2021

FIGURE 29 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 30 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 31 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY GENDER, 2021

FIGURE 33 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY GENDER, 2022-2029 (USD MILLION)

FIGURE 34 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY GENDER, CAGR (2022-2029)

FIGURE 35 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY GENDER, LIFELINE CURVE

FIGURE 36 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY END USER, 2021

FIGURE 37 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET: SNAPSHOT (2021)

FIGURE 45 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET: BY COUNTRY (2021)

FIGURE 46 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 MIDDLE EAST AND AFRICA AESTHETIC DERMATOLOGY MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 49 MIDDLE EAST & AFRICA AESTHETIC DERMATOLOGY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.